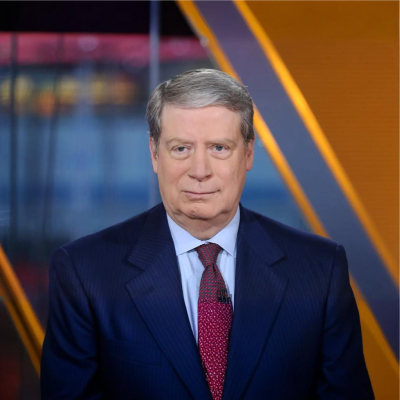

Stanley Druckenmiller Net Worth, Biography and Key Insights

Stanley Druckenmiller’s Profile Summary

|

Company

|

Duquesne Capital |

|---|---|

|

Position

|

Served as the founder and chairman of Duquesne Capital, a prominent hedge fund he established in 1981. He managed the fund until its closure in 2010, during which time it became known for its exceptional performance. |

|

Source of wealth

|

Druckenmiller's wealth primarily stems from management and performance fees from Duquesne Capital, as well as significant profits from his strategic investments and trading activities. |

|

Also known as

|

Philanthropist. Economic commentator. Public speaker |

|

Age

|

72 |

|

Education

|

Bowdoin College - Bachelor’s degree in Economics |

|

Citizenship

|

United States |

|

Residence

|

New York City, USA |

|

Family

|

Stanley Druckenmiller is married and has three children. |

|

Website, Social Media

|

https://www.duquesne.com/ |

Stanley Druckenmiller’s biography

Stanley Druckenmiller, born on June 14, 1953, in Pittsburgh, Pennsylvania, is a renowned investor and hedge fund manager, best known for his leadership at Duquesne Capital. He graduated from Bowdoin College in 1975 with a degree in economics. Early in his career, Druckenmiller worked as a management trainee at Pittsburgh National Bank, where he quickly distinguished himself. He then joined George Soros's Quantum Fund in 1988, where he famously played a key role in the fund's short sale of the British pound, contributing to a profit of over $1 billion. In 1981, he founded Duquesne Capital, which became one of the most successful hedge funds, achieving an average annual return of 30% over the next three decades. Druckenmiller is also noted for his philanthropic efforts, particularly in education and medical research, and has spoken extensively on macroeconomic issues, making him a respected figure in the investment community. Following the closure of Duquesne Capital in 2010, he has continued to invest independently and is often sought after for his insights into market trends and economic policy.-

How did Stanley Druckenmiller make money?

-

What is Stanley Druckenmiller net worth?

As of 2025, Stanley Druckenmiller’s net worth is estimated to be $6.9B.

What is Stanley Druckenmiller also known as?

Stanley Druckenmiller is recognized as a philanthropist for his substantial contributions to various charitable causes, particularly in education and healthcare. He has donated millions to institutions such as the Robin Hood Foundation and the University of Pittsburgh, aiming to combat poverty and improve education. As an economic commentator, Druckenmiller frequently shares his insights on macroeconomic trends and market forecasts through interviews and public speaking engagements. His views are highly regarded, making him a sought-after speaker at financial and economic conferences. Additionally, he has engaged with various media outlets, offering his perspectives on fiscal policy and investment strategies, further solidifying his reputation as a thought leader in the finance sector.Prominent achievements of Stanley Druckenmiller

Druckenmiller has received numerous accolades throughout his career, including being named to Forbes' list of billionaires and being recognized by Institutional Investor as one of the top hedge fund managers. He is often cited as one of the most successful investors of his generation, with Duquesne Capital achieving an average annual return of 30% during its operation. He has also been featured in various financial media, further establishing his reputation as a leading voice in investment and economic discourse.What are Stanley Druckenmiller’s key insights?

Stanley Druckenmiller emphasizes the importance of flexibility in investing, advocating for a macroeconomic approach to understanding market trends. He believes in doing extensive research and being prepared to change strategies based on evolving economic conditions. Druckenmiller also prioritizes capital preservation and risk management, often highlighting the significance of patience and discipline in achieving long-term investment success. His insights reflect a deep understanding of economic cycles and the interplay between monetary policy and market behavior.

Stanley Druckenmiller’s personal life

Druckenmiller's family includes his wife, Tania Druckenmiller, and their three children. He has maintained a relatively private family life, but his spouse and children are often mentioned in connection with his philanthropic activities and community involvement.

Useful insights

Understanding market forces

In my experience, to truly succeed as an investor, it’s essential to understand the driving forces behind market behavior. Market movements aren’t random—they’re influenced by a range of economic theories and dynamics. The following books provide valuable insights into these forces, offering a deeper understanding of how global financial markets operate and what shapes their trends.

-

Nassim Nicholas Taleb – "The Black Swan"

-

Summary:

Taleb explores the concept of rare, unpredictable events—so-called "Black Swans"—that can have massive impacts on markets and society. These events are often overlooked by traditional risk management models, leading to devastating consequences when they occur. Taleb illustrates how these unpredictable shocks shape our world, often more than gradual, expected changes.

-

Why read it:

This book challenges conventional thinking about risk and uncertainty, showing that many major historical and financial events were "Black Swans." It's a vital read for investors who want to build resilience in the face of market volatility.

-

-

John Maynard Keynes – "The General Theory of Employment, Interest, and Money"

-

Summary:

Keynes revolutionized economics by focusing on total demand within an economy and its effect on output and inflation. His theory suggested that government intervention could stabilize economic cycles through fiscal and monetary policy. The book also explains the consequences of under-consumption and the role of interest rates in managing economic stability.

-

Why read it:

For investors interested in macroeconomic trends and policy impacts, Keynes’ work is essential. Understanding the Keynesian framework can help investors predict how government actions might influence market performance.

-

Other profiles in category

Popular Financial Guides

Latest Financial News

Nvidia stock hits record high, first to reach $4 trillion

WTI crude oil price nears resistance as Red Sea tensions and U.S. supply shift sentiment