What Is DePIN Crypto? A Comprehensive Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

DePIN (Decentralized Physical Infrastructure Networks) enables blockchain-based management of real-world infrastructure. Here are key aspects:

Uses blockchain for infrastructure. Decentralizes ownership and operation.

Incentivizes resource sharing. Users earn tokens for participation.

Applies to energy, data, and IoT. Supports decentralized networks.

Reduces reliance on central entities. Shifts control to users.

Examples include Helium and Filecoin. Pioneers in DePIN adoption.

Enhances security and transparency. Improves data integrity.

DePIN crypto, short for Decentralized Physical Infrastructure Networks, uses blockchain to spread out control of real-world infrastructure, like wireless networks and cloud storage.

These networks let people share their hardware or internet power and get paid in crypto for helping run the network, building a system where users power and benefit from the network.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

What is DePIN crypto?

More than just another blockchain concept, DePIN is shaking up real-world industries. It lets people set up and earn from decentralized infrastructure, from internet networks to cloud storage, all tracked on the blockchain. Instead of corporations controlling these resources, DePIN takes power away from big corporations and spreads it across a network. This makes services cheaper, harder to censor, and more efficient.

One of the biggest things that sets DePIN apart is how it rewards participants. Unlike traditional infrastructure projects that depend on investors or government backing, DePIN projects run on token incentives. Users provide resources — like bandwidth or computing power — and get paid in crypto. This lets infrastructure grow naturally, based on user demand instead of corporate control. But there’s a challenge: if token rewards drop too much, people may stop contributing, which can put the network at risk.

DePIN isn’t just about decentralization — it’s changing how we trust online services. Most platforms today rely on big companies to handle cloud storage, GPS data, or wireless networks. DePIN removes the need for a central authority by making services fully transparent and self-running. One of its biggest impacts? It creates systems that governments and corporations can’t easily shut down. That makes DePIN one of the boldest blockchain innovations with real-world impact.

How does DePIN work?

Most people think DePIN (Decentralized Physical Infrastructure Networks) is just about using blockchain to manage infrastructure, but what makes DePIN different is how it changes the way resources are shared. Traditional infrastructure — like cloud storage, wireless networks, or energy grids — relies on centralized control, leading to inefficiencies, monopolization, and high costs. DePIN flips this by allowing individuals and businesses to contribute resources (like storage, bandwidth, or computing power) and get rewarded directly. Instead of big corporations setting prices, users decide pricing, access, and network growth based on what’s actually needed.

Something most people miss about DePIN is how it completely changes supply and demand in infrastructure. In traditional systems, companies must overbuild capacity to handle peak usage, leaving resources sitting idle most of the time. DePIN’s decentralized model means supply can adjust automatically — when demand spikes, more people join the network, and when demand drops, unnecessary resources scale back. This makes infrastructure cheaper, more flexible, and able to handle demand spikes better, something centralized providers struggle with.

A big plus of DePIN is that it lowers the barriers for new participants. In traditional infrastructure businesses, massive upfront costs make it almost impossible for new players to compete. DePIN removes this hurdle by letting anyone contribute whatever resources they have and get paid. It lets people make money from unused storage, internet bandwidth, or computing power, turning wasted resources into something valuable. The result? A constantly improving network where users add value instead of corporations.

Key features of DePIN

Here are some key features of DePIN:

Decentralization

DePIN removes the need for central control by letting anyone join and contribute. Individuals and businesses can add resources to the network and earn rewards without relying on a single authority. This builds a system that’s fairer and harder to break.

Decentralization also makes everything more open and traceable while preventing big players from taking over. By spreading control across many users, DePIN gives more people a say in how infrastructure operates.

Incentivization

DePIN networks rely on rewards to attract users. People earn crypto for sharing resources like storage or bandwidth. This system brings in more users and helps the network grow.

These rewards also bring in investors who help expand the network. Over time, this makes the system stronger and more reliable.

Transparency

Blockchain technology keeps all transactions visible on a shared ledger. This openness helps users trust the system and makes sure rewards go to the right people. With a system anyone can check, DePIN networks keep things fair and reduce conflicts.

Why is DePIN important?

DePIN isn't just about decentralizing data — it takes power away from monopolies that have controlled industries for decades. The biggest shift DePIN brings is the ability to crowdsource infrastructure without relying on governments or big corporations. Imagine an internet service that isn’t controlled by a few telecom giants but instead runs on a peer-to-peer model where individuals contribute bandwidth and get rewarded. DePIN is already reshaping sectors like wireless networks, energy grids, and mapping services, turning expensive, slow-moving projects into community-powered networks with real incentives.

What most people don’t realize is how DePIN changes the way infrastructure is built. Traditional infrastructure projects need massive funding upfront, which slows things down with corporate bottlenecks and political roadblocks. With DePIN, thousands of small investors help fund and maintain networks, so growth happens naturally based on demand, not just corporate decisions. This model makes infrastructure more flexible and efficient — think of decentralized solar grids, where local users provide extra power and get paid instantly. Instead of relying on subsidies or government rules, DePIN builds a system where infrastructure grows based on real demand, not corporate decisions.

The most exciting part of DePIN is how it resists censorship and outside control. A decentralized wireless network, for example, can’t be shut down by one authority, making it a lifeline for people in restrictive countries. The same applies to decentralized mapping systems, which prevent corporations or governments from controlling critical geolocation data. As more people realize the power of owning and contributing to physical infrastructure, DePIN could finally end the grip that centralized service providers have on critical infrastructure, paving the way for truly independent, user-powered networks.

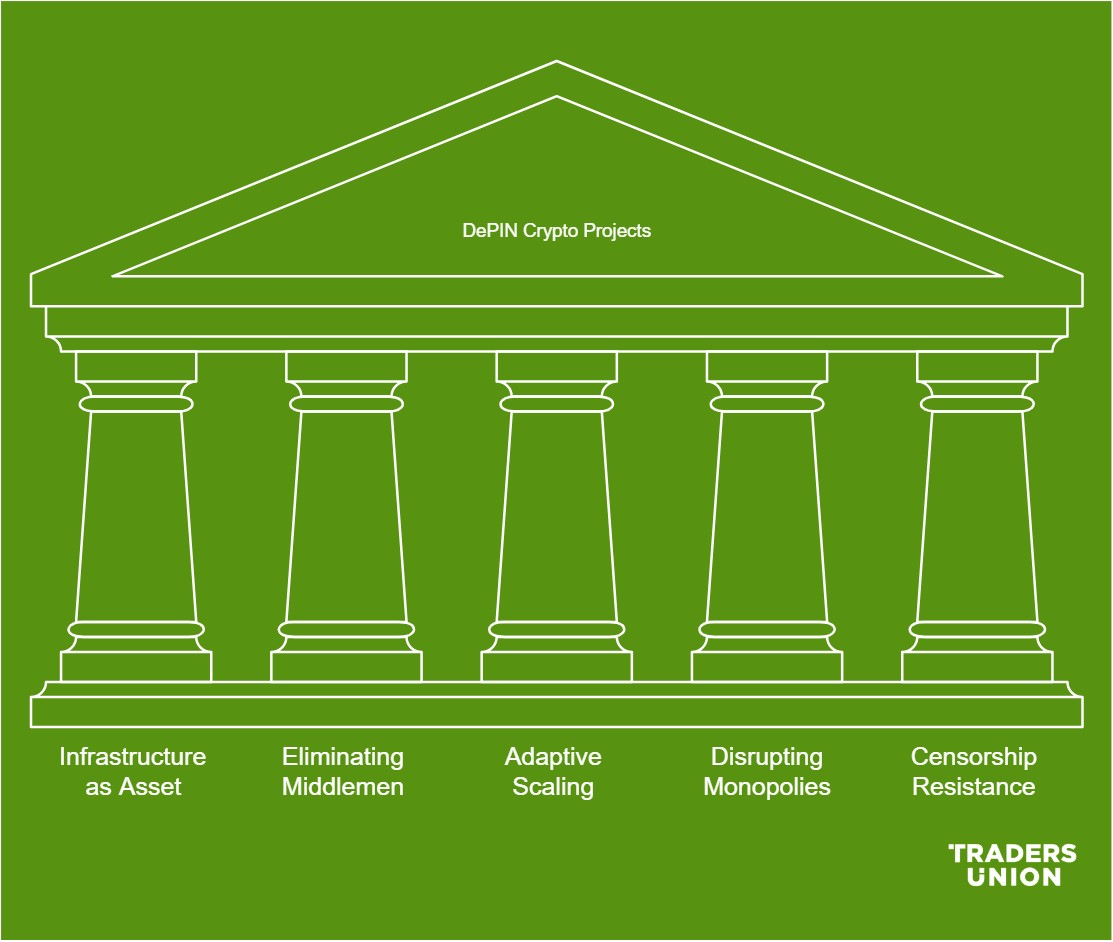

Advantages of DePIN crypto projects

Here’s why DePIN projects are creating real-world impact in ways traditional systems never could.

Turns infrastructure into an earning asset. In traditional systems, people pay for services like internet and energy, but in DePIN networks, contributors get paid for providing bandwidth, storage, or power. This flips the model — users become owners and profit from the very networks they help sustain.

Eliminates middlemen who slow progress. Centralized infrastructure is filled with bureaucratic delays, licensing, and inefficiencies. DePIN projects use blockchain to create direct peer-to-peer interactions, meaning new networks can launch and expand without waiting for corporate approvals or government funding.

Adapts faster to demand shifts. Traditional infrastructure takes years to scale, often leading to shortages or excess capacity. With DePIN, resources are added or removed in real-time based on demand, making networks far more flexible and efficient.

Makes monopolies irrelevant. Telecom providers, energy giants, and data networks thrive on control, but DePIN removes their grip. When networks are owned by participants rather than corporations, service quality improves, prices become fairer, and power shifts to the users.

Creates unstoppable, censorship-resistant networks. DePIN networks are not controlled by one entity, which makes them incredibly hard to shut down. Whether it’s decentralized wireless internet or peer-to-peer energy grids, these projects keep running even when governments or corporations try to interfere.

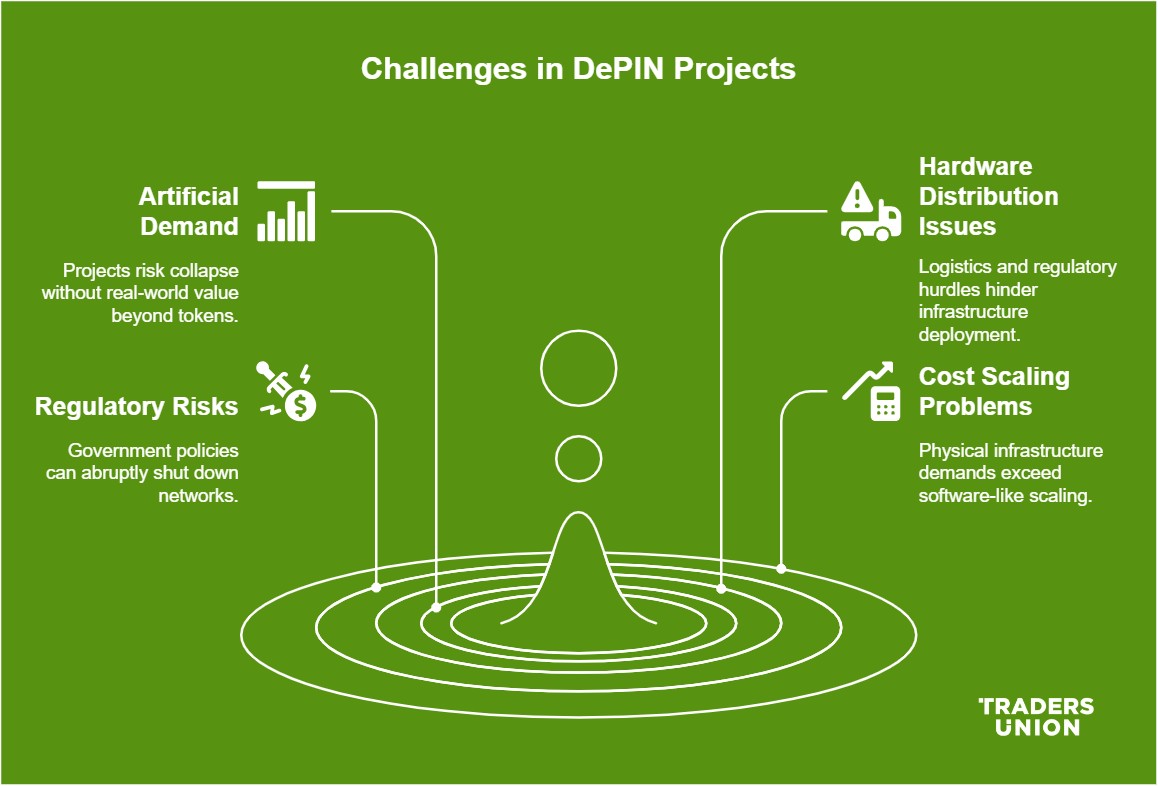

Challenges of DePIN crypto projects

Building a decentralized physical infrastructure network (DePIN) sounds revolutionary, but the real battle isn’t just about technology — it’s about adoption, incentives, and survival in a world built for centralized control. Here are the biggest challenges that most DePIN projects don’t talk about.

Token incentives create artificial demand. Many DePIN projects rely on token rewards to attract users, but what happens when incentives drop? If people only participate for rewards and not real-world value, the network collapses once token inflation kicks in. A DePIN project needs an actual use case beyond token farming, or it won’t survive long-term.

Hardware distribution is a nightmare. Unlike pure digital crypto projects, DePIN networks need real-world hardware deployment, and that’s where things get messy. Shipping delays, regulatory approvals, and logistics create bottlenecks. If a project can’t scale its hardware distribution smoothly, it risks becoming a ghost network — one where people hold tokens but the infrastructure never materializes.

Regulatory crackdowns can wipe out networks. Governments are wary of decentralized infrastructure, especially when it challenges existing industries like telecom or energy. A single policy change — such as restrictions on unlicensed wireless networks — can shut down a DePIN project overnight. Without a solid strategy to navigate regulations, projects risk dying before they reach mass adoption.

Infrastructure costs don’t scale like software. Unlike DeFi or blockchain projects, DePIN networks need physical assets, and that comes with a different cost structure. Infrastructure requires constant maintenance, repairs, and upgrades. Many projects underestimate long-term costs, assuming they can scale like a software platform. When unexpected expenses pile up, token value alone won’t be enough to keep the network alive.

Top DePIN crypto projects to watch

Here are top DePIN crypto projects to watch in 2025:

Helium (HNT)

Helium is creating a decentralized wireless network using blockchain technology. People set up hotspots to share internet access and earn HNT tokens. Helium’s approach has taken off in IoT, where devices need low-power, long-range networks.

By offering cheap, wide-area coverage, Helium is making a name for itself in DePIN. As the network grows, more people are joining to expand coverage and earn rewards.

Filecoin (FIL)

Filecoin is a decentralized network where people can rent out extra storage and get paid in FIL tokens. It works as a decentralized rival to big cloud storage companies, offering an alternative that isn’t controlled by a single provider.

It uses blockchain to keep files safe, verifiable, and affordable, making it a strong option for both businesses and individuals looking for secure storage.

Akash Network (AKT)

Akash Network is building a decentralized cloud service. It lets users rent out unused computing power in exchange for AKT tokens. This gives people an alternative to big cloud providers, making cloud services cheaper and easier to access. Akash’s flexible system makes it a real challenger in the DePIN market, a great option for developers and businesses looking for decentralized hosting.

How to get started with DePIN crypto projects

Here’s a step-by-step guide:

Step 1: Research DePIN projects

Start by researching popular DePIN projects like Helium, Filecoin, and Akash. Understand their goals, tokenomics, and technical requirements to determine which aligns with your interests.

Step 2: Acquire necessary equipment

Depending on the project, you may need specific hardware, such as a hotspot device for Helium or storage equipment for Filecoin. Check the project’s website for recommended hardware.

Step 3: Set up and configure

Follow the project’s setup guides to configure your equipment and connect it to the network. This may involve downloading software, creating a wallet, and staking tokens.

Step 4: Start earning rewards

Once your setup is complete, monitor your contributions and rewards. Regularly check your equipment to ensure it’s functioning optimally.

Here are some of the best crypto exchanges to start trading:

| DePIN supported | Coins Supported | Demo account | Min. Deposit, $ | Spot Taker fee, % | Spot Maker Fee, % | P2P Taker Fee, % | P2P Maker Fee, % | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 638 | Yes | 1 | 0,1 | 0,1 | 0 | 0 | 9.2 | Open an account Your capital is at risk. |

|

| Yes | 2276 | No | 1 | 0,05 | 0 | 0,2 | 0,2 | 9.1 | Open an account Your capital is at risk. |

|

| Yes | 329 | Yes | 10 | 0,1 | 0,08 | 0 | 0 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 415 | Yes | No | 0,1 | 0,1 | 0,1 | 0,1 | 8.7 | Open an account Your capital is at risk. |

|

| Yes | 831 | Yes | 10 EUR | 0,1 | 0,1 | 0,06 - 10 | 0,02 - 0,10 | 8.65 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

How to evaluate DePIN projects

Not all DePIN projects are created equal. While most people look at whitepapers and roadmaps, the real challenge is whether the project can actually function outside of theory. Here’s what really matters when evaluating DePIN projects.

Check how rewards are distributed. Avoid projects that just pump rewards early but fail to sustain payouts over time. A good project adjusts incentives gradually so contributors don’t get abandoned when the hype fades.

Look at hardware and network costs. If people can’t afford to use it, it won’t take off. A strong DePIN project makes sure participation is affordable and works even on low-cost devices.

Analyze who actually controls the network. If just a handful of insiders control most of the project, it’s no different from a traditional company. Real decentralization spreads power across many users, not just early investors.

See if real-world businesses use it. If businesses, local governments, or industries actually use the network, that’s a good sign. If only crypto enthusiasts care about it, the project probably won’t last.

Watch for hidden operational risks. If a single company or service provider can shut the whole thing down, it’s not decentralized. A real DePIN project can function even if individual providers disappear.

DePIN crypto lets users build and control real-world networks

Most people think crypto is only about digital assets, but DePIN bridges blockchain with real-world services. Unlike regular blockchain projects that stay online, DePIN lets everyday users contribute things like bandwidth, storage, or energy and earn crypto in return. This is already happening — projects like Helium allow users to set up wireless hotspots and get rewarded for network coverage. The biggest shift is that DePIN puts infrastructure into the hands of users instead of big companies. Instead of paying a telecom giant for cloud storage or internet, people can access decentralized networks at lower costs while keeping control within the community.

What most people don’t realize is that DePIN completely changes how physical services are bought and sold. Traditional infrastructure needs huge upfront investments and years of planning, but DePIN turns the old system upside down by paying people directly for their contributions. This makes it easier and cheaper to expand, as networks grow naturally when more users join and provide services. The best DePIN projects will be the ones that fix real-world problems and keep users engaged with fair rewards. Instead of just trading tokens, DePIN takes crypto beyond speculation and into real-world impact.

Conclusion

DePIN crypto projects are reshaping how we think about infrastructure by decentralizing ownership and incentivizing participation. By integrating blockchain technology with physical networks, DePIN creates transparent, scalable, and equitable solutions for real-world challenges.

As the DePIN ecosystem evolves, it’s essential to stay informed and participate actively to benefit from this innovative technology.

FAQs

What is DePIN crypto?

DePIN crypto refers to Decentralized Physical Infrastructure Networks that use blockchain to decentralize the ownership and operation of physical infrastructure like data storage or wireless networks.

How does DePIN differ from traditional blockchain projects?

Unlike traditional blockchain projects that focus on digital assets, DePIN integrates physical infrastructure with blockchain, enabling tangible resource contributions and incentivization.

What are the benefits of DePIN crypto projects?

DePIN projects offer decentralization, incentivization, transparency, scalability, and resilience, making them a promising alternative to traditional infrastructure models.

Are there any challenges in adopting DePIN?

Yes, challenges include high initial costs, regulatory uncertainty, technical barriers, adoption issues, and scalability limitations.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.