Best Trading Tools To Improve Your Analysis Skills

In this in-depth article, we will explore our top picks for the best trading tools available in 2023. Specifically, we will be looking into tools for things like trading data and chart analysis. Our list of the best trading tools out there is based on various criteria, such as cost, quality, use cases, features, and much more. We'll also break down exactly what trading tools actually are, research websites that can serve as tools for day traders, the best available trading platforms, and how to match various trading tools. Let's start by breaking down exactly what trading tools are and what they can offer.

Start trading or investing in stocks right now with Interactive Brokers!

What Are Trading Tools?

In order to accomplish your work well, day trading necessitates the use of a collection of tools and services. Some of the essential instruments are likely already in your possession. Day traders use the internet to access the financial markets, since modern-day trading is virtually entirely electronic. It's also a good idea to have a phone on hand in case you need to contact your broker, and you'll need a computer or laptop to access the internet and place transactions. On a basic level, if you have a laptop and internet access, you are already using trading tools. But you shouldn’t just stop there.

You may not have all of the necessary tools needed to be as successful as possible as an active trader. A direct access brokerage, real-time market data, and a trading charting platform are just a few of the tools you should consider using. These are instruments that are designed to improve analytical performance. However, you shouldn’t just use a tool for the sake of doing so. Look at your current trading style and processes and consider where you need a little bit of help. Do you need software that can be integrated with your charts? Do you need better signals and technical indicators for options trading? Consider your pain points and what you actually need.

With this in mind, let’s explore some great tools worth considering for day trading.

The Best Tools for Trading Data

The following tools and resources are designed to help you learn advanced trading statistics. Trading data tools can include reports and data sets for the futures and options markets, the stock market, etc.

Stock Rover

Stock Rover is a stock analysis and screening platform that provides investors with high-quality research tools, instructional information, expert analysis, and more. Stock Rover goes above and beyond traditional analysis tools, providing account users with one of the most complete sets of screening criteria and research credentials we've ever seen. With Premium Plus access, customers may filter investment possibilities using over 650 indicators, for example.

Stock Rover has four distinct plan tiers, which might be perplexing for first-time investors who aren't sure which tools they'll utilize. Free accounts, on the other hand, provide a wide variety of capabilities as well as a free trial of Premium Plus features, allowing customers to get a better feel for Stock Rover's setup. Opening a Stock Rover account is also quite simple and fast.

TradingView

TradingView is a robust stock screener, charting platform, and research powerhouse that offers a diverse set of tools for investors to gain a better understanding of the markets. TradingView's most notable features include a fully functional mobile app, a diverse set of screening criteria, the ability to include custom scripts, and much more.

TradingView provides a wide range of teaching resources in addition to charting and research tools. To develop your abilities, look at the news feeds linked with each asset, read articles, look at real-time market data, and even watch live streams with experienced traders. Paper trading accounts are also available to assist you to learn how to use TradingView's many features. TradingView is one of the most amazing research centers on the internet, despite the fact that its information can be daunting for beginner traders and investors.

Read also: TradingView vs. MT4: A Comprehensive Comparison in the TU article.

TraderSync

TraderSync is a simple, user-friendly interface that gives you the tracking and reporting data you need to take your trading to the next level. It's jam-packed with features that will help you enhance your journaling and analytics.

With a few mouse clicks, you may import your trades. The TraderSync import tool supports a wide range of brokerages, and all you have to do is click the "Add Trade" button in the top right-hand corner of the dashboard to get started. Then, from the dropdown menu, choose your broker, the portfolio to which you'd want to import the transactions, and finally, click the "Import Trades" button to finish the procedure.

The Best Trading Tools for Chart Analysis

The following trading tools for chart analysis are designed to help traders improve their technical analysis skills. Each of these tools is focused on technical analysis and offers various chart analysis capabilities.

Trading Central

Trading Central

Based on standard technical analysis methodologies, Trading Central's tools automatically evaluate price activity to detect and interpret classic chart patterns and other crucial criteria. This tool’s Technical Event alerts provide traders with information on the strengths and weaknesses of equities they are considering. Individual investors cannot use Trading Central’s products outside of brokerage systems, although their technology is integrated into a number of active trading websites that are popular today.

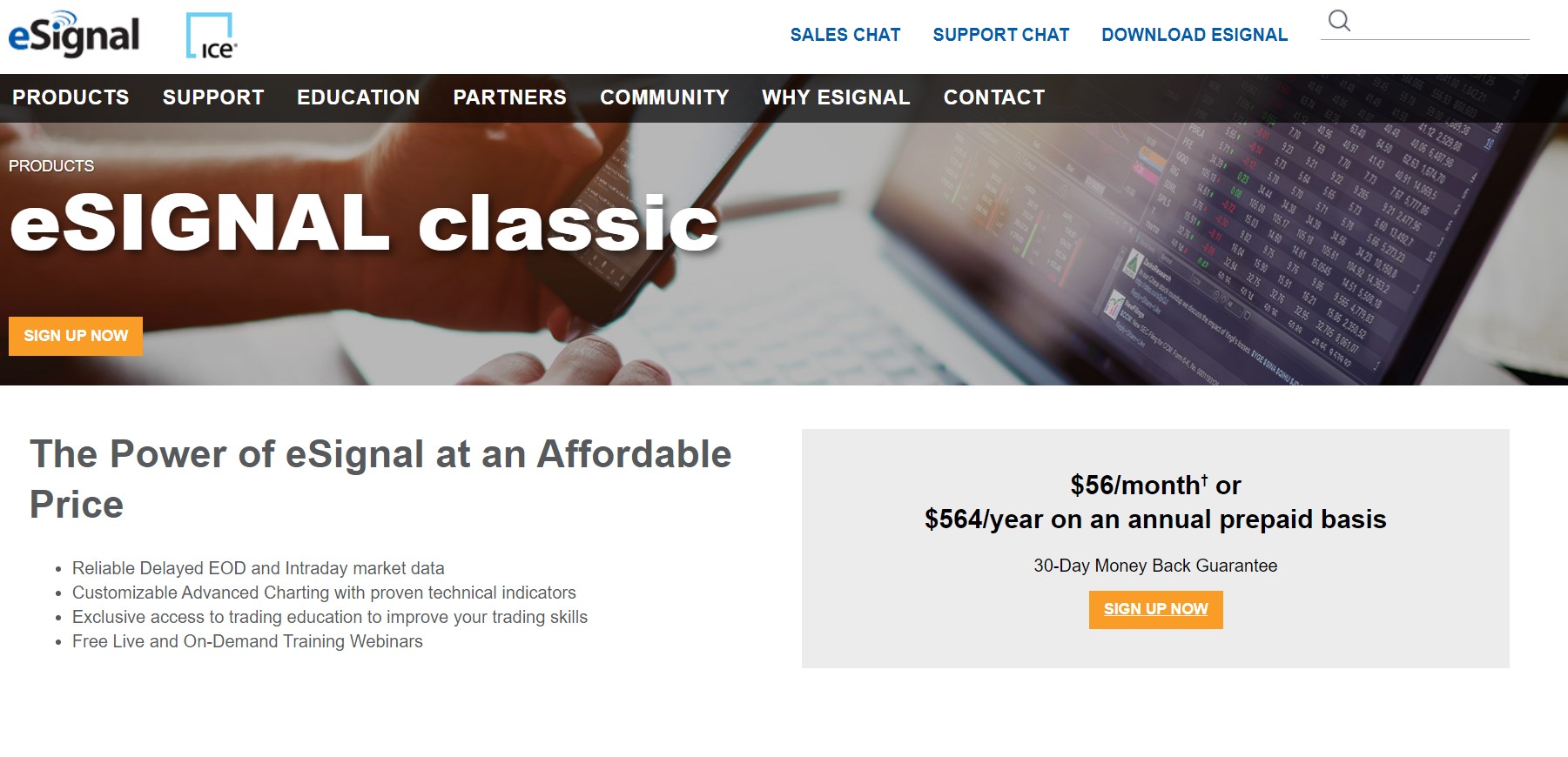

eSignal

eSignal

This tool is excellent for chart analysis as well as signal generation. With a history dating back to the mid-1990s, eSignal is one of the most venerable brands in technical analysis. eSignal 12, the most recent version, is a Windows-based software package that includes technical analysis studies, backtesting of trading techniques, customizable charting and charting analysis, and data from global exchanges.

Users may trade with a number of brokers through API, including Interactive Brokers. It's not cheap, unfortunately. The Classic edition costs $56 per month and utilizes fifteen-minute delayed data. eSignal’s Signature edition costs $183 a month and runs on real-time data with a slew of advanced features. The monthly fee for the Elite edition is $378.

MS Algo

This tool only works with TradingView, but it can be an excellent chart analysis tool to try. The Market Scalper Algo (MS Algo) is a tool that overlays your financial charts with purchase and sell signals. It also supplies everyone with its own escape signal.

MS Algo's tools may be used to trade stocks, futures, FX, and cryptocurrency. To give the most accurate signatures, it employs exclusive technologies and tactics. You can set up automated phone, email, and Webhook alerts. MS Algo strives to deliver the most precise buy, sell, exit, and take profit signals available. Investors can view such indications live on their Trading View charts, allowing them to execute trades fast based on them. It's also quite simple to set up.

The Best Research Websites

In addition to software, apps, and similar tools, websites can also be incredibly helpful when it comes to improving research skills as a trader. We recommend the following websites, as they have a great mix of free and premium access to trading guidance and indicators.

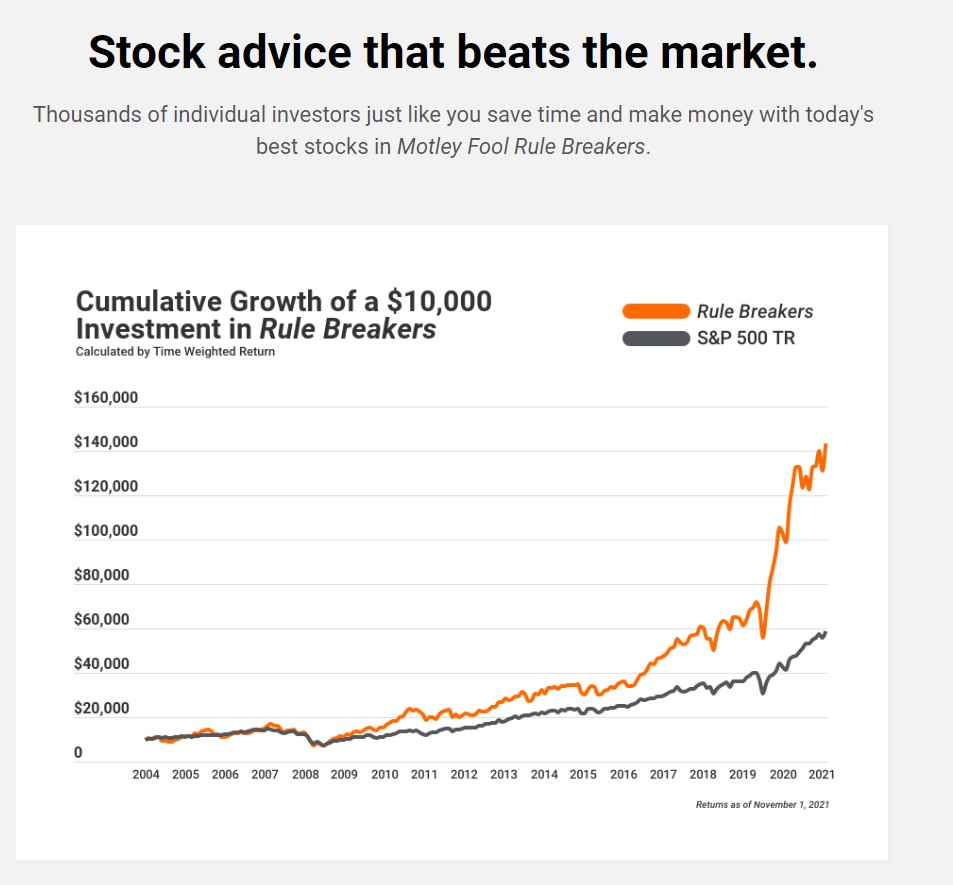

Motley Fool Rule Breakers

Motley Fool Rule Breakers

The Rule Breakers package caters to risk-takers looking for high-yielding equities. This stock investment website promises to assist you in identifying market-beating growth stocks and determining which companies will be tomorrow's stock market leaders.

Companies like Amazon and Tesla were notably suggested by the service before they became popular names. They began focusing on these businesses early on, and as additional investors joined their service, they continued to suggest them. Every Thursday, this stock advisor website sends out an e-mail with their most recent suggestions. Consider this research website a great source for trading signals.

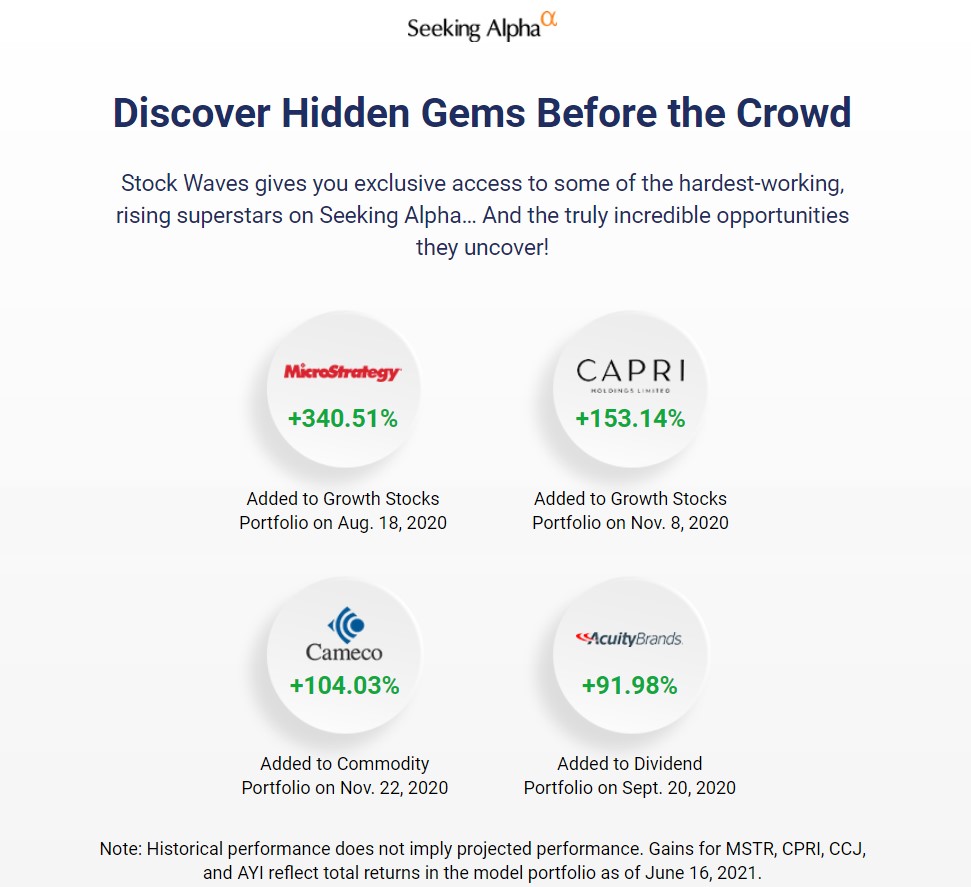

Seeking Alpha Premium

Seeking Alpha Premium

Intermediate and advanced investors searching for an inexpensive, all-inclusive, all-in-one solution for their investment requirements may find Seeking Alpha Premium to be a good fit.

Seeking Alpha Premium is an all-in-one investing research and suggestion service that provides in-depth analysis of financial news, companies, and other topics, all with the goal of assisting you in making better investment decisions. Whether you want to invest on the move or devote more time to in-depth study and analysis, Seeking Alpha has options to suit your requirements.

No other website offers the unique resources that Seeking Alpha does, including earnings call transcripts, Seeking Alpha Author Ratings, Author Performance indicators, the opportunity to compare stocks side by side with peers, dividend and earnings predictions, and much more.

Finviz

Finviz.com is a stock screener website that can help traders find the best stocks using dozens of parameters. The website does an outstanding job of condensing a big amount of data into clearly understandable charts and maps.

Each of the tools offered by Finviz is presented in a very graphic, user-friendly manner. Finviz is one of the most widely used stock screens accessible today. Finviz is a financial visualization application that includes a stock screener and trading tool.

Finviz helps traders and investors swiftly filter and locate stocks based on pre-defined criteria, which saves time for professional traders. Users may also utilize the company's tools to obtain a better understanding of what's going on in the industry. This website is also available for free.

The Best Trading Platforms

A trader can have the best tools, knowledge, skills, and signals in the world, but may find themselves losing out on profits because of the platform they are using. The following platforms are our top picks for traders who want to invest in stocks, options, and everything in-between.

Interactive Brokers - Best Platform For Stocks

Interactive Brokers

The award-winning platform and services of Interactive Broker were created with professional international traders in mind. This genuinely interactive broker provides market access 24 hours a day, 6 days a week, and allows you to trade in 135 different markets in 33 countries with a wide range of currencies.

A simple Client Portal, the Trader Workstation (TWS), and a mobile application are among the company's trading platforms. Although U.S. equities and ETFs can be traded commission-free, the firm's price varies on whether you pick IBKR Lite or IBKR Pro. You'll never feel like you're overpaying because your chosen investment can be tailored to your budget.

eOption - Best Platform for Options Trading

eOption

eOption excels in low-cost options trading, making it one of the top options trading providers available right now. Traders should use eOption to trade quite often or day trade, as the charge per options contract is only $0.10, though each transaction has a flat fee of $1.99. This fee structure benefits traders who purchase and sell options in lots of five contracts or more.

If you simply trade one contract at a time, eOption is not for you because the charges would quickly deplete your earnings. The minimum account balance is modest, yet the options available are extensive. The trading platform is solid, and the built-in paper trader serves as a backup. eOption, once again, is a fantastic way to save money by trading higher lot option sizes.

eToro - Best Platform for Copy Trading

eToro

eToro was established in 2007 and is regulated in two tier-1 and one tier-2 jurisdictions, making it a low-risk broker for trading foreign exchange and CFDs.

In 2023, we recommend eToro for both social copy trading and cryptocurrency trading, and it is our top selection in both categories. eToro also has a user-friendly online platform and smartphone app for casual investors, including newbies. Despite recently lowering spreads and providing zero-dollar charges for US stock trading, eToro is somewhat more expensive than most of its competitors for trading forex and CFDs. In addition, eToro's typical research resources and techniques are restricted in comparison to its competitors. Still, this platform is an excellent choice for traders who want to engage in social trading.

Can I Match Different Trading Tools?

Not only is it possible to match different trading tools, but it’s also actually quite smart to do so. However, be sure to carefully match different tools that provide different use cases. For example, it wouldn’t be particularly helpful to use two different chart analysis tools that do virtually the same thing and have the same features. This could be beneficial for verifying the accuracy of both tools, but you will run the risk of both tools becoming redundant. Rather, you should create a “tech stack” of tools that can benefit you.

We recommend following this strategy when choosing your tools:

-

Evaluate your broker or trading platform to see if the tools you need are already offered as native features of the software.

-

Use two different research websites.

-

Use two different signal or technical indicator sources that evaluate different things.

-

Use two different chart analysis tools, only if each tool has a different use case from the other.

-

Use two different trading data tools, only if each tool has a different use case from the other.

Summary

Trading tools are software, apps, websites, and other mediums that traders can use to improve their trading processes. Many trading tools out there are designed to process trading data, improve charting analysis, and make research much easier. It's also worth noting that many top trading platforms and brokers offer native tools designed to make traders' lives much easier, especially when it comes to day trading. Every investor out there should invest in at least a few different trading tools.

FAQs

What is technical analysis?

Technical analysis is a trading discipline that uses price trends and patterns on charts to analyze assets and uncover trading opportunities. Past trading activity and price variations of an asset, according to technical analysts, might be useful predictors of future price movements. Technical analysis may also be compared with fundamental analysis, which is concerned with a company's financials rather than previous price patterns or stock movements.

What are the limitations of technical analysis?

Some analysts and academic academics believe the EMH will explain why previous price and volume data can not be relied upon for actionable information. However, by the same logic, business fundamentals should not give any actionable information. The weak form and semi-strong form of the EMH are these points of view.

Another critique of technical analysis is that because history does not repeat itself perfectly, price pattern analysis is of questionable value and can be overlooked. Prices appear to be best approximated using a random walk assumption.

A third critique of technical analysis is that it succeeds in some circumstances but only as a self-fulfilling prophecy in others. Many technical traders, for example, will set a stop-loss order below a company's 200-day moving average. If a big number of traders have done so and the stock hits this price, a huge number of sell orders will be placed, causing the stock to fall, confirming the movement traders predicted.

Can I rely on tools to trade for me?

Because technical analysis tools lack the knowledge and expertise of a genuine human trader, you must rely on your intuition in this area. Technical analysis tools' efficiency can also be harmed by programming flaws. When deciding the tool's conditions and behaviors, you must also be particularly cautious.

It's important to note that technical analysis methods are generally used to provide marginal returns. For effective use of technical analysis tools, a thorough understanding of stocks, assets, and digital currency markets, as well as a strong supporting investment plan, is required.

What type of hardware should I invest in for trading?

Your laptop, computer, or mobile device is arguably the most important tool for trading that you could possess. Because technology is always developing, be sure your computer has adequate RAM and a fast enough CPU to avoid lagging, crashing, or stalling (taking forever to load). Most trading and charting software requires fast and up-to-date memory and CPUs. As you examine a transaction, you may find yourself bouncing between company and broker websites as well as your charting software screens. It is preferable to have two monitors, although it is not required.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

5

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Team that worked on the article

Winnifred Emmanuel is a freelance financial analyst and writer with years of experience in working with financial websites and businesses. Her expertise spans various areas, including commodities, Forex, stocks, and cryptocurrency. Winnifred tailors her writing to various audiences, including beginners, while also providing useful insights for those who are already familiar with financial markets.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).