deposit:

- $500

Trading platform:

- MetaTrader4

- Axi

- FSA

Axi Select Review 2024

deposit:

- $500

Trading platform:

- MetaTrader4

- Axi

- Universal program with a six-stage system

- Simple requirements

- Profit split is up to 90%/10%

- Scaling up to $1 million.

- Up to 1:100

Summary of Axi Select Trading Company

Axi Select is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.96 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Axi Select clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work. Axi Select ranks 28 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Axi Select launched this offer in the autumn of 2023. Its clients are eligible for funding if their Edge score is 50+. Traders are allowed to open only one prop account, but they still can trade on regular accounts. The progress takes long enough, but traders don’t risk anything. They can discontinue their participation in the program and return their funds. The development potential is significant and here the broker is superior to many top prop firms.

This proprietary (prop) trading firm is managed by Axi, a well-known Australian broker. It offers funding from $5,000 to $1 million without initial or subscription fees. It’s enough to have a certain amount in your account. The program implies six stages comprising Seed, Incubation, Acceleration, Pro, Pro 500, and Pro M. To complete each of the stages, fulfill certain conditions; for example, increase your capital by 5% and avoid losses of 10%. The result is larger funding and a more beneficial profit split, which is 90%/10% on Pro M.

| 💰 Account currency: | USD and EUR |

|---|---|

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs and CFDs on indices, stocks, energies, precious metals, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Axi Select:

- Participation in the program is free, registration takes 10-15 minutes, and there is the possibility to connect an active Axi account;

- Reasonable requirements for moving to the next stage and a high loss limit;

- Trader’s profit share can be 90% and it is possible to receive funding up to $1 million with only $4,000 on the balance;

- Over 100 assets from 6 groups are available and there are no restrictions on trading strategies and methods;

- Leverage is up to 1:100 and MetaTrader 4 is available;

- Spreads start at 0 pips, trading fees are either not charged or they are $7 per lot, and there are no withdrawal fees;

- 24/5 technical support is provided in English; 13 more languages are available from 8:00 to 20:00 (UTC+11) on weekdays.

👎 Disadvantages of Axi Select:

- Profit split is not large at the start; it takes not less than 150 days to achieve at least 70%/30%;

- To start or go to the next stage, it is required to reach the target Edge score, but its calculation algorithm isn’t clearly specified;

- Some financial instruments from Axi Select’s pool are not available with the prop firm.

Evaluation of the most influential parameters of Axi Select

Geographic Distribution of Axi Select Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

CA

CA Expert Review of Axi Select

This is one of the few cases when an established and reputable broker provides an opportunity to work with an attracted capital. AxiTrader Ltd was incorporated in 2007 in Sydney, Australia. It covers over 100 countries and has tens of thousands of users and representative offices in the UK, China, and Germany. In 2023, the broker introduced its prop funding offer, which became very popular.

Below is a brief description of the offer. When opening an account, traders can indicate if they want it to be funded. They need to execute 20 or more trades to achieve the Edge 50 score. Then Seed, Incubation, Acceleration, Pro, Pro 500, and Pro M stages become available to them. As examples, consider the conditions of Seed and Pro. The Seed stage requires depositing $500 to receive up to $5,000. To go further, it is necessary to reach Edge 60 and 5% profit, avoiding 10% losses. Another mandatory condition is to execute a minimum of 20 trades within 30 days. The trader’s balance on the Pro stage is $2,000 and the funding is up to $200,000. To go to the Pro 500 stage, increase the Edge score up to 90 and meet profit and loss requirements of 5% and 10%. This stage takes a minimum of 60 days and requires not less than 50 trades.

The maximum funding on the Pro M stage is $1 million. Here, traders keep 90% of the profit, while the profit split on the Pro stage is 70%/30%. Don’t consider the Seed stage, since the broker takes 100% of the profit there.

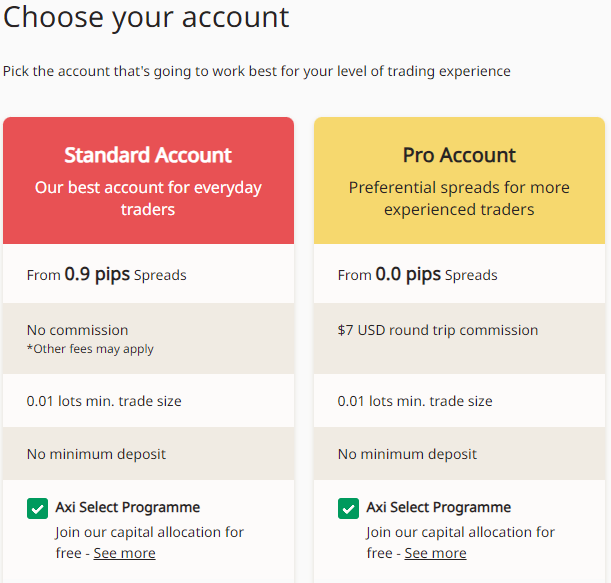

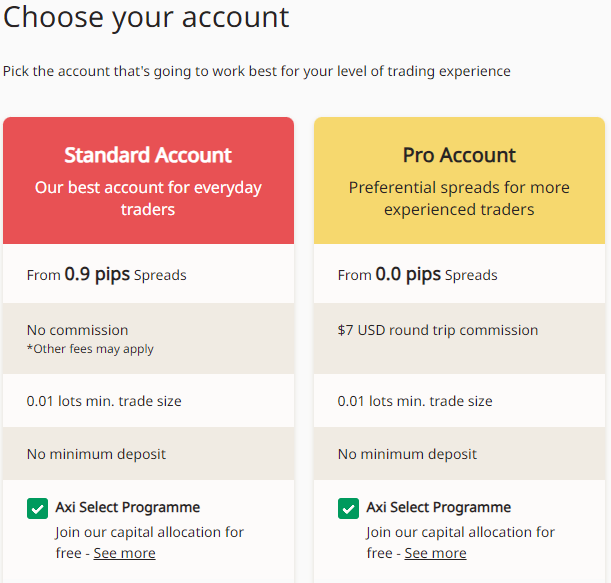

Traders can work with currency pairs and CFDs on indices, stocks, energies, precious metals, and cryptocurrencies. Leverage is flexible up to 1:100 and fees are typical for Axi Select. Spreads start at 0.9 pips with no fees on the Standard account and are from 0 pips, plus $7 fees per lot on Pro.

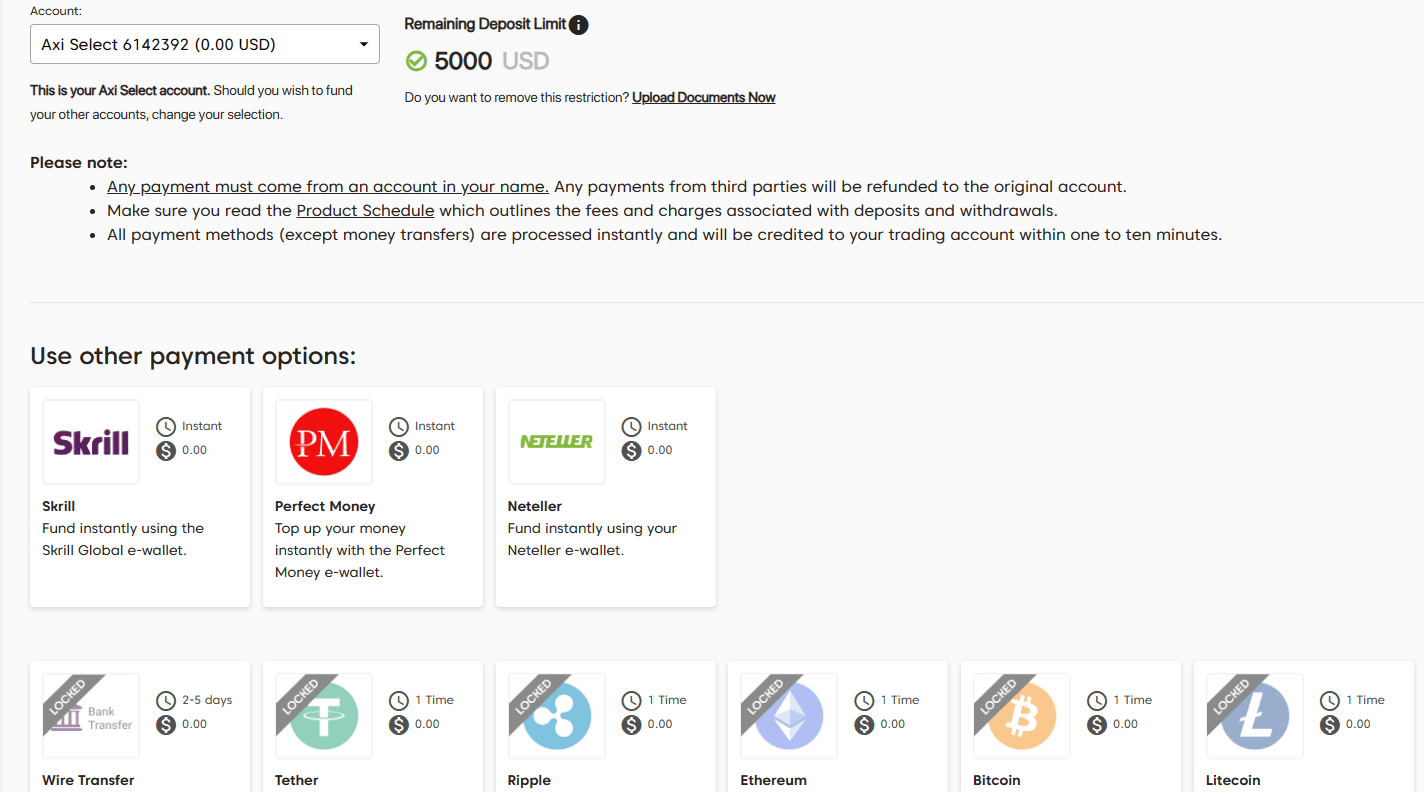

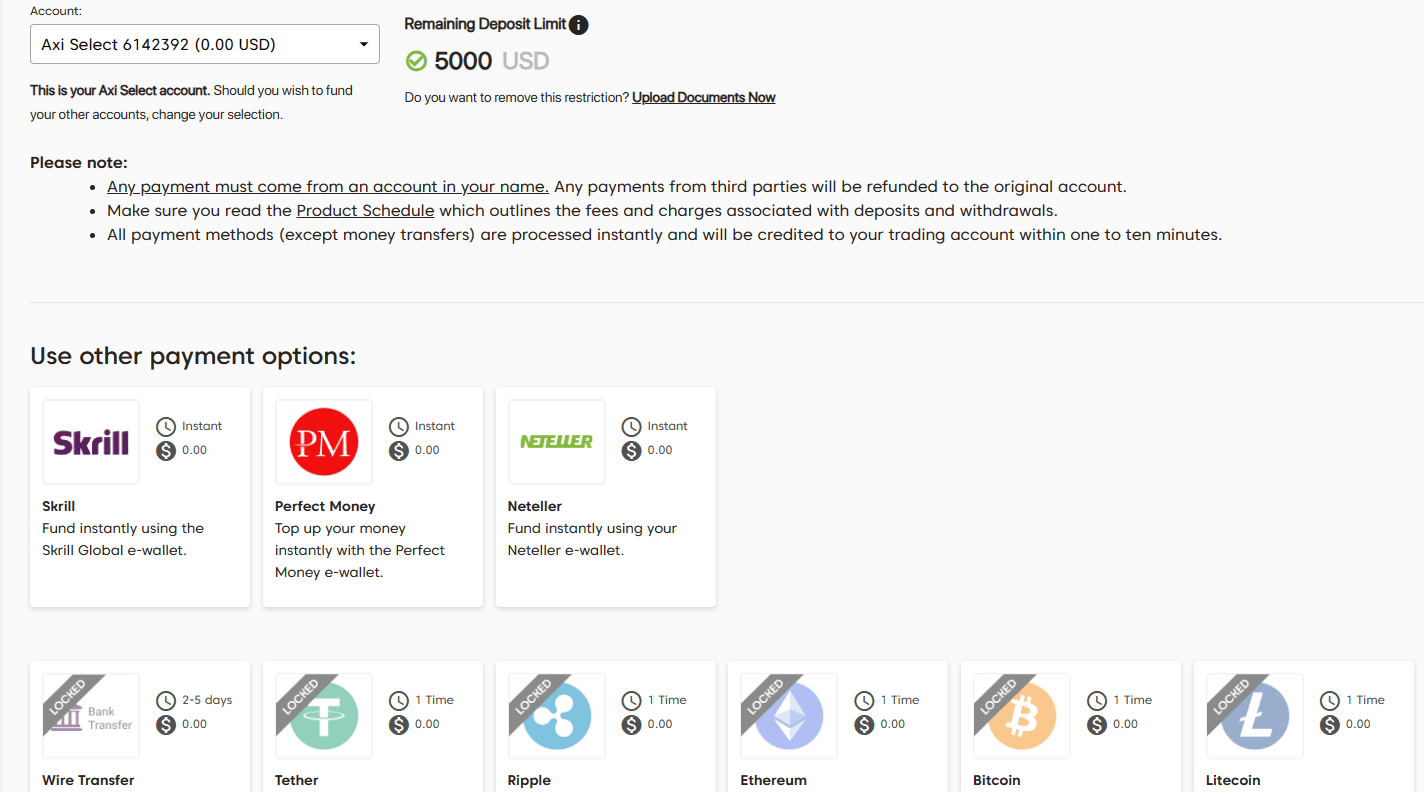

The broker offers a high-quality free education in different formats. Available materials range from eBooks and glossaries to video tutorials. Client support is available in 14 languages and is prompt on weekdays. Deposit and withdrawal methods are bank cards, bank transfers, crypto wallets, Neteller, Skrill, China’s UnionPay, etc.

There are disadvantages, but they are not critical. Traders deposit from $500 to $4,000, however, deposits are refundable and there are no subscription fees. The necessity to stay at one stage within 30-60 days results from the broker’s desire to check how successful the user is in the long term. The main disadvantage is not a very fair profit split at the first three stages, but the company needs time and the changes may come.

Axi Select from AxiTrader Ltd has a unique structure but is not perfect yet. Still, TU recommends traders of all levels who need funding to look closer at Axi Select.

Dynamics of Axi Select’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Brokers often provide PAMM or MAM accounts and copy trading, which are of interest to users who prefer passive income. Partnership (referral) programs require much time. Traders can ensure good income without risking their money at Axi Select, which offers all of the above options that are well-developed and profitable. Since this review considers Axi Select, these options are not described in detail.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trading Conditions for Axi Select Users

Here, a deposit means the trader’s own capital must be held in the account. The maximum funding amount is calculated based on the trader's capital and a multiplier available at a certain stage. At the Seed stage, it is enough to deposit $500, while to go to Pro M, traders need to increase their capital up to $4,000. Leverage is flexible up to 1:100. Traders can set a comfortable level for themselves or trade without leverage. Technical support is available 24/5 by phone, email, live chat, and tickets on the website.

$500

Minimum

deposit

1:100

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 4 and Axi (coming soon) |

|---|---|

| 📊 Accounts: | Standard and Pro |

| 💰 Account currency: | USD and EUR |

| 💵 Replenishment / Withdrawal: | Bank transfers, Visa, Mastercard, payment systems, and crypto wallets |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs and CFDs on indices, stocks, energies, precious metals, and cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Universal program with a six-stage system; Simple requirements; Profit split is up to 90%/10%; Scaling up to $1 million. |

| 🎁 Contests and bonuses: | Rebates from TU |

Comparison of Axi Select to other prop firms

| Axi Select | Topstep | FTMO | Funded Trading Plus | Earn2Trade | TopTier Trader | |

| Trading platform |

Axi, MetaTrader4 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | NinjaTrader, R Trader Pro, Finamark | MetaTrader4 |

| Min deposit | $500 | $1 | $155 | $119 | $90 | $225 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | 10% / 10% | No |

| Execution of orders | Market Execution | ECN | Instant Execution | Market Execution | Market Execution | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Axi Select | Topstep | FTMO | Funded Trading Plus | Earn2Trade | TopTier Trader | |

| Forex | Yes | No | Yes | Yes | No | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | No |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | Yes | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | No | Yes | No |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | Yes |

Axi Select Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $9 | No |

| Pro | From $0 | No |

Axi Select doesn’t charge withdrawal fees regardless of the method, which makes it superior to those competitors that still withhold such fees.

TU experts have compiled a comparative table of average traders’ expenses when working with Axi Select and two leading prop firms.

Detailed review of Axi Select

Axi Select doesn’t need recommendations, since it is popular among traders in many countries. It actively introduces innovative trading technologies, which results in overall high reliability and instant order execution. Its clients are provided with personal services and access to a wide range of educational and analytical tools. All of the above refers to the benefits of this prop broker. The unique Axi Select stage system allows users to develop and expand their trading potential by trading with larger capital and a fair profit split.

Axi Select by the numbers:

-

6 stages: Seed, Incubation, Acceleration, Pro, Pro 500, and Pro M;

-

Trader’s minimum equity is $500;

-

Scaling up to $1 million;

-

Profit split is up to 90%/10%;

-

Maximum allowable loss is 10%.

Comfortable and clear conditions for traders regardless of experience

Axi Select offers over 100 financial instruments from 6 categories, which allow traders to build diversified portfolios, where a temporary downtrend on one position is compensated by the stability and progress of other assets. The prop firm allows its clients to use any strategy, including scalping, hedging, trading on news events, and robots. Leverage is flexible and sufficient. The main thing is not to overuse it, otherwise, there is always the risk of violating the 10% loss requirements. However, if such a situation occurs, traders’ accounts are held in a two-week quarantine and they go back to a previous stage. In two weeks, they can continue trading without incurring sufficient financial losses.

Useful services offered by Axi Select:

-

Trading center. Here, the prop firm’s clients can communicate with other traders, exchange their ideas and strategies, and find answers to their questions.

-

Trading tools. These include free Autochartist, cheap VPS, TC Alpha indicators, economic calendar, margins calculator, etc.

-

Education. This section provides everything necessary for studying online trading currency pairs and different types of CFDs. The materials include structured text courses, video lessons, and eBooks.

Advantages:

No initial or monthly payments;

Reasonable requirements for switching to another stage;

Scaling range is from $50,000 to $1 million;

Trader’s profit share can be 70%, 80%, and even 90%;

Prompt and professional support in 14 languages.

Guide on how traders can start earning profits with the broker’s capital

First, choose the account type, Standard or Pro, and then connect a funding program to it during the registration process. Next, choose leverage according to your strategy and priorities. Download and install the appropriate version of MetaTrader 4. Execute 20 or more trades to achieve the Edge 50 score. Progressing through the stages requires increasing the Edge score and having a stable capital build-up without significant losses.

Account types:

To go to the next stage, achieve the profit target of 5% excluding 10% losses, which results in a two-week quarantine and going back to the previous stage.

If users already have an account with an Edge score of 50 or more, they can immediately participate in the prop program starting from the Seed stage.

Bonuses from Axi Select

Today, there are no special promotions. However, traders still can receive an important benefit from the trading process.

Rebates from Traders Union

To save on every trade regardless of its direction, parameters, or results, register on the TU website and find the link to your desired broker in your user account. Use this link to go to the Axi Select website and open the Standard or Pro account. To participate in the Axi Select program, tick the corresponding item. Link the trading account with your TU’s user account following these simple instructions. Thus, you earn automated rebates. This option is free and doesn’t result in any additional obligations or trading restrictions.

Investment Education Online

Axi Select offers good educational opportunities for traders who want to start trading with it, including its funding offers. Traders can obtain valuable knowledge that takes them to a new level.

Educational materials are free and are available in the public domain. Some of them are useful even for experienced users. The prop program conditions are described in detail in a separate section.

Security (Protection for Investors)

Axi Select is registered in St. Vincent and the Grenadines, which ensures protection for its clients. Moreover, it is regulated by the local Financial Services Authority (FSA). Axi Select is professionally developed and doesn’t violate the legislation of the respective countries or the rights of its clients.

👍 Advantages

- The broker has been in the market for a long time and has proven itself

- It is officially registered in St. Vincent and the Grenadines

- The company is licensed by FSA under number 25417 BC 2019

- Precise and clear conditions of the funding program

👎 Disadvantages

- The regulator doesn’t supervise the broker in all regions

Withdrawal Options and Fees

-

Traders execute trades with the broker’s attracted capital. If they are mostly profitable, traders can receive a share of profits.

-

Subject to the stage, the profit share is 40%, 50%, 70%, 80%, or 90%.

-

Withdrawals can be requested at any moment. However, it is desirable to request it at the beginning of the month, immediately upon receiving performance fees.

-

Available withdrawal methods are bank transfers, bank cards, crypto wallets, Neteller, Skrill, China’s UnionPay, etc.

-

The broker doesn’t charge withdrawal fees; and the minimum withdrawal amount is $5/€5.

-

The withdrawal period is 15 minutes for most methods, while bank transfers take 1-3 days.

Customer Support Service

Axi Select provides a lot of information on its website, including about the funding program. However, traders still may have questions. 24/5 technical support responds to relevant questions via phone, email, tickets, and in live chat on the website. However, if traders need advice in a language different from English, support is available only from 8:00 to 20:00 (UTC+11).

👍 Advantages

- Technical support is available at any time on weekdays

- Four most popular communication channels are available

- Managers are highly competent

👎 Disadvantages

- On weekends and holidays technical support isn’t available

The following communication channels to contact technical support are available:

-

Email;

-

Telephone;

-

Live chat on the website and in the user account;

-

Tickets on the website

Also, it is possible to contact Axi Select experts on Facebook, X (Twitter), LinkedIn, Instagram, and TikTok. Links to profiles are available on the website.

Contacts

| Registration address | Suite 305, Griffith Corporate Centre, PO Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines |

| Regulation |

FSA |

| Official site | https://www.axi.com/int |

| Contacts |

Email:

service@axi.com,

Phone: 1300 888 936, +61 2 9965 5830, +44 203 544 9646 |

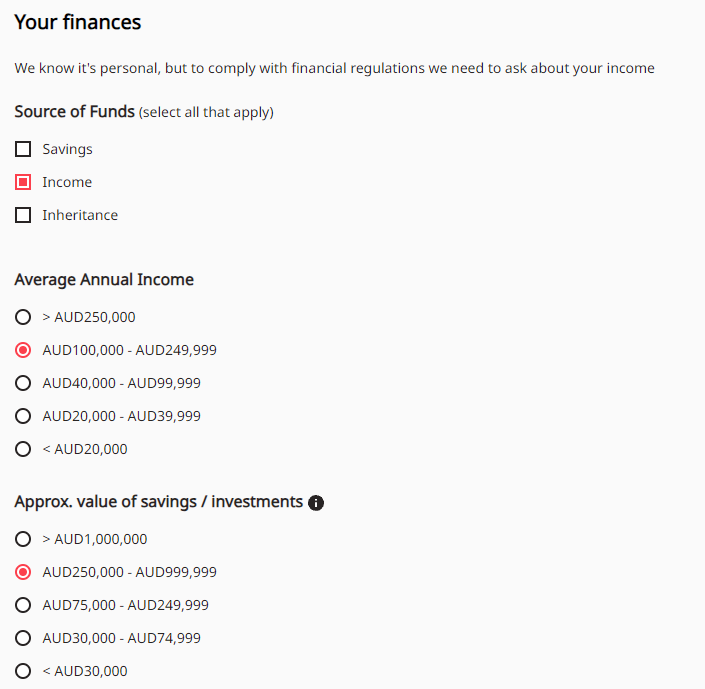

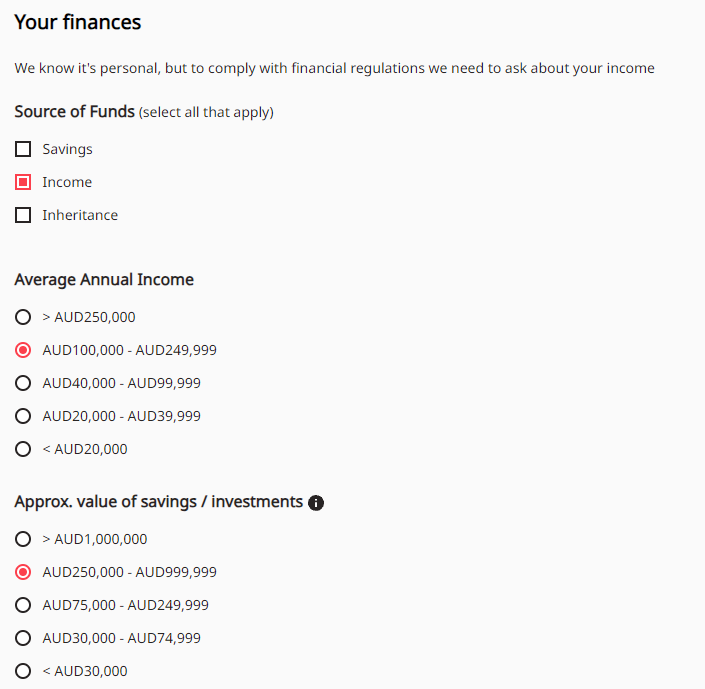

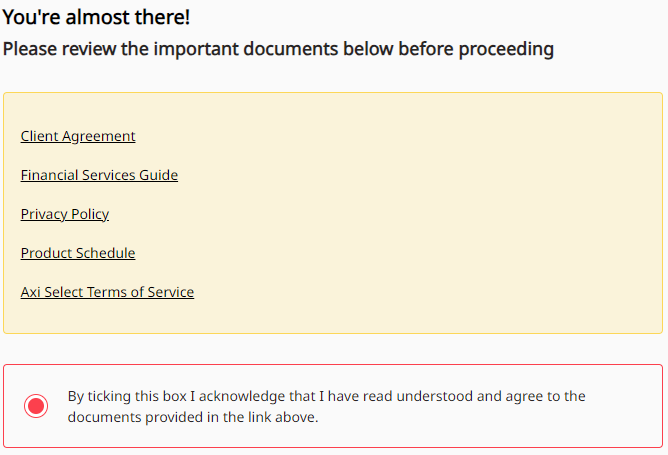

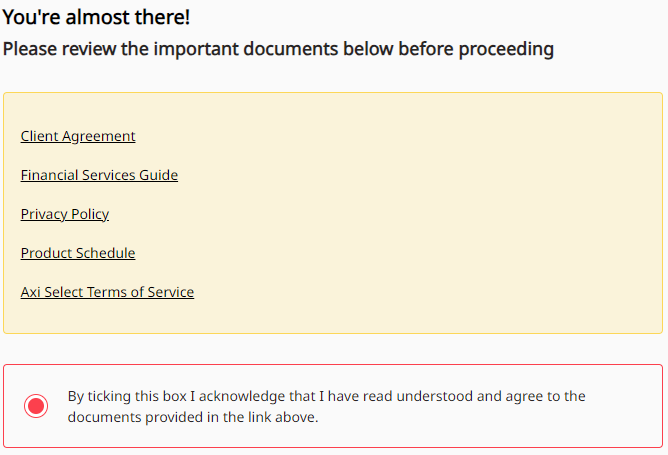

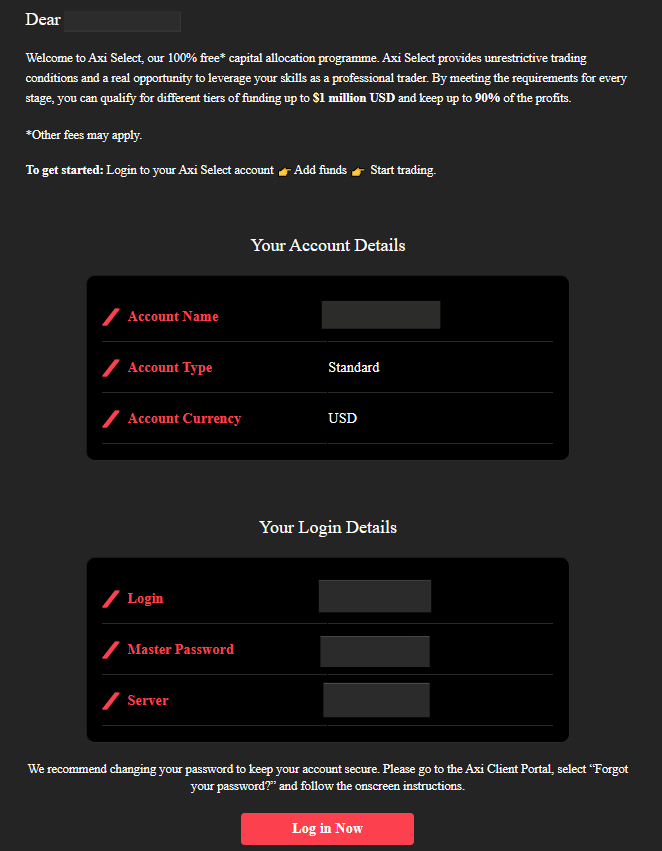

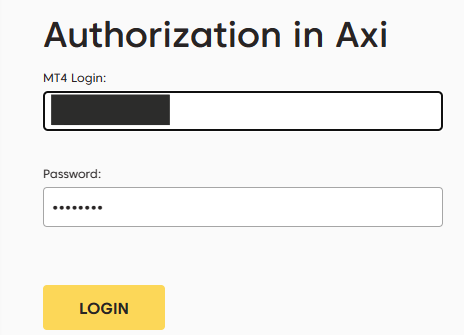

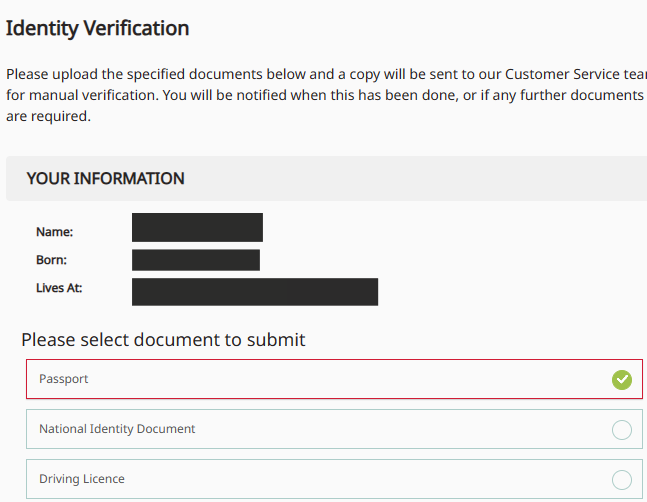

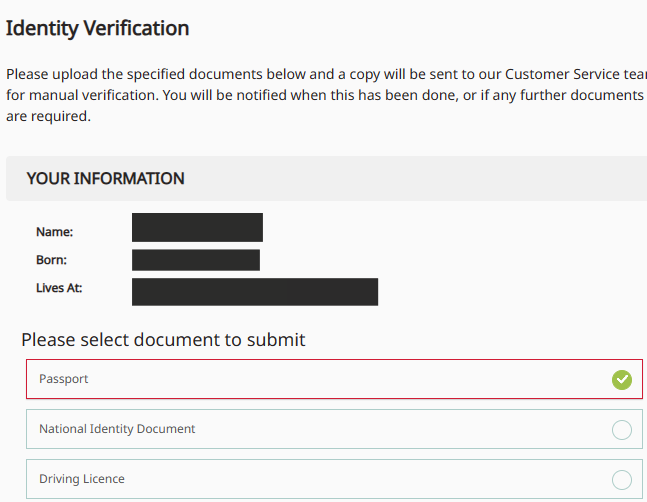

Review of the Personal Cabinet of Axi Select

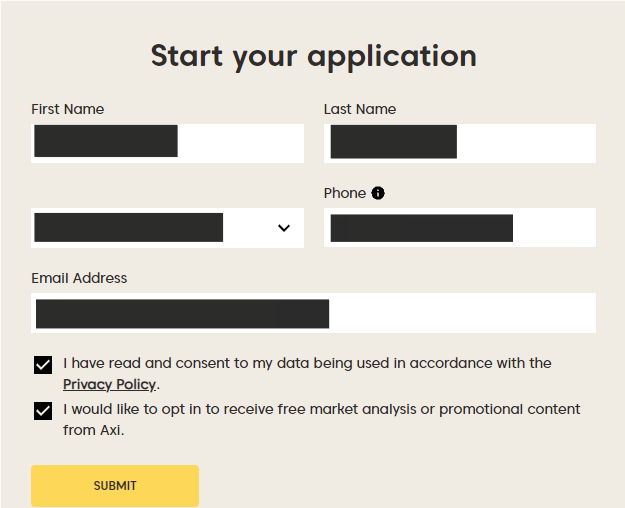

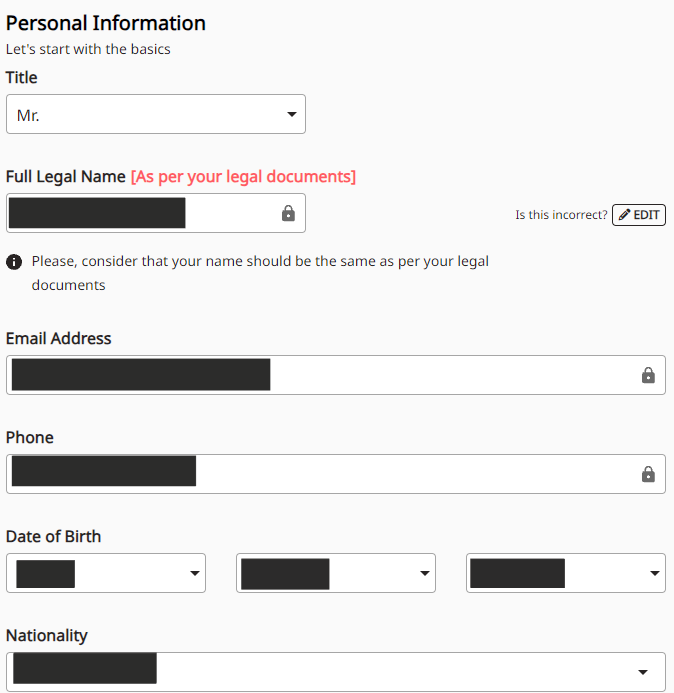

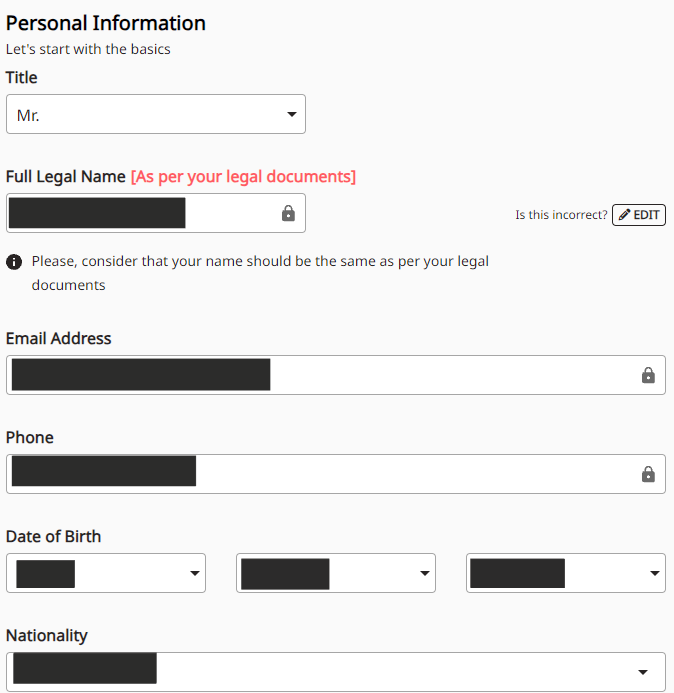

To use Axi Select’s user account, register on its official website, pass verification, open a live account, and link it to Axi Select. Also, make a deposit and install MT4. TU experts have prepared a detailed guide on all phases, and has indicated the main features of the user account.

Click the “Open Account” button in the right top corner of the Axi Select website.

Provide your first and last names, phone numbers, and email. Agree to the Privacy Policy and click the “Submit” button.

Choose the account type, base currency, and leverage. Tick the box to participate in the funding program and click the “Next” button.

Provide your title, country, residence address, date of birth, etc.

Answer several questions about your profession, income, etc.

Read important documents and agree to them.

Two emails are sent to the provided address. One of them contains a login and password to Axi Select’s user account. Click the link in the email.

Log into your user account using your registration data.

Pass verification by uploading your passport or another document that confirms your identity.

Make a deposit of $500 by any method available in your region.

Download a desktop or mobile version of MT4 or work in a browser version.

Main sections of Axi Select’s user account:

-

Trading accounts. This section provides for opening new accounts, changing their parameters, and viewing financial reports.

-

Funds. Deposits, withdrawals, internal transfers, and information about bank accounts are available in this section.

-

Tools. Here traders login to a web platform and download desktop or mobile MetaTrader 4. Also, this section provides the Axi Select block with information on the funding program and traders’ progress.

-

Help. It provides the detailed FAQ section and the ticket system. Also, it is possible to contact technical support here.

-

Verification. To get access to advanced capabilities, clients are required to pass verification.

Disclaimer:

Your capital is at risk. Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Axi Select rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Axi Select you need to go to the company's profile.

How can I leave a review about Axi Select on the Traders Union website?

To leave a review about Axi Select , you need to register on the Traders Union website.

Can I leave a comment about Axi Select if I am not a Traders Union client?

Anyone can post a comment about Axi Select in any review about the company.

Traders Union Recommends: Choose the Best!