Gharar And Risk In Sharia Contracts: Meaning, Risks, And Compliance

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

In Islamic finance, Gharar refers to excessive uncertainty that makes a contract unfair or unclear:

Make sure all terms are clear. Avoid vague or ambiguous contract language.

Only sell what you actually own. Prevents selling non-existent or future goods.

Spell out every contract detail. Full transparency helps avoid future disputes.

Too much guesswork breaks the rules. Uncertainty violates Islamic financial principles.

Hidden risks create unfairness. Gharar benefits one side unfairly.

Sharia finance values open deals. Clear, honest terms align with compliance.

Gharar is seen in Islamic law as something that disrupts fairness and openness in business deals. It’s important to understand Gharar when looking at contracts that involve unclear terms, timing, or responsibilities. This kind of uncertainty can lead to one-sided deals, which goes against Sharia values like fairness and transparency. In Islam, Gharar doesn’t just mean confusion — it covers any unclear condition that might cause disputes, losses, or mislead one party.

Contracts that include Gharar are not allowed in Islamic finance, especially in areas like banking and investment. This article looks at Gharar in Islamic banking and finance, offering real-world examples and the key rules used to judge whether a deal is compliant.

Gharar meaning

In classical Islamic jurisprudence, gharar refers to any substantial uncertainty or ambiguity present in a contract at the time of its formation. This uncertainty may relate to the subject matter, quantity, price, delivery terms, or other essential contractual conditions. The Gharar meaning in Islam refers to a violation of the principle of bayān (clarity), which is essential for any valid and ethical transaction.

The Qur’an warns against consuming wealth through unjust or unclear means. Allah says in Surah An-Nisa (4:29):

"O you who believe! Do not consume one another’s wealth unjustly, except through trade conducted by mutual consent..."

This verse is foundational in the principle of tarāḍī (mutual consent), which is voided when Gharar distorts the parties’ understanding of the contract.

What is Gharar can also be understood as a contractual state in which one or both parties are unable to assess the consequences of the agreement due to missing or incomplete information. This undermines the concept of mutual consent and may result in disputes, manipulation, or unjust enrichment — particularly when one party exploits information asymmetry.

The Prophet Muhammad ﷺ directly prohibited Gharar-based transactions. In a hadith reported by Abu Hurairah (Sahih Muslim, Book 10, Hadith 3663), he said:

"The Messenger of Allah forbade the sale involving Gharar."

Classical scholars, including Imam Nawawi, clarified in commentary that this includes sales with unknown outcomes, undefined goods, or unguaranteed delivery.

Modern scholars maintain this interpretation. According to the AAOIFI Shariah Standard No. 31, issued by the Accounting and Auditing Organization for Islamic Financial Institutions:

"Any contract involving excessive Gharar is invalid unless it is minimal (yasir) and does not lead to dispute or harm."

This standard is applied globally in Islamic banking to vet product structures for compliance.

Prominent contemporary jurist Sheikh Taqi Usmani explains in his work An Introduction to Islamic Finance:

"The rationale for prohibiting Gharar is to eliminate ambiguity that may cause conflict, promote injustice, or lead to unjust enrichment."

He emphasizes that eliminating Gharar is not only a legal requirement but also an ethical safeguard in commercial life.

Gharar covers more than just fake goods — it also shows up in unclear prices, vague deliveries, or deals tied to things beyond anyone’s control, like an unborn calf or a crop not yet planted. According to Sharia, contracts full of uncertainty are not valid because they lack openness and put one side at a disadvantage. This concept ties directly into the broader issue of uncertainty in Islam, where ambiguous terms and speculative elements are discouraged to protect fairness in trade. As classical jurist Ibn Qudamah noted in al-Mughni, agreements should be clear and honest so neither side carries an unknown risk. This shows how Islamic law values clarity, consent, and knowing what to expect in any trade or contract.

Gharar in Islamic finance and banking

Gharar in Islam is treated as a serious threat to trust between parties and goes against the principle of fair exchange. Sharia requires that every financial agreement be built on full transparency, equal access to important information, and a clear structure for how it will be carried out. If a financial contract lacks these elements — or distorts them in any way — it is seen as non-compliant.

Gharar in Islamic finance becomes especially relevant in today’s markets, where many financial products rely on forms of uncertainty — such as speculation tied to volatility, returns that vary without clarity, or contracts disconnected from actual, tangible assets. Islamic financial institutions that aim to follow Sharia law go a step further by applying added layers of screening to avoid such uncertainty. That includes steering clear of things like conventional insurance, non-deliverable derivatives, or investments that pass risk unfairly from one side to another.

Beyond just choosing the right products, Gharar also shapes how Islamic banks manage compliance and Sharia reviews. These institutions must examine contracts not only for interest (riba) but also for built-in uncertainty that might lead to unjust results. In this way, Gharar acts as a filter to catch deal structures that misalign with the goals of fair contracts or create unfair advantages.

By applying this principle to day-to-day banking, Islamic institutions make sure that every agreement is clearly defined, risk is shared fairly, and both parties are fully aware of what they’re entering into. This framework allows Islamic banks to build long-lasting, ethical partnerships with clients and financial partners alike.

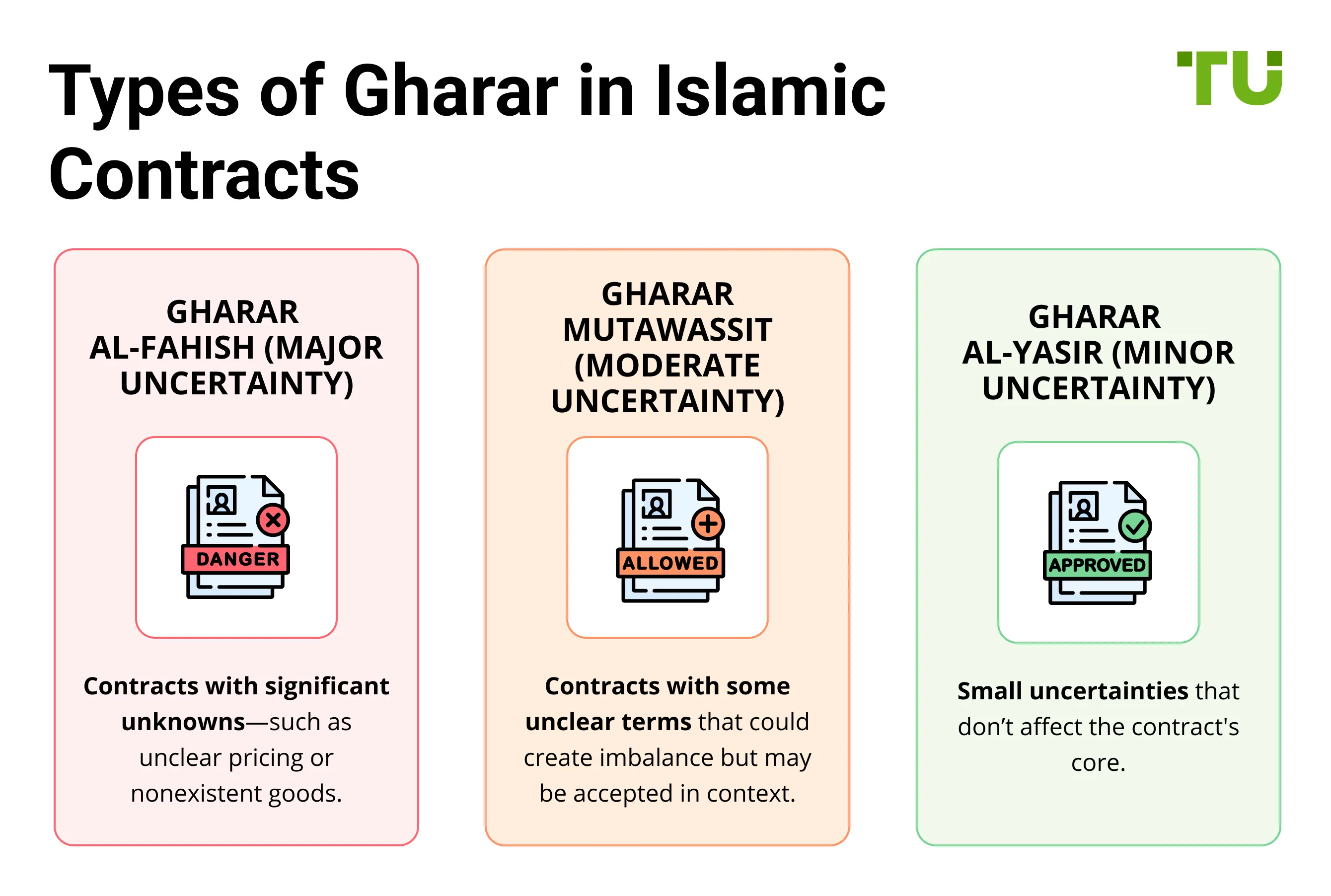

Types of Gharar

Islamic jurisprudence classifies Gharar into different levels, depending on how much uncertainty is involved and how it affects the validity of a contract. This classification plays an important role in assessing whether a trade, investment, or banking agreement aligns with Sharia.

The most serious form is Gharar al-fahish, or major uncertainty, which makes a contract invalid under Islamic law. This happens when key details about the contract’s subject are missing, or when the outcome depends on something highly uncertain or beyond the control of both parties. Common examples of Gharar include selling something that doesn’t yet exist without a firm delivery agreement, or entering into a contract with unclear pricing or vague terms. Such deals are void because they carry a high risk of injustice or financial harm.

A milder form is Gharar al-yasir, or minor uncertainty, which Islamic law permits if it doesn’t affect the contract’s core terms or introduce meaningful risk. Acceptable Gharar examples include small variations in delivery time or minor technical vagueness that doesn’t interfere with either party’s obligations. As long as this type of uncertainty doesn’t lead to conflict or unfair advantage, it is considered tolerable.

Some scholars also identify a middle category — Gharar mutawassit — which reflects moderate uncertainty. These cases must be evaluated in context, taking into account the nature of the contract, common market practices, and how much risk each side takes on. Jurists assess not only the wording of the contract but also the potential for harm or imbalance between the parties involved.

By separating Gharar into categories, Islamic law offers a practical framework to review modern financial contracts and ensure they meet both legal and moral expectations. This method allows some flexibility in practice while still protecting the core values of fairness, openness, and shared responsibility.

Examples of Gharar in modern finance

Structured notes with opaque payoffs

One of the most overlooked Gharar examples in today’s financial markets lies in structured notes that feature complex and non-transparent payoff formulas. These instruments often base investor returns on several variables — such as baskets of stocks, interest rates, or currencies — combined using formulas too obscure for the average investor to assess. This lack of clarity violates the Sharia requirement that all parties in a contract must fully understand the terms and outcomes, making such products non-compliant due to embedded Gharar.

Peer-to-Peer (P2P) lending platforms

Many P2P platforms operate in a legal and ethical grey area under Islamic law. When these platforms fail to disclose essential borrower information or default risks, they introduce unacceptable uncertainty. In jurisdictions with weak oversight, this lack of transparency disrupts risk evaluation and breaches the Sharia principle of fair and informed trade, where both parties must have access to the same material facts.

Weather derivatives and unpredictable triggers

Widely used in agriculture and energy sectors, weather derivatives pay based on future weather events like rainfall or temperature extremes. While they aim to hedge against uncertainty, they often fall into Gharar mutawassit (moderate) or Gharar fahish (excessive) if payout triggers are poorly defined or speculative. Unless these contracts are anchored to verifiable losses, they resemble gambling more than valid hedging, making them non-compliant in Sharia.

Gharar risks in Takaful (Islamic Insurance)

Even within Islamic finance, Gharar can arise. Certain takaful models include vague rules around fund pooling, surplus sharing, or re-takaful arrangements, which can confuse participants. When customers do not fully understand how their contributions are used or how claims are settled, the risk of Gharar increases — even if the product is marketed as Sharia-compliant. Transparency in fund structure and profit-sharing is essential to uphold compliance.

The distinction between Gharar and Maysir

Although Gharar and Maysir are both connected to uncertainty, they represent two separate legal and ethical concerns in Islamic finance. Maysir refers to transactions involving profit through chance, typically designed as zero-sum situations where one party’s gain results directly from another’s loss. This includes gambling activities or speculative ventures where outcomes rely solely on luck or unpredictable events.

Gharar, on the other hand, refers to uncertainty that exists within the structure or wording of a contract, which can open the door to confusion, conflict, or unfair sharing of risk. Unlike Maysir, where uncertainty defines the very nature of the activity, Gharar is often unintentional and stems from vague terms — such as unclear pricing, uncertain delivery timelines, or obligations that are not fully spelled out.

What separates Gharar and Maysir is how the risk begins and how it affects those involved. In Maysir, a person willingly enters a scenario based on chance, aiming to win by causing another to lose. In Gharar, the issue usually comes from poorly constructed agreements, where both parties might face harm because of confusion or a lack of clarity. Maysir reflects a speculative mindset, while Gharar can appear even in sincere agreements that fall short of Sharia’s standards for clarity and fairness.

Your safest bet for avoiding Maysir when trading or investing is by using Shariah-compliant brokers. And luckily, you don’t need to do the hard work here. We have already researched the market and presented the top Shariah-compliant brokers offering Islamic accounts in the table below. You can compare them and make a choice for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Vague terms and hidden risks make everyday contracts fall into Gharar

Many people new to Islamic finance think Gharar only refers to extreme cases like gambling or selling what doesn’t exist — but in real-world practice, the most overlooked form of Gharar is embedded in everyday business terms. For example, an agreement that uses vague phrases like “delivery in a few weeks” or “price to be determined later” may seem normal in casual commerce but could render a deal non-compliant under Sharia. This is because Gharar isn’t just about the outcome — it’s about the process. Even if both parties have good intentions, a loosely worded contract can open the door to disputes, unfair loss allocation, or exploitation.

What surprises most beginners is how Gharar is often hidden in routine practices, especially in modern markets. Selling something with incomplete ownership (like pre-selling shares you haven’t yet acquired) or trading in assets that lack full transferability (like NFTs without rights attached) can fall into this category. Scholars focus heavily on risk clarity and information symmetry — if one side holds critical details the other doesn’t, the transaction may be ethically compromised even if it’s legally binding. That’s why Sharia governance in Islamic finance goes beyond legal form and scrutinizes how risk and knowledge are shared in every transaction.

Conclusion

Understanding the nature of Gharar enables Muslims to make informed financial decisions and avoid transactions rooted in ambiguity and potential injustice. Contracts involving excessive uncertainty undermine trust and disrupt the balance of rights and obligations between parties. Sharia requires not only the absence of deception but also full transparency, predictable outcomes, and equal access to information. In today’s financial landscape, careful scrutiny is essential to identify hidden Gharar, especially in digital and automated financial products. By steering clear of such structures, a Muslim ensures compliance with Islamic ethical standards and protects against impermissible income. This approach supports a foundation for a more stable, trustworthy, and socially responsible economic system.

FAQs

Is it permissible to sell goods not yet in stock if a delivery date is fixed?

Yes, if all terms are clearly defined and delivery is guaranteed, the contract may be valid under salam — a Sharia-compliant forward sale with prepayment.

Can a contract price be tied to a future market rate?

It is allowed if the pricing formula is transparent and agreed upon by both parties. The contract becomes non-compliant if the price is left to one party’s discretion.

Does Gharar apply to hidden fees or undisclosed terms?

Yes. Withholding material terms or fees creates information asymmetry, which constitutes Gharar al-fahish and invalidates the contract under Sharia.

Are penalty clauses mandatory in Islamic contracts?

They are not mandatory but may be included if fair, reasonable, and mutually accepted. Omitting them can lead to contractual ambiguity, which may amount to Gharar in certain cases.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.