Sukuk Bonds: A Shariah-Compliant Alternative To Conventional Bonds

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Sukuk bonds are Shariah-compliant instruments in Islamic finance that offer investors a share in a real asset rather than a debt obligation. Unlike traditional bonds that generate income from interest, sukuk rely on profit-sharing or leasing structures based on lawful business activity. These instruments are seen as halal because they steer clear of interest, speculation, and industries that violate Islamic principles, making them a practical option for Muslim investors seeking integrity in their portfolios.

As more investors turn toward Shariah-compliant financial solutions, the demand for ethical investing tools continues to grow. A standout choice for many is the sukuk bond, which serves as a faith-aligned substitute for standard fixed-income products. Sukuk generate earnings through approved commercial ventures and are backed by tangible assets. In this guide, we’ll understand what are the key aspects of sukuk bonds, explain how they work, how they differ from regular bonds, why they qualify as halal, and how to invest in them wisely. For anyone wondering what is the idea behind sukuk, understanding this structure can be the key to aligning financial goals with Islamic values.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What are sukuk bonds?

Sukuk bonds are Shariah compliant bonds that serve as ethical alternatives to traditional fixed-income instruments. Unlike conventional bonds, which are structured around interest-based debt, halal bonds like sukuk give investors partial ownership in real assets, services, or projects. They steer clear of interest (riba) and instead share profits that come from approved business activities.

In line with Islamic finance values, these investments avoid interest, gambling (maysir), and excessive uncertainty (gharar), all of which are carefully addressed in the sukuk framework. As a result, sukuk bonds not only meet the standards of Sharia bonds but also appeal to those seeking investments that align with their ethical and religious values.

How do sukuk bonds work?

Most people think sukuk bonds are just Islamic versions of regular bonds, but that’s not how they work at all. Sukuk don’t represent debt. They represent partial ownership in a real business or asset that earns money. When you invest in sukuk, you’re putting capital into something physical like a toll road, a property, or equipment. Your profit comes from how that asset performs. That completely changes the deal. Instead of lending and collecting interest, you're involved in a real project that generates income. That’s what makes them fundamentally different from conventional bonds and qualifies them as Shariah compliant bonds.

Further, sukuk structures vary, and some are more secure than others depending on how they’re built. For example, Ijara sukuk pay you rent from leased assets, while Murabaha sukuk earn through resale profits. So the deeper question is not just how do sukuk bonds work, but which structure fits your personal goals and comfort with Islamic finance. Some are backed fully by real assets, while others are tied to receivables or promises to pay, which can raise red flags if no one is monitoring them properly. Understanding this helps you protect both your money and your religious values.

Sukuk vs bonds: key differences

While sukuk and conventional bonds may seem similar — both serve as tools for raising capital — they are fundamentally different in structure, ownership rights, and compliance with Islamic principles. When comparing sukuk vs conventional bonds, the key difference lies in how returns are generated and how assets are handled. Sukuk are designed to align with Shariah by avoiding interest (riba) and ensuring asset-backing, whereas traditional bonds typically involve debt obligations and fixed interest payments. Understanding these core differences is crucial for investors who seek halal investment opportunities while maintaining financial stability.

Below is a side-by-side comparison to highlight how sukuk and bonds differ across key aspects:

| Feature | Sukuk (Islamic Bonds) | Conventional Bonds |

|---|---|---|

| Ownership | Partial ownership in asset | Debt obligation |

| Returns | Profit from asset activity | Interest (riba) |

| Compliance | Shariah-compliant | Not necessarily compliant |

| Risk | Shared with issuer | Held by lender |

| Structure | Asset-based | Debt-based |

A comparison of Sukuk vs bonds shows a key difference that matters deeply for faith-based investors. Unlike traditional fixed-income securities, Shariah-compliant bonds such as sukuk do not involve interest or speculative contracts. Instead, they are built around genuine ownership and tangible assets that support real economic purpose.

This contrast is especially meaningful for those pursuing ethical investing grounded in Islamic principles. To understand how sukuk differs from bonds, it helps to see that sukuk aligns financial returns with shared business risk and asset-backed structures, rather than lending and debt-based returns.

Are sukuk bonds halal?

Yes, sukuk bonds are halal because they are structured to comply with Islamic law. They avoid interest payments and instead provide returns through profit-sharing, leasing, or sale-based mechanisms. Shariah boards play a critical role in certifying these instruments, ensuring that every element, from asset selection to payout, respects Islamic principles.

Qur’anic reference:

"Allah has permitted trade and forbidden riba." — Surah Al-Baqarah (2:275)

This verse forms the backbone of sukuk legitimacy, where profit from trade replaces interest as the foundation of return.

Other types of islamic bonds

There are other halal alternatives to conventional bonds apart from sukuk bonds. These include:

Green Sukuk. Used to fund environmentally sustainable projects within Shariah guidelines.

Premium bonds. Typically haram due to speculative prize-based returns, but opinions vary.

Prize bonds. Often classified as gambling (maysir), and thus impermissible.

Government bonds. Usually haram unless issued as sovereign sukuk.

Each bond category must be analyzed individually, considering the structure and source of returns.

Institutions and scholars on sukuk

AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions). Issues standards for sukuk compliance.

IFSB (Islamic Financial Services Board). Regulates Islamic finance globally.

Mufti Taqi Usmani. A leading Shariah scholar who helped pioneer sukuk development.

These authorities affirm sukuk as a legitimate halal financial tool when properly structured.

Types of sukuk

If you’re new to Islamic investing, knowing the different types of sukuk bonds is key. Each one works differently and can affect your returns, your risk, and whether it fits your Shariah values.

Ijara sukuk are rental-based. You earn income from leasing an asset like real estate or equipment, and the rent is passed on to you as profit.

Murabaha sukuk rely on cost-plus sales. The issuer sells an asset at a markup and pays you the profit over time, but it’s often not tradable on the secondary market.

Mudarabah sukuk involves passive partnership. You provide capital, the other party provides expertise, and you split the profit, but losses hit only the investor.

Musharakah sukuk are joint ventures. Both sides contribute capital, and profits or losses are shared based on pre-agreed ratios, making it more balanced than mudarabah.

Istisna sukuk fund construction or manufacturing. You invest in building projects or production, and profits come in once delivery or completion happens.

Salam sukuk are forward-based. You pay upfront for future delivery of goods, which is risky and usually only used in agriculture or commodities with known timelines.

Hybrid sukuk mix two or more structures. Some sukuk combine Ijara with Murabaha or Mudarabah to reduce risk or boost returns, but they can get complex fast.

Best sukuk bonds to invest in (2025)

These top sukuk bonds represent ownership in tangible assets or projects, offering returns through profit-sharing or leasing, in alignment with Islamic finance principles:

1. Public Investment Fund (PIF) Sukuk – Saudi Arabia

Size. $2 billion

Structure. Wakala bi Istithmar

Maturity. October 2028

Yield. Approximately 5.06%

Rating. Aa3 (Moody’s), A+ (Fitch)

Purpose. Funding Saudi Arabia’s Vision 2030 projects, including NEOM and Qiddiya.

Key aspect. Offers exposure to Saudi Arabia’s ambitious economic diversification initiatives. Click here for more information.

2. Al Rajhi Bank Sustainable Sukuk

Size. $1 billion

Structure. Wakala bi Istithmar

Maturity. March 2029

Yield. Approximately 5.05%

Rating. A1 (Moody’s), A- (Fitch)

Purpose. Financing sustainable projects under the bank’s green finance framework.

Key aspect. Ideal for investors interested in ethical and environmentally conscious investments. Click here for more information.

3. Islamic Development Bank (IsDB) Sukuk

Size. $1.75 billion

Structure. Al Murabaha

Maturity. October 2029

Yield. Approximately 4.48%

Rating. Aaa (Moody’s), AAA (Fitch)

Purpose. Funding development projects across member countries.

Key aspect. Backed by a multilateral institution with a strong credit profile. Click here for more information.

4. Dubai Islamic Bank (DIB) Sukuk

Size. $1.26 billion

Structure. Wakala bi Istithmar

Maturity. March 2029

Yield. Approximately 5.10%

Rating. A3 (Moody’s), A (Fitch)

Purpose. Supporting the bank’s general corporate purposes.

Key aspect. Offers exposure to one of the leading Islamic banks in the UAE. Click here for more information.

5. Saudi Electricity Company (SEC) Sukuk

Size. $2.75 billion

Structure. Al Ijara

Maturity. September 2028

Yield. Approximately 5.04%

Rating. Aa3 (Moody’s), A+ (Fitch)

Purpose. Financing infrastructure and energy projects.

Key aspect. Backed by a government-owned utility with a strong credit rating. Click here for more information.

Where and how to buy sukuk bonds

Here’s a guide on how to invest in sukuk bonds:

Brokerage platforms. Some global brokers offer access to sukuk ETFs or mutual funds.

Islamic banks and financial institutions. Many institutions in Muslim-majority countries offer sukuk directly.

Sukuk exchanges. Malaysia, UAE, and the UK have sukuk listings.

Islamic robo-advisors. Platforms like Wahed Invest offer sukuk-linked portfolios.

If, apart from sukuk, you wish to invest in financial assets (stock, crypto, Forex, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options where to buy sukuk bonds. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

If you're planning to buy sukuk for the first time, it's not just about finding a halal label. Here are the key things to keep in mind:

Don’t treat all sukuk as equal. Ijara, Murabaha, and Wakalah sukuk come with different return profiles and risk levels, so learn how the income is generated before you commit.

Look for asset-backed, not just asset-based. Some sukuk are only linked to assets on paper, while others give you a share of ownership — this difference affects both risk and Shariah strength.

Understand who is guaranteeing the payments. If the sukuk depends on a third-party guarantee or conventional insurance, it might weaken the compliance level even if the asset is halal.

Check how the sukuk handles defaults. In case of trouble, some sukuk give you access to physical assets while others just give a promise of payment — know which one you're buying.

Match the sukuk type to your cash flow needs.Ijara sukuk pays regular rental income, while Murabaha pays at maturity, so one works better for monthly income and the other for long-term growth.

Read the prospectus like a contract. Don’t rely on “Shariah-compliant” labels alone. Dig into who approved it, what the asset is, and how returns are structured.

Watch out for synthetic sukuk. Some products mimic sukuk features but aren’t fully compliant — they’re structured to attract Islamic investors without full adherence.

Sukuk market growth and trends

The global sukuk market has experienced significant growth, reaching approximately $1.2 trillion in 2024 and projected to expand to $3.99 trillion by 2033, with a compound annual growth rate (CAGR) of 13.44%. This growth is driven by increasing demand for Shariah-compliant financial instruments, infrastructure financing needs, and the rising popularity of ethical investments. Notably, green and sustainability sukuk issuances have surpassed $10 billion by the third quarter of 2023, reflecting a strong commitment to environmental and social governance (ESG) principles.

Understanding how sukuk bonds work is essential for investors seeking Shariah-compliant alternatives to conventional bonds. Sukuk represent ownership in tangible assets, services, or projects, and returns are generated through profit-sharing or lease agreements, rather than interest payments. This structure aligns with Islamic finance principles, providing a viable option for ethical investing. As the market continues to evolve, innovations such as digital sukuk and increased cross-border issuances are expected to further enhance accessibility and appeal to a broader range of investors.

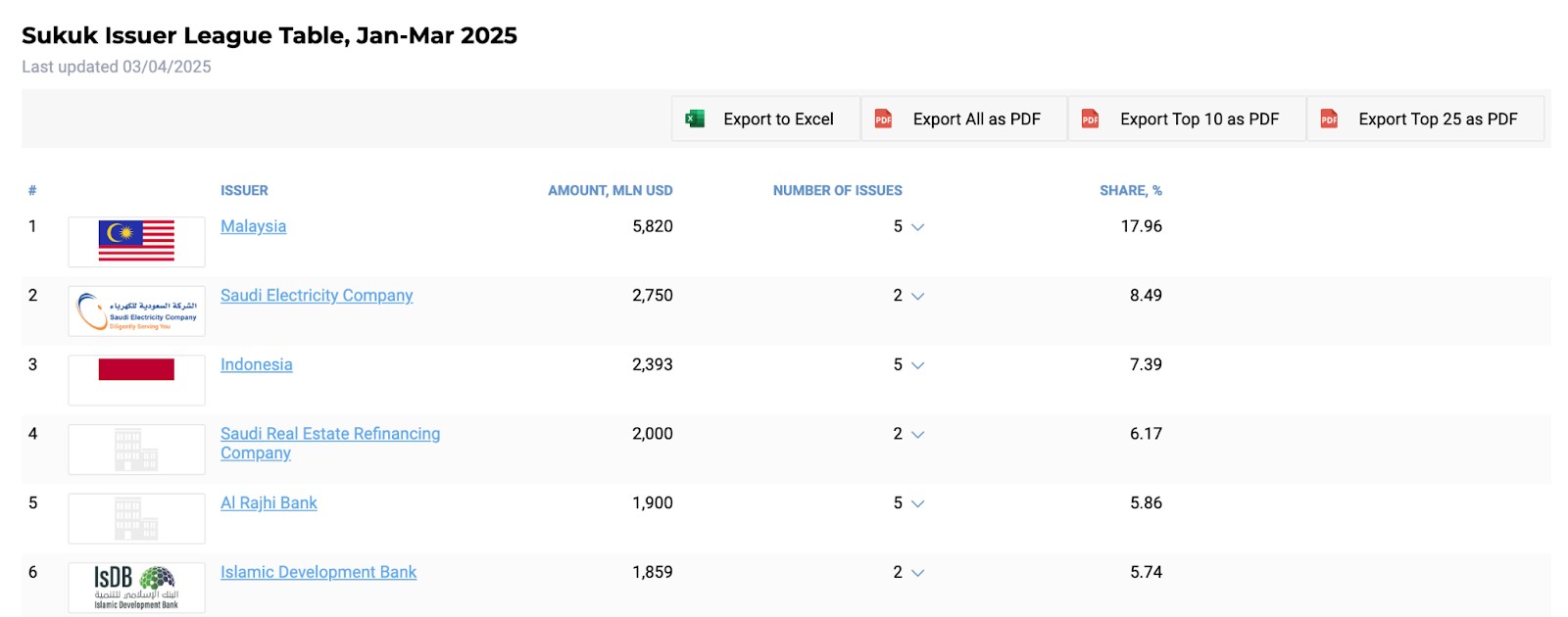

Largest sukuk issuers globally (2025)

1. Malaysia

Malaysia continues to lead the global sukuk market, issuing $5.82 billion in the first quarter of 2025 alone, accounting for 17.96% of the global market share.

The country's robust regulatory framework and active secondary market make it an attractive destination for sukuk investors.

2. Saudi Electricity Company (SEC)

SEC issued $2.75 billion in sukuk in early 2025, making it the second-largest issuer globally during that period.

As a state-owned utility, SEC's sukuk are considered low-risk and are often backed by government guarantees, appealing to conservative investors.

3. Indonesia

Indonesia issued $2.393 billion in sukuk in the first quarter of 2025, ranking third globally.

The government frequently issues green and sustainability sukuk, aligning with ethical investment goals.

4. Saudi Real Estate Refinance Company (SRC)

SRC issued $2 billion in sukuk in early 2025, focusing on the housing finance sector.

SRC's sukuk supports the Saudi housing market, providing investors with exposure to real estate-backed Islamic finance instruments.

5. Al Rajhi Bank

In March 2024, Al Rajhi Bank issued a $1 billion five-year sustainable sukuk, with proceeds aimed at funding environmentally and socially responsible projects.

As the world's largest Islamic bank, Al Rajhi's sukuk are highly regarded and align with ESG investment criteria.

6. Islamic Development Bank (IsDB)

IsDB issued a $2.5 billion sustainability sukuk in 2024, focusing on funding development projects across member countries.

As a multilateral development bank, IsDB's sukuk are AAA-rated and support socio-economic development in member countries.

Tapping sukuk bonds for asset-backed stability and geopolitical diversification

New investors exploring sukuk bonds often miss a key advantage: geopolitical diversification rooted in real assets. For those wondering what sukuk bond is, it is essentially a Shariah-compliant investment certificate backed by tangible assets rather than debt obligations. Unlike conventional bonds, Shariah-compliant bonds are typically tied to infrastructure, real estate, or energy projects in regions like the Gulf, Southeast Asia, or North Africa. This means that geopolitical shifts affecting oil, trade routes, or Islamic economies often create yield variations in sukuk that don’t move in sync with Western bond markets. For a portfolio looking to hedge against volatility in US or EU interest rate cycles, this is a goldmine of untapped correlation strategies.

Another hidden angle lies in sukuk tranches designed for retail investors within dual-listed jurisdictions. Malaysia, UAE, and even the UK have introduced frameworks where Shariah bonds are regulated both by local financial authorities and Islamic finance boards. For a beginner, this offers an unusual gateway: access to high-quality fixed-income products that meet ethical filters, without the liquidity traps common in small-scale investments. Pairing sukuk with short-term Islamic money market funds can help build a halal fixed-income ladder that mirrors traditional bond maturity ladders but stays fully compliant.

Conclusion

Sukuk bonds are a cornerstone of Islamic finance, offering halal, ethical, and asset-backed alternatives to conventional interest-bearing bonds. They empower Muslim investors to grow wealth without compromising on faith. By understanding how sukuk work, their types, and where to invest, you can build a portfolio aligned with your values and financial goals.

FAQs

Can I invest in sukuk bonds through a regular brokerage account?

Yes, but access is limited. Most traditional brokerage platforms don’t list sukuk directly. However, you can invest through Shariah-compliant ETFs or mutual funds offered on some platforms. Alternatively, Islamic banks or specialized robo-advisors like Wahed Invest provide direct sukuk exposure with built-in compliance screening.

Do sukuk bonds offer lower returns than conventional bonds?

Not necessarily. While sukuk avoid interest (riba), they are structured around profit-generating assets, which can deliver stable and competitive returns. Many sukuk are backed by government infrastructure or leasing projects, making them low-risk and attractive for conservative, long-term portfolios. Performance varies by structure and issuer, but ethical investing does not mean sacrificing returns.

Can non-Muslims invest in sukuk bonds?

Absolutely. Sukuk are open to everyone. Non-Muslim investors who value ethical finance, low leverage, and transparency often turn to sukuk as part of socially responsible investing. Because sukuk are tied to tangible assets and real economic activity, they appeal to investors beyond the Islamic world who want principled, low-risk exposure.

How are sukuk bonds different from regular bonds?

Sukuk are asset-backed and avoid interest payments, aligning with Islamic law. Regular bonds, by contrast, are debt instruments that pay fixed interest. Sukuk give investors ownership in a tangible asset or project, with returns generated from its use or profits—not from lending money at interest. This makes sukuk halal, while conventional bonds are generally haram in Islamic finance.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.