Quicken Review 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Quicken is a personal finance management software designed to help users track their expenses, budget, and manage their financial accounts in one place. It offers features such as bill tracking, investment monitoring, and detailed financial reports, making it easier to manage personal finances, plan for the future, and achieve financial goals.

Managing personal finances can be challenging, especially when balancing multiple accounts, budgeting, tracking expenses, and investments. With so many tools available today, finding the right one for your specific needs might seem overwhelming. One name that’s been around for decades is Quicken — a personal finance management tool that has evolved to adapt to the ever-changing digital world. In this review, we’ll dive into what makes Quicken stand out, what it offers, and whether it's the right tool for you in 2025.

What Is Quicken?

Quicken has long been a go-to software for managing finances, offering robust features that cover everything from simple budgeting to complex investment tracking. Initially launched in 1983, Quicken has evolved into a comprehensive financial platform that caters to both individuals and small businesses. If you're looking to streamline your finances and maintain control over your budgeting, bills, and investments, Quicken might be a tool worth considering.

Main features of Quicken

Quicken offers an impressive array of features, including:

Budgeting. Track income, set spending goals, and categorize expenses to gain a clear picture of where your money is going.

Bill pay and alerts. Easily manage bills and receive notifications when payments are due, helping you stay organized.

Account syncing. Sync all your bank accounts, investment portfolios, credit cards, and loans in one place for a unified financial overview.

Investment tracking. For those who invest, Quicken tracks your portfolio performance, offering tools to monitor asset allocation and returns.

Mobile app. While somewhat limited in comparison to the desktop version, Quicken’s mobile app allows you to view and edit transactions on the go.

Security. Quicken uses bank-level encryption and SSL protection, ensuring that your financial data remains secure.

Step-by-step guide to getting started

Setting up Quicken is relatively simple:

Sign up. Visit the Quicken website, choose a plan, and complete the payment process.

Download and install. If using the desktop version, download the software for Windows or Mac. Mobile users can access the app directly.

Sync accounts. Connect your bank accounts, credit cards, and investment portfolios. Quicken allows for direct downloads from most financial institutions.

Create budgets. Customize your spending categories and set budget limits based on your financial goals.

Set up alerts. Activate bill pay reminders and account balance alerts to avoid late fees and keep your finances in check.

Track investments. For advanced users, link your brokerage accounts and set up custom reports to monitor performance.

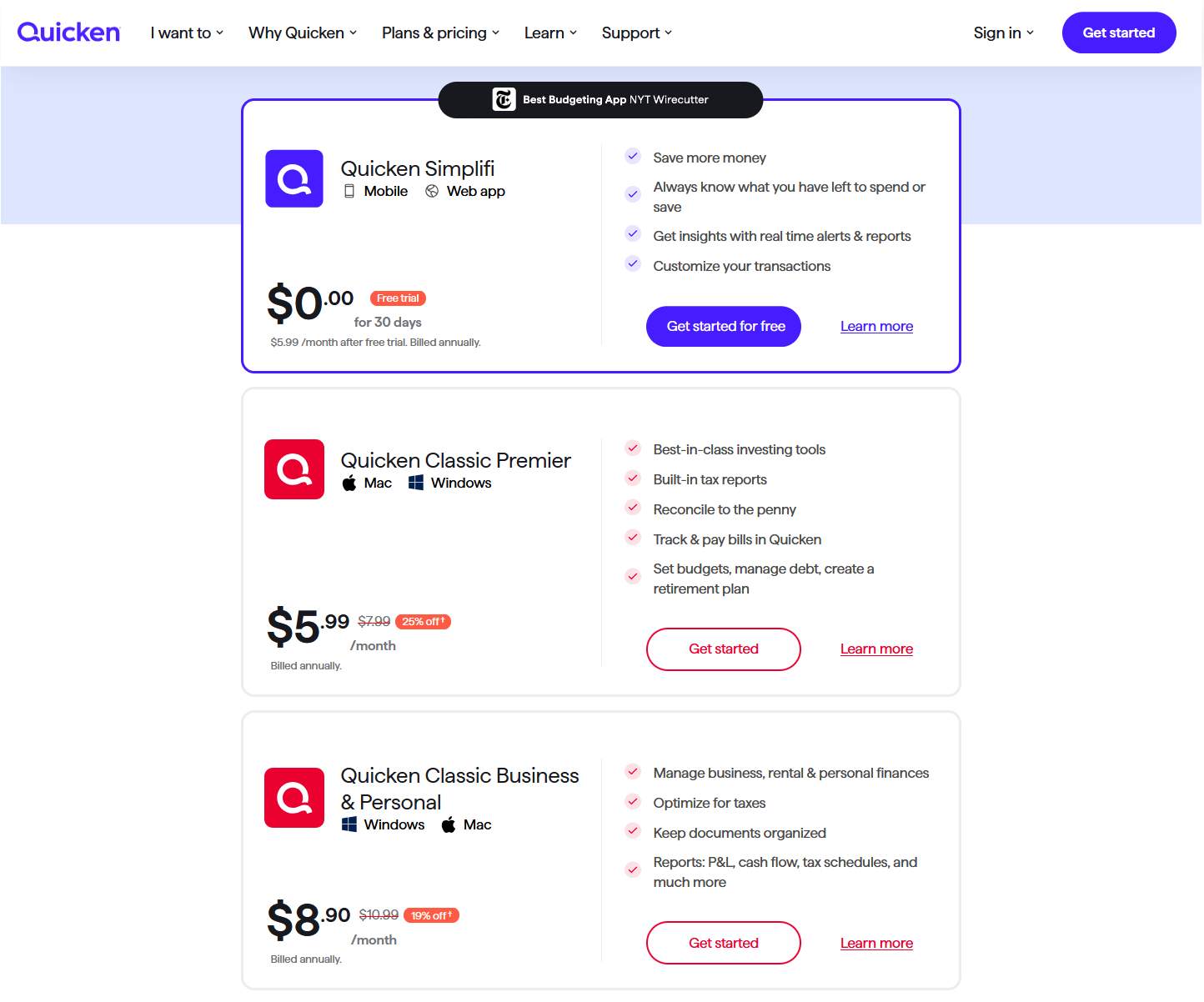

Quicken versions and pricing

Quicken offers several versions designed for various financial needs. Here’s an up-to-date breakdown of the latest pricing and features:

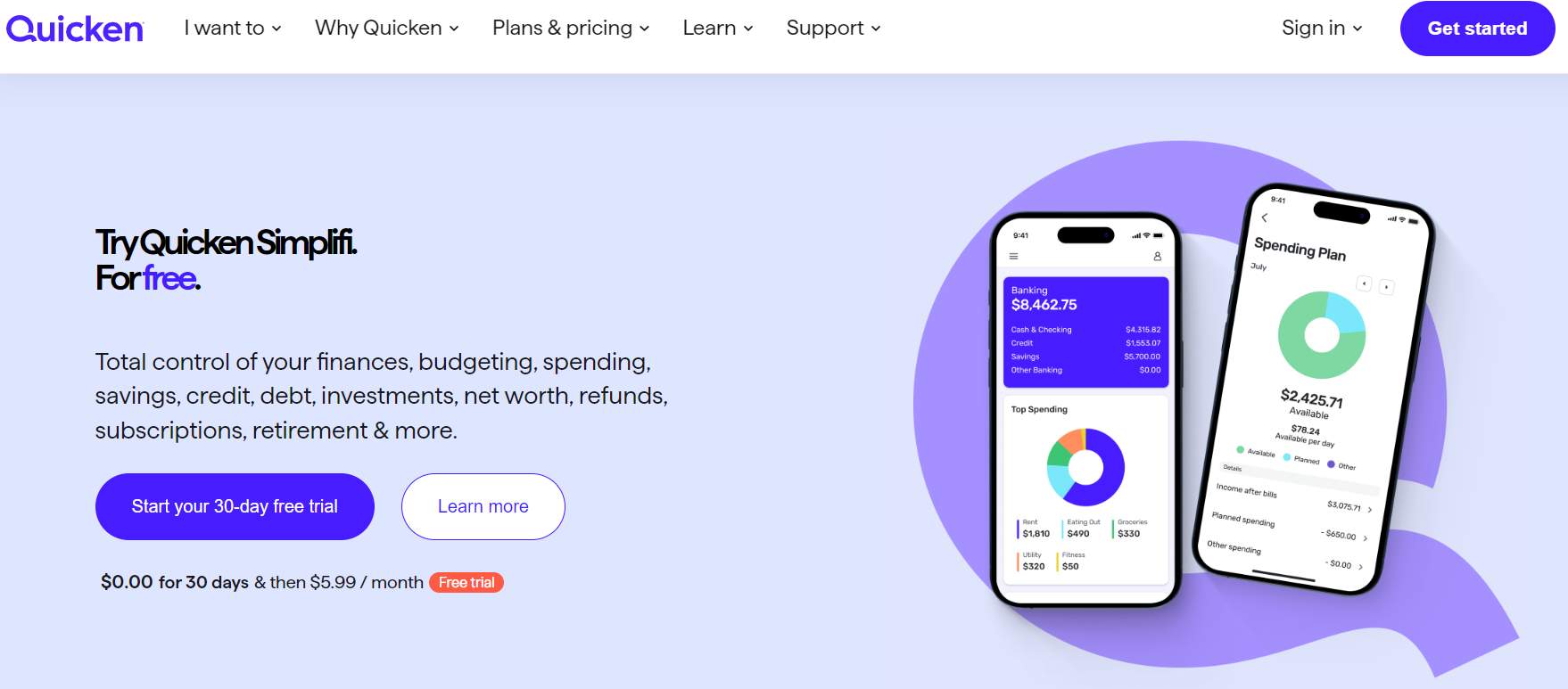

Simplifi by Quicken

This version is built for users who want a simple, intuitive way to manage their finances. It offers automation, real-time alerts, and savings goals integrated into a personalized spending plan.

Pricing: $0.00 for the first 30 days (free trial), then $5.99 per month (billed annually).

Features: Real-time alerts, spending reports, automated savings goals, customizable transaction categorization, and mobile access via web app.

Best for: Individuals who want an easy-to-use, web-based budgeting tool to track daily spending and savings.

Special Feature: Always know what you have left to spend with real-time updates on your finances.

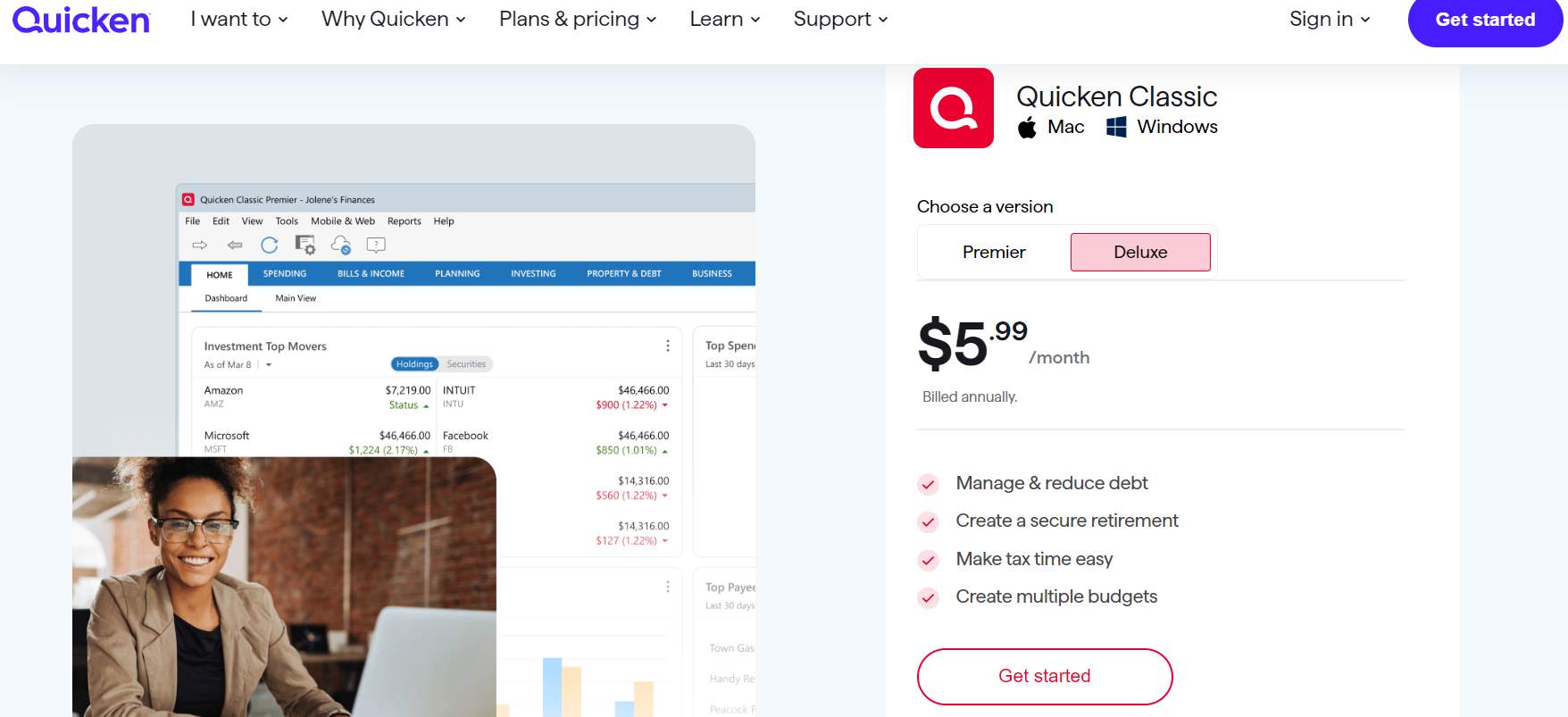

Quicken Classic Deluxe

A more advanced option for users who need multiple budgets and more detailed financial management.

Pricing: Starting at $5.99 per month (billed annually) with a 30-day money-back guarantee.

Features: Multiple budget creation, debt management tools, income tracking, expense management, and custom reports for tax preparation.

Best for: Users looking to manage multiple budgets and track financial goals more closely.

Quicken Classic Premier

Designed for serious investors who want to track and optimize their investment portfolios, along with all the features of the Deluxe version.

Pricing: $7.99 per month (25% off, if billed annually).

Features: Advanced investment tools, built-in tax reports, bill tracking and payment, and comprehensive debt management.

Best for: Investors looking for top-tier investment tracking and comprehensive financial management.

Special Feature: Premier offers tools for tax preparation, helping users maximize deductions and prepare for tax season with ease.

Which version is best for you? For simple budgeting, Simplifi by Quicken is an affordable, intuitive option with a free 30-day trial. If you need more control over your finances, Classic Deluxe or Classic Premier offer enhanced features like multiple budgets, tax reporting, and investment tracking.

Here’s a comparison table for Quicken Simplifi and Quicken Classic (Premier) to help users decide which version suits their needs:

| Feature | Quicken Simplifi | Quicken Classic (Premier) |

|---|---|---|

Price | $0.00 for 30 days, then $5.99/month (billed annually) | $5.99/month (Deluxe) or $7.99/month (Premier) (billed annually) |

Platform | Web & mobile app | Windows & Mac desktop |

Best for | Most people, simple budgeting | Investors and tax planning |

Save more | Custom savings goals | Custom savings goals |

Stay on budget | Auto-generated spending plan based on income & bills | Traditional, category-based budget |

Spending plan | Automatically generated based on transactions | Traditional, manual category-based |

Track spending | Real-time alerts & proactive reports | Spending reports |

Know what’s left to spend/save | Rollover spending, ignore select transactions | Multiple budgets, fiscal & calendar year options |

Debt management | Set goals and track debt | Debt reduction tool |

Investment management | Limited, focuses on personal finances | Performance tracking, investment optimization |

Tax management | Tag tax-related transactions | Built-in tax reports |

Reconcile accounts | Mark transactions as "reviewed" | Compare vs. bank statements |

Bill management | Track bills | Track & pay bills |

Future planning | Projected balances & cash flow | What-if scenarios, Lifetime Planner |

Sharing finances | Share with partner | N/A |

Cloud storage | Built-in app | Dropbox offer available |

Customer support | Free phone & chat | Premium phone & chat |

Best for investments & taxes | No | Yes |

Pros and cons of Quicken

- Pros

- Cons

- Comprehensive financial management. From budgeting to investment tracking, Quicken covers all aspects of personal finance.

- Customizable reports. Advanced users will appreciate the ability to generate detailed custom reports for income, expenses, and investment performance.

- Secure data encryption. Quicken takes security seriously, ensuring that your financial information is well-protected.

- Bill pay and alerts. Never miss a payment again with Quicken’s automated bill pay and reminder features.

- Limited mobile app. While convenient, the mobile app doesn’t offer all the functionality of the desktop version, limiting its usefulness for on-the-go management.

- Mac version lags behind. Quicken for Mac lacks some features found in the Windows version, particularly with custom reporting and investment tools.

- No payroll support. Small businesses looking for payroll integration may be disappointed, as Quicken lacks this feature.

Risk and warning section

While Quicken is a robust tool, there are a few risks and limitations to consider:

Data security concerns. While Quicken uses bank-level encryption, any online financial tool carries a potential risk of data breaches.

Platform-specific limitations. Mac users may find the platform lacking compared to its Windows counterpart. Additionally, the mobile app is limited in functionality, which could pose issues for users who frequently manage finances on the go.

Complexity for beginners. Though Quicken is user-friendly, beginners may still find its feature set overwhelming, especially when it comes to investment tracking and report generation.

Focus more on Quicken’s investment management capabilities

One feature that many new users miss is Quicken’s ability to keep an eye on investment accounts and tie them into your overall financial plan. Instead of just tracking spending, you can set up Quicken to watch over your retirement or brokerage accounts, giving you a heads-up on things like how much you’ve gained or lost, and what kind of taxes you might owe if you sell. This goes beyond simple budgeting — it helps you stay ahead of financial surprises, so you can make smarter moves with your money before things catch you off guard.

Another tip is using Quicken's bill reminders in a way that fits your payment style. If you’ve got bills or income that vary each month, try setting reminders not just for when things are due, but a little earlier. By paying early, you can show lenders you’re responsible, which could help you get better rates on loans. Over time, this habit can really help with how flexible your money feels, giving you more control over what you can afford without scrambling at the last minute.

Conclusion

Quicken remains a powerful tool for managing personal and business finances, especially for those who need a comprehensive platform to track spending, investments, and plan for future financial goals. For beginners, Quicken Simplifi offers a simple and user-friendly experience with automated budgeting and real-time insights. On the other hand, advanced users or small business owners will find Quicken Classic Premier highly valuable due to its investment optimization, tax preparation, and debt management features.

While it has some drawbacks — such as limited mobile app functionality and gaps in international support — its robust feature set and customizability make it a solid choice for users in the U.S. and Canada who need both flexibility and control over their finances.

FAQs

Can I use Quicken without linking my bank accounts?

Yes, you can manually enter your transactions and accounts without linking Quicken to your bank. This is useful for users who prefer not to share their bank information online.

Does Quicken work outside the U.S. and Canada?

Quicken primarily supports financial institutions in the U.S. and Canada. International users can still use the software, but they will need to enter transactions manually.

Can I import data from other financial apps like Mint into Quicken?

Yes, you can import data from Mint, but it may require exporting your transactions as a .CSV file and then manually uploading them into Quicken. Full compatibility may not always be seamless.

Is it possible to track cryptocurrencies with Quicken?

Currently, Quicken does not natively support cryptocurrency tracking. However, you can manually enter your crypto transactions as "other assets" in your investment portfolio.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

A Roth IRA (Individual Retirement Account) is a tax-advantaged retirement savings account available in the United States. It allows individuals to contribute after-tax income to the account, and the contributions grow tax-free. When qualified withdrawals are made in retirement, including both contributions and earnings, they are typically tax-free as well.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.