What Currency Does India Use?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

India's official currency is the Indian Rupee (INR), symbolized by ₹. The Reserve Bank of India (RBI) oversees its issuance and regulation. The rupee is available in coins of ₹1, ₹2, ₹5, and ₹10, and banknotes of ₹10, ₹20, ₹50, ₹100, ₹200, and ₹500. India operates under a managed floating exchange rate system, allowing the rupee's value to fluctuate based on market dynamics, with occasional RBI interventions to maintain stability.

India, one of the world's largest and fastest-growing economies, is firmly connected to the global economy. Whether you're a trader, investor, business owner, or traveler, understanding the Indian monetary system is essential. From daily transactions to international Forex trading, it all comes down to a simple question: what currency does India use? This guide explains India's currency with clarity and depth, including its history, current denominations, market trends, trading relevance, and risks; so you're ready to handle anything related to the Indian rupee.

What currency does India use?

India officially uses the Indian Rupee, denoted by the ₹ symbol and the currency code INR. Introduced in its modern form after independence, the rupee is the sole legal tender authorized for use across the Republic of India. While the INR is mandatory for most transactions, certain exceptions exist. For example, duty-free shops at international airports may accept foreign currencies like the U.S. Dollar or Euro in limited circumstances.

The Indian rupee (INR) is required for nearly all domestic economic activities, including retail purchases, salaries, contracts, government expenditure, and tax payments. Whether it’s buying groceries at a local market, booking accommodation, or closing a corporate agreement, the INR is the standard currency used for financial exchanges across India.

Legally, Section 26 of the Reserve Bank of India Act, 1934, confirms that all rupee banknotes issued by the RBI are guaranteed by the Central Government and must be accepted for all payments, unless explicitly restricted by law. This legal backing reinforces the rupee’s role as the country’s primary medium of exchange.

For international visitors and businesses, converting foreign currency to INR is essential before making transactions in India. Although it is legal to possess foreign currency under India’s foreign exchange regulations, directly using it in domestic markets without authorization is not permitted and may lead to penalties if it violates regulatory guidelines.

India’s currency framework plays a key role in safeguarding monetary sovereignty, enabling financial control, and expanding access to digital payments. As digital infrastructure grows, platforms like the Unified Payments Interface (UPI) and mobile banking apps have become central to the way Indians transact — both online and in-person.

With an economy ranked fifth globally by nominal GDP as of 2025, the Indian rupee supports critical areas of national interest including trade, investment, and macroeconomic stability. It continues to grow in importance as a regional currency within South Asia and in global economic discussions.

| Feature | Details |

|---|---|

| Official Name | Indian Rupee |

| India Currency Code | INR |

| Symbol | ₹ |

| Subunit | 1 Rupee = 100 Paise |

| Regulatory Authority | Reserve Bank of India (RBI) |

| Currency Type | Fiat |

| Exchange Regime | Managed Floating System |

| Year Symbol Introduced | 2010 (₹) |

When asking which currency does India use, the answer is unequivocally the INR, and it's central to every part of Indian economic life.

Denominations: INR coins and banknotes

As of 2025, India has a currency system that includes the following coins and banknotes:

Coins in circulation

₹1

₹2

₹5

₹10

₹20 (in circulation since 2019)

These coins are minted by government mints located in Mumbai, Kolkata, Hyderabad, and Noida.

Banknotes in circulation

₹10, ₹20, ₹50, ₹100, ₹200, ₹500, and ₹2000*

*The ₹2000 note is in the process of being withdrawn from circulation following the Reserve Bank of India’s 2023–2024 policy. It remains legal tender but is being slowly phased out.

Each banknote comes with built-in security features such as watermarks, latent images, micro lettering, color-shifting ink, and a transparent alignment mark.

Historical background: India currency name

The India currency name "rupee" comes from a rich historical background. It comes from the Sanskrit term rūpya meaning "wrought silver," and can be traced to the 6th century BCE when silver coins were used in ancient India. The first paper rupee was issued during British rule in the 18th century. After gaining independence, India began printing its own currency and in 2010, unveiled the current ₹ symbol, a blend of the Devanagari “र” and Latin “R”.

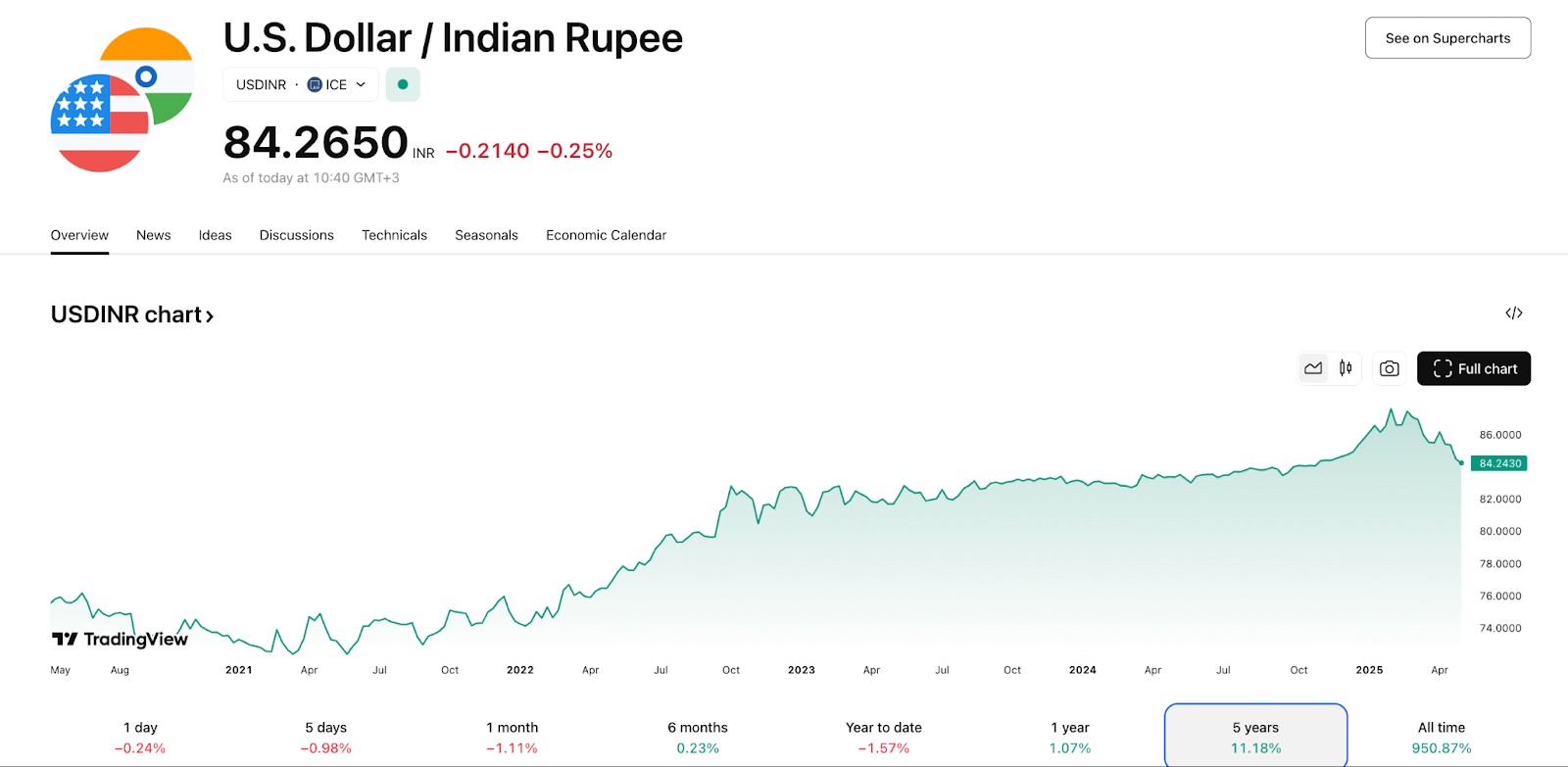

INR exchange rate – latest update

As of May 2025, the INR/USD exchange rate stands at approximately ₹84.63 per 1 USD, reflecting a modest appreciation from April’s average of ₹85.60/USD. This strengthening is attributed to:

Robust foreign portfolio inflows into Indian equities, supporting the demand for the rupee.

A softer U.S. dollar, amid expectations of Federal Reserve rate cuts.

Increased dollar sales by Indian exporters, taking advantage of favorable exchange rates.

However, the rupee's gains are tempered by ongoing geopolitical tensions between India and Pakistan, which have heightened market volatility.

Floating vs. Pegged: INR's exchange mechanism

The Indian Rupee (INR) operates under a managed floating exchange rate system, often mistaken for a pure float. In reality, the Reserve Bank of India (RBI) frequently intervenes (not to set a fixed value but to dampen excessive volatility).

In 2023 alone, RBI reportedly spent over $50 billion in Forex interventions to prevent speculative attacks on the INR amid U.S. Fed rate hikes and global dollar strength. This selective management gives India the benefits of a floating regime, like global investor confidence, while maintaining a defensive cushion against sudden capital flight.

One striking feature of India’s approach is how it avoids hard pegs but still maintains psychological levels. For instance, the INR/USD pair has hovered around 82-84 through much of 2024, not because of natural supply-demand balance but due to RBI’s repeated liquidity adjustments in the spot and forward markets.

Additionally, NDF (non-deliverable forward) markets in Singapore and Dubai often show divergence from the onshore INR, signaling where speculative sentiment exists. Unlike pegged currencies like the SAR or AED, INR’s flexibility gives policymakers room to fight inflation and maintain external competitiveness; yet it’s not a free float in practice.

INR in Forex and trade markets

The Indian rupee may not be a global reserve currency, but it plays a critical role in Asia-Pacific trading and emerging market currency portfolios. Key currency pairs include:

If you’re looking to trade the Indian Rupee (INR) in the Forex market, you’ll first need to register with a broker that provides access to INR currency pairs. Below, you’ll find a selection of top Forex brokers that support Indian Rupee trading. Compare their features, platforms, and trading conditions to choose the one that fits your strategy and preferences best.

| INR | Currency pairs | Min. deposit, $ | Max. leverage | Deposit fee, % | Withdrawal fee, % | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 60 | 50 | 1:30 | No | No | CySEC | 5.94 | Open an account | |

| Yes | 40 | 1000 | 1:500 | No | No | No | 4.73 | Open an account | |

| Yes | 70 | 50 | 1:1000 | No | No | No | 6.32 | Study review | |

| Yes | 25 | 1000 | 1:400 | No | 0-3,5 | FSC | 5.21 | Study review | |

| Yes | 45 | 250 | 1:400 | No | 3,5 | MISA | 5.11 | Study review |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

The Indian Rupee (INR) accounts for approximately 1.6% of global foreign exchange turnover, according to the Bank for International Settlements' Triennial Survey.

INR convertibility

Understanding INR convertibility isn’t just about knowing whether it’s free or restricted. It’s about seeing how capital controls shape India’s global playbook.

INR is current account convertible, not capital account. You can freely use it for trade and remittances, but large foreign investments and asset transfers still face RBI scrutiny.

RBI uses selective easing via ECB and FPI routes. Instead of opening the floodgates, India allows controlled flows through external commercial borrowings (ECB) and registered foreign portfolio investors (FPIs).

Offshore INR markets influence onshore policy. Non-deliverable forwards (NDFs) in hubs like Singapore often lead price discovery, forcing RBI to respond, even though those markets aren’t on Indian soil.

Full convertibility is more about timing than policy. India’s delay isn’t due to lack of intent but fear of sudden capital flight, especially with volatile fiscal deficits and crude-linked inflation risks. This makes INR a partially convertible currency with expanding global significance.

India currency and digital transactions

India has emerged as a leader in digital payments, with the Indian rupee becoming increasingly accessible through various platforms.

UPI (Unified Payments Interface). In March 2025, UPI processed approximately 19.78 billion transactions, highlighting its widespread adoption across the country.

Popular digital payment platforms. Platforms like RuPay Cards, Google Pay, Paytm, and PhonePe are widely used by millions of people, facilitating seamless digital transactions.

Digital currency initiatives. The Reserve Bank of India has introduced initiatives like e-RUPI and is piloting the Digital Rupee as part of its exploration into central bank digital currencies.

Cash usage in rural areas. While digital adoption has significantly reduced the reliance on cash, physical currency continues to be prevalent in rural and offline areas.

Risks of holding or trading INR

While the Indian Rupee (INR) serves as a stable and essential currency within India's domestic economy, it comes with certain risks, especially for international traders and investors.

Volatility is a primary concern. The value of the INR is highly sensitive to fluctuations in global oil prices, changes in domestic interest rates, and political events such as elections or policy reforms. These variables can lead to rapid currency depreciation or appreciation.

Regulatory controls also present challenges. India maintains restrictions on capital account convertibility, meaning foreign investors face limitations when moving funds in and out of the country. This can impact investment timing, returns, and flexibility.

Another significant factor is inflation risk. The INR’s purchasing power can be influenced by changes in the Consumer Price Index (CPI). As of the first quarter of 2025, inflation in India is estimated at 5.4%, prompting the Reserve Bank of India to pursue a more cautious monetary policy stance.

Lastly, global tensions, including trade wars, geopolitical disputes, and financial instability in other emerging markets, can indirectly affect the rupee’s performance. Such events often trigger capital flight from developing economies, weakening local currencies like the INR.

Pros and cons of using the Indian rupee

- Pros

- Cons

Widespread acceptability in South Asia. The rupee is informally accepted in neighboring countries like Nepal and Bhutan, which can simplify travel and cross-border microtrade.

Strong support from digital infrastructure. India’s fintech ecosystem, like UPI and mobile wallets, offers seamless rupee transactions, making it easier to transact without needing physical cash.

Regulatory backing with capital controls. RBI’s managed float policy offers a buffer against excessive volatility, creating a somewhat stable environment for importers, exporters, and small investors.

Low denomination for hyperlocal budgeting. With coins and notes catering to ultra-low price points, the rupee enables precise budgeting in daily retail and rural markets.

Limited convertibility on the capital account. The rupee is not fully convertible for international investments, which restricts freedom for businesses and investors to operate globally.

Exposure to oil price shocks. Since India imports most of its crude, the rupee is highly sensitive to oil price swings, which can quickly affect inflation and purchasing power.

Dependency on remittances and services exports. A large portion of rupee inflows comes from remittances and IT services, making the currency vulnerable to global job markets and outsourcing trends.

Lack of global reserve currency status. The rupee is not widely held by foreign central banks, which limits its use in global settlements and makes foreign borrowing more costly.

Using seasonal INR cycles and RBI signals for smarter forex timing

For those new to the Indian Rupee (INR), a smart move is to watch how it reacts to India’s seasonal spending cycles; like during big festival imports, crude oil demand shifts, and RBI’s policy decisions. These aren’t just economic events; they often cause sharp but predictable changes in INR’s value. Most beginners stick to just USD-INR, but you’ll spot better opportunities if you also track INR against currencies like the Euro or Yen, especially if you travel, send money home, or are looking for small but smart currency swaps.

Here’s another edge: INR’s link with digital banking systems like UPI and the way India handles capital controls gives it some unusual advantages. If you're an NRI or someone investing from abroad, you can actually time your money transfers based on short-term INR trends. It's not about luck; RBI’s foreign exchange reports and currency reserve updates usually hint at what’s coming. And if you learn to read those signals early, you can get far more out of your rupee than you’d expect.

Conclusion

So, what currency does India use? India’s answer is both simple and complex: the Indian rupee (INR), a historically rich, rapidly evolving, and strategically important fiat currency. Whether you’re looking to trade, invest, or simply understand India’s economic heartbeat, gaining familiarity with the rupee is essential.

The currency of India is more than just a note or a number, it's the backbone of a billion-person economy, supported by digital innovation, central bank policy, and centuries of financial tradition.

FAQs

Can I use US Dollars or Euros in India?

No, foreign currencies like USD or EUR are not accepted for transactions in India. You must convert them to INR for use.

Is the Indian Rupee accepted outside India?

The INR is not widely accepted outside India. It's primarily used within the country and is not a global reserve currency.

How secure is the Indian currency against counterfeiting?

The Reserve Bank of India issues banknotes with multiple security features such as color-shifting ink, micro-text, and watermarking.

Are there any plans to make INR fully convertible?

While INR is currently partially convertible, discussions on full capital account convertibility are ongoing but not yet implemented.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).