How do Hardware Wallets Work?

-

Hardware crypto wallets are physical devices ensuring high security.

-

They store private keys offline, protecting against online threats.

-

Support multiple cryptocurrencies, are user-friendly, and portable.

-

Initial cost and risk of physical loss are potential downsides.

-

Set up involves choosing, buying, and securely initializing the wallet.

-

Safety tips include regular updates, secure backups, and careful transaction verification.

In crypto investing, the security and management of assets are paramount. This is where crypto hardware wallets come into play, emerging as a crucial tool for anyone involved in the realm of digital currencies. But what exactly is a crypto hardware wallet, and why is it becoming an indispensable asset for crypto traders and investors?

At its core, a crypto hardware wallet is a physical device designed to offer enhanced security for managing digital currencies. This article will explore what hardware wallets are and how they work in more detail.

Start trading cryptocurrencies with ByBit-

Why use a crypto wallet instead of an exchange?

Crypto wallets offer enhanced security for your assets, as exchanges can be more vulnerable to online threats and hacking.

How do Crypto Hardware Wallets Work?

Crypto wallets come in two main types:

-

Hardware wallets

-

Software wallets

Hardware wallets, like Ledger or Trezor, are physical devices that securely store the user's private keys offline. On the other hand, software wallets are applications or programs that reside on your computer or mobile device, offering convenience but often at the cost of lower security.

Hardware crypto wallets.

Bitcoinmagazine.com

Hardware crypto wallets stand out due to their robust security features. They are designed to be immune to computer viruses and are often equipped with strong encryption to protect against hacking attempts. The wallets require physical confirmation on the device itself for any transaction, adding an extra layer of security.

Moreover, these wallets can support multiple cryptocurrencies, making them a versatile tool for traders and investors dealing with diverse digital assets.

Consider the Ledger Nano X as an example, a popular hardware wallet known for its sleek design and robust security features. It resembles a USB drive and connects to your computer or smartphone via USB or Bluetooth. This wallet supports over 1,000 cryptocurrencies and has a built-in OLED screen to double-check and confirm each transaction with a single tap on its side buttons.

Ledger Hardware crypto wallets.

Ledger.com

The core functionality of hardware wallets revolves around the concept of private and public keys. The private key, stored securely within the hardware wallet, is what you use to access and control your funds. This key should never be shared or exposed online.

The public key, akin to a bank account number, is what you share with others to receive funds. The seamless interplay between these keys allows for secure transactions while keeping your assets safe from unauthorized access.

Best crypto exchanges

How to Use a Hardware Wallet?

There are essentially 3 main use cases for hardware crypto wallets:

-

Sending Crypto

To send crypto, connect your hardware wallet to a device with Internet, such as a computer. Use the wallet's application to select the cryptocurrency, enter the recipient's address, and enter the amount. Confirm the transaction physically on the wallet, ensuring security even if your computer is compromised. -

Receiving Crypto

To receive crypto, use the wallet's app to get your public address, displayed as a QR code or a string of characters. Share this with the sender. Your private key remains secure within the wallet during this process. -

Storing Crypto

Hardware wallets are ideal for storing cryptocurrencies safely. Transfer your assets to the wallet for offline storage, protecting them from online threats. The wallet's encryption ensures your private keys are never exposed.

Using a hardware wallet is a secure and efficient way to handle cryptocurrencies, which is crucial for safeguarding your digital assets.

👍 Pros of Crypto Hardware Wallets

• Safety: The foremost advantage of hardware wallets is their unparalleled safety. By storing private keys offline, they are immune to online hacking attacks, phishing scams, and malware. Transactions require physical confirmation on the device, adding an extra layer of security against unauthorized access.

• Easy to Use: Despite their sophisticated security features, hardware wallets are user-friendly. They often come with intuitive interfaces and simple instructions, making it easy even for beginners to navigate the processes of sending, receiving, and storing cryptocurrencies.

• Support for Many Coins: Most hardware wallets are designed to support a wide array of cryptocurrencies, from popular ones like Bitcoin and Ethereum to various altcoins and tokens. This versatility makes them a one-stop solution for managing a diverse portfolio.

• Durability: Unlike software wallets that depend on the health of your computing device, hardware wallets are robust and less susceptible to damage. They are often built to withstand physical wear and tear, offering a long-term storage solution.

• Portability: Hardware wallets are typically small and easy to carry, resembling a USB drive. This portability allows users to manage their crypto assets on-the-go, ensuring continuous access to their funds.

👎 Cons of Crypto Hardware Wallets

• Price: One of the primary drawbacks of hardware wallets is their cost. Unlike software wallets, which are usually free, hardware wallets come with a price tag. This initial investment may be a deterrent for casual or small-scale investors.

• Risk of Loss or Theft: While hardware wallets are secure against online threats, they are physical objects that can be lost or stolen. If not stored securely, there is a risk of physical theft, which could lead to the loss of funds if proper backup measures are not in place.

• Learning Curve: For those new to cryptocurrency, the initial setup and understanding of how hardware wallets work can be daunting. The need to understand the concept of private and public keys, along with the wallet's functionalities, might overwhelm beginners.

• Dependence on Physical Device: Being a physical device, a hardware wallet's functionality can be hindered by damage or technical malfunctions. Also, in scenarios where the wallet is not readily accessible, immediate transactions cannot be made.

• Limited Transactions Without Connectivity: To execute transactions, hardware wallets must be connected to a device with internet access. This requirement can be limiting for users without immediate access to a computer or smartphone with the necessary interfaces.

How to Set Up a Crypto Hardware Wallet

Setting up a hardware wallet involves a series of straightforward steps. Here’s a guide to help you get started:

-

Choose the Right Wallet: Begin by researching and selecting a hardware wallet that suits your needs. Consider factors like supported cryptocurrencies, security features, price, and user reviews. Popular options include Ledger Nano S, Ledger Nano X, and Trezor.

-

Purchase the Wallet: Once you've chosen a wallet, purchase it from a reputable source. It's crucial to buy directly from the manufacturer or authorized dealer to avoid the risk of tampered devices.

-

Unbox and Verify: After receiving your wallet, unbox it and check for signs of tampering. Most wallets come with a seal that indicates if the package has been opened previously.

-

Install Software: Download and install the wallet's software from the official website. This software will interface with your hardware wallet and allow you to manage your crypto assets.

-

Initialize the Wallet: Connect the wallet to your computer or smartphone and follow the instructions to set it up. This will include creating a new wallet and generating a recovery phrase.

-

Secure Your Recovery Phrase: The wallet will generate a unique recovery phrase, usually 12-24 words long. Write this down and store it in a secure location. This phrase is critical for recovering your assets if the wallet is lost or damaged.

-

Create a Strong PIN: Set a strong PIN for your wallet. This PIN is required every time you access the wallet, adding an additional layer of security.

-

Transfer Crypto to Your Wallet: Once your wallet is set up, you can start transferring cryptocurrencies into it. To receive funds from exchanges or other wallets, use the public address that your wallet generates.

By following these steps, you can ensure that your hardware wallet is set up correctly and your digital assets are securely managed.

Hardware Crypto Wallets Examples

Ledger

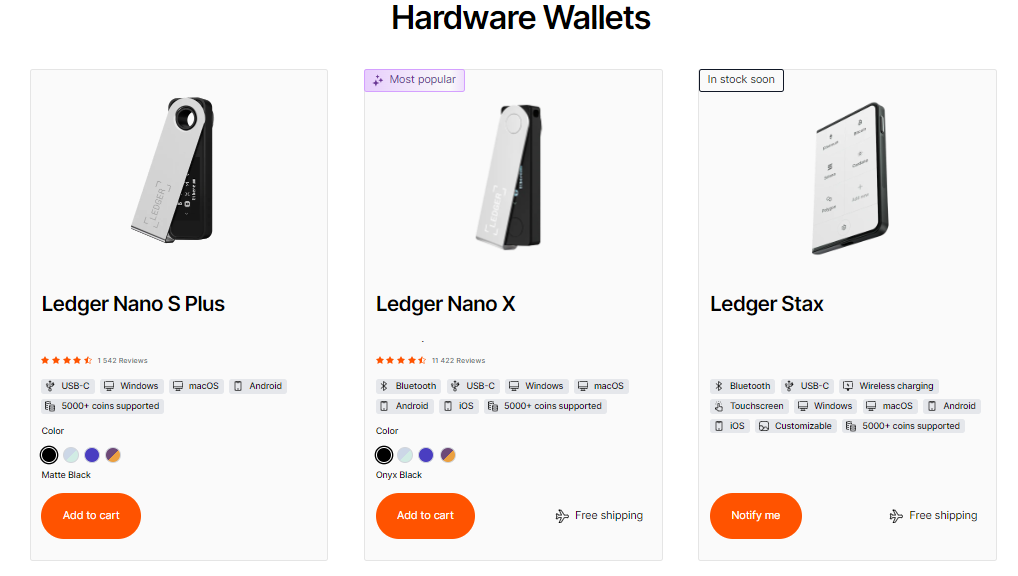

The Ledger Wallet exchange is a comprehensive platform tailored for cryptocurrency trading and storage. It encompasses a multifaceted portal featuring the Ledger Live application across various platforms, alongside two hardware wallet options—Ledger Nano X and Ledger Nano S. Trading on the exchange mandates the use of hardware wallets, which are synchronized with an application installable on PCs or smartphones.

The exchange platform offers trading contracts for 27 cryptocurrencies and 1,500 tokens, providing extensive options for users. Prominent cryptocurrencies available for trading include Bitcoin, Ethereum, Litecoin, Ripple, and BitcoinCash. Cryptocurrency holdings can be stored within the Ledger Wallet app or alternatively in a third-party wallet.

The Ledger hardware wallets have several security features to ensure your crypto is safe.The most basic of these features is the wallets' inherent design.

They are a separate storage space that is completely isolated from the rest of your computer. It means no malware or viruses can access sensitive data, like passwords and private keys for cryptocurrencies.

Trezor

The Trezor Wallet stands out as one of the leading hardware wallets for cryptocurrencies, with many users purchasing it primarily to gain access to the exclusive Trezor exchange.

The exchange boasts trading support for over 1,000 cryptocurrencies and tokens, including Bitcoin, Ethereum, Litecoin, Ripple, etc . Opting for the Premium package, which includes the Trezor Model T wallet model, grants access to several hundred more assets. The Model T features a color touchscreen, SD card compatibility, and direct connectivity to mobile devices.

Security is paramount with Trezor Wallet, safeguarded by the company's proprietary software, regularly updated and refined. Users benefit from multi-layered protection including a PIN code, passphrase, and cloud access recovery, ensuring secure access even in the event of device loss.

A notable aspect of the platform is the absence of commissions for deposits and withdrawals. Instead, users only incur short-term transaction fees necessary for including transactions in miners' blockchains. With the option to select from four commission levels, users have control over transaction processing speed, with higher commissions ensuring instant processing.

Tips for Maintaining the Safety of Your Crypto Wallet

Maximizing the security of your crypto wallet is essential. Here are some useful tips for safeguarding your digital assets:

-

Update Software Regularly: Always keep your wallet's software and firmware up-to-date.

-

Strong, Unique Passwords: Use robust and distinct passwords for related accounts.

-

Secure Your Recovery Phrase: Write down your recovery phrase and store it in multiple, secure offline locations.

-

Enable Two-Factor Authentication: Apply 2FA to associated accounts for an additional security layer.

-

Beware of Phishing: Stay alert to suspicious emails or messages pretending to be from wallet services.

-

Regular Backups: Backup your wallet frequently, especially after transactions.

-

Secure Internet Connection: Avoid public Wi-Fi when accessing your wallet; use a private connection.

-

Physical Safety for Hardware Wallets: Store hardware wallets in a safe, hidden place.

-

Stay Informed: Keep up-to-date with the latest in cryptocurrency security.

-

Verify Recipient Addresses: Always double-check addresses before sending crypto.

-

Trusted Networks and Devices Only: Access your wallet through secure, personal devices and networks.

-

Consider Multi-Signature Wallets: For substantial funds, a multi-signature wallet offers extra security.

Conclusion

The advent of hardware crypto wallets has revolutionized the way we store and manage digital currencies, blending high-end security with user-friendly interfaces. While they present a reliable shield against online threats, understanding their operation, setup, and maintenance is key to maximizing their benefits.

Carefully selecting, setting up, and maintaining your hardware wallet allows you to securely navigate the dynamic world of cryptocurrencies. Remember, the safety of your digital assets lies not just in the technology you use but also in the diligence with which you manage it.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Ethereum

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.