LTC/USD forecast by Traders Union analysts

The LTC/USD pair means that the price of Litecoin changes in the US dollars. This altcoin was launched as a BTC fork in 2011. The cryptocurrency was designed for faster transactions compared to the parent network. There is still a substantial correlation observed between Litecoin and Bitcoin. This explains the popularity of LTC/USD trading among traders, who want to make some money on volatility. Traders Union analysts make daily forecasts of Litecoin price against the US dollar so that you could monitor the price performance online. The forecasts are based on the instruments of technical analysis.

LTC/USD under pressure after rally

01.07.2025

LTC/USD remains under pressure

17.06.2025

LTC/USD moves higher

13.05.2025

LTC/USD remains under bearish control

06.05.2025

LTC/USD continues to rise

23.04.2025

LTC/USD returned to 80.00

15.04.2025

LTC/USD resumes decline

02.04.2025

LTC/USD remains within range

25.03.2025

LTC/USD remains under selling pressure

18.03.2025

LTC/USD declines

05.03.2025

LTC/USD remains within wide range

25.02.2025

LTC/USD bought on decline

18.02.2025

LTC/USD retests 130.00

11.02.2025

LTC/USD plunges following Bitcoin

04.02.2025

LTC/USD sold on rise

28.01.2025

LTC/USD sold on rise again

21.01.2025

LTC/USD bought on drop

15.01.2025

LTC/USD under pressure after rise

07.01.2025

LTC/USD recovering losses

24.12.2024

LTC/USD consolidates within narrow range

17.12.2024

LTC/USD under pressure after rally

03.12.2024

LTC/USD declines after rise

26.11.2024

LTC/USD under pressure after rise

19.11.2024

LTC/USD under pressure after testing 82.70

12.11.2024

LTC/USD under selling pressure

05.11.2024

LTC/USD advances following Bitcoin

29.10.2024

LTC/USD sold on rise

22.10.2024

LTC/USD still consolidating

15.10.2024

LTC/USD bought up on decline to 62.00

08.10.2024

LTC/USD under pressure after rise

24.09.2024

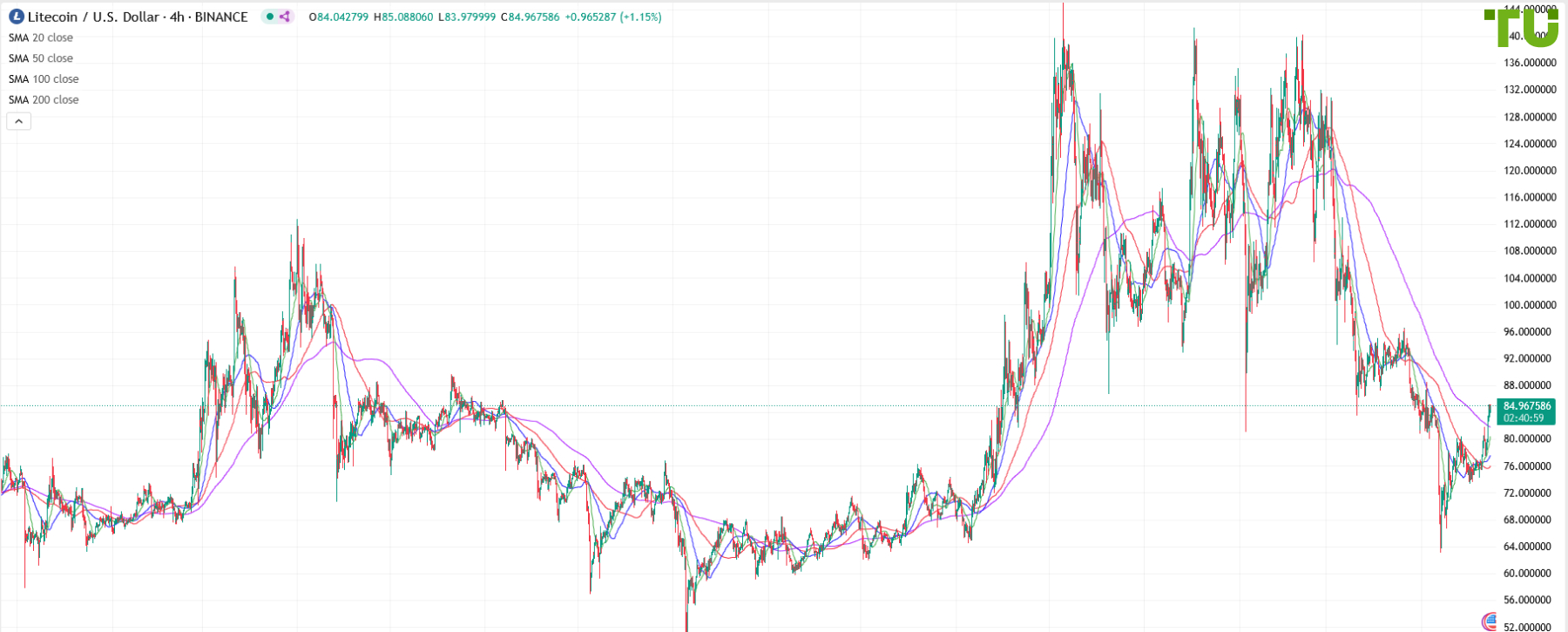

LTC/USD Chart

Why is it important to know the LTC/USD price prediction?

TU experts determined that trading LTC/USD allows you to make money even during minor changes in the price. Considering that the price of the base currency – Litecoin, correlates with Bitcoin, high volatility is possible. This indicates that you need to regularly monitor the price performance. If Litecoin strengthens, the US dollar drops and vice versa. Trading LTC/USD is suitable for advanced traders, as there are constant price fluctuations. There is a high risk of losing money if you don’t constantly monitor the online price chart.

FAQ

How is the LTC/USD forecast made?

What is technical analysis?

Can the LTC/USD forecast be relied upon?

What does the LTC/USD price depend on?

· Change of Bitcoin price;

· Volatility in the financial markets;

· Decisions of the Fed;

· Unplanned events and economic or political news.