deposit:

- $250

Trading platform:

- MetaTrader4

deposit:

- $250

Trading platform:

- MetaTrader4

- The challenge has no time limit, A target profit of 10% is required, The maximum drawdown is 10%, and the daily drawdown is 5%, 5 plans and all are scalable to $1 million, and The initial deposit is refundable.

- 1:10 (1:20 for a fee)

Summary of Nordic Funder Trading Company

Nordic Funder is a moderate-risk prop trading firm with the TU Overall Score of 5.73 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Nordic Funder clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. Nordic Funder ranks 17 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Nordic Funder prop trading company provides favorable collaboration conditions. The minimum deposit is low and refundable. The challenge is standard, with no time limit. There are numerous plans, and all are scalable. Moderate leverage, sufficient assets for risk diversification, and various strategies are available. Unfortunately, this company lacks alternative earning options, has transparency issues regarding fees, and does not facilitate stock trading. However, traders use MetaTrader 4 and have freedom in their decisions.

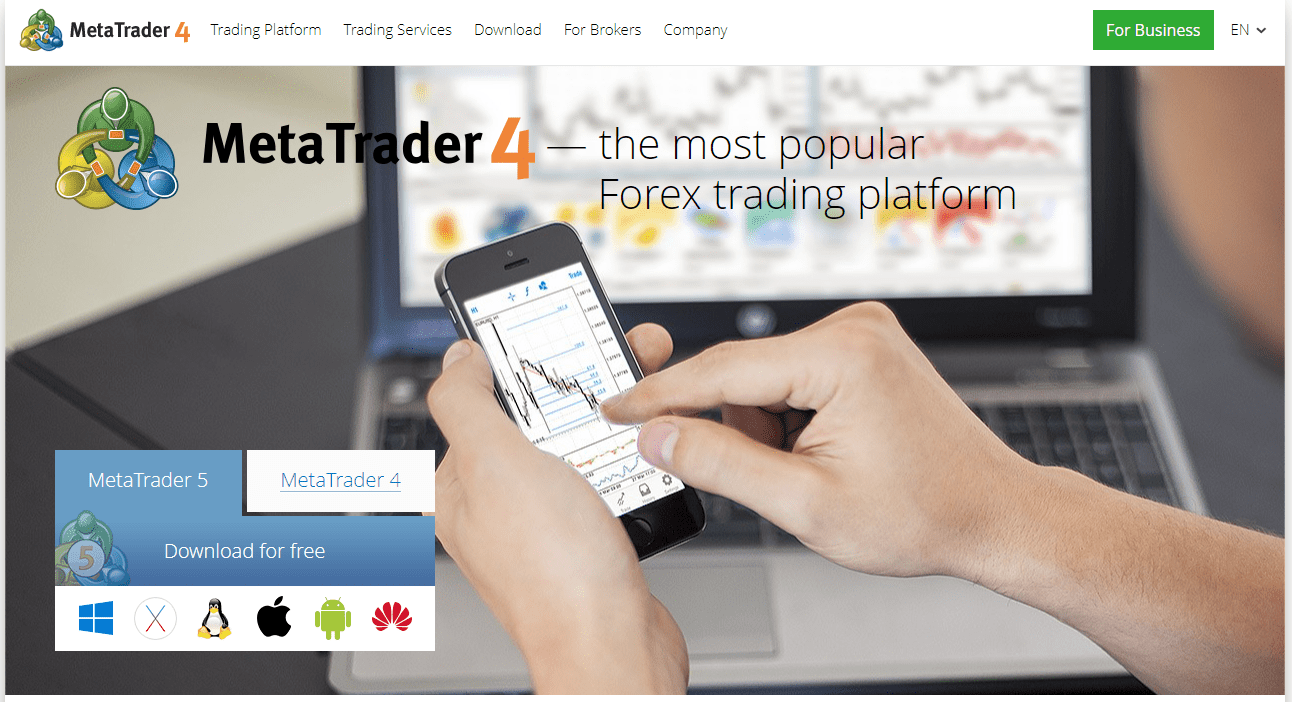

Nordic Funder is a proprietary (prop) trading company that offers 5 plans to its clients. Clients can get funding that ranges from $25,000 to $400,000. Regardless of the chosen plan, a balance scaling up to $1 million is available. The initial deposit starts at $250, refundable upon the successful completion of the challenge. There is no time limit to qualify as long as the trader achieves a 10% profit from the capital. Subsequent scaling requires the same profit. Also, the balance doubles upon each subsequent scaling. The maximum daily drawdown is 5%, with a total of 10%. Leverage up to 1:10 (up to 1:20 for an additional fee) is available. Initially, traders receive 50% of the profit, which can be increased to 90% for a fee or during scaling. Trading is conducted through the MT4 trading platform, and this company collaborates with the broker Scandinavian Capital Markets. No restrictions are imposed, and most trading strategies and methods are acceptable.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From $250 |

| ⚖️ Leverage: | 1:10 (1:20 for a fee) |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, oil, and metals |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Nordic Funder:

- There are 5 plans with initial funding up to $400,000, and each plan is scalable up to $1 million.

- Initial deposit starts at $250, fully refunded after the successful completion of the challenge.

- No time limit on the challenge; qualification requires a 10% profit.

- Traders are not restricted in trading styles and methods; advisors and copy trading are permitted.

- Trading via the MetaTrader 4 platform is customizable with plugins.

- ECN/STP accounts offer currency pairs, cryptocurrencies, indices, oil, and metals with leverage up to 1:10/1:20.

- Nordic Funder collaborates with the reputable Scandinavian Capital Markets broker.

👎 Disadvantages of Nordic Funder:

- There are no passive earning options; clients can earn only through active trading.

- There is a limited variety of assets, some popular classes are not represented, such as stocks.

- This company does not specify withdrawal fees on its website, but trader reviews suggest significant fees.

Evaluation of the most influential parameters of Nordic Funder

Table of Contents

Geographic Distribution of Nordic Funder Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Nordic Funder

Nordic Funder is a relatively young proprietary trading company registered in Sweden. It collaborates with Scandinavian Capital Markets, one of the most well-known Scandinavian brokers offering various types of ECN/STP accounts with low trading costs.

Clients of Nordic Funder have the option to choose among 5 plans. The advantage of this broad selection is that, at the outset, one can secure practically any capital ranging from $25,000 to $400,000, and all plans are scalable. Scaling is necessary to increase the balance (which doubles each time, up to $1 million. ) It also determines the profit split between the trader and this prop company, depending on the level. Initially set at 50/50, this may not be the most favorable split in the market, but it's not uncommon. Through scaling, clients can increase their share to 90%, which is also possible for an additional fee. The 90/10 split offers very favorable conditions, comparable to top-tier offerings.

Importantly, the target profit for scaling is the same as during the challenge, namely 10%. The maximum drawdown is also the same at 10%, with a daily limit of 5%. These are reasonable metrics, similar to those of most prop trading companies. The nuance is that Nordic Funder does not impose time restrictions on its clients as they can complete the challenge at their own pace or choose not to scale at all. Scalping, hedging, news trading, and most styles and methods of trading are allowed. Users can employ bots and advisors and even copy trades. However, this company itself does not offer copy trading or other alternative earning methods.

The website lacks educational resources and specialized tools for fundamental and technical analyses. While the assets are diverse, their quantity is not substantial. Unfortunately, this company is characterized by a lack of transparency, for instance, there's no information on withdrawal fees.

Taking all factors into account, experts conclude that Nordic Funder's offering is competitive, and it fulfils its obligations. Collaborating with it is considered reasonably safe.

Dynamics of Nordic Funder’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Essentially, the task of prop trading companies is to provide traders with funding and favorable trading conditions with a trusted broker. So, only a few of them offer alternative earning options to their clients, such as copy trading. Nordic Funder does not provide investment solutions, and in terms of cost-saving during trading, it's worth noting the rebate offer.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

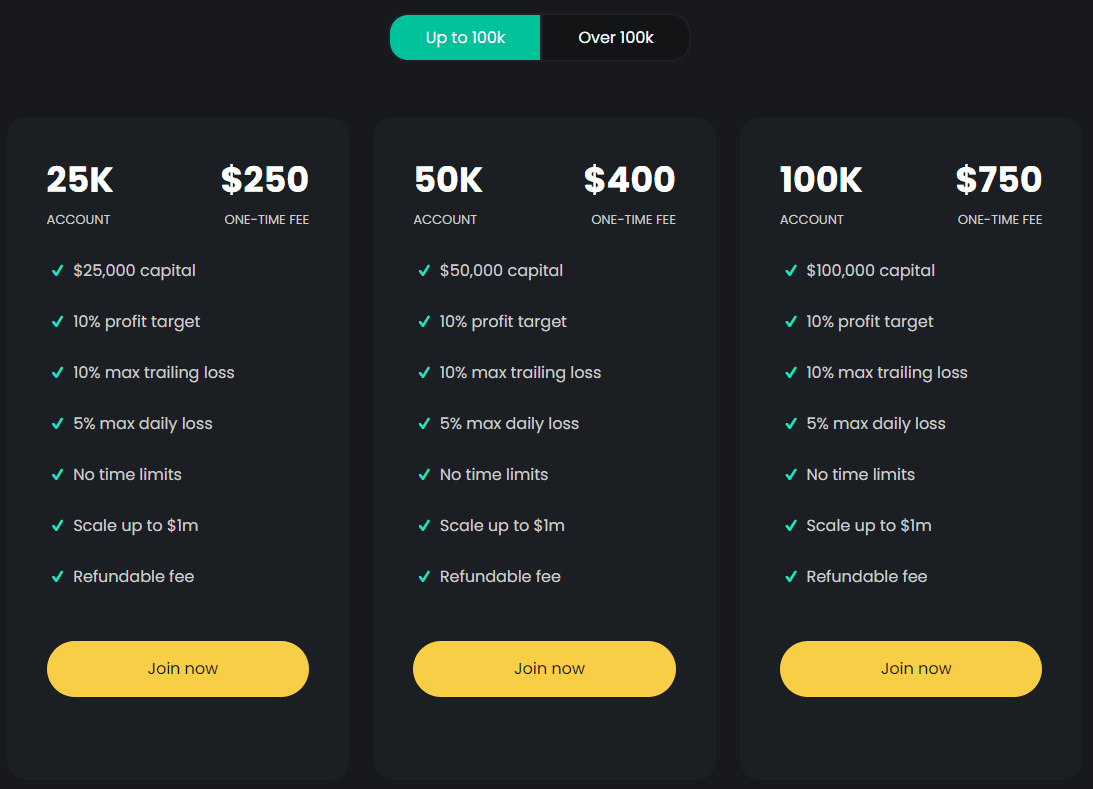

Trading Conditions for Nordic Funder Users

Proprietary trading companies typically offer several plans, each with its initial deposit. They differ in the capital available for trading and the conditions. Some in this field exclude the initial deposit, opting for a monthly subscription fee instead, but Nordic Funder has chosen the standard approach. When choosing the 25k plan, a trader needs to deposit $250. If they complete the challenge, the deposit is fully refunded. (This condition applies to other plans as well). For the 50k plan, the deposit is $400, for the 100k plan the deposit is $750, and so on. It's simple, the deposit increases with the balance growth. In the future, this prop company does not charge the trader any fees for the provided services. The maximum leverage is initially the same for all users, set at 1:10. Leverage of 1:20 can be obtained for an additional fee. Technical support is provided day and night but only on weekdays through a call center, email, and a Discord account. A Discord account is a free communication platform in one’s user account that allows traders to chat across platforms to share trading ideas, strategies, and market analysis with other traders.

$250

Minimum

deposit

1:10 (1:20)

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | 5 accounts are available |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, electronic payment systems, crypto wallets |

| 🚀 Minimum deposit: | From $250 |

| ⚖️ Leverage: | 1:10 (1:20 for a fee) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, indices, oil, and metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

The challenge has no time limit, A target profit of 10% is required, The maximum drawdown is 10%, and the daily drawdown is 5%, 5 plans and all are scalable to $1 million, and The initial deposit is refundable. |

| 🎁 Contests and bonuses: | Yes (rebates from TU) |

Comparison of Nordic Funder to other prop firms

| Nordic Funder | Topstep | FTMO | Funded Trading Plus | Audacity Capital | E8 Funding | |

| Trading platform |

MetaTrader4 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader4 | MT4, MT5 |

| Min deposit | $250 | $1 | $155 | $119 | $149 | $138 |

| Leverage |

From 1:1 to 1:10 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | Market Execution | ECN | Instant Execution | Market Execution | No | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Nordic Funder | Topstep | FTMO | Funded Trading Plus | Audacity Capital | E8 Funding | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | No | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | Yes | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | No | No | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

Nordic Funder Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| There are 5 plans | $7 per lot | Yes |

The withdrawal fee varies depending on the chosen withdrawal channel. Overall, it is acceptable, although for some channels, it may be higher than that of its leading competitors, and some do not charge any fees. It's also important to remember that additional fees may be imposed by the third party involved in the transaction, such as a bank or an electronic payment system. This prop company has no control over these fees.

The table below shows the average trading cost indicators for Nordic Funder clients and two other prop trading companies. This comparison shows if Nordic Funder's conditions are advantageous for you.

Detailed review of Nordic Funder

This prop trading company emerged relatively recently, but there are quite a few reviews and user comments about it on the internet, and they are predominantly positive. Partly, this is due to Nordic Funder's partnership with Scandinavian Capital Markets, a broker well-known in the Scandinavian countries for offering favorable trading conditions. This company itself provides quite favorable parameters for proprietary trading. There are no confirmed instances of its failure to fulfill its obligations to its clients. Nordic Funder does not offer alternative services; it focuses instead on financing traders and providing comfortable trading conditions. Perhaps that is why this company can compete with the leading representatives of the industry and has thousands of clients.

Nordic Funder by the numbers:

-

The minimum deposit is $ 250.

-

The scaling limit is $1,000,000.

-

The target profit on all plans is 10%.

-

There are 70+ trading instruments.

-

There are no additional fees.

Nordic Funder is a prop trading company for comfortable trading

For a trader, it is important to have maximum freedom of action, which includes having a large number of available assets. Nordic Funder's pool includes several dozen instruments from the following groups: currency pairs, cryptocurrencies, oil, metals, and indices. These can be traded with leverage up to 1:10 and 1:20 for a fee. The diversity of assets and leverage allows the use of almost any strategy and simultaneously builds a diversified portfolio, thereby reducing risks. Another advantage in this case is convenient scaling. The trader knows that as soon as their profit reaches 10%, their balance doubles. And so on, up to $1 million. As the balance grows, the share of payouts from profits increases. Initially, it is low at 50/50, but over time, it can be increased to 90/10, in favor of the trader. An increase is also possible for an additional fee. Full transparency and a clear understanding of the cooperation conditions, with no restrictions, allow clients of this prop trading company to work with absolute comfort.

Nordic Funder’s analytical services:

-

Traders can choose one of five plans, complete the challenge, and get back the initial deposit in full.

-

Nothing prevents this company's client from opening multiple accounts. Clients have the option to close accounts at any time.

-

Overall drawdown is up to 10% and the daily drawdown is up to 5%, which acts as protection against impulsive trader actions.

-

The number of lots depends on leverage and balance. Having $100,000 in the account and a leverage of 1:10, a trader can keep 10 lots open simultaneously.

-

This company does not set strict activity parameters; clients just need to trade at least once in a 30-day cycle.

Advantages:

This company is officially registered and operates with the well-known and trusted broker Scandinavian Capital Markets.

This prop trading company's pool includes over 70 instruments from different groups such as currency pairs, cryptocurrencies, oil, metals, and indices.

The trader pays only a refundable initial deposit, and there is no subscription fees or additional costs.

All accounts can be scaled up to $1 million. Upon reaching the profit goal, the account balance doubles.

This company's client support is provided by a call center, email, and the Discord channel.

Guide on how traders can start earning profits

First, the trader needs to choose a plan. Nordic Funder offers five plans from $25,000 to $400,000 on the balance, with a starting deposit ranging from $250 to $4,000. The other plans have the same parameters. However, the difference also lies in the number of steps to the scaling limit, which is $1 million. Starting from $100,000 or $400,000, it is easier to get a profit share of 90% compared to if you start at 50%. It makes sense to choose a plan based on your experience, ambitions, and financial capabilities. Nordic Funder clients only have access to MetaTrader 4. Its conceptual advantage is that it can be highly customized with hundreds of free plugins.

Plan types:

Nordic Funder clients undergo the challenge on a demo account, not a real one. They pay the fee before trading on the demo. If a user successfully achieves the 10% profit goal, they get back their deposit and continue trading on a real account without restrictions, and with scaling possibilities. If, for some reason, a trader fails the challenge, exceeds the drawdown level, or violates trading rules, they can start again on the same or another plan, but the fee will have to be paid again.

Bonuses from Nordic Funder

Some prop trading companies offer special bonuses to their clients. Often this refers to a discount on the initial deposit or subscription fee. Nordic Funder does not run special promotions. However, its clients still have the opportunity to obtain unique financial benefits.

Investment Education Online

Some prop trading companies offer educational programs to their clients. These programs are usually aimed at beginners, occasionally at intermediate-level traders, and rarely at professionals. Nordic Funder does not provide any educational programs. This company assumes that if a trader registers with them and applies for funding, they already have at some experience.

The FAQs section presented on the Nordic Funder website includes only a few questions. The main information about working with this company can be found on other pages of the site. If a trader wants to broaden their trading knowledge, they will have to use other resources.

Security (Protection for Investors)

Prop trading companies don't require monitoring by a regulatory agency. They just need to be registered as investment platforms. After all, they only provide funds to traders and don't execute their trades on international markets. This is done by the broker with whom this company collaborates. A broker, on the other hand, needs not only registration but also regulation, so that clients can trade in confidence. Nordic Funder collaborates with Scandinavian Capital Markets. This broker is registered with the Swedish Financial Supervisory Authority (Finansinspektionen) under number 80438. Nordic Funder is also registered in Sweden. This means that its clients are dealing with a reliable organization that fulfills its stated obligations.

👍 Advantages

- This company is officially registered.

- It operates with a licensed broker.

- No open conflicts with clients have been noted.

- Contact Traders Union’s legal department for a consultation and representation. It protects its members’ rights without charge.

👎 Disadvantages

- This company's clients cannot obtain regional protection beyond Sweden.

Withdrawal Options and Fees

-

While a trader is undergoing the challenge, they trade on a demo account and do not earn profits.

-

After completing the challenge, this prop trading company's client trades without restrictions on a real account and, if successful, can withdraw their share of the profits at any time.

-

Withdrawals can be made to a bank account, bank card, cryptocurrency wallet, or through an electronic transfer system.

-

The withdrawal process is initiated by submitting a request in the user's user account on this prop trading company's website.

-

Nordic Funder charges a withdrawal fee, which will be known in advance during the request submission.

-

Additionally, a fee may be charged by a third party participating in the transaction, such as a bank or electronic payment system.

Customer Support Service

Can the funds be deposited with a Visa card? What happens if I don't complete the Challenge? Is a transfer to a U.S. bank account available? Traders may have many questions about working with this company. If so, they may contact technical support, and if its response is prompt and competent, the client maintains a positive attitude and returns to trading. To preserve and increase the loyalty of traders, Nordic Funder offers assistance through the call center, by email, and in Discord. The support is available 24/5.

👍 Advantages

- Traders can use three communication channels.

- Even unregistered users can contact support.

- Managers are available around the clock except on weekdays.

👎 Disadvantages

- Client support does not operate on weekends.

Whether you're already collaborating with Nordic Funder or planning to become a partner with this prop trading company, in case of any difficulty, don't waste time, reach out to client support immediately. It is there to eliminate your concerns.

You can use the following communication methods:

-

Nordic Funder on Discord;

-

Email;

-

Call to the support section.

Nordic Funder also has profiles on Facebook, X (formerly Twitter), and Instagram. You can contact client support through these platforms. It makes sense to subscribe to this prop trading company’s page to promptly receive its latest updates.

Contacts

| Official site | https://nordicfunder.com/ |

Review of the features of Nordic Funder’s user account

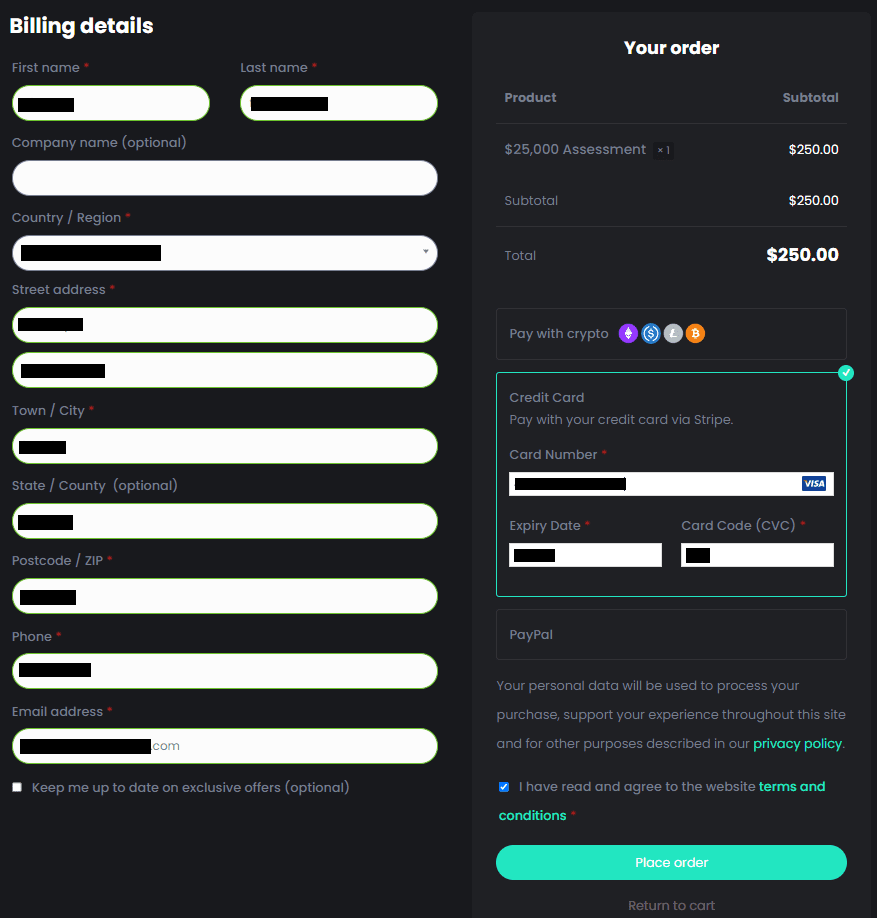

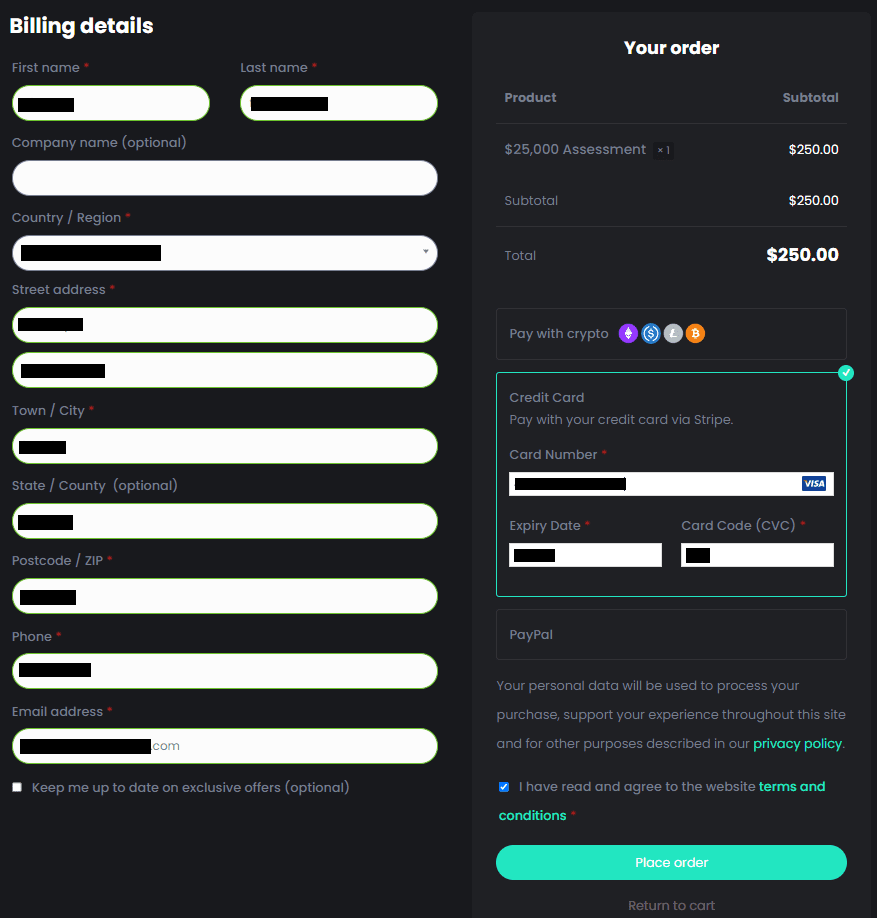

Go to this prop trading company’s website.

Scroll down the main page to the list of plans. Choose a plan and click the "Join Now" button.

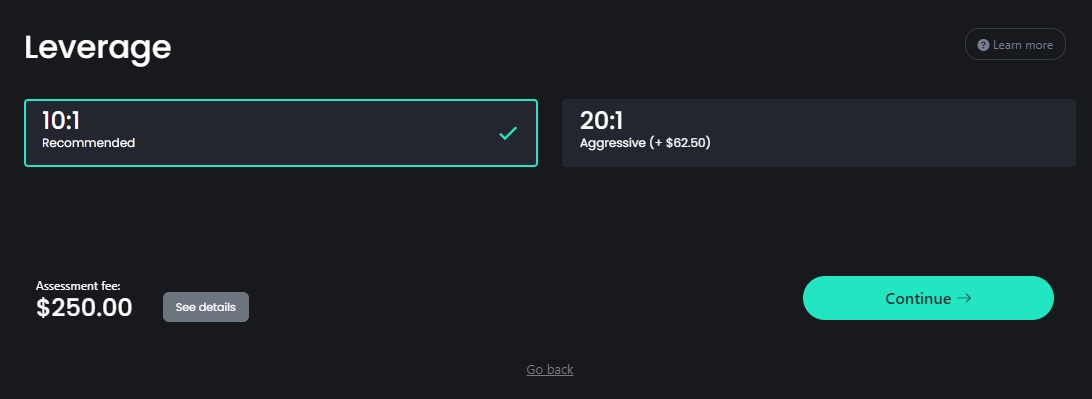

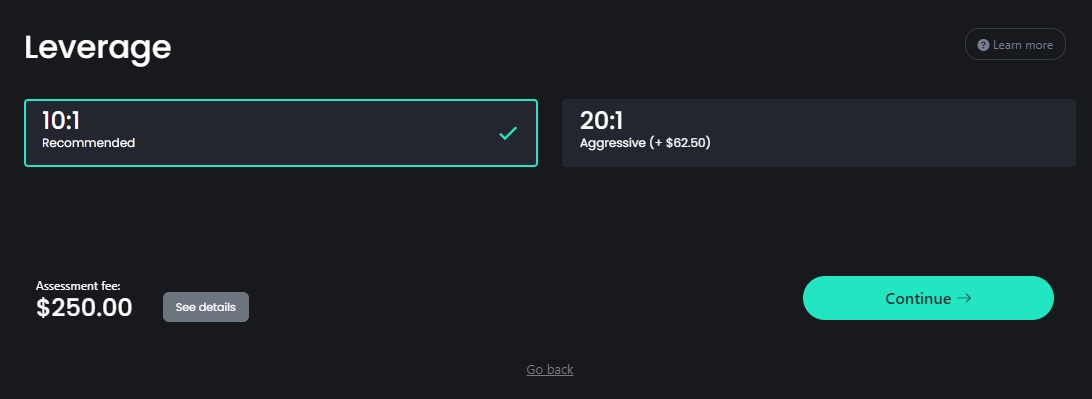

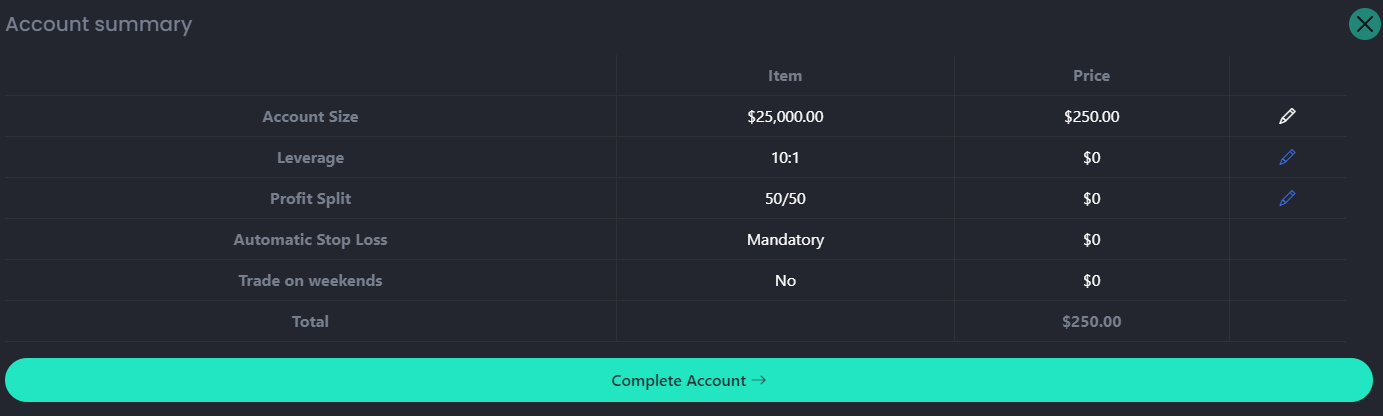

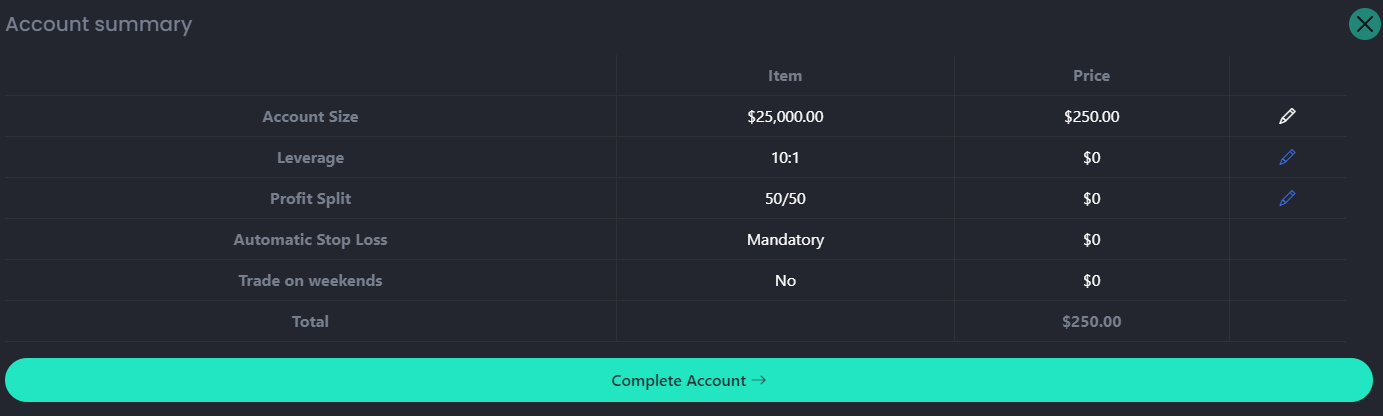

Choose the leverage. It is typically 1:10, but for an additional fee of $62.50, it can be increased to 1:20. Click "Continue".

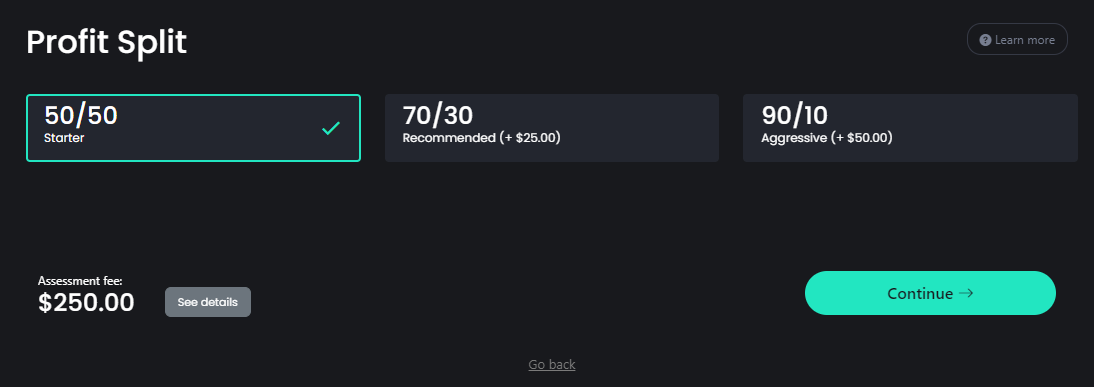

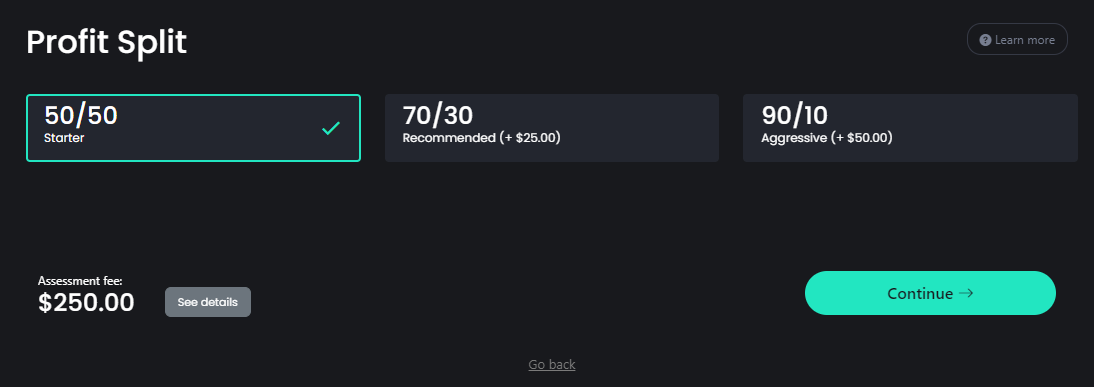

Specify profit distribution. The standard is 50/50. For $25, a more favorable ratio of 70/30 can be obtained; and for $50, it can be increased to 90/10. Profit share can also be increased during scaling. Click "Continue”.

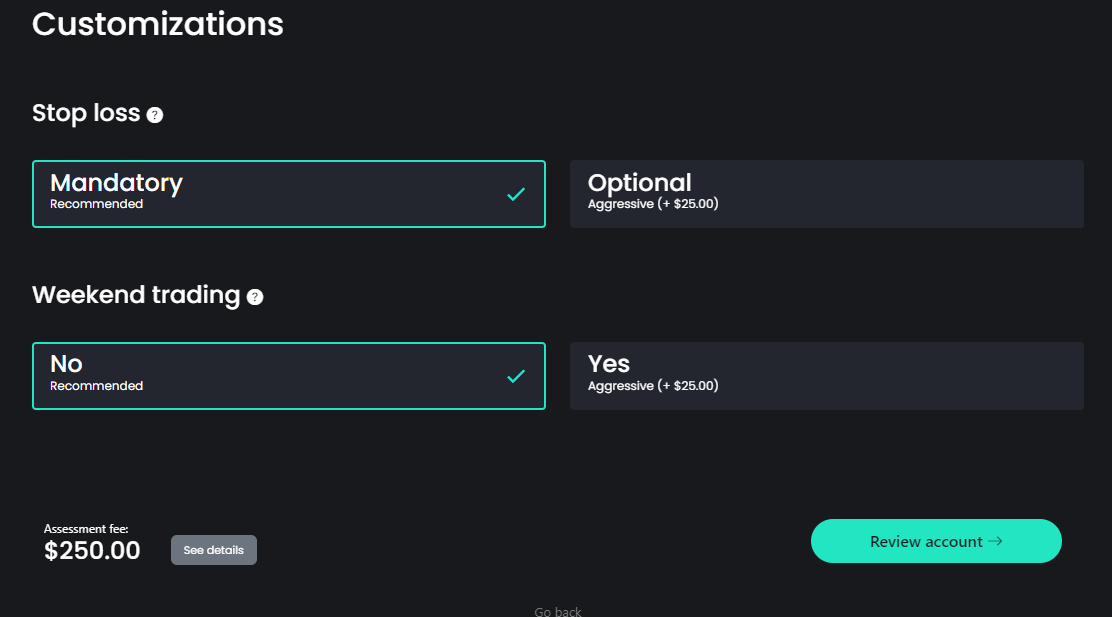

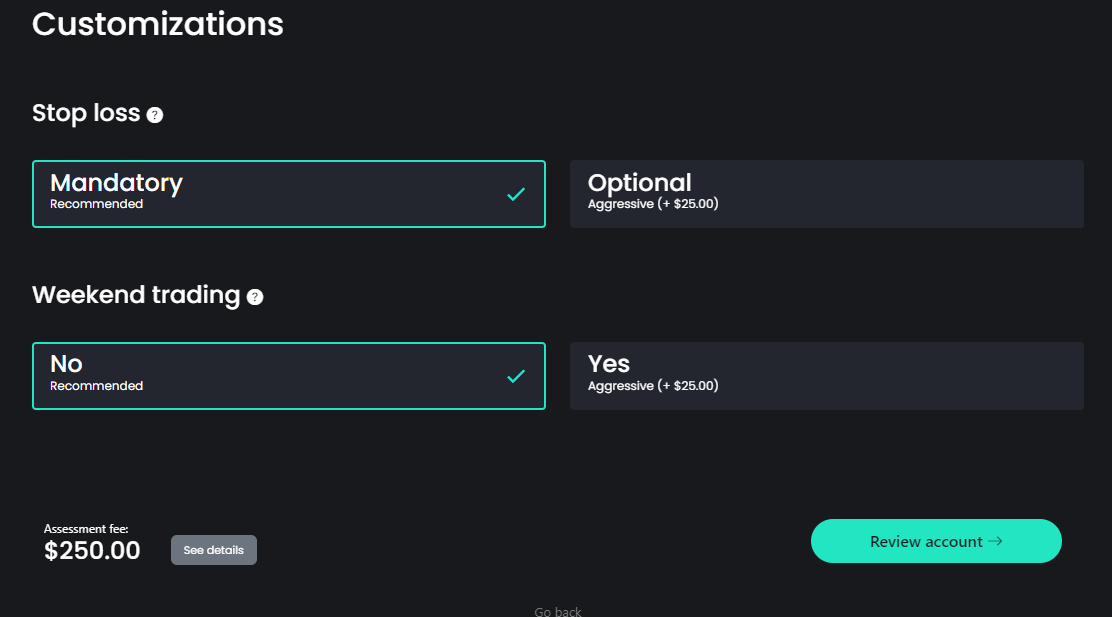

Choose additional plan parameters and click "Review account."

If everything is correct, click "Complete account."

Enter your name, surname, country of residence, full address with postal code, phone number, and email. Then, on the right side of the screen, choose the payment channel for the initial deposit and enter the required information. Agree to the terms of service by checking the box. Click "Place Order".

Wait for payment confirmation to gain access to the user account. Here, you can download the MetaTrader 4 trading platform to start the challenge. The platform distribution is also available on the official MetaTrader page.

Your Nordic Funder user account also allows you to:

-

Open and close accounts with different plans and get information on active accounts.

-

Pay initial deposits for new accounts and submit profit withdrawal requests.

-

Update personal information and adjust account security parameters.

-

Download the MetaTrader 4 trading platform.

-

Contact this prop trading company's technical support.

Disclaimer:

Your capital is at risk. Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Nordic Funder rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Nordic Funder you need to go to the company's profile.

How can I leave a review about Nordic Funder on the Traders Union website?

To leave a review about Nordic Funder , you need to register on the Traders Union website.

Can I leave a comment about Nordic Funder if I am not a Traders Union client?

Anyone can post a comment about Nordic Funder in any review about the company.

Traders Union Recommends: Choose the Best!