Is Scalping Trading Halal In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Scalping trading is seen as halal in Islam if it avoids interest (riba), gambling (maysir), and uncertainty (gharar). If the trader owns the asset, trades transparently, and stays away from forbidden elements, some scholars say it’s allowed under Shariah. However, views differ depending on how it’s applied.

Scalping is a common method in Forex and crypto markets that aims to earn small gains through quick trades. But Muslims who use this method regularly question if it fits Islamic values. Like any financial activity, scalping should be understood in line with Shariah principles, mainly steering clear of interest, fraud, and excessive speculation.

This article will help you understand the debate around scalping trading halal or haram within the framework of Islamic finance. It also explores how scalping compares to other strategies and outlines steps you can take to keep your trading halal.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

What is scalping in trading and how does it work?

Scalping refers to a fast-paced trading approach where individuals place numerous quick trades, aiming to benefit from slight shifts in price. This typically involves holding a trade for only a few seconds or minutes, focusing on capturing minimal gains that collectively become meaningful.

Scalpers usually operate in highly liquid markets such as Forex, stocks, or cryptocurrencies. They target small intraday movements and may execute dozens, or even hundreds of trades throughout a single session. While each trade brings a modest return, the accumulated outcome can become quite substantial. For Muslim traders, the question often arises: is scalping halal, especially given the rapid execution and speculative nature of the strategy.

Success in scalping depends on sharp reflexes, real-time data, and the use of tools like automated systems or curated trading alerts. Most traders base their decisions on technical indicators, key price zones, and established patterns. Unlike traditional investors, scalpers aren’t focused on fundamentals or broader trends — they act swiftly to capitalize on immediate price shifts.

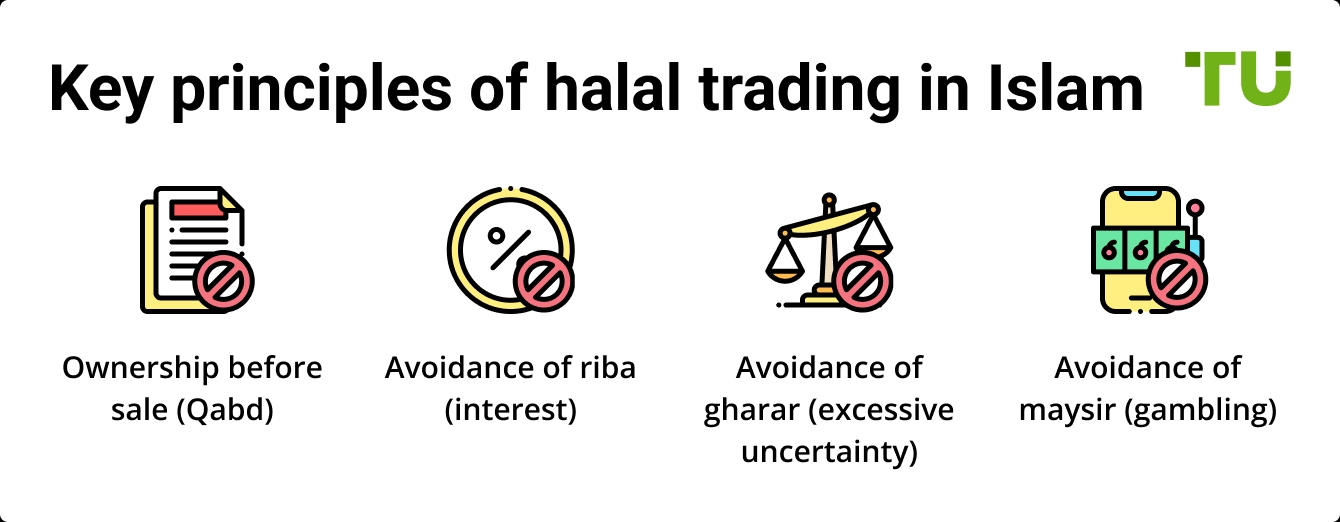

Ownership before sale (Qabd)

In Islamic finance, a trader must take real or effective possession of an asset before offering it for sale. This means you can't sell what you haven't yet acquired. For a scalp trade to remain halal, you should make sure the asset is in your control, even if only for a short time, before you attempt to resell it.

Platforms that deal in contracts for difference (CFDs) without real asset ownership raise concerns under Islamic principles. It's safer to trade through brokers that offer actual asset-backed transactions.

Avoidance of riba (interest)

Charging or earning interest is completely against Islamic teachings. Many trading platforms add overnight interest fees when trades stay open too long. Since scalping involves quick trades, usually completed within minutes, interest usually doesn't apply.

Still, it's important for Muslim traders to look out for hidden costs or interest-based features in their account settings. Choosing swap-free accounts designed for Islamic users helps ensure you're following the rules.

Avoidance of gharar (excessive uncertainty)

Islamic finance prohibits any trade involving uncertainty or deception. When scalping, it’s essential to fully understand what you're buying or selling. If the contract is complicated or unclear, it may involve gharar.

Clarity is essential in Islamic trading. Every condition, from price to timing, must be easy to understand. Using clear and reliable platforms helps avoid confusion and keeps the trade in line with Islamic principles.

Avoidance of maysir (gambling)

Trades shouldn’t feel like games of chance. If scalping depends only on instinct or luck, it may cross into gambling. But when it's based on planning, clear strategy, and controlled risk, it can be a form of legitimate business.

Muslim traders should focus on learning and thoughtful decision-making. Avoid chasing the market and always apply stop-loss tools to handle risk responsibly.

Scalping trading is halal or haram: What Islamic scholars say

Scalping isn’t automatically haram in Islam. What matters is how it’s done. A lot of scalpers use accounts that rely on borrowing with interest or carry overnight fees, which clearly contradicts Islamic values. As the Qur’an warns:

"O you who have believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful." (Surah Al-Imran 3:130)

Engaging in trades that involve riba (interest) is clearly forbidden, which is why using a conventional leveraged account for scalping could render the practice haram. But if you’re using a halal trading account, avoiding all forms of riba, and only risking your own capital, the method itself may be considered permissible. That’s why many traders ask: is scalping haram, or is it simply misunderstood when viewed through a Shariah lens?

The broader question of scalping halal or haram often depends on the trader’s intention and the structure of the trade. Scholars like Mufti Taqi Usmani, a widely respected Islamic finance authority, have emphasized:

"The permissibility of a transaction is not solely dependent on profit or loss, but rather on how the transaction is structured and whether it avoids elements prohibited by Shariah such as interest, uncertainty, and gambling."

If you're scalping just to game the system without any real strategy or value creation, it begins to resemble maysir (gambling), which is categorically prohibited in Islam:

"They ask you about wine and gambling. Say, 'In them is great sin and [yet, some] benefit for people. But their sin is greater than their benefit." (Surah Al-Baqarah 2:219)

However, if you’re actually studying the market, taking calculated risks, and treating it as a legitimate business activity, then it’s a different story. Many scholars agree that intention (niyyah) plays a vital role, and what separates halal from haram often lies more in your approach than the timeframe of your trades.

Another key consideration is how the platform handles trade settlement. If ownership doesn’t transfer immediately, or if the process involves ambiguity or hidden elements, this creates gharar (excessive uncertainty), which also makes the trade impermissible. For scalping to be halal, you must maintain real control over the asset, fully accept trading risk, and avoid synthetic setups or speculation that has no tangible backing.

"Trade by mutual consent and do not consume one another's wealth unjustly." (Surah An-Nisa 4:29)

So it’s not the speed of trading that makes it haram — it’s whether the structure and ethics behind it align with Islamic principles.

Factors that determine if scalping is halal or haram

Does the trade involve riba (interest)?

If the scalping platform adds or passes on any kind of interest, even in an indirect way, the trade becomes impermissible. Many brokers charge swap fees, especially in Forex trades. While scalping usually avoids overnight positions, some platforms may still factor interest into their pricing. To avoid this, traders should choose accounts that are clearly marked as swap-free.

Even a brief holding period must stay clear of any interest to be allowed under Islamic rules. It's important to review the account type and broker terms carefully before you begin trading.

Is there actual asset ownership?

Islamic rules do not allow selling something that hasn’t been acquired. Some platforms only let you trade based on market movements without owning the underlying asset. This is commonly seen in CFD setups.

To keep your scalping in line with halal principles, work with brokers that offer direct ownership of the asset in real time, even if it's only for a short period. Many crypto and stock brokers offer this option. It's best to avoid trades built on synthetic contracts.

Is the trading approach disciplined or based on emotion?

In Islam, emotional or reckless behavior in trading is discouraged because it mirrors gambling. If your scalping depends on guesses or quick reactions without a solid plan, it risks becoming impermissible.

But if you trade based on proper analysis, with clear rules for managing risk and a structured plan, your method is more aligned with the idea of honest business. The purpose behind your trade, known as niyyah, is an important factor in how it is judged.

Are the terms of trade clear?

If the prices, trade execution, or platform conditions are unclear or inconsistent, this creates unnecessary uncertainty. In Islamic finance, trades must be built on clear, well-understood terms. You should know how your broker charges fees, handles orders, and processes trades before you get started.

Watch out for confusing leverage rules, unclear order slippage, or fees that aren't explained. If these are part of your trading environment, they can turn scalping into a questionable practice.

How scalping compares to other trading strategies in Islamic finance

In contrast to scalping, swing trading tends to involve fewer trades held over several days, making it easier to ensure thoughtful analysis, Shariah compliance, and reduced speculation. Similarly, spot trading, when conducted hand-to-hand and without deferred settlement, is often viewed as more compliant with Islamic principles, especially in currency and commodity markets.

Scalping is also different from margin trading and proprietary trading, where borrowed capital or virtual funding often introduces elements of interest or ambiguity. That said, copy trading can mirror the same pitfalls as scalping — especially if trades are executed without the trader's direct control or understanding of the risk.

Even option trading and short selling are often scrutinized for introducing speculative behavior, but the ultra-short-term nature of scalping pushes it even closer to maysir territory unless extreme care is taken with account setup and asset selection.

If you wish to invest in financial assets (halal stocks, halal cryptocurrencies, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.96 | Study review |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Millisecond swaps and swap-free accounts shape halal scalping

If you're new to scalping and wondering about its halal status, here's a detail most people miss: the issue isn’t how fast you trade — it’s whether hidden swap charges are quietly built into the pricing. Even trades that last seconds can include a fraction of interest depending on your broker's setup. That’s why many traders ask: scalping is haram or halal, and the answer often comes down to the structure behind the trade. What matters most is using an Islamic account that doesn’t just cancel swaps on the surface but also uses a backend system that keeps the entire transaction interest-free from start to finish.

Another critical point in determining is scalp trading halal is execution transparency. While some scholars focus on excessive risk in short-term trades, few highlight the uncertainty caused by delayed or manipulated order fills. If your broker delays executions or operates through a market-making desk, you may be exposed to practices that conflict with Shariah principles. In this context, many ask is scalp trading haram when platforms interfere with fair trade execution. That’s why choosing ECN or STP brokers — those that route orders directly to the market without interference — is a smarter option if you want to keep your scalping activity clean from an Islamic perspective.

Conclusion

Scalping trading can be halal in Islam if done under strict conditions — no interest, real asset ownership, disciplined approach, and full transparency. While some scholars remain cautious due to the fast-paced and speculative nature of scalping, others permit it when traders follow Islamic guidelines.

The key is how the strategy is implemented. Intention, ethics, and knowledge are all critical in Islamic finance. If you want to scalp while following Shariah, choose a halal-certified broker, avoid interest, use real assets, and trade responsibly.

FAQs

Can I scalp trade during major Islamic events like Ramadan?

While there’s no specific restriction against scalping during Ramadan, many Muslims choose to trade more mindfully during this time. If your trading routine becomes distracting from spiritual focus or encourages impulsive behavior, it might be worth scaling back. Islam values balance, even in permissible acts.

Does the speed of execution in scalping affect its halal status?

Speed alone doesn’t make it haram. What matters is whether you own the asset and the trade is clear and fair. However, if speed results in slippage, price manipulation, or hidden contract terms, then the transparency issue might violate Shariah principles.

Is scalping allowed in commodity markets under Islamic finance?

Scalping in commodities can be halal if the underlying asset is lawful (like gold, silver, or oil), and there's real ownership and no interest involved. Be cautious with commodity CFDs, as many do not involve actual delivery or possession, which could make the trade impermissible.

What role does broker reputation play in halal scalping?

A broker’s credibility matters more than people think. If a broker isn’t transparent, delays executions, or mixes client funds, it can create ethical risks. Always research whether your broker aligns with Islamic values. Halal compliance isn’t just about features, it’s about trust.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.