How To Find a Prop Trading Firm

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To choose a proprietary trading company:

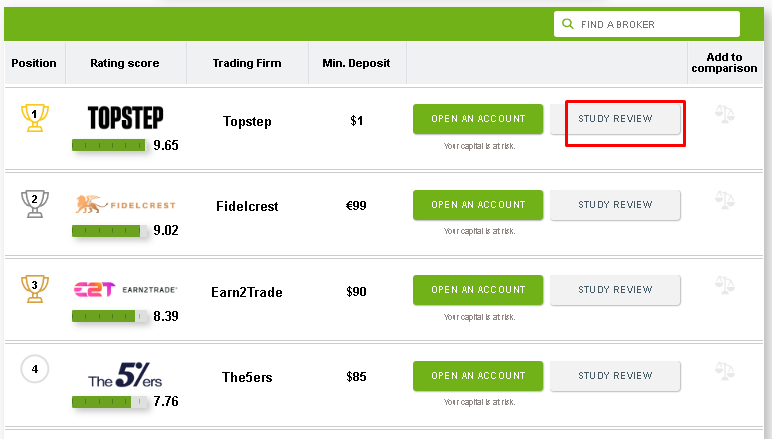

Start by reviewing the prop firms profiles on Traders Union

Study the key trading conditions, such as tradable assets, funded account size and leverage

Examine evaluation phase conditions

Pay attention to the profit split ratio

Examine reviews from other traders

In the world of trading, a trader's success is heavily reliant on making the right choice when it comes to selecting a proprietary trading company (prop firm) to partner with. This is because the prop firm plays a pivotal role in providing traders with essential resources and trading conditions that can greatly impact their performance and profitability. In this guide, Traders Union aims to review the crucial aspects of choosing the right prop trading company and highlight the key working conditions that traders should pay close attention to.

Choosing a prop company in 5 steps

1. Start by reviewing the prop firms profiles on Traders Union

To choose a proprietary trading company wisely, it is crucial to delve into reviews of these firms, where comprehensive information about trading plans, costs, available trading instruments, and other essential conditions is aggregated. The largest database of prop firms profiles can be found on Traders Union portal. These reviews serve as a valuable resource for traders seeking insights and detailed assessments to make informed decisions when selecting a prop trading company.

Profiles of proprietary trading companies on the Traders Union portal encompass essential information about each prop firm's safety, trading instruments, key trading conditions, trader feedback, as well as expert analytical assessments.

In the first stage, it is also crucial to determine the level of trustworthiness associated with a particular company.

2. Study the key trading conditions

The second step involves assessing how well the trading conditions of each company align with your personal preferences and trading needs. For instance, some companies exclusively offer futures trading, while others provide access to Forex, crypto trading, stock trading, stocks, and various other assets. It's important to carefully examine conditions related to profit targets, leverage, maximum drawdown, and any other factors that are pertinent to your trading strategy and risk tolerance.

Proprietary trading companies typically offer plans ranging from $10,000 to $250,000, with costs varying from $50 to $500. The funding size you can attract plays a significant role, but equally important is its cost along with all associated fees. Take note of the subscription cost and other trading-related and non-trading commissions that may arise.

Additionally, consider any unique features or advantages offered by each company, such as educational resources, trading platforms, or research tools, to make a comprehensive evaluation.

3. Examine evaluation phase conditions

It is imperative to meticulously scrutinize the terms and conditions of the evaluation phase. Pay close attention to the different stages involved in the evaluation process, which may include trading on demo accounts, interviews, or other specified requirements. While there are a few companies that offer single-stage evaluations or, in some cases, skip evaluations altogether, these are exceptions rather than the norm. More often than not, you will need to allocate anywhere from a week to a month for this stage and plan your schedule accordingly. Additionally, it is of utmost importance to assess conditions such as the cost, profit targets, and whether there is an option for reevaluation without additional charges.

4. Pay attention to the profit split ratio

Pay close attention to the profit split ratio; this is a crucial indicator. Typically, the top companies offer profit distribution ratios ranging from 70/30 to 90/10% in favor of the trader. Additionally, there may be additional privileges as your capital grows and your trading performance improves.

While the profit split ratio is undoubtedly a critical factor, it's essential to emphasize that it shouldn't be the sole focus of evaluation. Assessing a company should be done comprehensively, taking into account all relevant aspects.

5. Examine reviews from other traders

Some insights can only be provided by traders who have prior experience with the company. Within the profiles of proprietary trading companies on Traders Union, you can discover reviews from traders who have already utilized the services of the company.

Which is the best prop firm?

Determining the best proprietary trading firm is highly subjective and depends on individual preferences, trading goals, and circumstances. Factors to consider when evaluating a prop firm include the profit split ratio, available trading instruments, trading conditions, and fees.

Some well-known prop firms that are often regarded favorably include firms like TopStep and FTMO. These firms are recognized for their robust trading infrastructure, competitive profit sharing arrangements, and diverse range of trading opportunities. However, it's essential to conduct thorough research and carefully assess your own trading needs before making a decision. Ultimately, the best prop firm for you will align with your specific trading strategy, risk tolerance, and financial goals.

How do I join prop trading?

When considering how to embark on a career in proprietary trading, it's essential to follow a structured approach. Here's a step-by-step guide to help you get started:

Start by selecting a proprietary trading firm whose trading conditions align with your preferences and objectives

Begin by testing your trading skills on a demo account to avoid unnecessary commissions. Use this opportunity to familiarize yourself with the company's specific conditions. While some prop trading firms offer demo accounts, you can also use any trading platform for practice

Once you've honed your skills and feel confident, submit an application for the evaluation phase, where your performance will be assessed

Upon successful evaluation, you can start trading with the firm's capital and participate in profit-sharing based on predetermined terms

To thrive in prop trading, commit to ongoing learning and improvement. Stay updated on market trends, refine your strategies, and adapt to changing conditions

Remember that each proprietary trading firm may have its unique application and evaluation process, so be sure to follow their specific guidelines. Success in prop trading hinges on continuous learning and disciplined trading practices.

Is there any free prop firm?

Proprietary trading firms typically require traders to invest their own capital or undergo an evaluation process where they can earn a share of profits but not receive a salary. While there might be occasional exceptions, finding entirely free proprietary trading firms is rare. It's essential to carefully review the terms and conditions of any such opportunities, as there may be hidden costs or unfavorable profit-sharing arrangements that could impact your overall earnings.

FAQs

How many traders fail in prop firms?

The failure rate for traders in proprietary trading firms can vary significantly and usually vary from 70% to 90%.

How do prop firms pay out?

Proprietary trading firms typically pay out profits to traders based on predetermined profit-sharing arrangements. The profit split ratio is usually ranging from 50/50 to 90/10. It means traders can get up to 90% of their profit.

How does a Prop firm earn money?

Proprietary trading firms earn money primarily through the trading activities of their traders. They provide capital, trading infrastructure, and risk management services to traders, and in return, they share a portion of the profits generated by the traders.

Do prop firms offer demo trading?

While some prop firms provide demo accounts to traders for practice and evaluation purposes, others may skip this step and require traders to start with live trading immediately.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.