Webull Options: A Step-By-Step Guide

Trading options can seem complicated at first, but Webull makes it straightforward with tools designed for both beginners and experienced traders. This guide goes beyond the basics of options trading—it focuses on how to use Webull’s standout features like custom chart settings, support for advanced strategies, and tools to help manage risk. Whether you’re looking to protect your investments or try strategies for higher returns, this guide will show you how Webull can help you trade with confidence.

Webull options guide

Here’s a step-by-step guide to get you started.

Open an account

-

Register and download the Webull app. Visit your device’s app store and download the Webull app. Alternatively, you can access the platform through its desktop application or browser version.

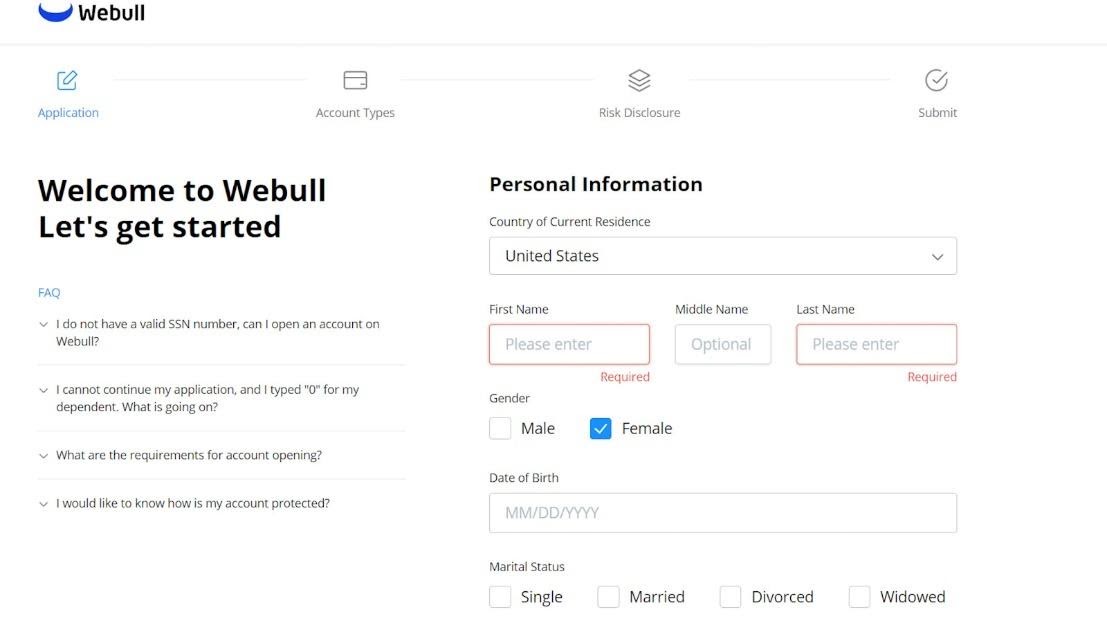

Account Opening on Webull

-

Sign up and submit your information. Click on the “Sign Up” button and provide your details, including your name, email address, permanent address, social security number, and date of birth. You may also need to upload a photo of your ID or passport.

-

Provide financial Information. Webull requires details about your financial status, employment, trading experience, and source of income. This helps the platform ensure you meet the eligibility requirements for trading.

-

Select account type. Choose between a margin account or a cash account. Margin accounts offer more flexibility but come with additional risk.

-

Submit the application. Review your information carefully and submit the application. Once approved, you can proceed to the next step.

Adding options trading to your account

To trade options, you’ll need to complete an additional application process mandated by regulatory authorities. Follow these steps:

-

Go to the options trading section. After logging into your account, go to the “Options Trading” section in the settings menu.

-

Answer the questionnaire. Webull will prompt you to answer a series of questions about your trading experience, risk tolerance, and investment goals.

-

Submit the application. Once you’ve completed the questionnaire, submit your application for review. Approval typically takes 24-48 hours.

Find the options on Webull

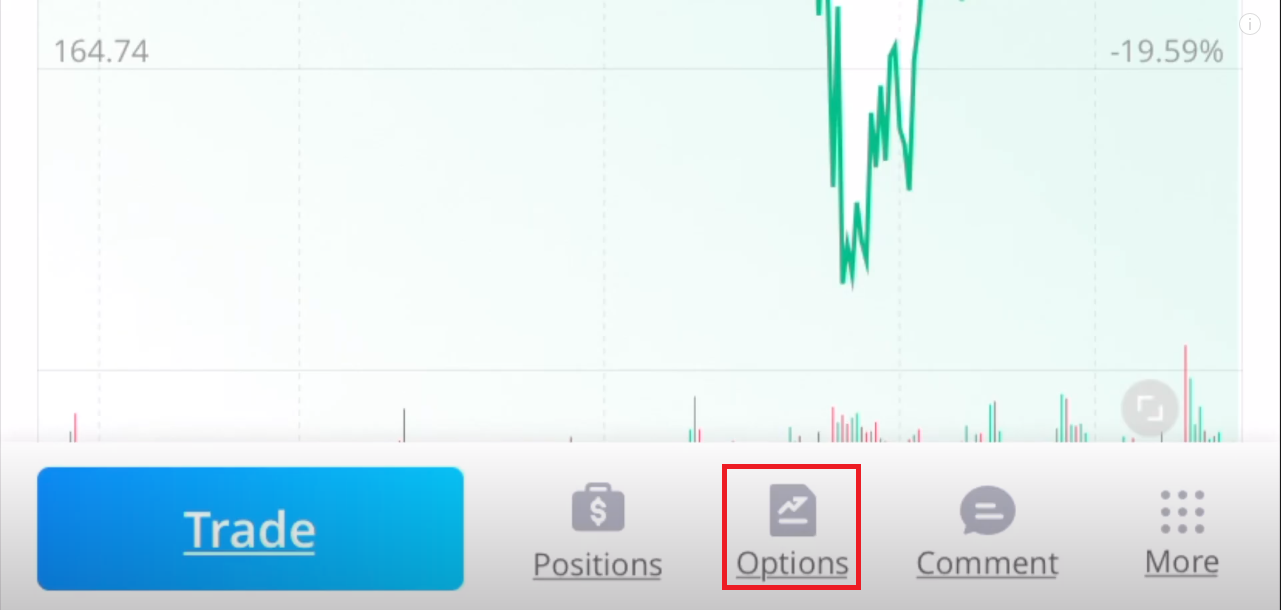

Find the options in the Webull Mobile App

In order to find the Options in the Webull mobile app, you’ll need to go to the stock details page. Here, you’ll need to tap on the “Options” button that will be located on the bottom bar. Then, you’ll need to tap on the option that you want to trade.

Options in Webull Trading App

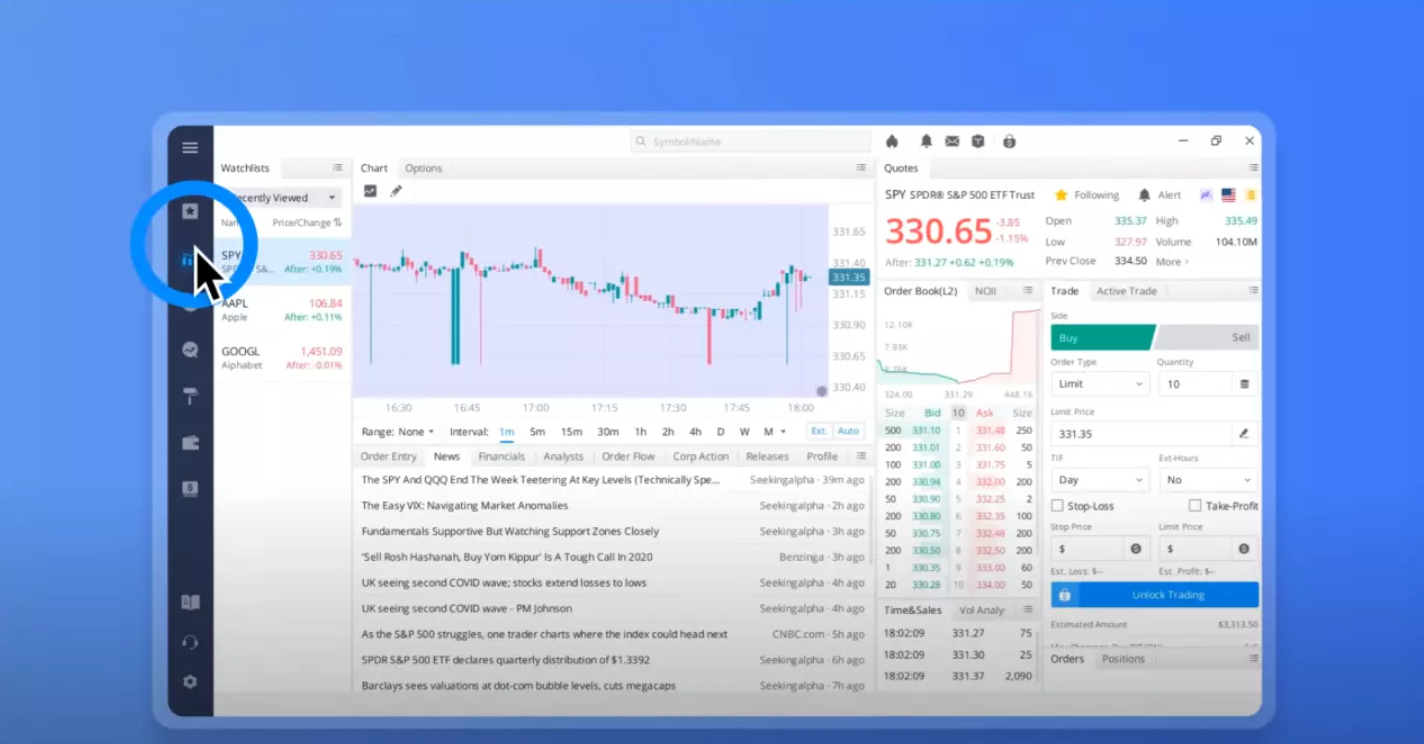

Find the options in the Webull desktop app

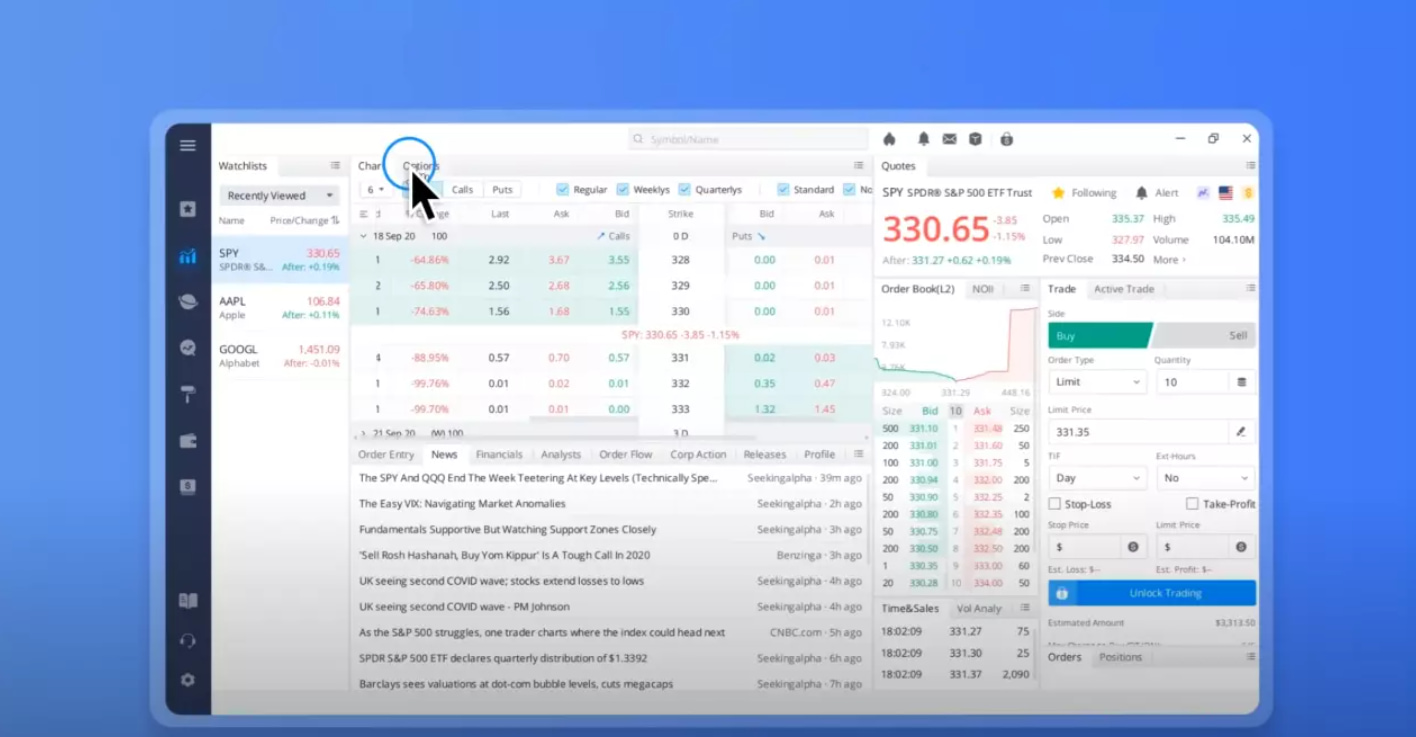

On the other hand, if you want to trade options by using the desktop application, then you'll need to tap on the “Stocks” icon located at the second number in the left-hand side column, as shown below.

Options on Webull Browser Version

Now you'll need to click on the "Options" tab, and it will take you to your selected stock's options chain.

Options on Webull Browser Version

Provide market research

Once your Webull account is ready for options trading, you need to spend sometime performing market research. An uninformed decision can entirely break the whole trading experience that you don't want. You'll need to take price movement and market timing into account while trading options much more than other types of trading. That's because option contacts, as mentioned above, have specified expiration dates.

Put vs Call: What to choose

Performing market research allows you to make sure whether you want to choose a put or a call. If you predict that the price of the underlying security will go up, then you’d want to choose a call. On the other hand, if you think that the underlying security will lose its value, then you’d want to buy a put option.

Take in account strike price and expiration date

While trading options, it’s also critical to consider the expiration date and the strike price. The strike price is what you lock in your option contract. For example, if you have chosen "call," then the strike price will dictate the rate at which you can purchase the security. In case of a "put," the strike price will indicate the rate at which you can sell the security.

Place your order

Once you have performed your due diligence and selected the option that you want to buy, then the only thing left is to place your order.

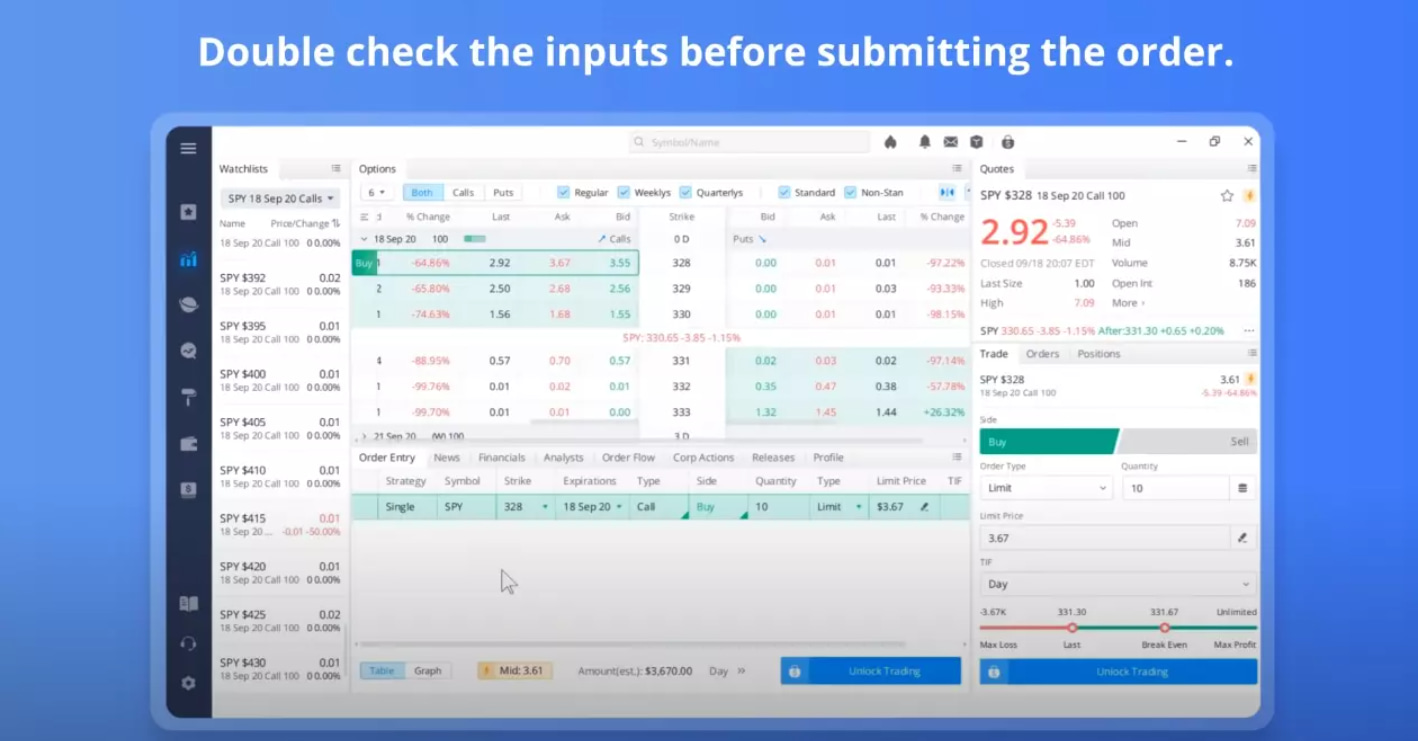

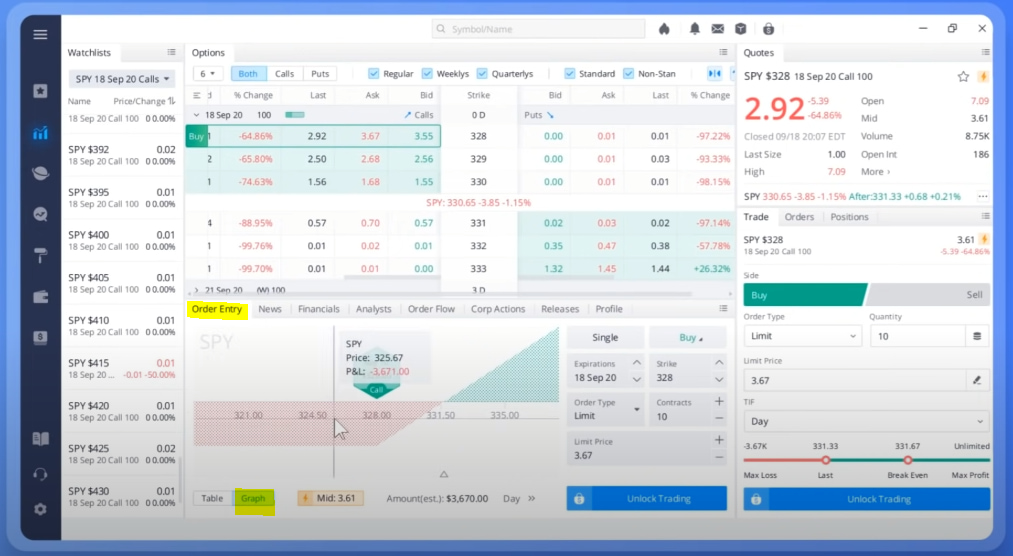

Placing order on Webull Platform

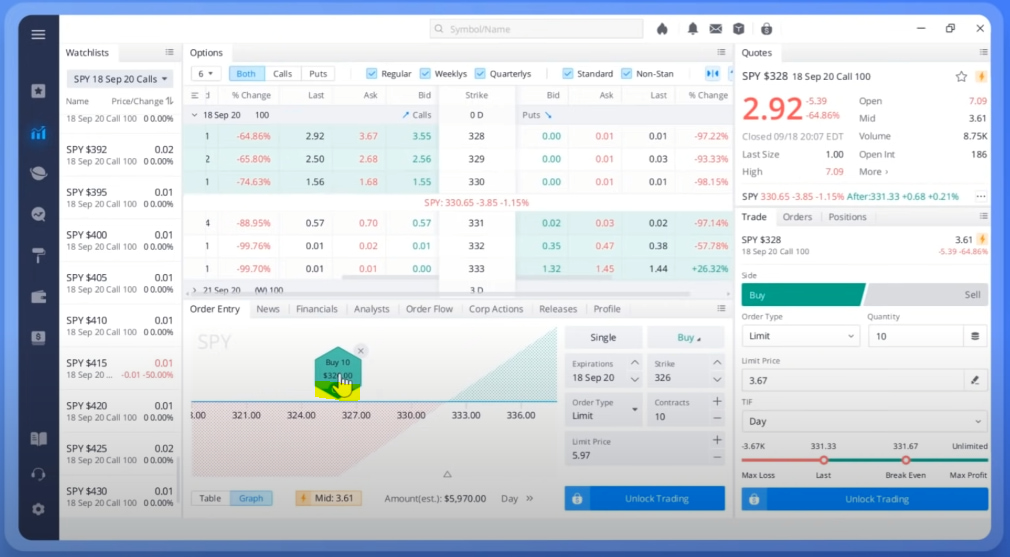

It’s important to double-check all the inputs before placing your order. You can also go to the graph section located at the left-bottom of the "Order Entry" tab. The graph provides you with a clearer idea regarding the profit and loss zones, as shown below.

Placing order on Webull Platform

You can also change the strike price by dragging the green hexagon.

Click on the “Buy” button to place your order.

Once you’re satisfied with all the entries and values, you’ll need to click on the “Buy” button to place your order.

Webull options fees

The best thing about using the Webull online trading platform is that it doesn’t charge any commission on options trading.

Is Webull options trading completely free?

Webull doesn’t charge any fee from its users to perform options trading, and it extends to all the platforms that Webull offers. However, it's important to note that the fee is still applied by OCC, FINRA, and SEC.

Fees charged by the OCC, FINRA and SEC

| Fee | Structure | Charged by |

|---|---|---|

| Transaction | $0.0000278 x Total Trade Amount (in dollars) [Sells only] | SEC (Securities and Exchange Commission) |

| Option Regulatory | $0.0017 x Number of Contracts | Options Exchange |

| Trading Activity | $0.00279 x Number of Contracts [Sells only] | FINRA (Financial Industry Regulatory Authority) |

| Clearing | (0.02 US dollars) x (Number of Contracts (Max 55 US dollars per Trade) (Buys and Sells)) | FINRA (Financial Industry Regulatory Authority) |

| Options Clearing Corporation (OCC) Fee | $0.045 x Number of Contracts [maximum $55.00 per trade for 0–999 (contracts)] | Options Clearing Corporation (OCC) |

How much money do I need for a start?

You can create your Webull account without spending a penny because there’s no account minimum required. But you’ll need an initial investment to start options trading. According to many trading experts, for the most effective options trading experience, you should have at least 3,000 to 5,000 US dollars as your initial investment.

The most advisable way is that it must happen gradually. We recommend you opt for the Webull demo account, where you don't need to pay anything. While you're playing around with your demo account, consider working on your trading strategy. Then you can start with your initial investment and keep in mind that having some extra amount of money brings flexibility. However, you should only invest the capital that you can afford to lose. Currently, the most active contracts for options trading as of December, 2024 are:

Most active contracts for options trading

| Company | Symbol | Bid | Ask | Volume | Open Int. | Strike | Stock |

|---|---|---|---|---|---|---|---|

| Apple | AAPL | 24.75 | 25.55 | 282 | 2307 | 230 | $254.49 |

| Tesla | TSLA | 42.8 | 45.9 | 500 | 2944 | 380 | $421.06 |

| Amazon | AMZN | 22.4 | 23.45 | 571 | 111 | 202.5 | $224.92 |

| Nvidia | NVDA | 13.1 | 13.65 | 694 | 1207 | 122 | $134.70 |

| Meta | META | 54.4 | 57.4 | 12 | 44 | 530 | $585.25 |

Top 3 options trading strategies

There are tons of option trading strategies that you can use to improve your trading experience. Moreover, you can also come up with your own strategy if you want. However, if you're just starting out, then consider using the following.

Single-leg Option

Single-leg options or simply single options is one of the basic trading strategies. It only has a single leg, and in this strategy, you either sell a single option (with short put or short call), or you purchase a single option with long put and long call.

Vertical

The vertical option strategy involved the buying and selling process of several options at the same time, associated with the very same underlying asset, with the same expiration date and type. However, the strike prices are different.

Covered stock

In the covered stock options strategy, you write a put or call option, and an equivalent short/long stock position covers it.

Is Webull safe?

Webull is a trusted name in the U.S. for online trading, offering options and stock trading with a user-friendly platform. It remains fully compliant with U.S. laws, including oversight by the SEC and FINRA. By the end of 2023, Webull had handled 430 million options contracts and grown to over 20 million users globally, highlighting its increasing popularity among traders.

That said, concerns about Webull’s connection to China have led to closer monitoring by U.S. regulators. In April 2024, states like Indiana began investigations into how Webull handles user data, questioning whether sensitive information could be accessed by foreign entities. By June 2024, Tennessee even banned Webull on government devices over these concerns. While Webull has promised stronger data protection measures, users should carefully assess whether the platform aligns with their privacy expectations. Plans for a public listing through a merger with SK Growth Opportunities Corporation are expected to bring more transparency to the company, but it remains important for users to stay updated on these developments.

Why choose Webull for options trading?

Webull stands out among online trading platforms for its unique features tailored to options trading. Here are some key reasons why Webull is an excellent choice for options traders:

-

Zero commission fees. Unlike many platforms that charge high fees for options trades, Webull allows you to trade options without incurring commission fees. This makes it a cost-effective solution for traders of all levels.

-

Intuitive platform. Webull offers a next-generation platform that is both easy to use and packed with advanced trading tools. Whether you prefer trading on your smartphone, desktop, or browser, Webull ensures seamless access.

-

Comprehensive market research tools. From real-time data to in-depth market analysis, Webull equips traders with all the tools they need to make informed decisions.

-

Accessibility for beginners and experts. Webull’s user-friendly interface and advanced features cater to all skill levels.

-

Enhanced security. As a registered broker with SEC and FINRA, Webull provides a secure trading environment, giving traders peace of mind.

Webull’s commitment to creating a supportive trading environment has made it a preferred choice for thousands of traders worldwide.

Master multi-leg strategies and IV timing on Webull options trading

Webull options trading has unique tools that can improve your trading skills, but getting to know how the platform works is key. Use the paper trading feature to safely practice advanced strategies like iron condors or credit spreads without risking real money. Instead of sticking to basic calls and puts, try multi-leg options to learn how to balance risk and boost returns. Use Webull's Probability Analysis tool to see how likely your trades are to succeed and stay cautious to avoid taking on too much risk.

Check out Webull’s implied volatility (IV) charts for smarter trading decisions. When IV is high, consider selling options like credit spreads to take advantage of inflated premiums. On the other hand, look at low IV periods to find cheaper options to buy. Webull's real-time IV analysis and detailed options chain help you spot the best opportunities and time your trades more accurately. These features give you a strategic edge in the options market.

Summary

Options trading can be very profitable, and undoubtedly it brings many advantages to the table. While the rewards can be high, so can the risks. That's why it's important to make sure that you understand the associated risk factors. Another critical aspect of becoming a successful options trader is choosing the right online platform. Affordability, available educational material, and ease-of-use are some of the most important factors, and you can find all of them with Webull. We hope this guide will help you to understand options trading and how to approach it.

FAQs

Why can't I trade options on Webull?

You may lack approval or not meet account requirements. Contact Webull’s customer service for help.

Is Webull good for day trading options?

Yes, Webull offers advanced tools ideal for day trading. However, options trading is risky and best for experienced traders.

How much money do you need to trade options in Webull?

The required capital depends on your strategy. Experts suggest starting with $3,000 to $5,000 for flexibility.

How do you get approved for options on Webull?

Complete a questionnaire on trading experience and risk tolerance. Approval typically takes 24-48 hours.

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).