deposit:

- from £149

Trading platform:

- MetaTrader4

deposit:

- from £149

Trading platform:

- MetaTrader4

- Account can be opened without completing the challenge

- there is a monthly fee, balance scalability, and advanced training (extra charge)

- Up to 1:100

Summary of Audacity Capital Trading Company

Audacity Capital is a moderate-risk prop trading firm with the TU Overall Score of 6.36 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Audacity Capital clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. Audacity Capital ranks 8 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Audacity Capital focuses on cooperation with traders of all levels. It has a fairly low entry level in terms of trading skills, but traders should consider the relatively high initial fee and monthly fees. Audacity Capital offers two types of accounts with leverage of up to 1:100. A trader starts with a balance of $15,000 and can increase it up to $480,000. The main instruments of the company are currencies, but under certain circumstances, a partner also gets access to the markets of indices and commodities.

The prop (proprietary) trading firm Audacity Capital is unique in that it does not work with retail brokers. It cooperates with an institutional liquidity provider, which allows it to receive the tightest spreads. Professional traders can open an account with a balance of $15,000 without taking an entry test. For beginners, the company offers a two-stage challenge, which takes place on a demo account. In the future, partners of the prop trader will receive 50% or 75% of the net profit depending on the account selected. The maximum possible drawdown is 10%. At the same time, whenever clients reach a profit of 10%, their account balance doubles. The maximum balance is $480,000. There are no restrictions on trading strategies. Trading is possible only via the MetaTrader 4 platform.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From £149 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | No |

| 🔧 Instruments: | Currencies, indices, commodities |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Audacity Capital:

- Challenge for beginners is quite simple. In case of failure, the test can be retaken; it takes place on a demo account;

- After a new partner of the company completes the challenge successfully, the initial fee is refunded;

- Professional traders’ applications are approved within 24 hours without taking the entry test;

- Balance doubles every time a trader reaches a profit of 10% of the current balance;

- The company provides fast executions, there are no swaps, no additional fees, and tight spreads;

- This prop trader provides its own app for traders to manage their accounts and interact with other partners;

- The company provides educational materials and specialized courses at an extra cost.

👎 Disadvantages of Audacity Capital:

- The initial fee starts at £149, which is quite a lot for a balance of $15,000;

- The company charges all its partners a monthly fee of £99;

- Initially, clients can only trade currencies and indices; and commodities become available from the fourth level.

Evaluation of the most influential parameters of Audacity Capital

Trade with this prop-trading company, if:

- You are an experienced Forex trader with a proven track record, as Audacity Capital's programs are tailored for individuals who have demonstrated consistent profitability and have well-defined trading strategies.

- You value flexibility and fast scaling, as Audacity Capital offers customizable initial capital and account growth based on your trading performance. This flexibility allows traders to start with a capital amount that suits their needs and scale their accounts rapidly as they demonstrate profitability.

Do not trade with this prop-trading company, if:

- You require substantial educational resources. Audacity Capital primarily focuses on providing funded trading accounts rather than extensive training or educational resources.

Table of Contents

Geographic Distribution of Audacity Capital Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Audacity Capital

This prop trading company was founded in 2012. Its headquarters is in London. Unlike most prop companies, Audacity Capital is regulated. Also, it does not cooperate with retail brokers, but uses an institutional liquidity provider. Among the basic assets available for trading are currency pairs, indices, and commodities. However, in order to trade indices and commodities, traders need to prove their qualification by increasing their account balance to $120,000.

The balance composition and the mechanism for its expansion are quite simple. Initially, a partner of Audacity Capital receives an account with $15,000 on it. A partner can use any strategy and even trade on weekends. The only way the company can control a trader is to track his drawdowns. As soon as a drawdown reaches 10%, traders are automatically excluded from the trading program until all the circumstances are clarified. But if they trade successfully, they do not have any limits on time and profit. When their profit reaches 10%, they can double the balance. And so on, up to $480,000.

However, not all terms of Audacity Capital are favorable. The initial fee is £149. This is quite a lot, considering that the initial balance is only $15,000. Only traders who successfully completed the challenge are eligible for a refund of the initial fee. They are provided with an improved payout ratio, which is 75/25, while it is 50/50 for the type of account that does not require the test. But the maximum leverage of 1:100 allows you to quickly increase profits.

Audacity Capital has a good partnership program with fixed payouts of $35 per referral. The educational courses are rated by experts as one of the best in the segment, although it should be taken into account that the most useful materials cost £649. However, online lessons provide a lot of theoretical and practical knowledge that will be of interest even to professionals. According to statistics, more than 70% of the company’s clients are progressing and constantly increasing profits, which can be regarded as an objective indicator of comfortable trading and well-structured training.

Dynamics of Audacity Capital’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The Audacity Capital prop trading company does not offer investment solutions, which are traditionally understood as financial investments with the possibility of passive income. For example, this could be the purchase of dividend stocks or cryptocurrency staking. The only opportunity for traders to make passive income with Audacity Capital is by inviting their colleagues and acquaintances to trade on the platform. However, it should be taken into account that to make a profit on a regular basis, high activity on various social platforms is required.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Conditions of Audacity Capital’s referral program:

The prop company’s partner applies for a referral link. It can be placed on the internet without any restrictions. Everyone who follows the link and registers on the Audacity Capital website becomes a referral of the link’s owner and earns $35 for the referrer. In the future, if a trader invites many new clients and is successful in trading, the amount of payments increases.

The Audacity Capital partnership program cannot become the main source of income, unlike full-fledged solutions for passive income. However, if you constantly communicate with colleagues on social networks and you have a popular blog, referrals can bring you good bonuses.

Trading Conditions for Audacity Capital Users

The initial fee of £149 is paid regardless of the account type and the expertise of a trader. However, in case of a challenge account, the fee is fully refunded when a trader successfully completes the test. Note that leverage may vary according to the asset, trader's balance, and other factors. The maximum leverage is 1:100 during the challenge. Technical support can be reached by call center, email, and live chat. Support works 24/7, but sometimes it can take a long time to respond due to the large number of requests.

from £149

Minimum

deposit

to 1:100

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Funded Trader Program and Ability Challenge |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer, bank cards, online transfer |

| 🚀 Minimum deposit: | From £149 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Currencies, indices, commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Account can be opened without completing the challenge; there is a monthly fee, balance scalability, and advanced training (extra charge) |

| 🎁 Contests and bonuses: | Yes |

Comparison of Audacity Capital to other prop firms

| Audacity Capital | Topstep | FTMO | Funded Trading Plus | FTUK | E8 Funding | |

| Trading platform |

MetaTrader4 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MT4, MT5 | MT4, MT5 |

| Min deposit | $149 | $1 | $155 | $119 | $119 | $138 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | No | ECN | Instant Execution | Market Execution | No | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Audacity Capital | Topstep | FTMO | Funded Trading Plus | FTUK | E8 Funding | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | Yes |

| CFD | No | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | No | No | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

Audacity Capital Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Funded Trader Program | Set by liquidity provider | No |

| Ability Challenge | Set by liquidity provider | No |

Spreads of institutional liquidity providers (as in the case of Audacity Capital) can vary, but they are always lower than those of brokers.

Detailed review of Audacity Capital

Since the Audacity Capital prop company has been operating for more than 10 years, the Traders Union was able to comprehensively assess the prop firm’s capabilities and conditions. Due to licensing and regulation, traders can be sure that the company fulfills its obligations, but it does not disclose its liquidity provider. The company is not required to do so, but partners do not get full transparency. However, since spreads and trading fees are indeed lower than most retail brokers, this fact is simply ignored by a majority of traders.

However, it should be noted that the initial fee of £149 or more (depending on the type of account) seems quite significant, given that the initial balance is only $15,000. The reverse of the medal is scalability with almost no limits. It is enough for traders to bring their profit up to 10% to double the balance. Thus, they can get up to $480,000 to manage. Moreover, if a trader is a professional, then there is no need to go through a challenge to start, an interview with a manager is enough. However, the profit between a trader and the company is divided 50/50 at the start. And if you choose an account with a challenge, the ratio will be 75/25 in favor of a trader.

Audacity Capital by the numbers:

-

Founded in 2012;

-

Covers 140 countries;

-

Total trading volume is $2.4 billion;

-

Maximum payout is $2.82 million;

-

Company’s fees are $0.

Audacity Capital is a prop trading company for trading currencies, indices, and commodities

The main group of instruments presented on the platform is currency pairs. The list of assets includes the most popular instruments, and the list is constantly expanding, in response to community requirements. Audacity Capital’s liquidity provider, among other things, provides the company with access to the markets of indices and commodities. Traders can access these instruments starting at the fourth level, which is $120,000 on the balance.

The level system in this prop company is simple and convenient. All traders start from the first level regardless of their skills and experience. Every time their profit hits 10%, the balance doubles and they move to the next level. These levels differ both in balance, the possible volume of trades, and available assets. The maximum possible drawdown is always 10%. Weekend positions are available at all levels. Time limits do not apply. At the moment, Audacity Capital is one of the few prop companies that does not set a lower limit of activity in the trading cycle. That is, a client may not trade at all within a whole month.

Useful opportunities offered by Audacity Capital:

-

If traders are experienced enough, they do not have to take the challenge. They can be interviewed and have their application approved within 24 hours;

-

Beginning traders who decide to take the challenge receive additional benefits in the form of increased leverage and a better payout percentage;

-

Clients can trade at their own pace, with no time limits, or trading strategy restrictions, except that trading on news is prohibited;

-

The levels system allows prop company’s partners to flexibly control their opportunities and receive increased balance only if it is appropriate;

-

Educational materials and specialized courses by Audacity Capital are aimed at improving its partners’ skills. Courses are paid, but they will be useful to traders of all levels.

Advantages:

Choice of two types of accounts for beginners and experienced traders, flexible setting of trading parameters without significant restrictions;

Each partner, regardless of his experience, can request an increase in the balance if he trades successfully enough;

The prop company educates its partners, there are free educational materials on the basics of Forex, as well as professional courses priced £649;

The platform works quickly and steadily, trades are carried out in the minimum time, and the application is convenient and functional;

Audacity Capital offers quite a big choice of assets; initially there are only currencies, but indices and commodities become accessible from the fourth level.

The ratio of profit that a trader earns and which is taken by the platform cannot be defined as an advantage, because the percentages are more profitable at most other prop companies. Moreover, Audacity Capital is one of the few platforms with a subscription fee. But these moments are more than compensated by objective advantages such as stability, reliability, and convenience of cooperation.

Guide on how traders can start earning profits

To competently use the opportunities that the prop company provides, traders need to objectively assess their own level. For most professional traders, there is no need to take a challenge, while beginners, by choosing an account type with a challenge, receive additional benefits. Further on, trading conditions are the same for everyone, these are $15,000 at the start and scalability up to $480,000 with a maximum allowable drawdown of 10% (general, not daily). Since there are no restrictions on trading strategies and limits on the number of working days during a trading cycle, traders can trade at their own pace with maximum comfort.

Types of accounts at Audacity Capital:

Note that the initial fee is mandatory, but it is fully refunded on the Ability Challenge account as soon as a trader completes the challenge successfully. In the future, the company’s partner pays a subscription fee of £99 per month, regardless of experience, account balance, or other conditions.

Investment Education Online

All prop trading companies strive to raise the professional level of their partners. The more experienced and successful traders are, the firm earns, and accordingly, the more the platform receives. Audacity Capital is no exception. Moreover, this company surpasses its competitors in many aspects of training.

Note that Audacity Capital’s free educational materials contain very general information only. The free content is useful, but it's the basics known to most traders. All the most interesting and higher-quality information is provided as a part of the advanced course, which costs £649.

Security (Protection for Investors)

Audacity Capital does not disclose its liquidity provider, but the company is officially registered in London and is subject to the UK financial laws, and the license number is in the footer of the website.

👍 Advantages

- Traders can consult the prop company’s lawyers

- Traders have the right to contact the UK regulating authorities

👎 Disadvantages

- Information on international regulation is not available, so a trader cannot address the regulator

Withdrawal Options and Fees

-

Depending on the selected account type, a trader receives 50% or 75% of the net profit;

-

Bonuses for the referral program are also credited to the user account of the platform’s partner;

-

Traders can withdraw funds once a month by submitting an application in their user accounts;

-

Withdrawal to a bank account, a bank card, or an e-wallet is possible, and other means are also available;

-

Traders can find out about all commissions and related fees in their user accounts.

Customer Support Service

Audacity Capital’s technical support is available 24/7. It is available via multiple channels. The only language used by the support team is English.

👍 Advantages

- Support is available to all traders, not only partners of the platform

- Three communication channels are available 24/7

👎 Disadvantages

- According to the users, responses via email and live chat are sometimes very slow

To get assistance from the prop trading company’s managers, traders can use the following channels:

-

call center;

-

email;

-

live chat in the app.

The prop company has official profiles on major social media, including Facebook, Twitter, YouTube, and some others. You can find links in the footer of the website.

Contacts

| Foundation date | 2012 |

| Registration address | One Canada Square, Level 8 Office 8.05, London E14 5AA |

| Official site | https://www.audacitycapital.co.uk/ |

| Contacts |

Email:

support@audacitycapital.co.uk,

Phone: +44 20 8050 1985 |

Review of the Personal Cabinet of Audacity Capital

To start a partnership with this prop trading company, it is necessary to register and verify your personal information. Then traders pay the initial fee and proceed to the challenge or interview (depending on the type of account selected). Traders also get a user account at their disposal, where they can manage their money account. Below a step-by-step registration process is provided and the main features of the Audacity Capital’s user account are described.

Go to the official website of the Audacity Capital prop trading company. In the upper right corner of the main screen, there is a "Get Funded" button. Below in the main block there is a "View all Funding Programs" link. Click on it.

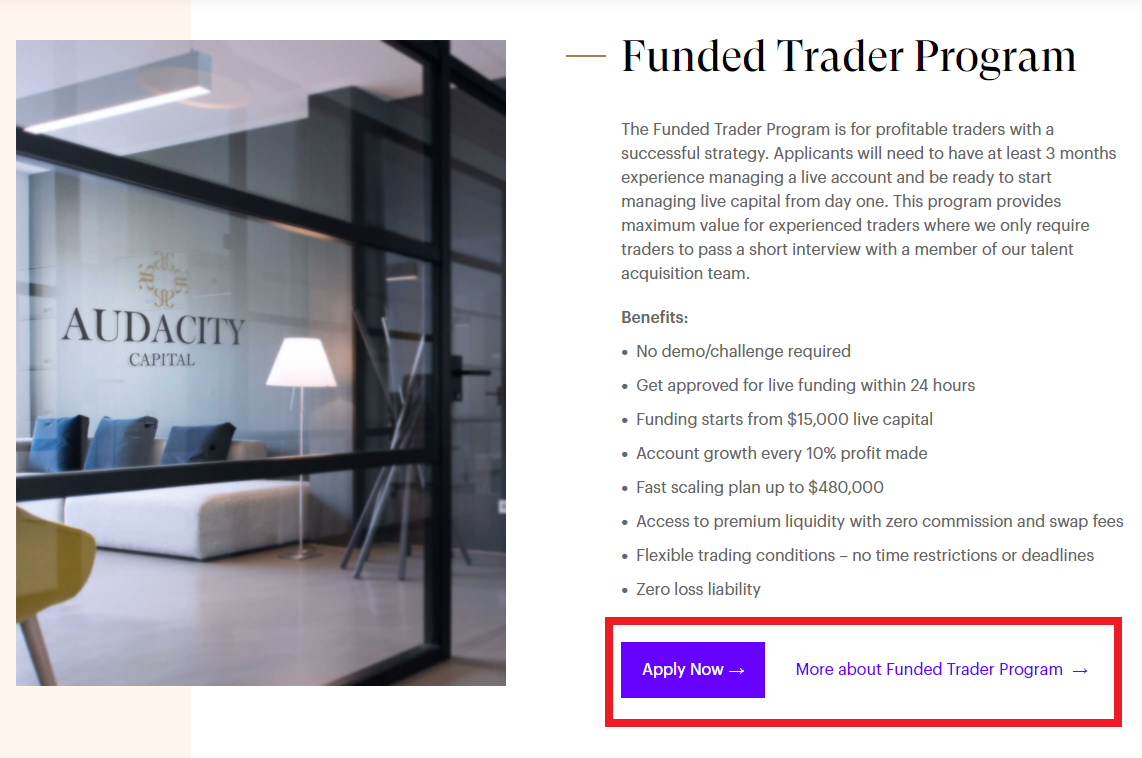

There are two blocks on the next page: the first one is dedicated to the Funded Trader Program, the second is for the Ability Challenge. Click the "Apply Now" or "More About" button, depending on the program that suits you best.

If you decide to learn more about a particular type of account, review the information on the next page and select the appropriate conditions. In any case, you will find yourself on the registration page. Click the "Apply for Funding" button (the button’s name may vary slightly depending on the page you are on).

Follow the instructions on the screen. You need to specify your first name, last name, registration address, email, and phone number, as well as your experience in trading. After that, go through verification and pay the initial fee in accordance with the type of account you selected. Payment can be made by card or PayPal. If you need an alternative payment method, contact the technical support.

After your data is verified and your payment is received, you will get access to your user account. The Audacity Capital mobile application is also available for download, and the link is available on the website. Once you have a user account and your money account, you can enter the data in your MT4 platform and start trading.

The main features of Audacity Capital’s user account:

It displays up-to-date information on your money account, as well as information about open and closed trades;

You can track your progress in the challenge in the corresponding section of your user account;

The eponymous tabs provide information on transactions and invoices;

Here you will also submit withdrawal requests using the specified methods of withdrawal;

In the user account there is a basic FAQs section, so you can get help from the support service as well.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Audacity Capital rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Audacity Capital you need to go to the company's profile.

How can I leave a review about Audacity Capital on the Traders Union website?

To leave a review about Audacity Capital , you need to register on the Traders Union website.

Can I leave a comment about Audacity Capital if I am not a Traders Union client?

Anyone can post a comment about Audacity Capital in any review about the company.

Traders Union Recommends: Choose the Best!