The Most Valuable Currencies In The World 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

As of 2025, the strongest currencies in the world based on exchange rates against the US dollar are:

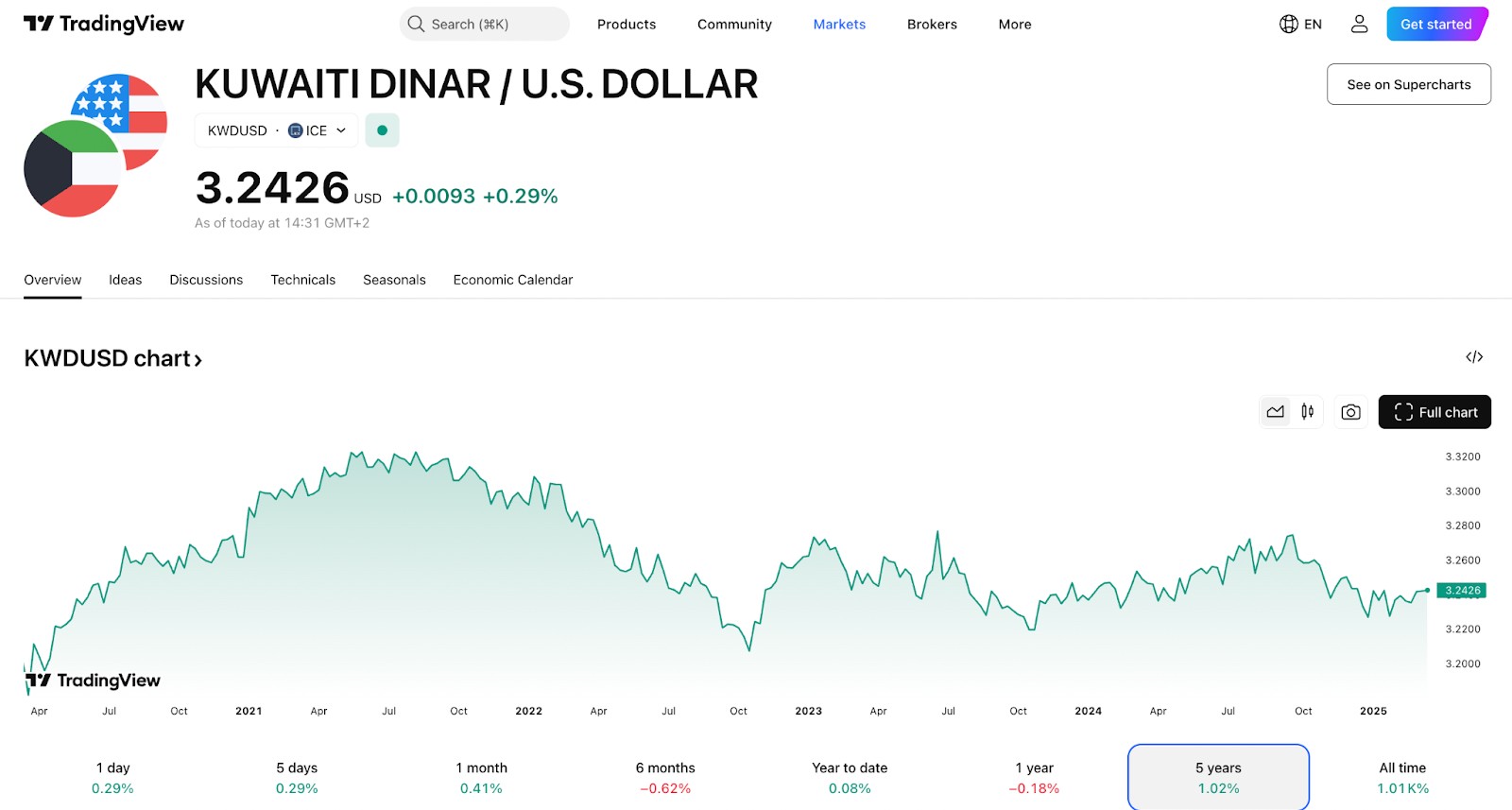

Kuwaiti Dinar (KWD) – 1 KWD = $3.2426

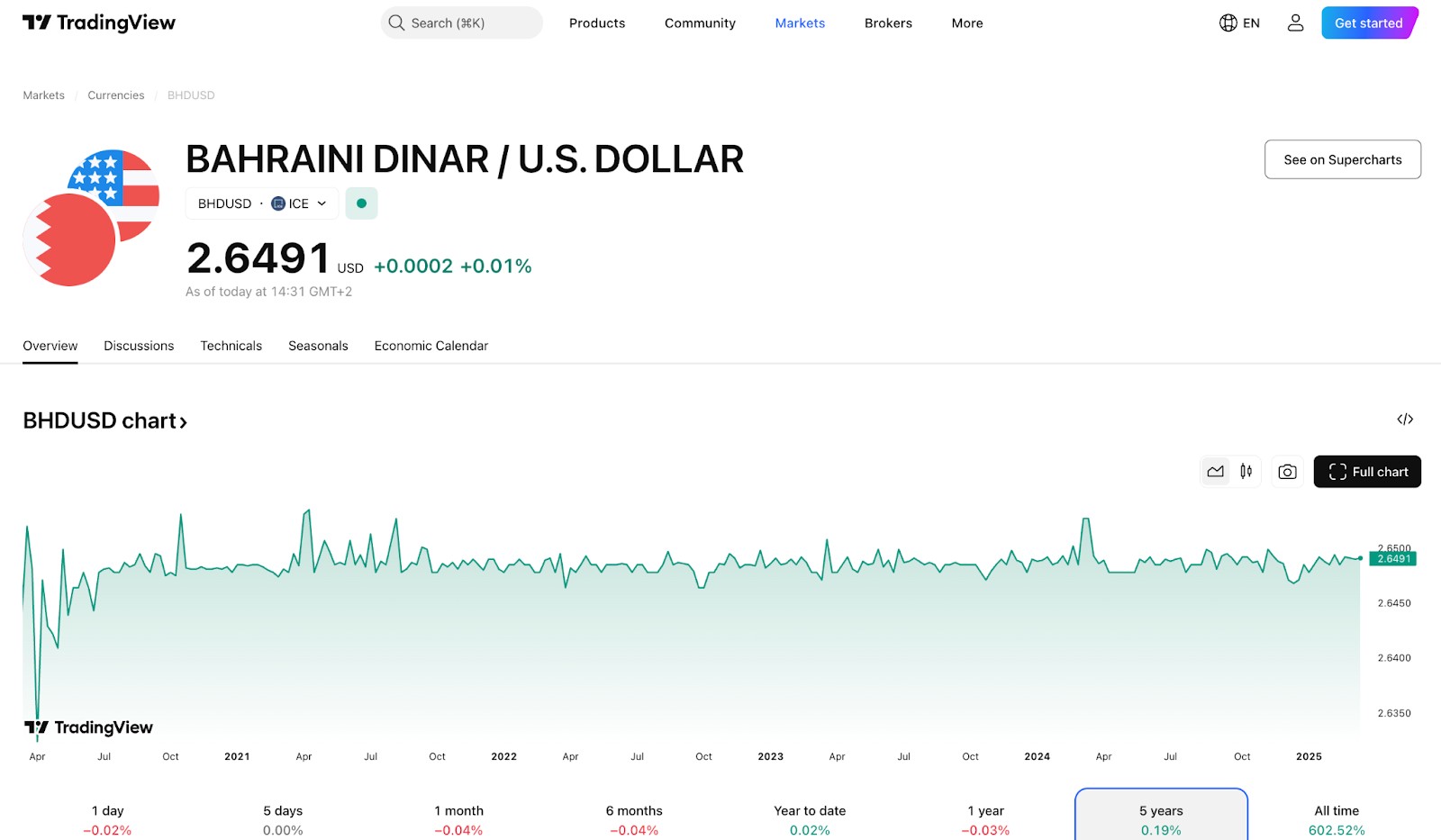

Bahraini Dinar (BHD) – 1 BHD = $2.6491

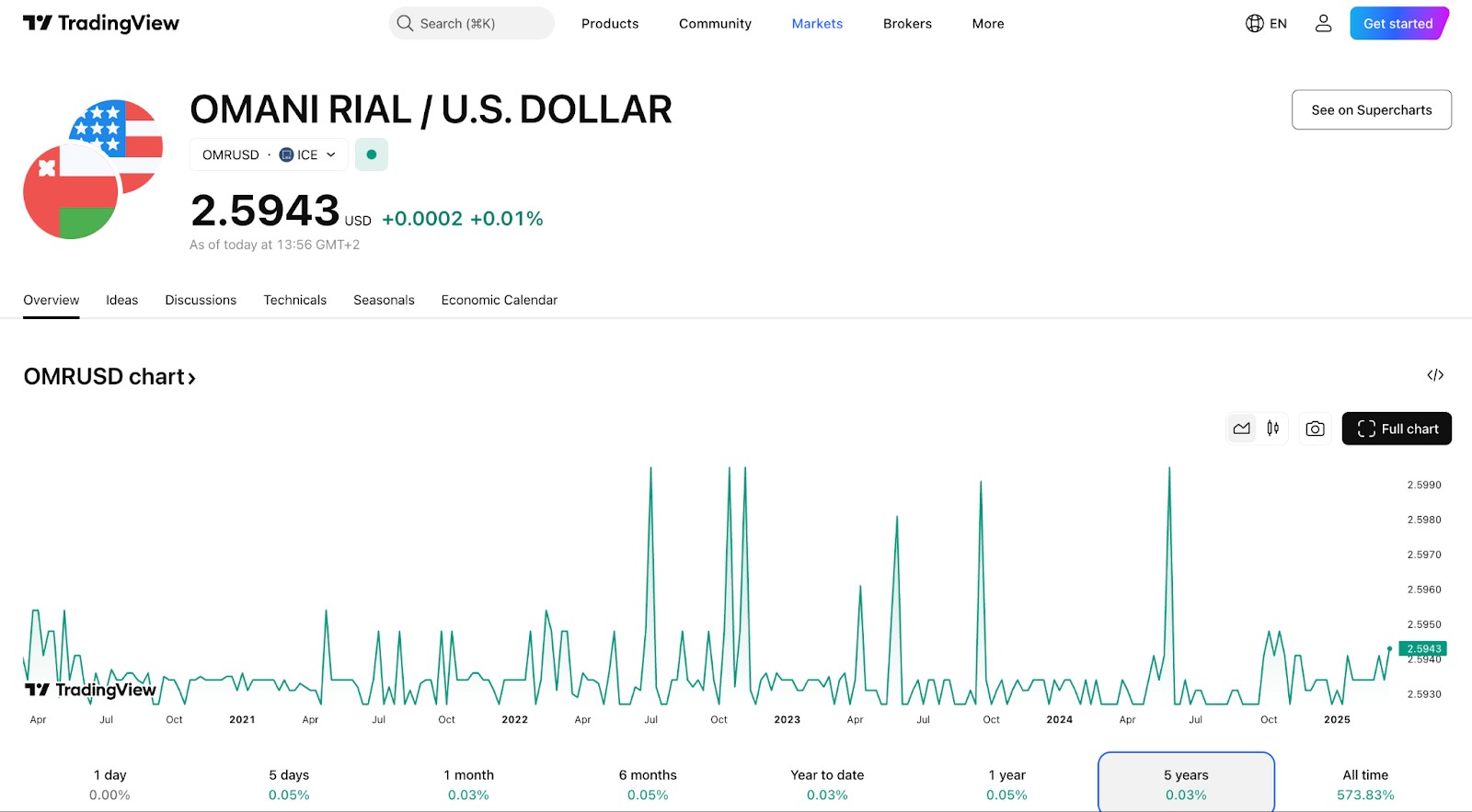

Omani Rial (OMR) – 1 OMR = $2.5943

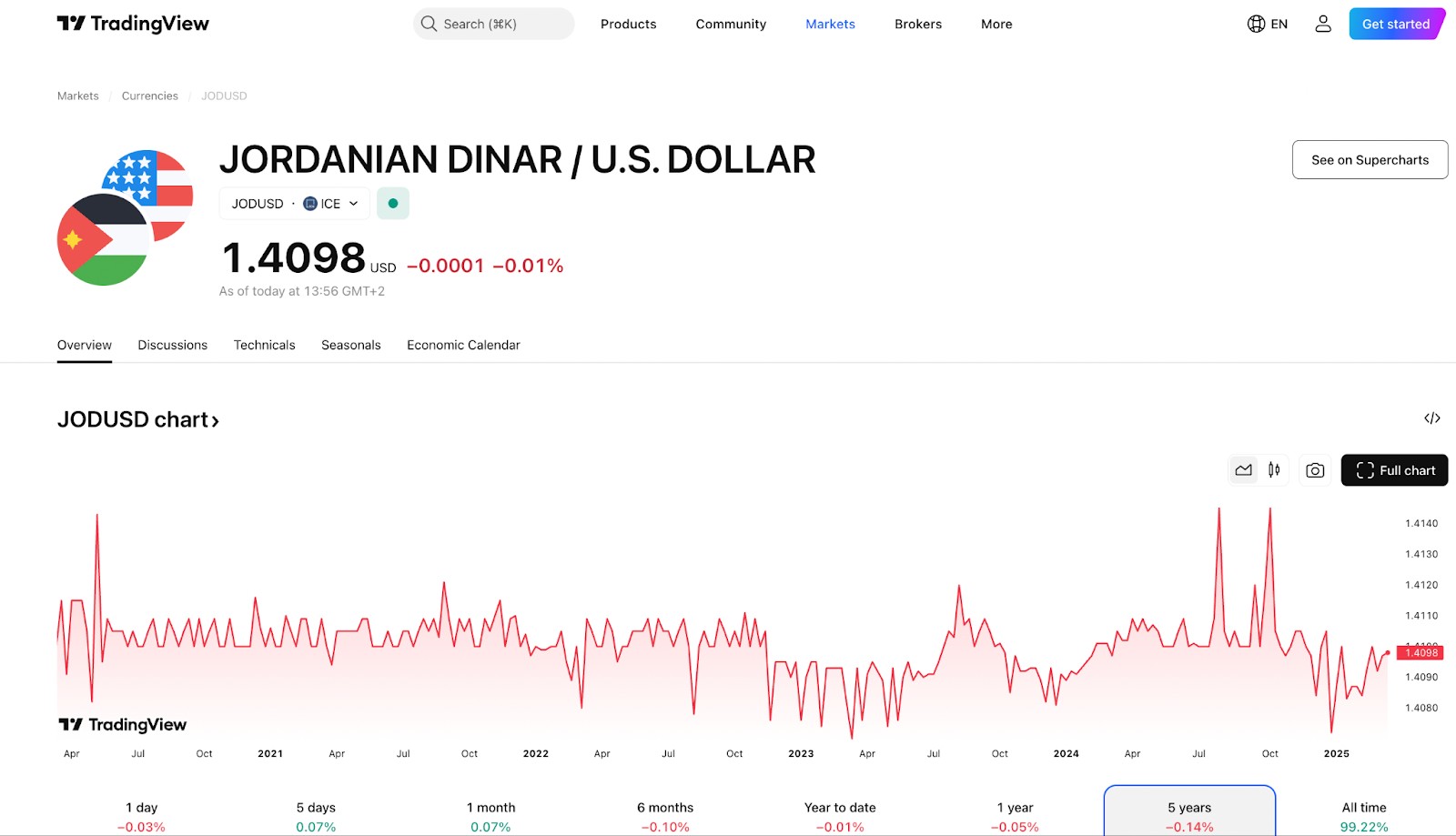

Jordanian Dinar (JOD) – 1 JOD = $1.4098

Gibraltar pound (GIP) – 1 GIP = $1.2985

When people think about the most powerful currencies in the world, they often assume the U.S. dollar or the euro must be at the top. However, some lesser-known currencies have even higher values. The strength of a currency depends on various factors, such as economic stability, inflation control, and demand in international markets. While a high exchange rate against the U.S. dollar doesn't always mean a country has the strongest economy, it does indicate confidence in its financial system.

This article highlights the 15 highest-valued currencies in 2025, showing why they hold such strong positions. From the Kuwaiti dinar, which remains the world’s most valuable currency, to the Singapore dollar, which plays a key role in global trade, each currency on this list has unique reasons for its strength.

Top 15 most valuable currencies in the world

The highest currencies in the world refer to those with the strongest exchange rates compared to other global currencies, particularly the US dollar (USD). A high-valued currency typically means that one unit of that currency can buy more US dollars or other foreign currencies.

Several factors contribute to a currency's high value, including:

Strong economic stability – countries with high GDP, low inflation, and strong financial policies often have stronger currencies.

Oil reserves and exports – many high-valued currencies belong to oil-rich nations that peg their currencies to the USD, ensuring long-term stability.

Monetary policies – Central banks maintain tight control over inflation and interest rates, helping to keep the currency strong.

Foreign exchange reserves – nations with large forex reserves can better stabilize their currencies against fluctuations.

Fixed or managed exchange rate systems – some currencies maintain their high value by being pegged to the US dollar, ensuring consistent demand.

Here are top 15 strongest currencies in the world in 2025:

Kuwaiti Dinar (KWD) – 1 KWD = $3.2426

Bahraini Dinar (BHD) – 1 BHD = $2.6491

Omani Rial (OMR) – 1 OMR = $2.5943

Jordanian Dinar (JOD) – 1 JOD = $1.4098

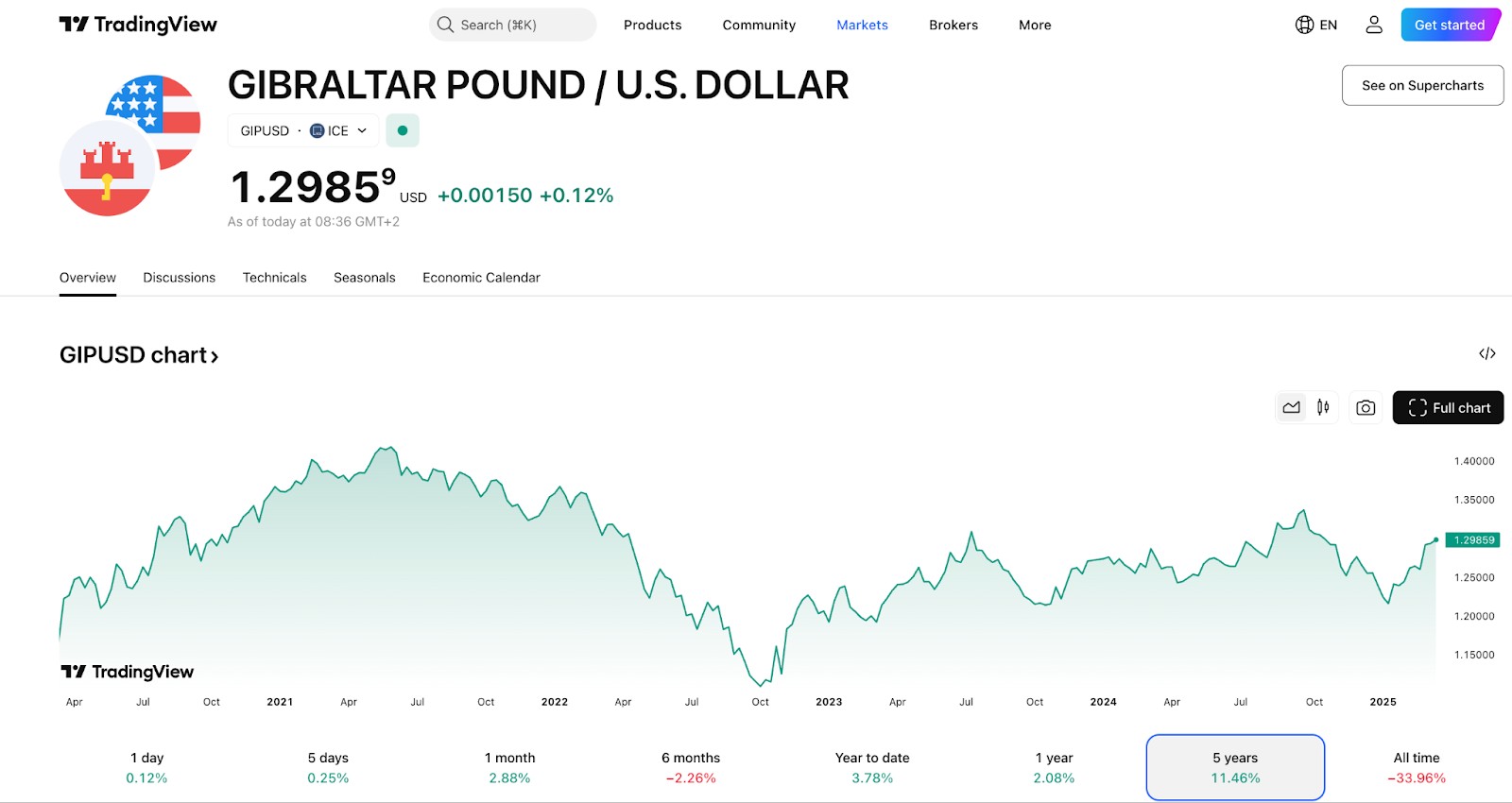

Gibraltar pound (GIP) – 1 GIP = $1.2985

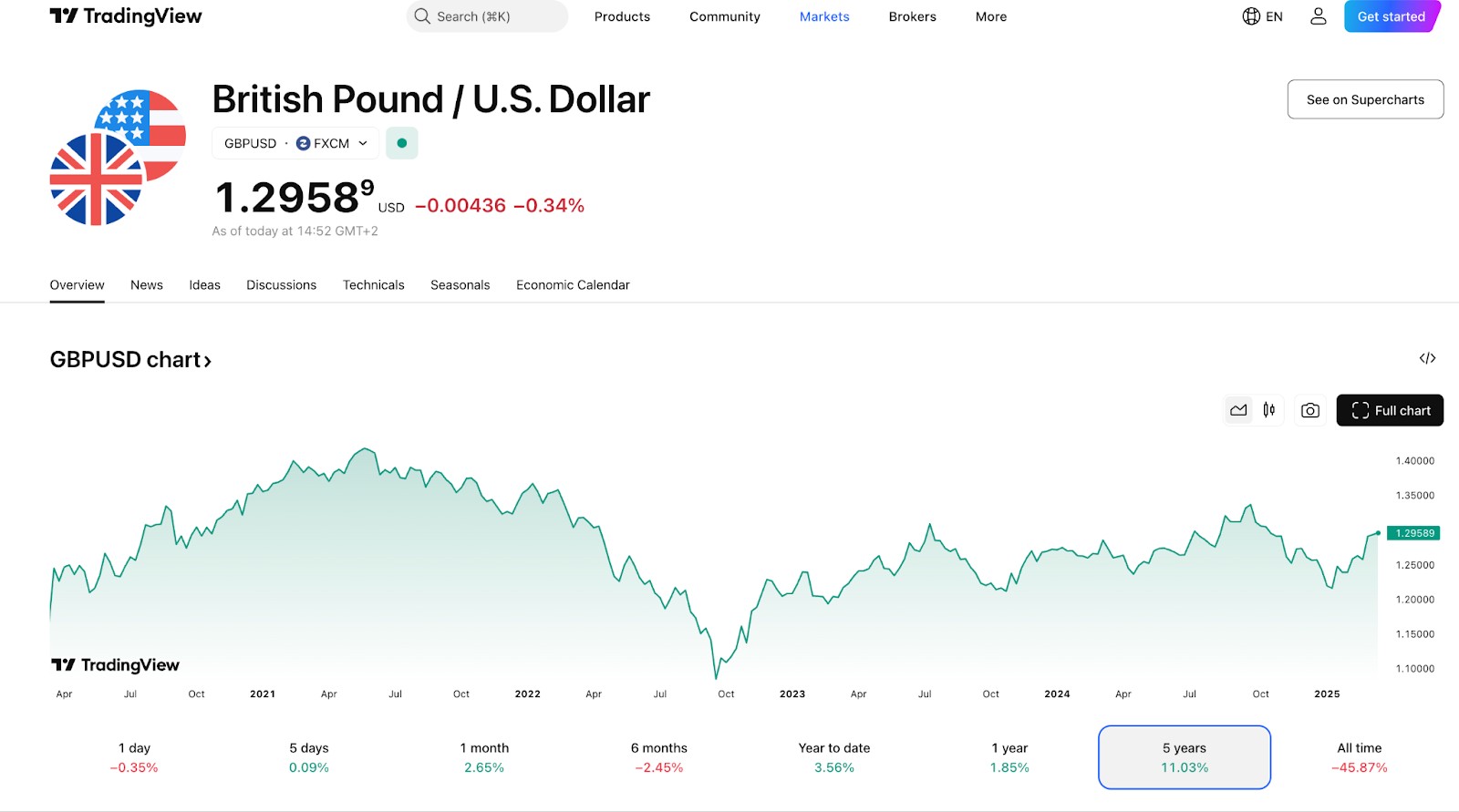

British Pound Sterling (GBP) – 1 GBP = $1.2958

Falkland Islands pound (FKP) – 1 FKP = $1.26.

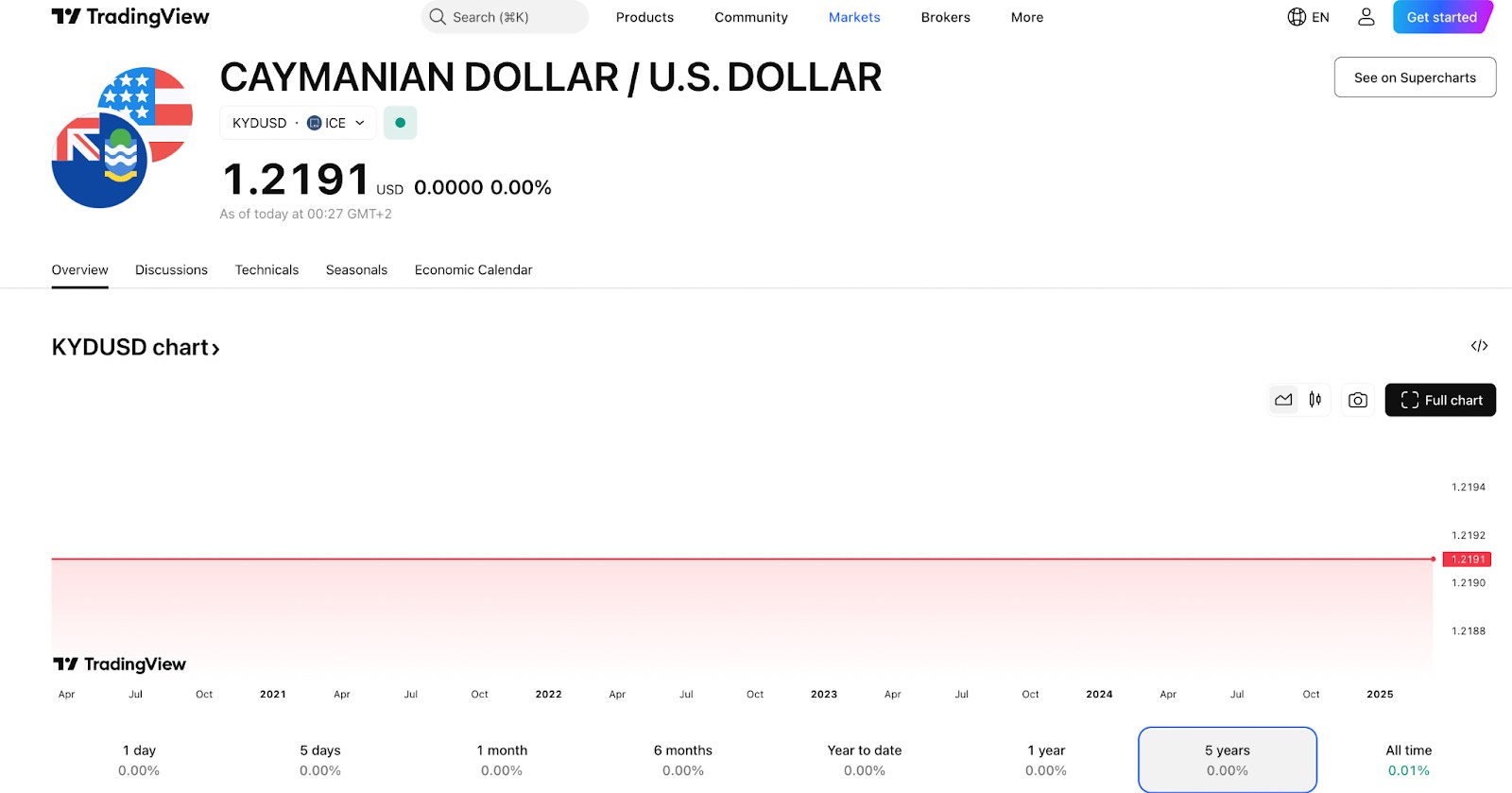

Cayman Islands Dollar (KYD) – 1 KYD = $1.2191

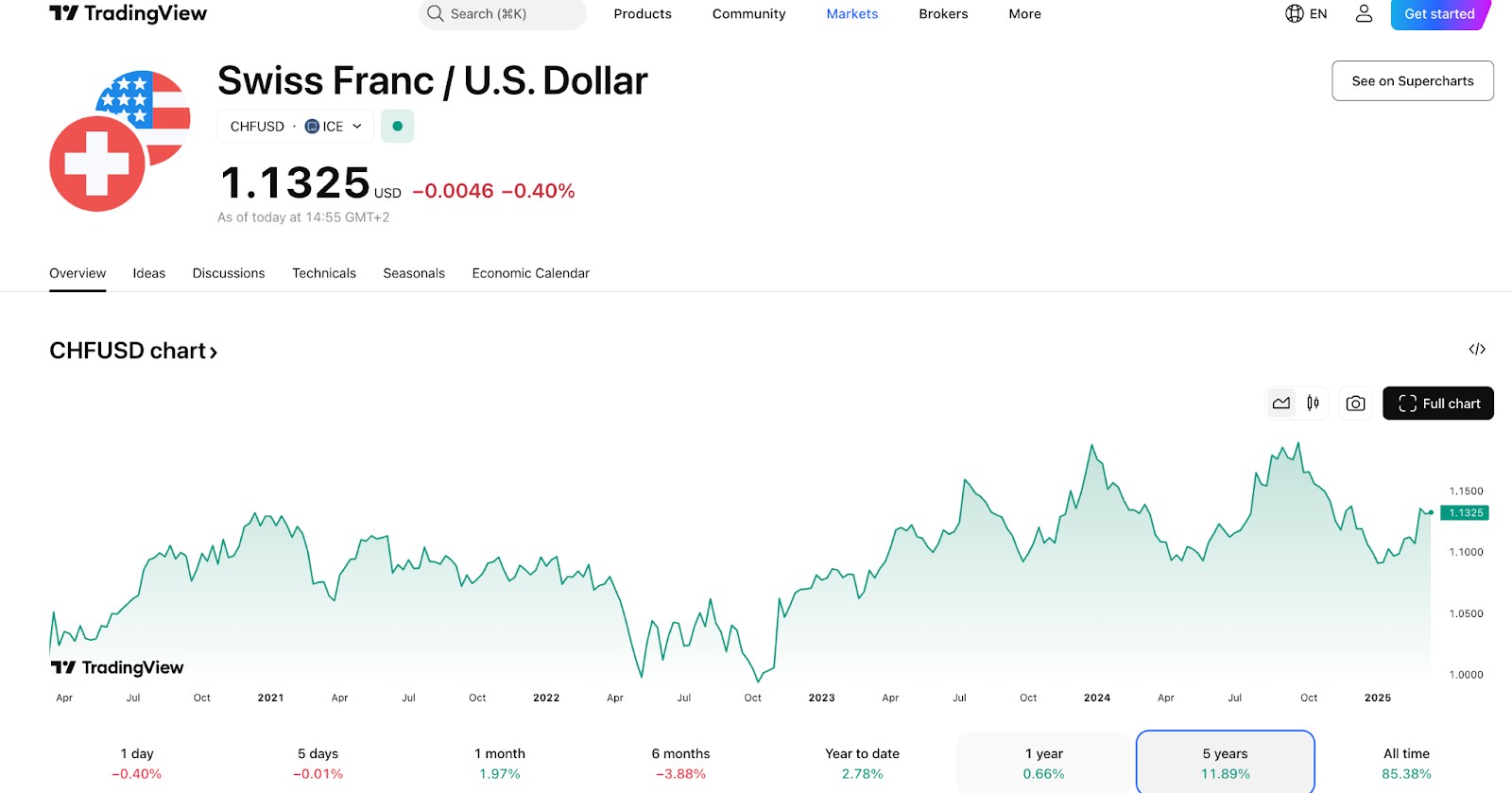

Swiss Franc (CHF) – 1 CHF = $1.1325

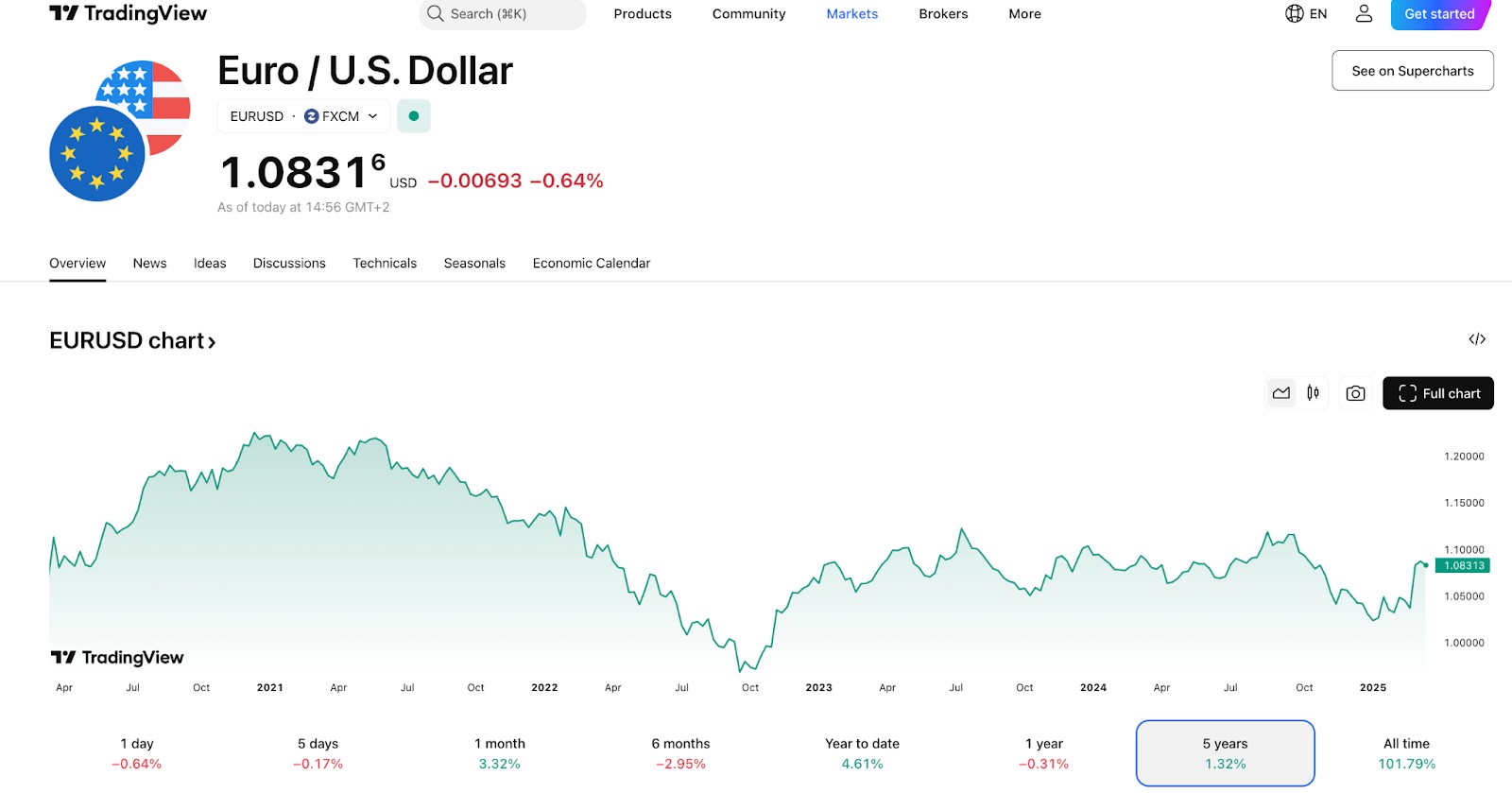

Euro (EUR) – 1 EUR = $1.0831

U.S. Dollar (USD) – 1 USD = $1.00

Panama balboa (PAB) – 1 PAB = $1.00

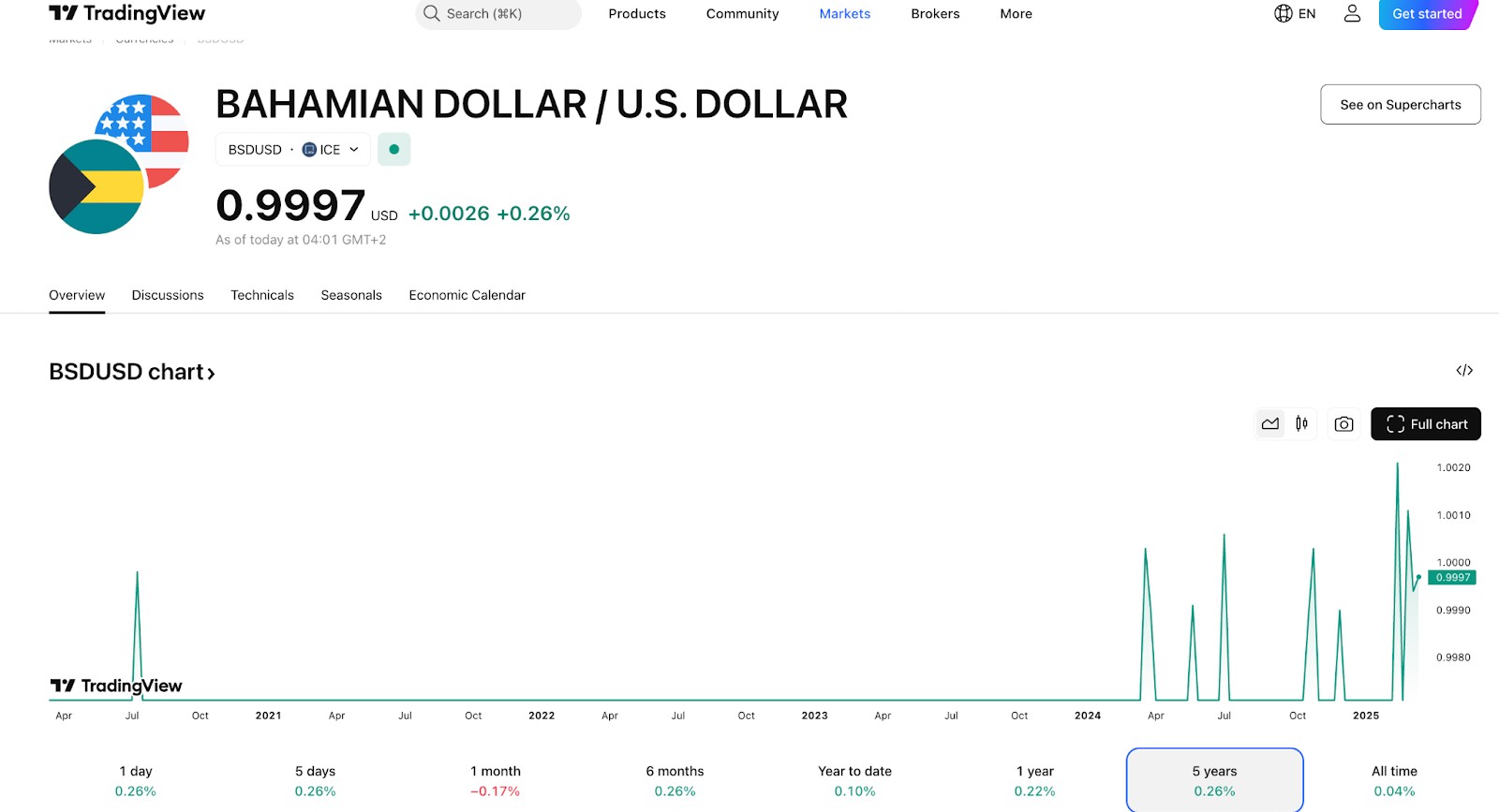

Bahamian dollar (BSD) – 1 BSD = $0.9997

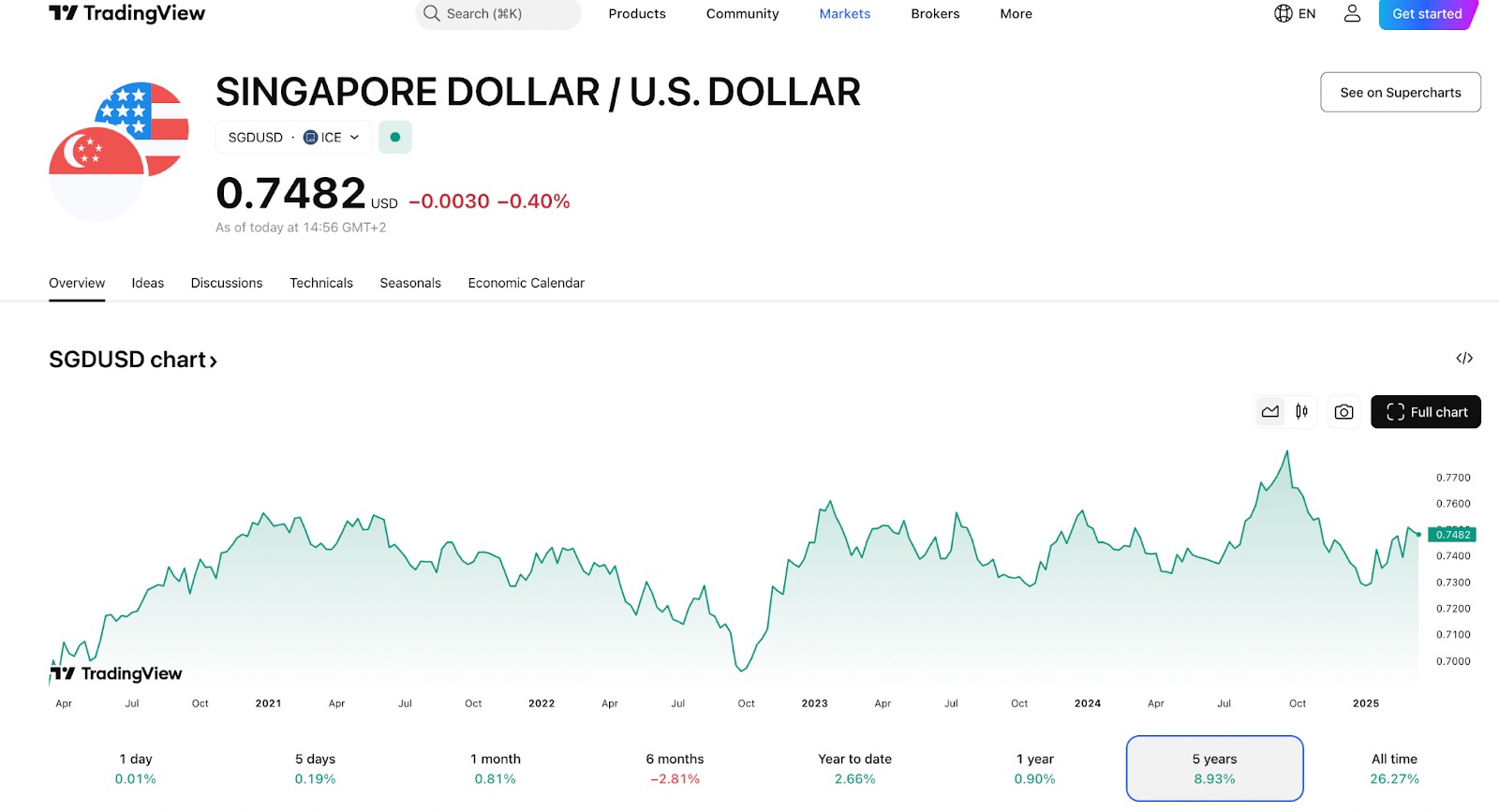

Singapore dollar (SGD) – 1 SGD = $0.7482

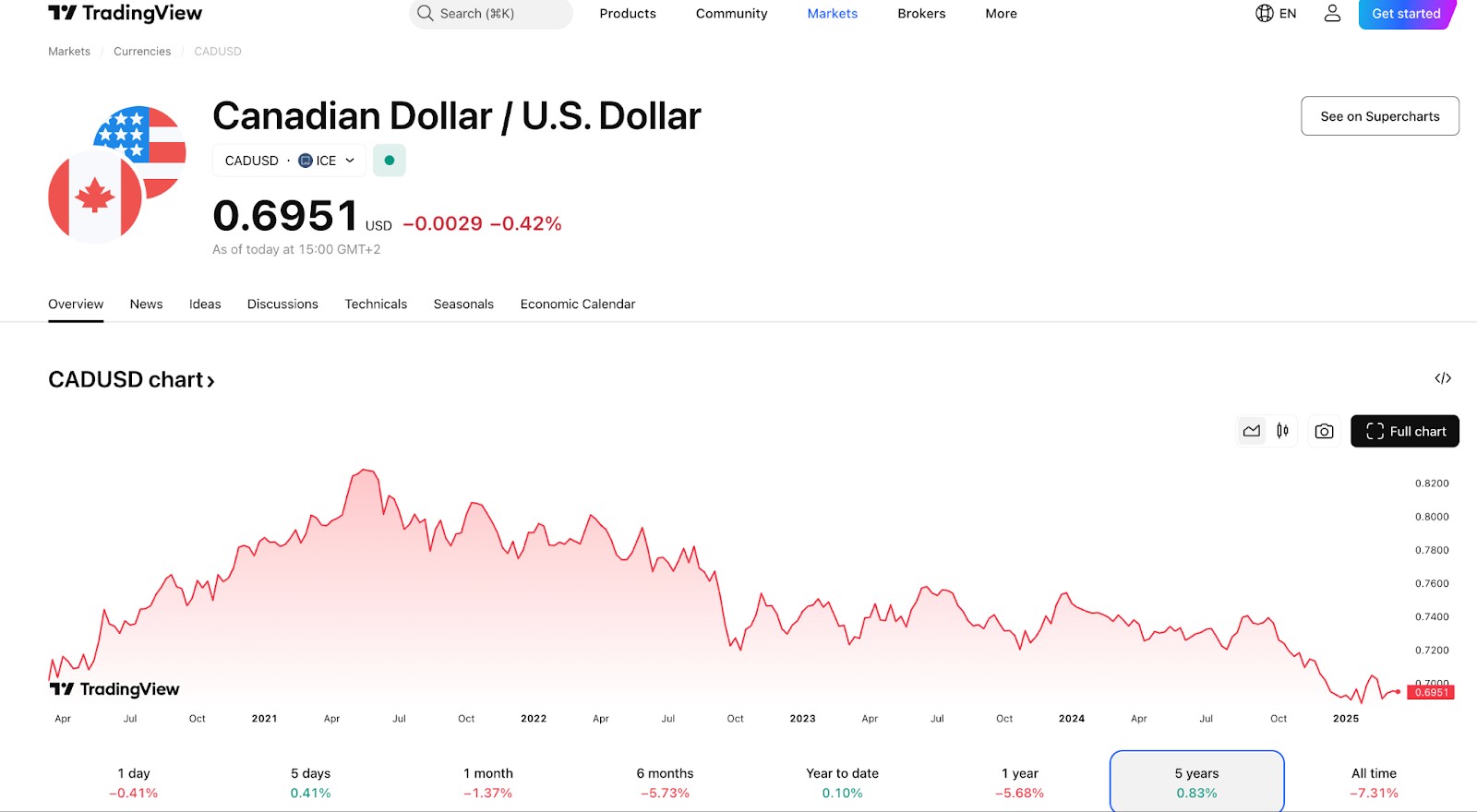

Canadian Dollar (CAD) – 1 CAD = $0.6951

The world’s three strongest currencies have been in this order for many years. The rest change their positions from time to time. Sometimes other currencies also make this rating. For example, in 2011-2013, the Australian dollar was worth more than $1. At the moment, the euro is in a precarious position because its exchange rate in January 2023 fell below the USD for the first time since 2002.

1. Kuwaiti dinar (KWD)

Today, the Kuwaiti dinar is the world’s strongest currency, and it has held this status for several years. In 2007, the country abandoned pegging to the USD in favor of a multi-currency basket. The secret of the high value of the dinar is the country’s large oil deposits and the low cost of their production. It is the low cost of production and export quotas set by OPEC that place the dinar among the world’s strongest currencies. With relatively equal market prices and fixed volumes, the one with lower costs is the winner. The country has almost no unemployment and no value-added tax. Because the government recognizes the risks of dependence on oil prices, it established a sovereign wealth reserve fund to maintain the exchange rate.

2. Bahraini dinar (BHD)

The situation is similar in Bahrain. As in the case of Kuwait, Bahrain has large deposits of energy resources, which are the main source of income. However, unlike Kuwait, Bahrain’s currency is pegged to the U.S. dollar. The regulator has sufficient gold and foreign exchange reserves to keep the national currency firmly within a narrow range. Interesting fact: the national currency of Saudi Arabia is the second legal tender in Bahrain.

3. Omani rial (OMR)

In Oman, the national currency was pegged to the U.S. dollar in 1973. The exchange rate was last adjusted in 1986, and it has remained at 2.6 USD since then. There is a slight deviation due to the dynamics of supply and demand, but the fluctuation range is so narrow that it can be ignored. The reason for stability, as in the cases of Kuwait and Bahrain, is oil exports. Falling oil prices and continued military conflicts in the Middle East are offset by gold and foreign exchange reserves. Recently, the government has been trying to diversify budget revenue items by gradually increasing the share of metallurgy, gas production, and tourism.

4. Jordanian dinar (JOD)

The price of this currency has been pegged to the U.S. dollar since 1995 (theoretically, it is pegged to special drawing rights (SDR), but in practice, it is pegged to the U.S. dollar). The national currency was pegged to the U.S. dollar to maintain the stability of the national economy and U.S. investments. A stable pegged exchange rate ensures peace of mind for foreign investors using the dinar to invest in local businesses, as well as for various programs funded by SDR. But whether Jordan will be able to maintain strict pegging in the future is a complicated question. Since 2011, the country has been experiencing a slowdown in economic growth, and there are no large oil reserves to support the budget.

5. Gibraltar pound (GIP)

Gibraltar’s national currency has historically been pegged to the British pound sterling. Initially, the currencies of Spain and the United Kingdom were in use in Gibraltar. The 1934 law authorized the country to issue its own currency, pegged to the pound. The country’s economy has a narrow specialization: agriculture does not exist here, and industry is represented by ship repair plants. The main industries are finance, tourism, and services. With a small level of inflation, the standard of living in Gibraltar is above average, while the income from re-export allows for maintaining the exchange rate at a fixed level.

6. Pound Sterling (GBP)

Before the U.S. dollar came to dominate global economic relations, the British pound was the dominant currency. The Bank of England deliberately set a higher exchange rate, but unlike previous banks with strong currencies, it refused to peg the pound to the U.S. dollar. The country is one of the world’s leading economies and one of the top business, stock exchange, and financial centers. The high price of the national currency is supported by positive macroeconomic statistics. Although Brexit and Europe’s geopolitical problems have shaken the pound’s position against the U.S. dollar, it remains more valuable.

7. Falkland Islands pound (FKP)

This is a very particular currency and its price chart is not easy to find. Like Gibraltar, the Falkland Islands are an overseas territory of the UK. However, Spain lays a claim on Gibraltar, while Argentina lays a claim on the Falkland Islands. Despite uncertain legal status, the islands have their own national currency, which is rigidly pegged to the GBP at a ratio of 1:1. The population barely reaches 3,500 people, nevertheless, the country earns very well on the export of seafood and wool, which allows it to maintain the stability of the national currency price.

8. Cayman Islands dollar (KYD)

The national currency of the Cayman Islands is also pegged to the U.S. dollar, with a fixed rate of 1.20, though there are still minor fluctuations. The status of the country helps to maintain a fixed rate within the jurisdiction. This small island state is an offshore tax haven. The country is among the Top 5 largest offshore financial centers in the world, where banking, insurance, trust investment, and hedge funds operate.

9. Swiss franc (CHF)

The Swiss franc ranks first in the rating of the most reliable currencies. CHF stability is ensured by a perfectly structured monetary policy, a managed banking system, a low level of public debt, and partial isolation from the EU. The CHF price rose against the background of the debt crisis in the United States. In 2015, the Central Bank unpegged the Swiss franc from the euro, and now the currency is seen as a safe haven asset in the event of problems with the economies of the United States and the Eurozone.

10. Euro (EUR)

The euro is the world’s second reserve currency after the U.S. dollar, with approximately 25 countries pegged to it. It also ranks second after the USD in terms of trade turnover. The stability of the currency price is ensured by the European Central Bank’s monetary policy, which has delegated some financial management powers to local Central Banks. However, history shows that the Eurozone has its weaknesses that could cause the EUR/USD price to eventually drop below 1.0000. In particular, there are problems with the stability of the banking systems of Italy and Spain, migration problems, problems of high reliance on the supply of energy resources, etc.

11. U.S. dollar (USD)

The U.S. dollar is the world’s most popular and freely convertible currency, serving as the financial equivalent. The dominance of the U.S. dollar is related to the country’s policy in the pre-war years and during the Second World War. In the early 1900s, the U.S. economy was in a deplorable state, and the British pound played the leading role in international payments. In the 1930s-1940s, the U.S. managed to accumulate gold reserves (part of the evacuated gold reserves of Norway, Poland, Belgium, and the Netherlands).

The war that engulfed Europe deprived it of its economic advantage in the international arena, and the United States assumed this role. Many countries began to use the gold-backed U.S. dollar for gold and foreign exchange reserves. Although the U.S. dollar is no longer pegged to gold, it is still used as the equivalent of gold and foreign exchange reserves.

12. Panamanian balboa (PAB)

Since 1934, the Panamanian currency has been rigidly pegged to the U.S. dollar at a ratio of 1:1. Any Central Bank can peg its currency to a fixed value of another currency. However, simply pegging is not enough; the exchange rate must also be supported. To that end, effective monetary policy tools, gold reserves, and a stable balance of payments are needed. Panama has all of the above.

13. Bahamian dollar (BSD)

The Bahamian national currency is pegged to the U.S. dollar at a ratio of 1:1. The Bahamian dollar can serve as a reserve investment asset in a critical situation.

14. Singapore dollar (SGD)

Singapore has one of the strongest economies in the Pacific region. With a relatively small domestic market, the country has built strong foreign economic relations. Trading partners are Japan, Hong Kong, China, and other countries in the Asian region. Singapore is also an international financial center. The monetary policy of the Central Bank is relatively flexible but regulated. The Central Bank determines the volatility corridor, which leaves opportunities for earnings on intraday and medium-term strategies.

The Australian and New Zealand dollars (AUD and NZD) were not included in the list. At the time of the rating, their prices were below USD 0.7. This does not mean that these currencies are weak or that their economies are experiencing difficulties. This is rather a temporary event caused by local fundamental factors. For example, the AUD price has crossed the 0.8 USD mark multiple times.

15. Canadian dollar (CAD)

The Canadian dollar ranks 6th in the world in terms of trade turnover. The country has a developed economy due to the volume of natural resources. Also, Canada has extensive oil fields, including shale, as well as uranium deposits (2nd place in the world in uranium reserves). The CAD price is strongly influenced by the USD price against other currencies since the U.S. is Canada’s key trade partner.

Why is it important to know the strongest currencies in the world

Understanding the world's strongest currencies is important for several reasons.

Investment strategies. Investors often seek stable currencies to preserve capital and minimize risk. Currencies backed by robust economies and political stability are considered safe havens, offering security during global economic fluctuations.

Global trade and business planning. Businesses engaged in international trade must monitor currency strengths to manage costs and pricing strategies effectively. A stronger currency can make exports more expensive and imports cheaper, influencing trade balances and profit margins.

Travel and tourism. For travelers, knowing currency values helps in budgeting and maximizing purchasing power abroad. A stronger home currency means travelers can get more value when exchanging money in countries with weaker currencies.

Economic indicators. Currency strength reflects a country's economic health, including factors like inflation rates, interest rates, and political stability. Monitoring these currencies provides insights into global economic trends and potential shifts in economic power.

Policy and decision making. Governments and financial institutions analyze currency strengths to formulate monetary policies, adjust interest rates, and implement measures to stabilize or stimulate their economies.

We have selected a list of the best Forex brokers based on key factors like trading conditions, security, and user experience. This ensures traders get reliable and efficient platforms for their needs.

| Eightcap | Bybit | TeleTrade | Vantage Markets | VT Markets | |

|---|---|---|---|---|---|

|

Tradable assets |

800 | 132 | 300 | 1000 | 1000 |

|

Currency pairs |

40 | 61 | 60 | 40 | 55 |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | 10 | 50 | 100 |

|

Standard EUR/USD spread |

1,0 | Not supported | 1.2 | 0,9 | 0,8 |

|

Cent |

No | No | Yes | Yes | Yes |

|

Copy trading |

No | Yes | No | Yes | Yes |

|

Regulation level |

Tier-1 | No | Tier-1 | Tier-1 | Tier-1 |

|

TU overall score |

9.1 | 9.2 | 8.6 | 8.25 | 8.69 |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

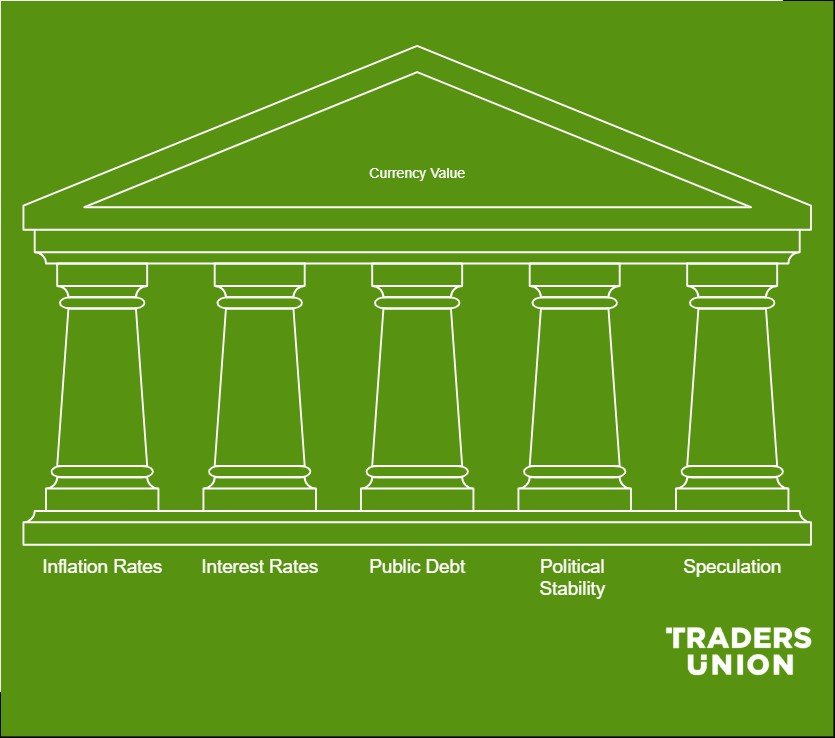

What impacts the value of currencies

The value of a currency is influenced by a mix of economic, political, and market-specific factors. Key determinants include.

Inflation rates. Lower inflation strengthens a currency’s value as purchasing power increases. Higher inflation can weaken it by reducing its buying power.

Interest rates. Higher interest rates attract foreign investment, increasing demand for the domestic currency and boosting its value. Lower rates can lead to depreciation.

Public debt. Large national debts can discourage foreign investors due to inflation risks and potential default concerns, leading to currency depreciation.

Political stability and economic performance. Countries with stable governments and strong economies attract more foreign investments, supporting a stronger currency. Political uncertainty can weaken it.

Terms of trade. A higher export-to-import ratio increases demand for a country’s currency, strengthening its value. A trade deficit can lead to depreciation.

Speculation. If investors expect a currency to strengthen, they buy more of it, driving up its value. Negative sentiment can lead to depreciation.

Government intervention. Central banks may buy or sell their currency to influence its value, often to stabilize markets or achieve economic goals.

Also, the influence of particular news needs to be considered. For example, in case macroeconomic statistics of both countries (in a currency pair) are released at the same time, it is necessary to determine which news will cause greater volatility of the price.

Which currencies are the weakest in the world

The list of the weakest currencies includes countries with weak economies that have structural problems, such as high inflation, unemployment, lack of production, import orientation, internal military conflicts, international sanctions, etc.

In recent years, the list of the world’s top 10 weakest currencies has remained mostly the same, with only the position in the ranking changing.

Top 10 weakest currencies

Here are the weakest currencies in the world:

Iranian rial. Rial began to devalue in 1979, after the revolution, when investors decided to withdraw money from an unstable country that got involved in an international conflict. The government imposed restrictions on the purchase of foreign currency, which led to an increase in the black market and an inflation rate of more than 400%. In recent years, the country has been under severe sanctions related to the deployment of Iran’s nuclear program.

Vietnamese dong. The country is attempting to completely rebuild its economy by putting it on the market rails. Analysts believe that if the country continues to develop a market economy, the dong will soon fall out of the Top 10 weakest currencies.

Lao kip. This is the only currency that was initially pegged to the USD with a purposefully low exchange rate. The kip has been gradually strengthening over the past few years, but the exchange rate is under the strict control of the Central Bank.

Indonesian rupiah. The country’s economy is considered to be steadily developing, but the measures implemented thus far have done nothing to strengthen the rupiah.

Sierra Leonean leone. The economy of this African country is ruined by the war and the pandemic (Ebola).

It would be fair to add the Venezuelan bolivar to this list. In 2019, inflation was around 9600%, and in 2020, it was nearly 3000%. At that time, Venezuela led the ranking of the weakest currencies in the world. However, in 2021, the third printing in the previous 13 years was held, removing six zeros from the bolivar.

Formally, the bolivar lost its place in the rating for this reason, but this did not change the fact that the country’s economy has been in a severe crisis for a long time, despite large oil reserves and high oil prices.

Consider long-term stability when dealing with high-value currencies

When evaluating the highest-valued currencies, look beyond the exchange rate and consider long-term stability. A currency’s strength today does not guarantee it will hold value in the future. Economic shifts, political changes, and central bank policies can all impact a currency’s reliability. From my experience, investors often chase high-value currencies without assessing the broader economic indicators that sustain them.

Diversification is key when holding foreign currencies. Relying solely on one strong currency can be risky, especially if it's tied to volatile commodities like oil. The Kuwaiti dinar, for example, benefits from oil wealth, but any major price drop in the global oil market could influence its value. A well-balanced portfolio that includes stable reserve currencies such as the Swiss franc or U.S. dollar can offer better protection.

Don’t overlook transactional factors when dealing with strong currencies. Exchange rate fees, liquidity, and accessibility in international markets all play a role in how practical a currency is for personal or business use. Even a high-value currency isn’t always the best option if it comes with high conversion costs or limited international acceptance.

Conclusion

A strong currency reflects a country’s economic stability, controlled inflation, and investor confidence, making it a valuable asset in global trade and finance. While the Kuwaiti dinar remains the highest-valued currency, others like the Bahraini dinar, Omani rial, and Swiss franc also hold significant strength due to their financial policies and economic structures. However, a high exchange rate does not always indicate economic dominance — some currencies are intentionally kept lower to support exports and economic growth.

Understanding the strongest currencies provides insight into financial markets, investment opportunities, and global economic trends. Whether for trading, investment, or economic analysis, knowing which currencies hold the most value can help businesses and individuals make informed financial decisions. As economies evolve, currency values shift, making it essential to stay updated on market conditions and monetary policies.

FAQs

Why has the USD become the most popular currency?

The U.S. economy is the strongest in the world. The country ranks first in terms of GDP. The ability of the government to keep the economy stable secures the U.S. money supply. The need for a freely convertible equivalent. For international settlements, an asset was needed that would play the role of “universal money”, which allows one to determine the value of another currency or product. The U.S. dollar plays this role.

What is the safest currency in the world?

The Swiss franc (CHF) is considered the safest among currencies. The 2008 crisis showed that the U.S. economy is not very resistant to force majeure events. The Swiss economy is isolated from the EU and is as balanced as possible. Therefore, the franc is considered a protective asset on par with gold and is used as a safe haven currency.

Which currency is the strongest in the world, and why?

Kuwaiti dinar is the strongest currency in the world. It is not pegged to the U.S. dollar, the country has the lowest oil production costs (Kuwait is one of the leaders in oil exports), low taxes and almost no unemployment.

Which currencies are the weakest in the world?

Some countries intentionally keep their exchange rates low to support exports and economic growth, especially those with smaller domestic markets. Devaluation can also result from trade imbalances, high import costs, or inflation driven by rising energy prices. The weakest currencies in 2025 include the Venezuelan bolivar, Iranian rial, Vietnamese dong, Laotian kip, Indonesian rupiah, and Uzbek sum.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

The deviation is a statistical measure of how much a set of data varies from the mean or average value. In forex trading, this measure is often calculated using standard deviation that helps traders in assessing the degree of variability or volatility in currency price movements.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.