Is Short Selling Haram Or Halal In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Short selling is viewed as haram by many scholars because it involves selling something one does not own, relies heavily on uncertainty, and frequently includes interest-based transactions, which goes against Islamic financial teachings.

Short selling is widely debated in the context of Islamic finance. While some describe it as a contemporary method applied for risk management and pricing accuracy, a large number of scholars deem it non-compliant due to the absence of actual asset ownership and the speculative elements involved. These aspects raise serious concerns under Shariah interpretations and highlight why short selling is haram in Islam, particularly when it involves selling what one does not own and profiting from uncertain outcomes.

Short selling in Islamic finance is especially problematic when it includes interest-based borrowing or ambiguous contracts, both of which are considered impermissible under core Shariah principles. In this article, we will take a detailed look into the idea of short selling as per Islamic finance, judging its permissibility, potential exceptions, and how it compares with ethical investment alternatives that align with Islamic values.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is short selling, and how does it work?

Short selling is a trading method where an investor borrows shares of a stock, sells them at the market rate, and later buys them back, ideally for a lower price, to return to the original owner and keep the profit made from the difference.

Put simply, short selling lets a trader benefit when a stock’s value goes down. The trader doesn’t own the stock. They borrow it against some margin, usually via a broker, with the agreement to give it back. If the stock drops in price after the sale, they can buy it at the new lower rate, return the shares, and keep the gains. But if the price climbs, the trader ends up taking a loss.

While this is a common practice in conventional markets for hedging or speculation, Islamic finance views it differently due to concerns like selling without owning the asset, high levels of uncertainty, and potential links to interest-bearing arrangements. These concerns are central to discussions around whether short selling is Shariah-compliant.

Is shorting stocks halal or haram in Islam?

Short selling — also known as shorting — is a trading method where a trader borrows shares, sells them on the market, and later buys them back at a hopefully lower price to make a profit. It’s a common strategy in modern finance, but many Muslim investors ask: is shorting stocks halal, or more directly, is shorting stocks haram?

According to most Islamic scholars, the core issue with shorting lies in its structure. Is shorting a stock halal if you don’t actually own the asset you're selling? The Prophet Muhammad clearly stated: "Do not sell what you do not own." (Sunan an-Nasa’i 4611). Since in a short sale the trader doesn’t truly own the shares, this condition is violated from the start.

Another reason why shorting a stock is haram according to many scholars is the excessive uncertainty (gharar) and speculative nature (maysir) involved. The trader is essentially betting on a price drop without contributing real economic value. In Islam, contracts involving such ambiguity or gambling-like behavior are considered impermissible.

There's also the matter of riba (interest). Many short-selling arrangements involve interest-based borrowing or collateral. This contradicts the Qur’anic injunction:

“Allah has permitted trade and forbidden riba (usury).” — Surah Al-Baqarah 2:275

Given all these elements — sale without ownership, speculative intent, and potential interest-based financing — the majority opinion is clear: shorting a stock is haram in its conventional form.

That said, some financial scholars are exploring halal-compliant alternatives that simulate short exposure using ethical mechanisms like Islamic ETFs and index funds or forward-style contracts. But these are very different from mainstream short selling.

So, if you're wondering if shorting is halal while trading on the stock market, the safe answer from a Shariah perspective is: no, not in its standard form. Muslims seeking to stay within halal boundaries are encouraged to invest in assets they own, using transparent, Shariah-compliant tools that align with Islamic values.

Is short selling halal or haram in Forex?

Many Muslim traders ask: is short selling halal or haram in Forex? According to most Islamic scholars, the practice of shorting Forex is haram because it usually involves selling assets you don’t actually own and may rely on interest-based leverage. Even within the broader context of halal Forex trading, this approach often contradicts Shariah principles like gharar (uncertainty) and riba (interest). While some modern interpretations try to justify that shorting Forex is halal, the consensus remains skeptical without full asset ownership and risk-free terms.

Is short selling crypto halal or haram?

With halal crypto trading becoming more mainstream, many ask: is short selling crypto halal? Generally, scholars argue that shorting crypto is haram due to its speculative nature, high volatility, and the fact that it often involves borrowed coins or margin. However, under specific conditions—such as real asset ownership and interest-free execution — some believe that shorting crypto is halal, though such scenarios are rare in standard trading platforms.

Why is short selling considered haram by many scholars?

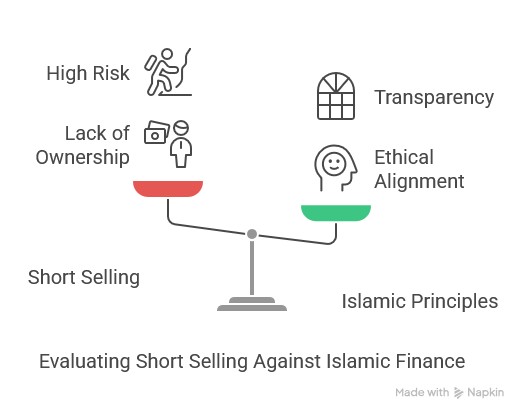

Short selling is widely viewed as haram by Islamic scholars, mainly because it clashes with key Shariah principles, like true ownership, avoiding uncertainty (gharar), and staying clear of interest (riba).

To begin with, Shariah law says you need to actually own something before you can sell it. In short selling, traders sell shares they don’t own, they borrow them instead. This lack of real ownership is a major concern raised by scholars.

It also involves a high level of speculation and some aspects of leverage as well, which many liken to gambling (maysir). The trader is essentially hoping the price will fall, but there’s no guarantee, making it risky. On top of that, borrowing shares often includes interest payments, which only strengthens the argument that this practice goes against Islamic financial ethics.

Islamic finance principles and the issue of ownership in short selling

Ownership holds a foundational place in Islamic finance. Under Shariah principles, a person is only allowed to sell what they actually own and control. This guideline promotes clarity in transactions, encourages fairness, and helps prevent future disagreements. In the case of short selling, though, the trader doesn’t genuinely own the asset at any point during the transaction.

The shares are temporarily borrowed via a broker, and the sale is completed before the trader even has control or legal possession. From an Islamic lens, this structure renders the transaction impermissible. There's also usually no intention to take actual ownership of the asset, it functions mainly as a tool for speculation, which goes against the values of ethical commerce in Islam.

Short selling also raises the issue of counterparty risk. If the share price moves upward without warning or the lender demands the shares back, the seller could suffer limitless financial losses. This extreme exposure to uncertainty mirrors gharar, an element that Islamic financial practices are designed to avoid.

Are there any halal alternatives to short selling?

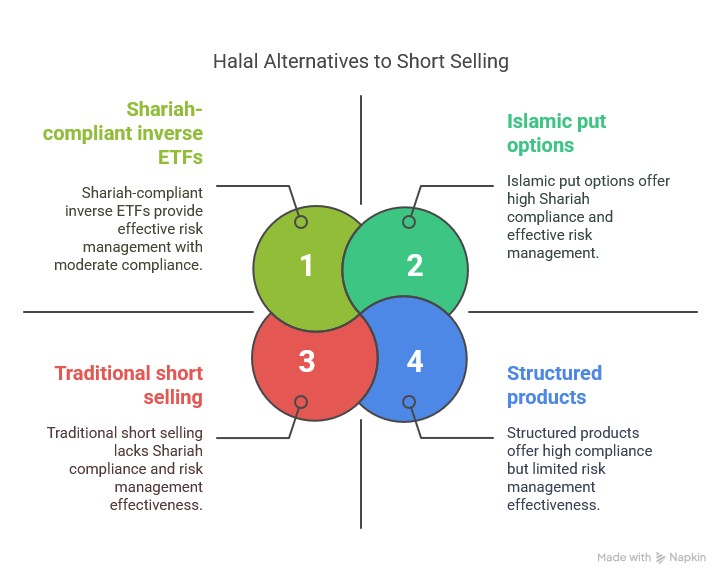

Yes, there are halal alternatives to short selling, including Islamic put options, trading stocks you already hold, or using Sharia-compliant inverse ETFs that avoid impermissible elements like riba.

Islamic scholars and financial experts have developed financial instruments that stay within Shariah boundaries. For instance, some Shariah-based funds utilize compliant derivatives or structured products designed to achieve similar outcomes to short selling, without relying on borrowing or interest.

Some investors manage downside exposure through strategies like shifting assets across sectors or adjusting their portfolio mix. By exiting certain holdings or moving toward lower-risk investments, they aim to control losses without engaging in transactions that contradict Islamic financial ethics.

If you wish to invest in financial assets (stock, crypto, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Fatwa short selling: What do different scholars and institutions say?

Short selling has been widely debated across Islamic finance councils, with the majority of scholars considering it impermissible due to its speculative nature and violation of the principle of ownership before sale (bay’ ma la yamlik). In 2006, the Islamic Fiqh Academy under the OIC ruled that conventional short selling is haram as it involves borrowing assets not owned by the seller and profiting from price declines, a practice that contradicts the ethical intent of trade in Islam.

Similarly, AAOIFI has consistently classified short selling as a non-compliant activity, reinforcing the idea that selling something you do not own constitutes gharar (excessive uncertainty) and maysir (speculation). However, some Shariah boards, particularly in Malaysia under the Securities Commission’s guidelines, have conditionally allowed Shariah-compliant short selling (SLB), only when the underlying asset is actually owned via a prior arrangement and borrowed through an Islamic sale-based structure.

In recent years, a small but growing minority of scholars have begun to explore derivative-like alternatives that mimic the economic effects of short selling without violating ownership rules. For instance, a 2022 paper published by the ISRA Research Journal proposed using urbun (Islamic down payment contracts) as a possible alternative structure, where the seller retains some level of risk and does not fully transfer ownership until a certain condition is met.

Additionally, some scholars from GCC-based institutions have proposed structured salam contracts or wa’d-based swaps as compliant hedging tools that could be used to simulate bearish strategies in equity markets. These ideas are still under debate and not widely adopted, but they reflect an evolving discussion among Islamic finance practitioners trying to bridge Shariah ethics with market realities.

How short selling compares to other trading methods

Each trading method has different levels of risk and rules around ownership. Some people wonder if fast-paced styles like scalping or day trading are allowed in Islam. These involve quick trades, similar to short selling, but the way risk is handled can be very different.

Others look into swing trading or copy trading, which seem slower-paced but still raise questions. With copy trading, for example, you’re following someone else’s moves, so it’s important to ask if that lines up with the responsibility and intention Islam encourages in financial decisions.

Bigger-picture strategies like Forex trading, stock investing, or crypto get mixed views too. These markets can involve speculation, but the rules depend on things like whether you actually own the asset and how transparent the transaction is.

Tangible investments like real estate or commodities tend to get more approval in Islamic finance, especially when they involve actual assets. But if you're using tools like futures contracts to trade those same assets, that’s a different story as it can easily cross into speculation, which is discouraged.

Financial products like binary options, CFDs, and options trading often get flagged for the same reasons as short selling; they involve betting on price changes without really owning the asset. That’s a big red flag in Islamic law.

Even something that feels safer, like spot trading, can become questionable if it's done with leverage or unclear settlement terms.

Looking at all these side by side gives a clearer sense of where short selling fits. It's not just about following a fatwa or checklist, it’s about making choices that stay true to Islamic values in both how and why you trade.

Synthetic Shariah-compliant strategies replicate short selling without violating Islamic finance

Short selling is generally considered haram in Islam due to its speculative nature, interest-based borrowing, and selling what one doesn’t own. For those asking “why is shorting haram”, these factors violate key Shariah principles like riba and gharar.

But does that mean shorting is always haram? Not necessarily. Some Islamic firms use alternatives like Arbun or Wa’ad-based contracts to simulate short exposure without violating Shariah. These structured instruments let investors benefit from falling markets while avoiding prohibited elements — raising the question: is shorting halal if done ethically?

Another Shariah-compliant method involves inverse ETFs designed to meet Islamic standards. While many ETFs aren’t halal, a few use asset-backed or equity-swap models to align with Islamic values.

So, is shorting halal or haram? It depends entirely on the structure. In Islamic finance, the how matters just as much as the what.

Conclusion

Short selling, as practiced in conventional markets, is generally considered haram in Islam due to its conflict with key Shariah principles. These include the requirements of asset ownership, the prohibition of excessive uncertainty, and the avoidance of riba. While some efforts are being made to design Shariah-compliant alternatives, the mainstream view among scholars and Islamic financial institutions remains firm. For Muslims seeking to align their investments with their faith, it's safer to avoid short selling and explore ethical alternatives that respect Islamic financial values.

FAQs

Can short selling be made halal through advanced financial engineering?

Some scholars believe it’s possible if the structure ensures real asset ownership, avoids interest, and removes uncertainty. Models like arbun (earnest contracts) and wa’ad-based promises are being tested to provide halal alternatives. However, these approaches remain under review and are not fully accepted across all Islamic schools, especially in debates around is short trading halal.

Does the type of asset being shorted matter in Islamic finance?

Yes. Even if the asset is halal — such as shares in a Shariah-compliant company — the act of shorting it still raises issues. The mechanics of borrowing and speculating make scholars question is short trading haram, regardless of the asset itself. It’s the method, not just the material, that defines compliance.

How do Islamic scholars view synthetic short positions?

Synthetic strategies — like combining arbun with conditional sales — are cautiously explored in Islamic finance. Scholars note that such models may offer a compliant answer to is short term trading halal, but only if contracts avoid riba, ambiguity, and speculative risk. Otherwise, they fall into the same concerns that lead others to say is short term trading haram.

Is it haram to benefit from someone else’s short position?

If your profit indirectly comes from another party’s haram activity, such as investing in a fund that uses conventional short selling, the ethical boundary is blurred. Islamic finance promotes distancing from questionable sources of income, reinforcing concerns around is short trading halal or not based on underlying operations. Due diligence is crucial.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.