Is Robinhood Good For Beginners?

Robinhood is a practical option for beginner investors, offering a user-friendly interface and commission-free trades. The platform is designed to make investing easy, with accessible tools for those new to stocks and cryptocurrencies. However, its limited research tools and past technical issues may mean it’s less ideal for investors seeking comprehensive support or advanced trading options.

Robinhood is a popular trading platform that is targeted at beginner investors and offers a user-friendly and intuitive interface. One of Robinhood's key benefits is that it charges no fees on trades, making it particularly attractive to those looking to start investing with small amounts of money. The platform quickly gained popularity among young people, especially Reddit users, due to its accessibility and low barrier to entry. Today, Robinhood is a starting point for millions of new investors, although critics sometimes point to the lack of educational and analytical tools that could help them better understand the market.

Is Robinhood good for beginners: key features, pros and cons

Yes, Robinhood can be a good option for beginners due to its user-friendly interface and commission-free trading. Here are some of the key features, pros and cons for new investors:

Key features for beginners

Robinhood offers the ability to trade stocks, ETFs, and cryptocurrency without a fee, which is especially attractive to beginners who want to try investing with minimal costs. Users can start with any amount, as the platform does not require a minimum deposit. This creates a low entry threshold, which allows beginners to immediately start investing without burdening them with additional costs or large investments. It is thanks to these conditions that Robinhood was able to significantly simplify access to the market for a wide audience of young people and attract millions of new users.

The platform supports fractional investing. What does this mean? An investor can purchase shares of even the most expensive companies starting from $1. Extremely useful for those who want to diversify their portfolio without having large funds. Robinhood has a user-friendly interface: simple design, the ability to monitor your portfolio, and only a few steps are required to get started. The app also offers cash management features, such as automatic dividend reinvestment and the ability to set up recurring deposits. These features make the platform particularly attractive to long-term investors who want to minimize expenses and take their first steps into the world of finance with minimal complications.

Robinhood advantages and disadvantages

👍 Advantages:

• User-friendly interface and easy access to stocks and cryptocurrency through the mobile app.

• Fractional shares and no minimum deposit, allowing investment with minimal funds.

• Basic educational materials and resources to help beginners understand investing essentials.

👎 Disadvantages:

• Limited analytical tools and lack of advanced features for in-depth market study.

• Risks of over-trading due to simplicity, which may lead to impulsive trades by beginners.

• Security incidents and controversies over trade execution and data protection practices.

How to trade on Robinhood

Sign up and initial setup

To get started with Robinhood, you need to download the app and register for an account. This will require you to provide basic information (name, contact information, address), as well as verify your identity using your Social Security Number (SSN) and a valid US address. Once you have successfully registered, you can link a bank account to fund your Robinhood account. We have covered the steps for the same below:

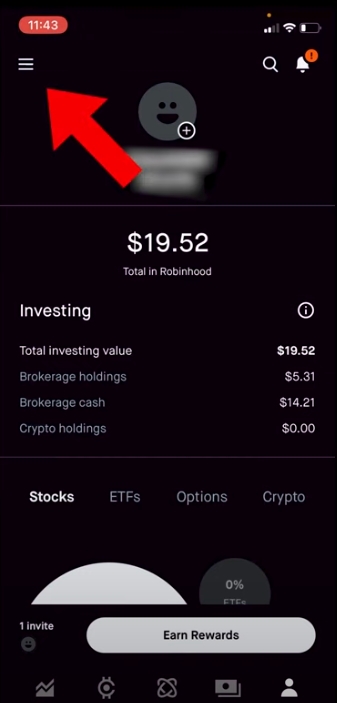

Step 1: Click on the profile icon.

Click on the profile icon

Step 2: In your profile, click on the three stripes in the upper left corner.

Three stripes in Robinhood app

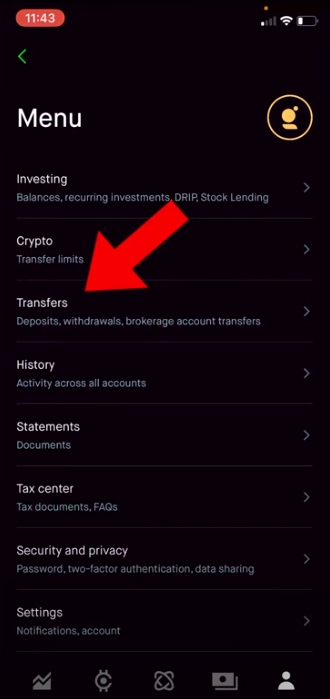

Step 3: Select the "Translations" tab.

Translations tab

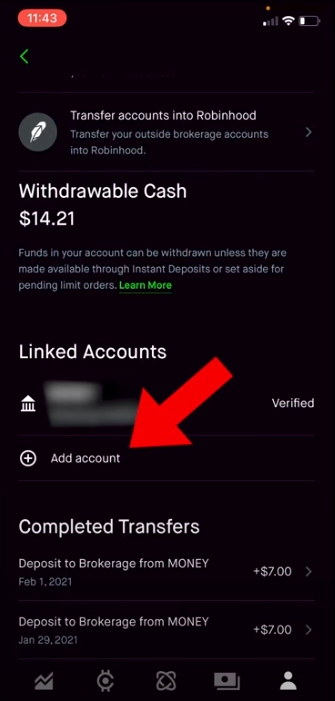

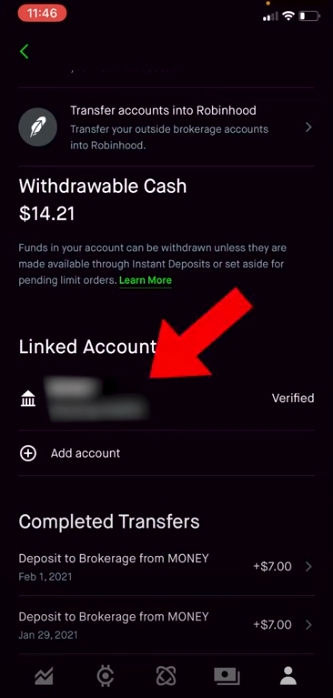

Step 4: Then select "add account".

Robinhood - Adding an account

Step 5: Link your debit card or bank account.

Link your debit card or bank account

Step 6: After linking, the "linked" tab will appear.

Account linking success

How to select and purchase assets

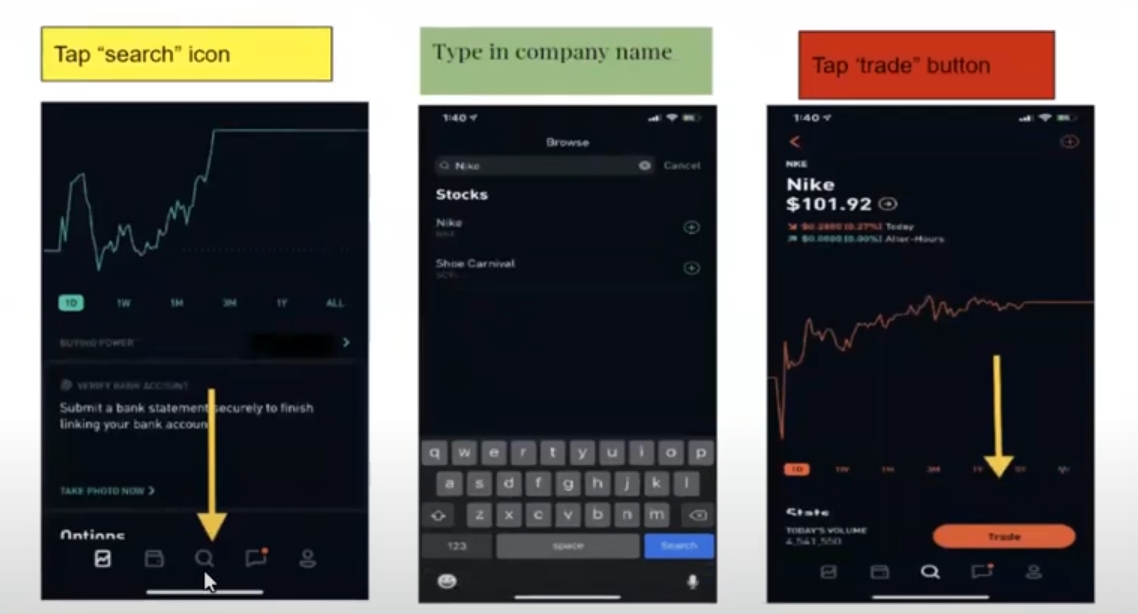

Robinhood makes it easy for users to search for and add stocks, ETFs, and cryptocurrencies to their portfolio. You can find the assets you are interested in using the built-in search function, simply by entering the name or ticker of the company.

Trading on Robinhood

Each asset page displays its current price, charts with historical data and key news, allowing you to assess the prospects for buying. After selecting an asset, simply click the "Trade" button and specify the desired amount.

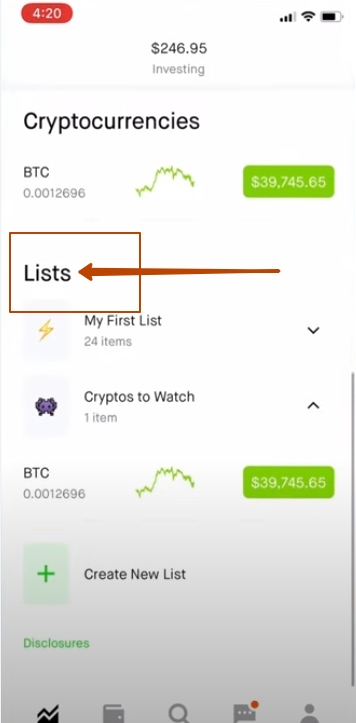

In addition, the application allows you to create watchlists - this is a convenient way to track price changes for assets of interest and quickly respond to their fluctuations.

Robinhood watchlist

This feature is especially useful for beginners, as it simplifies navigation and control over selected assets.

Basic tips for beginners

1. Avoid impulse trading

Beginner investors often make the mistake of being influenced by emotional market movements. Trading out of fear or greed is a common problem, especially when investors follow short-term news or market trends. This can lead to buying assets at peaks or selling at dips, which ultimately reduces long-term returns. We recommend sticking to an investment strategy and avoiding frequent trading, which can reduce overall portfolio returns. Strategies like diversification and cost averaging help reduce emotional risks and ensure portfolio resilience in volatile markets.

2. Portfolio diversification

This is an important element for reducing risk, especially for those using simple platforms like Robinhood. Since the platform is limited in its analysis capabilities, diversifying across different industries and asset types (such as stocks, ETFs, and cryptocurrencies) will help protect your portfolio from large price swings in one asset category. Diversified portfolios have historically shown more stable results and help avoid losses in the event of a sharp decline in one of the industries or asset categories.

Robinhood’s simplicity is a pro and a con

Trading platforms like Robinhood, due to their simplicity and convenience, encourage frequent trading which is not always beneficial for beginners. Trading stocks and cryptocurrencies requires patience and discipline: to avoid emotional decisions, I recommend creating an investment plan, recording specific goals and criteria for each asset. For example, it is worthwhile to determine in advance under what conditions you are ready to sell an asset, which will help to avoid panic during temporary market declines.

I also recommend expanding your knowledge of investments through external resources. Robinhood provides basic information, but it is useful to further study topics such as fundamental and technical analysis, which will help you more consciously evaluate potential assets. Subscribing to financial analysis publications or taking investment courses can have a significant impact on your confidence in the decisions you make and the long-term success of your portfolio.

Conclusion

Robinhood offers new investors a convenient, accessible way to get into the market with minimal overhead and easy navigation. However, be aware of the platform’s limitations, such as minimal analytical tools and the risks associated with overtrading. Successful investing requires following a well-thought-out strategy, avoiding impulsive decisions, and regularly learning the basics of financial analysis. Diversifying your portfolio can also help reduce risk and increase the stability of your investments. Ultimately, Robinhood can be a good starting point for new investors, as long as you invest responsibly and are willing to learn.

FAQs

What are some strategies to reduce the risks through mobile apps?

One effective method is dollar-cost averaging, where you invest a fixed amount regularly, which helps you avoid buying stocks at their peak. Another approach is to set specific profit targets and limit losses using limit orders, which helps manage risk over the long term.

What resources can help better understand market trends?

In addition to the basics, it is useful to study market reports, articles on fundamental and technical analysis, and follow financial news and company reports. Some apps and websites offer free educational programs that cover key investing concepts.

How do you determine how many assets to hold in a portfolio?

For beginners, we recommend building a portfolio with at least 10-15 different assets from different sectors to reduce dependence on one market. This may include stocks, ETFs, and other asset classes that are less correlated, which helps minimize fluctuations in the overall portfolio.

What steps can you take to protect your funds during volatility?

Set up profit and loss limits for each asset in advance to avoid impulsive decisions. You can also increase the share of less volatile assets, such as bonds, which will help soften the impact of sharp changes. It is wise to review your goals and keep some funds in reserve to be able to buy assets on declines.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).