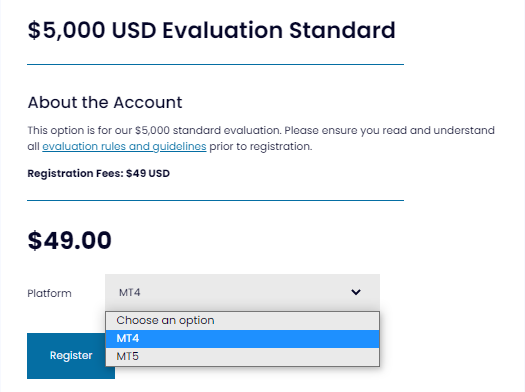

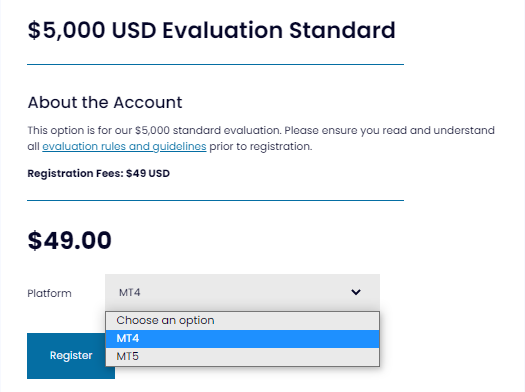

deposit:

- $49

Trading platform:

- MetaTrader4

- MetaTrader5

My Forex Funds Review 2024

deposit:

- $49

Trading platform:

- MetaTrader4

- MetaTrader5

- A fee per lot is charged on every instrument

- 1:50 (Accelerated Conventional); 1:100 (Evaluation, Accelerated Emphatic); 1:500 (Rapid)

Summary of My Forex Funds Trading Company

My Forex Funds is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.68 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by My Forex Funds clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work. My Forex Funds ranks 32 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

My Forex Funds is a young prop trading company that entrusts its own capital to experienced traders worldwide. It pays its clients ability major part of their profits and doesn’t withhold any additional trading or non-trading fees.

My Forex Funds is a prop (proprietary) trading company that has been providing its capital to professional Forex traders since July 2020. It suggests three financing plans including a program of a quick start with a live account on the day of subscription payment. Clients of My Forex Funds can use the money received from the company to trade currency pairs, metals, oil, stock indices and cryptocurrencies in CFD format. Trading with leverage and floating narrow spreads is carried out on MT4 and MT5 platforms.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $49 |

| ⚖️ Leverage: | 1:50 (Accelerated Conventional); 1:100 (Evaluation, Accelerated Emphatic); 1:500 (Rapid) |

| 💱 Spread: | from 1 pips (for currency pairs) |

| 🔧 Instruments: | Forex, CFDs, commodities, metals, indices, stocks, cryptos |

| 💹 Margin Call / Stop Out: | Not available |

👍 Advantages of trading with My Forex Funds:

- No country restrictions except for Canada. A trader from other countries, including the USA, can become a client of the company;

- Wide range of financing plans;

- Loyal requirements to the general and daily drawdown levels;

- Trader’s profit share is 12% - 85% of the total amount;

- The company’s capital is available for management after paying $49;

- An accelerated plan for professional traders starts from the first day of trading;

- Availability of partnership and bonus programs.

👎 Disadvantages of My Forex Funds:

- A fee per lot is charged for spreads on all trading instruments;

- There are restrictions on trading strategies;

- Technical support via telephone is not available.

Evaluation of the most influential parameters of My Forex Funds

Table of Contents

Geographic Distribution of My Forex Funds Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of My Forex Funds

My Forex Funds has been operating since 2020, however, its services are very popular among experienced traders who are interested in obtaining additional financing for Forex trading. This is because the company offers three programs with different conditions and deposit amounts, and also accepts clients worldwide. My Forex Funds server is located in London.

The minimum financing amount is $5,000, the maximum is $2,000,000. Traders are paid up to 85% of the profits they earn, while VIP clients receive up to 90%. If a client trades with a profit within 30 days, but he fails to reach the target value, then he is entitled to 2 free extensions for up to 14 days each. At the same time, a trader must use proper risk management methods, because the company does not accept overly aggressive trading tactics.

Many strategies are allowed for My Forex Funds clients, but Gap trading, arbitrage trading, and high-frequency trading like Quote stuffing are prohibited. The company uses a client-oriented approach and strives to provide traders with the best service. For example, My Forex Funds increases the account balance by 30% of the initial amount for those traders who have traded a plus for four months and have made a profit of 10% within two of them.

Dynamics of My Forex Funds’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

My Forex Funds is a prop trading company, that is, it is looking for professionals who will trade with its funds and thus generate income. My Forex Funds considers trading using signals to be of high risk, therefore it prohibits copying trades of other traders. At the same time, a client can copy his trades on different accounts. PAMM accounts are also prohibited.

It is allowed to use individual bots (robots) and EAs that are not used in trading by a third party. At the same time, it is forbidden to use algorithmic programs for high-frequency trading.

Participants of the Rapid program have access to a savings account called Funded earnings, or FE. If a client trades with a profit using his demo account, then the company places 3.5% of a trading account balance on the FE account. For example, holders of demo accounts with a $10,000 balance receive $350 on their savings account. These funds can be used after three months of successful trading on a virtual account and achieving a profit of 10% of the account balance. That is, $350 becomes available for live trading when a trader earns a virtual profit of $1,000 on his demo account.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from My Forex Funds:

Referral program. After the referral pays for the Evaluation or Rapid subscription plan via a partnership link, the referrer receives 5% of the paid amount. Rewards are not paid for inviting referrals to accounts of the Accelerated program.

If My Forex Funds client has a page or profile on social networks with more than 10,000 subscribers, then the company can offer individual terms of a partnership program.

Trading Conditions for My Forex Funds Users

My Forex Funds clients trade in classic Forex MetaTrader platforms with floating spreads and a low fee per lot. The amount of leverage varies depending on the trading instrument and account type. Assets are traded in the CFD format, that is, clients do not buy or sell actual currencies, stocks, metals, or commodities. Trades with cryptocurrency CFDs are available. The order execution type is Market Execution.

$49

Minimum

deposit

1:500

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5 |

|---|---|

| 📊 Accounts: | Evaluation, Rapid (CEA, NCA), Accelerated (Conventional, Emphatic) |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Subscription payment: bank cards, BTC, LTC, ETH, USDT, USDC Profit withdrawal: Deel, bank transfer, Paypal, TransferWise, Payoneer, Revolut, Mercury, and cryptocurrencies |

| 🚀 Minimum deposit: | $49 |

| ⚖️ Leverage: | 1:50 (Accelerated Conventional); 1:100 (Evaluation, Accelerated Emphatic); 1:500 (Rapid) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 1 pips (for currency pairs) |

| 🔧 Instruments: | Forex, CFDs, commodities, metals, indices, stocks, cryptos |

| 💹 Margin Call / Stop Out: | Not available |

| 🏛 Liquidity provider: | FinTech company of institutional level |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | A fee per lot is charged on every instrument |

| 🎁 Contests and bonuses: | Yes |

Comparison of My Forex Funds to other prop firms

| My Forex Funds | Topstep | FTMO | Funded Trading Plus | Funded Next | The Concept Trading | |

| Trading platform |

MetaTrader4, MetaTrader5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader4 | MetaTrader4, MetaTrader5 |

| Min deposit | $49 | $1 | $155 | $119 | $99 | $77 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:200 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 0 points | From 0 points | From 0 points | From 0.9 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | 75% / 50% |

| Execution of orders | Market Execution | ECN | Instant Execution | Market Execution | N/a | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| My Forex Funds | Topstep | FTMO | Funded Trading Plus | Funded Next | The Concept Trading | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | No | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | Yes | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | No | No | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | Yes |

My Forex Funds Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Evaluation | From $10 | Withheld by banks and payment systems |

| Rapid | From $10 | Withheld by banks and payment systems |

| Accelerated | From $10 | Withheld by banks and payment systems |

A swap fee for a position that remains open overnight is charged only on live accounts. Swap Free accounts are available, but for currency pairs with MXN and ZAR, swaps are charged in any case.

Traders Union experts calculated the average commissions of My Forex Funds and other prop trading companies and then compared them.

Detailed review of My Forex Funds

My Forex Funds is a Canadian prop trading company that accepts about 2,000 new clients per day. Traders can choose the terms of financing that are acceptable to them. There are options to evaluate your trading skills on demo accounts, but you can also start trading immediately with live money without confirming your expertise. The company aims to cooperate with traders who trade without any assistance of third parties and are able to manage risks.

My Forex Funds by the numbers:

-

300 employees globally;

-

More than 120,000 clients in 80 countries;

-

Leverage is up to 1:500 for basic currency pairs;

-

A client gets up to 85% of the profit for a transaction.

My Forex Funds is a prop trading company that allows margin trading

More than 100 financial instruments, including Forex assets and CFDs, can be used by My Forex Funds clients. However, their list and trading terms vary depending on the program that a trader selects. Thus, leverage in the Rapid tariff plans can reach up to 1:500. In the Evaluation plans, leverage was up to 1:100, and in the Accelerated plans, leverage was up to 1:50 for accounts with an acceptable general drawdown level of 5%, and up to 1:100, if a drawdown of 10% is acceptable. Evaluation and Rapid have no restrictions on trading assets, while subscribers to the Accelerated program cannot trade stock CFDs. My Forex Funds servers are disabled on weekends; so you can trade, including cryptocurrencies, only on weekdays.

My Forex Funds clients trade using MetaTrader 4 and MetaTrader 5 terminals. The company plans to provide the cTrader platform in the future, but the exact timing has not been specified yet.

Useful services of My Forex Funds:

-

Blog. It publishes trading tips, company news and information about its employees;

-

Interviews section. It features video reviews from real clients of My Forex Funds who have succeeded in Forex trading;

-

FAQs. A section with a detailed analysis of financing plans and conditions of trading.

Advantages:

The company does not set limits on lot size;

Traders can use trading robots;

There are many ways to withdraw profit, including in cryptocurrency;

More than 40 currency pairs are available;

Low floating spreads for all instruments;

Availability of live chat on the website and 24/7 technical support.

Various trading strategies are allowed: news, trend and long-term trading, holding trades on weekends, scalping, and swing trading.

Guide on how traders can start earning profits

To make a profit with My Forex Funds, you need to choose a financing program, pay a one-time fee and start trading. Live money can be earned after confirming the ability to trade with the drawdown percentage specified in the offer. For using a successful strategy, a trader receives from 12% to 85% of the total profit for the current trading period.

Available financing programs:

Having chosen the Evaluation and Rapid programs, a trader starts trading on a demo account. When paying for the Accelerated plan, transactions are immediately executed on a live account, and not on a virtual account. My Forex Funds offers a variety of financing plans that allow its clients to trade like institutional-level professionals with no equity capital.

Investment Education Online

My Forex Funds does not educate traders, as it is a prop trading company and aims to cooperate with professionals. The educational information on its website is definitely not enough for a deep dive into the topic of investing in CFDs and currency pairs.

There is a blog in the Trading Tips section on the company's website. The main indicators of technical analysis are reviewed and tips on how to pass the evaluation stage in My Forex Funds are provided also.

Security (Protection for Investors)

The My Forex Funds brand is owned and operated by Traders Global Group Incorporated, registered in Canada under 1264617-0.

My Forex Funds is a funding company, not a broker, so it does not need a financial regulator’s license to provide its services. Traders do not make deposits, but use the My Forex Funds’ capital for trading, so they cannot lose their own funds with a losing strategy.

👍 Advantages

- Clients trade using a prop trading company’s funds

- To withdraw profit proven payment systems and classic bank transfers are available

- Clients can trade with leverage up to 1:500

👎 Disadvantages

- A client does not know what dealer executes his deals

- The company does not guarantee that its service always works without mistakes and malfunctions

- A trader does not have an opportunity to file a complaint to a third party

Withdrawal Options and Fees

-

A client can withdraw his profit through Wise, PayPal, Revolut, bank transfer, Payoneer, Mercury, and others. Also he can withdraw profit in USDT, BTC, ETH, LTC, and USDC cryptocurrencies. Withdrawal conditions depend on the financing program selected by the trader;

-

Frequency of payments for the Rapid program members depends on the type of account. If a client trades on a CEA account, he can withdraw funds once every two weeks. NCA account holders can withdraw profit once a month;

-

Clients with the Accelerated accounts can withdraw money every week. The first withdrawal is possible after trading for 5 days. A profit withdrawal request must be submitted by 15:00 (EST). Otherwise, the company will conduct the transfer in the next payment period. Terms for crediting funds is 1-3 days;

-

There have been some changes for participants of the Evaluation program as of January 1, 2023, regarding fixing a minimum withdrawal amount. Traders with financing of $5,000 - $20,000 can withdraw not less than $50. Those with financing of $50,000 - $100,000, can withdraw not less than $100; and finally, traders with financing of $200,000 - $300,000, can withdraw not less than $150. The first funds withdrawal can be requested after a month of trading, while all others can be requested every two weeks.

Customer Support Service

My Forex Funds support is available 24/7.

👍 Advantages

- 24/7 online chat

- Chat support is available to clients and traders without an account

- Chat operators respond in 5 languages

👎 Disadvantages

- Telephone communication is not available

- Long wait for a response due to heavy workload

Clients can contact the company’s representative by:

-

online chat on the website;

-

email;

-

Facebook, Instagram, and LinkedIn.

Traders can also join the My Forex Funds community on the Discord platform and communicate with the technical service team and other clients of the company.

Contacts

| Foundation date | 2009 |

| Registration address | Traders Global Group Incorporated, 9131 Keele Street, Vaughan, Ontario, ON L4K 2N, Canada |

| Official site | https://myforexfunds.com/ |

| Contacts |

Email:

support@myforexfunds.com,

|

Review of the Personal Cabinet of My Forex Funds

To participate in the My Forex Funds financing program, you need to create a user account and make a payment. A brief description of each step follows:

When you enter the main page of the My Forex Funds official website, click the “Start Now” button. The button is in the center of the screen.

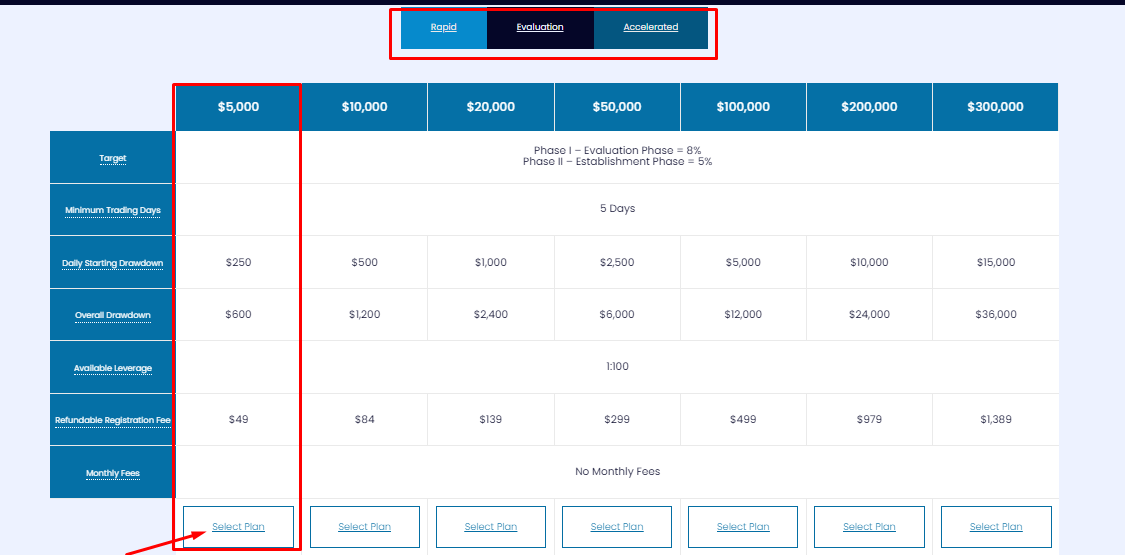

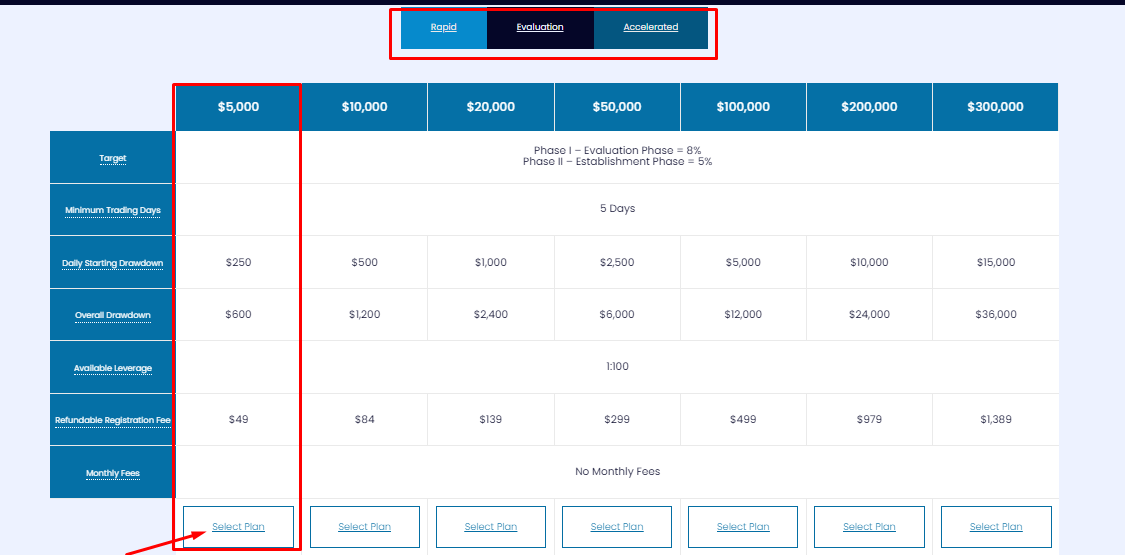

All available tariff plans will be displayed. Choose the one that suits your goals and strategies, and then click the “Select Plan” button.

A form for account creation will appear. Select a trading platform and click Register.

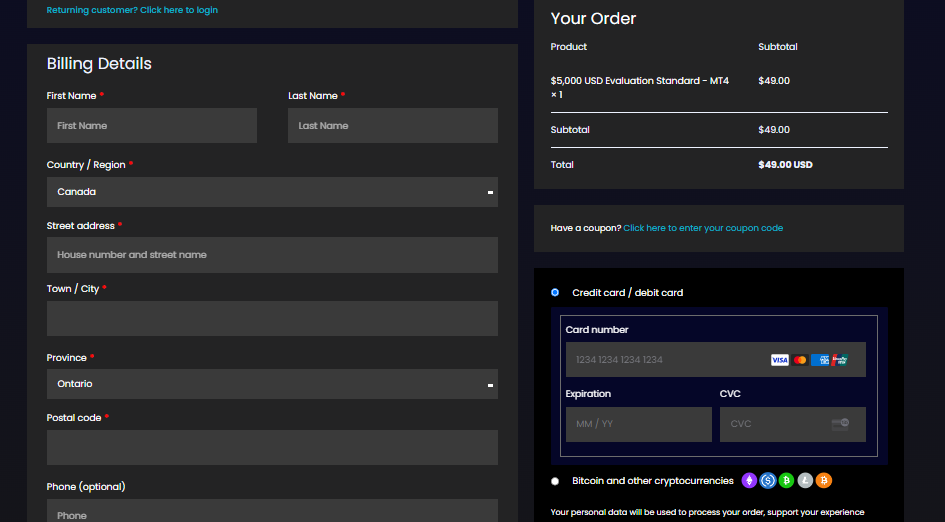

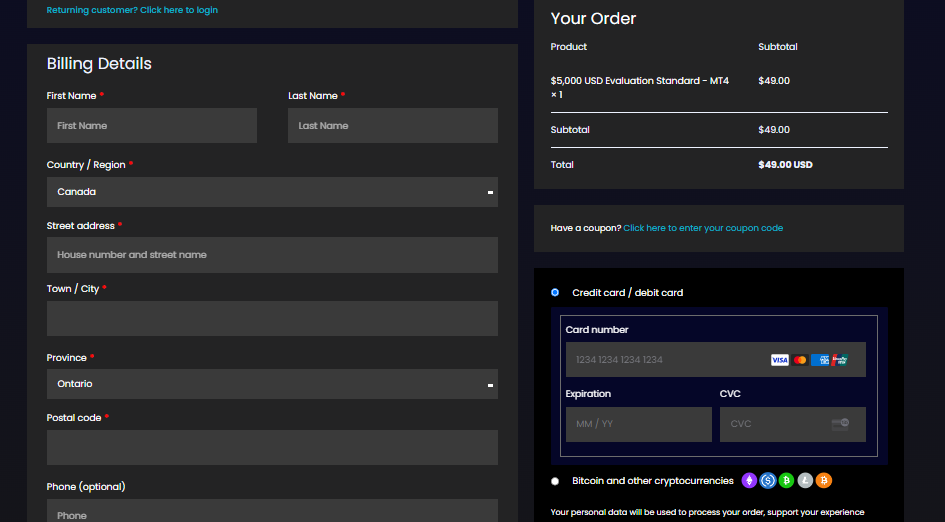

Next, two forms will be displayed. In the first, specify personal information - first and last names, country and address of residence, and phone number and email. The second form is for making a payment.

Articles that may help you

FAQs

How do client reviews impact My Forex Funds rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about My Forex Funds you need to go to the company's profile.

How can I leave a review about My Forex Funds on the Traders Union website?

To leave a review about My Forex Funds , you need to register on the Traders Union website.

Can I leave a comment about My Forex Funds if I am not a Traders Union client?

Anyone can post a comment about My Forex Funds in any review about the company.

Traders Union Recommends: Choose the Best!