What Is Murabaha In Islamic Finance

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Murabaha is a well-established form of Islamic finance in which the bank buys goods and then resells them to the client at a predetermined profit. This arrangement avoids the use of interest (riba), aligning the transaction with Sharia principles. As a result, Murabaha financing has become a practical and halal alternative to conventional loan structures. It’s especially common in home buying, car financing, and various types of trade-related purchases.

As one of the core models in Islamic banking, the Murabaha contract plays a vital role in offering ethical financing options to customers. Instead of lending cash and charging interest, Islamic banks take a more involved approach by purchasing the asset themselves and selling it to the client for a clearly stated profit. This method helps ensure transactions remain compliant with Islamic finance laws while also addressing modern financial needs across sectors.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is Murabaha and why is it important in Islamic finance

Murabaha is a deal where profit is added to the purchase price of a product the bank buys for a client, then resells to them at that agreed markup. This model avoids charging interest entirely. Instead of lending money, the bank sells the product, so both sides know exactly what they're agreeing to, and it follows Islamic rules. The genius lies in how it changes the entire approach to money: instead of earning from lending, it earns from trade, which is encouraged in Islamic investing ethics.

While it may sound like a regular loan, the whole setup works differently. Murabaha in Islamic banking means the bank must first own the asset and carry the risk before it sells it. This rule is more than just a formality. It makes the bank a real participant in the transaction. If it doesn’t actually take ownership, the whole deal could be invalid. That’s why institutions like the Islamic Development Bank take careful steps to make sure Murabaha is practiced properly and not just Islamic-looking on paper.

People often talk about Murabaha loans, but what they really mean is a Murabaha agreement where the price and profit are agreed up front. It's often used for cars, homes, or trade financing. But what most people miss is that if the customer delays payment, the bank can't charge interest. This forces Islamic banks to choose clients more carefully and assess risks thoroughly. In complex deals, some banks even break the financing into stages, stacking smaller agreements that stay within Islamic guidelines while funding long-term needs.

How Murabaha works: Structure and basic rules

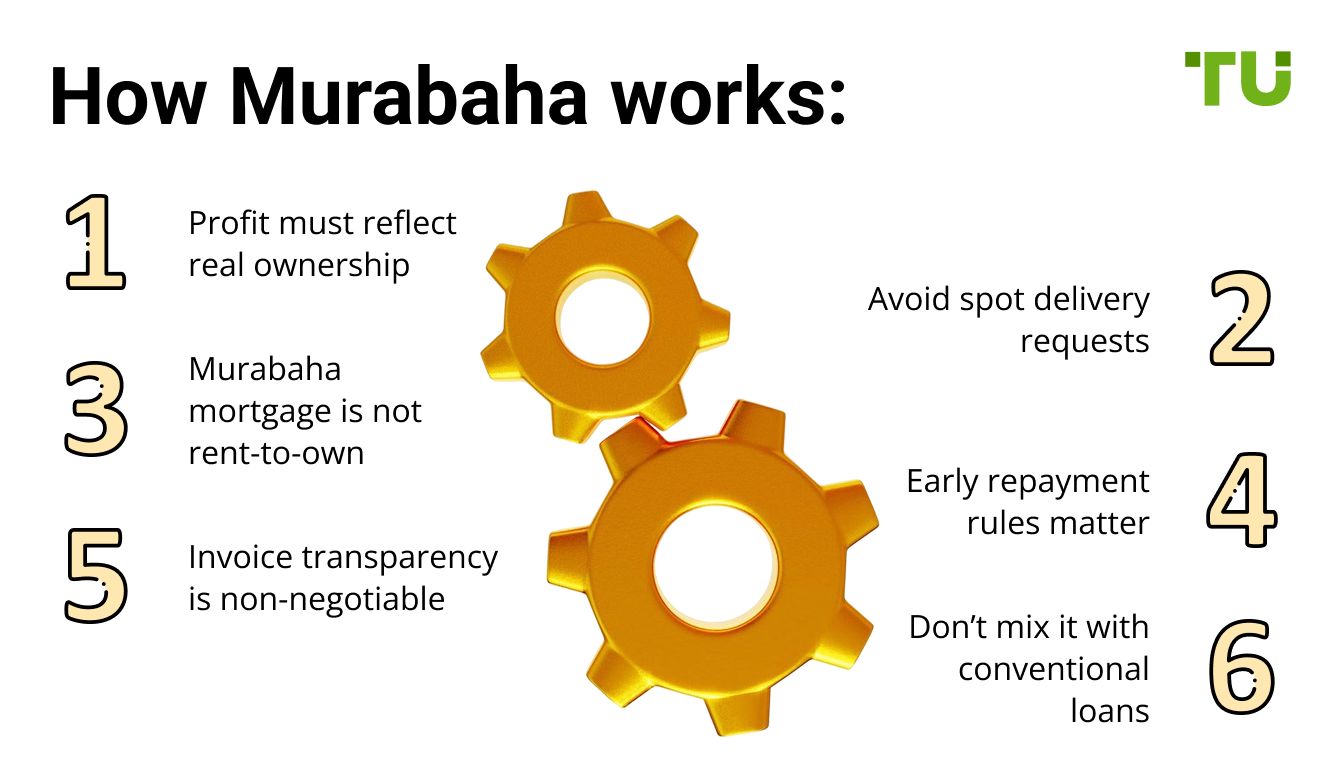

Here’s what most beginners don’t realize about how Murabaha really works in practice and how to make the most of its structure.

Profit must reflect real ownership. The bank must actually own the asset, even for a short time, before charging profit. That’s what gives the Murabaha structure its link to Islamic rules.

Avoid spot delivery requests. If you ask for instant delivery before the bank has ownership, the deal can fall apart and cause major problems with the bank.

Murabaha mortgage is not rent-to-own. In a Murabaha mortgage, the bank buys the house first, then sells it to you at a profit. You become the owner right after the contract is signed, unlike rent-to-own setups.

Early repayment rules matter. If you want to repay early, ask upfront if the bank offers a discount on the profit. Some places let you agree to that in advance.

Invoice transparency is non-negotiable. The original price the bank paid should be written down and shown to you. It’s key to keeping things honest under Islamic law.

Don’t mix it with conventional loans and mortgages. Even if a combo deal looks attractive, adding interest-based loans to a Murabaha plan goes against the whole idea of Islamic finance.

Basic rules of Murabaha

The bank must own the asset before selling it to the client.

All costs and profits must be disclosed upfront.

The transaction must not involve prohibited (haram) goods.

The contract must clearly outline repayment terms without hidden charges.

| Type | Use case |

|---|---|

| Classic Murabaha | Consumer goods and services |

| Commodity Murabaha | Trade financing, investment |

| Murabaha Mortgage | Home financing |

| Murabaha Loans | Personal or business needs |

Murabaha isn’t just a fixed-margin sale. It has different versions that, when used the right way, can give traders and clients an edge.

Spot Murabaha lets the buyer get the item right away. This form is common in halal short-term trading where ownership needs to transfer immediately, often used as a base Murabaha financing example in textbooks and training sessions.

Deferred Murabaha gives payment flexibility. The bank buys the item, marks up the price, and the customer pays in parts, which is great for people with monthly salaries or those avoiding interest-based financing.

Parallel Murabaha helps manage trades involving more than one party. It’s useful in halal commodity trading where the bank buys from one seller and sells to a buyer through a separate deal, an advanced form among the many types of Murabaha.

Murabaha to the purchase customer cuts down the chance of things going wrong. The client tells the bank what to buy, and once the bank owns it, the client agrees to purchase it. This keeps things within Sharia rules and avoids risky guessing.

Post-shipment Murabaha helps exporters get their money faster. After goods are shipped, the bank buys them and pays the exporter, giving quicker access to cash without needing a traditional loan.

Reverse Murabaha is designed to look a bit like a regular loan. The bank buys a commodity and resells it for cash, offering liquidity while staying within Islamic guidelines.

Murabaha financing example: How it works in practice

Imagine someone looking to buy a car worth $20,000.

The bank purchases the car from the dealer for $20,000.

It then sells the car to the buyer for $22,000 through a Murabaha contract, with the amount repayable over 24 months.

The $2,000 profit is agreed upon upfront, and no interest is involved.

This clear process makes Murabaha both ethically sound and aligned with Islamic principles.

Murabaha vs interest: What’s the difference and is it halal?

The basic rule of Murabaha includes upfront disclosure of profit, while traditional loans typically involve hidden or changing interest charges.

It relies on real asset ownership, whereas regular loans only provide cash without a physical exchange.

Is Murabaha halal?

Yes, most Islamic scholars and financial experts agree that when carried out in the correct manner, Murabaha steers clear of maysir, gharar, and riba.

Murabaha vs other Islamic financing models

Murabaha vs Musharakah

Murabaha. Fixed profit, low risk, transactional.

Musharakah. Profit-sharing partnership; higher risk, higher potential return.

Difference between Murabaha and Musawamah

Murabaha and Musawamah are both Islamic sale contracts, but they differ significantly in terms of pricing transparency and structure.

In Murabaha, the seller is required to disclose the original cost of the item to the buyer, along with the exact profit margin being added. This ensures full transparency and is commonly used in Islamic financing, particularly by banks and financial institutions for asset-based transactions like home or vehicle purchases. The buyer knows both the purchase cost and how much profit the seller is making, which aligns with Shariah principles of honesty and trust.

In contrast, Musawamah does not require the seller to reveal the cost price or profit margin. It is a more traditional form of sale where the final price is negotiated between the buyer and the seller without any obligation to disclose how much the seller originally paid for the goods. This method is often used in everyday market transactions and retail trade.

Difference between Mulhaq and Murabaha

Mulhaq and Murabaha serve very different purposes within Islamic contractual frameworks, and understanding the distinction is important for clarity in Shariah-compliant finance.

Murabaha is a primary Islamic finance contract used in trade and asset-based transactions. It involves a cost-plus-profit sale where the seller discloses the original purchase price of an item and adds a clearly agreed-upon profit margin. Murabaha is widely used by Islamic banks for financing assets such as homes, vehicles, and equipment, offering an alternative to interest-based lending.

On the other hand, Mulhaq refers to a supplementary agreement or annex that is attached to an existing contract. It is not a standalone transaction, but rather a supporting document that outlines amendments, additional terms, or clarifications related to the original contract. Mulhaq can be applied to various types of contracts, including Murabaha, to address updates in pricing, delivery schedules, responsibilities, or other mutually agreed modifications.

In summary, Murabaha is a core financial contract, while Mulhaq is an addendum or modification to an existing agreement, used to ensure continued compliance and clarity as terms evolve.

How Murabaha fits among other Islamic finance models

Murabaha is just one piece of the larger puzzle in Islamic finance, which also includes several other Shariah-compliant structures used for different financial needs. For instance, in cases where a product needs to be built or manufactured before delivery, Islamic banks may turn to Istisna contracts. This is especially useful in construction or industrial financing, where payment can be staggered until the project is complete. If goods are to be delivered at a later date but paid for upfront, the Salam contract becomes relevant, often used in agricultural or commodity-based finance.

To delegate financial tasks like investment banking or asset management, Islamic banks sometimes use Wakalah agreements, where a client appoints the bank as an agent. For more entrepreneurial partnerships, Mudarabah comes into play, where one party provides capital and the other offers expertise, with profits shared under agreed terms. Meanwhile, in asset-leasing situations, banks prefer Ijarah, a model closer to leasing than lending, allowing clients to use an asset while paying rent instead of interest.

Together, these models offer Islamic finance practitioners a full suite of tools to meet both commercial and personal needs, each with its own unique structure, purpose, and Shariah compliance mechanism. Murabaha remains widely used for its clarity and fixed-profit approach, but its effectiveness becomes even more apparent when seen alongside these other ethical finance solutions.

Keeping banking aside, if you're also looking to grow your money through halal investment options via stock, crypto, or Forex markets while staying true to your faith, it's important to use an Islamic trading account. These accounts are designed to align with Shariah principles, helping you invest without compromising your beliefs. Below, you'll find a list of top brokers that offer such accounts. Take your time to compare their features and choose the one that fits your values and trading goals.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.77 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 70 | 10 | No | 1.96 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.82 | Open an account Your capital is at risk. |

Murabaha gives buyers quiet control and shields them from asset risk

Most people think Murabaha is just about paying a bit more instead of paying interest, but there's a smarter layer to it. If you're the one picking the supplier, the product, and even the delivery plan before the bank gets involved, you’ve already got a big say in what you're buying. You’re not paying yet, but you’re setting the terms. That kind of control helps you make sure you're getting value, not just a compliant contract.

There’s also something most beginners miss: in a Murabaha deal, the bank owns the item before selling it to you. So if anything goes wrong with it during that brief window, damaged goods, delay, even loss, it’s on the bank, not you. That tiny detail means you're better protected than in most regular loans. It’s not just ethical financing, it quietly shifts the burden of risk away from your shoulders.

Conclusion

Murabaha stands as a cornerstone of ethical and Sharia-compliant finance. It empowers individuals and businesses to meet their financial goals without compromising their faith. Whether for purchasing a home, funding a business, or making personal purchases, Murabaha offers transparency, fairness, and peace of mind.

FAQs

Can a Murabaha agreement be canceled after signing?

Only under specific conditions. If the asset hasn’t yet been purchased by the bank, the client can usually back out. But once the bank has bought it based on your request, canceling may involve penalties or obligations since the bank took on financial risk on your behalf.

What happens if I miss a payment in a Murabaha agreement?

Islamic banks can’t charge interest on late payments, but they might impose a penalty that’s donated to charity. Still, late or missed payments can impact your credit record and future eligibility for Islamic financing.

Can Murabaha be used for startup or working capital needs?

Yes, but with limits. Since Murabaha is tied to asset purchases, you can use it to buy equipment, inventory, or fixed assets,not for covering salaries or paying rent. It’s asset-backed, not cash-based.

What’s the sukuk Murabaha meaning in Islamic finance?

Sukuk Murabaha refers to Islamic investment certificates structured around Murabaha transactions. Investors fund the purchase of assets, which are then sold at a profit. The returns come from that pre-agreed markup, not interest.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.