Fidelcrest Review 2025

Attention!

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of Fidelcrest Trading Company

Fidelcrest, a brokerage firm, operated as a Ponzi scheme, defrauding thousands of investors of billions of dollars. This scam was orchestrated by the company's founder and CEO, who lured investors with promises of unrealistic profits generated through his proprietary trading strategies.

In reality, Benson and his associates used funds from new clients to pay off existing ones, creating the illusion of successful investments. This scheme began in the late 2010s and persisted until 2022 when authorities uncovered the fraud and initiated an investigation.

Former users reported sudden and unjustified account closures, often following significant gains. Investigations revealed questionable practices, such as the manipulation of trading results and the use of unfavorable terms hidden in the fine print.

By the time of its closure, Fidelcrest had amassed over $8 billion from more than 50,000 investors worldwide. Benson and several top managers were arrested and charged with securities fraud and money laundering.

The Fidelcrest scandal stands as one of the largest financial frauds in recent history, leaving countless investors without their capital and underscoring the urgent need for increased regulatory oversight in the financial sector.

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

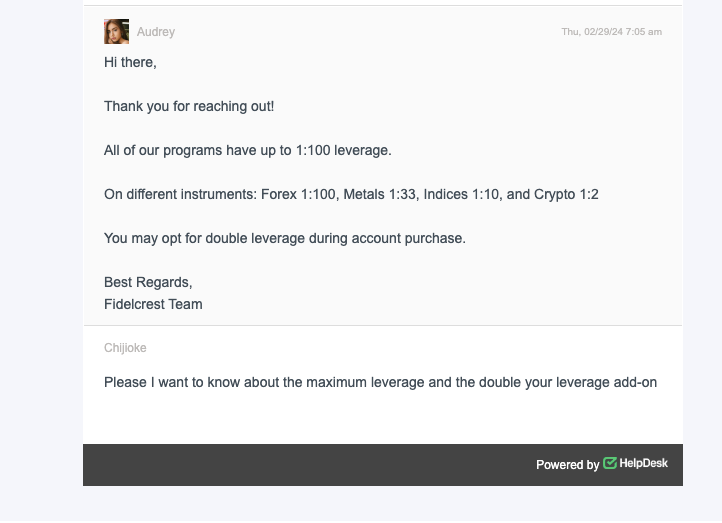

Why has prop company Fidelcrest been blacklisted?

Possible reasons:

• The prop company Fidelcrest was found manipulating traders' evaluation stages, such as manipulating spreads, quotes, or forcibly closing trades under false pretexts.

• The website is malfunctioning or offline, and regulators have complaints against the company.

• The company lacks transparency, with complaints from traders.

I saw Fidelcrest in the blacklist. What should I do?

Take this fact into account. Prop trading during the evaluation stage involves trading on a demo account, so your only risk is the fee paid for the evaluation. If you plan to redo the evaluation, consider choosing a different company.

Should I continue working with prop company Fidelcrest if it’s been blacklisted?

If you are already in the evaluation stage, continue to complete it. This is additional experience for you without any significant risk. There’s a chance the prop company could be removed from the blacklist by the time you finish.

How can I file a complaint against a prop company to have them blacklisted?

You can share your review through the form on this page. Alternatively, you can send an email to Traders Union's support service, providing details of your experience with company Fidelcrest along with supporting screenshots. After reviewing your complaint, Fidelcrest may be added to the blacklist.

Traders Union Recommends: Choose the Best!

KG Bishkek

KG Bishkek