Is Real Estate Halal Or Haram? What You Must Know Now

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Here's what every Muslim must know about the halal or haram status of real estate investment:

Property ownership is halal.

Rental income is halal.

Interest-based loans are haram.

Halal financing is required.

Intent must be Shariah-compliant.

Avoid unethical property dealings.

Real estate investing is a well-known way to grow assets. But for Muslims, many wonder: Is real estate halal in Islam? The answer, as of 2025, is yes, if handled within Shariah guidelines. Keep reading to know all about it.

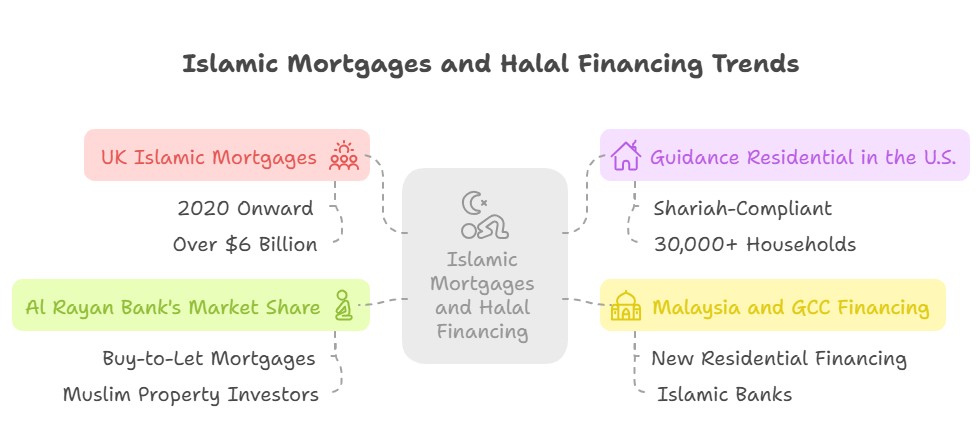

Recent figures for halal financing (2023–2025):

Over $6 billion in Islamic mortgages issued in the UK since 2020.

Guidance Residential in the U.S. has helped over 30,000 Muslim families with Shariah-compliant home financing.

In Malaysia and GCC, over 60% of new residential financing now happens via Islamic financial firms.

Al Rayan Bank’s Buy-to-Let (BTL) Islamic mortgage holds over 10% share among Muslim investors in the UK.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Is real estate halal?

Yes, real estate is halal when transactions follow Islamic principles. Islam encourages trade and asset ownership but prohibits:

Riba (interest);

Gharar (excessive uncertainty);

Haram income (alcohol, gambling, etc.).

Owning, renting, or developing real estate is permissible when financed and utilized ethically.

Is real estate haram?

When beginners explore real estate in Islam, the question often isn't just about halal or haram, it's about how to align every part of the deal with faith.

Start with your niyyah. Your intention shouldn’t just be profit; aim to provide value through ethical housing, which aligns your purpose with Islamic values.

Avoid “paper-only” ownership. Buying property just to flip contracts without real transfer of risk or ownership can resemble riba-based trading, check this against Islamic scholars' views.

Check builder financing links. Many developers tie-up with banks that charge interest; buying from them may involve indirect riba, which makes your purchase doubtful from a halal lens.

Don’t ignore ground rent clauses. In some countries, leasehold property involves rising ground rent, a potentially unjust clause that violates fairness (adl) in Shariah.

Use musharakah structures. Instead of conventional mortgages, explore diminishing musharakah where you co-own the house with the bank and gradually buy their share, it's profit-sharing, not interest.

Consult a scholar before signing. Even if the deal feels halal, hidden terms in contracts (like penalty interest or force majeure linked to riba) can make the transaction haram.

What is a shariah-compliant real estate investment?

A Shariah-compliant real estate investment is a property investment built in line with Islamic legal rules. It bars dealings involving interest, uncertainty, or unlawful trades (e.g., alcohol, gambling, adult entertainment, or unethical business practices).

To be considered halal, both the source of capital and the usage of the property must follow Islamic legal and moral rules. So how the deal is set up matters just as much as the property itself.

A Shariah-compliant real estate investment avoids:

Interest (riba);

Speculation (gharar);

Income from haram activities (like alcohol sales, casinos, etc.).

Key features include:

Use of Islamic contracts like Ijara, Murabaha, and Musharakah.

Rental income from permitted business or residential use.

It also involves ethical checks and regular reviews.

| Sector | Global Value (2025) | Halal Status |

|---|---|---|

| Residential Homes | $180 trillion | if financed ethically |

| Commercial Real Estate | $50+ trillion | depends on tenant use |

| Islamic REITs | ~$14 billion (growing) | if Shariah-audited |

| Sukuk-backed Projects | $823 billion issued | Shariah-supervised |

| Crowdfunding Platforms | Rapid growth in UK & UAE | if certified |

A Shariah-compliant real estate investment ensures that your capital is not just growing, but it’s doing so in a way that aligns with your faith, values, and ethics.

| Criteria | Halal | Haram |

|---|---|---|

| Type of Mortgage | Islamic (Ijara, Murabaha) | Interest-based mortgage |

| Property Use | Residential, ethical commercial | Casinos, nightclubs, alcohol stores |

| Investment Vehicles | Islamic REITs, Sukuk-backed funds | Speculative flipping, riba-driven derivatives |

| Tenancy Screening | Compliant with Islamic values | No screening/haram tenants |

| Returns | Rent, long-term appreciation | Interest or unethical business revenue |

In case you want to explore alternatives to real estate investing, we suggest you consider investing in financial assets (like Forex, stocks, and cryptocurrencies) through Shariah-compliant brokers. Some of the top options have been listed below for you to compare:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.96 | Study review |

How to buy property the halal way

Buying a home or investment property is a major financial step with long-term impact, and for Muslims, doing so in a halal (permissible) way is essential. Fortunately, by 2025, there are now multiple Shariah-compliant financing solutions available worldwide, helping Muslims stay clear of riba and unfair terms. For those seeking ethical property investments, Shariah compliant real estate investment options have also grown, offering faith-aligned opportunities in both residential and commercial sectors.

Here’s how you can buy property the halal way, step by step.

Step 1: Choose shariah-compliant financing

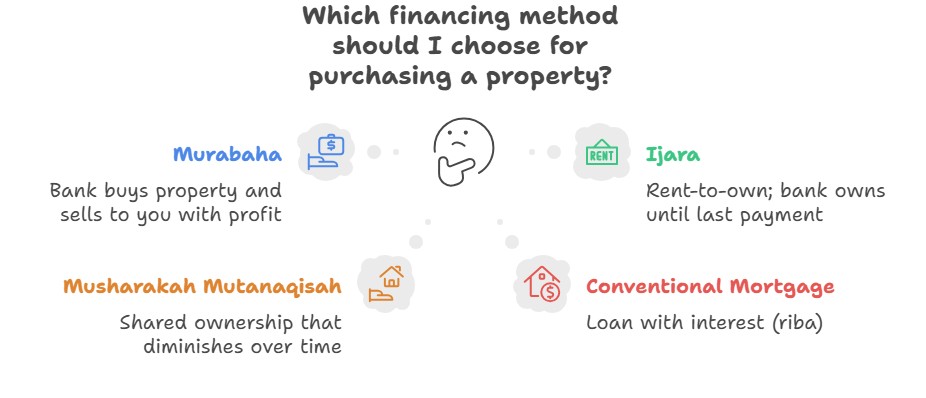

Avoid conventional mortgages, these are based on interest, which is haram in Islam. Instead, use one of the following Islamic financing models, and are commonly accepted in Islamic finance:

| Financing Type | Description | Halal? |

|---|---|---|

| Murabaha | Bank buys property & sells to you with profit | Yes |

| Ijara | Rent-to-own; bank owns until last payment | Yes |

| Musharakah Mutanaqisah | Shared ownership that diminishes over time | Yes |

| Conventional Mortgage | Loan with interest (riba) | Yes |

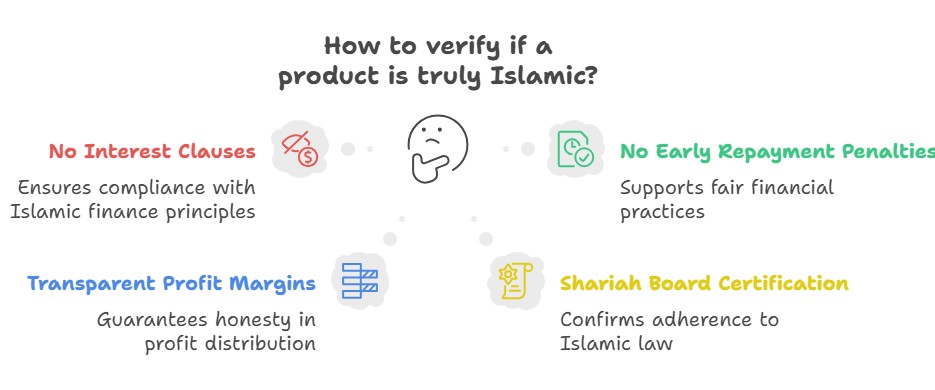

Step 2: Verify the terms are truly halal

Even if a product is marketed as “Islamic,” it’s important to confirm:

No interest clauses in any form.

No penalties for early repayment unless contractually halal.

Clearly stated, reasonable profit terms.

Independent Shariah board certification.

Clear transfer of ownership over time.

Some banks offer Islamic versions, but these may fall short of full compliance, so consult with an Islamic finance expert or scholar before signing.

Step 3: Complete due diligence

Buying halal isn’t just about the financing, it's also about who you buy from and what you’re buying. Make sure to:

Avoid buying from developers involved in unethical industries.

Make sure the property isn’t tied to unlawful additions or risky resale tactics.

Prefer locations with minimal presence of prohibited activities (e.g., nightclubs, gambling halls).

Step 4: Document ownership and title transfer properly

Your property contract should:

Reflect your share of ownership clearly.

Be free from ambiguous or vague terms (avoiding gharar).

Include provisions for dispute resolution that are fair and ethical.

Is Halal real estate investing profitable?

Yes, especially as new Shariah-compliant choices gain traction:

In 2023, Pentavirate issued a $100M Sukuk backed by U.S. commercial real estate.

This was part of a $2 billion halal program designed to help Muslims invest in U.S. properties aligned with Islamic rules.

Islamic REITs and crowdfunding platforms are expanding rapidly year over year across the GCC, UK, and Southeast Asia.

London suburban property drew nearly a third of wealthy GCC investors in the past year.

Islamic finance has grown steadily in recent years, driven by the global demand for ethical, interest-free financial solutions. In 2023, the global Islamic finance market was valued between USD 2.82 trillion and USD 3.5 trillion, depending on the reporting source. By early 2025, estimates suggest it had expanded to approximately USD 4.5–5.3 trillion. According to multiple industry research groups, the market is projected to reach as high as USD 8.07 trillion by 2032, with an expected compound annual growth rate (CAGR) ranging from 9.7% to 12.67%.

This explosive growth includes halal property investment vehicles such as Islamic mortgages, Shariah-compliant REITs, and Sukuk-backed real estate.

Co-owning undervalued real estate with Islamic finance structures can unlock halal wealth in 2025

Instead of rushing into a solo property purchase, consider entering a Shariah-compliant co-ownership agreement with trusted family or community members. In 2025, rising real estate prices make it nearly impossible for first-timers to buy alone. The more sustainable option? Use a Musharakah Mutanaqisah (diminishing partnership), where your share of ownership increases over time as rental payments decrease.

“Allah has permitted trade and forbidden riba (interest).” — Surah Al-Baqarah 2:275

This model, verified by scholars, allows you to build equity gradually without engaging in haram mortgage debt — a powerful way to stay within Islamic boundaries while still investing early.

Another overlooked but impactful route is investing in distressed waqf-adjacent properties — real estate donated for religious or public use, now underused due to mismanagement. In regions like Malaysia, Indonesia, and East Africa, Islamic urban trusts are opening opportunities for private halal investors under profit-sharing models.

“Help one another in righteousness and piety, but do not help one another in sin and transgression.” — Surah Al-Ma’idah 5:2

These aren’t quick flips. You’ll be part of reviving ethical, socially beneficial assets while earning long-term passive income — true to both investment logic and Islamic principles.

“And whatever you spend of good – it will be fully repaid to you, and you will not be wronged.” — Surah Al-Baqarah 2:272

Conclusion

So, is real estate halal in 2025? The answer is a confident yes, and now more data-backed and actionable than ever before. With the Islamic finance sector projected to hit $8.07 trillion by 2032, Muslim investors worldwide are embracing ethical and structured approaches to property investment.

We’ve seen the rise of Sukuk-backed U.S. property programs, the GCC’s billion-dollar shift into UK real estate, and the expected surge of Shariah-compliant REITs, all confirming that real estate is not only halal, but also highly lucrative when managed under Islamic principles.

If you’re looking to grow your wealth while staying true to your values, now is the time to explore halal property investment options, from compliant mortgages to REITs and global Sukuk funds.

FAQs

Can I invest in real estate using cryptocurrency and still be halal?

Only if the crypto used is earned through halal means and the property deal avoids riba or speculation. Some Shariah scholars now approve stablecoins for halal property purchases, but always check how the transaction is structured and if it’s screened by a Shariah advisory board.

Is it halal to lease property with variable rent based on business profits?

Yes, if structured as a profit-sharing (Mudarabah or Musharakah) model with clear terms and no interest. This model is gaining traction for commercial property leasing in model with clear terms and no interest. This model is gaining traction for commercial property leasing in Islamic finance circles and aligns with the concept of shared risk and reward.

Can Muslims invest in short-term rental properties like Airbnb?

Yes, but ensure guests are not using the space for haram activities. Also, your intention matters, if you’re offering halal-friendly spaces and not profiting from unethical tourism (e.g. alcohol, nightlife zones), it's considered halal.

What if I inherit property tied to an interest-based mortgage?

You’re not sinful for inheritance, but you should aim to refinance it under a Shariah-compliant model or clear the riba as soon as possible. Scholars recommend prioritizing conversion to halal financing to purify the income and ownership path.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.