According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT5

- 4 account types

- 6 balance options

- initial fee is non-refundable

- profit split is up to 95%

- all accounts are scalable

- minimum restrictions

- trading through MT5 only

- Up to 1:400

Our Evaluation of Finotive Funding

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Finotive Funding is a prop trading firm with higher-than-average risk and the TU Overall Score of 3.63 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Finotive Funding clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work.

Finotive Funding offers quite favorable conditions that attract many partners. A large choice of accounts, many incremental steps in the balance, hundreds of assets, and impressive leverage are the main advantages of Finotive Funding. Minimal restrictions, the possibility to scale accounts, and a unique profit withdrawal system can be added to the list of advantages. Traders can withdraw funds weekly, if their profit exceeds 2.5% of the balance.

Brief Look at Finotive Funding

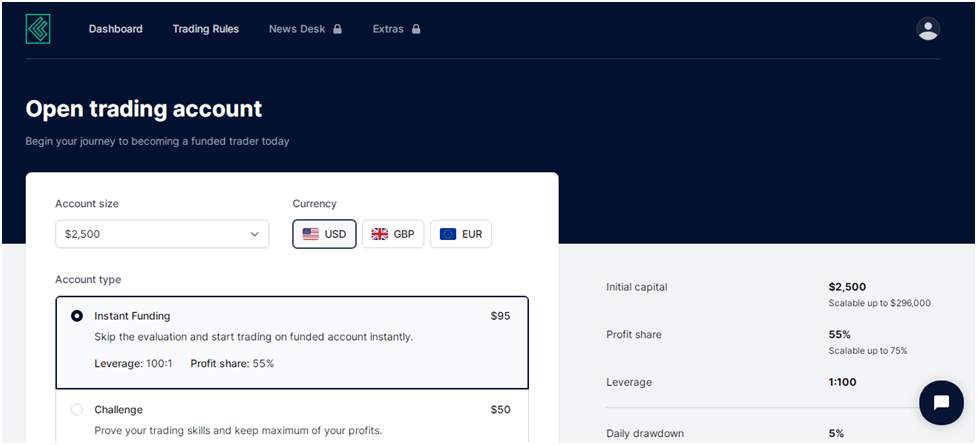

Finotive Funding has been operating since 2021. Despite the young age of the firm, it is quite famous among traders worldwide. It offers four account types, including the Instant Funding account, which is not associated with the typical trading challenge. The balance range on this account is from $2,500 to $200,000. All accounts are scalable up to $3,200,000. Trading is carried out using MetaTrader 5 (MT5). Finotive Funding uses liquidity providers from the Deep Liquidity pools, attracting them through Finotive Markets. This provides minimal spreads and the lowest fees in the segment. Currency pairs, stocks, indices, cryptocurrencies, and commodities are available for trading. The maximum leverage is 1:400. The firm practically does not limit its partners, so you can trade news, trade during weekends, and use advisers. There are no competitions, bonuses, or referral program.

- For all accounts, scaling up to $3,200,000 is available. An increase in the balance is possible every 90 days;

- The minimum initial fee for a standard account with a balance of $2,500 is only $50;

- Trading is carried out through MT5, one of the most popular platforms. It is simple and reliable, and you can use plugins;

- Different groups of assets with leverage of up to 1:400 are available for trading, which significantly increases potential profit;

- The profit split is 55% or 75% at the start depending on the account, but it can be increased up to 95%.

- Despite the fact that Metatrader 5 is considered a convenient platform, other platforms are preferable for some traders, but additional trading platforms are not offered by this prop firm;

- Some prop trading firms refund the initial fee upon successful completion of the challenge. The initial fee of Finotive Funding is non-refundable;

- You can contact support by email, through a live chat, or tickets on the website, but the firm does not provide its own call center.

TU Expert Advice

Author, Financial Expert at Traders Union

Finotive Funding offers a variety of trading instruments, including Forex, stocks, indices, cryptocurrencies, and commodities, available through the MetaTrader 5 platform. The firm provides four account types with initial investments starting at $50, scalable up to $3.2 million, with leverage up to 1:400. A distinct advantage is its unique profit split, which can reach 95%, and the flexibility to trade during weekends and use expert advisors.

However, Finotive Funding presents some drawbacks, such as the non-refundable initial fee and limited access to client support, lacking a call center. Additionally, trading is restricted to MT5, which may not suit all traders. Given these factors, Finotive Funding may be suitable for traders who prioritize asset diversity and high leverage but may not be preferred by those seeking refundable fees or varied platform options.

- You meet the minimum capital requirement. Finotive offers various account sizes, each with a minimum funding requirement. Ensure that you have the necessary capital to qualify for your desired account size before applying.

- You're comfortable with their evaluation process. Finotive provides two evaluation options: a two-phase evaluation involving live trading and a faster "Instant Funding" option with a higher upfront cost. Choose the evaluation path that aligns with your preferences and risk tolerance.

- You prefer a refundable initial fee structure. Though some prop trading firms refund the initial fee upon successful completion of the challenge, the initial fee of Finotive Funding is non-refundable.

- You require immediate access to telephone support, as while you can contact Finotive support via email, live chat, or tickets on their website, they do not provide a dedicated call centre hotline.

Finotive Funding Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ5 |

|---|---|

| 📊 Accounts: | Classic Challenge, One-Step Challenge, Instant Funding (Standard), and Instant Funding (Aggressive) |

| 💰 Account currency: | USD, GBP, and EUR |

| 💵 Deposit / Withdrawal: | Bank cards, bank transfers, and e-wallets |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Currency pairs, indices, stocks, cryptocurrencies, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Not available |

| ⭐ Trading features: |

4 account types; 6 balance options; initial fee is non-refundable; profit split is up to 95%; all accounts are scalable; minimum restrictions; trading through MT5 only |

| 🎁 Contests and bonuses: | No |

The initial fee depends on the type of account and its balance. The largest fee is for Instant Funding (Aggressive) accounts. It ranges from $165 to $2,500. However, traders choose Classic Challenge or One Step Challenge accounts more often. The initial fee starts from $50 and $60, respectively. The leverage is not determined by the account, it depends only on the asset selected for trading. Currently, the maximum leverage for foreign currency pairs is 1:400 and this significantly increases the potential for profit. Technical support works without breaks and days off. Live chat and email are available 24/7. However, during rush hour, the speed of managers' responses may decrease slightly.

Finotive Funding Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Challenge rules and pricing

Finotive Funding provides access to funding up to $1 400 000, with challenges requiring at minimum of No time limits trading days. The entry-level plan starts at $50, and the fee is refundable if the challenge is successfully completed.

- High funding potential — up to $1 400 000

- Free evaluation option available

- Low entry cost — from $50

- Minimum trading period required

- No demo account provided

Finotive Funding Challenge fees and plans

We compared Finotive Funding’s challenge plans by key parameters including pricing, profit targets, loss limits, and managed capital.

Available Trading Plans

| Trading Plans | Managed amount, USD | Price, $ | 1 step profit target, $ | 2 - Profit target, $ | Daily loss,% | Max. loss, % |

| Finotive Pro |

|

|

|

|

|

|

| Challenge |

|

|

|

|

|

|

| Instant Funding |

|

|

|

|

|

|

What’s the minimum trading period for Finotive Funding’s challenge?

No minimum trading days. You can complete the challenge as soon as you reach the profit target.

Does Finotive Funding offer a free evaluation?

Yes, Finotive Funding offers a free evaluation option. However, conditions may vary, so we recommend checking the latest details on the company’s official website.

Is instant funding available at Finotive Funding?

Yes, Finotive Funding offers instant funding. Details may vary by plan, so we recommend checking the latest terms on the company’s official website.

Trading rules

Finotive Funding outlines the main rules for funded accounts, including a max. loss of 8% and a daily loss limit of 5%. The firm also restricts certain trading strategies, which are detailed below.

- No weekend close rule

- Flexible leverage up to 1:400

- News trading allowed

- Multiple trading restrictions may apply

Finotive Funding trading conditions

We compared Finotive Funding’s leverage and trading conditions with competitors to help you better understand how it measures up.

| Finotive Funding | Hola Prime | SabioTrade | |

| Max. loss, % | 8 | 5 | 6 |

| Max. leverage | 1:400 | 1:100 | 1:30 |

| Weekend close rule | No | No | No |

| Mandatory Stop Loss | No | No | No |

| Trading bots (EAs) | Yes | Yes | Yes |

| News trading | Yes | Yes | Yes |

| Scalping | Yes | No | Yes |

| Copy trading | Yes | No | No |

Deposit and withdrawal

Finotive Funding earned a Medium score based on how smoothly and conveniently traders can deposit and withdraw funds.

The deposit and withdrawal options at Finotive Funding meet most standard requirements and are in line with what many prop firms provide.

- Bitcoin (BTC) supported

- Multiple base account currencies

- Weekly payouts

- Bank сard deposits and withdrawals

- Limited deposit and withdrawal options

- PayPal not supported

- USDT payments not supported

Deposit and withdrawal options

To help you evaluate how Finotive Funding performs, we compared its deposit and withdrawal methods with those of two competing proprietary trading firms.

Finotive Funding Payment options vs Competitors

| Finotive Funding | Hola Prime | SabioTrade | |

| Bank Card | Yes | Yes | Yes |

| Bank Wire | No | No | No |

| Crypto | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| Payoneer | No | No | No |

| Skrill | No | No | No |

| Neteller | No | No | No |

Profit withdrawal frequency

We compared Finotive Funding with other prop firms based on how frequently traders can withdraw their profits: on demand, weekly, or monthly. Firms that allow more frequent payouts offer greater flexibility and quicker access to earnings.

| Finotive Funding | Hola Prime | SabioTrade | |

| On demand | No | No | Yes |

| Weekly | Yes | Yes | No |

| Biweekly | No | Yes | No |

| Monthly | No | Yes | No |

What base account currencies are available?

Finotive Funding offers the following base account currencies:

Trading Account Opening

In order to start trading with the prop firm, register on its official website, and then pay the initial fee for the selected account and balance. For your convenience, below is a brief guide for registration.

Go to the firm's website. Click the “Login to member area” button in the upper right corner or the “Sign Up Today” button in the main block.

If you already have a user account, enter your registration email and password. If you are not registered, click the "Create New Account For Free" link.

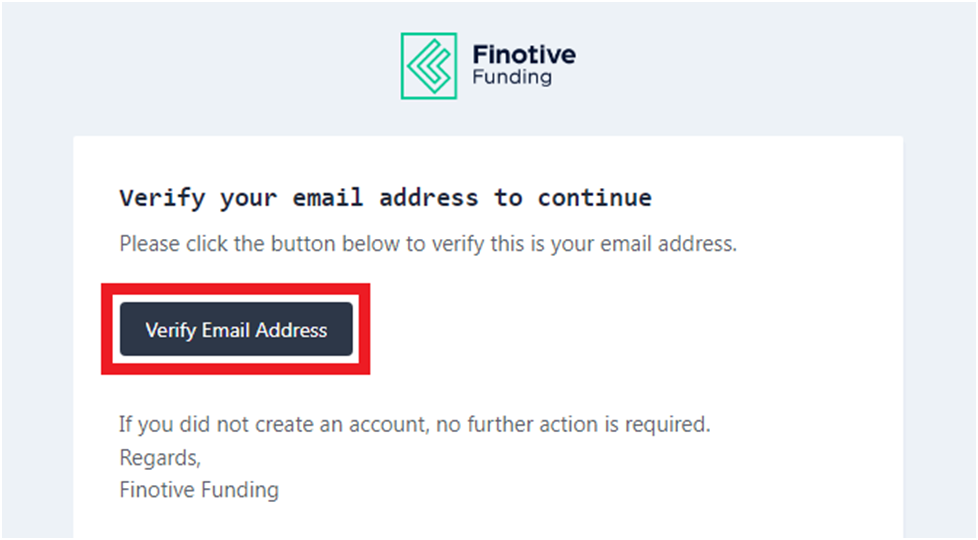

Indicate your name, email, and mobile phone number. After that, generate a password and confirm it. Indicate your country of residence and agree to the terms and conditions by ticking the appropriate field. After that, click the "Create an Account" button. A confirmation letter will come to your email. Follow the link in it to confirm your registration.

Now get acquainted with trading conditions and confirm this action to gain access to your user account. After that, you can choose the type of account, pay the initial fee, and start a challenge. Also, you can immediately start trading, if you have chosen an account without a test.

Services of Finotive Funding’s user account:

Dashboard. Information on all current accounts with the possibility of detailing any parameter is aggregated there. Traders can monitor their progress and payments in this block;

Trading rules. The main restrictions that apply to partners of Finotive Funding are stated here. This menu is a must read;

Profile. This is the menu with the user’s information and the registration address for payments. Without indicating an address, you will not be able to apply for the withdrawal of funds.

Regulation and safety

This prop trader is officially registered. However, it does not need to be licensed by a financial regulator, because it does not submit the transactions of its traders directly to the interbank. Brokers are responsible for this, thus regulation is required for them. Finotive Funding works exclusively with licensed organizations.

Advantages

- Traders can apply for assistance to the legal department of the prop firm

Disadvantages

- Traders cannot contact the broker directly

- This prop trader’s partner cannot address the regulator

Markets and tradable assets

Finotive Funding has a score of 7/10, reflecting a strong variety of markets and assets available for trading.

- Forex trading supported

- CFDs offered

- Indices available

- Options not supported

- Futures not available

Tradable markets

We compared the range of tradable instruments offered by Finotive Funding with two leading competitors to highlight the differences in market access.

| Finotive Funding | Hola Prime | SabioTrade | |

| Futures | No | No | No |

| CFDs | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Options | No | No | No |

| Stocks | No | No | No |

| Crypto | Yes | Yes | Yes |

| Indices | Yes | Yes | Yes |

Investment Options

Some prop firms invite individuals to invest in traders in order to receive a percentage of their profit. Such platforms have no other options for investing, like purchase of dividend shares or cryptocurrency staking. Sometimes partnership programs are considered as an investment decision when a trader receives payments for inviting new users.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Reason why Finotive Funding does not have a referral program:

As a rule, the referral (partnership) program is based on using special links. Traders post such links on the internet and everyone who clicks them and registers with a prop firm brings them fixed profits or a percentage of the initial fee. Prop trading firms use referral programs to stimulate the influx of new partners. But sometimes firms do not need to do this. Finotive Funding is currently highly in demand and has thousands of partners globally, therefore, additional involvement is inappropriate at the moment.

Customer support

Technical support is necessary if a trader faces an unusual situation or cannot find the answer using the FAQs. The Finotive Funding support is considered one of the highest quality, because it works without breaks and days off, and gives expert answers. Two communication options are available, namely email and live chat. Also there are tickets in the corresponding section of the website.

Advantages

- Technical support responds promptly, especially in live chat

- Non-members of the prop firm can contact support

Disadvantages

- No call center

To get help from the support managers, you can use one of the following channels:

-

Email;

-

Live chat;

-

Tickets in the Contact section.

If you address support through tickets, the response will come to your email. The fastest way to communicate is via live chat.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | Honvéd utca 8. 1st floor, 1054 Budapest, Hungary |

| Official site | https://finotivefunding.com/ |

| Contacts |

Education

The prop firm is interested in its partners to trade successfully, because it receives part of their profits for providing funds for trading. In this regard, some platforms place training materials on their websites, hold webinars, and publish analytics. However, Finotive Funding has another approach to the issue. You can find only the basic FAQs on the website of this prop firm.

As you can see, Finotive Funding assumes that its partners are experienced traders. This is logical, given that for Classic Challenge accounts you need to complete a challenge, while trading with one of the Instant Funding accounts with no experience in trading is foolhardy.

Comparison of Finotive Funding to other prop firms

| Finotive Funding | FundedNext | Hola Prime | SabioTrade | FTMO | Earn2Trade | |

| Trading platform |

MT5 | MetaTrader4, MetaTrader5, cTrader | MetaTrader5, Match Trader, DXTrade, cTrader | Exclusive QuadCode trading platform (web, mobile app, desktop) | MetaTrader4, MetaTrader5, cTrader, DXTrade | NinjaTrader, R Trader Pro, Finamark, Overcharts |

| Min deposit | $50 | $32 | $48 | $119 | $155 | $150 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:1 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0.1 points | From 0.9 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | No | No | 100% / 50% | 50% / 50% | 10% / 10% |

| Order Execution | No | N/a | Market Execution | Market Execution | Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of Finotive Funding

Usually, experts are suspicious of the prop trading firms that have existed on the market for only a couple of years. Finotive Funding is an exception for a number of reasons. First, the firm is founded by a professional trader and is supported by a large enterprise. Second, it is the first-level platforms from the Deep Liquidity pool that act as liquidity providers, not brokers. Third, the trading conditions of Finotive Funding are objectively profitable in most aspects. Of course, the profit split of 55% is not the best market indicator, but we are talking about instant funding up to $100,000 without completing any challenge. On standard accounts, the parameters are much more loyal. In addition, reasonable restrictions like a mandatory stop loss, as well as a large choice of financial instruments, allow you to successfully diversify trading risks.

Finotive Funding by the numbers:

-

The initial balance is up to $200,000;

-

The average spread is 0.2 pips;

-

Speed of order execution is less than 15 ms;

-

Maximum leverage is 1:400;

-

More than 60 currency pairs are available for trading.

Finotive Funding is a universal prop trading platform

There are a lot of prop firms with favorable conditions that have one key minus: they offer the only group of financial instruments. Usually it is currency pairs, because they are the most traded. However, many traders are also interested in stocks and indices. Considerable benefits can be obtained as a result of competent work with futures as well. In recent years, cryptocurrencies have gained more and more popularity. Finotive Funding allows you to use all of the above instruments, which is an indisputable advantage. When there is the opportunity to trade different assets, traders do not have to limit themselves. Moreover, traders can diversify risks working with several instruments at once. To make increased profit it is necessary to reduce risks by all means when you trade with high leverage.

Useful features offered by Finotive Funding:

-

If traders do not want to go through a standard challenge, they can choose an account with a one-phase test. It is also possible to get funding instantly, without completing a challenge;

-

All account types have a small step in balance. The prop trader offers six options ranging from $2,500 to $100,000 or $200,000, depending on the account. Such a wide choice makes the proposal more targeted;

-

All partners have their own dashboard in their user account on the firm’s website. On this panel, all information on active accounts with the possibility to detail any parameter is aggregated.

Advantages:

At the start, traders can get up to $200,000. This is a Classic Challenge account with the initial fee ranging from $50 to $950;

Scaling is available for all account types, regardless of conditions. The maximum balance is $3,200,000;

Traders are practically not limited in their work. All they need is to avoid a large drawdown and not forget to insert a stop loss;

The prop firm is loyal to all types of strategies. Holding positions, trading news, trading during weekends, and usage of advisers are all allowed;

If traders do not intend to scale the balance, the firm does not insist. In this case, there is no profit target;

More than 60 currency pairs, cryptocurrencies, stocks, indices, and futures are available for trading. The maximum leverage is 1:400;

MetaTrader 5 is considered one of the most convenient and innovative trading platforms, it is easily mastered and customized.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i