According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MetaTrader4

- MetaTrader5

- Own platform

- CySEC

- FSC (Mauritius)

- SVG FSA

- 2005

Our Evaluation of LiteFinance

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

LiteFinance is a reliable broker with the TU Overall Score of 7.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by LiteFinance clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

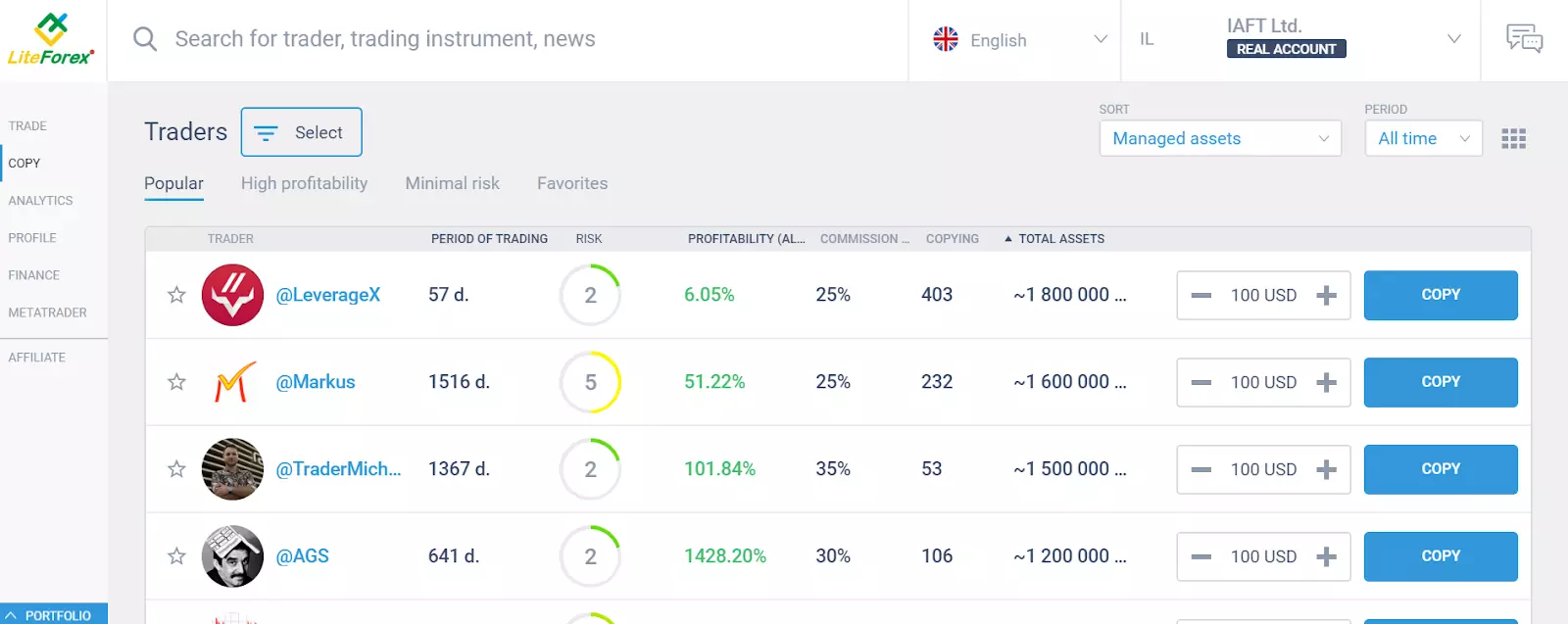

LiteForex (LiteFinance) is more in demand by traders who already have basic trading skills like professional traders and those who are interested in passive investing.

Brief Look at LiteFinance

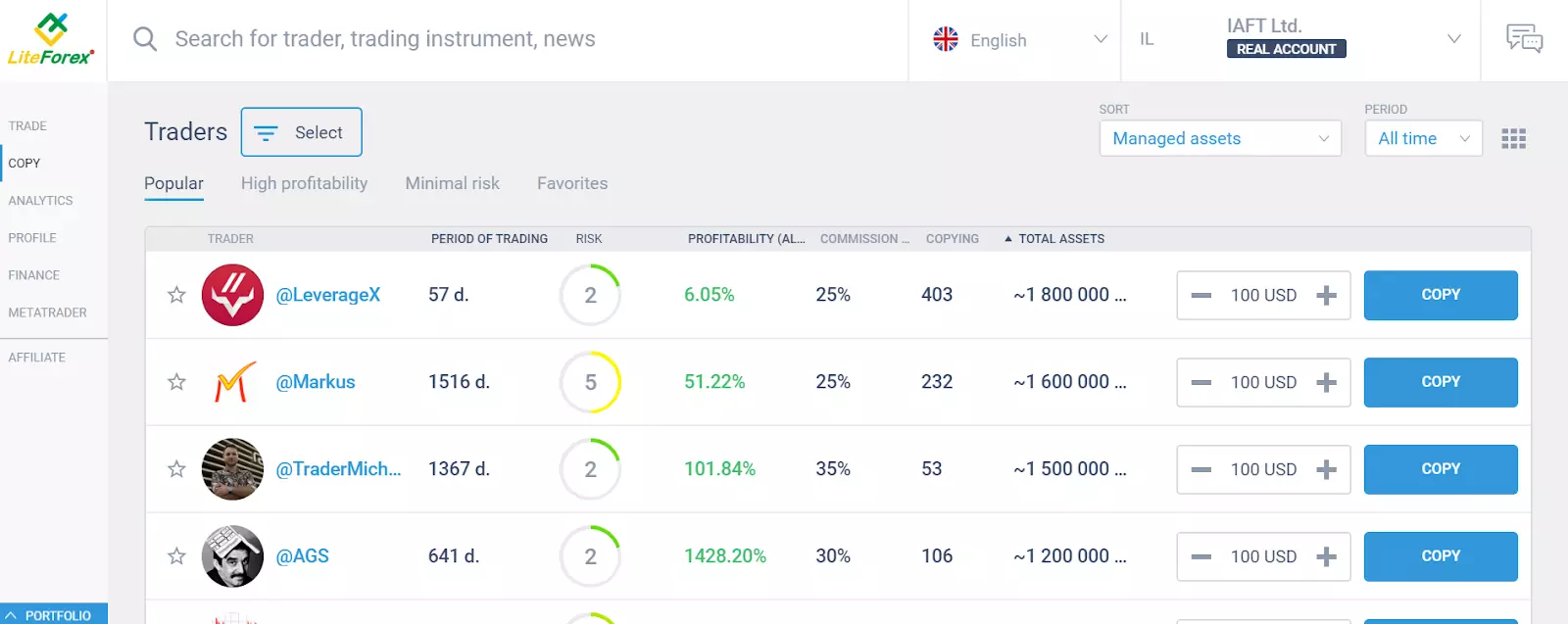

The LiteForex (LiteFinance) broker is a high-tech company that constantly offers innovative solutions for active and passive trading. The LiteForex group of companies was incorporated in 2005, and it has risen through the ranks to become a market leader. Today, LiteForex (LiteFinance) is an online ECN broker with unique technical solutions for transferring transactions to the interbank and directly to liquidity providers. Social Trading is a mechanism for automatic copying of other traders’ transactions (see, SocialTrading platform) and other advantages for comfortable and efficient trading. LiteForex Broker is one of the largest and leading brokers in Malaysia.

- Correspondence to the A-Book model, STP (straight-through processing) and ECN technologies for processing client orders and pin spreads with instant market execution with minimal slippage in both directions;

- Own trading platform for personal accounts that was designed for novice traders with the ability to copy transactions, analyze market sentiment, etc.;

- Several types of affiliate programs with a multi-level system and cashback;

- Automatic reimbursement of commissions paid when replenishing and withdrawing money.

- No cent accounts, which are often of interest to novice traders;

- Supplement of additional indicators is not provided in the trading platform of your personal account; algorithmic trading and testing are not provided;

- There is no information on how the risk level is assigned to traders from the social trading rating;

- Complex verification procedure.

TU Expert Advice

Author, Financial Expert at Traders Union

LiteFinance offers a diverse set of trading instruments, including Forex, stocks, and cryptocurrencies, along with MT4, MT5, and a proprietary platform. Traders can choose from Classic and ECN accounts with a minimum deposit of $50, and benefit from high leverage up to 1:1000. The broker provides attractive features such as low Forex trading fees, the absence of deposit and withdrawal fees, and a copy trading platform, catering especially to traders interested in technical and social trading.

However, LiteFinance does present certain drawbacks: the absence of cent accounts may limit options for beginners, and its platform does not support algorithmic trading, which can be a disadvantage for traders who rely on automated strategies. Despite these disadvantages, LiteFinance may be more suitable for experienced traders who appreciate its advanced features and transparent trading conditions. For beginners, the complexity of account types and verification may be challenging, while the lack of mobile alerts may be a drawback for traders who depend on timely information on the go.

We checked the office of the LiteForex brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

124 Gladstonos Street, The Hawk Building, 4th Floor, 3032, Limassol, Cyprus

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office

-

LiteFinance Trading Conditions

Your capital is at risk. Trading on financial markets carries risks. Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, CFDs may not be suitable for all investors because you may lose all your invested capital. You should not risk more than you are prepared to lose. Before deciding to trade, you need to ensure that you understand the risks involved and take into account your investment objectives and level of experience.

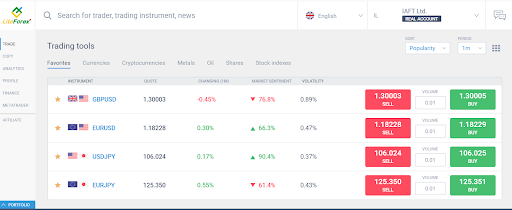

| 💻 Trading platform: | МТ4, МТ5, own platform integrated in the personal account. |

|---|---|

| 📊 Accounts: | Demo, Classic, ECN |

| 💰 Account currency: | USD, EUR, CHF, MBT |

| 💵 Deposit / Withdrawal: | WebMoney, Perfect Money, Neteller, Skrill, Visa, MasterCard, bank transfers (SWIFT), 6 types of cryptocurrency |

| 🚀 Minimum deposit: | $50 USA |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01-100 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Currencies, assets of stock and commodity markets, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100% / 20% |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Cryptocurrency trade; Compensation fund; A blog is written by leading traders. |

| 🎁 Contests and bonuses: | Yes |

Trading conditions are extremely transparent and easily understandable. There are only two types of accounts: classic and professional. The minimum deposit is $50 for either account, order execution, market, and leverage is up to 1:1000.

LiteFinance Key Parameters Evaluation

Video Review of LiteFinance

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

How to make money with LiteForex (LiteFinance)? Register an account and create a personal account. The registration procedure is standard:

Register on the Traders Union site and follow the affiliate link to the LiteFinance broker's website. Click the “Registration” button in the right upper corner. If you need to open a demo account, do it in the "For novice traders" menu.

Go through authorization, following the prompts: enter the initial data (login, password, email). Then confirm the registration by the link that has been sent via email, and enter your personal account. This is enough to start. To conduct real trading and before making a deposit, you need to go through verification by providing personal data and screenshots of documents. If you are planning to become a partner you need to go through a specific verification.

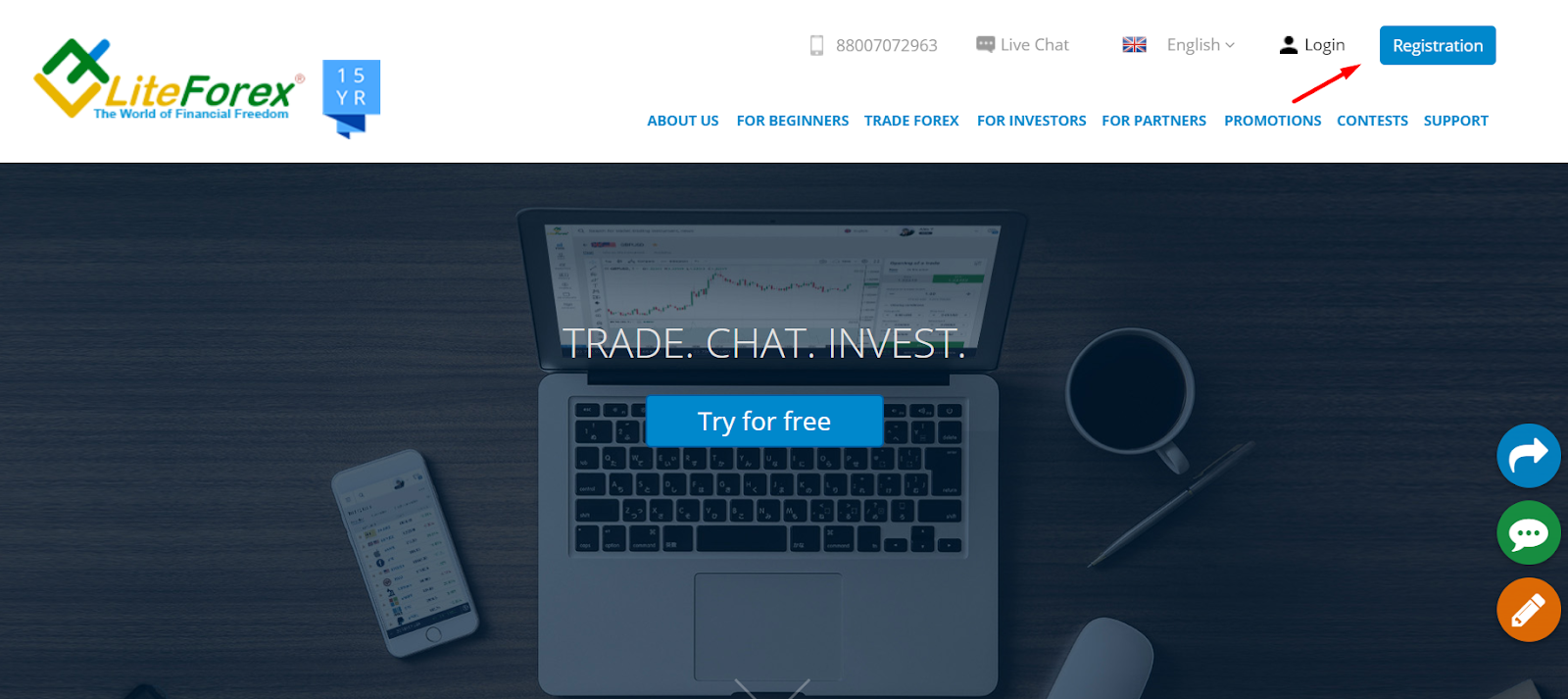

The following is available in the LiteForex (LiteFinance) personal account:

Other useful functionality and features:

-

access to analytics: economic calendar, news feed, signals, information on interest rates;

-

managing trade and trade statistics overview by profile: data on copying transactions (who copied/who was copied — statistics on transactions), data on the portfolio, trade statistics, profitability;

-

statistics of deposits and withdrawals;

-

management of affiliate programs, statistics of profitability in the context of each campaign and partner groups;

-

trading through MetaTrader.

LiteForex - How to Open an Account | Firsthand Experience of Traders Union

Regulation and safety

LiteFinance has a safety score of 9.4/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 20 years

- Strict requirements and extensive documentation to open an account

LiteFinance Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

LiteFinance Security Factors

| Foundation date | 2005 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker LiteFinance have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Bybit and XM Group, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of LiteFinance with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, LiteFinance’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

LiteFinance Standard spreads

| LiteFinance | Bybit | XM Group | |

| EUR/USD min, pips | 1,8 | Not supported | 0,7 |

| EUR/USD max, pips | 2,0 | Not supported | 1,2 |

| GPB/USD min, pips | 1,2 | Not supported | 0,6 |

| GPB/USD max, pips | 1,0 | Not supported | 1,2 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

LiteFinance RAW/ECN spreads

| LiteFinance | Bybit | XM Group | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,2 |

| GBP/USD avg spread | 0,4 | 0,2 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with LiteFinance. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

LiteFinance Non-Trading Fees

| LiteFinance | Bybit | XM Group | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0 |

| Inactivity fee ($, per month) | 0 | 0 | 10 |

Account types

LiteForex (LiteFinance) offers two types of accounts. The classic account is an account for those who prefer intraday, medium and long-term strategies with small trade volumes. ECN account is a professional account with market spreads from 0 pips and instant order execution. It is perfect for high-frequency trading.

Types of accounts:

You can get acquainted with the broker's capabilities and platform functionality using a demo account.

Deposit and withdrawal

LiteFinance received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

LiteFinance provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Low minimum withdrawal requirement

- BTC available as a base account currency

- Bitcoin (BTC) accepted

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

What are LiteFinance deposit and withdrawal options?

LiteFinance provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, M-Pesa, BTC, USDT, Ethereum.

LiteFinance Deposit and Withdrawal Methods vs Competitors

| LiteFinance | Bybit | XM Group | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | Yes | No |

| BTC | Yes | Yes | Yes |

What are LiteFinance base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. LiteFinance supports the following base account currencies:

What are LiteFinance's minimum deposit and withdrawal amounts?

The minimum deposit on LiteFinance is $50, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact LiteFinance’s support team.

Markets and tradable assets

LiteFinance provides a standard range of trading assets in line with the market average. The platform includes 600 assets in total and 56 Forex currency pairs.

- Indices trading

- Crypto trading

- 600 assets for trading

- No ETFs

- Futures not available

LiteFinance Supported markets vs top competitors

We have compared the range of assets and markets supported by LiteFinance with its competitors, making it easier for you to find the perfect fit.

| LiteForex | Bybit | XM Group | |

| Currency pairs | 56 | 61 | 57 |

| Total tradable assets | 600 | 132 | 1400 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | No |

| Stock indices | Yes | Yes | Yes |

| Options | No | No | No |

Investment options

We also explored the trading assets and products LiteFinance offers for beginner traders and investors who prefer not to engage in active trading.

Trading platforms & tools

LiteFinance received a score of 9/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- One-click trading

- MetaTrader is available

- cTrader with advanced tools and Level II pricing

- Free VPS for uninterrupted trading

- No access to API

- No TradingView integration

- Strategy (EA) Builder is not available

Supported trading platforms

LiteFinance supports the following trading platforms: MT4, MT5, cTrader, Proprietary platform, WebTrader. This selection covers the basic needs of most retail traders. We also compared LiteFinance’s platform availability with that of top competitors to assess its relative market position.

| LiteForex | Bybit | XM Group | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | Yes | Yes |

| cTrader | Yes | No | No |

| TradingView | No | Yes | No |

| Proprietary platform | Yes | No | No |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key LiteFinance’s trading platform features

We also evaluated whether LiteFinance offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 600 |

Additional trading tools

LiteFinance offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

LiteFinance trading tools vs competitors

| LiteForex | Bybit | XM Group | |

| Trading Central | No | No | Yes |

| API | No | Yes | Yes |

| Free VPS | Yes | No | No |

| Strategy (EA) builder | No | No | No |

| Autochartist | No | No | No |

Mobile apps

LiteFinance supports mobile trading, offering dedicated apps for both iOS and Android. LiteFinance received 3.51/10 in this section, which suggests limited user interest or weak performance of the apps.

- Supports mobile 2FA

- Indicators supported

- Mobile alerts not supported

- Weak user feedback on Android

We compared LiteFinance with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

Education

There are several subsections devoted to training on the LiteForex (LiteFinance) website, focused on novice traders, on professionals, and those who are interested in analytics.

There is a demo account where you can step by step master the knowledge gained from books, webinars and training materials, work out indicators, and test strategies.

Customer support

The broker's support service is available for each trader 24/5.

Advantages

- There is a distinction between partner support, financial department and trader support

- Multilingual support for over 15 languages

Disadvantages

- Not available on weekends

There are several ways to contact Customer Support:

-

LiveChat (online chat on the broker’s website is available without registration);

-

communities links to which are indicated on the site (social networks and specialized groups);

-

by phone, the numbers are indicated on the site;

-

via email.

Support is available on the broker's website and in a personal account.

Contacts

| Foundation date | 2005 |

|---|---|

| Registration address | First Floor, Mandar House, Johnson's Ghut, P.O. Box 3257, Road Town, Tortola, British Virgin Islands |

| Regulation |

CySEC, FSC (Mauritius), SVG FSA

Licence number: 093/08, GB20025921, 931 LLC 2021 |

| Official site | litefinance.com |

| Contacts |

88007072963

|

Comparison of LiteFinance with other Brokers

| LiteFinance | Bybit | Eightcap | XM Group | TeleTrade | NPBFX | |

| Trading platform |

MT4, MT5, MultiTerminal, Sirix Webtrader | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5 | MT4 |

| Min deposit | $10 | No | $100 | $5 | $10 | $10 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:200 to 1:1000 |

| Trust management | Yes | No | No | No | No | No |

| Accrual of % on the balance | 7.00% | No | No | No | No | No |

| Spread | From 0.5 points | From 0 points | From 0 points | From 0.8 points | From 0.2 points | From 0.4 points |

| Level of margin call / stop out |

50% / 20% | No / 50% | 80% / 50% | 100% / 50% | 70% / 20% | No / 30% |

| Order Execution | Market Execution, Instant Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | No | No | No |

Detailed Review of LiteForex (LiteFinance)

The LiteFinance brokerage was founded in 2005. Thereafter, the company has become one of the largest participants in the European brokerage markets. The top goals of the broker are to improve the technology for bringing client transactions to the interbank market and to liquidity providers, as well as to provide additional services for passive investment.

LiteForex (LiteFinance) is one of the best ECN brokers on the European market

LiteForex (LiteFinance) holds itself out as an ECN broker that level out traders' deals directly in the ECN network without the participation of a middle man. LiteFinance is a high internal liquidity company, providing its clients with a transparent and large-scale market with order execution at the best price and without delay. This model avoids conflicts of interest and offers challenges for the trader to use any trading tools.

LiteForex's trading instruments include classic currencies and cross rates, metals, stocks, stock indices, and assets of commodity markets. The company was one of the first to offer cryptocurrency trading using classic BTC and ETH, and second tier cryptocurrencies like LTC, XRP, and others.

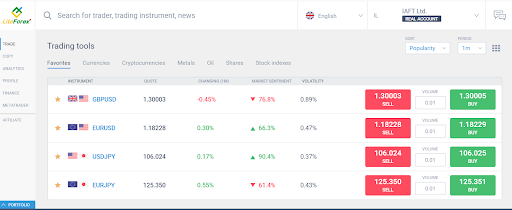

Its own trading platform, built into your personal account and being an addition to the classic MT4 and MT5 is another component of LiteForex (LiteFinance). Unlike MT overloaded with opportunities, it has a simplified functionality that allows a novice investor to quickly understand the specifics of trading. Another feature of the platform is a scalable chart and an extended set of analytical tools.

Useful analytical services and applications of LiteFinance:

-

analyst from the independent company Claws&Horns. It offers technical analysis, signals, and video reviews;

-

trader's calculators. Assistance in calculating the volume of a position, taking into account the leverage, trading asset and quotes. Fibonacci Calculator — a technical analysis tool for making strong levels, potential reversal points, and trend direction;

-

VPS server. Trading 24 hours a day with the ability to use a trailing stop even when there is no connection between the client’s terminal and the broker's server.

Advantages:

an intuitive platform built into your personal account. Rigorous trader selection process in the form of rating the social trading service;

the optimal combination of the level of spread and the speed of execution of transactions. No requotes, almost no slippage;

compensation fund (protection of the trader's money in case of unexpected circumstances);

excellent support service. An instant answer to any question; assistance in resolving disputes, taking into account the client's opinion;

a blog is written by leading traders, investment management analysts and trading systems developers.

There are no trading restrictions. The use of trading advisors and scalping is allowed; there are no Stop&Limit levels.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i