What is a Call Option? And How to Trade it?

A call option allows you to buy the underlying asset at a specified price (“strike price”) at a future date ("expiration time").You might want to buy call options when:

-

You expect the underlying asset to increase in price.

-

You want to hedge against a decline in the underlying asset.

You might want to sell call options (very risky) when:

-

You expect the underlying asset to decrease in price.

-

You want to generate income. Selling call options can be a good way to generate income if you do not believe that the underlying asset price will go down.

Buying and selling call options in options trading is an attractive yet complex investment strategy used by traders to increase their opportunities for profit generation. Using call options offers flexibility, provides leveraged gains and income generation, and is a useful tool for hedging. However, it also requires a strong level of trading knowledge. In this article, we explain call options and break down the various strategies traders use for buying and selling call options.

-

How do you trade call options?

To trade call options, select a stock, determine a target price, and buy call options with a strike price below the target. If the stock rises, the call option gains value. Manage risk by setting stop-loss orders and consider factors like expiration dates and implied volatility for more informed decision-making.

-

Is it hard to learn to trade options?

Learning to trade options can be challenging initially due to the complexity of strategies and various factors influencing option prices. However, with enough dedication, education, and practice, you can grasp the fundamentals and develop proficiency over time. Continuous learning and simulated trading should ease the learning curve.

-

Is there a demo account for options trading?

Yes, AvaTrade, a brokerage company that provides optimal working conditions for traders of all skill levels offers a demo account. AvaTrade’s demo account gives users $10,000 of virtual capital to trade on over 250 assets. For a detailed review of AvaTrade, see our AvaTrade Review 2023.

-

Is Options Trading a good investment?

Options trading can be a good investment if you have a solid understanding of the market and risk management. It offers flexibility and potential for profit, but it also involves risks. Success depends on thorough research, strategy development, and disciplined execution, making it suitable for informed and experienced investors.

What is a Call Option?

Options are a type of derivative contract, meaning that its value is derived from that of an underlying asset. When you buy an options contract, thus becoming an option holder, you gain the right (but not the obligation) to buy or sell the underlying asset at a predetermined “strike” price at a specified later “expiration” date. When initiating the contract, the option holder pays a fee for this right, which we call a “premium”.

Options contracts are split into two types: “call” options and “put” options. When a buyer opens a call option, they obtain the right to buy the underlying asset at the predetermined strike price. Conversely, if they opt for a put option, they acquire the right to sell the underlying asset at the strike price when the contract expiration date rolls around.

Put simply, buying a call option means you expect the price of the underlying asset to increase, so you open an options contract allowing you to buy it at its current lower price when the contract expires. A put option contract signifies that you expect the underlying asset’s price to go down in the future, with the contract allowing you to sell at a higher price in the future. Call options are based on bullish sentiment, while put options are bearish.

When talking about options contracts, you should know the meaning of these key terms:

-

Strike price: The strike price, sometimes called the exercise price, is the price at which the underlying asset can be sold or bought once the contract expires. When buying an options contract, prices will be listed at several strike prices above and below the current market value of the underlying asset.

-

Premium: This is the name given to the current market price of an options contract. The broker selling the options contract receives the premium. For stock options, the premium represents a dollar amount per share, with most contracts representing 100 shares. Typically, the more time there is left until a contract expires, the higher the premium will be.

-

Expiration: The expiration is the date that the options contract will expire. This date is chosen when the contract is initiated, and signifies when the strike price must be reached before executing the purchase or sale.

How does a Call option work?

A call option is a type of options derivative contract, which allows the contract buyer to buy an underlying asset at the strike price when the contract reaches its expiration. When the expiration date arrives, the buyer can choose to exercise their right to buy at the agreed, predetermined price, or to let the contract expire, depending on which is most profitable for them.

Let’s imagine an example where Jason is feeling bullish about Tesla (TSLA) and wants to invest $500. TSLA stock is trading at $255 per share, so with his $500 he couldn’t even buy two whole TSLA shares. So, he opens a call option contract, with a strike price of $260 and an expiration date one month from now. He pays a $5 premium for a contract on 100 shares, totaling $500.

When the expiration date arrives, TLSA is trading at $270, $10 higher than the strike price. This means that Jason can buy 100 TSLA shares at the pre-arranged price of $260, then sell at the new current price of $270, resulting in a $1000 profit. After subtracting the capital spent on the premium, Jason has just made a $500 profit (without taking into account commissions) on this call option contract.

Since the current price of the TSLA stock in this scenario is above the option’s strike price, the call option is considered ‘in the money’. The buyer, Jason, exercises his right to buy the stock at the agreed strike price and turn a profit.

How to trade call options

To demonstrate how to trade call options, we will be using AvaTrade’s options trading terminal. AvaTrade is an Irish broker with a high level of trustworthiness and reliability, with over 300,000 registered users and more than 2 million transactions occurring each month. They are a market leader with offices in 10 countries and accreditation across five continents. We conducted a thorough review of their trading platform, allocating it a score of 8.10 out of 10. You can see the review here: AvaTrade Review: Pros, Cons, and Key Features.

Trading Strategy: Buying Call Option

Buying a call option can be incredibly lucrative if done correctly. The strategy is used to capitalize on the potential rise in price of an underlying asset. It is advised that only knowledgeable traders engage in call options trading. If you strongly believe that the price of an asset will rise significantly, call options offer leveraged gains compared to simply buying the asset itself. A small investment in a call option can yield a much larger profit if the price rises beyond the strike price.

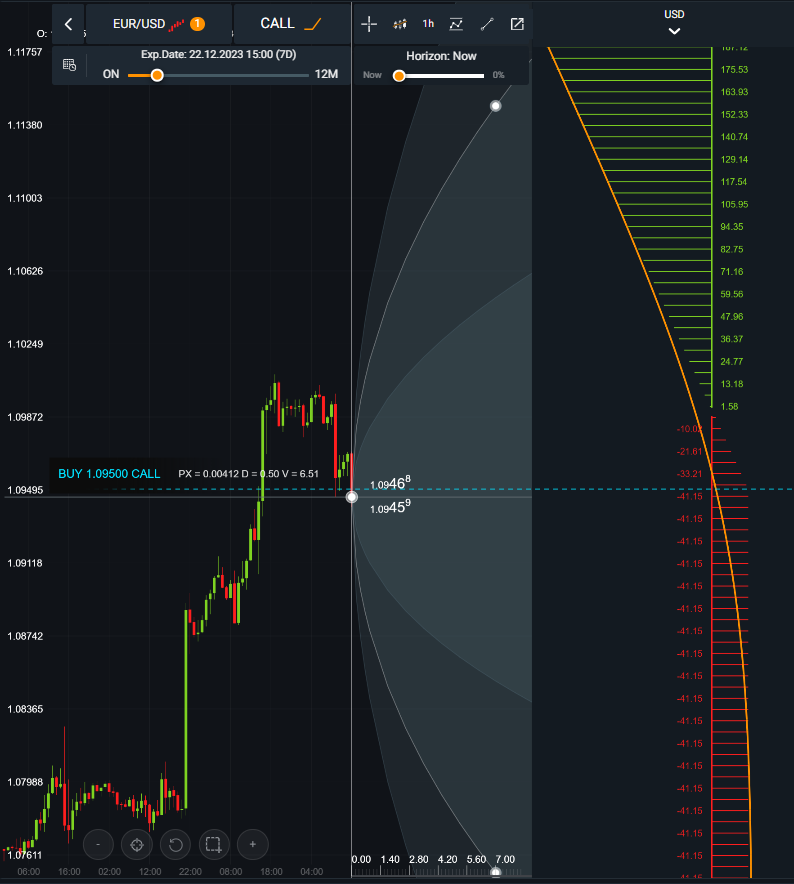

Trading Strategy: Buying Call Option

On the AvaTrade platform, you can find options contracts in the top-left under “strategy”. To begin buying a call option contract, click “call”. You can select the expiry date directly beneath this for up to one year from the current date. A slider on the right allows you to select the strike price. AvaTrade’s dashboard shows positive and negative price projections that adjust depending on the expiration date you select, allowing you to pick the best strike price for your strategy aligning with your speculation.

In the example above, we have selected a call option strike price of 1.09500 for the EUR/USD pairing, to expire in seven days. The current price is 1.09495. In one week, if the currency pair price is more than 50 pips above the current price (the strike price), we exercise the option, buying the EUR/USD at 1.09500 and then selling it at the higher market price to make a profit.

👍 Pros:

• Leveraged Gains: Buying call options provides an opportunity for leveraged gains. With a relatively small investment (the premium you pay for the option), you can control a larger position in the underlying asset.

• Limited Risk: Call options provide limited risk exposure. The maximum loss is capped at the premium paid for the option. This risk limitation provides a defined and known loss, making it attractive to some investors

• Flexibility: Options offer a high degree of flexibility. You can choose from various strike prices and expiration dates, allowing you to tailor your investments to match your risk appetite and expectations for price movement. This adaptability is valuable for constructing strategies that align with individual trading preferences.

• Income Generation: Through various strategies, such as covered calls, you can generate additional income by selling call options against held stock positions. This potential for regular income adds another layer to the overall benefits of buying call options.

👎 Cons:

• Time Decay: The value of an options contract decays over time (theta), even if the underlying asset’s price remains unchanged. This can lead to losses if the option is not exercised before the expiration date.

• Implied Volatility: Option prices are influenced by market expectations of future price fluctuations, known as implied volatility. High implied volatility can inflate option prices, making them more expensive to purchase and directly affecting profitability.

• Complexity: Options can be complex instruments, so understanding their intricacies is crucial for successful use. This added layer of complexity can make options trading difficult to access.

Trading Strategy: Selling Call Option

Selling a call option, also known as writing or shorting a call, is another call option strategy that traders may use to generate profit which involves the opposite of buying one. Instead of acquiring the right to buy an asset at a specific price, you're selling that right to buy to somebody else. If you believe that an underlying asset’s value will remain flat in the future, you could sell calls to generate income from the premiums paid by options buyers, without risking significant losses. Additionally, if you complement this strategy by holding a short position in the underlying asset, selling calls could limit potential losses in the event of a price increase.

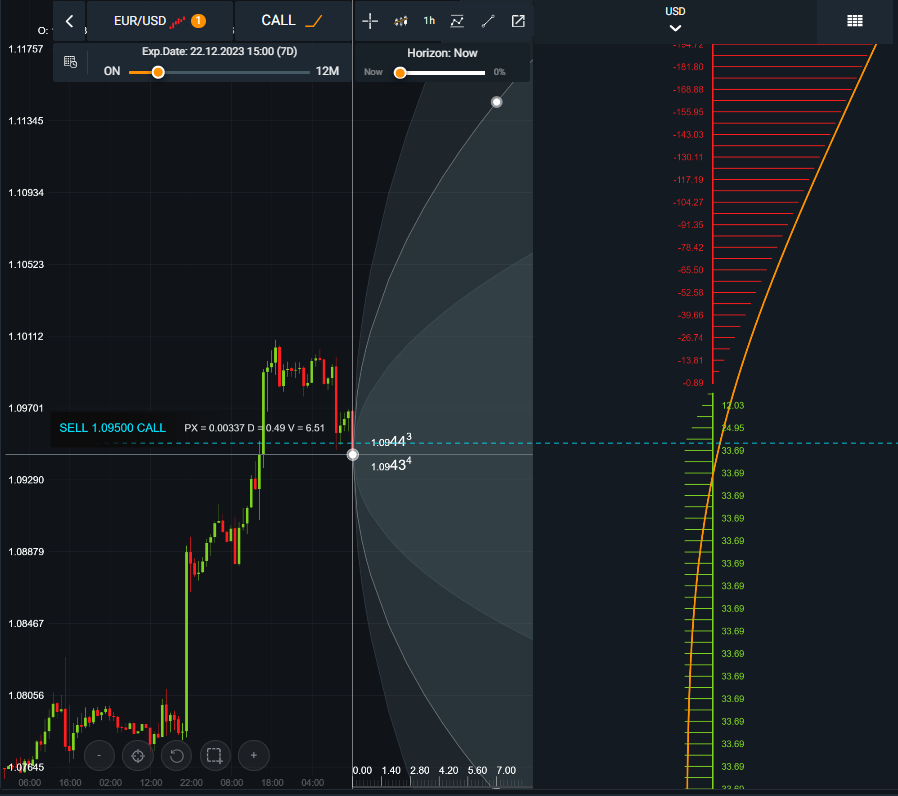

Trading Strategy: Selling Call Option

Let’s take a look at this example of selling a call option on AvaTrade. Here, we are selling a call option, setting the expiry date to seven days from now, with a strike price of 1.09500. We can see that the price is starting to trend downward, so selling a call option rather than buying could be profitable.

Potential Outcomes:

-

Price Stays Below Strike: If EUR/USD remains below 1.09500 after one week, the option expires worthless. You keep the premium as profit.

-

Price Exceeds Strike: If EUR/USD rises above 1.09500, the buyer may exercise the option. You'll be obligated to sell them EUR/USD at the strike price of 1.09500, potentially limiting your gains or resulting in a loss.

👍 Pros:

The advantages of selling call options:

• Premium Income: Selling call options allows you to receive an upfront premium payment from the option buyer. This premium is retained by you, the seller, regardless of whether the option is exercised or expires worthless.

• Capital Efficiency: Selling calls can free up capital that would otherwise be tied up in owning the underlying asset. This unlocked capital can be deployed elsewhere or used to diversify your investment portfolio.

• Hedging Benefits: Selling call options can be used to hedge existing positions and reduce your overall portfolio risk. This allows you to participate in stock ownership while implementing a strategy to offset any potential downside risk.

👎 Cons:

The potential disadvantages of selling call options:

• Unlimited Risk: Although your losses are capped in terms of the premium you receive, there's an unlimited (!) potential downside if the asset price ends up rising significantly. The buyer could exercise the option at any time (if available on the platform providing the options trading service), forcing you to sell the underlying asset at the strike price.

• Early Exercise Risk: The call option buyer could exercise the option before expiry, which would limit your overall profit potential.

• Complexity: Like buying calls, selling calls requires a good understanding of option mechanics and the associated risks. The added complexity can itself increase risk, as an inexperienced trader may not fully comprehend how it works.

Trading Strategy: Call Spread

When using a call spread strategy, you simultaneously buy and sell call options with different strike prices but using the same expiration date. The goal is to benefit from a moderate upward price movement in the underlying asset. The maximum loss is limited to the initial investment, while the potential profit is capped at the difference between the two strike prices minus the total premium paid.

On the other hand, selling a call spread involves beginning the trade at net credit, by selling the lower-strike call option and buying the higher-strike call option. This strategy can generate profits if the underlying asset's price remains below the lower strike when the contract reaches the expiration date.

If a trader was feeling bullish on a stock, they could buy a lower-strike call option and sell a higher-strike call option, creating a spread that allows for profit within a specific price range. Conversely, if they expected the stock to stay flat or fall slightly, they could sell a lower-strike call and buy a higher-strike call, and receive net credit. If the stock remains below the lower strike at expiration, the options would expire worthless, and the trader would retain the premium received.

Selling Call Spread

In the example above, we can see the price trending downward, signifying bearish movement, so we adopt the strategy of selling a call spread. The current price is 1,09427, and we are selling a call option at the lower-strike price of 1.09000, and buying a call option at 1.10000, both with an expiration seven days from initiation.

👍 Pros:

• Risk management: Call spreads come with limited risk as the maximum loss is capped at the initial premium paid for the spread. Selling call spreads can act as a risk management tool if you are holding the underlying asset, as the premium received helps offset potential losses in the stock's value.

• Profit potential:

-

Selling call spreads offers immediate income from the premium received but carries the risk of having to sell the underlying asset at a fixed price if the price rises unexpectedly.

-

Buying call spreads offers moderate profit potential within a specific price range while limiting your risk compared to buying a single call option. Your maximum loss is capped at the initial investment.

• Cost-efficient: Compared with buying or selling a single call option outright, call spreads are often a more cost-efficient strategy. The net premium paid for the spread is typically lower, making it accessible for traders with a smaller budget.

👎 Cons:

• Limited Profit Potential: Buying and selling call spreads has capped profit potential. The maximum profit is the difference between the two strike prices, minus the net premium paid or received.

• Time Decay: Both call spread strategies are affected by time decay. As options approach their expiration date, their value erodes, affecting the overall profitability of the position. You should consider the time factor and manage your strategy accordingly.

• Commission Costs: Buying and selling call spreads involves multiple legs, which can lead to higher commission costs. You should be aware of these costs when evaluating the overall profitability of your strategy.

Best options brokers

How to Start Trading Call and Put Options

Now that we’ve explored the various strategies used to trade call options, it’s time to get started on trading.

Follow these steps:

-

Learn the basics: Learning about what call options are, like we did in this article, is a good start, but there is a lot more to learn – you need a solid understanding of the basics of options trading. Explore fundamental analysis to grasp the core factors influencing option prices, such as earnings reports and market trends. Study technical analysis by learning to read charts and identify patterns, so you can evaluate historical price patterns. Comprehend core risk management principles to protect your capital.

-

Open account: You can’t get started trading without an account to do it from. Select a reputable brokerage platform that offers options trading, making sure it aligns with your broker preferences. Consider factors such as commissions, fees, available options markets, and the platform's overall functionality. Check our review: 7 Best Option Trading Platforms

-

Practice using demo: Most brokers offer demo accounts, where you can practice trading using virtual capital in simulated market environments. Use demo accounts to familiarize yourself with the platform, test strategies, and build confidence. Practice your analysis and refine your decision-making process. Then, when you feel comfortable and have a demonstrated understanding of the options market, transition to live trading with real capital.

We explain options trading on a demo account in much more detail in this article: How To Practice Trading Options Without Risking Money?

Summary

Buying and selling call options can be a great way to leverage your gains and generate profit substantially larger than you would by simply buying the underlying asset. It can also provide additional income through premiums, and comes with limited risk and flexibility. However, the complexity of options trading can make it inaccessible to many traders. To overcome this hurdle, make sure you do extensive research before investing any real capital. Understand the intricacies of call options trading before engaging, and always employ stringent risk management.

Glossary for novice traders

-

1

Forex Risk Management

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

-

2

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

3

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

-

4

Binary options trading

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.