Top 7 Best Trading Apps in Singapore (2024)

Best Trading Apps in Singapore - Tickmill

Top Trading Apps in Singapore:

Tickmill - Best Mobile Charting

IC Markets - Low Spread Forex Trading

IG Markets - Best CFD Trading Experience

Interactive Brokers - Best for Stock Trading

AvaTrade - Best For Beginners

CMC Markets - Best Analytical tools

Plus500 - Low Trading Costs

Many trading apps are regulated by the Singaporean regulatory body or allow users from Singapore. However, these trading apps have different use cases. This article examines the different trading apps according to their core features.

-

Can I start trading with $100?

Yes, most of the brokers have a minimum deposit requirement below $100.

-

Can I open a trading account with SGD?

Yes, you can find a lot of brokers that have such option.

-

Can I access international markets through these platforms?

Yes, these platforms provide access to multiple international markets and trading instruments.

-

Which trading platform has the lowest fees and commissions?

Most brokers offer competitive pricing. Tickmill, IC Markets and Interactive Brokers are often cited as having among the lowest trading fees and commissions in Singapore.

Top 7 Trading Apps in Singapore

Here is a list of seven trading apps ranked according to their core features.

Best trading Apps 2024

| App | Best For |

|---|---|

Best Mobile Charting |

|

Low Spread Forex Trading |

|

Best CFD Trading Experience |

|

Best for Stock Trading |

|

Best For Beginners |

|

Best Analytical tools |

|

Low Trading Costs |

Best Forex Trading Apps In Singapore Comparison 2024

This table compares the seven trading apps according to certain relevant features.

| Broker | Trading App | Minimum Deposit | Local Regulation | Copy-trading (yes/no) | Max Leverage | SGD Account | |

|---|---|---|---|---|---|---|---|

Tickmill app |

$100 |

No |

Yes |

30:1 |

No |

||

IC Markets mobile |

$200 |

No |

Yes |

30:1 |

Yes |

||

IBKR Mobile |

$0 |

Yes |

No |

1:50 |

Yes |

||

IG Trading |

$0 |

Yes |

Yes |

30:1 |

Yes |

||

AvaTradeGO, AvaOptions |

$100 |

No |

Yes |

30:1 |

No |

||

CMC Markets mobile |

$0 |

Yes |

Yes |

30:1 |

Yes |

||

Plus500 mobile |

$100 |

Yes |

No |

30:1 |

Yes |

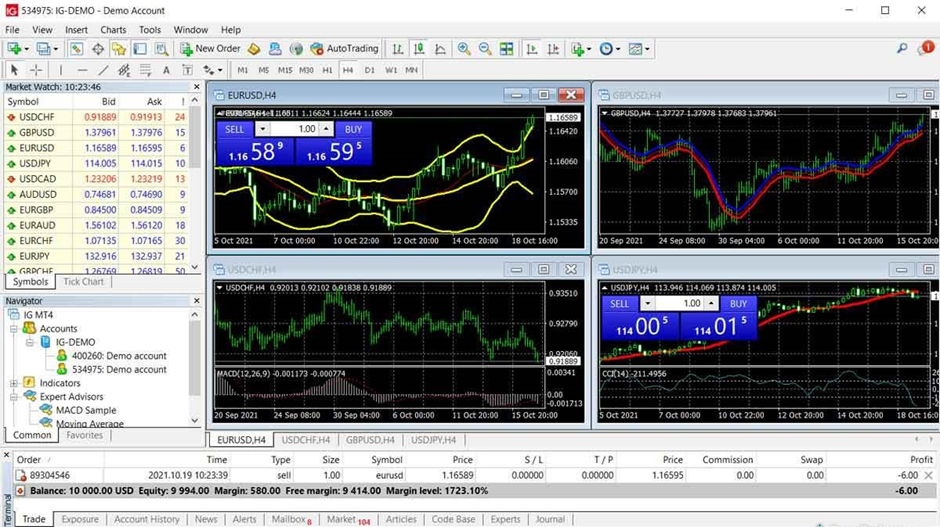

Tickmill - Best Mobile Charting

Tickmill trading app

Launched in 2014, Tickmill is an average risk broker regulated by a tier-1 regulator, Financial Conduct Authority (FCA). The broker offers 85 tradable symbols covering CFDs on indices, currency pairs, bonds, cryptocurrencies, and metals. Also, there are 62 symbols for options trading and futures, which can be accessed through a different account.

Tickmill offers three types of accounts, the Classic, the Pro, and the VIP account. The broker is ideal for active and VIP traders who have access to fees among the lowest charged by brokers in the industry. The classic account of Tickmill is commission-free which means traders only pay the bid/ask spread. Typically, the average spread on the classic account is much higher than Tickmills other account types.

Tickmill has two apps, its mobile app for account management, which does not support trading. Also, the Tickmill has the iOS and Android versions of the MetaTrader 4 and 5 app.

Tickmill has good charting tools and 31 technical indicators, which you can find on the MT4 and MT5 trading platforms. This charting feature is the most popular feature of Tickmill.

IC Markets - Low Spread Forex Trading

IC Markets trading app

IC Markets is a trading platform launched in 2007 with its headquarters in Australia. The broker is regulated by the Australian Securities and Investments Commission (ASIC) and two other regulatory bodies. Most traders prefer IC Markets because of their low forex fees. Opening an account with IC Markets is easy and fast, with free and user-friendly deposit and withdrawal processes. The minimum deposit for IC Markets is $200, and there are no charges for account inactivity.

The IC Markets trading platform has good features like the charting tools, which provide 31 technical indicators and a range of other technical tools, including the Fibonacci retracement and trendlines.

The IC Market news feed is called Market Buzz. It is a feature that offers sentiment indicators and market analytics. The education and research services offered by IC Markets are some of the best in the industry.

IC Markets mobile app is better than the industry average with good search functions, different order types, a variety of order terms and expiry, and the app supports many languages.

IG Markets - Best CFD Trading Experience

IG Markets trading app

IG Markets is a safe broker that was launched in 1974 and is regulated by the Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Commodity Futures Trading Commission (CFTC), and three other regulators.

IG Markets offers over 19,000 tradeable instruments and is widely preferable for its CFDs offerings. On IG Markets, cryptocurrency trading is possible through CFDs only.

The broker’s apps are among the best in the market as it comes with plenty of features for both new and professional traders. Also, IG has two trading apps, a MetaTrader 4 app and its app, IG Trading or IG Forex. Also, the broker has an app for education, IG Academy, and another app for account security, IG Access. The IG Trading app is well designed and has features like advanced charts, sentiment readings, and alerts. The research provides signals from PIA First and Autochartist. Also, you can find news headlines from Reuters on the research.

One of the outstanding features of IG markets is that it supports DailyFX. This news website provides traders with various tools and news content. Also, there is an IG community, which is a merge between a social network and an advanced forum with over 60,000 users. And although the content is crowdsourced, it is as valuable considering the research articles are handpicked.

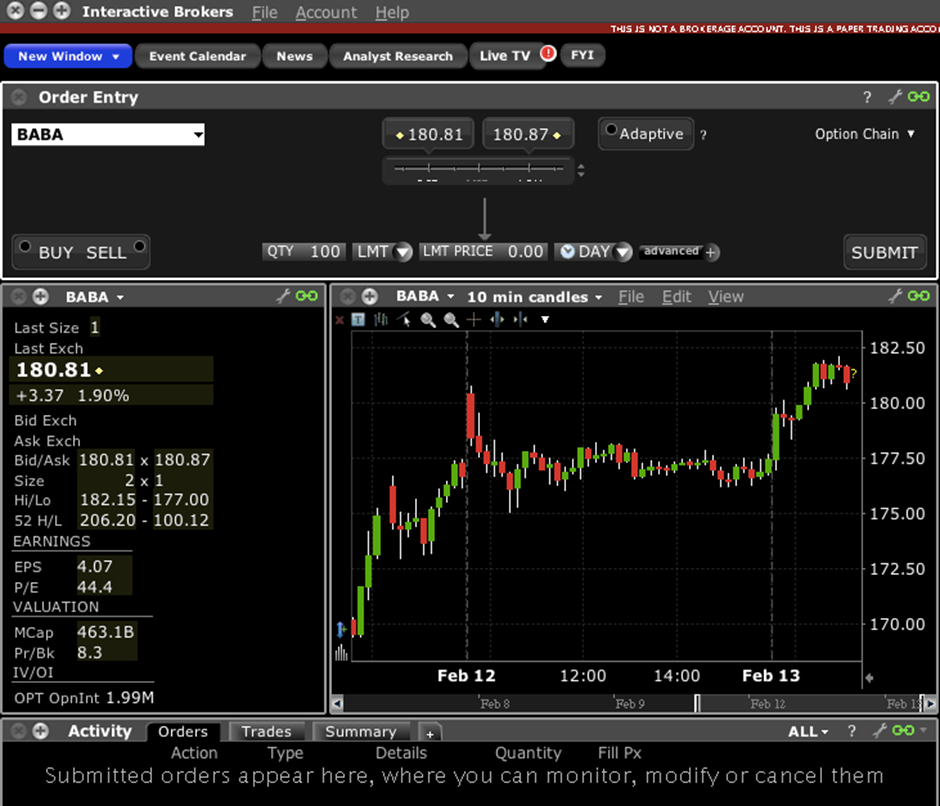

Interactive Brokers (IBKR Mobile) - Best for Stock Trading

Interactive Brokers trading app

Interactive Brokers is a safe brokerage firm that Singapore traders prefer for its many advantages. The company was founded in 1978. Its primary focus has been on low costs, superior trade execution, and broad market access. The broker is regulated by the Monetary Authority of Singapore (MAS), the Japanese Financial Services Authority (JFSA), and four other tier-1 regulators.

On Interactive brokers, traders can trade funds on over 130 markets, options, forex, stocks, futures, and bonds from a single integrated account.

Interactive Brokers is widely known for its low fees for international stocks, especially US Stocks. The broker charges $0 per trade, and it does not have a minimum account opening balance, which means you can start with $0.

Another reason traders use interactive brokers is that they have two platforms

On the IBKR Lite platform, traders are entitled to unlimited free exchange-traded funds and trades and stocks listed on US exchanges. Also, with a Lite account, you can trade in other investments on 135 exchanges in 33 countries, although the trading costs will be the same as what the IBKR pro traders pay.

They also have IBKR Pro, which is for professional and experienced traders. The IBKR Pro for professional traders has a broker per-share pricing of $0.005 per share, for a minimum of $1. The IBKR Pro also has an advanced trading platform, low margin rates, and a wide range of tradable securities, including foreign stocks.

Interactive Brokers has a mobile app, IBKR mobile, where the workflow is much more fluid and offers the same research capabilities like options strategy tools, screeners, and client portal.

The IBKR app is distinguished by the high speed of execution of transactions, the wide range of trading assets, and its reliability.

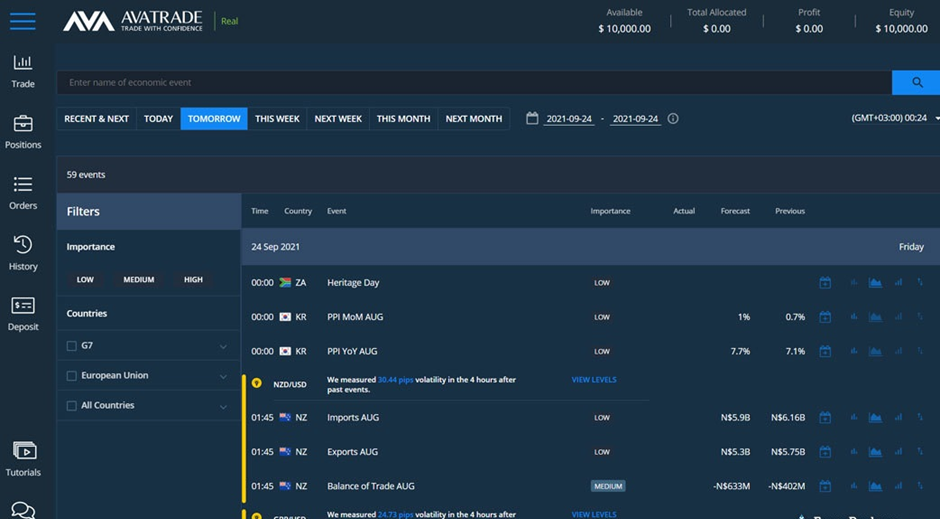

AvaTrade - Best For Beginners

AvaTrade trading app

AvaTrade is a safe broker launched in 2006 and headquartered in Dublin, Ireland. The broker is regulated by Canada's Investment Industry Regulatory Organization (IIROC) and two other tier-1 regulators. AvaTrade has 1260 tradeable symbols and 55 forex pairs.

The minimum deposit for AvaTrade is $100, and it is considered the best trading app for beginners, mostly for its offerings.

The broker has its proprietary trading apps, which provide a satisfactory trading experience. Avatrade offers three apps: AvaTradeGO, AvaOptions, and the full MetaTrader suite (MT4 and MT5) for both Android and iOS devices.

The AvaTradeGo app is similar to the web platform, and it provides an impressive default set of syncing watch lists. The app also offers AvaProtect, a feature that allows a trader to reduce the risk on an open trade for an additional cost. There are 93 indicators on the charts in the AvaTradeGo app.

AvaTrade offers a robust copy trading feature that is competitive with the industry’s best.

AvaTrade provides features like Analyst Views, Economic Calendar, Featured Idea Tools, and Market Buzz alongside its daily market analysis articles and daily market video updates.

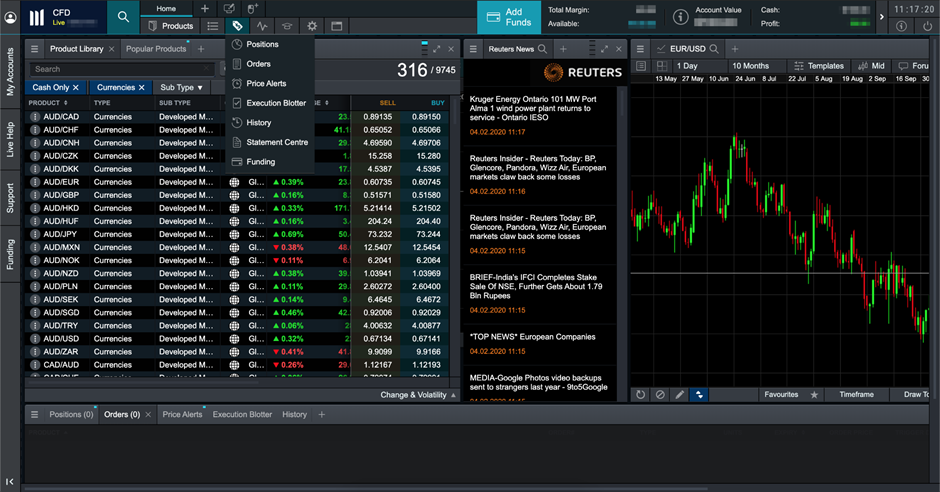

CMC Markets - Best Analytical tools

CMC Markets trading app

CMC Markets is a trusted broker launched in 1989 and is regulated by the Monetary Authority Singapore (MAS), Financial Conduct Authority (FCA), and two other tier-1 regulators.

CMC Markets has a wide range of offerings, including 12,000 CFDs, 158 currency pairs that can also be quoted inversely, which brings the total number to 316 available pairs. The broker is cost-conscious as it offers low spreads accessible to all account types and customer segments.

The minimum deposit required by CMC Markets is $0. CMC Markets has a well-designed mobile app with up-to-date features like integrated news, educational content, predefined watchlists, powerful charts, a variety of research tools, and many more.

The features available on the CMC Markets mobile app are the charts, and these have 86 technical indicators. However, only 29 of the indicators are available. Also, research resources like Price Mover categories, Morning Call, Evening Call, Intraday Update, and many other themes are available. Other research materials are webinars, educational content, CMC TV, and over 20 videos that teach trading strategies. Also, users can subscribe to an event in CMC Markets economic calendar and get notified when it's time for the event or news release.

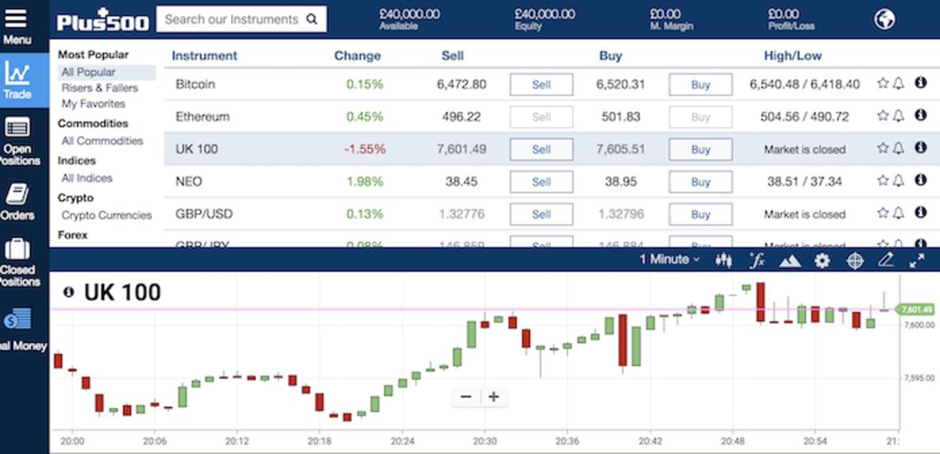

Plus500 – Low Trading Costs

Plus500 trading app

Plus500 is a safe broker regulated by the Monetary Authority of Singapore (MAS), the Financial Conduct Authority (FCA), and another tier-1 regulator. The broker was founded in 2008 in Israel and gives traders access to more than 2,000 CFDs.

The minimum deposit on Plus500 is $100, and there is no withdrawal fee. The broker offers two account types: a retail account and a professional account. However, the professional account is an exclusive account that is only accessible when a trader has traded sufficiently in 12 consecutive months. Also, the professional account is only available to traders with a portfolio over $500,000. Finally, the trader should have relevant experience in the financial services sector.

Plus500 has a mobile trading platform with similar features as the web platform. The app is available for iOS, Android, and Windows devices. The mobile trading platform offers 109 indicators and 20 drawing tools. Generally, Plus500 is preferred for its low trading costs.

Learn about best apps to trade ForexWhat to look for in the best trading app

Real-time Updates

One of the essential features to consider is if your app gives real-time updates. This is because the value of a currency or an asset can change in a second, and you'll need up-to-date information to make good trades. This is particularly problematic on mobile apps that don't have as much processing power as desktop computers. The apps can crash or lag during a trade. To be safe, do some tests on the app before you decide.

Advanced Analytics

With advanced analytics, you can discover the best trades to make, either through purchasing, selling, or shorting. These advanced features can send alerts when certain currencies or assets reach a particular price. Through historical data and software-based notifications, you can make informed trades.

Trading Research and Education Resources

The forex market is constantly changing. To stay on top of things, you need proper education. The best forex apps by industry standards and user reviews offer precise information on the technical part of trading and international updates on news and trends. This goes a long way in helping traders make informed predictions of which assets will rise or fall in value.

Functional for Experts and Beginners

The best forex apps are convenient for both the expert and the novice. As a beginner, using the right app will help you find your footing as you invest and speed up the learning process. As an experienced investor, you'd prefer an app that focuses more on the customer. That is why you should find an app that caters to new and professional traders.

Minimal Spreads

Spread is the difference between the asking price and the bid of a currency. It is essential to know the commission your broker charges to carry out your trade. It is common to see most high-frequency traders lose a large percentage of their earnings through fees and commissions. That is why you should search for a broker with fair fees, as this will minimize potential losses during trading. Paying for spreads and commissions is natural in trading, but you should endeavor not to overpay in the short-term and long term.

How to Choose a Trading App in Singapore?

1. Learn regulation and reliability:

There are many trading apps globally, and with the high number, comes the risk of using one without the proper regulation or license. When you use a trading app without the appropriate regulation, you may end up losing your funds. Usually, it's preferable to use a broker regulated by the Monetary Authority of Singapore (MAS), a local regulator, or use any other trading app regulated by an internationally recognized regulator. Also, your preferred trading app should be reliable at all times. You should be able to access your funds and the app's features whenever the need arises.

2. Research Trading assets

It's essential to know the assets offered by your broker because without certain assets, you cannot trade, and that would mean you have to go through the process of finding a new broker. So, depending on your interest, you should ensure your preferred broker has all the tradable assets you would need. These assets are cash, cash equivalents, real estate, cryptocurrency, gold, bonds, stocks, commodities, forex, and derivatives.

3. Explore App's Features

Before you decide on a trading app, you should find out the app's features and compare them to the industry's standards. This is because the difference between a profitable and non-profitable trader sometimes lies in the trading app used. One of these features is the execution speed; without a fast degree of trade execution, you could lose money. Another notable feature is the analytical tools provided by the app, which is vital because professional traders need quality analysis to make profitable trades. Finally, you also need to look out for the charting feature and ensure your preferred app supports it.

4. Try demo

Some trading apps come with a demo account for new traders to practice with, and your trading app must have a demo account, especially as a beginner trader. Without the demo account, you will practice with live funds, which increases your risk of making losses.

5. Open an account

The last step is to open an account. This requires that you know the minimum opening balance supported by your broker and the fees associated with the different types of accounts. To begin trading, you have to open an account and make a deposit when it is required.

Best Forex Trading Apps For Beginners in Singapore

As a beginner, the best trading app for you has excellent copy trading capabilities and efficient educational materials. This is because you will be trying to learn as much as possible in a little time. You can limit your risk and depend on other professional traders with copy trading. The trading apps that fit this description are Interactive Brokers and AvaTrade.

Rules and Regulation

Licensing in Singapore

Forex trading in Singapore is overseen and regulated by the Monetary Authority of Singapore (MAS), the country's central bank and financial regulatory authority. The MAS plays a crucial role in maintaining the stability and integrity of the financial system, including the Forex market. Through comprehensive regulatory frameworks and ongoing supervision, the MAS aims to ensure that Forex trading activities in Singapore adhere to high standards of professionalism, transparency, and ethical conduct.

Investor protection in Singapore

The regulatory framework established by the MAS in Singapore prioritizes investor protection by fostering transparency, accountability, and fair practices within the Forex market. By enforcing regulations that govern broker-dealer relationships, trade execution, and financial disclosure, the MAS aims to safeguard the interests of investors and promote confidence in the integrity of the financial markets. Additionally, the MAS offers investor education initiatives to empower individuals with the knowledge and skills needed to make informed investment decisions.

Taxation in Singapore

One of the key attractions of Forex trading in Singapore is the absence of capital gains tax on profits derived from trading activities. This favorable tax treatment makes Singapore a highly attractive destination for Forex traders seeking to maximize their returns. However, it is essential for traders to be aware of other taxes that may apply to their trading activities, such as income tax or Goods and Services Tax (GST). By understanding the tax implications of their trading endeavors, traders can ensure compliance with Singapore's tax laws and optimize their financial outcomes.

Tips For Successfully Using Trading Apps in Singapore

Trading apps have revolutionized the financial world by making trading accessible to all, right at their fingertips. Navigating this world of instant access and constant market changes, however, requires specific strategies. Here are some tips for successful stock trading using apps in Singapore:

Implement a Sound Trading Strategy

Every successful trader has a plan, and with the number of trading apps available in Singapore, finding one that fits your strategy is easier than ever. A well-planned trading strategy is fundamental for consistent returns. Most apps offer technical analysis tools, real-time charts, and other advanced features, helping you form and implement your strategy more effectively.

Practice Risk Management

The essence of successful trading lies in managing your risks. Not every trade will be profitable, so protecting your capital is essential when trades don't go your way. Many trading apps available in Singapore have built-in risk management tools, like stop-loss and take-profit features, that you can use to manage your risks effectively.

Stay Informed and Up-to-date With Market Trends

Like any other, the Singapore market is influenced by various global and local events. Therefore, staying informed about the latest news and market trends is crucial. Many trading apps include live news feeds and provide notifications about market events, helping you stay updated.

Learn From Successful Traders and Experts

Some Singapore-based trading apps offer social trading platforms where you can follow and learn from successful traders. This feature allows you to mirror their trades while understanding their strategies. However, always remember to conduct your own research and analysis, as what works for one might not work for another.

Understand Singapore's Trading Regulations

Each country has its own set of trading regulations, and Singapore is no exception. Familiarize yourself with local laws and regulations related to trading and taxes. There are apps that provide resources to help you understand these aspects better.

Make Use of the Educational Resources

Many apps offer educational resources like webinars, articles, and even demo accounts where you can practice trading without risking actual money. Use these resources to continuously enhance your trading knowledge and skills.

Free Trading Apps Pros and Cons

Free trading apps come with their own set of advantages and disadvantages. Here's a breakdown:

👍 Pros

• Accessibility

• Ease of use

• Educational resources

• Convenience

👎 Cons

• Limited features

• Potential for overtrading

• Customer service

• Data Security

While free trading apps offer a convenient and accessible entry into the world of stock trading, consider the pros and cons before deciding which platform best suits your needs.

Team that worked on the article

Dwight specializes in risk, corporate finance, alternatives, fintech, general business trends, and financial markets, and he has broad experience managing complex projects. Dwight is an author for the Traders Union website.

Dwight was a financial columnist for The Wall Street Journal and The New York Times during the Great Financial Crisis. He has served as Editor-in-Chief of Worth, a personal finance magazine for the wealthy, and as Editor of Risk, the premiere global publication about derivatives, risk management, and quantitative finance, based in London.

He has also served as Managing Editor at The Economist Group and ran the Americas operations of two British trade publications.

For the last 12 years, Dwight has worked as a freelance writer and editorial project manager, serving clients in the financial technology, banking, broker/dealer, consulting, asset management, and corporate sectors. This has given him considerable experience in idea generation and project management, working collaboratively to help clients meet their goals with little or no supervision.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).