NZD/USD forecast for today by Traders Union analysts

The New Zealand dollar / US Dollar currency pair belongs to the group of the major currency pairs. The pair enjoys moderate popularity among Forex investors and traders. Traders Union experts prepare an analytical NZD/USD price prediction daily so that each trader could find the latest information on the NZD/USD price performance and also study the NZD/USD price chart online. The forecast is based on the technical analysis of the Forex market.

NZD/USD remains under pressure

14.07.2025

NZD/USD attempts to hold above 0.6000

11.07.2025

NZD/USD moves higher

10.07.2025

NZD/USD remains under pressure

09.07.2025

NZD/USD tested 0.5990 support

08.07.2025

NZD/USD under moderate pressure

07.07.2025

NZD/USD demand on dip remains

04.07.2025

NZD/USD under moderate pressure

03.07.2025

NZD/USD under pressure after rise

02.07.2025

NZD/USD also moves higher

01.07.2025

NZD/USD bulls fail to break resistance

30.06.2025

NZD/USD challenges resistance

27.06.2025

NZD/USD demand persists

26.06.2025

NZD/USD recovers after decline

25.06.2025

NZD/USD under bearish control

23.06.2025

NZD/USD tests support

16.06.2025

NZD/USD returns to support

12.06.2025

NZD/USD falls after gains

09.06.2025

NZD/USD also sold on rally

06.06.2025

NZD/USD remains in demand

05.06.2025

NZD/USD may continue to rise

02.06.2025

NZD/USD under pressure

29.05.2025

NZD/USD extends decline

28.05.2025

NZD/USD was bought from 0.5900

26.05.2025

NZD/USD could extend its advance

23.05.2025

NZD/USD continued to decline

16.05.2025

NZD/USD was also sold on rally

15.05.2025

NZD/USD tests 0.5940

14.05.2025

NZD/USD selling resumes

13.05.2025

NZD/USD still under pressure

12.05.2025

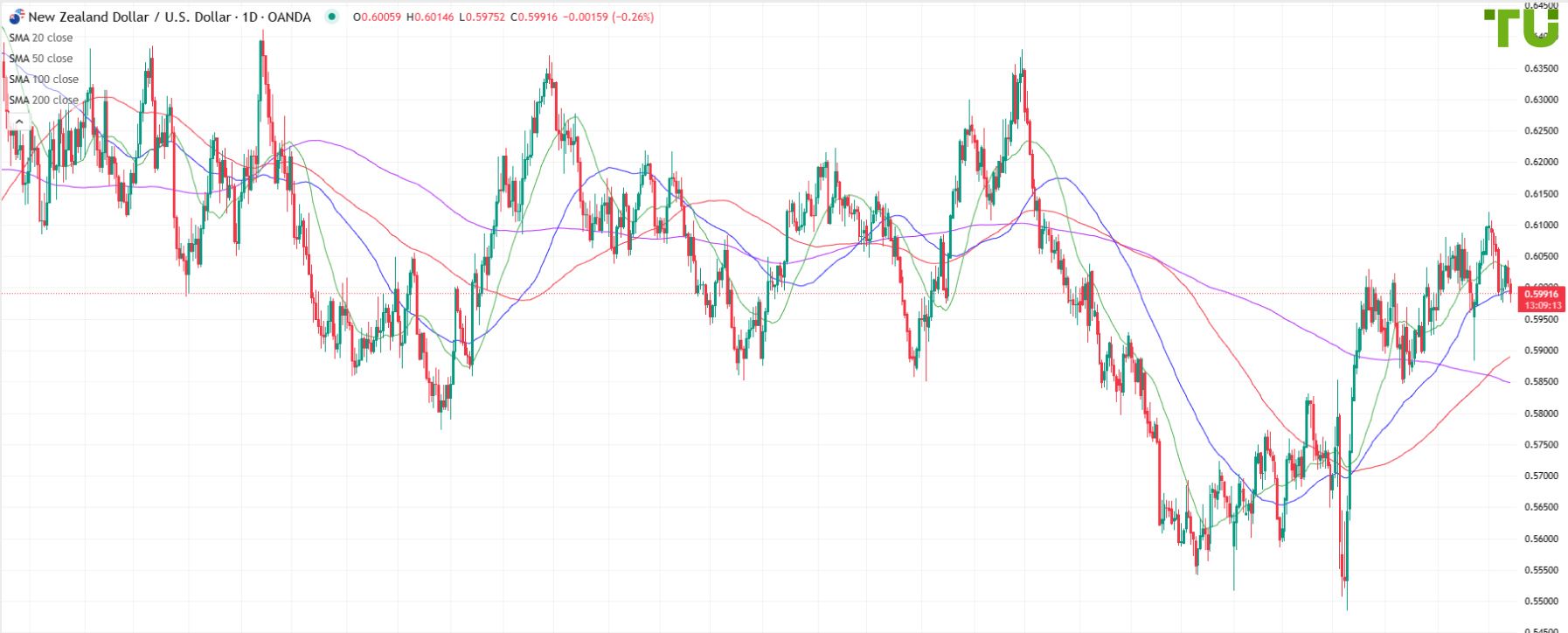

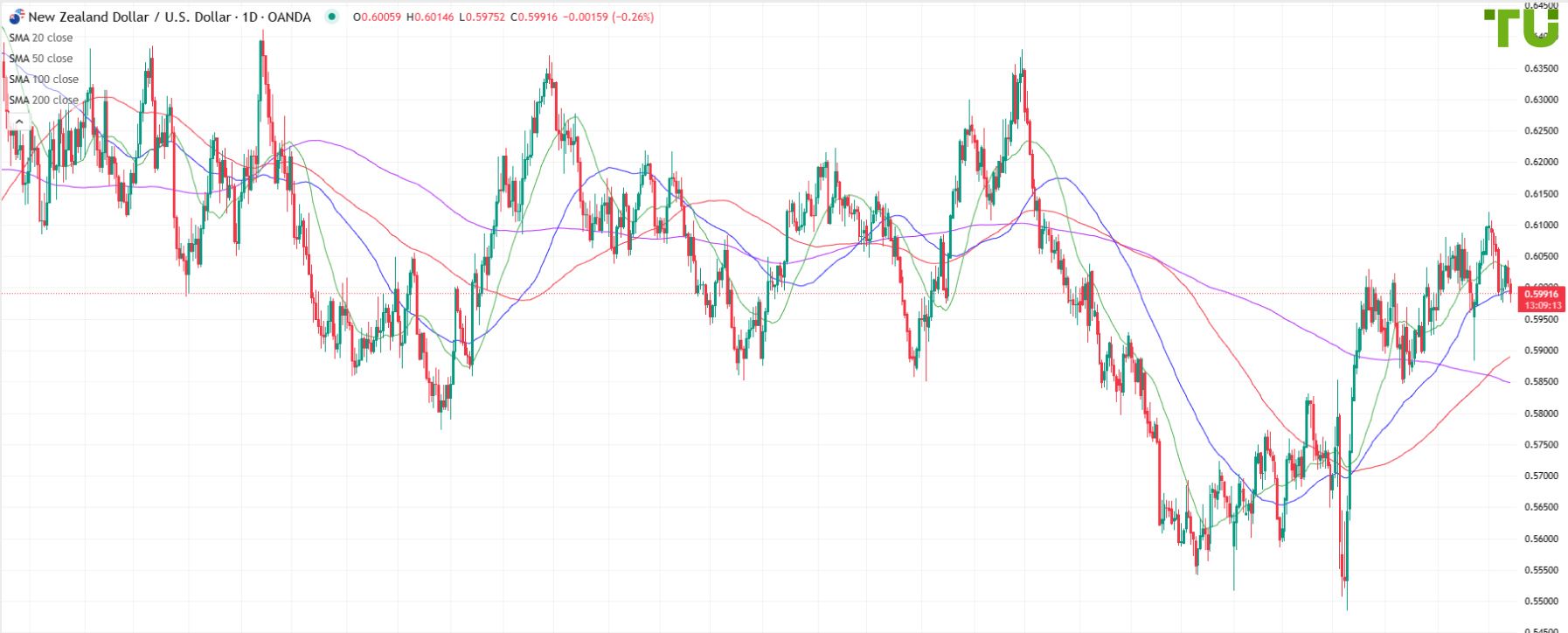

NZD/USD chart

Why is it important to know NZD/USD price prediction?

Research conducted by Traders Union experts shows that the NZD/USD pair accounts for around 7% of all currency exchange transactions in the Forex market. This indicates that the pair enjoys popularity among Forex traders and is a desired asset with moderate level of volatility, thanks to which you can use it to grow your capital at a minimum risk. The pair is informally called Kiwi / Dollar by traders in the Forex market and exchanges, since the Kiwi bird is depicted on the one-dollar coin of News Zealand. Kiwi is also a symbol of New Zealand. NZD is the base currency in the New Zealand dollar / US dollar pair.

FAQ

What is the NZD/USD price prediction based on?

What is technical analysis in the Forex market?

Can the NZD/USD price prediction be trusted?

What impacts New Zealand dollar price against the US dollar

- Internal events at the New Zealand Exchange;

- Policies of the Reserve Bank of New Zealand and the U.S. Fed;

- Dynamics of export-import transactions between the U.S. and New Zealand;

- Inflation in New Zealand and the U.S.;

- Statements of New Zealand and U.S. officials;

- General trends in the global financial markets and in the Forex market in particular.