Fake Forex Brokers List In India

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Fake Forex brokers in India:

Profit Trade: claims to offer high Forex profits but lacks transparency and regulation.

Armax Trade: fake Forex broker with high deposit requirements and limited customer support.

ASIC: misuses the name of a regulatory body to appear legitimate without proper oversight.

CFDS100: promises quick profits but offers vague terms and limited trading tools.

Forex trading in India remains a popular activity, despite several legal restrictions. Indian traders are permitted to trade currency pairs involving the Indian rupee, specifically with the US dollar, Japanese yen, or British pound. However, there is speculation that authorities may ease these regulations to provide traders with more earning opportunities.

India's status as one of the world’s top ten economies by GDP supports its growing trade activities. This article outlines the regulatory framework for Forex trading in India and offers tips on avoiding fraudulent brokers found on the Forex scam list.

Blacklist of Forex brokers in India

In India's evolving financial landscape, it's crucial for traders to distinguish between legitimate brokerage firms and fraudulent entities. The Reserve Bank of India (RBI) has issued an Alert List identifying unauthorized Forex trading platforms that operate without proper authorization under the Foreign Exchange Management Act (FEMA), 1999.

Engaging with these unauthorized platforms can lead to significant financial losses, as they often engage in unethical practices such as financial extortion and refusal of fund withdrawals. The Traders Union has compiled a list of such fraudulent brokers operating in India, highlighting their establishment dates and minimum deposit requirements.

| Name | Establishment date | Minimal losses |

|---|---|---|

| Profit trade | 2017 | $250 |

| Armax Trade | 2019 | $400 |

| ASIC | 2015 | $200 |

| CFDS100 | 2018 | $100 |

| SkyFX | 2011 | $100 |

| High Tech Trade | 2021 | $500 |

| Investing Capital | 2014 | $250 |

| CFreserve | 2018 | $250 |

| Libra Markets | 2019 | $250 |

| FVP Trade | 2019 | $5 |

| Ibell Markets | 2021 | $100 |

Profit Trade

Established: 2017

Minimum deposit: $250

Profit Trade claims to offer easy access to Forex markets with promises of high profitability. However, their vague policies and lack of transparency raise concerns.

Scam indicators:

Guarantees of quick profits with minimal investment.

No license or registration with regulatory authorities.

Non-transparent withdrawal conditions.

Armax Trade

Established: 2019

Minimum deposit: $400

Armax Trade offers trading in Forex and CFDs but provides limited information about its operations or regulation. High deposits and poor customer support are red flags.

Scam indicators:

High minimum deposit requirements.

Inaccessibility of customer support.

Use of unreliable trading software.

ASIC

Established: 2015

Minimum deposit: $200

ASIC markets itself as a reliable trading platform but appears to misuse the name of the Australian regulatory body to create a facade of legitimacy.

Scam indicators:

Pretending to be affiliated with recognized regulatory bodies like ASIC.

Lack of transparency in trade reporting.

Frequent changes to trading rules and conditions.

CFDS100

Established: 2018

Minimum deposit: $100

CFDS100 attracts novice traders with promises of easy trading and substantial profits but fails to provide clear terms and conditions.

Scam indicators:

Unrealistic promises of high returns in a short period.

Lack of educational resources or tools for traders.

Hidden fees and unclear withdrawal processes.

SkyFX

Established: 2011

Minimum deposit: $100

SkyFX is an older broker that has faced criticism for unethical practices, including manipulation of trades and poor client support.

Scam indicators:

History of trade manipulation accusations.

Outdated and unreliable trading platforms.

Poor handling of client funds.

High Tech Trade

Established: 2021

Minimum deposit: $500

A newly established platform, High Tech Trade offers no verifiable credentials or reviews, relying heavily on aggressive advertising.

Scam indicators:

Extremely high minimum deposit for new users.

Lack of credible reviews or user feedback.

Overly promotional claims with no evidence.

Investing Capital

Established: 2014

Minimum deposit: $250

Investing Capital claims to provide diverse investment options but has been criticized for opaque operations and unreliable customer support.

Scam indicators:

Hidden charges and unclear fees.

Vague terms regarding account closure and withdrawals.

Frequent complaints about unresponsive support.

CFreserve

Established: 2018

Minimum deposit: $250

CFreserve targets beginner traders with attractive packages but lacks regulatory approval or reliable market data.

Scam indicators:

Lack of regulation or authorization from financial authorities.

Promises of "guaranteed" returns.

Limited market tools and analytics.

Libra Markets

Established: 2019

Minimum deposit: $250

Libra Markets advertises itself as a trusted Forex and cryptocurrency platform but offers no transparency in its operations or regulatory status.

Scam indicators:

Unverified claims of being regulated.

Poorly explained trading conditions.

Frequent reports of withdrawal issues.

FVP Trade

Established: 2019

Minimum deposit: $5

FVP Trade offers an unusually low entry barrier but compensates with unclear fee structures and questionable trade execution practices.

Scam indicators:

Extremely low deposit requirements paired with high-risk terms.

Lack of clear regulatory compliance.

Reports of inconsistent trade execution.

Ibell Markets

Established: 2021

Minimum deposit: $100

Ibell Markets is a newly launched broker claiming advanced features but with no credible background or regulatory oversight.

Scam indicators:

No verifiable track record.

Overpromised features without technical backing.

Poorly defined withdrawal terms.

Rules and regulation in India

Licensing in India

In India, Forex trading is regulated by:

Reserve Bank of India (RBI). Oversees foreign exchange transactions and implements policies under the Foreign Exchange Management Act (FEMA).

Securities and Exchange Board of India (SEBI). Regulates securities markets, including certain Forex-related activities.

To operate legally, Forex brokers must secure licenses and meet strict requirements, such as:

Maintaining adequate capital.

Submitting detailed business plans.

Employing qualified professionals.

Ensuring a solid reputation for ethical operations.

Find out if Exness is legal in India.

Investor protection in India

The RBI and SEBI have established frameworks to safeguard traders and investors.

Regulatory oversight. Both institutions monitor financial markets to prevent malpractices and ensure compliance with legal standards. They regulate authorized electronic trading platforms and recognized stock exchanges, such as the National Stock Exchange (NSE), BSE, and the Metropolitan Stock Exchange (MSE), to facilitate permitted Forex transactions.

Dispute resolution. SEBI provides mechanisms for addressing grievances between investors and financial service providers, ensuring fair and timely resolution.

Investor education. Both bodies conduct programs to educate investors about the risks of Forex trading and the importance of dealing with authorized entities.

Taxation in India

Forex trading income in India is taxable, and traders should be aware of the tax implications.

Income classification. Profits from Forex trading are generally treated as business income. The classification can vary based on the trading activity, and consulting with a tax professional for accurate assessment is advisable.

Income tax rates. Business income is taxed according to individual tax slabs, ranging from 5% to 30%, plus applicable surcharges and cess. For the fiscal year 2024-2025, the slabs are:

Up to ₹2.5 lakhs. Nil.

₹2,50,001 to ₹5,00,000. 5%.

₹5,00,001 to ₹10,00,000. 20%.

Above ₹10,00,000. 30%.

Goods and services tax (GST). Forex transactions are subject to GST, with rates based on the transaction amount.

For amounts below ₹1 lakh. 1% of the transaction amount, with a minimum of ₹250.

For amounts between ₹1 lakh and ₹10 lakhs. ₹1,000 plus 0.5% of the amount exceeding ₹1 lakh.

For amounts above ₹10 lakhs. ₹5,500 plus 0.1% of the transaction amount.

Maintaining accurate records of all trading activities and consulting tax professionals ensures compliance with tax regulations. By following regulatory guidelines and understanding tax obligations, Indian Forex traders can safeguard their investments and operate effectively in the market.

Forex trading in India has seen significant growth, attracting both legitimate investors and unscrupulous individuals seeking to exploit unsuspecting traders. Understanding common Forex scam schemes is crucial for safeguarding investments. Here are some prevalent scams in the Indian Forex market.

Unauthorized Forex trading platforms

Many entities offer Forex trading services without proper authorization. These platforms often promise high returns but operate outside legal boundaries, exposing traders to financial and legal risks. Engaging with such platforms can lead to significant financial losses.

Ponzi and multi-level marketing (MLM) schemes

Scammers lure individuals with promises of high returns through recruitment-based investment structures. These schemes collapse when new recruitments dwindle, leaving investors with substantial losses. It's essential to be cautious of investment opportunities that emphasize recruitment over legitimate trading activities.

Scam expert advisors (EAs)

Expert advisors are automated trading programs designed to execute trades on behalf of traders. While legitimate EAs exist, the market is flooded with fraudulent ones that promise guaranteed profits. These scam EAs can be expensive and may lead traders to take on excessive risk, resulting in financial losses.

Fake Forex brokers

Unregulated or fake brokers often entice traders with attractive offers and bonuses. Once funds are deposited, these brokers may manipulate trading platforms, provide false information, or refuse withdrawal requests. It's crucial to verify the legitimacy of a broker before engaging in any transactions.

Advance-fee scams

In this scheme, scammers request an upfront fee from traders, promising access to high-return investments or exclusive trading strategies. After the fee is paid, the scammer disappears, and the promised services are never delivered. Traders should be wary of any service requiring advance payments without verifiable credentials.

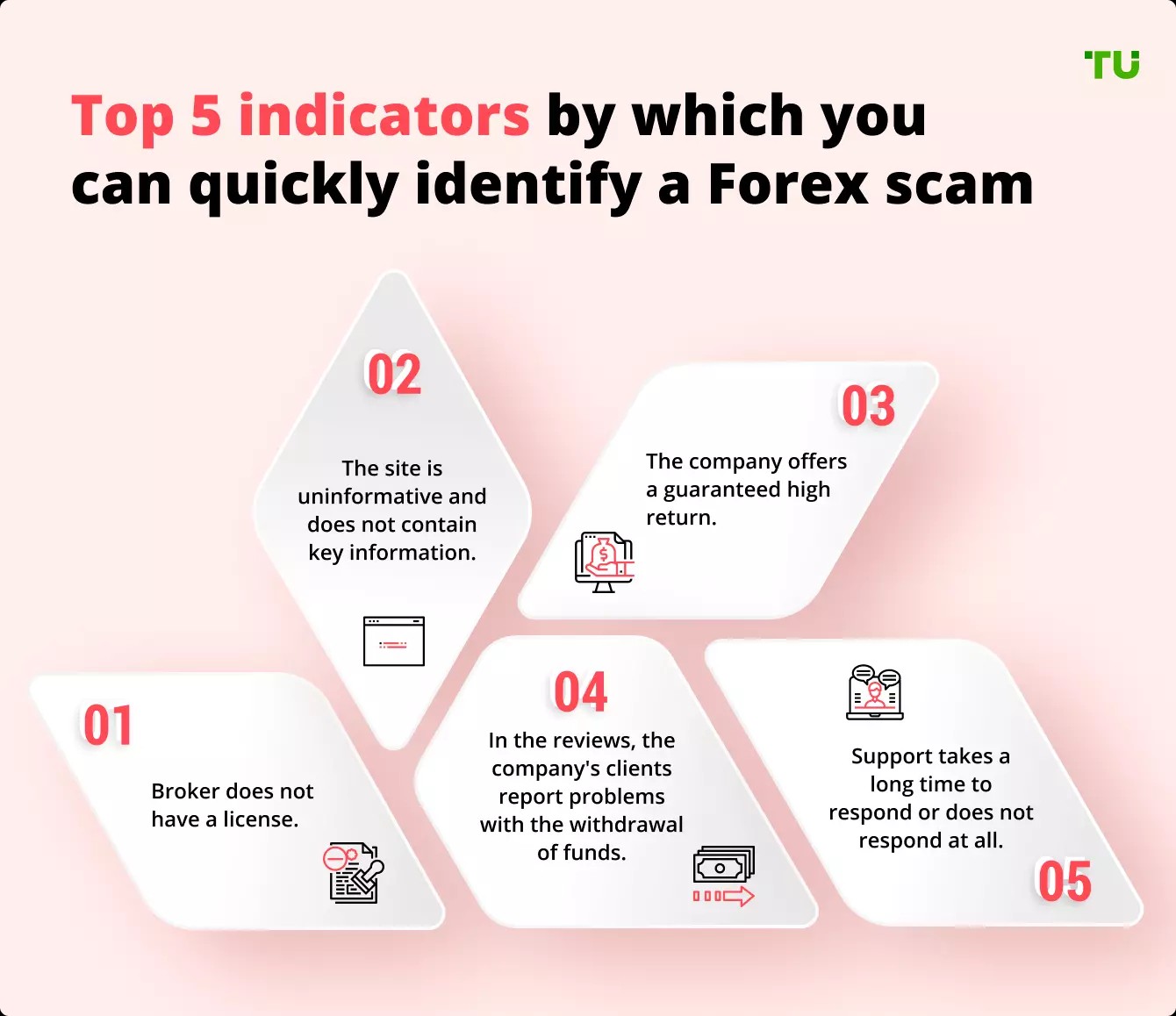

How to avoid Forex scams

Avoid risky brokers. Stay away from brokers promising high returns or risk-free trading. Legitimate brokers provide realistic expectations and prioritize client security.

Choose regulated firms. Work only with brokers licensed by reputable regulatory agencies, as they follow strict guidelines to protect investors.

Be wary of automated trading claims. Successful trading requires analysis and strategy, which automated systems cannot fully replace.

Ignore false promises. Be skeptical of brokers guaranteeing overnight riches. Genuine brokers emphasize realistic risk management and trading strategies.

Ensure website security. Before sharing personal or financial information, check for secure connections (SSL certificates) and website authenticity.

We have carefully reviewed and identified the most trustworthy Forex brokers to help you make informed trading decisions.

| Available in India | Demo | Min. deposit, $ | Max. leverage | ECN Spread EUR/USD, avg, pips | Investor protection | Regulation level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | 100 | Tier-1 | 0,1 | £85,000 €20,000 | Tier-1 | 9.1 | Open an account Your capital is at risk. |

|

| Yes | Yes | 5 | Tier-1 | 0,2 | £85,000 €20,000 | Tier-1 | 9 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | No | 0,1 | No | No | 9.2 | Open an account Your capital is at risk. |

|

| Yes | Yes | 10 | Tier-3 | 0,2 | €20,000 | Tier-3 | 8.9 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | Tier-1 | 0,3 | No | Tier-1 | 8.69 | Open an account Your capital is at risk. |

By testing the withdrawal process early, you can spot red flags

When navigating Forex trading in India, one of the most effective steps for beginners is to dig deeper than the broker’s website claims. Many scam brokers create polished sites with fake reviews and inflated success stories. Instead of relying on surface information, verify their regulatory status on official platforms like SEBI or RBI.

A simple yet effective method is to check if the broker has a customer service number and a physical office address in India. If the only contact method is a generic email or unverifiable phone number, that’s a major red flag.

Another important but often ignored approach is to try withdrawing a small amount early on. Fraudulent brokers often complicate withdrawals by stalling with excuses like technical glitches or unnecessary verification steps. By testing the withdrawal process early, you can spot red flags before investing more.

Keep records of all interactions—screenshots of emails, chat conversations, and transaction details. These documents can be helpful if you need to report the issue to SEBI or file a formal grievance. Taking small but proactive steps can make a big difference in avoiding scams and protecting your hard-earned money.

Conclusion

Navigating the Forex market in India offers immense potential, but it also comes with risks due to the presence of fake Forex brokers. By trading only with regulated entities and conducting thorough due diligence, you can protect your investments and enjoy a secure trading experience.

Remember, reliable brokers emphasize transparency, provide clear terms, and never promise guaranteed profits. Empower yourself with knowledge, verify broker credentials, and make informed decisions to avoid falling into scams.

FAQs

Is Forex trading legal in India?

Yes, Forex trading is legal in India, but only through authorized brokers who offer currency pairs approved by the RBI.

What are the risks of trading with unregulated brokers?

Trading with unregulated brokers exposes you to financial fraud, lack of legal recourse, and potential loss of funds.

How can I verify if a broker is legitimate?

Check the broker’s regulatory status with the RBI or other recognized authorities and read reviews from credible sources.

What should I do if I’ve been scammed?

Report the scam to your local authorities, file a complaint with the RBI, and seek legal assistance to recover your funds.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).