Juno Markets Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $25

- MT4

- 2021

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $25

- MT4

- 2021

Our Evaluation of Juno Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Juno Markets is a high-risk broker with the TU Overall Score of 2.46 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Juno Markets clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. Juno Markets ranks 368 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Juno Markets is a broker for both professional traders and beginners. Clients trading for the first time have a special training platform, where a novice trader is introduced to the basics of asset trading. Juno Markets provides educational materials for professional traders as well. The broker focuses on the Asian market.

Brief Look at Juno Markets

Juno Markets is a brokerage that has existed since 2014 and specializes in Forex, CFDs, and commodities. It offers such trading platforms as MT4 and its proprietary Juno Auto Trader and focuses on the Asian market. Its trading servers and liquidity providers are registered and hosted in Asia. Juno Markets Limited operates under an official license and is registered as an international broker. Its financial activities are regulated by the Vanuatu Financial Services Commission (VFSC).

- Its official VFSC license is No. 40099;

- Its Official marketing partnership is with the Nasdaq stock market;

- Traders have access to real-time Forex signals;

- There are opportunities to partner with Juno Markets as an IB (Introducing Broker), Money Manager, and White Label;

- There are 7 ways to fund an account;

- Cash back for clients up to $300 is paid monthly. The amount of cash back depends on the number of closed trades.

- The minimum deposit is $25 for STP accounts, $500 for ECN accounts, and $25,000 for institutional accounts;

- Mandatory verification;

- Restrictions for the USA, Iran, and Korea. Citizens of these countries will not be able to open an account.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker Juno Markets has been providing financial instruments for trading since 2014. Within 9 years of operation, more than 100,000 traders in more than 90 countries have used the services of this company. The broker offers over 100 instruments, such as Forex assets, among which are 75 currency pairs, and metals including gold, silver, platinum, palladium. There are more than 11 liquid global stock indices, such as the FTSE (Financial Times Stock Exchange) and Dow Jones. Also, clients can choose to trade in energy commodities and CFDs on shares.

Juno Markets offers 3 types of accounts that differ in the minimum deposit, leverage, spreads, fees, and swaps. The withdrawal of funds is fast. If traders are not confident of their abilities, Juno Markets can educate them for free. Clients can make deposits both with cryptocurrencies and fiat money from a bank card.

There is no office support, but online technical support is available. Live chat operators respond fast and informatively.

Juno Markets Summary

| 💻 Trading platform: | МТ4 (desktop, mobile, web), Juno Auto Trader |

|---|---|

| 📊 Accounts: | Demo, STP, ECN, Institutional |

| 💰 Account currency: | USD, AUD, EUR, CNY, VND, VND |

| 💵 Replenishment / Withdrawal: | Credit cards, bank transfer, NETELLER, UnionPay, Skrill, Alipay, Ngan Luong, Fasapay |

| 🚀 Minimum deposit: | from $25 |

| ⚖️ Leverage: | 1:100, 1:400, 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0 pip for Institutional accounts / ECN, 1.5 pip for STP |

| 🔧 Instruments: | Currency pairs (67), CFDs on shares (20), indices (13), metals (7), energy (4), and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | More than 20 major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution, market execution |

| ⭐ Trading features: | A fee of 50 units of the base currency for inactive account within 30 days is possible |

| 🎁 Contests and bonuses: | No |

Juno Markets offers clients more than 100 trading instruments to trade. Both classic MetaTrader 4 and Juno Auto Trader platforms are available. Trading leverage depends on the type of program selected. For regular Straight-Through Processing (STP) traders, it is 1:500, for ECN accounts, it is 1:400, and for institutional accounts, it is 1:100. There is a demo mode where traders can try out the Juno Markets’ modern financial instruments. Muslim traders can use Islamic swap-free accounts.

Juno Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

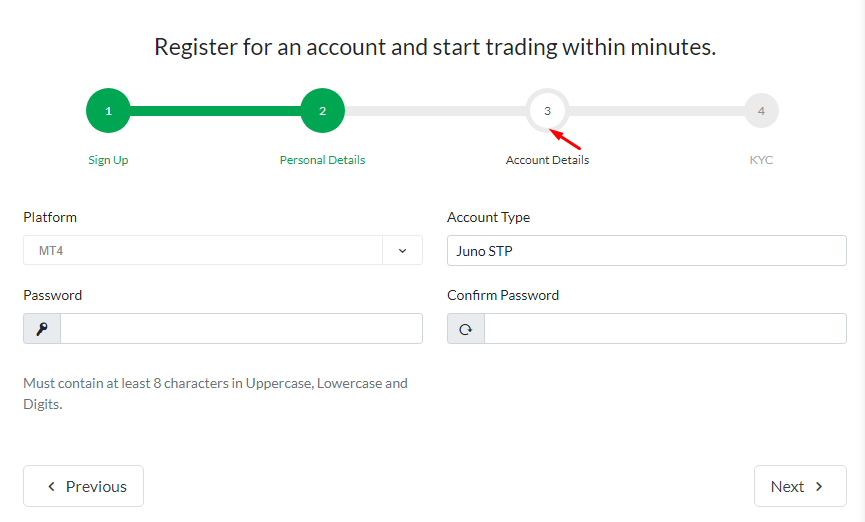

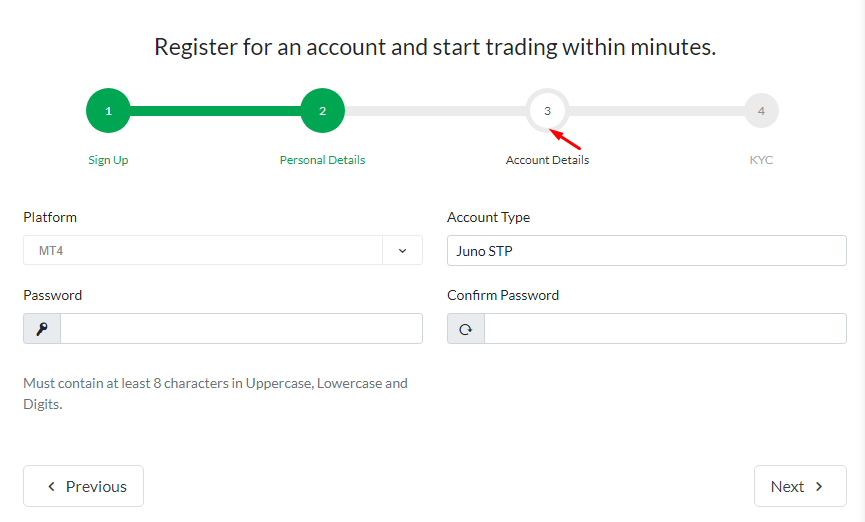

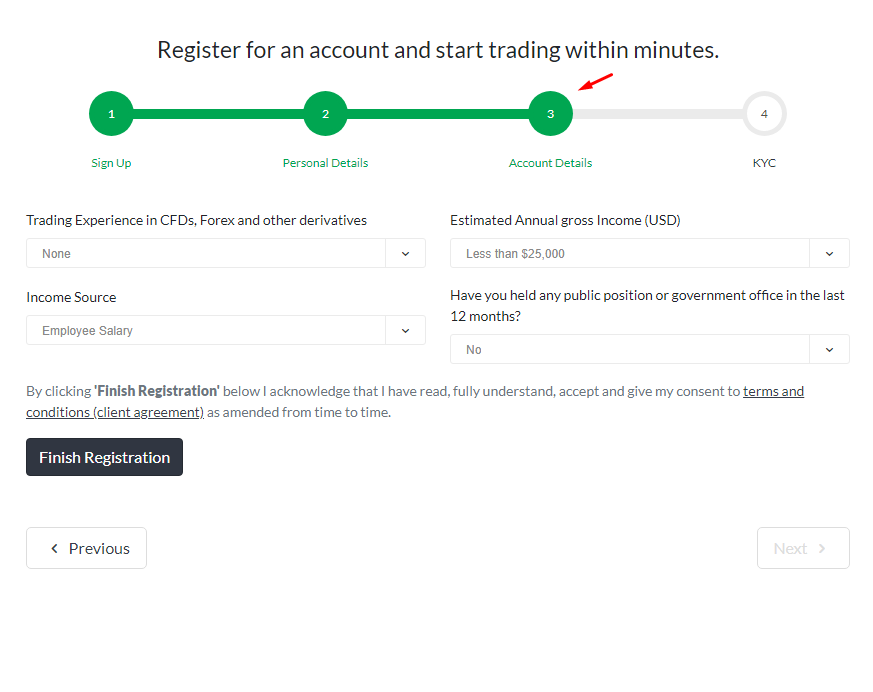

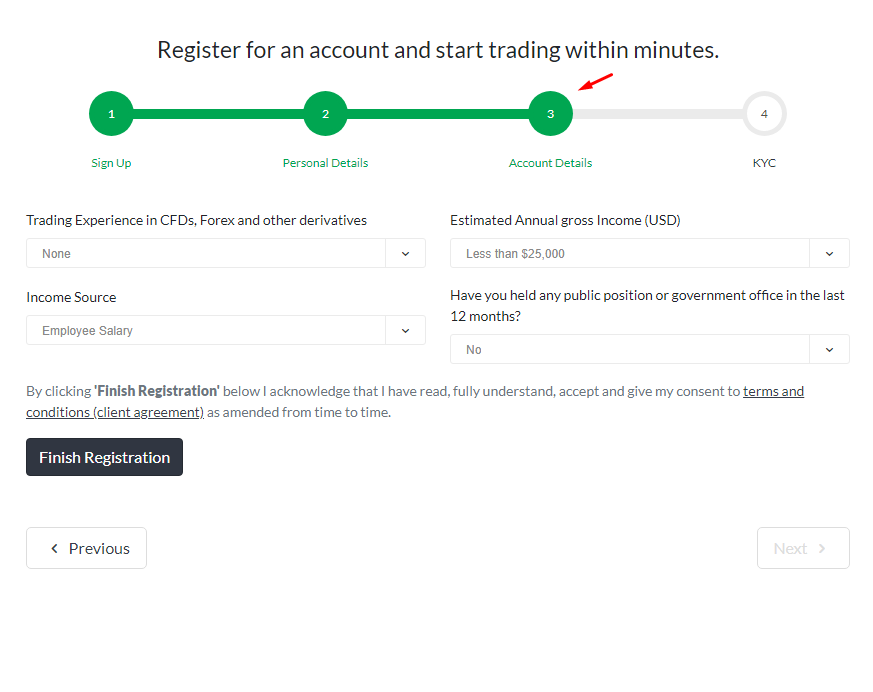

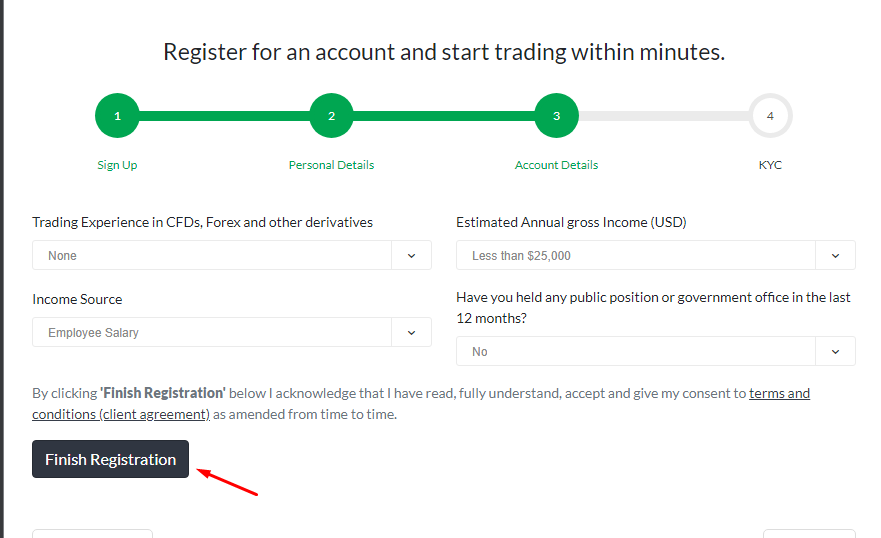

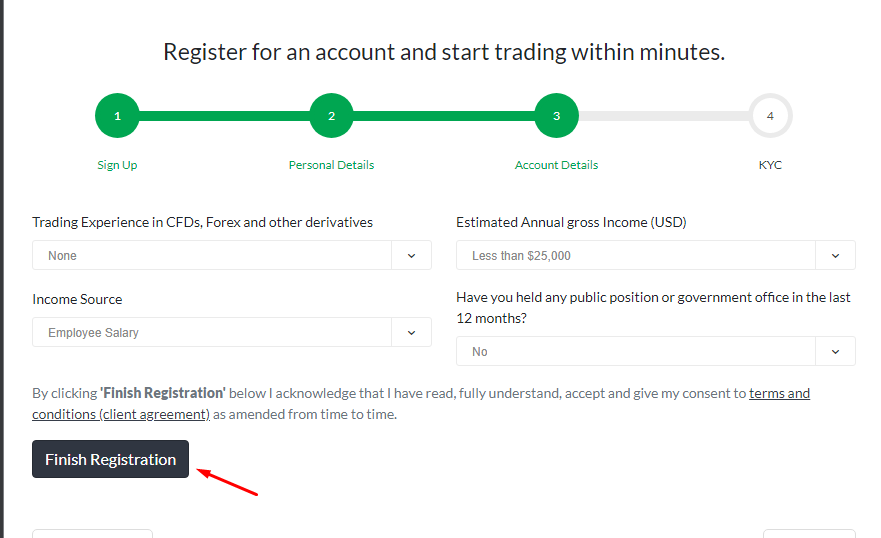

To access Juno Markets’ options, you must register a user account. How to create an account:

On the Juno Markets website, click the “Open an Account” button. Or you can try a demo account by clicking the “Try a Free Demo” button.

If you choose Open An Account, you must fill out the registration form indicating the following information: your first name, last name, mobile phone number, and email address. Then indicate your personal data: date of birth, country and city of residence, address.

Next, enter details of the future account: select a trading platform, account type, and create a password.

Indicate your trading experience, estimated income, and source of income.

Finish your registration by clicking the “Finish Registration” button.

An email with a link will be sent to your address. To activate the account, follow the link from the letter.

To withdraw the earned money it’s mandatory to get verified first. To start the identification process and go to the “Settings” section.

To replenish your account, go to the “Deposit Funds” section. There are 7 ways to make a deposit.

Click on the “Personal Information” menu and attach scanned documents.

Other options available in the user account:

-

User account statistics;

-

Transfer of assets;

-

Downloading the platform to the device;

-

Support contact section;

-

Withdraw funds.

Regulation and Safety

Juno Markets is officially registered in the Republic of Vanuatu. The brokerage company is regulated by VFSC. Since 2017 VFSC has tightened its regulatory requirements to protect clients. In accordance with the new rules, Juno Markets shall undergo an annual comprehensive financial audit by an independent auditor. It shall also deposit the VFSC bonds in the amount of Vt.5,000,000, which is a mandatory requirement to the equity.

Advantages

- If the broker fails to fulfill its obligations, a client has the right to file a complaint with a regulating authority

- Availability of automated trading, which reduces the risks of loss

- Availability of passive investing and trust management

Disadvantages

- Mandatory verification for all accounts

- The company is closed on holidays

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| STP | From $1.5 | Yes |

| ECN | From $4 | Yes |

There are no swaps for STP and ECN accounts. A swap fee is charged for institutional accounts.

Also, Traders Union experts conducted a comparative analysis of trading fees of Juno Markets, RoboForex and PocketOption. The results of the analysis are listed in the table below:

| Broker | Average commission | Level |

|---|---|---|

|

$2.75 | |

|

$1 | |

|

$8.5 |

Account Types

There are three types of accounts for Juno Markets’ clients:

For major currency pairs, spreads start from 0.2 pips for a EUR/USD pair (for ECN accounts). When trading with STP accounts spreads start from 2.2 pips. Spreads for a GBP/USD pair start from 0.3 pips for ECN accounts, and spreads rise to 2.3 pips for STP accounts. Spreads for the S&P 500 (Standard & Poor’s) index are 2.4 pips; for the FTSE 100, they are 4 pips. When trading in silver on ECN accounts, spreads of 0.01 pips are charged and they rise to 0.33 pips for STP accounts.

All platforms have a demo account. Trading conditions are favorable for both beginners and experienced traders.

Deposit and Withdrawal

-

To make a deposit, you should go to the “Deposit Funds” section, which will be available after registering an account;

-

You can withdraw money in cryptocurrency, by bank transfer, or to an e-wallet; the money will be credited within 7 days. But withdrawals will become available only after the verification of the user account.

Investment Options

The brokerage company Juno Markets offers investment programs for both active traders and passive investors. The broker provides an opportunity to invest in trust management of the MAM/PAMM programs. But investors can also become Introducing Brokers whereby they can receive additional income under the terms of partnership within the IB program.

PAMM/MAM investment programs

An investor can cooperate with the broker under the MAM (Multi-Account Manager) program, the essence of which is to earn money by solo investment, or to receive income from money management.

A client who chooses the MAM program gets access to the major banks’ liquidity and to account management to increase the investor’s income:

Equity Lot Share. It is one of the most popular MAM methods. It is also known as the percentage allocation management module with the help of an ELS. The point is that a money manager distributes the trades according to the percentage of total pool contribution;

Balance Lot Share. Here the trades are distributed according to the client’s balance not his equity. Therefore, according to this program, a coefficient of profit and loss at current open positions is not taken into account;

Equity Cash Share. The trades are placed from the account of a money manager. The principle of profit/loss distribution is based on the percentage of total pool contribution by each investor. This program is more flexible.

It is worth noting that every client can become an investor. Only professional traders can become money managers. An account manager has wide opportunities to control and distribute funds in investors’ accounts.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Juno Markets’ affiliate program:

Introducing Broker is a program that allows other companies to partner with Juno Markets. Partners get the opportunity to earn commissions, but also rebates from affiliate companies are provided under the terms of the IB program.

Customer Support

Support is available from 9:00 p.m. Sunday to 8:59 p.m. Friday (GMT). The schedule applies to all days except December 25 and January 1.

Advantages

- Live chat and email communications are available

- Telephone communication is available

Disadvantages

- No office support, online communication only

- Only 5 languages are available

Clients can contact the broker by:

-

telephone;

-

email;

-

live chat;

-

or order a callback on the website.

Any client can ask a question, regardless of the user account verification.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | 100 Cyberport Road, #09-13, Hong Kong. |

| Official site | https://www.junomarkets.com/ |

| Contacts |

+60182756732

|

Education

The Juno Markets website provides a complete Trading Guide. Even professional traders will find useful information there. To get access to the guide, you need to open an account.

You can master your trading skills and strengthen the knowledge gained from the Guide on a demo account.

Comparison of Juno Markets with other Brokers

| Juno Markets | RoboForex | Pocket Option | Exness | Vantage Markets | FxGlory | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, WebTrader, Mobile Apps | MT4, MobileTrading, MT5 |

| Min deposit | $25 | $10 | $5 | $10 | $50 | $1 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 2 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 20% / 10% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of Juno Markets

The brokerage company Juno Markets specializes in Forex, CFDs, and commodities trading. Its financial activities are maximally focused on the Asian markets, but it does not limit its functions for global traders. Juno Markets’ operation is based on the principles of simplicity and functionality. The company in no way cuts the effectiveness of various trading strategies and does not impose its own trading principles. Clients have the right to choose how they trade on its platforms.

Traders are given the opportunity to both standard and automated trading. For novices and professional traders, there is the Juno Markets training platform. STP, ECN, and PAMM/MAM accounts are available.

Juno Markets by the numbers:

-

Over 100,000 clients worldwide;

-

Trading in more than 90 countries;

-

The broker has been providing services for 9 years.

Juno Markets is a broker for active traders and investors

The brokerage company has three types of accounts: STP, ECN, and Institutional. ECN accounts allow clients to trade directly with top liquidity providers. Direct cooperation gives minimum trading spreads. You can trade currency pairs and digital assets, CFDs on shares, stock indices, metals, and energy.

Investors can use the Introducing Broker program, which allows them to receive passive income and has 9 levels of loyalty. Each level provides a corresponding reward. Trades can be made via the platforms MT4 and Juno Auto Trader. There are desktop and mobile versions of the platforms.

Useful additional services of Juno Markets:

-

Beginners Trading Guide. The training database is regularly updated with relevant materials on trading and investment;

-

Insights. Traders can get acquainted with the latest news and learn how different events affect the trading market as a whole;

-

White Labels. This solution includes the MT4 client platform and back office;

-

Trading calculator;

-

MT4 alpha generation indicators;

-

Economic calendar;

-

Juna Auto Trader. Clients get access to automated trading strategies and can diversify their portfolio based on proven traders. It is suitable for novice traders.

Advantages:

Free analytics from proven experts;

Over 5 classes of assets for trading;

Juna Auto Trader platform;

Multi-level loyalty program within the IB program.

User Satisfaction