Istisna: Types, Conditions, Parallel Contracts, Difference from Salam and Ijarah

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Istisna in Islamic finance and banking refers to a Shariah-compliant agreement primarily used for construction and manufacturing financing. It enables a buyer to request a product to be built or manufactured according to specific terms. Payments can be made over time or deferred entirely until completion. Often favored by traders and institutions, this contract type contributes to nearly 25–30% of Islamic project finance, especially in sectors like infrastructure and industrial equipment.

To better understand Istisna's meaning, it helps to view it as a custom-made contract tailored for projects that require time and precision, such as large-scale construction or bespoke manufacturing. Its structure supports ethical investing by ensuring transactions align with principles of Islamic investing, avoiding uncertainty and non-permissible elements. This makes it especially valuable for long-term projects that require both financial flexibility and Shariah compliance. In this guide, we will place a key focus on clarifying what is Istisna used for along with its key aspects.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is Istisna?

Istisna centers around a contract where a manufacturer agrees to create goods based on the specific requirements of the buyer. This arrangement provides greater flexibility than many other Islamic financial agreements, making it popular in trade and industry-related financing.

Instead of immediate exchange, Istisna's contract is designed as a forward agreement where payment and delivery can be deferred. This unique structure sets it apart from conventional sale contracts and provides room for customization and extended timelines.

One of the key strengths of Istisna's definition lies in how it enables both parties to openly negotiate terms such as quality of materials, project timelines, and delivery schedules. It remains fully compliant with Shariah law by avoiding interest (riba), uncertainty (gharar), and gambling (maysir) as emphasized in principles surrounding riba in Islam.

When someone asks for a clear explanation as to define Istisna, it helps to think of Istisna as a custom-built agreement, a make-to-order model that provides financial flexibility while maintaining religious and ethical integrity.

In the context of modern finance, answering what is Istisna in Islamic banking becomes particularly important. It refers to a well-structured tool that Islamic banks use to fund infrastructure, manufacturing, or construction projects in a way that avoids haram elements and upholds Islamic legal standards.

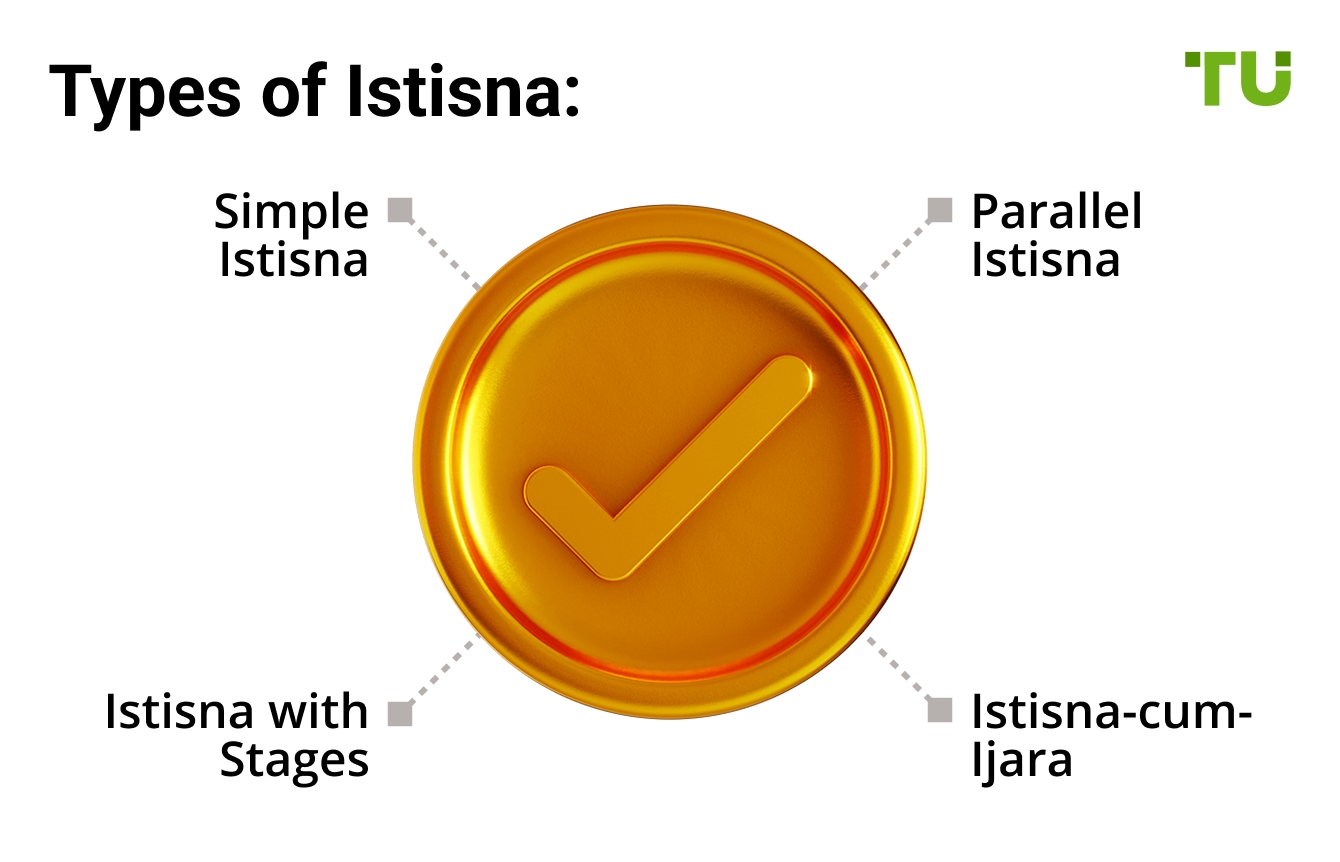

Types and structures of Istisna

There are various contract models in Islamic finance, and when it comes to the types of Istisna, two stand out as the most significant: the classical model and the parallel arrangement. Each serves a unique function in facilitating manufacturing or construction-based transactions, depending on the complexity of the project and the parties involved.

What we discussed earlier was classical Istisna. In the structure of a parallel Istisna, two separate agreements are executed. The first contract is drawn between the customer and the Islamic bank, while the second is signed between the bank and a supplier or manufacturer. Though these contracts are legally distinct, they are tied together in terms of the project’s flow and final outcome.

A commonly cited parallel Istisna’s example involves a scenario where an Islamic financial institution agrees to deliver a completed factory to its client, while outsourcing the actual construction work to a third-party contractor. This arrangement allows the bank to fulfill its obligation to the client without having the in-house capability to manufacture or build.

A practical understanding of Islamic finance is often enhanced by examples. A good way to illustrate Istisna's example would be a custom furniture order where the buyer commissions a craftsman to build a unique piece with agreed specifications and payment milestones, demonstrating how the contract allows for tailored production under Islamic guidelines.

Real-world application of Istisna

Most people wondering what is an Istisna contract consider it as just a deal where something is built and delivered later. But few realize how Istisna in Islamic finance helps tackle large-scale projects banks usually avoid. In 2023, an Islamic bank in Indonesia put together a $200 million deal using Istisna to build a water desalination plant. What made it stand out? Payments were made in phases, only when progress happened on the ground. It gave the builder working capital without front-loading debt like a regular loan.

Istisna financing works especially well in sectors where projects take time and budgets keep changing. Think aerospace, custom housing, even military tech. During the COVID-19 crisis, Pakistan used Istisna to build modular hospitals. That’s a big deal because even within salam and Istisna, salam demands full upfront payment while Istisna lets you change the design as you go and doesn’t need money paid all at once. This kind of flexibility makes it ideal for urgent or one-of-a-kind projects.

And now, the rise of Istisna sukuk brings a fresh way to approach funding for public projects. Turkey recently used this to raise money for new highways. What’s smart about this approach is that investors are tied directly to the progress of the project, not just promised profits. It’s a model that helps everyday people invest in their own country’s infrastructure while knowing where their money is going and how it’s being used.

Advantages for traders

Most traders focus on speed, spreads, and leverage, but few realize the structural advantages that come from Istisna from Islamic banking when applied in trade finance. Unlike conventional contracts, Istisna allows a buyer and seller to agree on the production of goods that don’t exist yet, with payment terms that can be staggered. This flexibility means traders can secure custom manufacturing or processing agreements without upfront capital, giving them a competitive edge in markets where liquidity is tight.

One of the hidden perks lies in how the conditions of Istisna allow traders to lock in raw material prices and delivery timelines even before a product is created. This is a game-changer in volatile sectors like commodities or custom equipment, where prices move fast. Because the contract is binding but doesn't require immediate asset existence, traders gain time to hedge, raise funds, or even pre-sell the output while maintaining compliance with Shariah principles.

Beyond risk management, Istisna also offers strategic breathing room. Traders working with Islamic banks can negotiate delivery windows and financing terms based on project milestones rather than rigid schedules. This kind of deal-making is rare in conventional setups and gives Islamic traders a psychological and operational advantage. Over time, the ability to customize contracts under Istisna through Islamic banking helps build stronger relationships with suppliers, funders, and clients.

Comparing Istisna with other contracts

To fully grasp how Istisna operates within Islamic finance, it's essential to compare it with other key contract types that serve different financial functions but often work alongside Istisna in complex projects.

Wakalah is commonly used in agency-based structures where an investor appoints someone to act on their behalf in managing funds, a feature sometimes integrated into Istisna-based investment models.

Mudarabah allows for profit-sharing between capital providers and entrepreneurs, making it ideal for early-stage financing where the outcome is uncertain, but growth potential is high.

Murabaha is better suited for clearly defined asset purchases with fixed markups, offering a structured alternative when immediate delivery is required.

Musharakah provides a partnership-based model where all parties contribute capital and share profits and losses, often layered with Istisna in large-scale infrastructure or development projects.

Difference between Istisna and Salam

Next, let's look at salam and Istisna together. While both are contracts involving delivery at a future date, they differ in their payment structure, only Salam requires full payment to be made in advance. Gaining clarity on the difference between Istisna and Salam is important, especially for businesses that need flexibility in payment timing and production stages.

Understanding these distinctions, particularly the difference between Salam and Istisna, enables traders to select the right contract type that aligns with their production timelines, payment preferences, and overall business strategy. While a Salam contract requires full payment in advance for goods to be delivered later, Istisna provides flexibility in both delivery schedules and payment terms, which makes it more suitable for construction and manufacturing deals.

Difference between Ijarah and Istisna

When comparing contract types, it's also helpful to understand the difference between Ijarah and Istisna. Ijarah typically involves leasing assets that already exist, such as equipment or vehicles. In contrast, Istisna is used when a product still needs to be manufactured or constructed before it can be delivered. To further clarify key distinctions, the difference between Istisna and Ijarah lies in their application.

Execution guide: Step-by-step Istisna process

Trader identifies a need for a product not yet manufactured.

Signs a detailed contract with a bank or manufacturer.

Payment terms and delivery schedule are agreed upon.

Manufacturing starts according to the specs.

Final inspection and delivery.

Final payment is made, completing the Istisna contract.

Risks and mitigation

Istisna is a useful, but tricky contract in Islamic banking, and beginners often miss the risks that aren't obvious at first.

Delayed delivery is a recurring issue. Check progress at each stage, not just at the end, so you catch problems early.

Price inflation can harm margins. Lock in material costs with suppliers ahead of time and add backup plans for price jumps.

Buyer default risk is real. Ask for payments in steps and tie them to actual work done, verified by someone neutral.

Contract misinterpretation happens easily. The application of Istisna needs clearly written instructions, timelines, and rules for changes so both sides stay on the same page.

Quality disputes often slow down payments. Bring in a trusted third-party to confirm the product meets Islamic rules and quality standards before delivery.

Over-customization raises complexity. Only offer heavy personalization if the buyer agrees to pay more for the extra effort and time involved.

Mitigation strategies

Istisna contracts carry unique risks, but Islamic banks have developed smart, targeted ways to minimize them. Here are some expert-level strategies that go beyond the basics.

Use phased payments with inspections. Tie each payment to a specific construction or manufacturing milestone, and add mandatory inspections before release to reduce delivery risk.

Add performance-based penalties. Including strict late-delivery or non-compliance clauses pushes the manufacturer to stay on schedule and reduces default chances.

Structure parallel Istisna with buffers. In a parallel application of Istisna, leave a margin between deadlines of the bank’s contract with the buyer and with the supplier to manage unexpected delays or defects.

Use Islamic insurance (takaful). Protect the project value with coverage that complies with Shariah and steps in during loss, damage, or contractor failure.

Prequalify contractors based on past builds. Don’t just pick the cheapest bidder. Evaluate previous projects, financial health, and factory setup to reduce the risk of underdelivery.

Monitor raw material supply chains. Many defaults in Istisna come from delays in key inputs. Regular updates on inventory and sourcing status help prevent surprises.

References and religious endorsements

Islamic scholars have consistently emphasized the permissibility and ethical value of Istisna within the framework of Shariah. For instance, the AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) outlines detailed standards for Istisna, reinforcing its legitimacy in Islamic finance.

In addition, Mufti Taqi Usmani, a leading scholar in Islamic jurisprudence, has noted that Istisna is particularly effective for public-benefit projects and custom manufacturing when governed by clear contractual obligations.

Qur’anic principles such as fulfilling contracts and avoiding uncertainty (gharar) underpin the validity of Istisna in Islamic banking, ensuring that every transaction remains just and transparent:

"O you who have believed, fulfill [all] contracts..." – Surah Al-Ma'idah, 5:1

Some halal-certified trading communities and online influencers like Halal Investing Group on social media platforms have endorsed Istisna-based financing for its ethical alignment with Islamic values in asset creation.

Where Islamic regulatory bodies like Bahrain’s Central Bank or Malaysia’s Bank Negara approve Istisna-based sukuk issuance, it further signals institutional confidence in this financing structure.

As new fatwas or scholarly opinions are published, this section should be updated to reflect evolving interpretations and endorsements by recognized Islamic financial authorities.

Beyond banking, if you are also interested in investing, whether it is stock, crypto or Forex markets, we suggest you to use an Islamic account for the same to avoid clashes with your religious beliefs. We have presented the top brokers offering such accounts in the table below. You may compare them and choose the best one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.77 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 70 | 10 | No | 1.96 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.82 | Open an account Your capital is at risk. |

Use Istisna contracts to optimize risk-sharing and cash flow in manufacturing finance

One of the most overlooked aspects of Istisna is its potential to manage working capital for small manufacturers or project developers. While most people see Istisna only as a forward sale tool, advanced users leverage it to delay upfront liquidity needs while ensuring that the pricing structure adjusts for raw material volatility. By inserting milestone-based payment clauses and tying costs to commodity indexes, Islamic banks can shield both parties from major price shocks. This transforms Istisna into more than a contract, it becomes a flexible financing buffer.

Also, most beginners underestimate how Istisna can be layered with parallel contracts to handle multi-party supply chains. Let’s say a construction firm uses Istisna to finance a bridge. That firm can simultaneously enter a parallel Istisna with subcontractors, transferring timelines and obligations without transferring risk back to the buyer. It’s an elegant way to decentralize responsibility while staying Shariah-compliant. Knowing when and how to split contracts this way can significantly lower risk exposure and smooth delivery cycles.

Conclusion

Understanding what is an Istisna contract and its business value can empower traders and businesses to pursue ethical financing options tailored to complex manufacturing needs. Whether it's large-scale infrastructure or custom production, Istisna remains one of Islamic banking's most trader-friendly tools.

FAQs

Can small businesses use Istisna contracts for equipment purchases?

Yes, Istisna is ideal for SMEs needing custom machinery or production tools with flexible payments and Shariah compliance.

Is it possible to cancel an Istisna contract after signing?

Cancellation is allowed by mutual consent before manufacturing begins, but penalties may apply depending on the contract terms.

Which industries benefit most from Istisna financing?

Construction, aviation, packaging, and manufacturing sectors often use Istisna to finance tailored equipment and infrastructure.

How does parallel Istisna protect Islamic banks from production risks?

By engaging a third-party manufacturer in a separate contract, banks transfer performance risk while maintaining financial control.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

The idea behind mitigation is to recognize and effectively trade mitigation blocks. These blocks consist of specific price action patterns that signal a change in market sentiment or demand-supply dynamics.