Is Leverage Trading Halal | Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Leverage trading is generally considered haram in Islam because it usually involves interest (riba), which is strictly prohibited. It also carries high risks and uncertainty, resembling gambling, which is also forbidden. However, some scholars argue that under certain conditions — such as using Islamic accounts with no interest and ensuring ethical trading practices — leverage trading may be permissible.

Leverage trading has become a hot topic in Islamic finance circles, raising important questions for Muslims who want to participate in the markets without violating Sharia principles. The practice allows traders to borrow money from a broker to increase their buying power, but this often involves interest charges and high levels of risk.

From an Islamic perspective, the debate centers around the presence of riba, the level of uncertainty (gharar), and whether the assets involved are halal. While many scholars reject margin trading due to these concerns, others suggest that with the right conditions — such as interest-free accounts and ethical risk management — it might be acceptable. Let’s break down both sides of the argument and explore where scholars agree and disagree.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is leverage trading?

Leverage trading allows you to control a larger position in the market with a smaller amount of capital. In simple terms, it means borrowing funds from a broker or platform to amplify your potential profits — but it also increases your potential losses.

In Forex trading, leverage is widely used. For example, a trader might use 1:100 leverage, meaning they can control $100,000 in the market with just $1,000 of their own funds. In crypto trading, platforms like Binance or Bybit allow up to 10x or even 100x leverage. That means if you have $100 and use 10x leverage, you're opening a position worth $1,000. In stock trading, leverage often comes in the form of margin trading, where you borrow money to buy more shares than you could afford on your own.

While this sounds powerful, the risk is just as real. If the market moves against you even slightly, the loss is multiplied too. That’s why leverage is often seen as a double-edged sword.

This brings us to a critical question for Muslim investors: is trading with leverage haram? The concern is that many leverage models involve borrowing with interest (riba) or expose the trader to excessive risk (gharar). These factors play a major role in determining is leverage in trading halal.

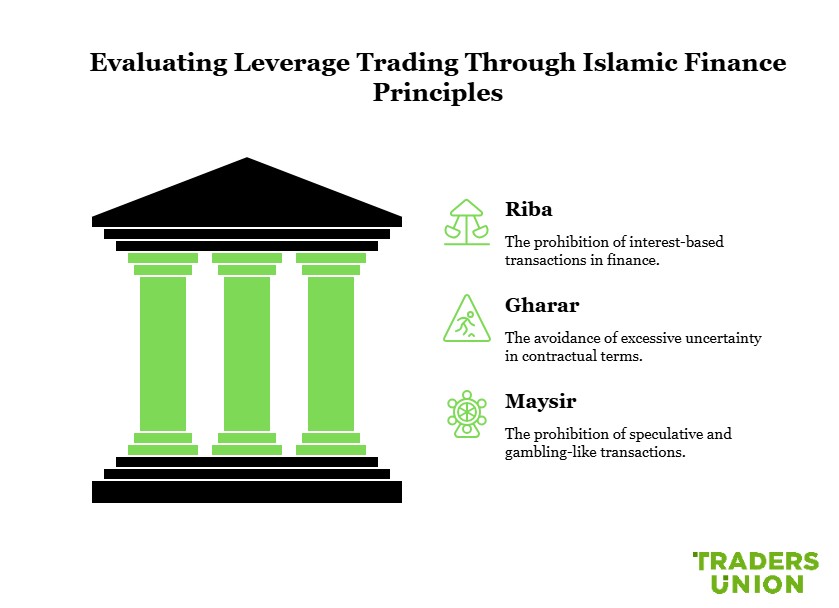

Core Islamic finance principles relevant to leverage trading

1. Riba (interest) – the prohibition of interest-based transactions

In Islamic finance, riba, or interest, is strictly prohibited. This principle stems from the belief that earning money from money, without engaging in tangible economic activity, is exploitative and unjust. Leverage trading often involves borrowing funds from a broker to increase one's market exposure. If this borrowing incurs interest, it directly contravenes the prohibition of riba. Therefore, when considering whether leverage trading is halal or haram, the presence of interest-bearing loans is a critical factor that leans towards it being haram.

2. Gharar (excessive uncertainty) – the risk of ambiguity in transactions

Gharar refers to excessive uncertainty or ambiguity in contractual terms and conditions. Islamic finance emphasizes clarity and certainty in transactions to ensure fairness and prevent disputes. Leverage trading amplifies both potential gains and losses, introducing a high level of uncertainty. This heightened risk can be seen as a form of gharar, making such transactions potentially non-compliant with Shariah principles. Thus, the question of whether leverage trading is halal or haram hinges on the degree of uncertainty involved, with excessive uncertainty rendering it haram.

3. Maysir (gambling) – the prohibition of speculative transactions

Maysir denotes gambling or speculative transactions where the outcome is highly uncertain and depends on chance. Islamic finance prohibits such practices as they can lead to unjust enrichment and social harm. Leverage trading, especially when used for short-term speculative purposes, can resemble gambling due to the high stakes and unpredictability involved. This speculative nature aligns with the concept of maysir, thereby influencing the determination of whether leverage trading is halal or haram.

Scholarly views on leverage trading in Islam

Whether leverage trading is halal or haram has become one of the most discussed topics in Islamic finance circles. Islamic scholars and boards like AAOIFI have laid down specific criteria based on the core principles of riba (interest), gharar (uncertainty), and maysir (speculation). These concepts are critical when assessing whether leverage trading is halal in Islam or falls into the category of forbidden practices.

Mufti Taqi Usmani’s perspective

Mufti Taqi Usmani, one of the most respected scholars in Islamic finance, has expressed serious concerns about the permissibility of derivatives and leverage trading. He argues that most leverage trading models involve speculation and non-ownership of the asset being traded, both of which go against Shariah principles. According to him, when you engage in a transaction without taking real ownership, and especially if it includes interest, it loses its halal status.

AAOIFI's position on leveraged products

AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) emphasizes that trading must involve full ownership and real transfer of the asset. If you’re entering a leveraged trade where you’re only speculating on price movement without ever owning the underlying asset, this setup may violate both riba and gharar restrictions. This is a key point when determining is leverage trading halal in Islam, especially in modern markets like Forex or crypto.

Is leverage trading without interest halal?

Many traders assume that removing interest (riba) makes leverage trading halal — but that’s only scratching the surface.

Interest-free (swap-free) accounts are just step one

Islamic or swap-free accounts remove overnight interest, but that doesn’t make the contract automatically halal.

Is leverage trading without interest halal depends not just on the fees but on how the trade is structured behind the scenes.

Ask the deeper questions

Are you borrowing money — interest-free or not?

Do you actually own the asset you're trading?

Is the risk exposure fairly shared?

If you’re technically borrowing, even without riba, and you don’t have actual possession or liability in a Shariah-compliant way, it may still be non-permissible due to gharar (excessive uncertainty).

Riba-free ≠ Halal

Think beyond the label. Is using leverage in trading halal? Only when:

Ownership is clearly transferred.

Contracts are transparent.

There’s no speculation or unfair risk allocation.

Without these, you’ve just removed the interest — but not the Shariah concerns.

When is leverage trading haram?

Even if interest isn’t involved, leverage can easily cross into haram territory. Here’s when that happens.

Interest-based margin accounts

If you're borrowing funds and paying interest, that's clear riba.

This setup alone answers the question: is leverage trading haram ? — Yes.

Trading without understanding the risk

Using 20x or 100x leverage without risk controls turns trading into maysir (gambling).

No matter how attractive the po tential profit, this is why leverage trading is haram for many retail traders — because it's done recklessly.

Engaging in high-risk derivatives

Futures, perpetual swaps, or synthetic products with no asset ownership? That’s not trading — it’s betting on volatility.

These instruments often involve both gharar and maysir, making them incompatible with Islamic investing.

If you're unsure about the permissibility of leveraged trading, there are practical and Shariah-compliant alternatives. These options allow Muslim investors to stay active in the market without violating Islamic financial principles.

Can you use margin trading in islam?

Margin trading is a type of leverage trading, where a trader borrows funds — usually from a broker — to open positions that are larger than their actual account balance. Essentially, it allows you to control more capital than you actually own, amplifying both potential gains and losses. However, this borrowed amount is almost always provided with interest, which is the core issue from an Islamic perspective.

In most cases, margin trading is considered haram in Islam. That’s because it involves paying or receiving riba (interest), which is strictly prohibited in the Qur’an. As clearly stated in Surah Al-Baqarah (2:275–279):

“Allah has permitted trade and forbidden interest...” (Qur’an 2:275)

Beyond interest, margin trading also introduces gharar (excessive uncertainty) and maysir (gambling-like behavior), since a trader may lose more than they initially invested due to volatility and high leverage. These elements further conflict with Islamic financial ethics, which require transparency, real asset backing, and avoidance of unjustified risk.

Ethical alternatives for Muslim traders

Stick to cash or spot trading

Spot trading is the most straightforward halal option. You use your own capital to buy and sell actual assets — be it stocks, crypto, or currencies — without borrowing. There’s no riba, no speculation, and ownership is immediate, making it compliant with core Islamic finance rules. It’s especially important for Muslim traders to avoid high-risk practices such as CFD trading, option trading, or short selling, which often involve leverage, non-ownership, or uncertainty (gharar), rendering them non-compliant.

Use Islamic Forex brokers with compliant leverage

Some brokers offer Shariah-compliant trading accounts that remove interest (swap-free) and are structured around permissible contract models like Murabaha or Wakala. They also avoid instruments commonly associated with prop trading or scalping, which, depending on execution and structure, may involve excessive speculation. For those considering day trading or swing trading, it's crucial to ensure that all trades are backed by real asset ownership and not executed through margin or interest-bearing facilities. When considering this route, check if the broker has certifications or reviews by a recognized Shariah advisory board.

Consider Islamic ETFs and mutual funds

These funds follow strict Islamic screening guidelines. They avoid companies involved in prohibited sectors like conventional finance, alcohol, gambling, or weapons. Many track halal indices like the S&P 500 Shariah or MSCI Islamic Index, offering broad exposure to equity markets without leverage or interest. If you prefer a more passive approach, you may also explore copy trading platforms that follow Shariah-compliant strategies and portfolios.

We have selected a list of beginner-friendly brokers that support halal trading practices, including interest-free accounts and verified Shariah screening. These platforms are ideal for Muslims seeking ethical access to global markets, while steering clear of non-compliant models like CFD trading, short selling, and speculative prop trading setups.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

How to reduce risks of haram (prohibited) leverage trading?

Reducing the risks of haram (prohibited) leverage trading in Islamic finance involves adhering to ethical and Sharia-compliant investment principles. Here are some steps to consider:

Avoid interest-based transactions. Since leverage trading often involves paying or earning interest (riba), which is forbidden in Islam, it's crucial to avoid such transactions entirely.

Use Islamic trading accounts. Some brokers offer Islamic trading accounts, which are designed to be Sharia-compliant by eliminating interest charges and ensuring all transactions comply with Islamic law.

Engage in halal trading. Focus on trading permissible (halal) assets and financial products, such as stocks of companies that do not engage in prohibited activities like alcohol, gambling, or pork production.

Seek ethical alternatives. Consider alternative investments that are more in line with Islamic finance principles, such as equity participation (e.g., profit-sharing arrangements like Mudarabah and Musharakah), rather than conventional leverage trading.

Consult a Sharia advisor. Before engaging in any form of trading, it's advisable to consult with a knowledgeable Sharia advisor or scholar who can provide guidance on whether a particular trading strategy is compliant with Islamic principles.

Halal leverage depends on structure, not labels

Most beginner traders assume leverage is only haram because of interest — but the deeper issue is how the contract is structured. If you’re using leverage without riba, but you don’t have actual ownership of the asset or you're entering a derivative contract that mimics gambling, that’s still not halal. The real problem isn’t just the interest — it’s the presence of gharar (uncertainty), maysir (speculation), and non-ownership. That’s why the question of leverage trading halal or haram doesn’t have a simple yes-or-no answer — it depends entirely on the structure behind the trade.

What most platforms call “Islamic” leverage still operates on the same foundations as conventional systems — just repackaged. Before using leverage in Islam, ask this: Would this contract hold up if put under Shariah-based scrutiny of ownership, risk sharing, and asset transfer? If the answer isn’t crystal clear, it likely leans toward non-compliance.

One powerful but underutilized approach is to work with brokers that use actual Islamic contracts — like Murabaha-based leverage, where the asset is purchased and resold at a markup rather than lent. This replaces debt with a real transaction and eliminates riba.

A beginner serious about halal investing should dig into contract-level mechanics and ask hard questions — not just look for “swap-free” labels. That’s where halal finance truly starts — not at the marketing layer, but inside the structure of the trade.

Conclusion

The question of whether leverage trading is permissible under Shariah remains complex and requires careful consideration. Different Islamic scholars have expressed conflicting opinions, reflecting the diversity of interpretations of Islamic financial principles. Some scholars allow leverage trading under certain conditions, such as no interest and fair risk sharing.

Others, on the contrary, consider it haram due to the high level of uncertainty and speculation. It is important for Muslim traders to consult with reputable Islamic financial experts and choose investment strategies that comply with Shariah principles. An ethical and responsible approach to investing, as well as the use of halal financial instruments, will help traders successfully manage their capital in a religiously compliant manner.

FAQs

Why is leverage trading haram?

Leverage trading is haram because it typically involves borrowing money with interest (riba), introduces excessive uncertainty (gharar), and can resemble gambling (maysir) — all of which are prohibited in Islam.

What approaches are there to assess the halal nature of financial products?

Assessing the halal nature of financial products involves checking for the absence of riba, gharar, and maiser. It also involves using products that are backed by real assets and approved by Islamic scholars and financial advisors.

What factors should be considered when choosing an Islamic broker for leverage trading?

When choosing a broker, it is important to consider the availability of an Islamic account without interest, transparency of terms, the size of fees, and the reputation of the broker. You should also ensure that the broker provides services that are compliant with Shariah principles.

What are the benefits of long-term investing for Muslims?

Long-term investing allows Muslim traders to avoid speculation and focus on investments that can adhere to the ethical principles of Islam. It also helps in accumulating capital and maintaining sustainable growth in accordance with Shariah.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.