Core Scientific Review 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Core Scientific is a premier blockchain technology firm renowned for managing one of the largest and most advanced cryptocurrency mining operations in North America. The company offers a comprehensive suite of services, including digital asset mining and enterprise-grade hosting solutions. By leveraging state-of-the-art facilities and cutting-edge technologies, Core Scientific ensures efficient and sustainable mining practices, catering to both institutional and individual clients seeking reliable blockchain infrastructure.

This article provides an in-depth look at Core Scientific, one of the largest blockchain infrastructure providers specializing in Bitcoin mining and high-performance computing (HPC) hosting. We explore its business model, financial performance, expansion into AI-driven computing, and key industry differentiators. Investors and crypto enthusiasts will gain insights into its market position, sustainability efforts, and future growth potential.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Core Scientific overview

Core Scientific specializes in providing digital infrastructure for high-performance computing, with a primary focus on Bitcoin mining and hosting services. Core Scientific was founded in 2017 by Michael Levitt, Aber Whitcomb, and Darin Feinstein.

The company operates dedicated, purpose-built data centers that support both self-mining operations and third-party hosting services. Additionally, Core Scientific is expanding into high-performance computing (HPC) hosting, catering to the growing demand from artificial intelligence (AI) applications.

Region of operation

The company manages a network of data centers across the United States, strategically located in Alabama, Georgia, Kentucky, North Carolina, North Dakota, and Texas. This geographical distribution ensures operational resilience and optimized access to power infrastructure, which is crucial for energy-intensive operations like Bitcoin mining and HPC hosting.

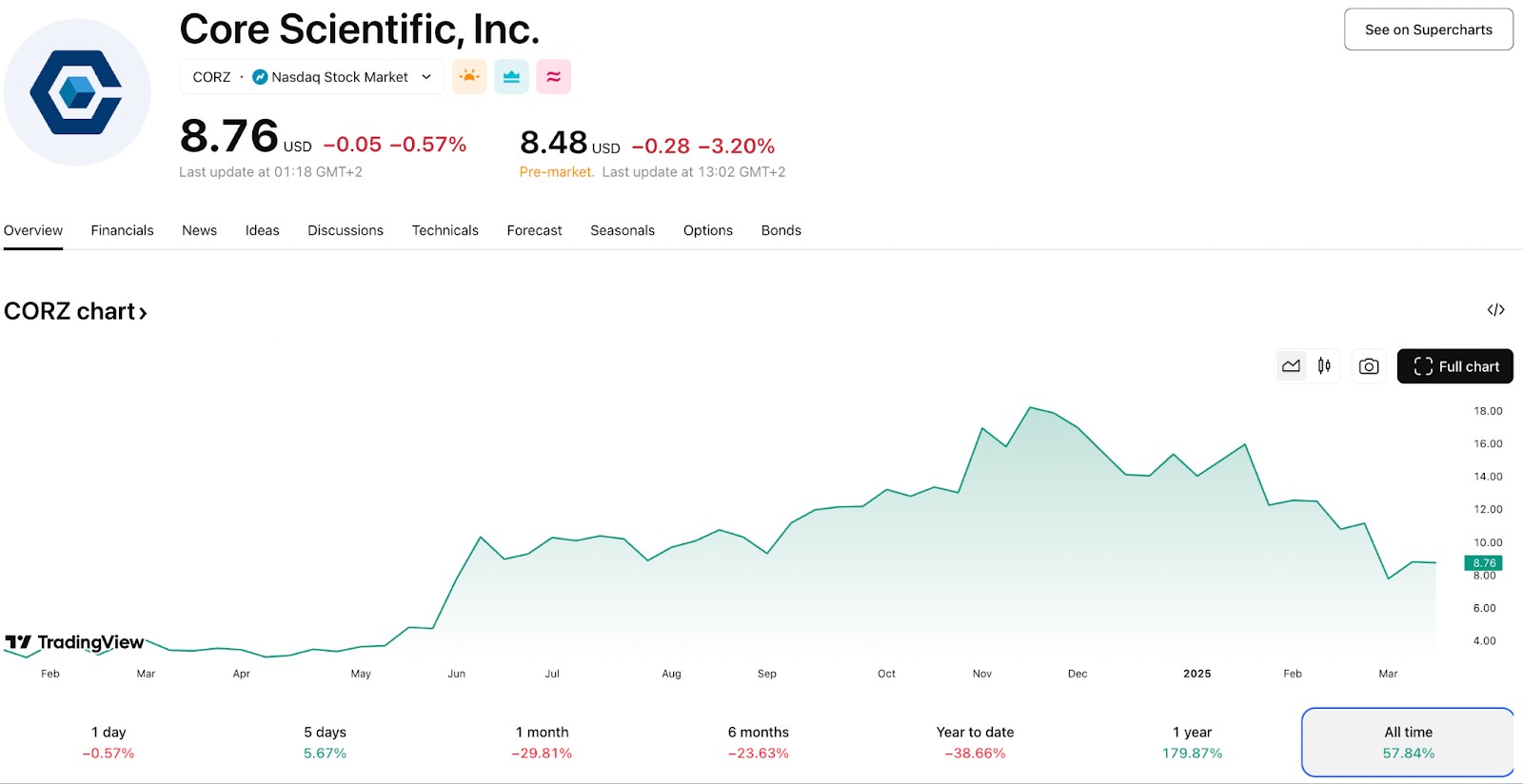

Market capitalization and recent performance

Company’s main product

Core Scientific’s services include:

Bitcoin self-mining. Operating a large fleet of mining machines to generate Bitcoin.

Hosting services. Providing infrastructure and operational support for institutional mining clients.

High-Performance Computing (HPC) hosting. Repurposing part of its facilities for AI-driven workloads and advanced computing.

Core Scientific history

Year of Emergence: Core Scientific was founded in 2017.

Main phases of development:

2017: founded and acquired its first data center.

2018-2019: expanded data centers in North Carolina, Georgia, and Kentucky, reaching 100 MW capacity.

2021: further expansion into North Dakota and Texas, increasing capacity to 250 MW.

2022: reached over 500 MW capacity, becoming one of the largest Bitcoin miners in the U.S.

2023: developed software capable of managing up to one million mining machines.

2024: secured contracts to lease data center space for AI-related computing, valued at over $8 billion.

| Company Name | Year Established | Main Focus | Market Capitalization | Key Differentiator |

|---|---|---|---|---|

| Core Scientific | 2017 | Mining/HPC Hosting | $2.59 billion | Large-scale hosting and AI integration |

| Riot Platforms | 2000 | BitcoinMining | $3.1 billion | Focus on renewable energy |

| Marathon Digital | 2010 | BitcoinMining | ~$6 billion | Large-scale mining operations |

| Hut 8Mining | 2011 | BitcoinMining | $2.95 billion | Canadian operations and AI diversification |

Interesting facts

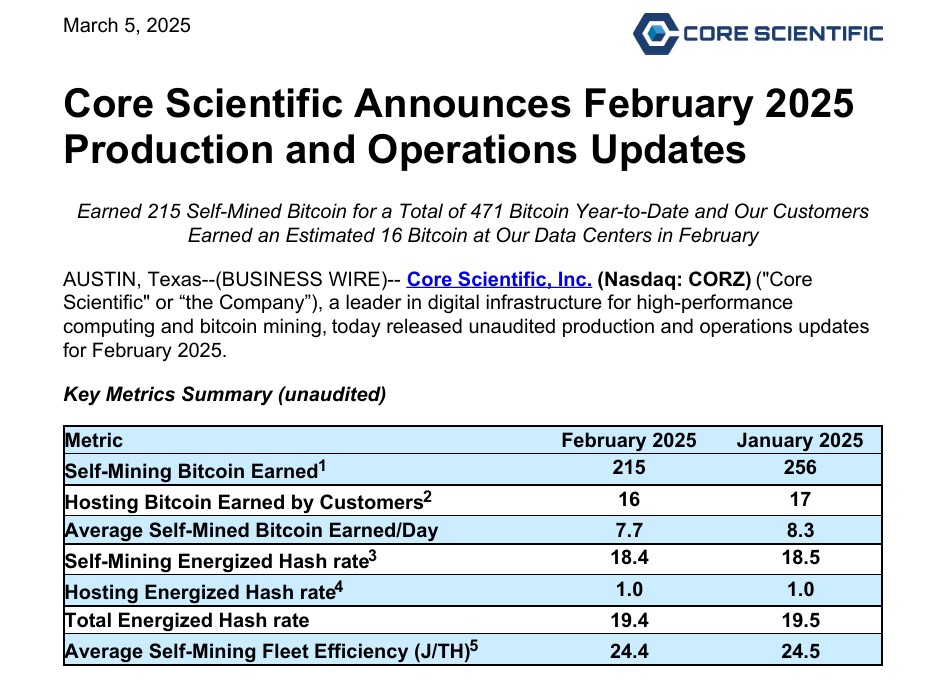

Core Scientific operates one of the largest Bitcoin mining operations in the world, with a hash rate exceeding 19.4 EH/s.

The company filed for Chapter 11 bankruptcy in December 2022 but emerged stronger in 2023 with restructured debt.

Core Scientific’s emphasis on renewable energy usage has gained attention for its commitment to sustainable mining practices.

In a recent partnership, Core Scientific collaborated with NVIDIA to enhance AI-based blockchain solutions.

Where you can buy shares/goods of the company

Core Scientific is a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol CORZ. Investors can buy shares through brokerage platforms that provide access to U.S. stock markets. Core Scientific's market capitalization is approximately $2.59 billion.

How to spot Core Scientific’s hidden growth potential before everyone else

Core Scientific isn’t just a Bitcoin miner — it’s shifting gears to make serious money in the AI space. A lot of people miss this because they only focus on Bitcoin prices. The company is converting its mining facilities into AI data centers, which could be a game changer. Instead of worrying about whether Bitcoin goes up or down, keep an eye on whether they land big AI contracts. If they secure deals with major tech firms, it could make their earnings more predictable and less tied to crypto’s ups and downs.

Another overlooked factor is electricity pricing. Core Scientific has mining sites in different U.S. states, and some of them have much cheaper power than others. This matters a lot because energy costs can make or break a mining business. Instead of just reading financial reports, check where they’re expanding and whether local laws support lower energy costs. Some states might offer incentives for using sustainable energy, which could cut expenses and boost profits. If you spot these trends early, you’ll be ahead of most investors who only look at the big headlines.

Conclusion

Core Scientific has established itself as a dominant force in the blockchain infrastructure space, offering large-scale Bitcoin mining and AI-driven hosting solutions. With a focus on energy efficiency, scalability, and strategic partnerships, the company continues to evolve beyond traditional crypto mining. As it expands its high-performance computing capabilities, Core Scientific is positioned to benefit from the growing demand for AI and cloud-based data services. Investors seeking long-term opportunities in blockchain and AI should closely monitor its developments.

FAQs

What does Core Scientific specialize in?

Core Scientific specializes in cryptocurrency mining and hosting services, as well as blockchain software solutions.

Where is Core Scientific headquartered?

The company is headquartered in Austin, Texas, USA.

Can I invest in Core Scientific?

Yes, shares of Core Scientific are publicly traded on NASDAQ under the ticker symbol "CORZ."

What sets Core Scientific apart from competitors?

Core Scientific’s scale of operations, focus on renewable energy, and strong partnerships with tech companies like NVIDIA make it a leader in its niche.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.