Forex is an exchange for trading currencies. It can be compared to a huge marketplace, only on the Internet. Everyone can access this marketplace through a special "handler", called a broker. Everyone can explore how the marketplace works FOR FREE by opening a demo account, which uses virtual money.

The Forex market is traded in most countries.

Forex participants are not only ordinary people but include Central Banks of different countries, commercial banks, investment funds, and currency exchanges.

The market turnover is measured at 6.6 trillion US dollars per day.

Do you prefer watching videos? Then watch the video summary of this article.

Below you will find all the information.

Currency trading for dummies in simple terms

The Forex market trades at rates (charts) that are represented by currency pairs.

For example, the euro (EUR) and the US dollar (USD) form the euro/dollar (EUR/USD) currency pair.

The answer to the question "How to make money on the Forex market?" actually comes down to predicting where the rate of a particular currency will go, i.e., whether it will fall or rise/increase or decrease.

The cost of EUR / USD is indicated for example 1.1759 / 1.1762, where the first price shows how many US dollars you can sell 1 euro for (Bid price), and the second price shows the price of buy 1 euro (Ask price). Everything operates the same everywhere, including in exchange offices and banks. The difference between buying and selling prices is called the spread or the commission that the broker takes for conducting your foreign exchange transactions. In our example, it is 3 points.

If you think that shortly the euro will grow against the dollar, then you buy 1 EUR for 1.1762 USD, wait until your forecast comes true, and close the buy transaction by making a sale.

If you think that the euro will fall in price against the ruble, then you sell 1 EUR for 1.1759 USD, if you expect the euro to fall in price, then buy it back at a lower rate.

You can buy and sell currencies, as well as see the charts of currency movements, in special trading applications. You can download this and other applications for free on your computer or smartphone from the website of any broker. A complete list of all brokers and their rating is on our website.

To summarize, if the chart goes up (the euro increases against the ruble), we buy. If the chart goes down, we sell.

Okay, I think you are ready now.

Learn Forex trading: Selecting a broker

Choosing a broker is a critical step and should not be taken lightly. In the early stages, selecting the best broker you can find (and that fits your goals and trading personality) should occupy 90% of the time you spend engaging in Forex activities. You should spend many hours and even days analyzing and reviewing dozens of brokerage firms and reading the reviews of other traders about each broker that taps your interest. Our website was created to simplify this work for you. With our help, you will need substantially less time in the broker selection process. But you must nevertheless approach the task studiously and not whimsically or nonchalantly. To state the proposition bluntly, if you pick the best broker, you will make a lot of money; if you don’t, you won’t. That should be all the motivation you need. But again, using the Traders Union’s broker rating list with objective reviews of each broker will save you tons of time. So don’t start by cheating yourself. Invest the time and energy it takes to make the best choice for your trading style.

Do not make the wrong choice of brokers?

You can rely on us to help you in this matter. Our experts have been analyzing brokers in the Forex market for over 10 years, collecting all the reviews about them on our website. We keep a dossier for every company in the Forex market, tracking each broker’s historical performance and applying a matrix of more than 100 objective parameters. We have created the ability to compare brokers with each other according to key criteria that make it convenient for beginners to analyze and choose the right brokerage firm for themselves. And every month, based on the combination of those 100+ objective factors, our experts adjust the rankings on our list.

Without going into great detail, we advise you to work with companies from the Top10 Rankings, since the place in the rating reflects the respective brokers’ overall assessment in all parameters.

Forex Brokers List

Best Forex trading platform for beginners

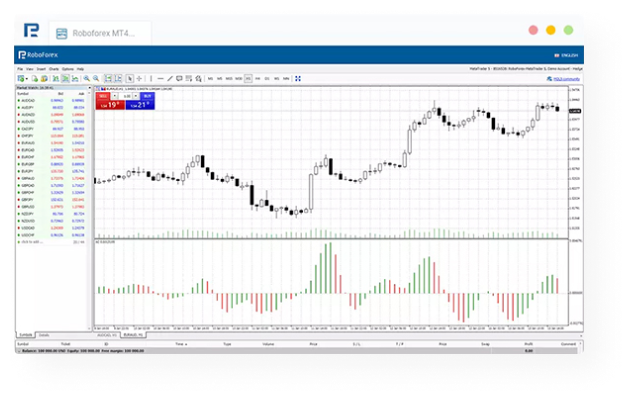

Next, you need to download and install the trading platform from the selected broker's website to your computer, smartphone, etc. The most popular trading platform is MetaTrader 4 (you can download it from the broker's website). To get started, open a training demo account to practice on. You are not yet ready to explore a real account yet. Pace yourself. Learn the ropes first. You won’t regret it.

You can also practice on the trading platform of the leader of Forex Ratings, RoboForex. This can be done directly in the web version of the MetaTrader 4 platform, which is supported by all available browsers.

The MT4 web platform

Or download the trading terminal to your smartphone or computer:

Eager to earn but have no desire to learn Forex Trading protocols and possibly lose money trading on your own?

You can also receive passive income on Forex just by investing your money and doing nothing more! To do this, brokers have special investment programs, which are called PAMM accounts. PAMM allows you to entrust your money to a broker or experienced “senior” trader and let him manage your investment as he bids in the marketplace. He will charge you a small commission (either a flat fee or a percentage of the profit), but only on successful transactions. If he loses, you pay him nothing.

To invest in Forex, do the following:

1

Register with your desired broker.

2

Open a PAMM account.

3

Make a deposit to your account.

4

Select a PAMM account where you want to invest your money.

We recommend that you pay close attention to investing in PAMM accounts opened with such brokers:

If it is too complicated, contact the Traders Union’s support service. Our support staff will help you figure it out and go through every step with you. Also, we will tell you how to further protect your investment.

Forex trading tips on being a Traders Union member

As in other markets, in the Forex market, you need to make sure your investments are well protected, and that the conditions for working with brokers are as transparent and fair as possible. These functions are undertaken by the Traders Union by providing:

Ongoing audit of Forex brokers

Free legal support

A reliable compensation fund

Payment of a percentage of the spread for each trade you make, in the form of a rebate.

If you start working in the Forex market through Traders Union, then this allows you to receive additional income from each transaction with a broker directly from us. The more transactions you make with a broker, the more money you get from us!

Join the Traders Union

How do payments from the Traders Union work?

When trading on Forex, you will pay the broker a commission on each transaction. The difference between the rates is called the spread, which we discussed above. Brokers, following their partnership agreements with Traders Union, deduct part of this spread and pays it to TU for each of your transactions. And then TU returns this money to you (the rebate), leaving the Traders Union with only a tiny percentage. If you work with a broker without going through Traders Union, you will not receive such payments.

Broker

Traders Union

Trader

Thus, with the help of the Traders Union, each trader can reduce his expenses on the commission that the broker takes from himself, which means that traders can earn more with us!

Here is an example. Assume you made a large transaction on the EUR | USD pair, while paying the broker $200 commission for your currency transactions. The broker transferred the deductions to Traders Union in the amount of 50% (i.e., $100) of his commission (pursuant to our partnership agreement). From this money, you will receive a refund of 80% from the Traders Union (i.e., $80). It turns out that in addition to the income for a completed transaction, the trader is returned $80 from the $200 commission. This is a win-win situation.

How to join Traders Union?

1

Register on the site here.

2

Go to the Traders Union Personal Account, which will be available after registration.

3

Follow this link and choose a broker.

4

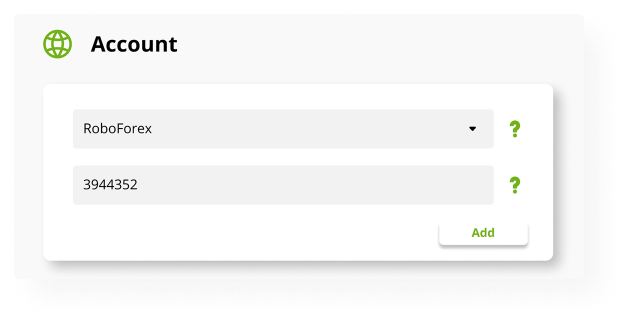

Open an account on the broker's website for Forex trading.

5

Add the account number to your personal account on the Traders Union website in the "Accounts" section.

You will receive your money from Traders Union daily, weekly, or monthly, depending on the conditions of the chosen broker. You can withdraw money at any time in the "Balance History" section.

Get Payments