Gold Analysis: Gold's Future Looms After Stellar Performance Early in 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Top 5 Gold Forecast For 2025:

- Goldman Sachs predicts an all-time high of $2,700 by the end of 2024, driven by economic uncertainties and high inflation.

- UBS forecasts gold to reach $2,600 by the end of 2024, up from their initial $2,200 projection.

- ING expects gold prices to remain above $2,000 due to ongoing geopolitical tensions and central bank buying.

- The World Bank projects gold to average $1,900 per ounce by the end of 2024 due to improving economic conditions and shifting investor sentiment.

- J.P. Morgan expects gold prices to peak around $2,175 per ounce by the fourth quarter of 2024.

Gold has performed remarkably well in 2024 outpacing most major asset classes and making headlines this year, after breaking record highs in mid-March and mid-May. However, after gaining good momentum in the first quarter of the year, Q2 was characterized by a slightly upward range-bound performance.

This article reveals:

The factors that were behind gold’s record-breaking performance from Q1 2024 to date.

Factors that will shape gold prices in the second half of 2024.

Gold Outlook for Q3 and Q4, 2024.

Gold surpasses its previous all-time high of $2,070.70 per ounce due to investor demand for safe havens.

Aggressive gold accumulation by central banks suggests potential future volatility.

Concerns about a potential US recession and anticipated interest rate cuts bolster gold's appeal.

Projections for the second half of 2024 include range-bound prices, upward price movement, or downward pressure.

Gold Price Outlook

Gold Price Outlook 1

Economic Scenario: Moderate Recovery

Projected Impact: Range-bound Price Action

Factors That Can Contribute to Moderate Economic Recovery and Range Bound Price Action:

Federal Reserve Policies:

The Fed's current interest rate stands at 5.25% - 5.5%, with an anticipated 25 basis point cut by year-end. This minor reduction will have a limited impact on lowering the opportunity cost of holding gold, leading to stable rather than significantly rising priceOpportunity Cost:

If the 10-year Treasury yields remain stable or marginally decrease, while the dollar stays flat or slightly weakens. These conditions will not support a significant increase in gold prices but it will support a stable trading range.Economic Expansion:

Economic growth below trend but improving may provide a neutral backdrop for gold. This moderate recovery will not create strong upward or downward pressure on gold prices. Therefore, it will contribute to a range-bound performance.Risk and Uncertainty:

Persistent inflation and geopolitical risks will continue to create demand for gold as a safe-haven asset. However, the impact of these factors is expected to be balanced by risk-on positioning in other markets, limiting significant price movements.

Gold Price Outlook 2

Economic Scenario: Economic Recession

Projected Impact: Upside Price Movement

Factors That May Contribute to Gold Uptrend:

Federal Reserve Policies:

Expectations of more rate cuts by the Fed are priced into the market. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors seeking safety and value preservation.Opportunity Cost:

Lower ten-year Treasury yields and a stronger dollar driven by safe-haven demand indicate a risk-averse market environment. While a stronger dollar can typically weigh on gold prices, in this scenario, the overall fear and uncertainty in the market may outweigh this effect, leading to higher gold prices.Economic Expansion:

Increased recession risks projected for 2025 enhance gold’s appeal as a hedge against economic downturns. As fears of a recession grow, investors are likely to flock to gold to protect their portfolios from potential losses in other asset classes.Risk and Uncertainty:

While inflation is expected to drop, it remains above target levels, creating a persistent environment of uncertainty. Combined with geopolitical risks and a shift to risk-off positioning, these factors can amplify gold’s status as a secure investment during turbulent times.Market Momentum:

If central bank purchases of gold continue above the trend, this can provide consistent support. Although there are expectations that commodities may sell off. If so, an increase in gold net positioning will indicate strong investor interest and confidence in gold's future performance.

Gold Price Outlook 3

Economic Scenario: Prolonged Rate Hike

Projected Impact: Downside Price Movement

Factors That May Contribute to Downward Pressure:

Federal Reserve Policies:

If the Fed funds rate rises between 5.5% and 6.5% by the end of the year, higher interest rates will increase the opportunity cost of holding non-yielding assets like gold. This scenario reduces the appeal of gold as investors seek higher returns from interest-bearing securities.Opportunity Cost:

If 10-year Treasury yields rise slightly, and the dollar strengthens due to interest rate differentials. A stronger dollar and higher yields will typically exert downward pressure on gold prices, as these conditions make gold more expensive for foreign investors and increase the attractiveness of alternative investments.Economic Expansion:

Economic growth is projected to slow down in this scenario. Slower growth diminishes overall demand for commodities, including gold, as industrial and consumer demand weaken. The prospect of subdued economic expansion further limits gold's appeal as a growth asset.Risk and Uncertainty:

Assume inflation reaccelerates, and geopolitical risk rises. These factors will drive demand for safe-haven assets like gold, but a stronger dollar and higher interest rates in this scenario could offset the positive impact of uncertainty on gold prices.Market Momentum:

Central bank purchases of gold are expected to continue but at a slightly below-trend pace. Additionally, a rebound in commodities and deteriorating gold net positioning indicate weakening investor sentiment towards gold. These factors suggest that while there will be some demand, it will not be sufficient to support higher prices.

Economist Forecast for Gold Q3 and Q4 2024

The outlook for gold prices in the second half of 2024 is varied, with projections ranging from bullish to bearish, and some expecting neutral trends. Here's a summary of the key forecasts:

Gold Bullish Projections

Goldman Sachs has revised its forecast upwards to an all-time high of $2,700 by the end of the year, driven by expectations of economic uncertainties and high inflation.

UBS projects gold to reach $2,600 by the end of 2024, up from their initial forecast of $2,200.

ING expects gold prices to remain above $2,000 due to ongoing geopolitical tensions and central bank buying.

Gold Bearish Projections

Some experts including the World Bank anticipate a potential decline in gold prices due to improving economic conditions and shifting investor sentiment:

Gold Neutral Projections

J.P. Morgan expects gold prices to peak around $2,175 per ounce by the fourth quarter of 2024.

Morgan Stanley forecasts an average price of $2,019 per ounce for the year, considering geopolitical risks and economic factors.

Overall, the outlook for gold in the latter half of 2024 remains varied, with some experts predicting continued strength while others anticipate potential declines depending on evolving market dynamics.

Factors Behind Gold’s Record-breaking Performance, Q1 2024 to date

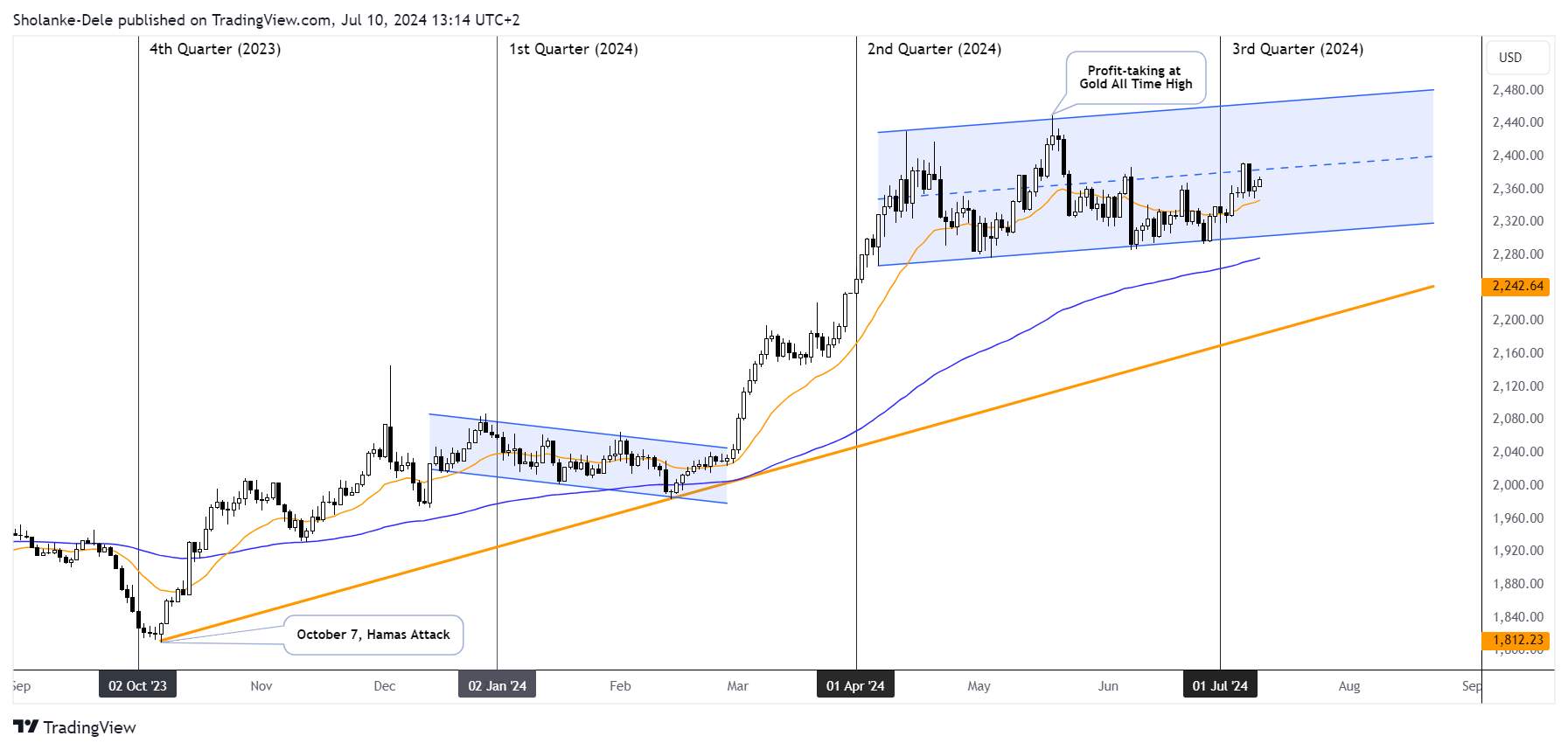

Prior to October 2023, central banks, particularly in emerging markets like China and India, were aggressively accumulating gold to diversify reserves and lessen dependence on the US dollar. But then, rising interest rates in major economies weighed heavily on the yellow metal in 2023.

Then came October 7th, Gold prices experienced a dramatic shift as the attack by Hamas on Israel reignited a long-standing conflict. Fears of wider Middle Eastern instability, a region notorious for its impact on global markets, returned with a vengeance. This surge in geopolitical tensions sent investors scrambling for safe havens, propelling gold prices above its 2020 all-time high of $2,070.70 per ounce.

The previous all-time high, recorded in 2020, was a confluence of economic woes. The COVID-19 pandemic's fallout, fears of inflation fueled by massive stimulus packages and central bank interventions sent investors flocking to gold. October 2023, however, painted a different picture. Here, it was geopolitical turmoil, not economic anxieties, that drove gold prices to new record highs.

The first two months of 2024 saw gold locked in a sluggish consolidation, with a slight downward bias. However, a dramatic shift unfolded in late February, igniting a significant rally that carried through Q1 and Q2. This bullish resurgence was fueled by several risk factors, such as:

The ongoing war in Ukraine, coupled with rising tensions in Gaza, stoked fears of wider conflict and market disruption.

Concerns about a potential US recession prompted investors to seek alternative investments.

Strong demand for gold during the Chinese Spring Festival provided a welcome boost to gold prices.

Stubborn inflationary pressures further bolstered gold's appeal as a hedge against rising prices.

Anticipation of interest rate cuts by major central banks, like the Federal Reserve and the Bank of England, weakened the US dollar and made gold a more attractive proposition.

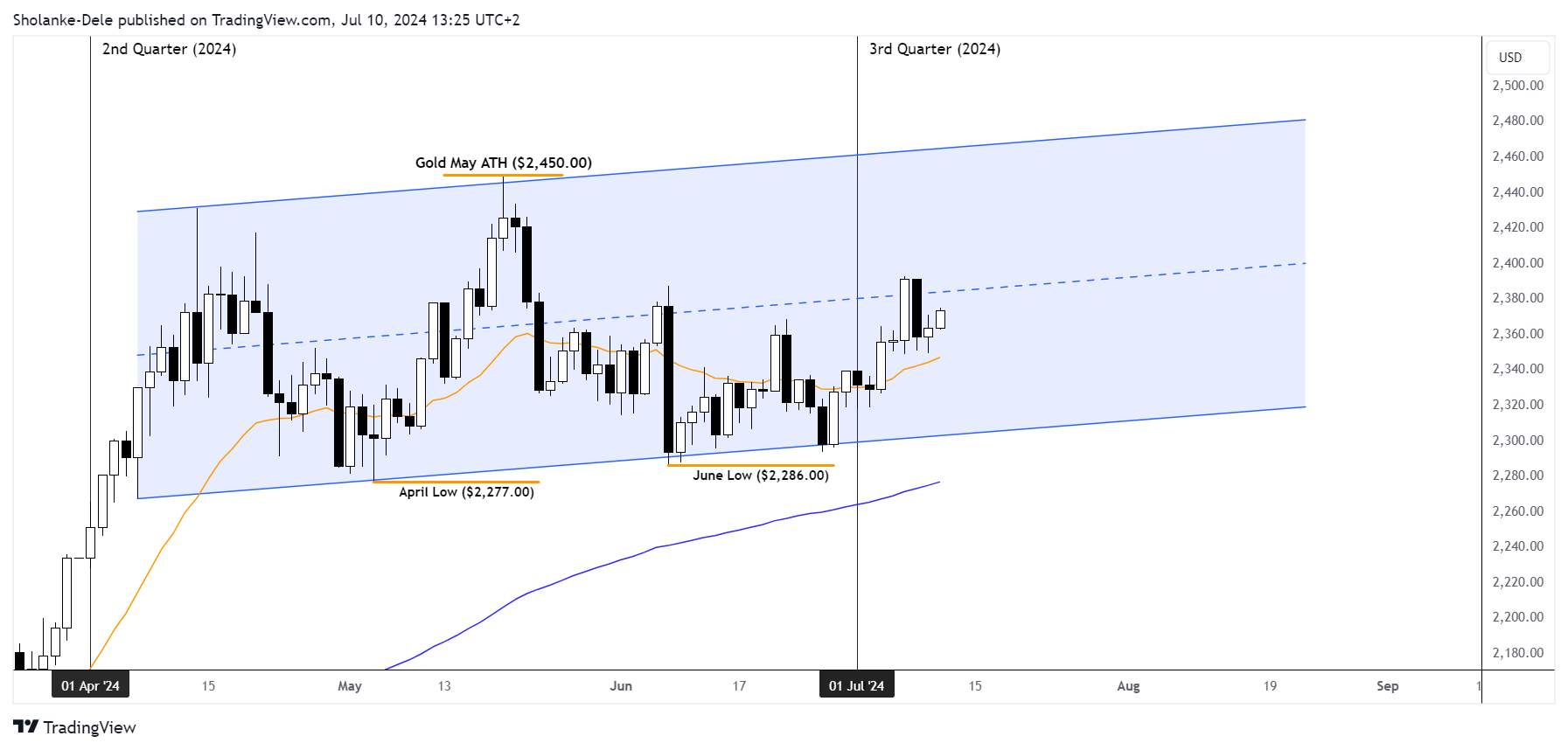

A confluence of these factors propelled gold to a record-breaking high above $2,450 per ounce in May. However, this golden ascent was short-lived. Profit-taking and a pause in Chinese central bank buying triggered a correction, erasing over half of May gains. While Q1 undoubtedly belonged to the bulls, Q2 witnessed a more muted price action, characterized by a "slightly bullish consolidation" with higher lows.

Looking ahead to the second half of 2024, a crucial question looms: can gold reclaim its bullish momentum, or is the rally fizzling out?

Factors Shaping Gold Prices

The current global economic landscape and financial markets are experiencing a transitional phase. Looking ahead to the third and fourth quarters of 2024, several key drivers are bound to shape the trajectory of Gold. These factors will determine whether the precious metal experiences varying outcomes amidst evolving market dynamics. They include:

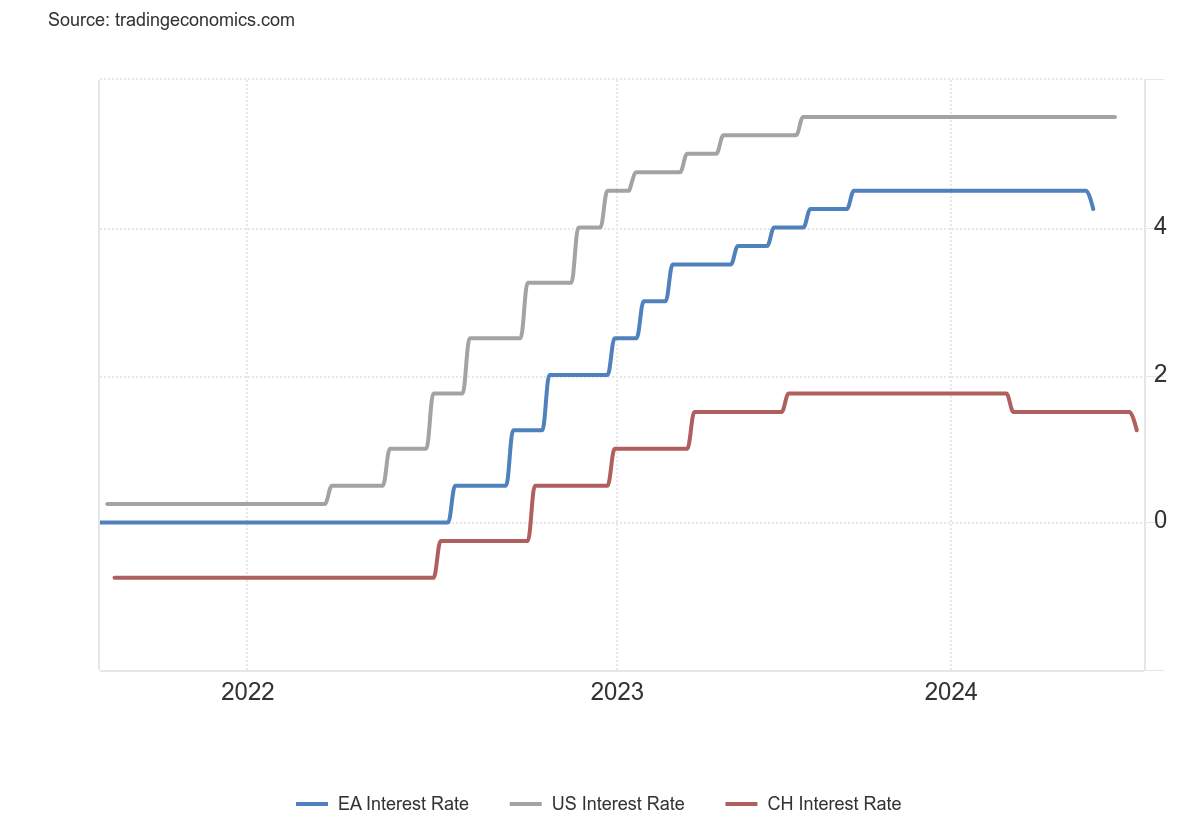

Interest rates:

Following the European Central Bank's (ECB) rate cut in May, European gold ETFs have seen notable inflows, indicating increased investor interest. If this trend continues, it will further bolster gold prices. Meanwhile, the market has already factored in a 25 basis point cut by the Federal Reserve that is to happen later in the year. An official policy decision confirming this, would provide investors with clarity on the future direction of interest rates, likely sustaining the current momentum in gold inflows. However, if the Fed adopts a "hawkish" stance on interest rates, it might discourage some potential gold investors from entering the market.

Recession

While the likelihood of an immediate recession remains low, the global economy is not operating at full capacity. With inflation still above target levels, central banks are hesitant to implement more aggressive rate cuts. Furthermore, in the financial markets, US equities have been performing well. However, current indicators show a deceleration in manufacturing activity. This slowdown could pose risks to corporate earnings growth and overall economic stability.

Geopolitical Tensions

Historically, gold prices have risen 2.5% for every 100-point increase in the Geopolitical Risk (GPR) Index. While short-term spikes in gold may settle, persistent geopolitical risk could trigger a more sustained deterioration in financial conditions, making gold even more attractive as a safe-haven asset.

Central Banks

Central bank buying has been a major force propelling gold prices in recent years. However, a recent slowdown in Gold purchases by the People's Bank of China (PBoC), with holdings flat since May, raises questions about the sustainability of this demand. This could put downward pressure on gold prices, especially if other central banks follow suit.

Asian Investors

One of the silent forces behind gold's recent ascent has been the Asian investors. Traditionally, Asian investors were known for "buying the dip," but a recent shift suggests they're increasingly riding the trend. Early Q2 witnessed a gold rush in Asia, with both Indian and Chinese gold ETFs experiencing a surge in Assets Under Management (AUM) that coincided with the rise in Shanghai gold futures trading volume. Notably, this demand was bolstered by the positive sentiment surrounding central bank buying, particularly by the PBoC. However, while the long-term allure of gold ownership in Asia remains intact, the pause in Chinese buying could be the catalyst for a short-term correction.

Moving on to the gold Outlook for 2024, there are three distinct economic scenarios and their projected impacts on gold prices based on key drivers like the expected Federal Reserve (Fed) funds rate, opportunity cost, economic expansion, risk and uncertainty, and momentum. The scenarios are categorized as moderate growth, economic downturn, and prolonged rate hikes.

Related Articles

Team that worked on the article

Sholanke is a financial market analyst, trader, and writer. He has over 10 years of experience in forex, stocks, commodities, indices, cryptocurrencies, and other financial assets. As an author for Traders Union, he enjoys sharing institutional insights, analytics and expert forecasts on various financial instruments.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.