Stop-Loss Orders On Robinhood: A Complete Guide For 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To manage trading risk with stop-loss orders on Robinhood:

Managing risk is a critical aspect of successful trading, and stop-loss orders are one of the most effective tools for minimizing potential losses. For Robinhood users, understanding how stop-loss orders work within the platform’s unique ecosystem is essential. This guide risk will walk you through the specifics of setting up and utilizing stop-loss orders on Robinhood, highlighting its advantages, limitations, and strategies tailored to this broker.

How to reduce risks using stop-loss orders on Robinhood

Stop-loss orders are an effective way to manage trading risks by automatically selling a security when its price reaches a specified level.

To reduce risks:

Set appropriate stop prices

Align your stop price with your risk tolerance and the asset's volatility. For instance, if a stock is highly volatile, setting a stop price too close to the current market price may result in premature triggers.

Avoid tight stops

Don’t set the stop price too close to the current market price to avoid unnecessary triggers from minor fluctuations.

Regularly review and adjust

Market conditions and your investment strategy may change over time. Regularly reviewing and adjusting your stop-loss orders ensures they remain aligned with your current objectives and market realities.

Use for risky assets

Stop-loss orders are particularly useful for volatile or speculative investments, helping to limit potential losses in unpredictable markets.

Combine with diversification

While stop-loss orders can help manage individual asset risks, combining them with a diversified portfolio can further mitigate overall investment risk.

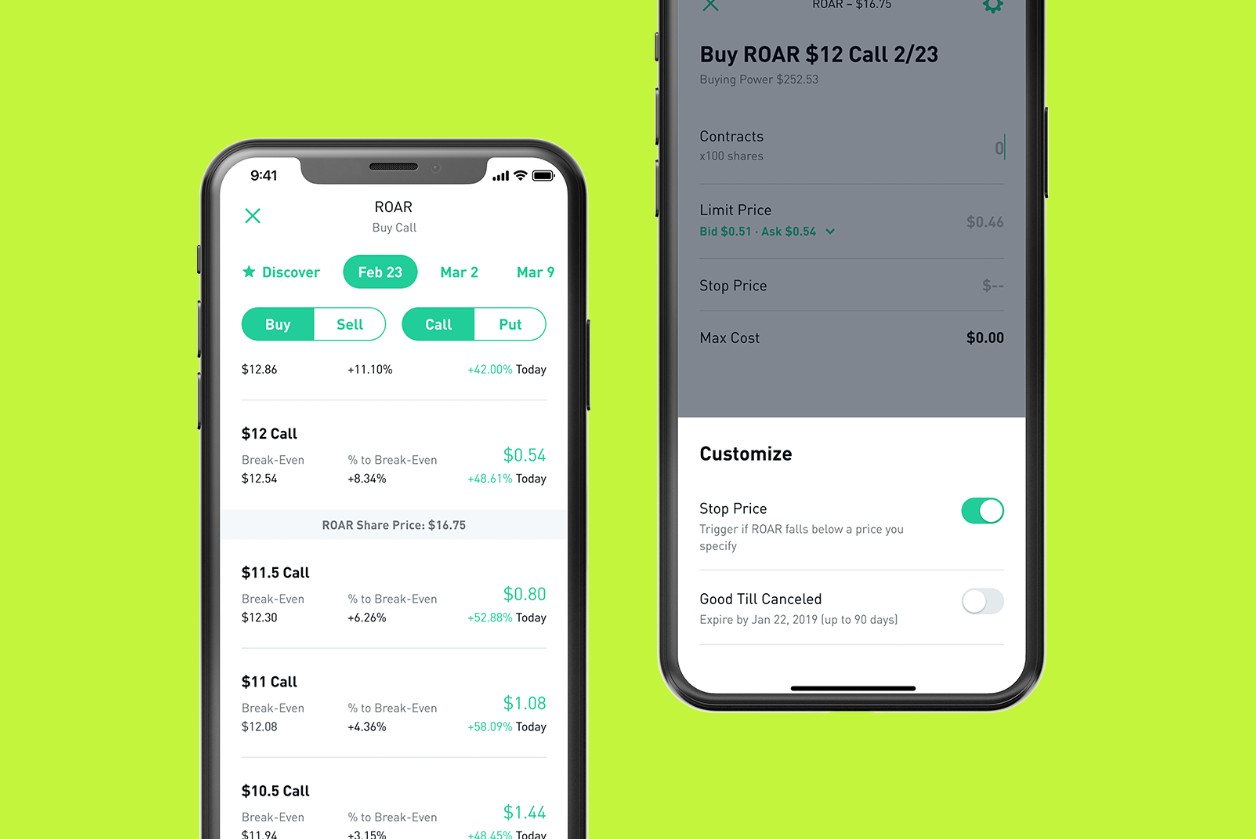

How to set up a stop-loss order on Robinhood

Robinhood simplifies the process of placing stop-loss orders, making it accessible for both beginner and experienced traders. Here’s how to set one up:

Open the app

Navigate to the stock you own or want to sell.

Select “Trade”

Tap on the “Trade” button and choose “Sell.”

Choose order type

Under “Order Types,” select “Stop Order.”

Set the stop price

Input the price at which you want the order to be triggered.

Review and confirm

Double-check the details of your stop-loss order and confirm to activate it.

What Is a stop-loss order?

A stop-loss order is an instruction to a broker to sell a security when its price falls to a predetermined level, known as the stop price. This mechanism prevents further losses by exiting the position automatically, even if the trader is not actively monitoring the market.

For example, if you purchase a stock at $50 and set a stop-loss order at $45, the system will automatically sell the stock if its price drops to $45 or below. This helps protect your capital from further decline.

Pros and cons of stop-loss orders on Robinhood

- Pros

- Cons

Cost-effective. No commission fees for placing or executing stop-loss orders.

User-friendly interface. Easy to set up and monitor orders on both desktop and mobile apps.

Real-time alerts. Notifications keep you informed of order execution.

Risk management. Helps limit losses during market downturns.

Execution variability. Market order execution can lead to unfavorable prices in volatile markets.

No trailing stops. Lacks advanced features like trailing stop-loss orders.

Triggered by volatility. Short-term price swings may lead to premature sales.

Limited asset coverage. Not available for options or cryptocurrencies.

Risks and limitations of stop-loss orders on Robinhood

Despite its advantages, there are specific risks and limitations to consider when using stop-loss orders on Robinhood:

Execution price uncertainty. As stop-loss orders convert into market orders, the final sale price may differ significantly from the stop price, particularly in volatile markets.

Temporary market dips. Short-term price fluctuations can trigger stop-loss orders, potentially selling shares that might have rebounded.

Price gaps. Overnight price movements or sudden market changes can result in execution at much lower prices than expected.

Lack of advanced tools. Unlike some other brokers, Robinhood does not offer advanced order types like trailing stop-loss orders.

Smart stop-loss strategies Robinhood traders rarely use but should

According to seasoned traders, one of the most underrated tactics when using stop-loss orders on Robinhood is syncing them with earnings calendar events or macroeconomic data releases. Instead of placing static stops based on technicals alone, consider the timing of announcements that can cause massive price swings — like Fed interest rate decisions or company earnings. For example, if you hold a stock that's about to announce earnings, widen or temporarily disable your stop-loss to avoid being stopped out on short-term volatility, then reapply your risk management once the dust settles.

Another advanced technique is using the "mental stop-loss" paired with a trailing alert system. Robinhood doesn’t currently support trailing stop-loss orders, but you can mimic this manually by setting price alerts at levels where you'd normally trail a stop. This hybrid approach works especially well for swing traders who want more control. You stay in the trade longer, maximize gains, and avoid the frustration of being stopped out too early — something that’s common when trading choppy or news-driven stocks.

Conclusion

Robinhood’s stop-loss order feature provides traders with an effective risk management tool to protect their investments. Its ease of use and mobile accessibility make it an excellent choice for beginners and casual traders looking to automate their risk control strategies. However, users should remain aware of the limitations, such as price variability and potential over-reliance on stop-loss orders during market volatility. By setting thoughtful stop prices and periodically reviewing your positions, you can leverage Robinhood’s stop-loss feature to safeguard your portfolio while aligning with your broader financial goals.

FAQs

Can I set a stop-loss order for all types of assets on Robinhood?

No, stop-loss orders on Robinhood are currently available for stocks and ETFs only. They are not supported for options or cryptocurrencies.

Will my stop-loss order execute exactly at the stop price I set?

Not necessarily. On Robinhood, stop-loss orders become market orders when triggered, meaning the execution price depends on market conditions and could be higher or lower than the stop price.

How do I adjust or cancel a stop-loss order on Robinhood?

You can modify or cancel a stop-loss order anytime before it’s triggered. Go to the "Pending Orders" section in the app, select the stop-loss order, and adjust or delete it as needed.

How should I determine the best stop price for my Robinhood trades?

The best stop price depends on the stock’s volatility and your risk tolerance. A common approach is to set it 5-10% below the current price for moderate risk management, but this may vary based on your trading strategy.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).