9 Best Bitcoin Forex Brokers in 2024

Best bitcoin Forex broker - AMarkets

TOP bitcoin Forex brokers:

-

AMarkets - best broker for trading with advisors.

-

Pepperstone - with better trade execution.

-

FxPro - best for testing strategies on micro lots.

-

AvaTrade - best for trading with innovative technologies.

-

Admiral Markets - well-regulated broker

Cryptocurrency trading is a new trend in Forex, which experts predict to have stable growth over the next five years. You do not need to open an account on cryptocurrency exchange as you can trade all popular cryptocurrencies through Bitcoin brokers.

Forex Bitcoin (BTC) Trading

Earning options for cryptocurrency trading:

-

transactions on short-term exchange fluctuations;

-

investment;

-

arbitration.

Trading on exchange fluctuations of cryptocurrency on the Forex market is one of the most popular for achieving earnings. Today many brokers offer Bitcoins and other cryptocurrencies for trading. Each company sets its own trading conditions for traders in the form of a minimum deposit, spread, or list of available cryptocurrencies. All Bitcoin brokers provide an opportunity for traders to trade using leverage, which makes it possible to gain profitability several times over. Also, all traders have access to analytical tools, which gives confidence and the ability to predict the price range.

Top 10 Best Bitcoin Forex brokers in 2024

It is extremely important to choose a trusted broker for successful Bitcoin trading on Forex to protect your investments from fraudulent activities. In this article, you can find a list of the largest and best Bitcoin brokers offering to trade a BTC/USD pair and other cryptocurrencies.

| Broker | Minimum deposit | Cryptocurrencies available | Types of account for Bitcoin trading | |

|---|---|---|---|---|

|

$100 |

ADAUSD, BCHUSD, BTCUSD, DOTUSD, DSHUSD, EOSUSD, ETHUSD, LTCUSD, TRXUSD, XLMUSD, XMRUSD, XRPUSD. |

Standard, Fixed, ECN |

||

|

$200 |

Bitcoin, Bitcoin Cash, Cardano, Chainlink, Dash, Dogecoin, EOS, Ethereum, Litecoin, Polkadot, Ripple, Stellar Lumens, Tezos, Uniswap etc. |

cTrader, TradingView, MetaTrader 4 and MetaTrader 5 |

||

|

$100 |

26 cryptocurrencies, including Bitcoin, Ethereum, Ripple and Litecoin, etc. |

FxPro MT4 Instant (with fixed spreads), FxPro MT4 Instant (with floating spreads), FxPro MT4 Market, FxPro MT5, FxPro cTrader, VIP-account |

||

|

$100 |

Bitcoin, Bitcoin Gold, Dash, EOS, IOTA, Ripple, Bitcoin Cash, Litecoin, Ethereum, Stellar, NEO, etc. |

Standard, Demo |

||

|

$1 |

Вitcoin, Bitcoin Cash, Dash, Ethereum, Eos, Litecoin, Stellar, Monero, Ripple, Zcash, etc. |

Trade MT4, Trade MT5 |

||

|

$1 |

Bitcoin, Litecoin, Ethereum, Ripple, Bitcoin Cash, etc. |

Standard, Pro, Zero, Raw Spread |

||

|

$10 |

Bitcoin, Litecoin, Namecoin, Peercoin, Emercoin, Ripple, Eos, IOTA, Monero, NEO, Omni, etc. |

Crypto account, crypto 10 account |

||

|

$50 |

Bitcoin, Bitcoin Cash, Bitcoin Gold, Litecoin, Ethereum, Ripple, Eos, Dash, UTA, Stellar, etc. |

Classic, ECN, Demo |

||

|

$10 |

Bitcoin, Bitcoin Cash, Ether, Ripple, Litecoin, etc. |

Insta.Standard, Insta.Eurica, Cent.Standard, Cent.Eurica |

How to Choose a Bitcoin Forex Trading Platform?

ЕYour success depends directly on your choice of a broker.

According to professional traders, it is critical that you pay attention to the following criteria:

-

list of available cryptocurrencies for trading.

The wider the list, the more opportunities you have to profit; -

real reviews about brokers.

They warn against potential problems and help you choose a reliable broker; -

the minimum deposit to open a real trading account.

The best Bitcoin brokers often set a low threshold for entering the market, therefore simplifying the learning process and allowing you to start trading without risking large a investment; -

broker’s features:

Licensing, several options for working platforms, favorable trading conditions, transferring funds between internal accounts, and bonus programs that make working with a broker enjoyable and profitable.

Entrust your funds only to reliable licensed Bitcoin brokers that provide quality service. You can verify any Bitcoin broker on our website in the broker’s dossier in the rating section. There you will find information about licenses and customer reviews of a broker.

How to Trade Cryptocurrencies on Forex?

Cryptocurrency trading in the Forex market implies the sale and purchase of CFDs, but not real assets. Profit consists of the price difference between the sale and purchase, that is, it is speculation on a change in cryptocurrency rates. When trading on Forex you don’t obtain ownership of bitcoin or currencies credited to your wallet, unlike buying Bitcoin on cryptocurrency exchanges and foreign exchange offices. This allows you to save on commissions when trading. That is why recently there has been an increase in interest in trading in cryptocurrencies with Forex brokers.

Crypto assets are traded on the Forex market 24/7, which allows you to trade on weekends. Crypto traders often trade every day because digital currencies fluctuate even on weekends.

In general, the cryptocurrency trading process in the Forex market is no different from regular currency trading. To start, open and replenish a real account. You are welcome to register on the Traders Union website first, which will allow you to get additional profit.

Bitcoin Forex Brokers Vs Crypto Exchanges

Many novice traders and investors have a logical question: “Which is better: a Bitcoin Forex broker or a cryptocurrency exchange?” After all, both options have their pros and cons. We have compiled a comparative table to help you make the choice. We used typical examples, although the conditions of specific brokers and exchanges may differ to an extent.

| Bitcoin Brokers | Crypto Exchanges | |

|---|---|---|

| Assets | Forex pairs, major cryptocurrency pairs, CFDs on gold, energies, stocks, ETFs, and other types of assets | Cryptocurrencies, cryptocurrency futures and options |

| Number of cryptocurrency pairs | Up to 20, mainly only major coins | From 100 to several thousand, including rare coins |

| License/Regulation | Strong. Top brokers hold the licenses of the EU, UK, Australia and the USA | Weak. The majority of exchanges are not regulated |

| Commissions for BTCUSD | Floating spread, which depends on the liquidity in the market | Typical fee on the trading volume – 0.2% |

| Deposit/withdrawal methods | Debit/credit cards, electronic payment systems, cryptocurrencies | Cryptocurrencies, also debit/credit cards, electronic payment systems, but only at top exchanges |

Conclusion:

Many novice traders and investors have a logical question: “Which is better: a Bitcoin Forex broker or a cryptocurrency exchange?” After all, both options have their pros and cons. We have compiled a comparative table to help you make the choice. We used typical examples, although the conditions of specific brokers and exchanges may differ to an extent.

What cryptocurrencies are traded on Forex?

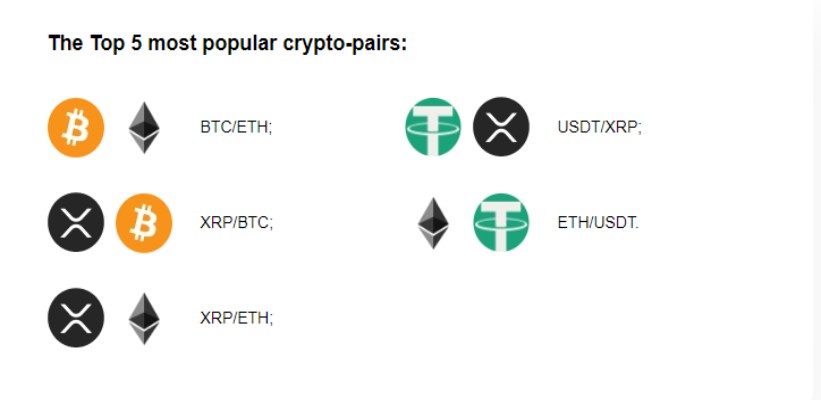

New types of cryptocurrencies are added to the Forex market every year. For example, according to analytical updates, the Tether cryptocurrency (USDT) is increasing its capitalization and catching up with Bitcoin and Ethereum on demand. Also, the EOS cryptocurrency shows an increase in popularity on many exchanges after improving its blockchains.

Many traders still use Bitcoin as a base currency, so the probability of making a profit increases when Bitcoin is one of the cryptocurrencies that make up a currency pair.

The new trends also indicate an increase in USDT trading volumes. Such pairs as USDT/BTC, USDT/EOS, USDT/XRP, and USDT/ETH are also rapidly gaining popularity in 2024.

Choosing a crypto-pair for trading focuses not only on its current popularity but also on the forecast of trends regarding the demand for it in the future.

Advantages and disadvantages of crypto trading

It is worth evaluating the advantages of this financial instrument over the usual currency pairs of the Forex market, as well as considering all its shortcomings to determine whether cryptocurrency trading is suitable for you.

👍 Advantages:

• unlike trading in classic currency pairs on weekdays, cryptocurrency pairs with BTC can also be traded on weekends;

• as a rule, cryptocurrency pairs are more volatile than regular currencies. And this increases your potential profit.

👎 Disadvantages:

• digital currency is less stable than classic currencies. Sudden jumps/drops in the value of crypto-pairs increase risks when trading;

• it becomes more difficult to analyze the price changes due to the strong volatility of the market; therefore, a trader will have to devote more time to forecasting cryptocurrency compared to trading in classic currency pairs.

A trader needs to be able to navigate the market situation well, forecast the price, and react quickly to gain large profits on cryptocurrency trading, otherwise strong volatility can cause serious losses.

How to Make Money Trading in Cryptocurrency? | Expert Opinion

It was less than five years ago when brokerage companies first offered cryptocurrency as a trading tool: High volatility made it popular among traders who are risk-tolerant but not suitable for those who are risk-averse. Today, every Forex broker among the Top 20 of the best companies provides an opportunity to trade in cryptocurrencies.

Trading cryptocurrency is not much different from working with regular currency pairs or stocks. However, it is much more affected by the news. Any information on the sale and purchase of a large batch of Bitcoins or other digital currency is quickly disseminated and greatly affects the exchange rate. For this reason, it is not recommended to use long-term strategies for cryptocurrency. But news trade and candlestick analysis on small timeframes will match. The key advantages and disadvantages of digital currency trading are connected to its high volatility. Therefore, sudden currency jumps make it possible to get a large amount of profit in a single transaction. In contrast, the same fluctuations in price may lead to substantial losses of your invested funds.

This suggests that the use of cryptocurrency pairs with Bitcoin as financial instruments requires the ability to correctly analyze the market and respond quickly.

FAQs

Is cryptocurrency suitable for novice traders?

In trading, there are no restrictions on the professional level of traders for trading cryptocurrencies. Novice traders can take a broker training and practice course for the first time on a demo account.

What cryptocurrency is best to start working with?

The most popular cryptocurrencies are Bitcoin and Ethereum and transactions using them are carried out daily all over the world.

What is the legal process of cryptocurrency trading on Forex?

In the Forex market, ownership of the cryptocurrency can not be transferred — you are trading through CFDs. Earnings are formed from the price difference between buying and selling.

How to choose a reliable Bitcoin broker?

To choose a reliable Bitcoin broker, use the rating of brokers from Traders Union, where information about their reputations and advantages and disadvantages is presented.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Ethereum

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).