TopFX Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €50

- MT4

- cTrader

- 2015

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €50

- MT4

- cTrader

- 2015

Our Evaluation of TopFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TopFX is a high-risk broker with the TU Overall Score of 2.36 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TopFX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. TopFX ranks 378 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

TopFX is a CFD broker. It is an experienced and trusted broker that is officially registered and regulated. TopFX offers favorable conditions, an intuitive user account interface, integration with popular trading platforms, a wide range of assets, and leverage up to 1:30. The broker does not offer a training program, and there is no up-to-date analytics, only a section with trading charts. Yet, it has its own copy trading service, which allows investors to earn passive income and learn from the experience of successful traders.

Brief Look at TopFX

The TopFX broker offers access to CFDs on currency pairs, stocks, indices, precious metals, energies, and ETFs, with more than 600 assets in total. The maximum leverage is 1:30. The two account types are RAW and ZERO. The accounts have a number of trading differences: for example, the spread is either 0 or 0.5 pips, and the commission is either 2.75 or 0 euros. Other conditions are either average or more beneficial: the minimum trade size is 0.01 lots, the stop-out is set at 50%, the minimum deposit is EUR 50, and there is no withdrawal fee.

Traders can use cTrader and MT4 platforms, including their mobile versions. The broker sets no restrictions on trading strategies and methods, such as weekend trading, scalping, hedging, use of expert advisors, and bots. The broker does not offer referral programs or discount promotions; rebates from Traders Union are the only bonus available. The platform has its own copy trading service.

- low entry threshold, popular trading platforms, no restrictions on strategies and styles;

- several hundred CFDs on the most popular asset groups, moderate leverage, tight spreads;

- trade commissions are lower than market average, no deposit or withdrawal fees, transparent broker policy;

- low minimum deposit, instant admission, and withdrawals for most methods take no more than 1 day;

- convenient division of accounts into two types, also traders can trade on a demo account;

- the CFD broker uses an LD5 data processing center, which provides high-speed performance on the 3Ms level;

- support service is represented by all communication options and is available 24/7.

- TopFX is a CFD broker, which means that traders can trade only contracts for differences, not assets;

- the company does not offer investment opportunities; there is not even a standard referral program with bonuses for referred clients;

- TopFX supports only two platforms (cTrader and MT4), other popular platforms (like MetaTrader 5) are not available.

TU Expert Advice

Financial expert and analyst at Traders Union

The CFD broker TopFX has been operating since 2010. The platform is officially registered in Cyprus and regulated by the FSA (The Seychelles Financial Services Authority). A retrospective assessment did not reveal any conflicts with traders since the broker fully meets its obligations while operating transparently within international financial regulations. The liquidity providers are first-tier organizations such as major banks. TopFX has developed its own CRM for automating routine processes and an original integration system with MetaTrader 4 and CTrader trading platforms. High-speed performance is within 2.3-3 ms (confirmed by dynamic tests). From a technical standpoint, TopFX’s operation does not raise any questions.

Trading conditions are competitive and often more favorable than average. The RAW and ZERO accounts offer narrow spreads ranging from 0-0.5 pips, which is better than most brokers (not just CFDs in general). Trading commissions are below average on one account and non-existent on the other. Most transactions are conducted without fees: for example, withdrawal fees are only charged for wire transfers, whereas the trader incurs no costs for Visa, MC, PayPal, Neteller, Skrill, or SOFORT. The leverage is moderate, and the stop-out level is typical. The performance is market-based, and there is no dealing center. The client can practice on a demo account. The broker does not set restrictions, bots and advisors are available, and trading is open on weekends.

In reviews, people often mention that TopFX does not offer investment options and passive income opportunities. That is not entirely true. While there is no referral program and traders cannot invest in dividend stocks, clients can invest in more experienced colleagues using copy trading. This proprietary feature was developed by TopFX specialists and is conveniently integrated into the main platform. However, it is important to note that copying is only available through the cTrader platform. If the client uses MT4, they cannot avail themselves of the copy trade feature. This cannot be seen as a disadvantage, rather, it is a constructive feature of the platform that has been implemented with the highest level of convenience for investors and signal providers.

TopFX Summary

| 💻 Trading platform: | cTrader, MT4 |

|---|---|

| 📊 Accounts: | Demo, RAW, ZERO |

| 💰 Account currency: | USD, EUR |

| 💵 Replenishment / Withdrawal: | Visa and MC cards, PayPal, Skrill, Neteller, wire, Przelewy24, PaySateCard, iDEAL, SOFORT |

| 🚀 Minimum deposit: | €50 or equivalent |

| ⚖️ Leverage: | up to 1:30, depending on the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lots |

| 💱 Spread: | 0.0-0.5 pips |

| 🔧 Instruments: | CFDs on currency pairs, indices, stocks, precious metals, energies, and ETFs |

| 💹 Margin Call / Stop Out: | N/A |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | N/A |

| ⭐ Trading features: | Demo and two live accounts, CFDs only, more than 600 assets, moderate leverage, no trade restrictions, no deposit or withdrawal fees, narrow spreads, 2 trading platforms, use of expert advisors and bots, its own copy trading service |

| 🎁 Contests and bonuses: | Yes (rebates from Traders Union) |

Often, the minimum deposit depends on the type of account, but in the case of TopFX, traders must deposit at least €50 regardless of the account they register for. Note that accounts also support U.S. dollars, so deposits can be made in USD (the minimum amount must be equivalent to €50 at the market rate). Funds can also be deposited in other currencies but automatically converted to one of the supported currencies. Leverage is determined by the selected asset. The maximum leverage is available for currency pairs and is 1:30, which is a market average indicator. Finally, the website offers technical support via phone, email, LiveChat, or support tickets. It operates 24/7.

TopFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start cooperating with the CFD broker TopFX, you need to register on its official website, go through verification, select an account type, and make a deposit. Usually, this process is not difficult, but Traders Union has prepared this step-by-step algorithm to eliminate any questions for new users.

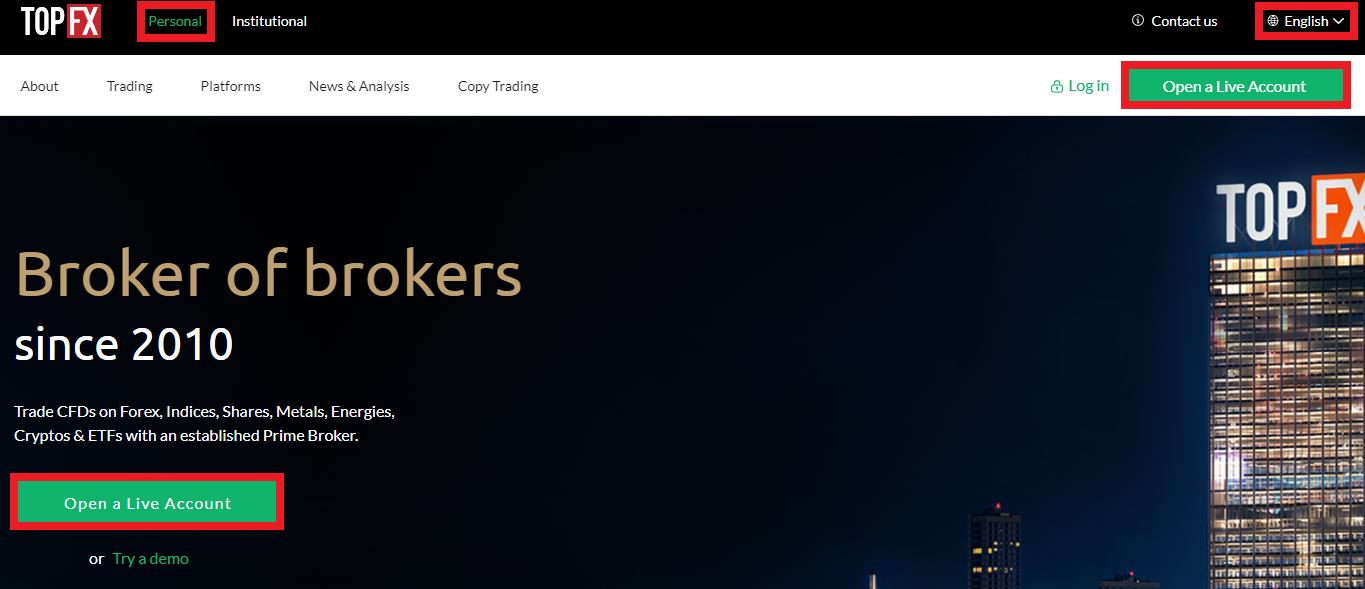

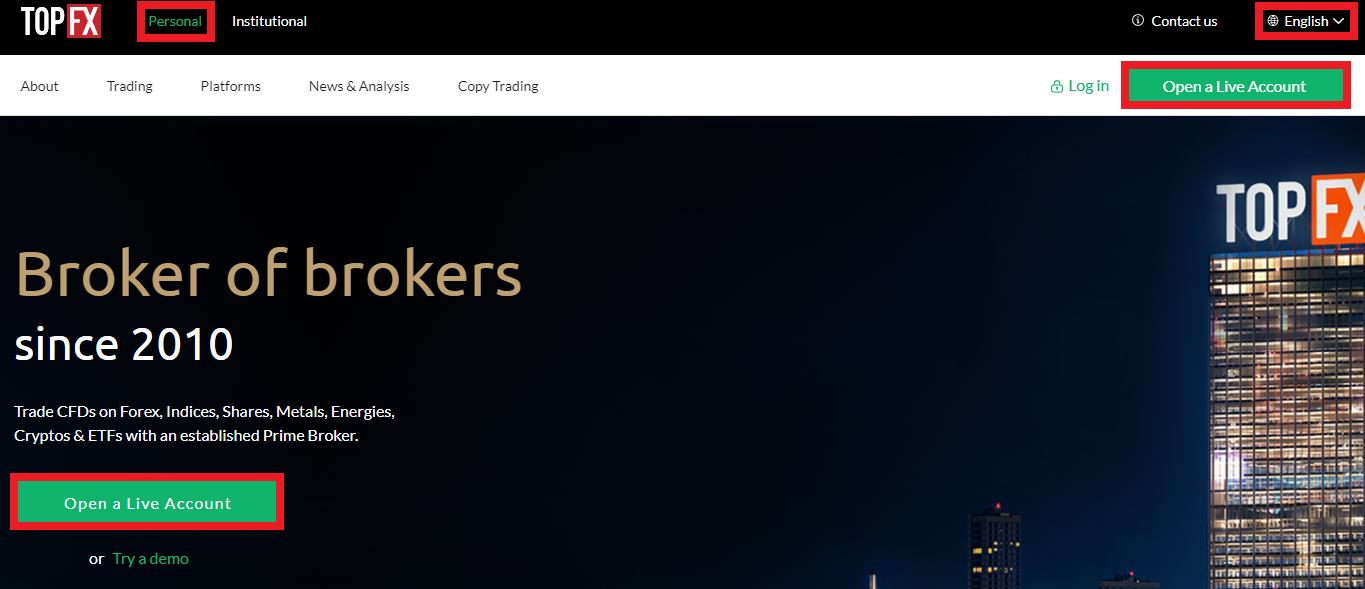

Go to the broker’s website. Make sure that the “Personal” type of offering is selected in the top menu (the “Institutional” designation is intended for legal entities). In the same menu on the right, select the interface language. Then click on “Open a Live Account” (in the menu or advertising block).

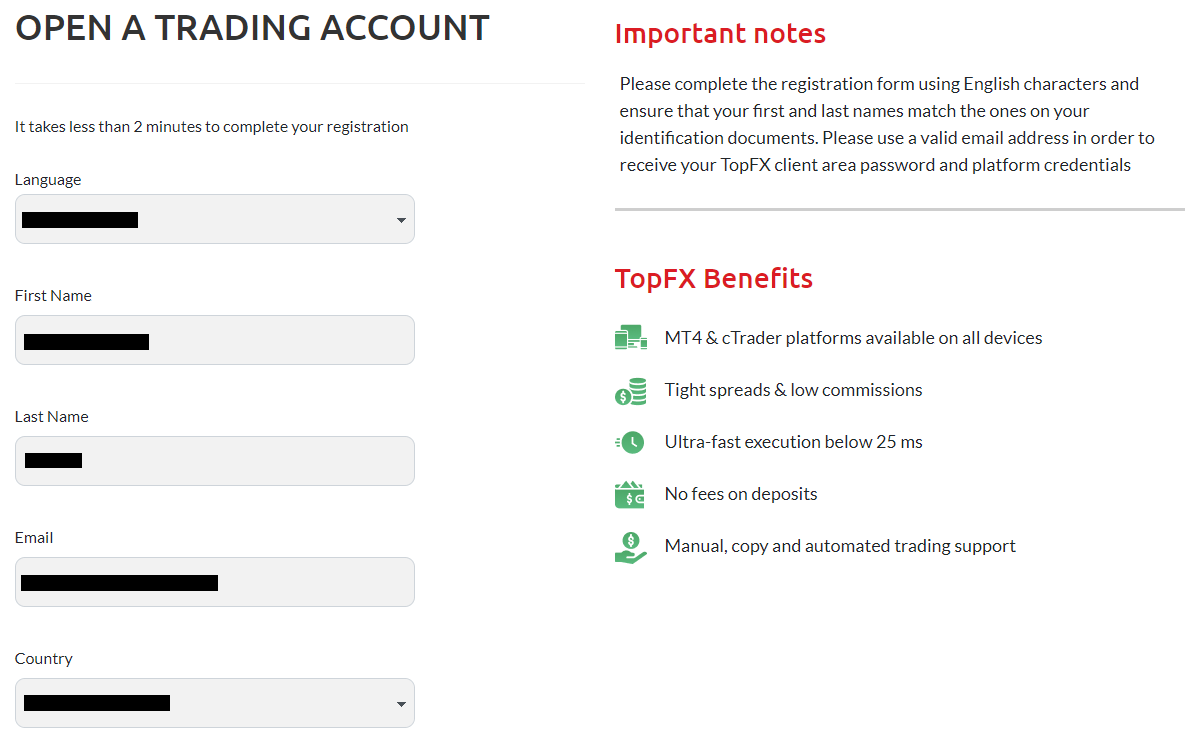

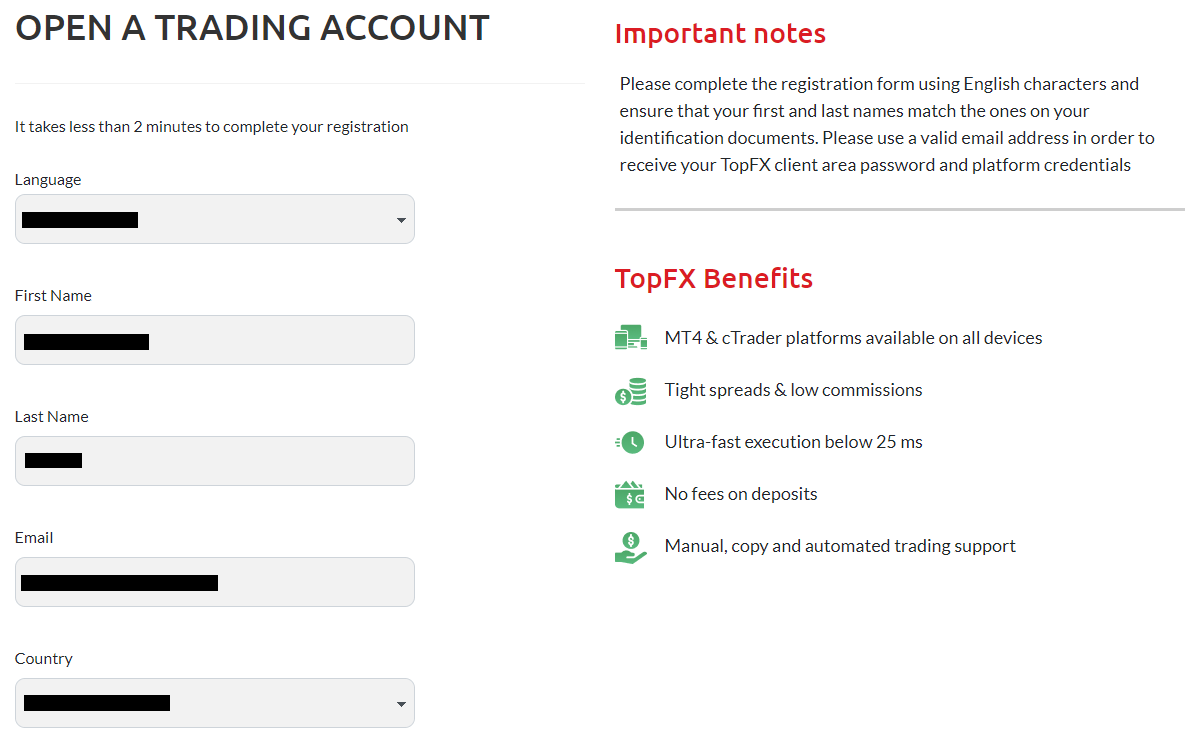

Choose your preferred language and enter your first and last names. Enter your email, country of your residency, and phone number. Then select the trading platform you will be working with and the account type, either RAW or ZERO. Agree to the “Newsletters and special offers" subscription by ticking the box (it’s not mandatory). Click on the Create Account button.

You have entered the user account, but you cannot deposit and start trading yet. You need to get verified by confirming your personal information. But first, open your email (you will receive 2 emails). The first email will contain your login and password, and the second one will contain a link to download the selected trading platform.

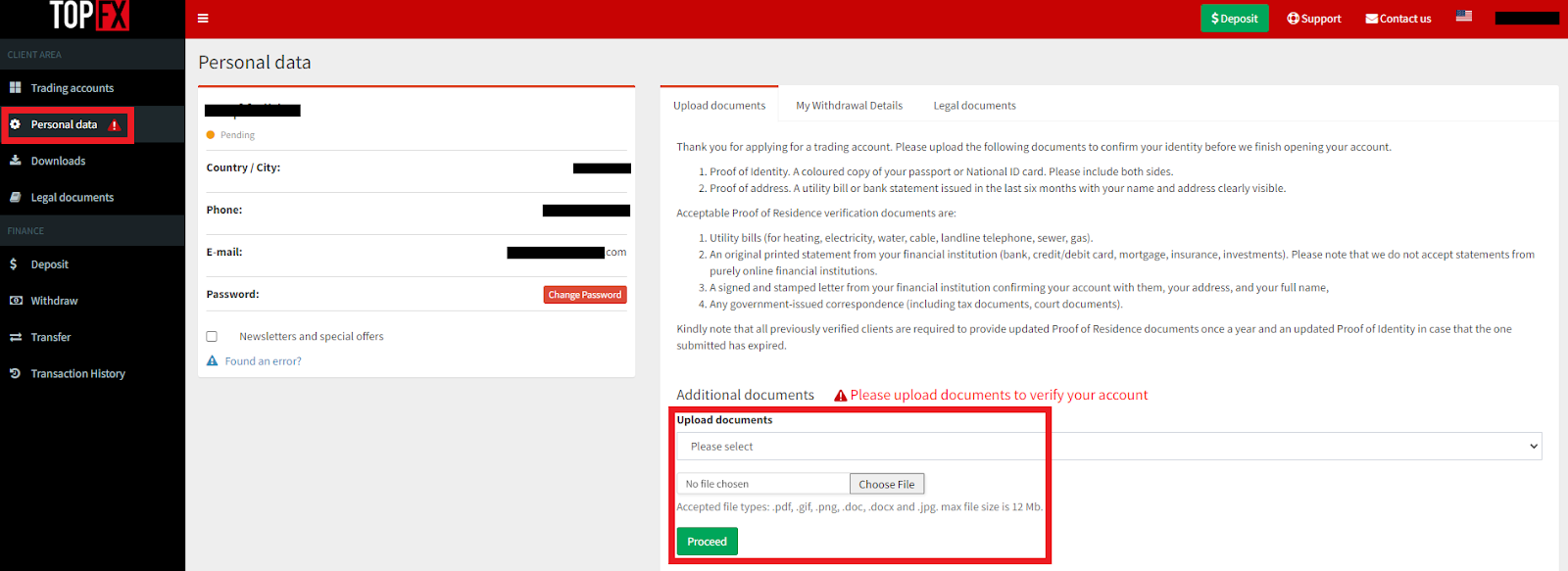

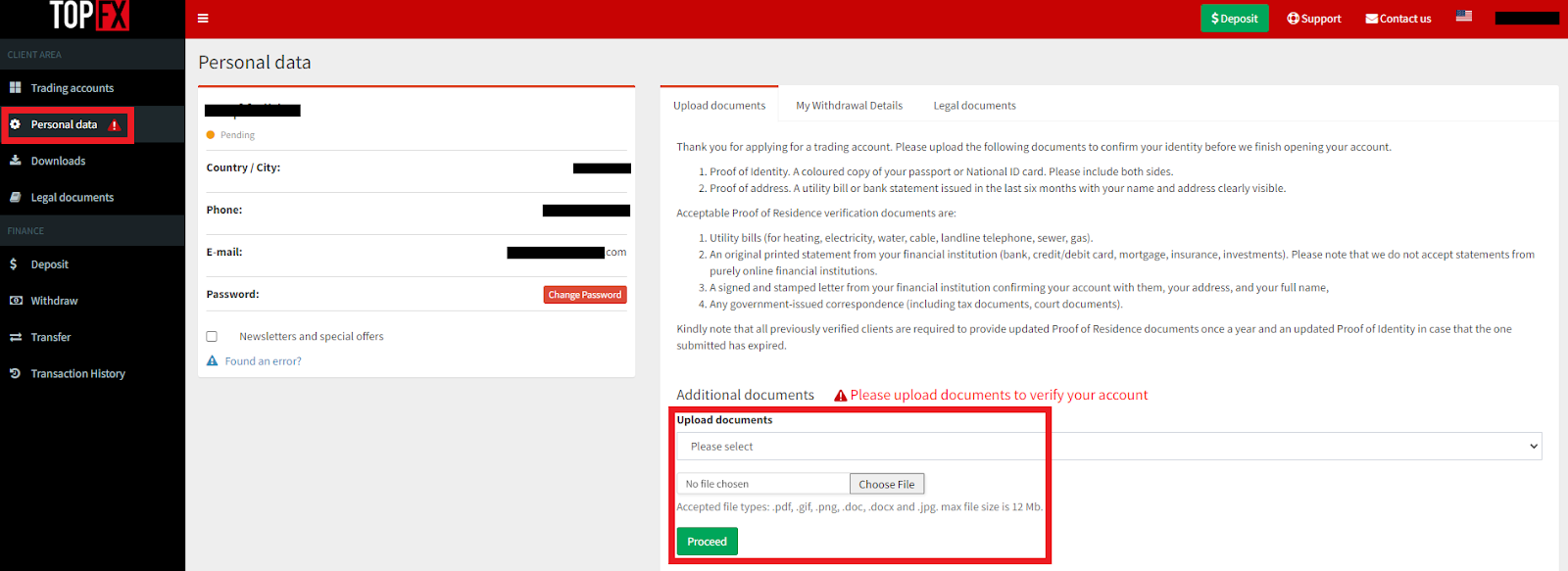

Go back to your user account. Open the “Personal data” in the left menu. You will see a feature for uploading scans/photos that verify your identity. Read the recommendations, upload the files, and wait for the specialists to review them. The verification status will be displayed at the bottom of the page.

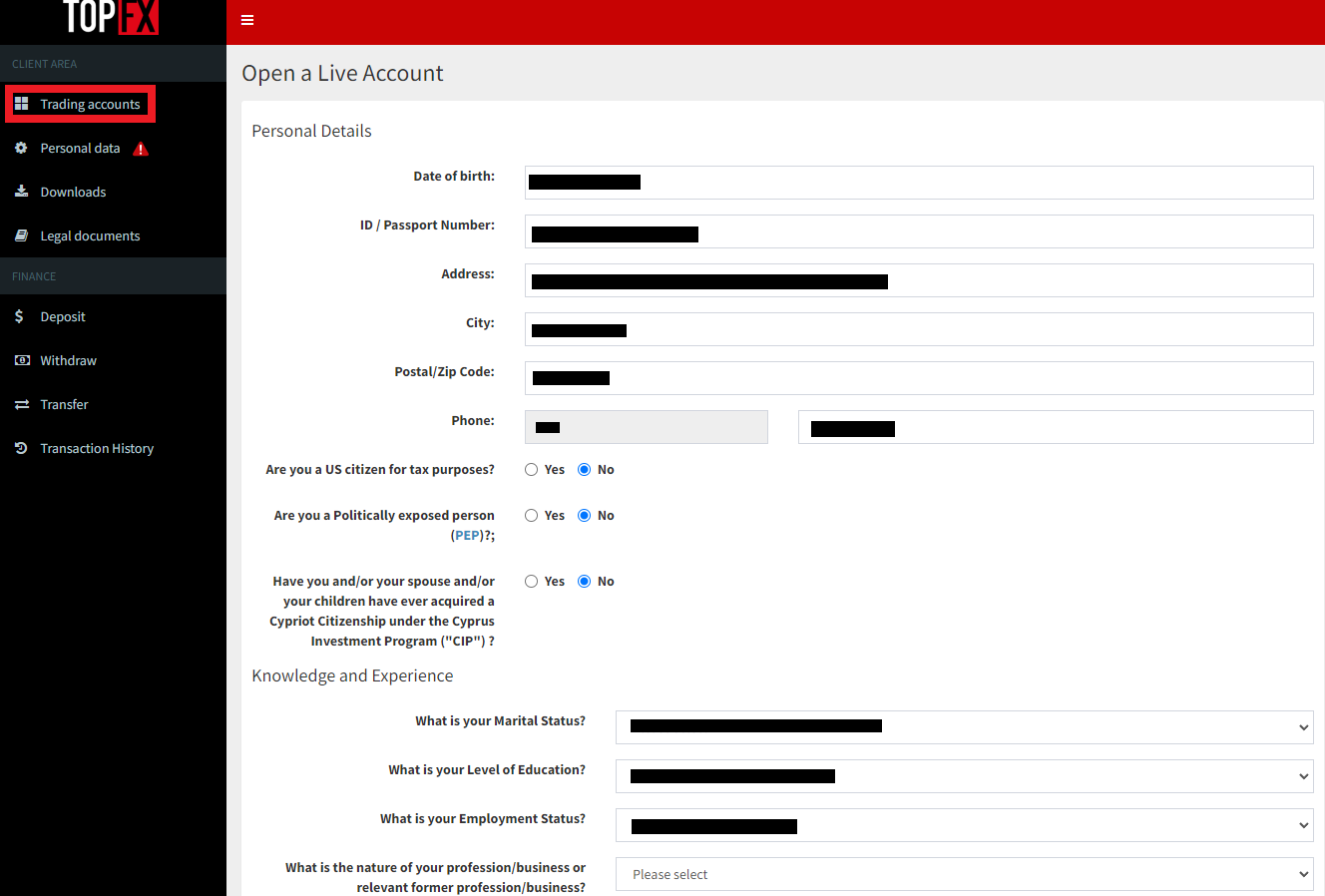

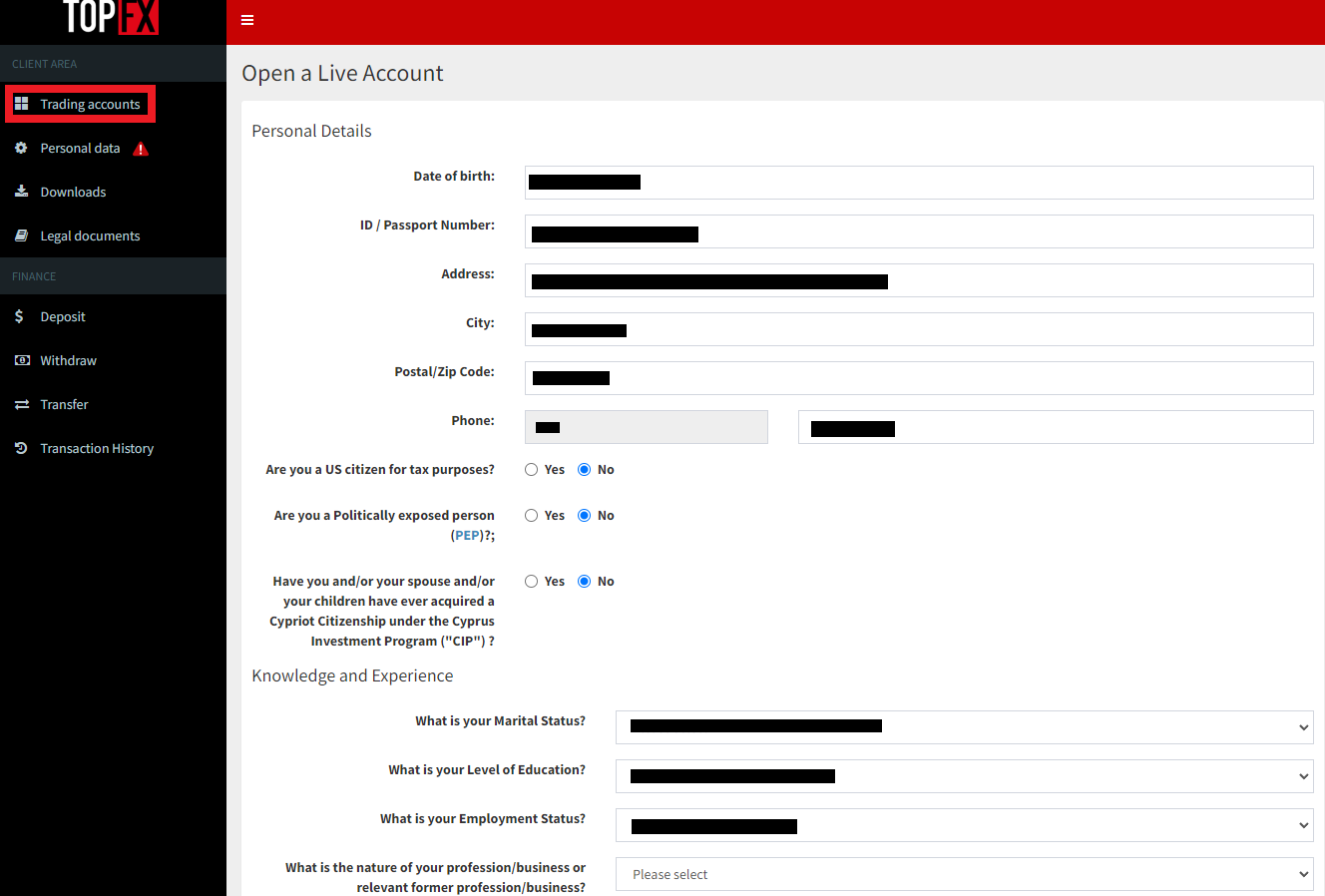

Go to “Trading accounts” and click on “Open a Live Account”. Enter your personal information such as date of birth, ID/Passport number, address, etc. Answer all the questions. Agree to the terms of service by checking the boxes at the bottom. Click “Accept”.

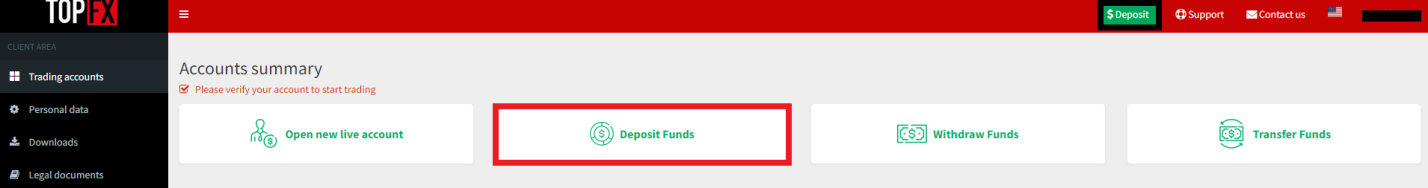

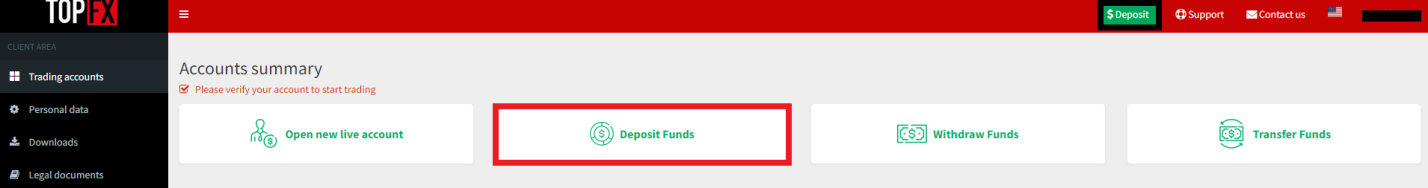

After you open a live account, click on the Deposit button located in the upper right corner. You can also go to the “Trading accounts” menu and click on Deposit Funds. Both buttons initiate the process of adding money to your account balance. Follow the on-screen instructions. Once funds have been credited to your account balance, you will have full access to the platform’s features and will be able to trade through the selected platform.

Your TopFX user account also provides access to:

-

Trading accounts. In this menu, the trader can open a live account, make deposits, withdraw funds, and make an internal transfer. When selecting an open account, detailed data about it is displayed.

-

Personal data. Here traders can upload documents for verification, and if necessary, they can be replaced with others (by notifying the broker of the reason for the correction).

-

Downloads. In this menu, you can download the installation files for cTrader and MetaTrader 4 – desktop and mobile versions.

-

Legal documents. Redirects the trader to the corresponding submenu of the “Personal data” menu. Here, the terms of service and platform rules are posted.

-

Deposit, withdraw, transfer. Three separate buttons in the main block allow you to quickly access the required feature. Each function is accompanied by detailed instructions.

-

Transaction history. This block includes all information on deposits, withdrawals, and internal transfers. The transaction time and status of each transaction are specified (the full archive is saved).

Regulation and Safety

For a trader, there are two important factors, that the broker has official registration and regulation, then they can be confident that they are not dealing with a fraudster. TopFX Ltd is registered as a Cyprus Investment Firm (CIF) and licensed by the Cyprus Securities and Exchange Commission (CySEC) under license number 138/11 in accordance with the Markets in Financial Instruments Directive (MiFID II). TopFX Global Ltd with registration number 8424819-1 is a company registered under the Laws of Seychelles and licensed by the Financial Services Authority (FSA) of Seychelles under the Securities Act 2007 with a Securities Dealer License No: SD037.

Advantages

- To the broker’s technical support

- To the Cyprus Securities and Exchange Commission (CySEC)

- To the Financial Services Authority (FSA)

Disadvantages

- The regional financial control authorities if you are not a resident of Cyprus or Seychelles

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| RAW | $1 | No |

| ZERO | $5 | No |

The commissions are shown in a separate table, and a comparison has also been made between TopFX and two other platforms. This will allow traders to assess how profitable it is to work with this CFD broker.

| Broker | Average commission | Level |

|---|---|---|

|

$3 | |

|

$1 | |

|

$8.5 |

Account Types

The account type is the key. With a demo account, everything is clear: the trader trades with virtual funds on real market indicators to practice and refine their strategy. Live accounts are represented by RAW and ZERO types. The RAW one has a lower spread, but there is a trading commission. The ZERO account has a higher spread, but no commission. The spread is floating, and the commission is fixed. All assets are available on both accounts, and the maximum leverage is the same. The stop-out and other indicators are also the same. Therefore, it cannot be said that one account is better than the other, everything depends on the trader’s preferences and preferred trading style.

Account types:

To open a live account, the trader needs to register, verify their identity, and make a deposit. Verification and deposit are not required to trade on a demo account. Traders can work on a demo account while managers verify the new user's personal information.

Deposit and Withdrawal

-

If a trader is trading on a demo account, they are using virtual finds and therefore not earning real profits.

-

When trading on real RAW and ZERO accounts, the trader is working with real money and can replenish their balance after successful trades.

-

Withdrawals are possible at any time, with the minimum amount depending on the withdrawal channel.

-

For example, there is no minimum amount for Visa cards and PayPal, while Skrill has a minimum of 1 euro.

-

The maximum limit also depends on the withdrawal channel. A fee is only charged when using wire (€10 for amounts less than €100).

-

In most cases, withdrawal processing takes no more than one day, while wire transfers may take 3-5 days, and Visa/MC cards can take up to 7 days for funds to be withdrawn.

-

All withdrawal operations are carried out through the user account on the broker’s website.

Investment Options

Many brokers offer opportunities to earn money through methods other than active trading. For example, in recent years cryptocurrency staking has become popular. However, such programs are rarely considered the main source of income, as most traders come to trade financial instruments with leverage on their own. In the case of TopFX, users can only work with CFDs (contracts for difference), but there are quite a few of them. From the perspective of passive income, TopFX doesn’t have a typical referral program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TopFX’s trading service:

Copy trading is a way of earning passive income when a trader becomes an investor. They select a signal provider and copy their trades, but with personal adjustments, such as setting their own stake. If the provider’s trade succeeds, the provider and linked investors profit according to the established stakes. Additionally, the provider charges a small fee from investors. However, if the trade fails, everyone loses their stakes. TopFX’s copy trading service is available through the cTrader platform. Any trader can register as a signals provider or investor. The system is characterized by full transparency, high-speed performance, and an intuitive interface. Besides earning money without trading independently, an investor also has an opportunity to learn, because they can see all the nuances of trade and apply them to the market situation. This is a priceless practical experience.

Customer Support

Technical support is essential for every broker. Regardless of the intuitiveness of the website interface and the quality of the FAQs, all traders sooner or later face situations that they cannot resolve on their own. In this case, they turn to platform managers. If the manager is incompetent, slow to respond, or works limited hours, the trader may become disappointed with the broker and switch to a competitor. Understanding this, TopFX provides its clients with 24/7 top-level technical support, which is available by phone, email, and live chat. It is also possible to create a ticket on the website (the response will be sent by email).

Advantages

- Even if you are not registered it is possible to contact technical support for assistance

- Technical support works 24/7

- The broker offers all the main options for communicating with support

Disadvantages

- During peak hours, the call center may sometimes be overloaded

If you are already working with TopFX or are considering becoming a client of this CFD broker, you can use the following communication channels to resolve issues:

-

call center;

-

email;

-

LiveChat on the website in the user account;

-

tickets in the “Contacts” section.

The broker has official Facebook and Instagram pages. It makes sense to subscribe to them, as the company publishes up-to-date information about its work there.

Contacts

| Foundation date | 2015 |

|---|---|

| Registration address | 3rd Floor, Stratigou Gianni Timagia 19, Limassol, 3107, Cyprus |

| Official site | https://topfx.com/ |

| Contacts |

+357 25352244

|

Education

One aspect of trading involves the necessity for constant improvement. Traders should constantly practice, learn new styles and methods, try additional financial instruments, communicate with colleagues, and participate in webinars. Otherwise, they face slow regression or may even stop making successful trades. For this reason, some brokers offer educational materials and even full training programs to their clients. However, TopFX takes a different approach.

As you can see, the broker assumes that their clients are already familiar with the interbank market and have experience trading contracts for difference. TopFX doesn’t provide education, and it doesn’t even have proper news. This is a bit of a drawback of the platform. However, they do offer copy trading, which can provide relevant experience for beginners.

Comparison of TopFX with other Brokers

| TopFX | RoboForex | Pocket Option | Exness | IC Markets | Libertex | |

| Trading platform |

cTrader, MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, cTrader, MT5, TradingView | Libertex, MT5, MT4 |

| Min deposit | $50 | $10 | $5 | $10 | $200 | 100 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.5 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 50% / 50% |

| Execution of orders | N/a | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of TopFX

TopFX offers CFDs (contracts for difference) only. The platform has been operating for 13 years and currently offers more than 600 assets in its pool, with the number constantly growing. The largest number of assets consists of 500 stocks and the smallest number consists of 18 ETFs (exchange-traded funds). There are 60 currency pairs available, including exotic ones. The leverage is determined by the asset, for indices it is 1:20; and for currencies, it is 1:30 (the maximum rate). Traders work through the highly customizable cTrader and MT4 platforms, which offer competitive trading conditions. Additionally, TopFX uses Intelligent Routing technology and other high-tech solutions to operate quickly and without relying on dealing centers. The platform also boasts a modern level of security, including a full range of solutions from SSL certificates to separate storage of company and traders’ funds.

TopFX by the numbers:

-

The minimum deposit is €50;

-

The real spread is from 0.0 pips;

-

The transfer fee is €0;

-

The average execution time is 25-30 ms;

-

Withdrawal of funds takes 1 day.

TopFX is a premier CFD broker

It is quite common for brokers to focus on a specific group of assets. Some platforms offer only currency pairs or securities, but TopFX has chosen CFDs as its main focus. This means that all financial instruments available to traders for trading are CFDs, including currency pairs, stocks, indices, energies, metals, and exchange-traded funds (ETFs). Trading CFDs is very profitable under the conditions of narrow spreads and low commissions (0 or €2.75). Moreover, traders can choose one of two platforms, and cTrader and MT4 have mobile versions and can be customized with third-party plugins. Through the user account, traders have full control over their trading. In case of a dispute, technical support can provide a prompt response even on a Saturday night. Plus, high transparency is another important advantage.

ForexChief’s analytical services:

-

Copy Trading. Every trader who works with TopFX can register an account in its copy trading service, becoming either a signals provider or an investor. The service is implemented through cTrader.

-

Range of Markets. This is a section on the broker's website where information on available trading assets is constantly updated (minimum lot size, minimum spread, maximum leverage).

-

Market holidays. This is an extremely useful service that consists of a separate page on the TopFX website, where the trading hours are published in accordance with national holidays.

Advantages:

More than 600 CFDs are offered on currencies, indices, ETFs, metals, and energies;

Registration takes only a few minutes, verification is standard. Traders can open either a demo or a live account (two types are available);

The trading conditions, including spreads and commissions, are more favorable than the market average, with no fees for deposits or withdrawals.

The platform operates using advanced technological stacks, ensuring the high-speed performance of 25-30 ms.

An advanced security system also reliably protects users’ funds and data from fraudsters.

User Satisfaction