BDSwiss Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MetaTrader4

- MetaTrader5

- BDSwiss Webtrader

- BDSwiss (Mobile app)

- FSA

- FSC

- FSCA

- MISA

- 2012

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MetaTrader4

- MetaTrader5

- BDSwiss Webtrader

- BDSwiss (Mobile app)

- FSA

- FSC

- FSCA

- MISA

- 2012

Our Evaluation of BDSwiss

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

BDSwiss is a moderate-risk broker with the TU Overall Score of 5.13 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by BDSwiss clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The BDSwiss broker is suitable for users of all levels of Forex trading experience and is focused on cooperating with active traders.

Brief Look at BDSwiss

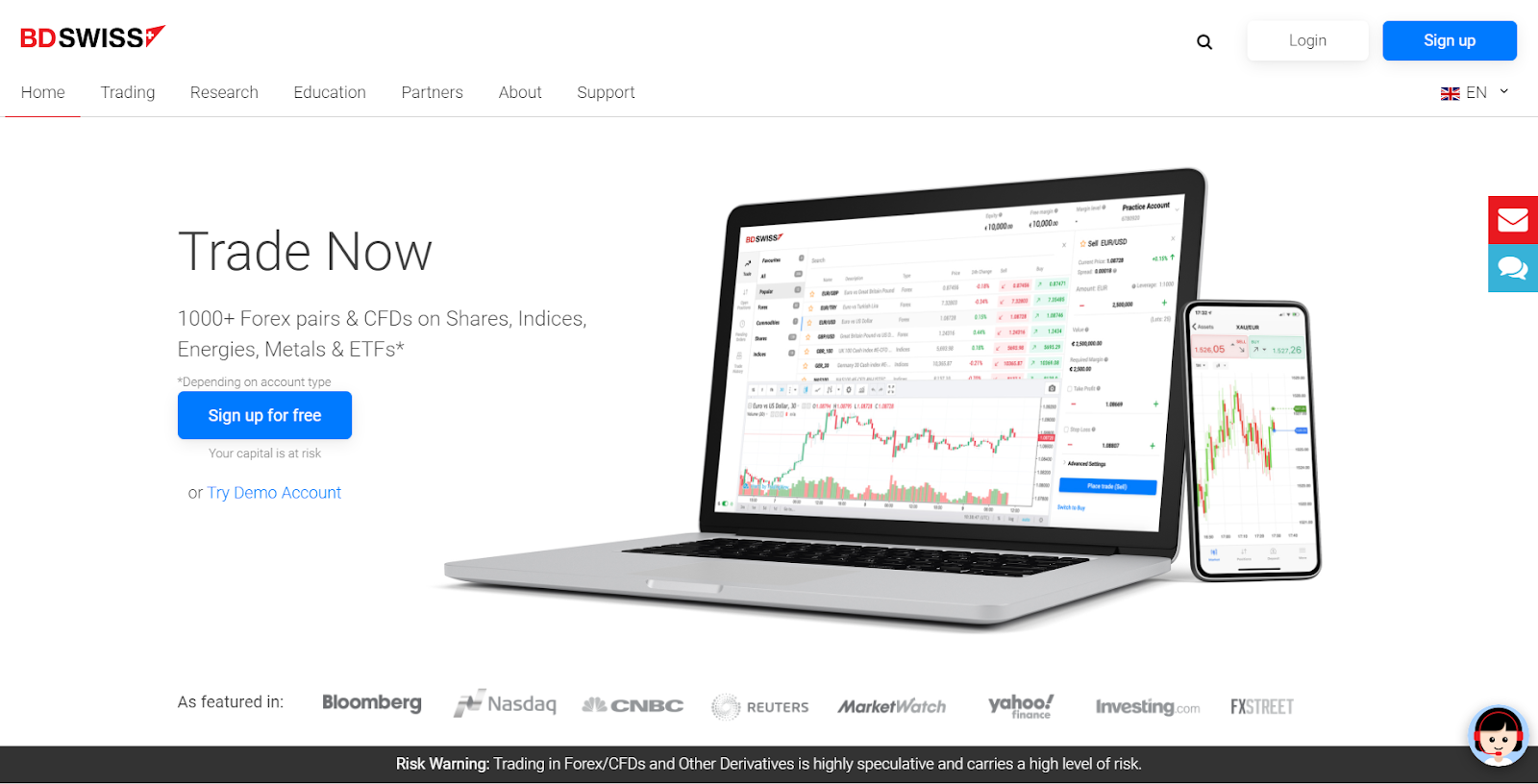

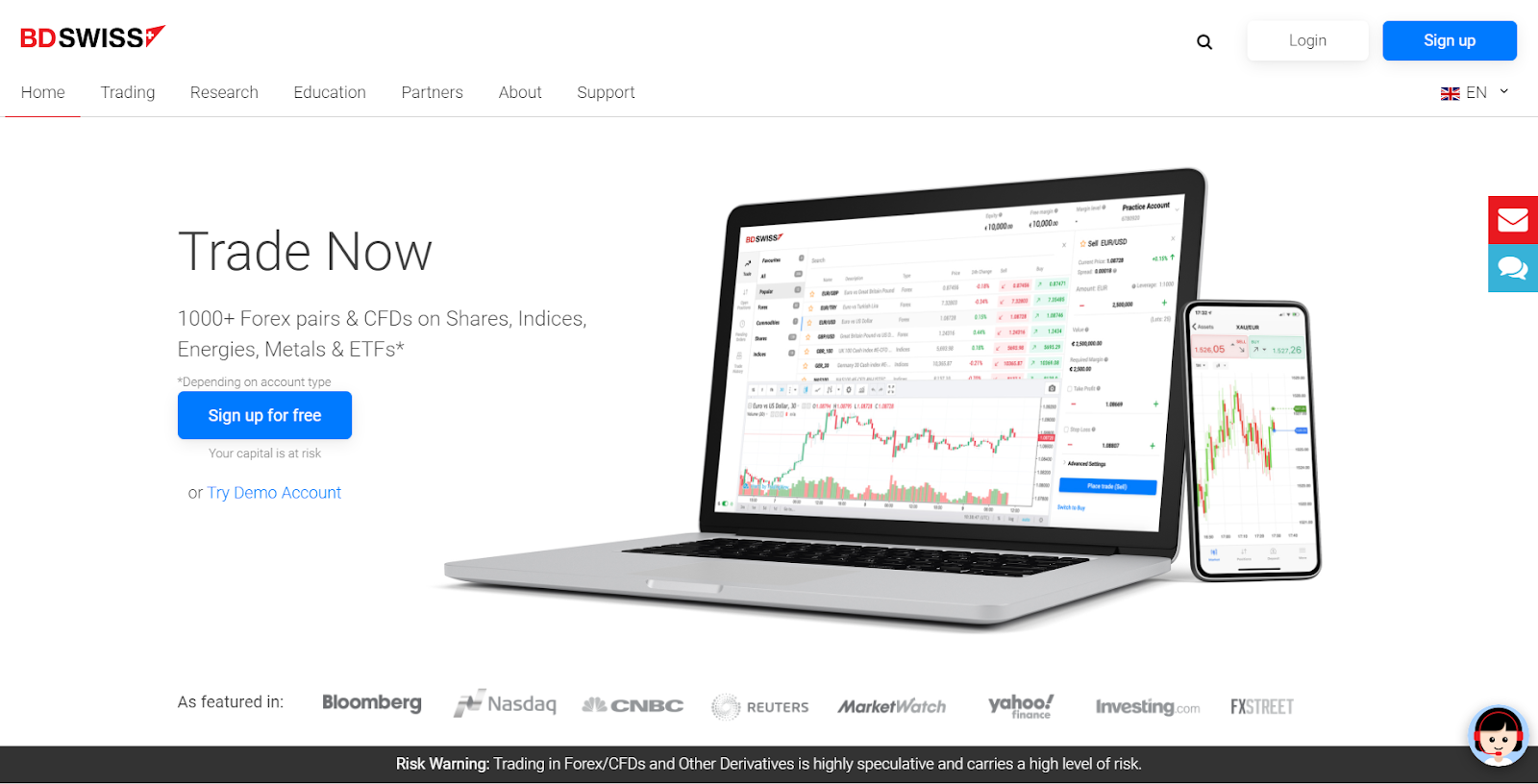

The BDSwiss brokerage company has provided financial services in the Forex market since 2012. The broker is keen to cooperate with traders worldwide. Over the past year, the broker has received World Finance Awards such as Best Market Analytics Service Provider (FxScouts Awards), and Best Forex & CFD Broker (International Investor Awards).

- A vast array of trading assets.

- The ability to trade from both PC and mobile devices.

- A wide range of deposit and withdrawal methods.

- Withdrawal fees are paid by the company.

- The broker periodically conducts online lectures for its clients.

- Lack of investment programs and trading bonuses.

- The broker charges a fee for inactivity on the account.

- Support is unavailable on weekends.

TU Expert Advice

Financial expert and analyst at Traders Union

BDSwiss is a broker that offers traders from all over the world optimal trading conditions for working with Forex assets. The range of trading instruments also includes CFDs, ETFs, stocks, indices, and cryptocurrencies. BDSwiss’ clients can use the familiar MetaTrader 4, MetaTrader 5, as well as the broker's trading platform BDSwiss Webtrader as trading platforms. There are 6 trading accounts.

The company is focused on cooperating with traders from different countries — the broker's website is translated into 22 languages, and the support service is also multilingual and speaks 20 languages. Trading fees in the company are lower than those of its competitors, and there are no non-trading fees, except for having an inactive account. The size of the minimum deposit is average. The company offers trading conditions that will be beneficial to both novice and professional traders.

The main disadvantage of the BDSwiss broker is the lack of investment programs and Islamic accounts. To resolve any issues that have arisen, a trader or a user who wants to open an account with the company can contact the support service. Important: the support service is available around the clock, except on weekends (Saturday, Sunday).

- You want to start trading quickly. Opening a trading account with BDSwiss takes less than 5 minutes and requires minimal personal information. Plus, you can begin trading on classic and cent accounts with a low deposit of $10.

- You value flexibility in trading platforms. BDSwiss offers a range of options, including the classic MetaTrader 4, the more advanced MetaTrader 5, proprietary mobile applications, and a web platform.

- You prefer having a broader choice of account currencies. BDSwiss only supports USD, EUR, and GBP as account currencies, potentially resulting in extra exchange fees for trading instruments using less common currencies.

- You are interested in investment services, PAMM or MAM accounts, capital management services, or ready-made asset portfolios. BDSwiss does not offer these services.

BDSwiss Summary

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, BDSwiss Webtrader, and BDSwiss mobile apps for iOS and Android |

|---|---|

| 📊 Accounts: | Cent, Classic, Premium, VIP, Zero Spread, StockPlus |

| 💰 Account currency: | EUR, USD, GBP |

| 💵 Replenishment / Withdrawal: | Visa/MasterCard, Skrill, Neteller, Bank Wire, Pay Retailers, Crypto, Online Banking, AstroPay, Globe pay, Direct Bank transfer, Korapay |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | 1:1000 (available for certain countries and regions.) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.0 p |

| 🔧 Instruments: | Forex, Commodities, Shares, Indices, Cryptocurrencies, ETFs |

| 💹 Margin Call / Stop Out: | 50% / 20% |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

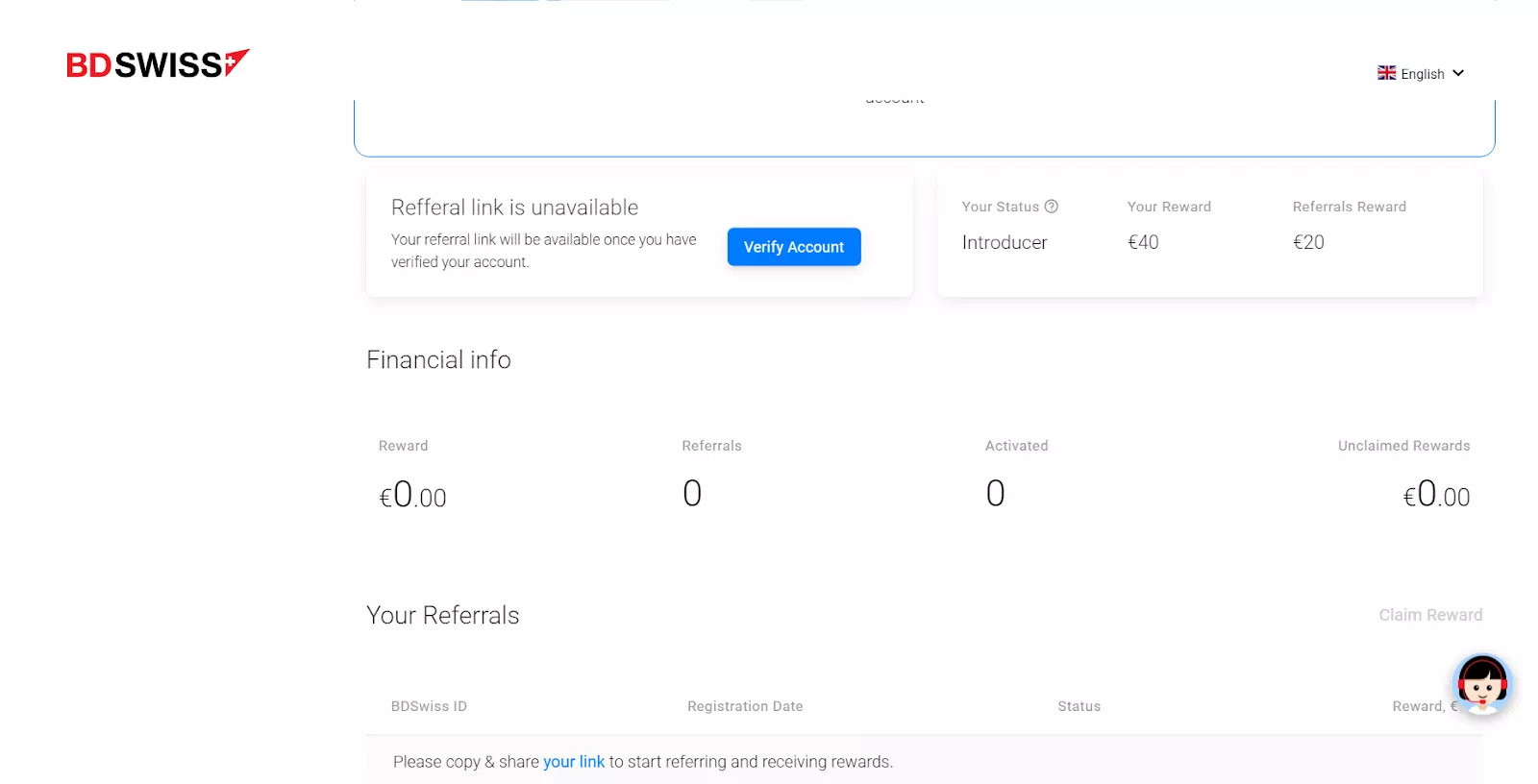

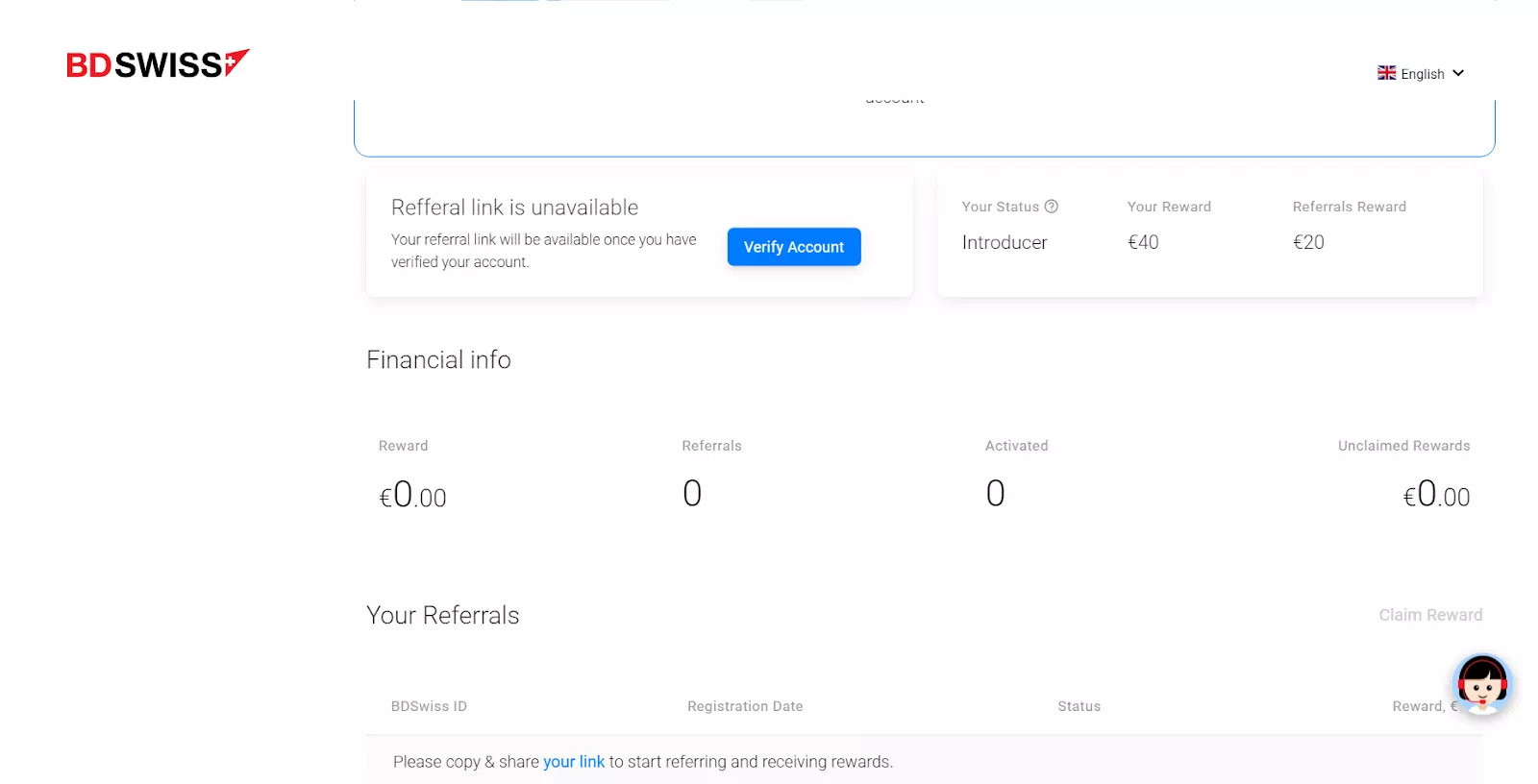

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Not indicated |

| ⭐ Trading features: | When trading CFDs, a trader can set the lot size single-handedly |

| 🎁 Contests and bonuses: | No |

This broker allows its clients to trade Forex assets, as well as indices, stocks, CFDs, ETFs, cryptocurrencies, and commodities.The size of the spread depends on which account the trader opened and what trading instruments he uses. On the broker's website, users can familiarize themselves with the current spread sizes for different assets.

BDSwiss Key Parameters Evaluation

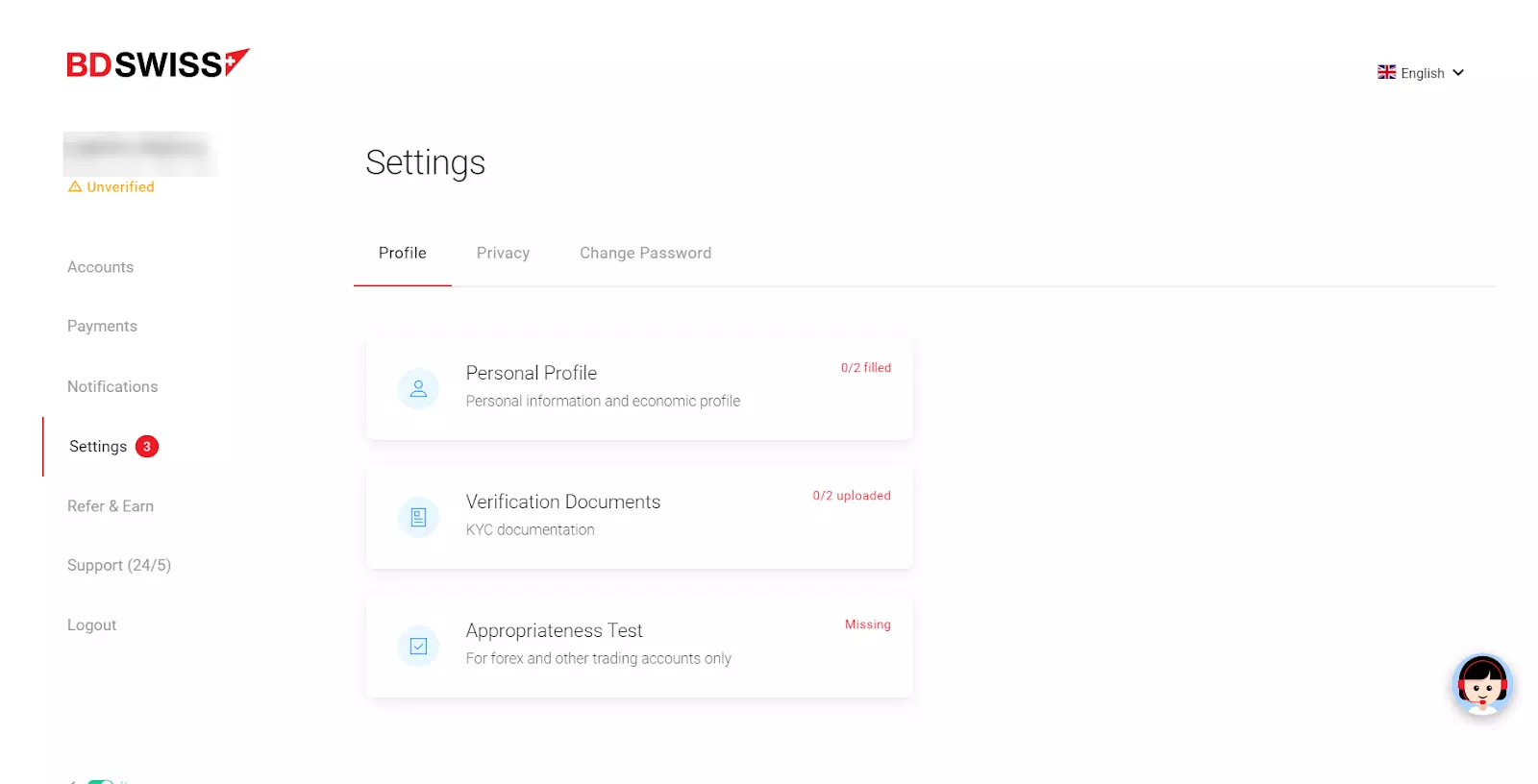

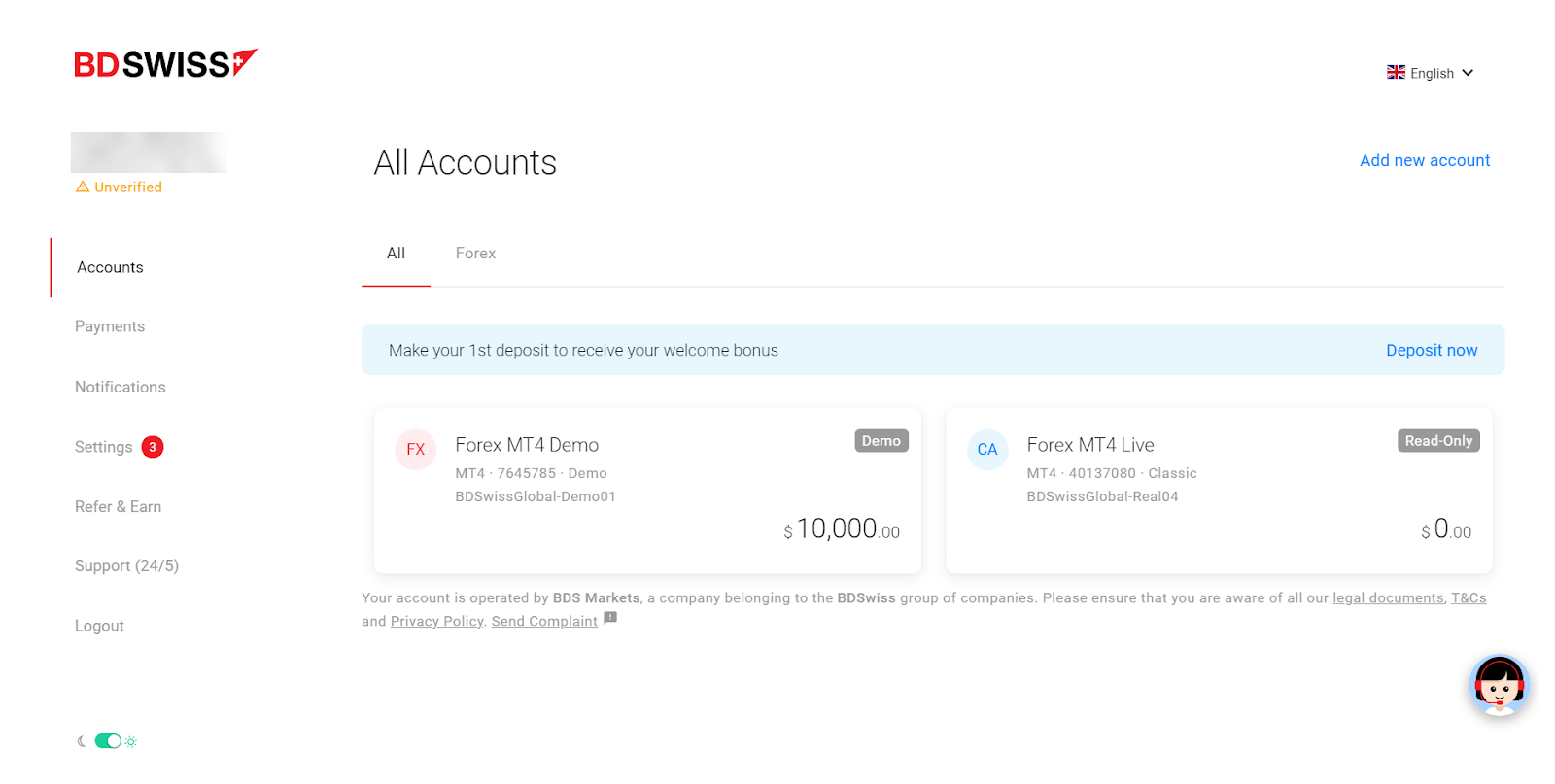

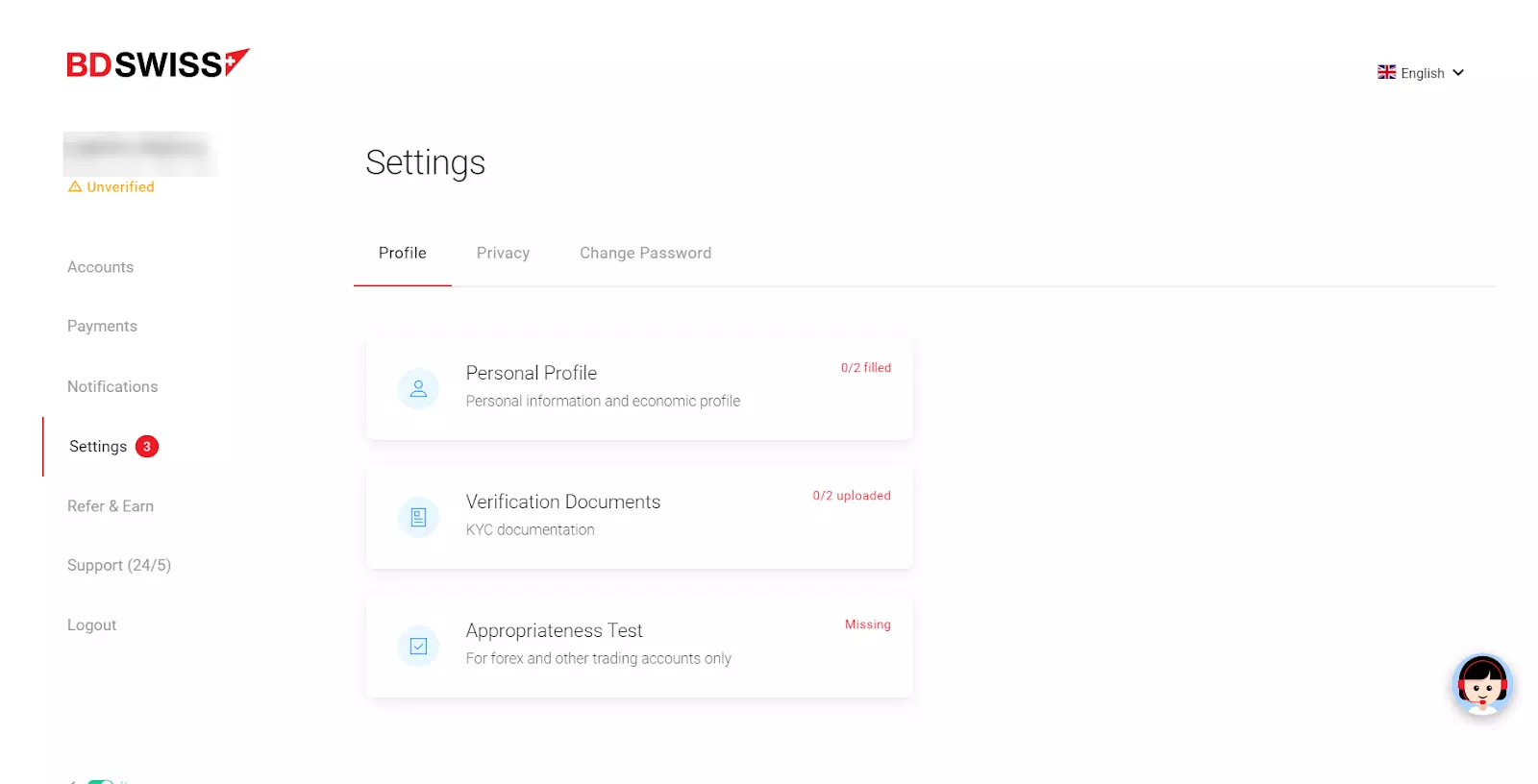

Trading Account Opening

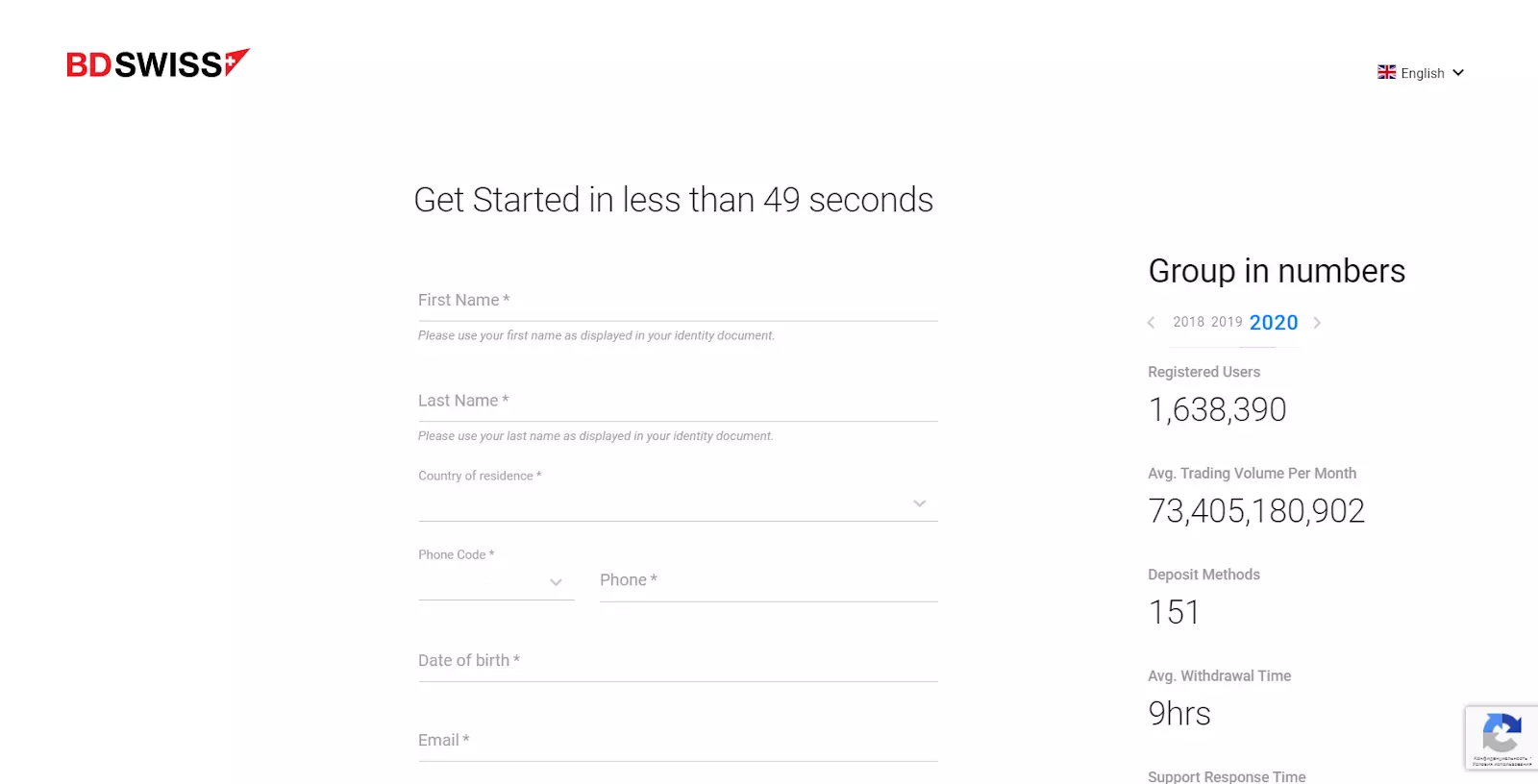

To become a BDSwiss partner and take full advantage of its services, you need to open a trading account with the broker. To do this, follow the steps outlined in the instructions below:

Go to the broker's official website and click on the "Sign Up" button located in the upper right corner.

Select the language in which you will receive all notifications and messages from the company. Then fill out the form with personal data such as your name, surname, phone number, date of birth, email address, and password.

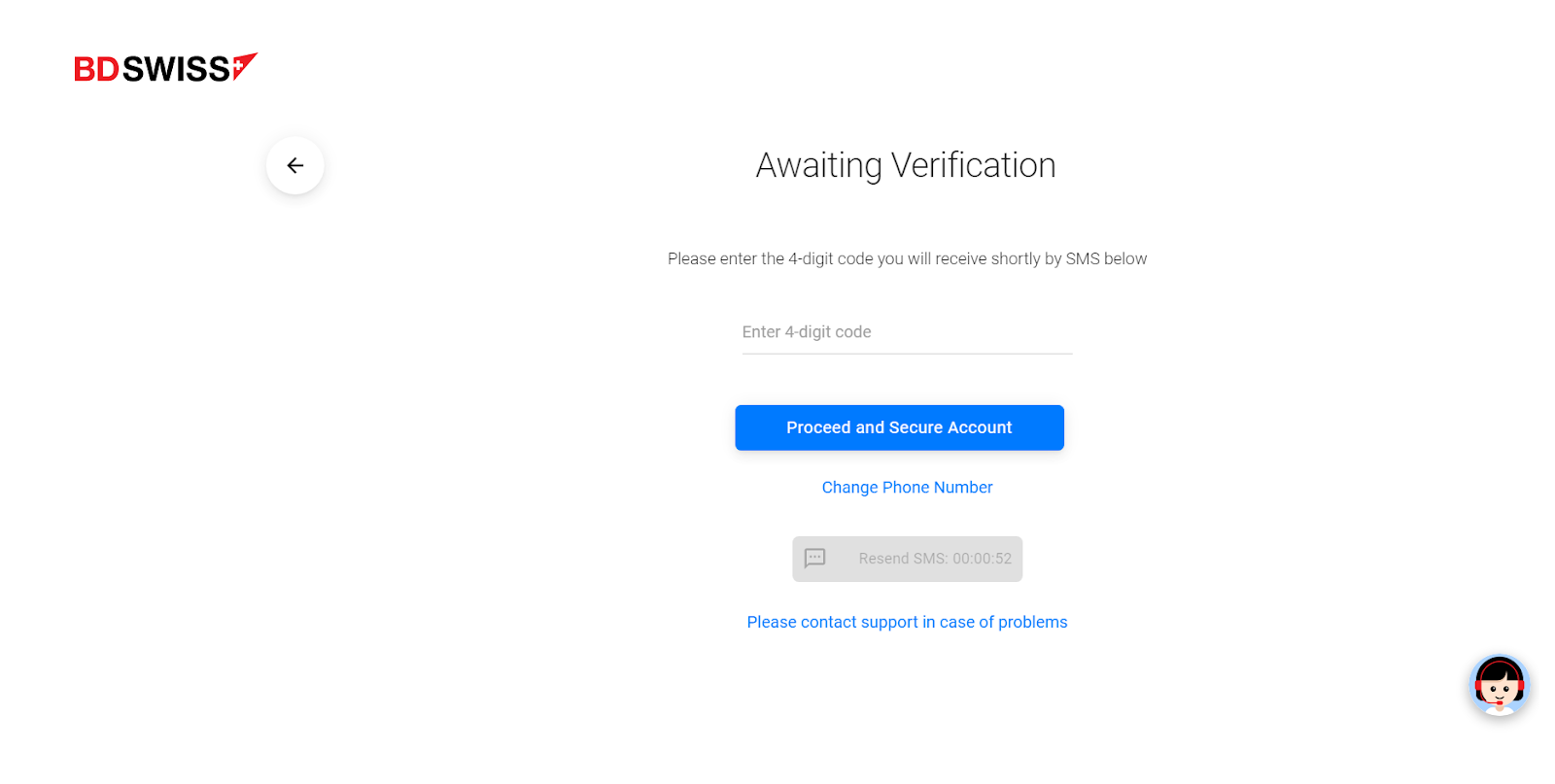

Then enter the four-digit code that will come to your phone number. If necessary, you can change the phone number by clicking on the "Change Phone Number" button.

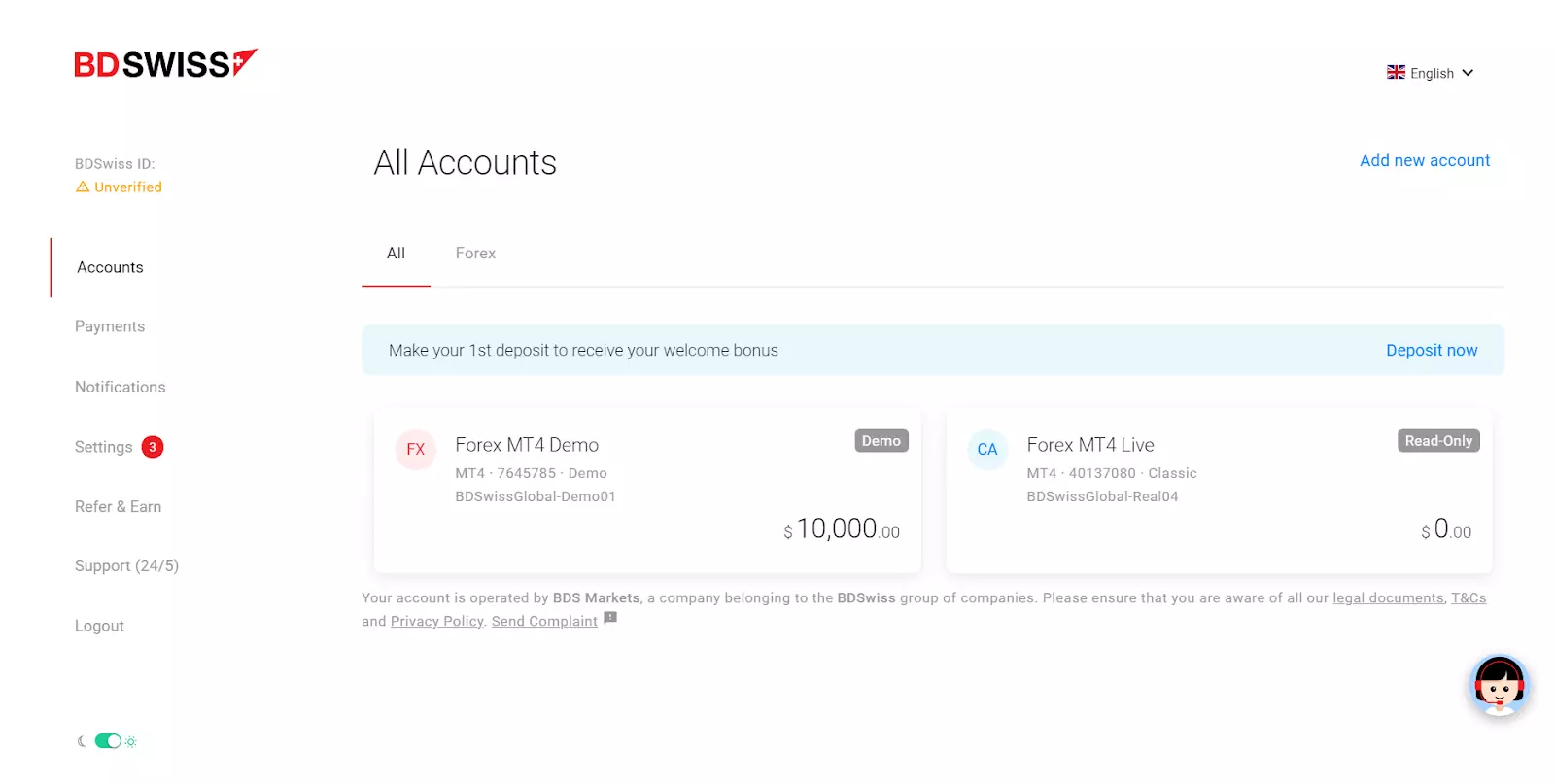

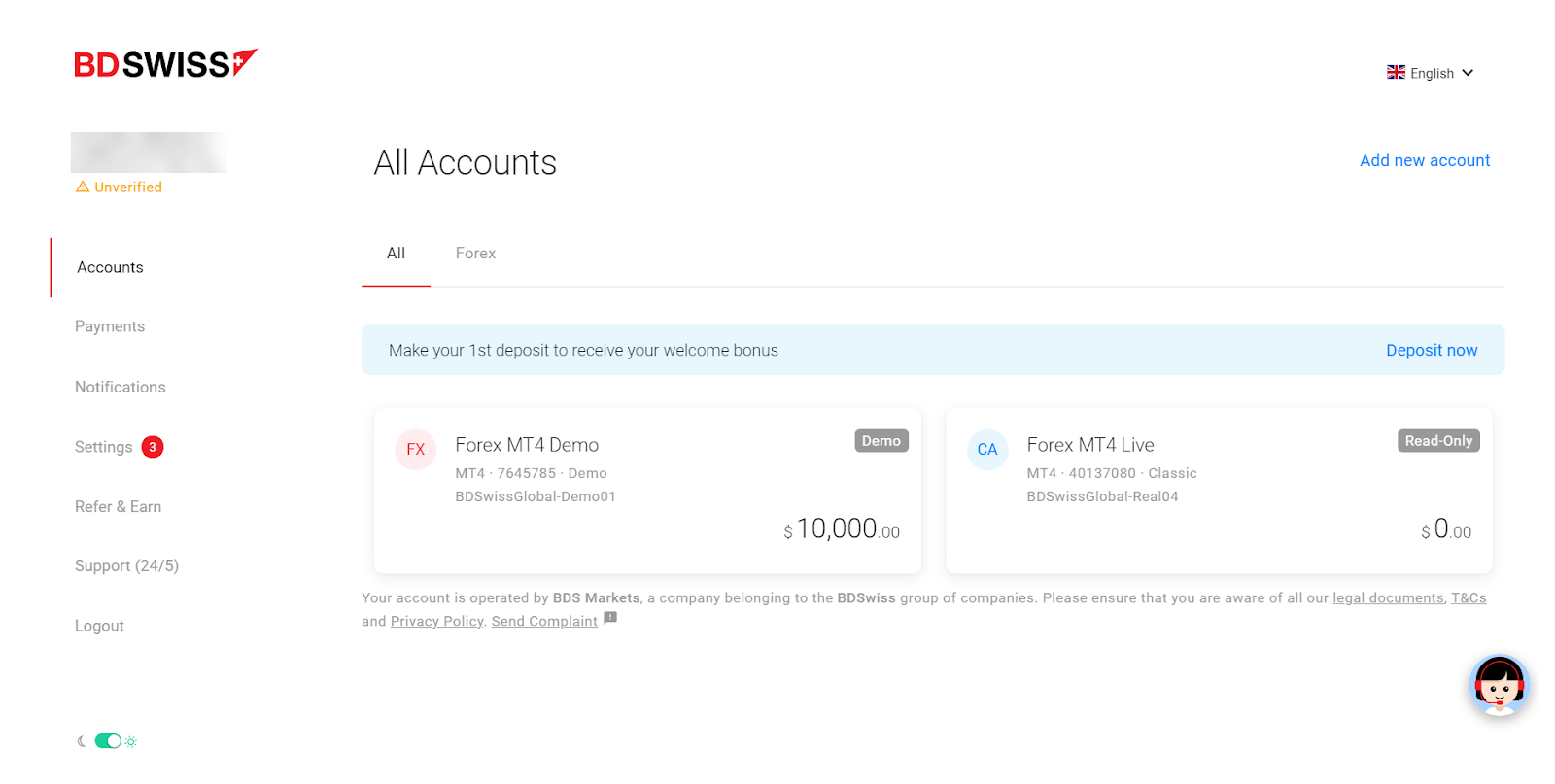

After entering the code, you will be taken to your personal account, where you can enter additional data about yourself, go through verification, and fund your trading account to start trading.

The functionality of the BDSwiss personal account:

Also in the personal account, the trader has access to:

-

Notifications. Here are the messages that the broker sends to clients regarding their activity, transactions, financial transactions, etc.

-

Support section. Traders can contact the Support service directly from the personal account. The broker offers two communication options: by email and via Live chat.

-

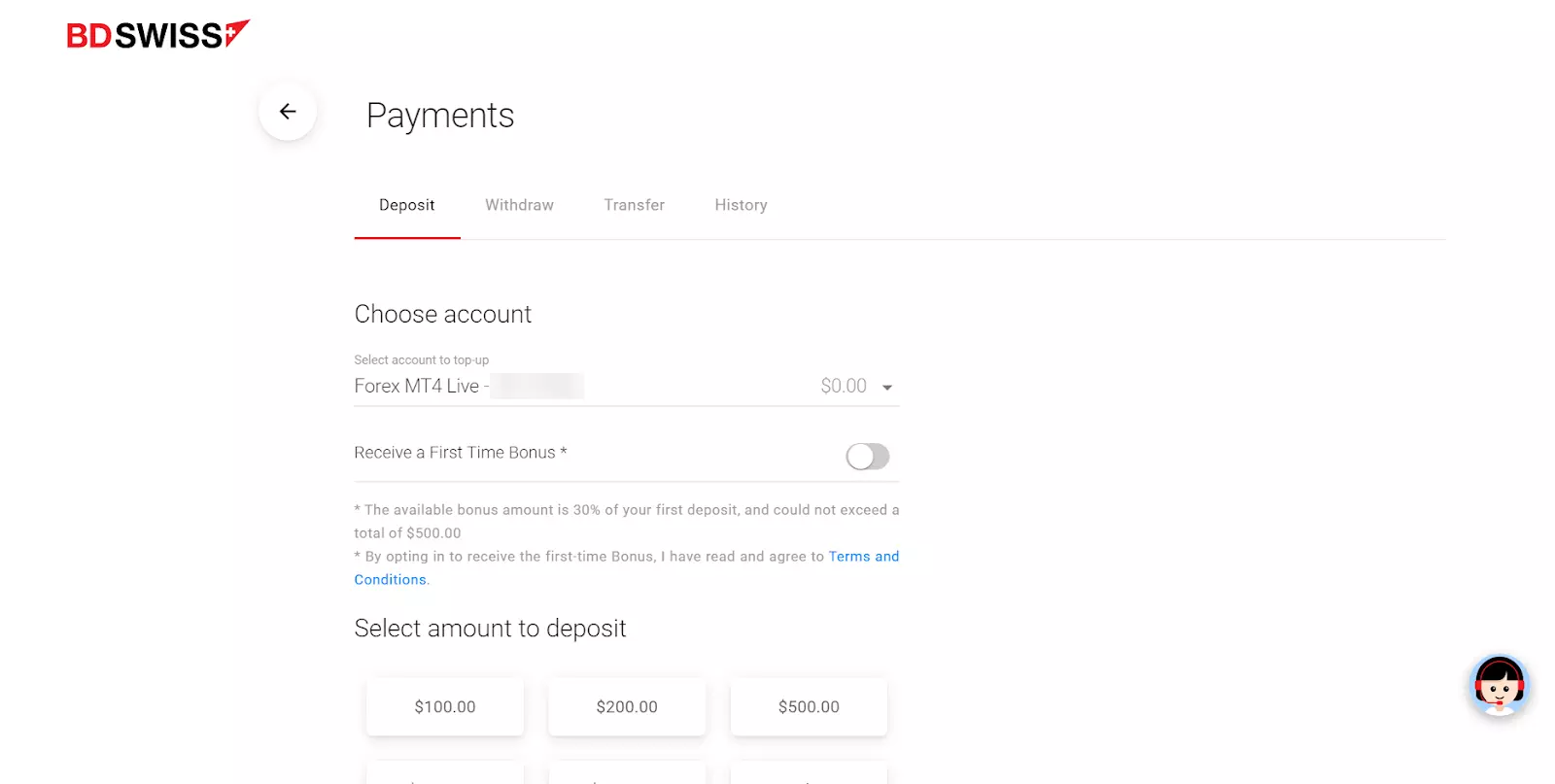

The transfer of funds from one trading account to another can be done in the Payments section via the Transfer subsection.

Regulation and safety

To protect the personal data of each client, the company uses advanced software that encrypts all data. In particular, the automated protocol SSL (Secure Sockets Layer) is responsible for the security of information, which makes all transactions as secure as possible.

Advantages

- The broker's activities are under the supervision of several regulatory bodies

- Data encryption ensures the confidentiality of customers' personal information

Disadvantages

- Client funds are not held in segregated accounts

- BDSwiss does not cooperate with compensation funds

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Cent | $15 | No |

| Classic | $15 | No |

| Premium | $11 | No |

| VIP | $11 | No |

| Zero Spread | $0 | No |

| StockPlus | DMA | No |

The broker charges a fee for transferring an open position to the next day (swap). Also, Traders Union analysts compared the size of the average trading fee in BDSwiss, Admiral Markets, and FXPro. As a result of the analysis, each of the brokers was assigned a fee level of low, medium, or high.

| Broker | Average commission | Level |

|---|---|---|

|

$8.66 | |

|

$1 | |

|

$8.5 |

Account types

BDSwiss offers users six types of accounts to choose from. Trading conditions for account holders differ in the minimum deposit size, access to Autochartist, trend analysis instruments, trade alerts, and access to online lectures.

Account types:

*Please note that Premium and Cent accounts are only available in certain countries and regions.

The broker also offers a demo account so that traders can test their trading skills, BDSwiss conditions, and test new trading strategies without risking one’s capital. BDSwiss is a broker that offers favorable trading conditions to both novice and experienced market participants.

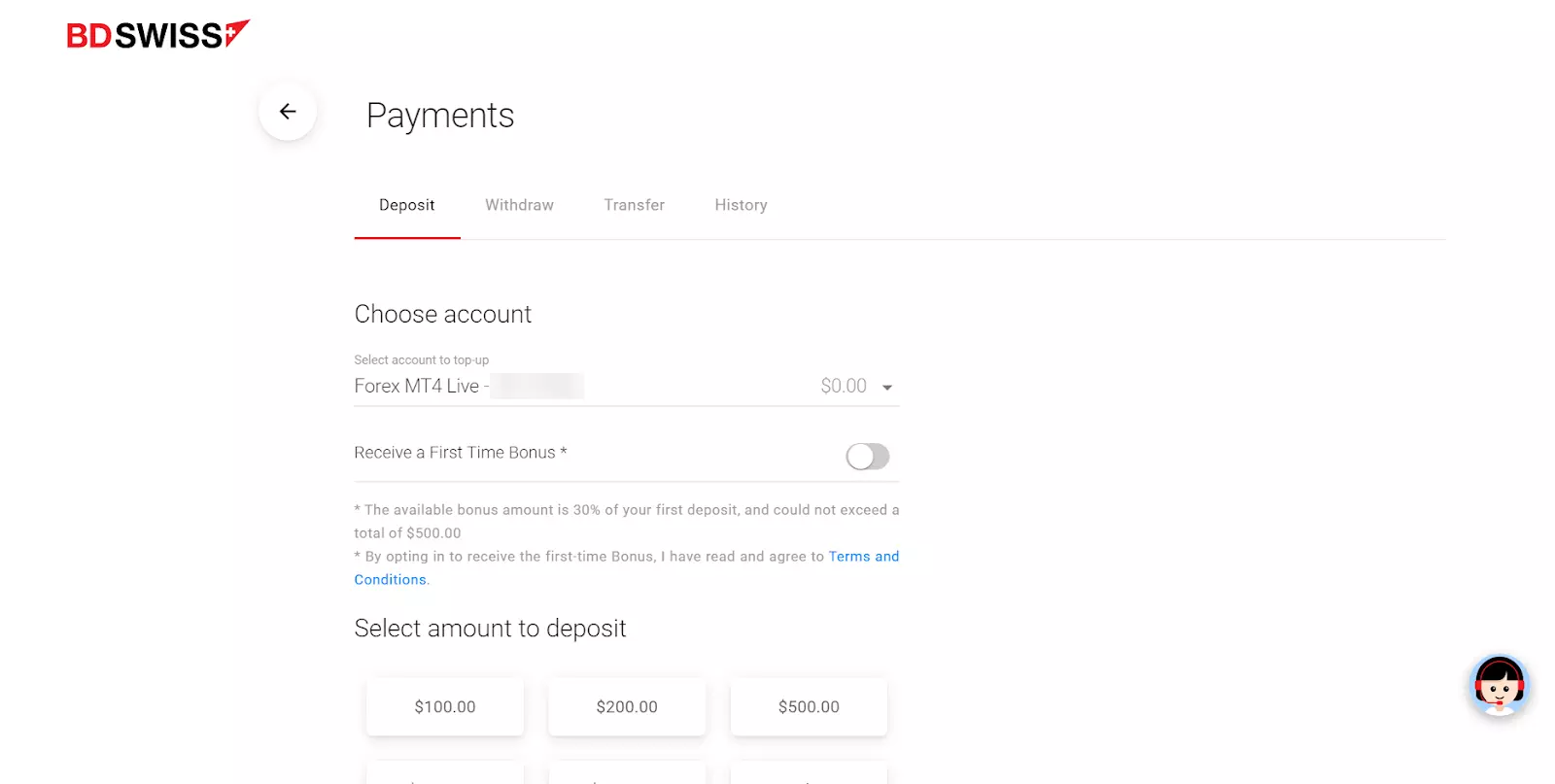

Deposit and Withdrawal

-

To withdraw funds to a personal account, a trader must submit a withdrawal request in the appropriate section of the personal account.

-

To replenish the account and withdraw funds, the broker offers the following methods: Visa, Mastercard; Skrill, Neteller, Pay Retailers, Crypto, AstroPay, Globe pay, Direct Bank transfer, Korapay electronic payment systems. Transactions via online banking and wire transfers are also available.

-

The broker guarantees clients instant crediting of funds to a trading account or card, bank account, and e-wallet upon withdrawal.

-

There is no commission for replenishment of the account, BDSwiss will cover the costs of withdrawing funds. An exception is an application for withdrawal via bank transfer if the amount is less than 100 EUR, as well as withdrawal of less than 20 EUR through electronic payment systems. In such cases, the broker charges a fee of 10 EUR for withdrawing funds.

-

To withdraw funds, the trader must verify the account with the help of documents confirming his identity.

Investment Options

The BDSwiss broker is aimed at cooperating with active traders who are ready to trade on their own and, therefore, it does not offer services for copying transactions, PAMM accounts, or investment programs for generating passive income.

Customer support

If a trader has any questions during the process of opening an account, trading, or non-trading operations, he can contact the broker's support service. The service is open 24/5 and is available to all users, not just the company's clients.

Advantages

- You can reach out to the support at any time

- Many ways to communicate with company employees

Disadvantages

- There is no callback function

- Support doesn’t work on weekends

Available communication channels with customer support specialists include:

-

filling out a feedback form on the site;

-

call by phone number, numbers are indicated for these countries: Germany, Greece, Italy, France, England, Spain, and Portugal;

-

message to the online chat on the broker's website;

-

letter to the broker's email.

The broker is also represented on social networks and messengers, such as: Facebook, Twitter, LinkedIn, Instagram, and YouTube.

Contacts

| Foundation date | 2012 |

|---|---|

| Registration address | Suite 3, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, Seychelles |

| Regulation |

FSA, FSC, FSCA, MISA

Licence number: SD047, C116016172 |

| Official site | https://global.bdswiss.com/ |

| Contacts |

+44 2036705890, +49 3021446991, +30 2111984082

|

Education

BDSwiss makes sure that novice traders gain the basic knowledge necessary to trade on Forex, and that market participants can improve their skills. To do this, the site has an Education section.

Before starting to trade like a real ace on the market, feel free to test the trading conditions of the broker, as well as practice and try out different trading strategies without financial risks on a demo account.

Comparison of BDSwiss with other Brokers

| BDSwiss | RoboForex | Pocket Option | Exness | XM Group | AMarkets | |

| Trading platform |

MT4, MT5, WebTrader, BDSwiss (Mobile app) | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, MobileTrading, XM App | MT4, MT5, AMarkets App |

| Min deposit | $10 | $10 | $5 | $10 | $5 | $100 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 50% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | Yes | No | No | Yes | No |

Detailed Review of BDSwiss

The BDSwiss broker offers over 1,000 trading instruments for active trading. The company is focused on cooperation with traders from around the world, regardless of their experience in trading. The website contains educational materials in the public domain, free webinars on relevant topics, and a variety of analytical materials that will help increase your level of professional skills.

About BDSwiss broker in numbers:

-

More than 1,000 trading instruments are available to the company's clients.

-

The maximum leverage is 1:1000 (available for certain countries and regions).

-

The company has over 1.6 million registered accounts.

-

The broker provides financial services to traders from 180+ countries.

-

The support team speaks more than 20 languages.

-

The fee for depositing and withdrawing funds is $0.

-

The company has been providing financial services for over 8 years.

BDSwiss is a broker for newcomers and professionals in the Forex market

Clients of BDSwiss can choose from one of four accounts and a convenient trading platform, and the broker will ensure that trades are executed in at least 0.01 seconds. The company also guarantees the absence of requotes and high liquidity of trades. Five classes of CFD assets will help diversify any portfolio. Spreads in BDSwiss are floating and depend directly on the trading instrument the trader uses. There are practically no non-trading commissions, and there is no fee for withdrawing money to a personal account.

Trading platforms offered by BDSwiss are available in the web version or can be downloaded from the AppStore or PlayMarket. The platforms can be used to trade from anywhere that has internet access.

Useful BDSwiss services:

-

Economic Calendar. Alerts traders about economic events that may affect market trends. Knowing about future events will allow you to develop a trading strategy for the coming days, taking into account market changes.

-

Autochartist. The service analyzes data on more than 1,000 instruments around the clock, shows trends at the time of their formation, and provides users with information about trading opportunities.

-

Trading Calculators. The section includes calculators for calculating margin, swap, pip value, and a currency converter.

-

Research & Analysis. This section contains daily market analysis, technical analysis, weekly forecasts, daily videos, and other information that allows you to keep abreast of the state of the market.

-

Trading Alerts. The function provides traders with real-time trading signals. Available only for VIP and Raw account holders.

Advantages:

A wide range of trading assets.

Freely available training materials and periodic online lectures on relevant topics.

Many ways to deposit and withdraw funds, and transfer funds between accounts.

A large amount of analytical data is freely available.

All trading instruments are available to traders, regardless of the type of account.