W7 Broker Review (W7BT) 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT5

- 2019

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT5

- 2019

Our Evaluation of W7 Broker

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

W7 Broker is a high-risk broker with the TU Overall Score of 2.63 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by W7 Broker clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. W7 Broker ranks 351 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

W7 Broker & Trading offers its services to both novice and professional traders, but there are some limitations. The brokerage company doesn’t provide services to residents of the U.S.A., Canada, Brazil, Sudan, Syria, North Korea, and the United Kingdom.

Brief Look at W7 Broker

The W7 Broker and Trading (W7BT) firm is an ECN (Electronic Communication Network) broker that has provided services since 2019. The broker provides opportunities to trade six classes of assets, including cryptocurrencies and indices. The official representative office of the company is located in an offshore economic zone, in Kingstown of Saint Vincent and the Grenadines. For financial regulation, W7BT works closely with clients' legal departments to ensure compliance with the regulatory requirements of the offshore zone.

- MAM accounts;

- Negative balance protection;

- Policy of utmost transparency;

- Fast execution of orders;

- No dealing table;

- Simplicity of trading;

- Tight spreads.

- Mandatory verification;

- No cent accounts;

- Limited range of deposit methods.

TU Expert Advice

Financial expert and analyst at Traders Union

W7 Broker & Trading has been operating since 2019. All traders have access to trading advisors that improve the quality of trading. This feature has a positive effect on the total profitability of clients of the brokerage company.

W7 Broker & Trading works on the principle of ECN. Traders are offered 3 types of accounts, such as Standard, Professional (Pro), and Privilege (Priv). The conditions of a Standard account can hardly be called favorable. Spread starts from 1.5 pips and the broker's fee is $7.5 per lot. But there are also advantages. The minimum deposit is $100 and you can increase the leverage up to 1:200. The Professional and Privilege accounts have relatively loyal conditions. Pro accounts offer spreads from 1.0 pips and fees of $6 per lot, while Priv accounts offer spreads from 0.7 pips and fees of $5 per lot. But it should be understood that the minimum deposit has been increased to $10,000 and $100,000, respectively.

The minimum trade size on all accounts is 0.01 lots. There is a postscript for each account stating for whom it is intended. The Standard account is for practicing, the Pro account is for advanced investments and for those who already have commercial experience, and the Priv account is intended for traders with experience in dealing with large amounts of transactions.

W7 Broker Summary

| 💻 Trading platform: | МТ5 (desktop and mobile versions) |

|---|---|

| 📊 Accounts: | Demo, Standard, Professional, and Privilege |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank cards, Bitcoin, and Sepa-Transfer |

| 🚀 Minimum deposit: | From $100 |

| ⚖️ Leverage: |

Up to 1:30 for retail trading; up to 1:200 for professional traders |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: |

From 1.5 pips for Standard accounts; from 0.7 pips for Professional and Privilege accounts |

| 🔧 Instruments: | Currency pairs (67), CFDs on stocks (20), indices (13), metals (7), energies (4), and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Over 20 major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution and market execution |

| ⭐ Trading features: | Deposit of $1,000 to activate account |

| 🎁 Contests and bonuses: | Yes, through Traders Union |

W7 Broker & Trading offers over 50 currency pairs, CFDs on indices, digital coins, silver, gold, oil and oil products, and energies as trading instruments. Traders get the opportunity to open three account types, for various skill levels. A demo account is available to test trading strategies, but there are no Islamic accounts. Leverage can be chosen independently and the initial value is 1:30 and it goes up to 1:200.

W7 Broker Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

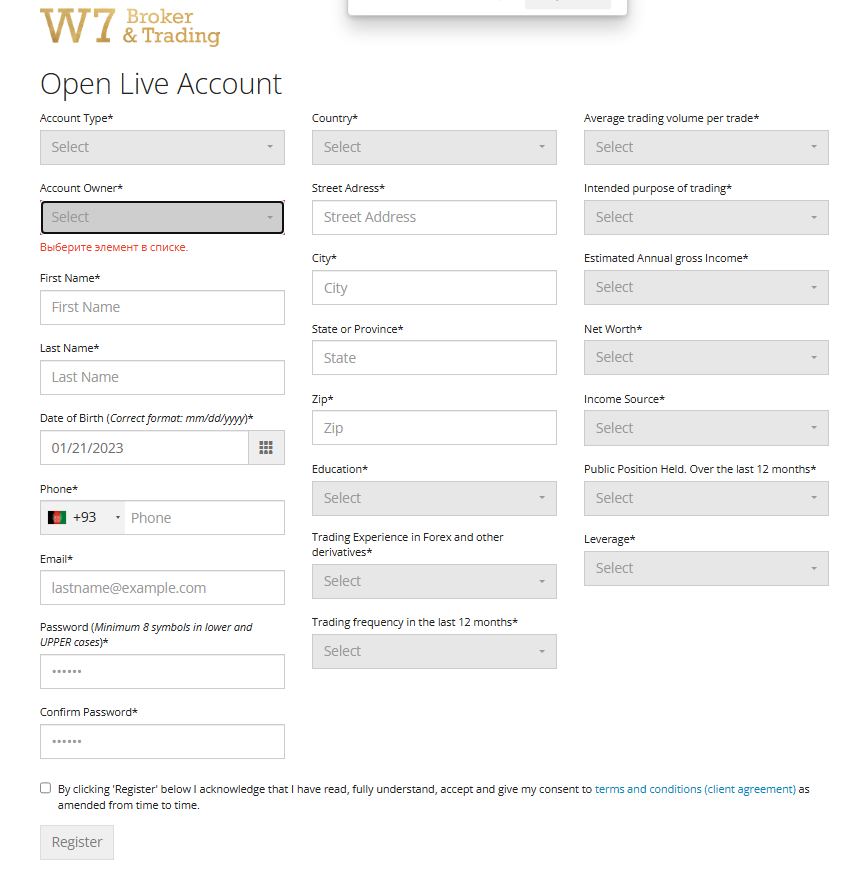

Trading Account Opening

Access to trading opportunities will open only after registration. To become a client of the brokerage company, open a trading account. The instructions are as follows:

Go to the W7 Broker & Trading website. On the main page select the type of account and click the Open Live Account or Open Demo Account buttons.

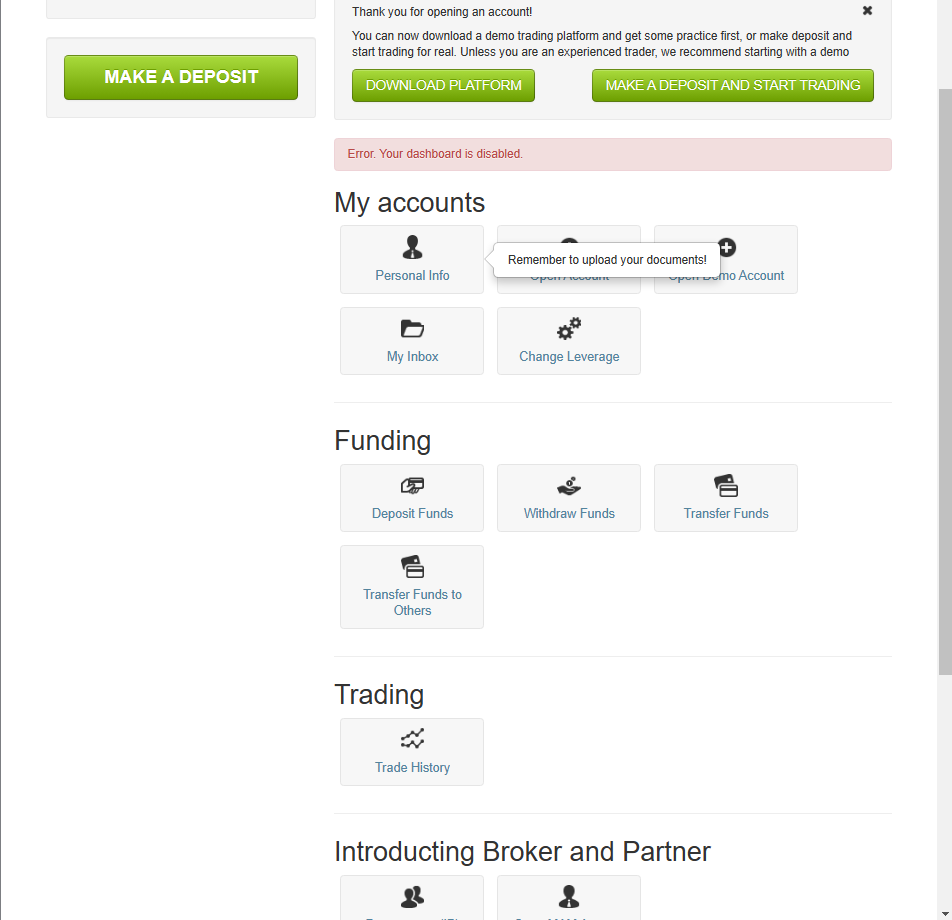

You will receive an email informing you of the creation of your user account.

The system will automatically transfer you to the user account login page. Now enter your email and password.

Finish filling out the user account, indicating contact information, trading experience, and the amount of initial capital.

The user account will become available when a trader links Google Authenticator to the account.

The final step is the user account verification. To pass it, go to the Personal Info section and upload scanned documents.

Additional features of the user account:

Deposits;

Change of leverage;

Withdrawals;

Asset conversion;

Trading history;

Registration as an IB or MAM participant.

Regulation and Safety

The brokerage company has representative offices in the offshore economic zone, in Kingstown of Saint Vincent and the Grenadines. W7 Limited is registered under number 25512 BC 2019. The activity of the brokerage company is regulated by the legislation of the offshore zone.

Advantages

- Clients funds are kept separately from the broker’s equity

- Negative balance protection for all users’ accounts. It is automated

- Traders can contact technical support any time when having problems with financial instruments

Disadvantages

- To open an account it is necessary to fill out a complicated registration form and indicate financial information

- To conduct full trading activity and to deposit and withdraw funds, verification is required

- Limited range of withdrawal instruments

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | $7.5 | Yes |

| Pro | $6 | Yes |

| Priv | $5 | Yes |

Swaps are charged.

Traders Union analysts compared the trading fees of W7BT, RoboForex, and PocketOption. The average indicators are presented in the table below:

| Broker | Average commission | Level |

|---|---|---|

|

$6.25 | |

|

$1 | |

|

$8.5 |

Account Types

W7 Broker & Trading offers 3 types of ECN accounts. The maximum leverage goes up to 1:200 and is available for all accounts. But it is possible to set leverage only after the verification of a trader in the user account.

Details of W7BT accounts:

Demo accounts can be used to test trading strategies. They can be created for any version of the platform.

Deposit and Withdrawal

-

The brokerage company accepts a withdrawal application within 48 hours. But most often, the withdrawal period is 24 hours;

-

Money can be withdrawn to bank cards, in cryptocurrency, or via Sepa-Transfer;

-

Withdrawal fees depend on the chosen method or payment system;

-

To deposit or withdraw funds, it is required to pass verification. You can do this in your user account;

-

Withdrawals by standard bank transfers are not available.

Investment Options

This brokerage company offers various programs for both active traders and passive investors. This makes W7BT different from similar brokers. It offers its clients work on the principle of trust management of MAM accounts. The company allows traders to independently choose their preferred method of trading and partnership.

MAM accounts for money management

The MAM position is only available to experienced investors. Accounts are available through MT5. Clients who choose the MAM program get competitive spreads and direct access to liquidity that are provided by major banks. Also, the scope of duties of a funds trust manager includes the distribution of assets and diversification of risks.

Features of MAM accounts:

Full transparency. A client who decides to invest in MAM accounts receives advanced analytics and also sees everything in detail on the trading platform;

Trading is carried out using a pool of funds;

MAM managers open accounts absolutely free of charge, and there are no fees for partnership;

Investors have the right to independently determine the type of funds distribution and the type of trading. For example, it can be in lots, as a percentage, or at a fixed rate;

Access to MAM accounts is received by an unlimited number of clients.

Novice traders will not be able to become Multi-Account Managers, but they will be able to invest in a common financial pool. The MAM position is reserved for experienced investors only. W7BT carefully ensures that only qualified traders manage a pool of funds.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from W7BT:

W7 Broker & Trading provides an opportunity for partnership under the Introducing Broker (IB) program. Partners who register as IBs receive reduced spreads. The clients they invite get the opportunity to trade with a major brokerage player.

Within the IB program, partners can independently manage the markup. You can receive remuneration both in the form of a fixed income and as a percentage of the trading volume that IB clients make on the platform of the main broker.

Customer Support

W7 Broker & Trading technical support managers are available 24/7.

Advantages

- Non-registered clients can contact technical support

- Prompt responses by operators

Disadvantages

- Support is available in English only

- Limited range of communication channels to contact technical support

Ways to contact tech support:

-

email;

-

live chat from the user account;

-

Telegram of W7BT.

Any trader can use technical support services.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | W7 Limited, Beachmont Business Center, Suite 16, Beachmont, Kingstown, St. Vincent and the Grenadines. |

| Official site | https://www.w7bt.com/ |

| Contacts |

Education

There are no educational materials directly on the website. To gain access to training programs and free advice, you must pass your user account verification and make a minimum deposit. The amount of the deposit depends on the type of a trading account.

W7BT does not have cent trading accounts. Practice and testing of trading skills are possible on demo accounts only.

Comparison of W7 Broker with other Brokers

| W7 Broker | RoboForex | Pocket Option | Exness | InstaForex | 4XC | |

| Trading platform |

MT5 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader | MT5, MT4, WebTrader |

| Min deposit | $100 | $10 | $5 | $10 | $1 | $50 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.5 point | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 30% / 10% | 100% / 50% |

| Execution of orders | Instant Execution, Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | Yes | No | No | Yes | No |

Detailed review of W7 Broker

W7 Broker & Trading is a company that provides brokerage services based on understanding the desires of its clients. W7BT was created by traders Willy Heine Neto, Paulo Roberto, and five of Willy's clients for traders like them. The company allows its clients to use most trading strategies in independent trading or copy trades of professional traders using the MAM account program.

W7BT by the numbers:

-

4 years in the field of brokerage services;

-

Trading volume is over $3.9 trillion;

-

6 classes of assets.

W7 Broker & Trading is a broker for active trading and passive investment

Traders who work with W7BT get the opportunity to conduct automated trading and use various financial instruments. Each client chooses the appropriate financial instrument, such as currency pairs, CFDs on stock prices, indices, metals, or energies. Investors who want to secure passive income can use MAM accounts for funds trust management. The form of payment of remuneration is chosen by traders independently. They can receive a fixed income or a percentage of the total volume of transactions.

Clients of the brokerage company can trade using desktop and mobile versions of the MT5 platform. For successful trading, you can use free advice from professional traders of W7 Broker & Trading.

Useful services offered by W7 Broker & Trading:

-

News. Events that take place in the global market are published here;

-

Economic calendar. Traders have access to up-to-date data for the MetaTrader platform, assets value, spreads, and swaps. Information is updated in real-time, allowing traders to create adaptive trading strategies;

-

A training center with educational materials for both novice and professional traders.

Advantages:

Traders have access to 6 classes of assets;

The brokerage company provides negative balance protection. This feature applies to all accounts, regardless of the balance;

Tight spreads for ECN Pro and Priv accounts;

Free analytics for every trader;

Updated MetaTrader 5;

Constantly expanding base of educational materials.

These useful services are available to traders regardless of trading volume or account balance.

User Satisfaction