cTrader for Forex Traders | Top Pros and Cons

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

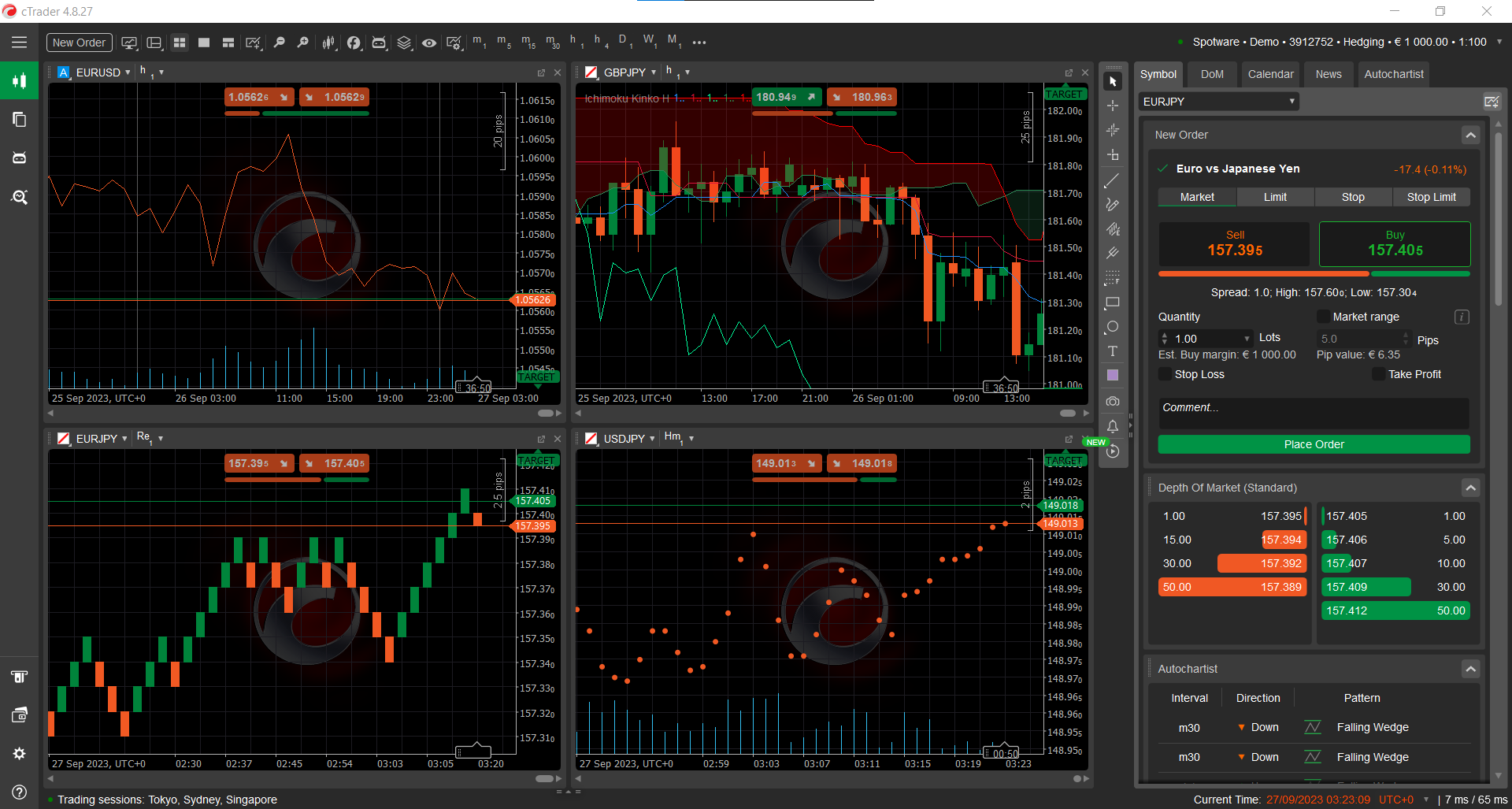

cTrader offers advanced charting tools, extensive technical indicators, and multiple timeframes for in-depth analysis. The platform also supports algorithmic trading through cAlgo, allowing traders to automate their strategies.

cTrader has emerged as a noteworthy contender in the financial markets, offering traders a range of tools and capabilities designed to enhance their trading experience. In this review, the experts at TU delve into the world of online trading using cTrader, exploring its features, advantages, and potential drawbacks of this popular trading platform.

What is cTrader?

cTrader, developed by cTrader Limited in London, is a specialized Forex trading platform that has gained recognition for its compatibility with ECN (Electronic Communication Network) brokers. Initially launched in partnership with FxPro, cTrader has emerged as the platform of choice for several leading ECN brokers, including Liquid Markets, Pepperstone, and Admiral Markets. This platform serves as a complete solution for Forex and CFD (Contract for Difference) online trading and is developed by Software Systems Ltd.

cTrader is highly regarded for its efficiency in executing trades swiftly and accurately, making it a preferred option for traders who prioritize quick and precise transactions. Additionally, cTrader provides Level II pricing, giving traders transparent insights into market depth and pricing information. The platform supports various order types, including order processing, ensuring smooth and efficient execution. Moreover, cTrader incorporates advanced order protection mechanisms to safeguard traders' positions.

One of the standout components of cTrader is "cTrader Automate”, which allows traders to delve into algorithmic trading. This feature offers a robust and user-friendly solution for creating and deploying trading robots, effectively automating trading strategies. In summary, cTrader excels in both trade execution and charting, providing a premium charting experience with customizable trading charts and indicators. Traders of all levels can tailor their experience, and the platform supports the integration of external tools, enhancing its versatility and utility for traders.

- cTrader pros

- cTrader cons

- Swift execution : cTrader offers fast entry and execution of trades, making it a good choice for traders who value quick and accurate transactions

- Transparent pricing : With Level II pricing, traders gain insights into market depth and pricing information, enhancing transparency in trading

- Advanced charting : cTrader provides advanced charting capabilities with various responsive and detachable charts, multiple timeframes, and zoom levels. It has over 70 pre-installed technical indicators and supports custom indicators for in-depth technical analysis. Traders can choose from different viewing modes, access up to 50 templates, and utilize sharing tools, including embedding charts

- User-friendly navigation : cTrader offers easy navigation between tabs and available options, ensuring a seamless user experience

- Versatile accessibility : It is accessible as a standalone application for Windows-based PCs, a web trading app, and mobile trading applications, catering to traders' preferences for different devices

- Stop-loss order variability : Some users have reported significant fluctuations in stop-loss orders, which can be a concern for traders relying on precise risk management

- Proxy network connection : To access cTrader, each trader must connect to Spotware's global network of proxies, which can introduce additional complexity to the trading process

- Limited broker availability : While cTrader has gained popularity, it may have limited broker availability compared to some other trading platforms, potentially limiting traders' choices in selecting a brokerage that supports cTrader

Key tools and platforms

cTrader is a charting and manual trading platform designed for Forex and CFD traders. Here are the top tools and features of the platform.

cTrader copy

cTrader Copy allows traders to become Strategy Providers. They can broadcast their trading strategies for a commission or fee, opening the door to a new world of commitment-free investing. Additionally, traders can exercise control over their risk management settings while searching for and replicating strategies offered by others.

cTrader automate

cTrader Automate presents a comprehensive and user-friendly solution for traders looking to automate their strategies. This feature allows traders to develop algorithmic trading robots with ease. Leveraging the modern C# API, traders can seamlessly write and test code within the integrated development environment. It offers the capability to optimize custom indicators and robots effectively.

Open API for custom applications

cTrader offers an open API, a secure and publicly accessible interface, inviting developers to create their web, mobile, or desktop applications. This API provides developers with access to cTrader's established technologies, enabling them to connect to and trade with any cTrader account. Read also information about best brokers with API trading.

Favorites and Depth of Market enhance trading

Traders on cTrader can personalize their trading experience by setting up their favorite underlying assets. This feature ensures quick access to preferred assets and real-time price information. Further, cTrader's depth of market tools equips traders with a good understanding of market dynamics, offering benefits such as enhanced decision-making through comprehensive market insights and trend analysis.

Robust encryption for security

cTrader prioritizes security through robust encryption protocols, including secure socket layer (SSL) encryption. This technology safeguards user data and communication, ensuring that sensitive information like login credentials and financial data remains secure and protected from unauthorized access or interception.

Charting

cTrader provides advanced charting capabilities that enable traders to conduct in-depth market analysis and make informed trading decisions.

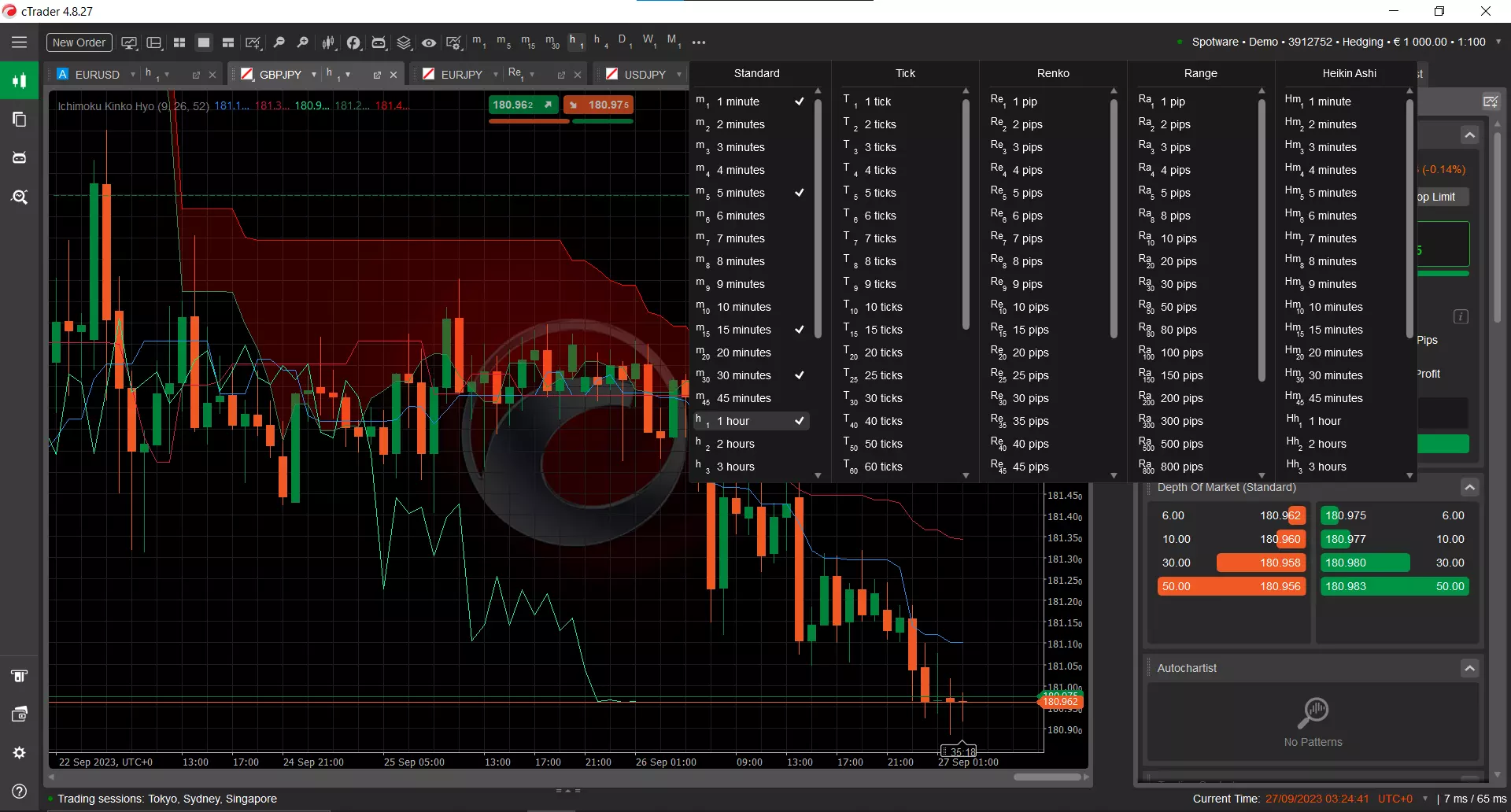

Variety of chart types

cTrader platform

cTrader platformcTrader offers a wide range of chart types to cater to various trading preferences and analysis needs. Some of the commonly used chart types include:

Candlestick charts - These provide a visual representation of price movements and are widely used for technical analysis

Line charts - Simplistic charts that display the closing prices over time, useful for tracking trends

Bar charts - Display price data in the form of vertical bars, showing the open, close, high, and low prices for a specified period

Renko charts - Based solely on price movement, Renko charts filter out noise and focus on significant price changes

Heikin Ashi charts - Smooth out price fluctuations, making it easier to identify trends and reversals

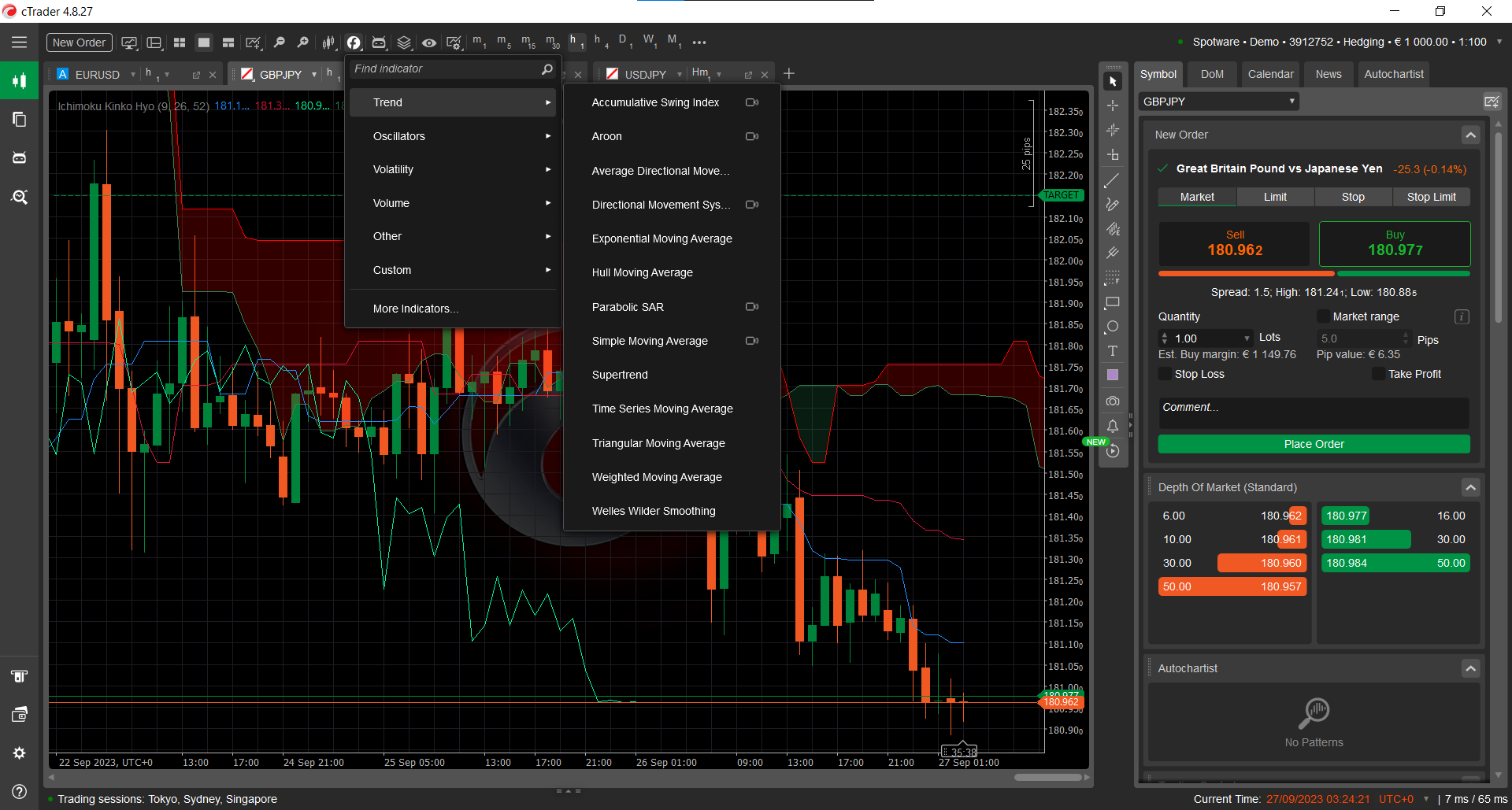

Extensive technical indicators

cTrader platform

cTrader platformcTrader offers a comprehensive library of technical indicators that traders can apply to their charts. These indicators help traders analyze price movements, identify trends, and make informed trading decisions. Examples of technical indicators include moving averages, relative strength index ( RSI), MACD (Moving Average Convergence Divergence), Bollinger Bands, and more.

Flexible timeframes

cTrader platform

cTrader platformTraders can select from a wide range of timeframes to view price data, ranging from tick charts for very short-term analysis to daily, weekly, or even custom timeframes. This flexibility allows traders to adapt their charts to different trading strategies and time horizons.

Advanced drawing tools

Image_Title

Image_TitlecTrader provides a suite of advanced drawing tools that enable traders to mark up their charts with trendlines, support and resistance levels, Fibonacci retracements, and other custom annotations. These tools are invaluable for technical analysis and strategy development.

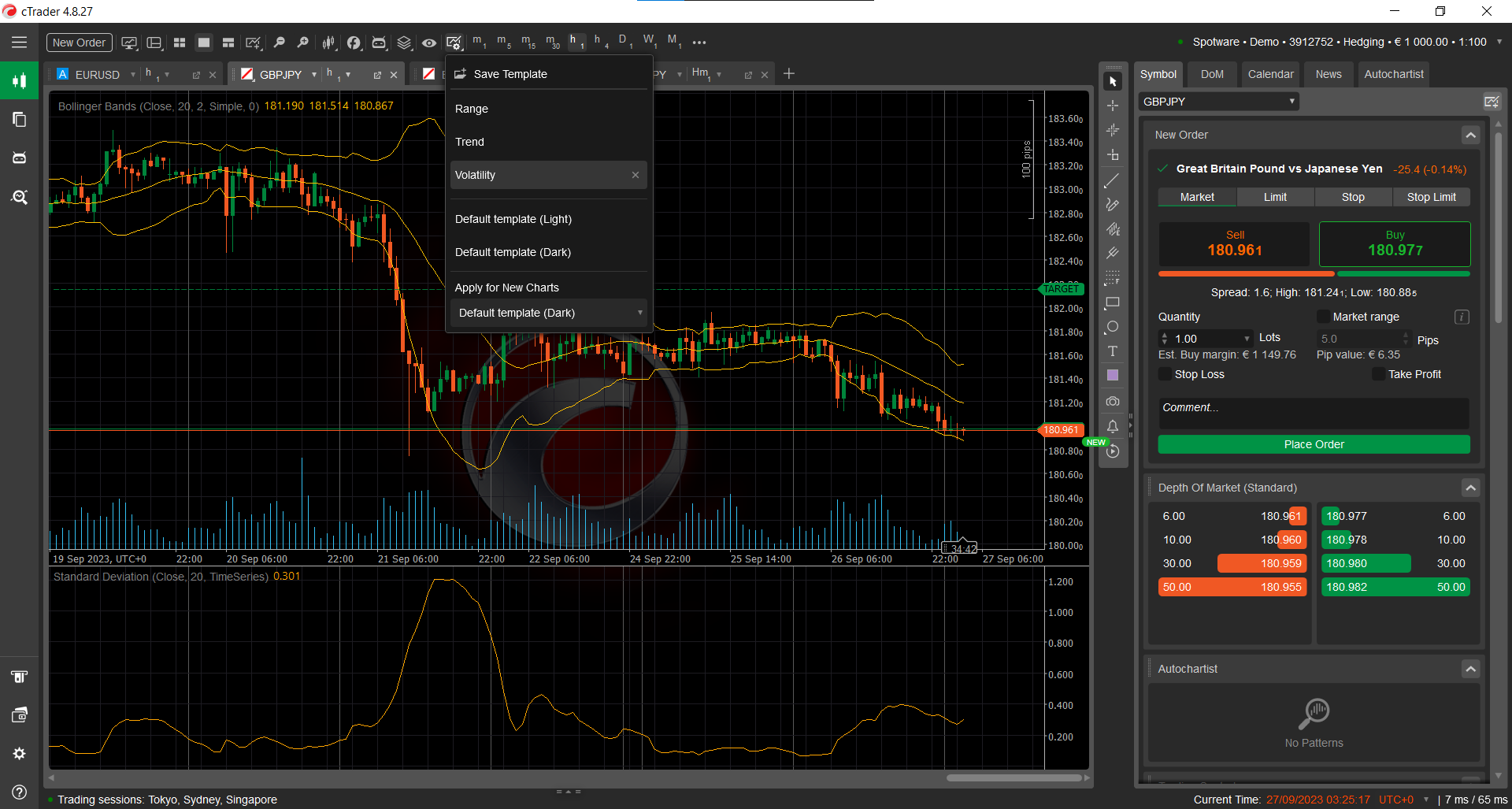

Efficient chart templates

cTrader platform

cTrader platformChart templates in cTrader allow traders to save and apply their preferred chart setups, indicators, and drawing tools with ease. This feature saves time and ensures consistency in analysis across different trading sessions and instruments.

Analytics

cTrader offers a variety of analytical tools and features for traders.

Comprehensive trade analytics

cTrader provides traders with essential trade metrics, including profit/loss, win rate, and average trade duration, for evaluating trading performance.

Customizable visual dashboards

The platform offers customizable trade dashboards and charts to visualize trading data, aiding in pattern recognition and data-driven decision-making.

Effective risk management

cTrader's analytics cover risk management metrics like maximum drawdown, risk-reward ratio, and position sizing, facilitating informed risk management.

Detailed trade history logs

cTrader maintains comprehensive trade history logs, allowing traders to analyze past trades, track performance, and identify recurring patterns or errors.

Real-time market sentiment

The platform provides real-time trade sentiment indicators, offering insights into market sentiment based on fellow traders' positions, aiding in more informed trading decisions.

cTrader indicators

In the world of trading, access to the right indicators can make all the difference. On similar lines, cTrader caters to traders' needs with a selection of useful indicators, each designed to enhance your trading insights.

Hull MA Indicator

cTrader platform

cTrader platformAllan Hull's Hull Moving Average (HMA) indicator in cTrader is renowned for its speed and smoothness, offering minimal lag and enhanced smoothing for both intraday and long-term moving averages.

Larry Williams Indicator Package

cTrader platform

cTrader platformThis package includes indicators created by legendary trader Larry Williams, such as the Williams Ultimate Oscillator, Advance/Decline Line, Cycle Identifier, and VIX FIX, providing valuable tools for traders.

Candlestick Patterns - Doji

cTrader platform

cTrader platformThe Doji candlestick pattern indicator in cTrader helps traders identify market reversal signals, ensuring they don't miss critical turning points for well-informed trading decisions.

Correlation Indicator

Image_Title

Image_TitlecTrader's correlation indicator allows traders to compare two instruments and assess their historical and current correlation, aiding in effective risk management and loss prevention.

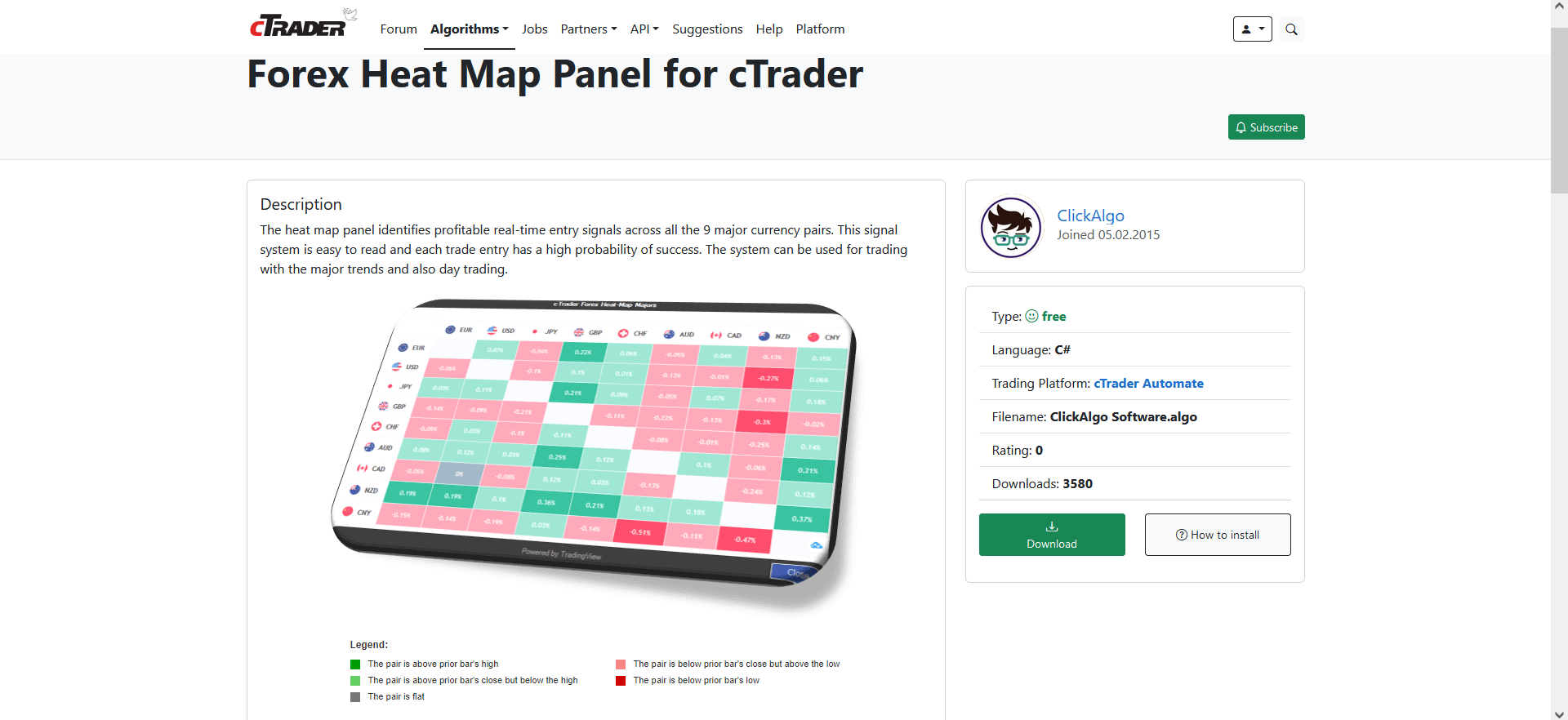

Forex Heat Map Panel

cTrader platform

cTrader platformThis unique panel in cTrader monitors 9 currencies, revealing their relative strength and weakness, helping traders identify strong or weak currencies and potential reversals.

Can I install indicators in cTrader mobile?

Yes, you can install indicators in cTrader mobile.

Can I add new indicators to cTrader?

Yes, you can add new indicators to cTrader.

How do I set indicators on cTrader?

To set indicators on cTrader, simply click on the 'Indicators' icon located in the top-most control row. From the newly opened section, select the indicator you'd like to add. Depending on the indicator settings, its output will either overlay on the chart or display in a separate section. After adding an indicator, cTrader will display a new toolbar, either on the trading chart or below it, with three icons showing the indicator name, parameter values, and the indicator output. Additionally, you can create custom indicators and add them directly to the trading chart.

How to trade on cTrader?

Here's a step-by-step guide to getting started with cTrader:

Select a reputable broker

Begin by choosing a broker that offers cTrader as a trading tool. Ensure the broker is not only legitimate but also regulated for added security. Once you've made your choice, proceed to sign up for a trading account.

Register your trading account

Registering a trading account is a straightforward process and completely hassle-free. Provide your basic details such as name and email to initiate your journey.

Opt for demo or live account

Upon signing up, you'll have the option to choose between a demo account and a live account for cTrader. The demo account is an excellent opportunity to explore the platform's functionalities without financial risk. Note that the duration of free demo access may vary among brokers, typically ranging from 30 to 60 days.

Dive into cTrader

With your live trading account on cTrader, you're ready to start on your trading journey. Ensure your account is funded with the required amount specified by your broker. You can also explore an alternative method by downloading cTrader directly from its official website.

Download and install cTrader

To download cTrader, visit the official website and locate the “download cTrader” option. Follow the installation instructions.

Log in and trade

Once installation is complete, log in using your credentials if you're registered with a broker supporting cTrader. It's worth noting that cTrader is accessible on mobile devices as well, with downloadable versions available on the App Store and Google Play Store.

Before downloading cTrader, ensure your device meets the platform's compatibility requirements. For desktop use, ensure your PC runs on Windows 7 or later.

cTrader bots

cTrader provides a diverse array of algorithmic trading options, making it a go-to choice for traders seeking automation. The key highlights of this feature include:

cTrader automate : This comprehensive solution empowers traders to create and deploy custom trading indicators and cBots, which are autonomous computer programs that execute and manage trading operations within the cTrader desktop platform

Custom indicators : Traders can harness custom indicators to perform calculations on cTrader charts, utilizing various data inputs like price data, chart drawings, and account properties. This flexibility allows for precise analysis and strategy execution

Community engagement : cTrader fosters a vibrant community where traders can download, share, and discuss Forex robot and indicator algorithms. The cTrader forum serves as a hub for asking questions, sharing ideas, and collaborating with fellow traders

cTrader Automate API : Specifically designed for margin trading, this API employs a user-friendly format that engages both users and developers. Its extensive functionality covers a wide range of trading aspects in the Forex and CFD markets

Educational resources : cTrader offers educational materials for traders new to algorithmic trading. These resources include video tutorials and a comprehensive video library covering various aspects of using cTrader Automate

Expert Advisors (EAs) : Within the cAlgo platform, traders can construct Expert Advisors (EAs). These automated trading robots diligently monitor market data and execute trades based on predefined rules, eliminating the potential for human error and ensuring precise and rapid order placement

Can I install new bots in cTrader?

Absolutely, you have the freedom to install new bots in cTrader. The platform provides a user-friendly environment for traders to explore the exciting realm of automated trading. You can access and download Forex robot and indicator algorithms from the cTrader community, all at no cost.

Are bots free or paid in cTrader?

In cTrader, bots come in both free and paid categories, catering to the diverse preferences of traders. The cTrader community offers a variety of Forex robot and indicator algorithms that you can freely download and use.

cTrader copy trading

cTrader serves as a hub for traders to connect, share insights, and exchange ideas. Its community offers opportunities for traders to engage in discussions and gain market knowledge. Here, traders can connect with peers, learn from experienced individuals, and stay informed about market trends.

cTrader provides a copy trading feature, enabling traders to replicate the trades of experienced counterparts. This social trading functionality facilitates learning from experts and potentially benefiting from their strategies. Traders can access a list of top performers, analyze their trading methods, and choose to automate the replication of their trades. This feature promotes knowledge transfer and potential profitability.

Beyond copy trading, cTrader allows trade following and information sharing within its community. Traders can share trade ideas, market analysis, and insights. This collaborative environment encourages discussions about trading opportunities, strategy validation, and diverse viewpoints. Traders can monitor others' trades, provide commentary, and engage in constructive discussions, enhancing their learning and trading capabilities.

Is cTrader free?

Using cTrader as a trading platform doesn't come with a direct cost to the trader. Instead, it's the broker you choose that provides access to cTrader. Therefore, the fees associated with cTrader are typically covered by the broker.

In addition to this arrangement, traders need to be aware of the commissions charged by the cTrader broker. The platform offers competitive spreads, starting as low as 0.2 pips on major currency pairs. Commissions, however, come into play at $3.50 per lot of the base currency for each trade, applied upon both entry and exit.

Is cTrader good for beginners?

According to TU’s team of experts, cTrader can be a good platform for beginners venturing into the world of Forex trading. Its user-friendly interface and intuitive design make it easy for newcomers to navigate and understand. The platform offers a demo account, allowing beginners to practice trading without risking real money. Furthermore, cTrader's trader community provides a supportive environment where beginners can seek advice, learn from experienced traders, and gain valuable insights into Forex trading.

Customer support

cTrader places a strong emphasis on customer support, offering various avenues for assistance. Users can turn to the cTrader Help Center, a comprehensive resource brimming with answers to common questions, tutorials, and usage guides. Additionally, the cTrader Forum serves as a community hub for discussions on platform-related topics, from indicators to automated trading strategies. Direct contact with Spotware Systems Ltd, the company behind cTrader, is possible for sales and marketing inquiries, with contact details available on the Contact Us page. To ensure users receive prompt assistance, cTrader provides 24/5 support through email-based ticketing and phone support during trading hours. These support options underscore cTrader's commitment to aiding users and enhancing their trading experiences.

Best cTrader brokers

FxPro

FxPro is a well-established broker offering traders access to over 2,100 financial instruments across multiple asset classes, including Forex, stocks, commodities, indices, and cryptocurrencies. It is regulated by reputable authorities – FCA, CySEC and others.

The broker stands out with its focus on technology and offers an average order execution speed of 14-30 ms, setting a market benchmark. FxPro also provides an impressive suite of trading tools and educational resources, such as Trading Central analytics. The minimum deposit of $100, however, is higher than some competitors.

FTMO

FTMO is a prop trading firm offering experienced traders the chance to manage a funded account of up to $200,000 with a wide range of instruments including Forex, stocks, indices, commodities, and cryptocurrencies. To qualify, traders must pass a two-step evaluation process.

Beginners may start with a Free Trial account which has the same trading conditions as the challenge ones. Long-term traders are free to use a Swing Account that has no restrictions on holding positions over the weekend or trading during macroeconomic releases. The company offers trading with the most popular platforms – MT 4/5, cTrader, and DXtrade. The leverage is up to 1:100. Additionally, FTMO is recognized for its educational resources and continuous support.

FAQs

Is cTrader better than MT4?

Both platforms have their strengths, so it depends on your trading preferences.

Which is better MetaTrader or cTrader?

The choice between MetaTrader and cTrader depends on your trading style and needs.

Which broker is best for cTrader?

The best broker for cTrader varies based on factors like trading conditions and your location. Some notable brokers that support cTrader are IC Markets, Pepperstone and FxPro.

Is cTrader better than MT5?

cTrader and MT5 each have unique features; the better choice depends on your requirements.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

An Expert Advisor (EA) is a piece of software or script used in the MetaTrader trading platform to automate trading strategies. EAs are programmed to execute trading decisions based on predefined criteria, rules, and algorithms, allowing for automated and systematic trading without the need for manual intervention.

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.