FINMA | Financial Regulator Of Switzerland

FINMA is a government regulator of Switzerland that was established in 2007 and is controlled by the Parliament. FINMA is the country’s highest regulatory authority that controls the banking and insurance sectors, investment and management companies, brokers, and other financial entities.

Systems of financial regulators can be centralized or decentralized. In a centralized system, a financial regulator has unlimited powers to supervise and control the exchange and over-the-counter (OTC) markets, including the cryptocurrency sector. Regulatory functions can be carried out by the central bank or another entity that is accountable to the country’s government. In a decentralized system, regulation is performed by regional agencies controlled by the central bank. In a hybrid system, the main regulator may have only part of the overall regulatory powers, e.g., overseeing the non-banking sector or the OTC market only.

For a broker, holding a license means:

-

Access to the world’s exchanges and OTC markets. Access to international capital and partnership with institutional clients and liquidity providers.

-

Necessity to register with self-regulatory organizations (SROs) and compensation funds if this is required by the regulator.

-

Necessity to disclose information to the regulator and auditors.

A license gives traders more opportunities when cooperating with the broker and reasons to trust it. Unlicensed brokers cannot access the exchange market. A license means that client funds are protected through account segregation, the broker is supervised by the regulator and auditors, and clients can seek help from the regulator.

In this post, TU explores FINMA’s functions, mandate, and procedures for confirming licenses on the website and filing complaints, as well as reviews and an expert’s opinion of this regulator.

Description and functions of FINMA

FINMA is a government regulator of Switzerland that was established in 2007 and is controlled by the Parliament. FINMA is the country’s highest regulatory authority that controls the banking and insurance sectors, investment and management companies, brokers, and other financial entities. Initially, FINMA was created to counteract fraud and money laundering. Before 2007, these functions were fulfilled by several agencies that acted discordantly and therefore ineffectively. Since 2007, FINMA has had all the regulatory functions and powers.

FINMA’s mission and objectives in the Forex market:

-

Fully control commercial banks; insurance and investment companies; stock, futures, and currency exchanges; and dealer banks.

-

Assist in settling disputes between licensees and their clients.

-

Develop statutes, norms, and provisions that regulate the interaction between all market participants.

Although FINMA was created in 2007, the OTC Forex market was not regulated in Switzerland until 2009. The situation changed after the passage of the Financial Market Supervision Act (FINMASA) which obliged all Forex brokers to obtain the status of a dealer bank. In other words, all dealers in the Forex market have been required to obtain a banking license since 2009. Thus, they automatically become licensees of the Swiss National Bank which has unlimited rights to conduct scheduled and unscheduled audits.

To obtain a FINMA license, a broker has to:

-

Have a registered office in Switzerland.

-

Provide clients with all information about possible risks. This is one of the main rules, and its breach leads to a serious penalty.

-

Meet minimum capital requirements that are set individually, depending on the broker (dealer bank) category.

-

Segregate the broker’s funds from its clients’ funds. Banks with which brokers are allowed to open client accounts are determined by the National Bank.

-

Regularly report to FINMA details and/or changes in its internal organization and operations.

The regulator permits high-risk trading (binary options, cryptocurrencies, etc.) if it is transparent and clients are fully informed. If FINMA detects deception or imposed high-risk services, the firm can be canceled, fined, or blacklisted.

Official website and available information

The FINMA website has a convenient structure, but some lists are only in PDF format. This complicates searching, as you have to know which list contains the needed information and directly enter your search query there.

Overview of the website:

-

Upper main menu.

-

Information part. Latest news and archives; useful links; description of FINMA’s operation, including control tools and interaction with investment and insurance companies, brokers, banks, etc.

-

Footer. It fully repeats the upper menu with its structure and provides contact details, sitemap, abbreviations used in economic theory and practice, and more.

FINMA Review — Section of the website

FINMA Review — Section of the website

FINMA Review — Section of the website

Main menu structure:

-

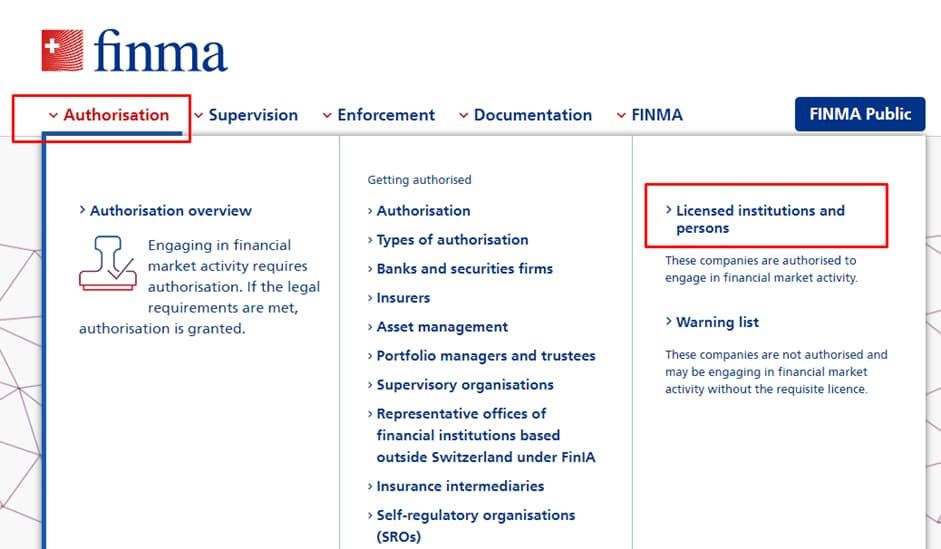

Authorization is a section for companies that are planning to obtain a FINMA license. Here you can find SROs, types of authorization, categories of licensees, and much more.

-

Supervision. Risk categories and licensee supervision principles that depend on categories of companies.

-

Enforcement. Information about successors, lists of entities that operate without a FINMA license, alerts for traders, etc.

-

Documentation. Regulatory documents, self-regulation provisions, consulting, FATF (Financial Action Task Force) statements, publications, and more.

-

FINMA. Mission and objectives, international activities, national cooperation, auditing, etc.

Potential traders primarily want to know if a broker is licensed by FINMA and how to file a complaint in case of a dispute. Actual traders are interested in the information part, warnings, publications about current investigations, and other content that can improve their financial literacy.

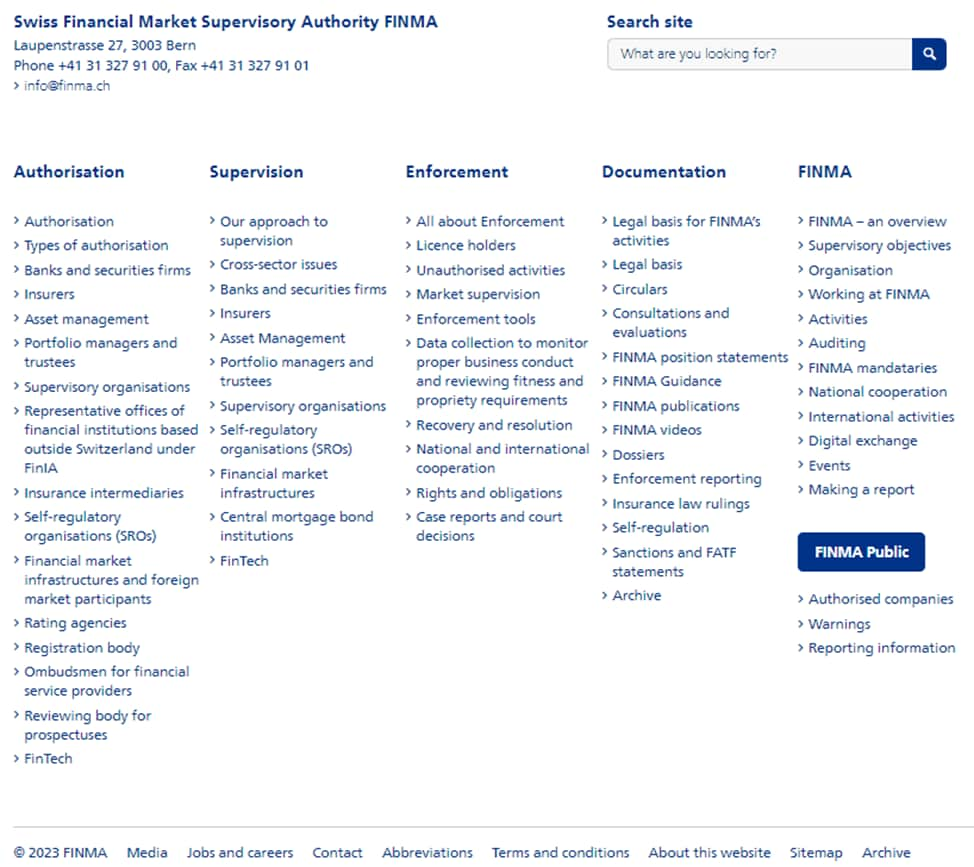

How to confirm a broker’s license on the FINMA website

FINMA works with all Swiss market participants and therefore finding information is not easy even though the Authority’s website is well-structured. The search page offers several filters, such as document type, topic, year, etc. Searching by the broker’s legal name only gives you mentions of the company in various articles, some of which can be in German or French.

FINMA Review — Section of the website

To confirm a broker’s license on the FINMA website, do the following:

-

1

Find information about active licenses on the broker’s website. It is incumbent on traders to make sure that the information provided by a broker is accurate and true. In most cases, license numbers and regulators are indicated in the footer of the broker’s website. Sometimes, they can be found in the description of the broker’s mission or structure.

-

2

On the FINMA website, go to “Authorisation” and select “Licensed institutions and persons”.

-

3

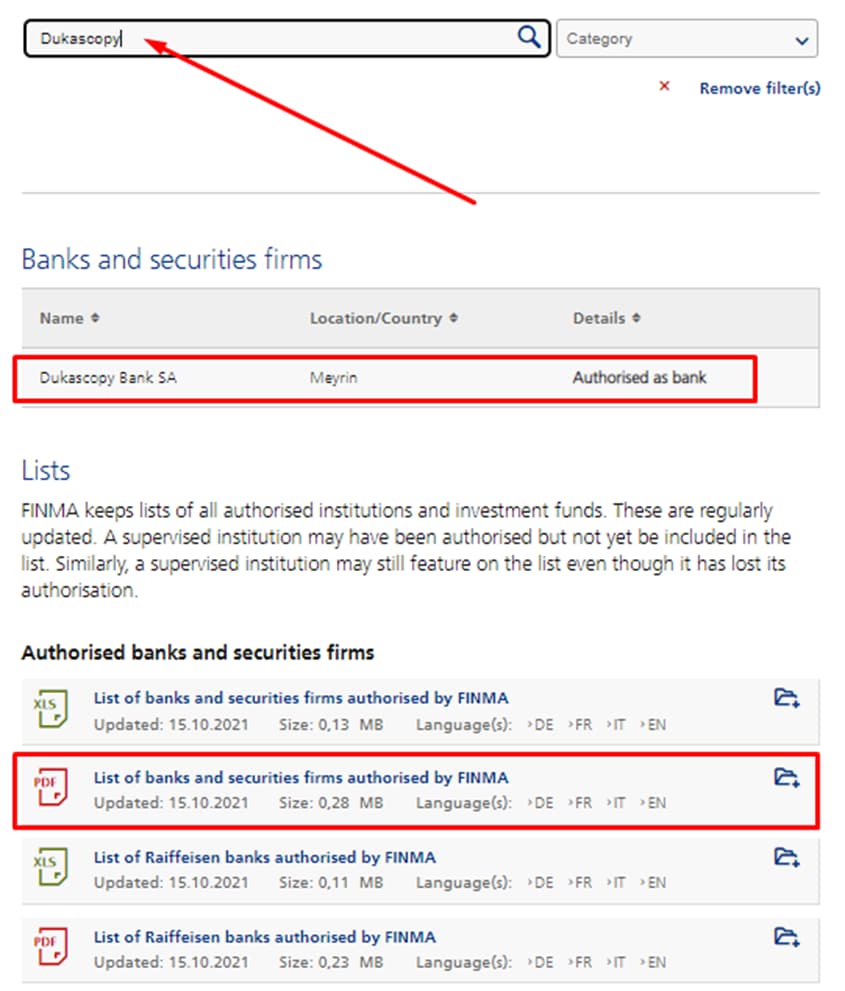

Enter the broker’s name in the search box.

FINMA Review — Section of the website

FINMA Review — Section of the website

FINMA Review — Section of the website

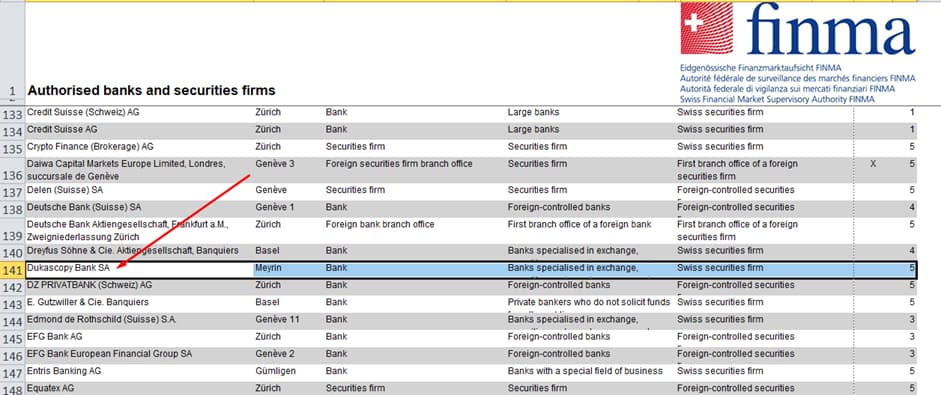

Search results include the category to which the broker belongs. Below are .pdf and .xls lists with categories of licensees and detailed information about them. In particular, Dukascopy is authorized as a bank, so look for detailed information about it in the banks section.

FINMA Review — Section of the website

The indicated category helps find types of permitted services.

FINMA’s basic requirements for brokers

Basic requirements to obtain a license:

-

Fully disclose information, including the client risk optimization policy;

-

Have an office in Switzerland;

-

Meet requirements that are set individually.

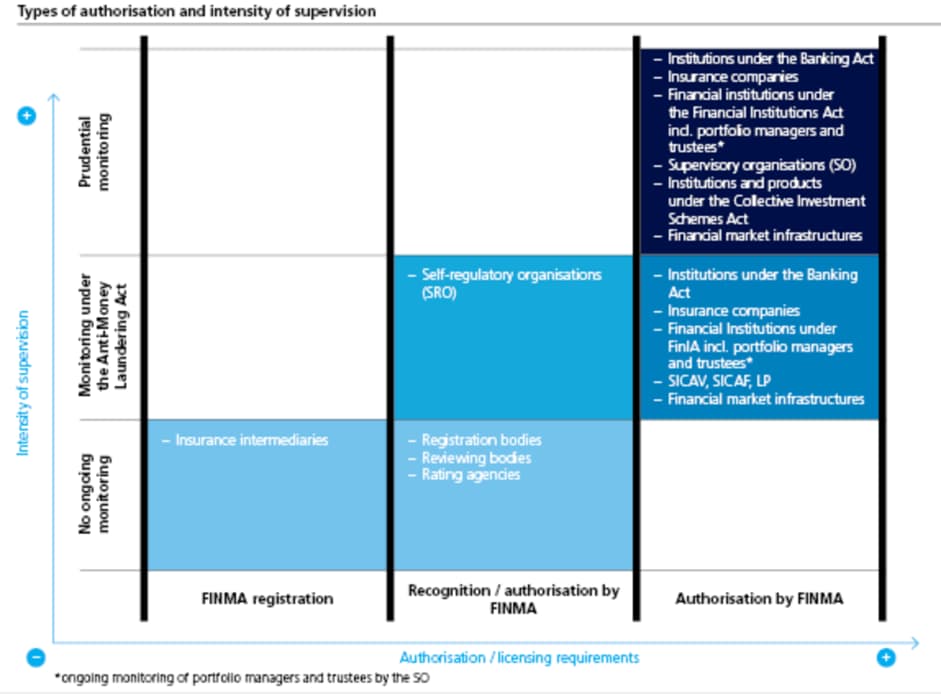

FINMA grants five types of authorization:

-

Licensing is granted to dealer banks that operate in financial markets.

-

Recognition of SROs.

-

Authorization to special registering agencies that are not controlled by FINMA, but submit annual reports to it.

-

Approval of separate financial products.

-

Registration to insurance intermediaries.

FINMA Review — Section of the website

Requirements for capital, multipliers, etc., are set by FINMA individually.

FINMA license | Pros and cons

FINMA’s mandate is practically unlimited, which is the regulator’s main advantage. The absence of bureaucracy and the right to make decisions allow FINMA to promptly and effectively respond to any violation at an early stage. The regulator supervises SROs that resolve issues with brokers, cooperates with the Swiss National Bank, and can engage international agencies in investigations.

Advantages of trading with a FINMA-licensed broker:

-

FINMA cooperates with SROs and ombudsmen that also consider trader complaints and can help to quickly settle issues at the initial stages.

-

There is a compensation fund. Every broker must obtain the dealer bank status, which means that investors’ money is held by commercial banks licensed by the Swiss National Bank. All client accounts are protected by the deposit insurance program that provides up to 100,000 CHF (Swiss franc; or about 109,000 USD) in coverage.

-

Switzerland is a country with a stable economy and strict financial regulation.

FINMA is as reputable as the SEC (U.S. Securities and Exchange Commission) and the FCA (UK Financial Conduct Authority).

Disadvantages of trading with a FINMA-licensed broker:

There are no significant disadvantages for traders. The regulator responds to complaints, does not delay their consideration, and tries to prevent brokers from misleading traders. However, the complaint filing process can be complicated. You have to know which department of FINMA to approach, in what language, etc.

FINMA’s jurisdiction

A license from FINMA is valid all over Switzerland. The Authority operates in the international legal framework and therefore its license is recognized in some countries of the EU and other regions. FINMA-licensed brokers can render services to non-residents of Switzerland, and non-residents can get compensation in case of a broker’s failure if the laws of their country are not violated. For example, some FINMA-licensed brokers don’t provide services to residents of Belgium, Russia, Israel, Canada, and the United Kingdom.

The Swiss Banking Ombudsman Foundation was established in 1992, and protects the rights of investors of companies classified as banks. In cooperation with the Swiss National Bank and ombudsmen, FINMA considers and settles claims and looks for assets for compensation.

Submission and consideration of complaints

First, FINMA recommends contacting the support service of the company with which you have an issue. In roughly half the instances, a reasoned request helps resolve the problem without engaging third parties. If the problem remains unsettled and you are sure that you are right, FINMA offers to also approach the SRO and the ombudsman. Before approaching the SRO, confirm the broker’s membership in it. The claim amount does not influence the consideration process.

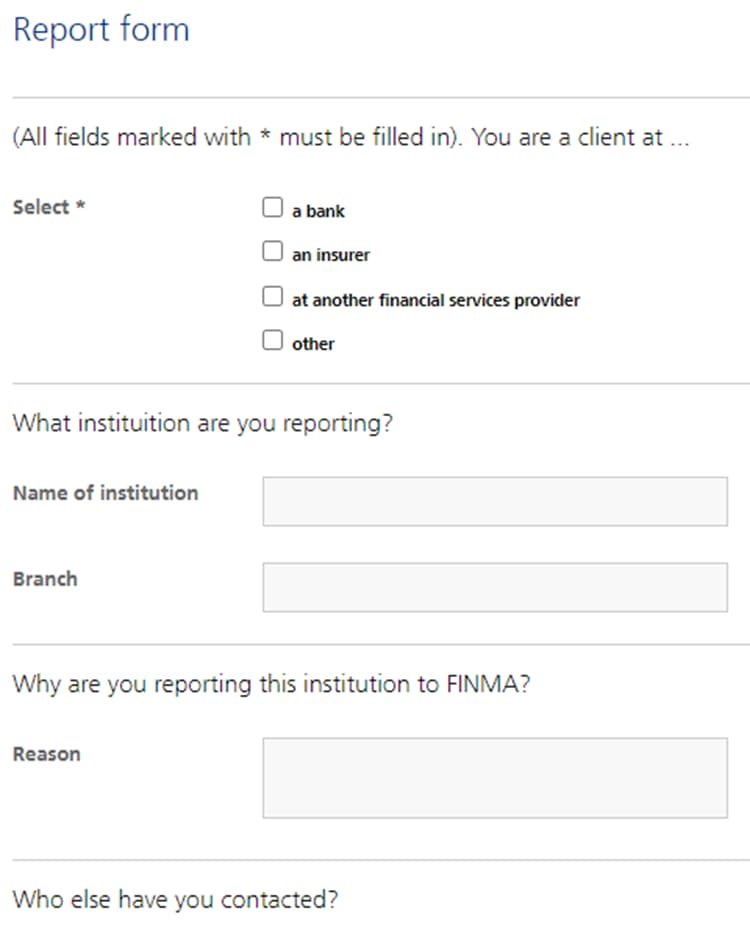

Complaint submission procedure:

-

On the FINMA website, go to “Reporting an incident”.

-

Complete the “Report form for clients of financial institutions” and attach confirming screenshots of conversations with the broker, account statements, etc.

FINMA Review — Section of the website

FINMA Review — Section of the website

FINMA considers actual complaints. It doesn’t respond to questions like “Is this company reliable?”, “Is this broker licensed?”, and so on.

FINMA-licensed brokers | How to examine a broker

This section features information about all valid licenses held by the broker, including a FINMA license. You can also find:

-

A list of the broker’s branch offices in other countries and licenses that are valid there.

-

Types of services permitted by licenses.

-

Alerts or investigations in relation to the broker if any.

All information is taken from regulators’ websites and updated on the Traders Union website every month.

Reviews of FINMA by complaining investors and traders

Vladislav, trader and manager, Moscow

In theory, a FINMA license is good for traders. It means the broker is trustworthy. But the most interesting things begin upon registration. The broker being FINMA-licensed doesn’t mean that you immediately become a client of a Swiss bank. Theoretically, the broker should open a client account with a Swiss bank and follow the segregation rule. In this case, the trader has to go through the whole process of opening a bank account for a non-resident. But practically, things are a bit different. The broker opens a client account and what comes next is individualized. That’s why my advice is:

-

Always look at with whom you are concluding an agreement.

-

Always look at the details for making a deposit.

-

Don’t count on FINMA’s help if the amount of your claim is under 1,000 USD.

A license from FINMA guarantees that the broker exists, but does not guarantee that you will get your funds back. Loopholes can always be found.

Dmitry, cryptocurrency trader, Kyiv

The cryptocurrency segment started developing in Switzerland in 2017-2018. The Swiss have their own crypto exchanges, the Crypto Valley, and products that depend on the quotes of several major cryptocurrencies. While the SEC still can’t make a decision about launching Bitcoin ETFs in the U.S., crypto derivatives are already traded on the SIX (Swiss Infrastructure and Exchange) stock exchange in Switzerland.

Konstantin, trader | Angarsk, Russia

Interestingly, FINMA is relatively lenient to binary options, which are classified as gambling in many countries. Binary options are either illegal (and therefore traders can lose all money at any moment) or require a special license and much higher contributions and taxes.

FINMA approaches this issue philosophically and permits brokers to offer even binary options. The Authority requires that companies obtain a banking license, don’t deceive clients (i.e., play the shell game fairly and warn investors about the risks in advance), and comply with the law. If a broker breaks the rules, FINMA cancels its license and puts it on the “Warning List”. I mean everyone understands that binary options have nothing to do with the real market. But if a trader wants to play, FINMA allows it. The trader just has to realize that it’s a shell game.

Alexander, trader, Moscow

I’ve been wondering why brokers need a license from such bodies as FINMA. It limits their income. A FINMA license means constant audits, more expenses on various contributions, and limits on rendering some services. As far as traders go, it doesn’t matter whether it’s FINMA or CySEC (Cyprus Securities and Exchange Commission).

Most people don’t know anything about regulation and are unlikely to file complaints. Of those who open at least 10 trades, only 3-5% stay in real trading. The other 95-97% are replaced by new beginners. Brokers attract beginners with large bonuses, affiliate programs, rebates, 1:2,000 leverage, etc. And FINMA restricts all that. Why would a broker accept unfavorable conditions? The exchange market can be accessed with a simpler license and, to offer CFDs over the counter, a CySEC license is more than enough.

Miron, trader | Belgorod, Russia

I will complement the previous comment. It depends on the broker’s goals. If it’s a classic CFD broker that uses 2-3 liquidity providers and has no access to platforms such as Integral and Currenex, let alone exchanges; and if the broker has two hundred assets, including a dozen top securities CFDs and a couple of crypto CFDs, then a CySEC license is quite sufficient. I’m talking about brokers that mostly operate online and have less than a hundred employees, more than half of whom are IT support. Their clients are traders with $50-500 deposits who don’t even know English well enough to write a complaint. They enjoy the very process of clicking buttons like in a casino.

FINMA-licensed brokers:

-

Count on working with institutional clients that trade hundreds of thousands of dollars. People with that kind of money want stability, transparency, and guarantees of the safety of their funds. What can be more reliable than a Swiss bank?

-

Operate in many countries. They are multinational companies with branch offices in Asia, Africa, and Europe.

-

Provide all types of services from trading exchange assets to consulting and trust management of investments.

FINMA is an international regulator for large corporations with a few thousand employees, not for retail brokers. They need a good international reputation, steady clients, and large money turnovers. Who would leave his money in the trust of a broker licensed by an offshore regulator that doesn’t care what its licensees do?

Consider the aforementioned Dukascopy. This is a liquidity provider and an exchange and Forex broker that offers crypto and binary options. It is also a full-fledged commercial bank that offers classic services, such as lending, deposit accounts, and online banking. It has branch offices in dozens of countries!

Expert’s assessment

FINMA is a government regulator whose mandate and leverage over licensees are similar to those of the Singaporean MAS. FINMA’s resources allow it to get almost any information about its licensees, e.g., financial statements, money turnovers, changes in the organizational structure, etc. The Authority promptly puts a stop to any attempted manipulations with assets and quotes and eliminates the possibility of using insider information in exchange markets.

Some interesting facts about FINMA:

-

FINMA is one of the most respected regulators in the international economic arena. In 2011-2013, along with the FCA, the SEC, and commissions from Japan and the EU, FINMA conducted an investigation into global-scale manipulations with LIBOR (London Interbank Offered Rate). Back then, claims were made against such banks as Barclays, HSBC (Hongkong and Shanghai Banking Corporation), UBS (Union Bank of Switzerland/Union de Banques Suisses) Royal Bank of Scotland, Lloyds, and Citigroup. The very fact that FINMA participated in the investigation into artificial manipulations with quotes that lasted 8 years testifies to the regulator’s resources and influence.

-

In 2019, FINMA assumed control of the cryptocurrency sector. Since then, a license has been mandatory for crypto exchanges, exchange offices, and startups.

Switzerland is not part of the eurozone. Although the country’s standards for economic interaction are in full compliance with international standards, Switzerland and the EU have different norms. Therefore, the main benefit of a FINMA license for brokers is access to the Swiss capital market which is known for its transparency and stability.

Conclusion

FINMA is a strict regulator that builds a transparent system of interaction in its jurisdiction. The regulator does not aim to integrate into the European Economic Area but is very active in the international arena. FINMA has its own standards and mechanisms of influence. For a trader, a FINMA license means that the broker is 100% trustworthy. For brokers, FINMA is access to one of the world’s largest financial markets, access to dozens of unique instruments, and much more.

About the author of this review

Oleg Tkachenko, author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 trading systems. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is FINMA?

FINMA is an independent financial regulator of Switzerland. It is supervised by the Parliament and is the main regulatory body alongside the National Bank. FINMA’s licensees are commercial banks, dealer banks, investment funds, insurance intermediaries, and SROs.

What do I get from trading with FINMA-licensed Forex brokers?

-

1

In case of a dispute, you can approach SROs, the ombudsman, or the regulator.

-

2

In case of a broker’s failure, you can get up to 100,000 CHF in compensation.

The FINMA license is adapted to European law but differs in some aspects. In particular, the regulator is lenient to cryptocurrencies and high-risk assets.

How to check if a broker holds a FINMA license?

There are two options:

-

1

On the FINMA website, go to “Authorisation” and select “Licensed institutions and persons”. Find the category to which the licensee belongs and open the corresponding PDF list.

-

2

Find current information about all valid licenses held by the broker on the Traders Union website.

The second option is advantageous in that you don’t have to open all sections of the FINMA website, looking for ongoing investigations or proceedings in relation to the broker. All this information is already updated on the TU website.

How to submit a complaint against a broker to FINMA?

-

1

Fill out the reporting form on the regulator’s website. Send the information to the ombudsman. If the broker is a member of an SRO, file the complaint with the SRO as well.

-

2

Register on the TU website and refer to TU’s lawyers.

Traders Union is interested in protecting its members’ rights. TU registration and membership are free of charge. Every TU member can get free legal assistance, which is the most effective in the early stages of the settlement of issues.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.