FSC | Financial Regulator Of Belize

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The Financial Services Commission of Belize regulates the non-banking sector of that country. The Commission issues licenses to brokerage, investment, and insurance companies, collects and analyzes information about the operation of its licensees, develops the jurisdiction’s financial sector, and assists in organizing effective interaction between all financial market participants.

In many countries, a financial regulator is an independent government body responsible for the licensing and control of legal entities in the banking and non-banking sectors. Regulators perform in-depth inspections of licensees’ financial documentation, organizational structure, risk management system, and foundation documents at the time of registration. They control licensees’ compliance with the local law, counteract fraud, abuse and the usage of insider information, and protect clients’ rights, and control licensees’ fulfillment of their requirements.

The necessity to follow the regulator’s rules, keep operations transparent, possess registered capital required by the regulator, go through yearly audits, observe the account segregation rule, etc

Freedom of licensed brokers to advertise their services

For a trader, a valid license means that a broker is a real company abiding by the law. If a trader’s rights are violated, a regulator can revoke the license in the acquisition of which the broker invested time and money. Therefore, brokers aim to uphold a positive reputation and operate transparently.

This post explores the functions, advantages, and complaint submission procedure, as well as reviews and an expert’s opinion of FSC Belize.

Description and functions of the FSC Belize

The FSC’s predecessor, the International Financial Services Commission of Belize (IFSC), was created in 1999. Prior to its establishment, the banking sector was controlled by the National Bank of Belize. But due to the country’s simplified tax regime, the number of registered companies grew every year. In 1999, the IFSC was entrusted with the supervision of the whole non-banking sector of the jurisdiction. In 2021, the IFSC was transformed into the FSC and given additional responsibilities.

Tasks and purposes of the FSC Belize in the Forex market

Issue licenses and certificates

Keep accounts for the National Bank and government bodies

Inform licensees about forthcoming changes and innovations in the financial field

Assist government bodies in the development of statutory documentation

Analyze yearly financial statements

Consider complaints

The FSC Belize is an offshore regulator that carries out auxiliary functions. It maintains order in the interaction between all participants in the Belizean financial sector and responds to obvious violations of the law. The FSC does not have the power to make key decisions on its own. The ways in which it influences offenders include warnings, small fines, and license revocation. Control of each licensee comes down to the general examination of documents at the time of registration. After that, the FSC only collects brokerage statements.

To obtain an FSC license, a broker has to

Complete registration documents. The registration form of 4-5 sheets can be found on the Commission’s website

Open an account at a Belizean bank and freeze the funds in it. This is an analog of the requirement for minimum registered capital. Deposit for an international license is from $100,000. Deposit for a local license, which does not give brokers the right to provide services in international markets, is from $25,000. The amount can be increased

Provide the founders’ personal information

Provide documented confirmation of the management team’s competence in the financial field

Pay fees. There may be other expenses

Documents review takes 1-3 months. Registration conditions are lenient: executives are not required to be personally present, and opening a physical office in Belize is not needed. Requirements for minimum registered capital are several times lower than European regulators. Brokers also don’t have to disclose their organizational structure, technologies, and risk management system.

Official website

The Commission’s website has a complex, but comprehensible structure. The content is mostly introductory. The FSC Belize website features financial legislation, registration rules, a list of licensed legal entities, news, and much more. The website’s structure is as follows:

Main menu and a downloadable FSC Strategic Plan at the top

FSC Belize Review — Website sections

FSC Belize Review — Website sectionsCentral part with public notices, laws and regulations, and guidelines and procedures

FSC Belize Review — Website sections

FSC Belize Review — Website sectionsThe part below features information about government agencies, with which the regulator works closely

FSC Belize Review — Website sections

FSC Belize Review — Website sectionsFooter contains the regulator’s contact information

FSC Belize Review — Website sections

FSC Belize Review — Website sections

International cooperation. Exchange of tax information with other jurisdictions and international agreements within which the Commission’s licensees can operate

Domestic cooperation. Structure of internal government agencies responsible for the regulation of various sectors of Belize’s economy

Career. The Commission’s vacancies

About Us. Information about the Commission’s objectives, mission, and team

Regulatory framework. Legislation, regulations, standards

Licensing. License verification, applying for a license, authorizations, and licensed service providers

Compliance. Supervision, AML/CFT (Anti-Money Laundering and Countering the Financing of Terrorism), on-site examination and off-site surveillance, and scams targeting FSC clients

Enforcement. Enforcement activities, disciplinary proceedings, and complaints

Library. Publications, news and press releases, industry updates, warning notices, guidelines and guidance notes, etc

Some sections are especially important for traders. In Licensing, you can confirm a broker’s license. In Enforcement, you can file a complaint. It is also useful to view the news and warnings regularly. A broker’s license may remain valid, but fines or official warnings issued by the regulator are reasons to be on guard.

How to confirm a broker’s license on the FSC Belize website

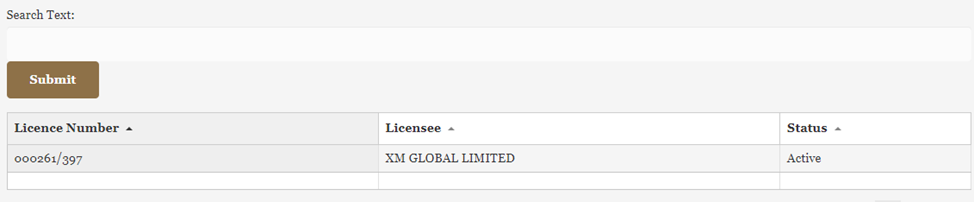

The information on the website is well-structured and therefore finding a license is easy.

On the broker’s website, find its license number. It can be in the homepage’s footer, FAQs, or About Us

On the FSC website’s homepage, go to Licensing/License Verification

FSC Belize Review — Website sections

FSC Belize Review — Website sectionsEnter the license number

FSC Belize Review — Website sections

FSC Belize Review — Website sections

Unlike the FCA or CySEC, the Belizean regulator only displays whether a license is active or not. Its type, expiry date, and other details can be found out on a separate request.

FSC’s basic requirements for brokers

Hold at least $25,000 or $100,000 in the transaction account. The amount depends on the type of license. This condition is an analog of the requirement for minimum registered capital

Limit cooperation with Belize residents and do not open accounts in the national currency

Go through yearly audits and provide statements

The main requirements come down to freezing a fixed amount in the account and the absence of violations of local laws.

FSC Belize license | Pros and cons

The authority of an FSC Belize license is relatively low. Brokers register in Belize to optimize taxation, and a license is not so much a goal as an additional option for them. In theory, the FSC can cancel a license because of violations, but it’s not an obstacle for brokers. Most of them keep operating in international markets under the laws of separate countries where they provide services.

- Main advantages of trading with an FSC-licensed broker

- Main disadvantages of trading with an FSC-licensed broker

- The broker passed an initial examination. Its financial documents and founders’ personal details were reviewed. The executives confirmed their qualifications

- The regulator’s help in a disputed situation. Sometimes, this argument helps to resolve an issue in the trader’s favor

- Superficial control. The regulator collects financial statements but does not require full information disclosure. It is also not necessary to segregate accounts or open a physical office in the jurisdiction. A broker’s existence online is sufficient

- No compensation fund.

Most fraudulent companies exist on the internet only. They don’t have a legal registration, don’t create substantive websites, and often disappear after a trader makes a substantial deposit. Or, they may block the deposit because they know the trader can’t go to any authority. A license testifies that a broker has real founders, a legal address, and professional experience. Such a broker is less likely to resort to fraud as its reputation is more important to it.

An FSC Belize license is of little use to a trader. It is better than nothing, but it has little reassuring effect. At least, a license means that a broker indeed exists legally and its constitutional documents were reviewed by the regulator. But traders’ interests aren’t actually protected. Information about license types is not publicly available, inspection of brokers is informal only, and there are no real examples of how private traders received help.

FSC Belize jurisdiction

The FSC Belize entitles its licensees to operate within and outside its jurisdiction. The Commission grants two license types: international and local. The first type enables brokers to provide services internationally on the condition that they do not contravene the laws of traders’ countries. Obtaining and keeping such a license requires a broker to freeze $100,000 in its account in Belize. The local license type permits providing services in Belize only and requires freezing from $25,000.

Some brokers like to use this loophole. A broker acquires a local license that imposes a lot fewer obligations, but prohibits providing brokerage services outside of Belize. The license number is included on the broker’s website, but to find out the license type, a trader has to submit a separate request to the Commission; this information is not on the FSC website. Therefore, the Commission does not consider complaints by non-residents. In fact, the broker is violating the license acquisition conditions, but the FSC ignores it.

Submission and consideration of complaints

In theory, the regulator considers all complaints regardless of the deposit amount or the number of traders. But practically, there is no confirmation of it. The FSC website does not feature examples where concrete issues were resolved. It is unclear what kind of complaints are considered first and foremost. In trader forums, there are no reviews by those who have applied to the FSC.

Complaint submission procedure:

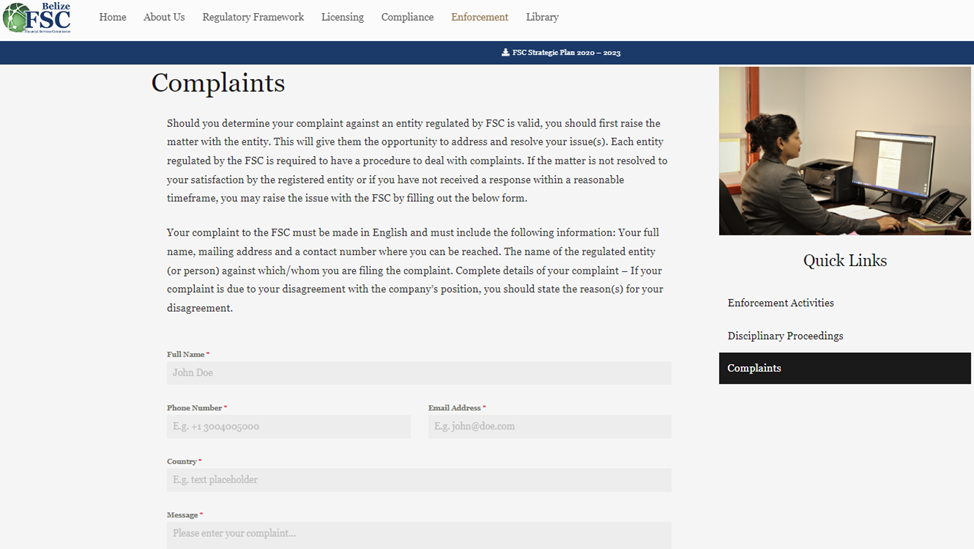

On the FSC website’s homepage, go to Enforcement and select Complaints

FSC Belize Review — Website sections

FSC Belize Review — Website sectionsComplete and send a form

FSC Belize Review — Website sections

FSC Belize Review — Website sections

Unfortunately, it is unknown whether the regulator will receive and consider your complaint and how long it will take. You cannot attach screenshots to the form. Information that your application received a unique number and was sent does not arrive at the email address you included in your application. This has been confirmed by the author of this review.

Overall:You can send any number of complaints to the FSC Belize using the form on the website, but results are not guaranteed because you won’t be able to prove to the regulator’s support team that you have created an application on the website. For this reason, TU recommends sending a copy of your complaint to the regulator’s email address with a read notification. This way, you will at least be able to see if your message was read and prove that you sent it on a concrete day

FSC-licensed brokers | How to check on a broker

Do you want to save time and always know relevant information about brokers without having to visit dozens of regulators’ websites? On the Traders Union website, you will find a monthly updated Forex brokers rating. Every month, TU’s analysts view regulators’ websites, checking on active licenses and analyzing news about fines or warnings. Every broker may have several licenses, and all information about them is available on TU’s website.

Expert’s assessment

The FSC Belize is an offshore regulator with an average trust level determined by the inactivity of the regulator itself. In theory, the FSC has to strictly control its licensees. But at this point, neither on the internet, nor on the Commission’s website, can you find information about large fines, sanctions, investigations, or the suppression of illegal activities. Although to improve its reputation, the Commission should publish such information transparently.

The Commission’s tasks come down to coordinating the interaction between non-banking sector participants. Practically, the FSC does not take preventative measures. Its mission is to develop the financial sector, simplify communications, and resolve disputes between licensees. Dealing with private individuals’ problems is only theoretically included in that list.

Interestingly, the local legislation forbids brokers with international licenses to provide services to Belize residents. Apparently, the state understands the possible consequences for the national economy.

Conclusion

Registration in Belize is popular among brokers due to beneficial taxation and nominal control by the FSC. The regulator nominally collects financial statements (without publishing them), and brokers try not to commit evident violations of the law. Such a model satisfies everyone, but traders. The regulator doesn’t have a compensation fund, and account segregation only exists in word. FSC-licensed brokers don’t disclose segregation details. Consideration of complaints is only formal. A trader shouldn’t count on real help from the FSC in settling disputable situations with brokers.

About the author of this review

Oleg Tkachenko, Author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 proprietary trading strategies. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is the FSC Belize?

The Financial Services Commission of Belize regulates the non-banking sector of that country. The Commission issues licenses to brokerage, investment, and insurance companies, collects and analyzes information about the operation of its licensees, develops the jurisdiction’s financial sector, and assists in organizing effective interaction between all financial market participants.

What do I get for trading with FSC-licensed Forex brokers?

The regulator’s help in resolving disputes

A guarantee of a broker’s reliability because the regulator has reviewed its constitutional documents and information about its executives

Relevant information about a broker’s financial state and ability to fulfill its obligations. Brokers are audited yearly

The Commission performs periodical legal inspections of its licensees and, based on the results, can issue warnings or impose fines of up to $5,000. If a broker has a license, you will immediately learn about such significant violations from the FSC Belize website.

How to check if a broker holds an FSC Belize license?

You have two options:

On the FSC website’s homepage, go to Licensing/License Verification and enter the license number in the search box. You can find the license number on the broker’s website

On the Traders Union website, open the Forex brokers rating, find a particular broker, and see the current status of all its licenses, including information about warnings, fines, and sanctions, if there are any. This option is convenient in that you don’t need to look for this information on the websites of several regulators because it’s already collected and updated on TU’s website

How to submit a complaint against a broker to the FSC Belize?

On the Commission’s website, complete an application form, which can be found in Enforcement/Complaints. Registration numbers are not assigned to applications and therefore it will not be possible to see if your complaint was accepted for consideration.

Contact TU’s legal department. TU’s lawyers help every member of the Union. In any disputes with brokers, TU defends traders’ interests. This service is free

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

The Financial Services Commission of Belize regulates the non-banking sector of that country. The Commission issues licenses to brokerage, investment, and insurance companies, collects and analyzes information about the operation of its licensees, develops the jurisdiction’s financial sector, and assists in organizing effective interaction between all financial market participants.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.