deposit:

- $500

Trading platform:

- MetaTrader4

- Mobile Apps

- Proprietary web platform

Almahfaza Review 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of Almahfaza Trading Company

Almahfaza is a full-fledged STP (Straight Through Processing) broker specializing in trading currencies, stocks, indices, metals, and other commodities in CFD format. It offers 5 account types with fixed spreads, including cent accounts as well as Islamic accounts. With Almahfaza, you can earn not only active but also passive income via automatic trading and through its affiliate program.

👍 Advantages of trading with Almahfaza:

- A wide range of currency pairs and CFDs.

- Leverage is up to 1:400.

- Choice between the author's trading platform and MetaTrader 4.

- Available cent and demo accounts.

- Referral program with high commissions.

- Free analytical tools such as economic calendar, WisdomHub, and trading signals are available.

- Simple account registration.

👎 Disadvantages of Almahfaza:

- Absence of license from regulators.

- The minimum deposit is $500 on cent accounts and $1,000 on standard accounts.

- Floating spread accounts are not available.

Geographic Distribution of Almahfaza Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Trading Conditions for Almahfaza Users

The minimum trading volume differs for different accounts: for a Mini account, it is $1,000; for Standard, it’s $10,000; for Gold, it’s $50,000; for Platinum, it’s $100,000; and for Diamond, it’s $500,000. Trading is conducted from Sunday 22:00 to Friday 21:00 GMT. Almahfaza supports only spot trades, and forward deals are not available. Clients can place two order types — market and limit/pending, including stop loss and take profit.

$500

Minimum

deposit

1:400

Leverage

24/5

Support

| 💻 Trading platform: | Broker’s proprietary web platform and mobile apps, MetaTrader 4 (MT4) |

|---|---|

| 📊 Accounts: | Demo, Mini, Standard, Gold, Platinum, Diamond, Islamic |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Visa, MasterCard, bank wire transfer |

| 🚀 Minimum deposit: | 500 USD |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Fixed from 2 pips |

| 🔧 Instruments: | Currencies, stocks, indices, commodities, ETFs |

| 💹 Margin Call / Stop Out: | 50%/20% (for МТ4 accounts)100%/25% (for rest of accounts) |

| 🏛 Liquidity provider: | Banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Fixed spreads |

| 🎁 Contests and bonuses: | Cashback bonus |

Almahfaza Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Mini | From $0.4 | Broker does not charge |

| Standard | From $30 | Broker does not charge |

| Gold | From $20 | Broker does not charge |

| Platinum | From $20 | Broker does not charge |

| Diamond | From $20 | Broker does not charge |

If a trader keeps a position open after 00:00 (GMT), they either pay or receive an interest rate. This type of commission is called a swap and is calculated for all assets traded on the Almahfaza platform. To compare commissions, Traders Union analysts chose two popular forex brokers: RoboForex and PocketOption.

| Broker | Average commission | Level |

| Almahfaza | $18.1 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed review of Almahfaza

Almahfaza is an STP broker, not a market maker, which means they are interested in generating stable profits for their clients and establishing long-term partnerships with them. The company partners with leading banks to ensure the security of traders' funds and protect them from being used for commercial expenses. Almahfaza uses SSL encryption to maintain confidentiality and offers the most reliable payment gateways: Visa, MasterCard, and bank transfers.

Almahfaza by the numbers:

-

5 trading account types are available.

-

Partner rewards starting from $100 for each referral.

-

Over 5,000 traders use the Almahfaza mobile application.

-

The proprietary trading platform allows traders to open up to 4 charts simultaneously.

Almahfaza is a broker that allows trading with over 300 financial instruments.

As a Forex broker, Almahfaza is not directly related to any stock exchange. Clients can trade stocks but only in the form of CFDs. There are over 200 CFDs on stocks available with trading leverage ranging from 1:5 to 1:20. Almahfaza's main specialization is trading currency pairs, with 45 pairs available. The standard leverage ranges from 1:4 to 1:30 (depending on the pair), but upon client request, it can be increased to 1:100 or to 1:400. Stock indices such as Dax 30, Dow Jones, Nasdaq, S&P 500, and Nikkei can be traded with leverage up to 1:20, while BIST 100 offers leverage up to 1:4. Additionally, there are over 20 ETFs (exchange-traded funds) available with leverage up to 1:5, as well as energy resources (oil, gas), metals (gold, silver, platinum, palladium), and corn.

For trading, the company offers its proprietary WebTrader trading platform and the classic MetaTrader 4 platform, as well as their adaptations for iPhone and Android devices. The Almahfaza mobile application was released in January 2019.

Almahfaza’s analytical services:

-

Asset Expirations. This section on the website displays the expiration dates of futures contracts.

-

Overnight Commissions table. Provides real-time commission data on the broker's website.

-

An economic calendar. Is used to track important events in the economy and conduct fundamental analysis.

-

WisdomHub data. Provides traders with information on trend movements, volatility changes, and increases/decreases in the price of assets. WisdomHub also alerts traders if the number of open positions for a particular instrument is increasing.

Advantages:

The proprietary platform displays market sentiments for each asset, facilitating trading decisions.

All clients receive daily market reviews, access to a library of educational videos, round-the-clock support, and assistance from a personal trading coach.

Traders who deposit over $1,000 receive VIP support and access to exclusive trading recommendations.

In case of technical issues with the trading platform, remote assistance from Almahfaza staff can be requested via TeamViewer.

The broker offers cent accounts, allowing trading with cents instead of dollars, reducing the potential losses in case of a losing trade.

All possible broker commissions are listed on their official website, allowing each client to calculate expenses for specific trades.

Guide on how traders can start earning profits

To enter the real market, traders need to open a trading account. Almahfaza offers 5 account types, including an Islamic account upon request. All clients receive leverage up to 1:400 and fixed spreads. The accounts differ in the size of trading commissions and additional features.

Account types:

Before trading on a real account, traders can practice on a demo version without making a deposit.

Almahfaza, as an STP broker, offers accounts for traders with different levels of experience who prefer trading with fixed spreads.

Investment Education Online

The Almahfaza website does not provide comprehensive trading education. The company does not conduct webinars for beginners and does not offer e-books or video lessons on the basics of Forex. There is some theory available in one of the subsections of the FAQs section called “Trading Basics”.

The broker offers a demo account, which can be used to learn how to trade without losing money.

Security (Protection for Investors)

Almahfaza is a trademark owned by St Services Ltd. The company is registered in the Marshall Islands and operates in accordance with the legislation of that jurisdiction. Almahfaza has been assigned the number 83416 in the general company registry.

The broker claims to hold client funds in leading banks worldwide, although specific names are not mentioned on the website. To ensure secure trading, Almahfaza utilizes SSL encryption systems to protect clients' data from unauthorized use.

👍 Advantages

- Clients of the broker have access to leverage up to 1:400 regardless of their level of expertise.

- No additional questions about capital size, trading experience, etc., need to be answered when opening an account.

👎 Disadvantages

- The company may transfer client funds to a third party outside the EU, such as an intermediary broker, bank, settlement agent, or clearinghouse.

- There is no regulation of Forex brokers' activities in the Marshall Islands.

- Clients of Almahfaza do not have access to a compensation fund for damages in the event of the broker's suspension of operations.

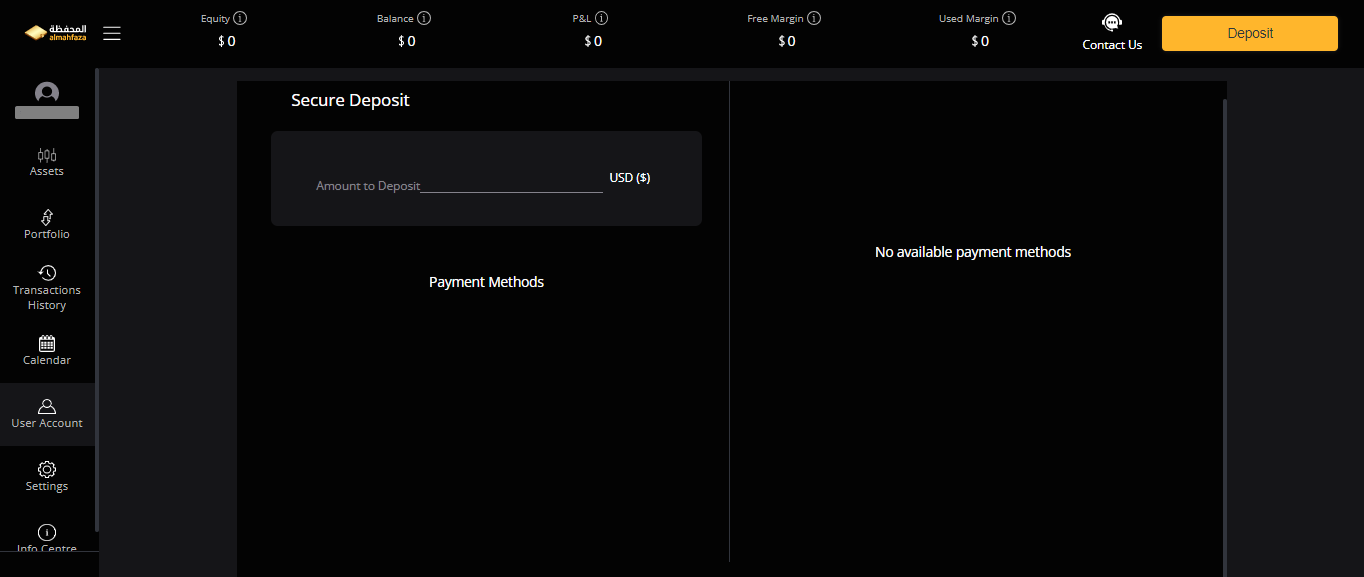

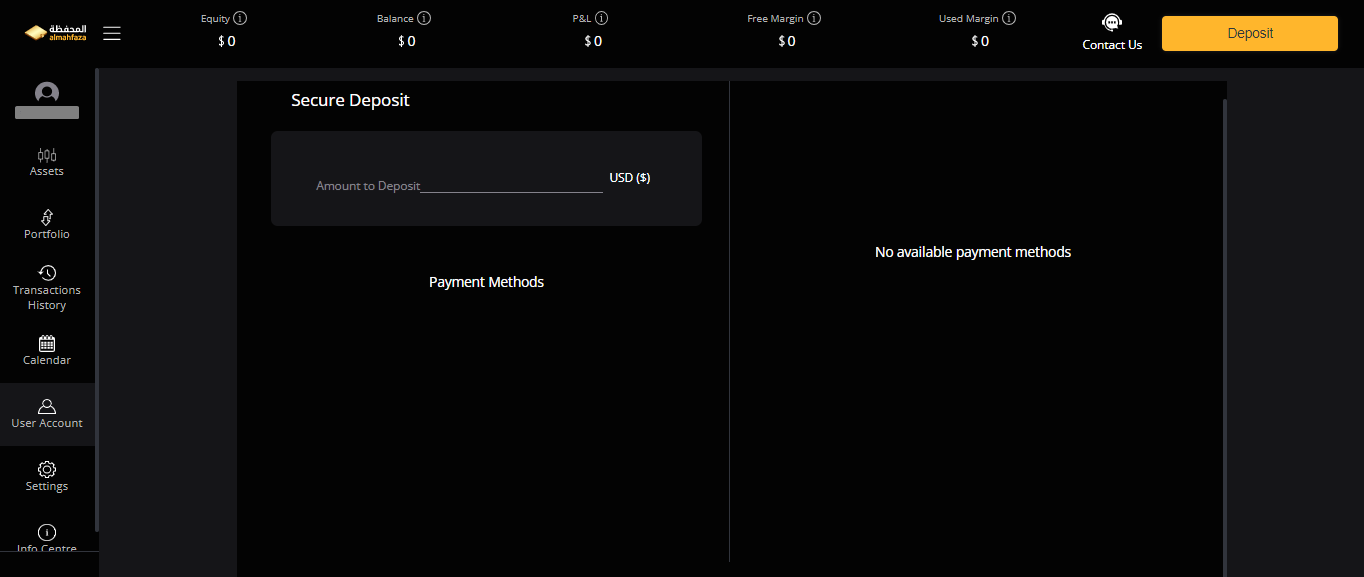

Withdrawal Options and Fees

-

The deposit amount is refunded using the same method through which the funds were first deposited. The remaining amount is withdrawn via bank transfer. The funds are credited to the account or card owner's name, and transfers to third parties are not allowed.

-

The minimum withdrawal amount for cards is $25, and for bank transfers, it is $60.

-

Almahfaza processes withdrawal requests within 5 business days. The time for funds to be credited depends on your bank. The overall withdrawal process may take up to 10 business days.

Customer Support Service

Clients are served during market hours, which means 24/5.

👍 Advantages

- Chat operators in the user account respond within 1 minute.

- Any website visitor, not just the broker's clients, can seek assistance from a customer support representative.

👎 Disadvantages

- The LiveChat button on the website is unresponsive.

- Support is unavailable on Saturdays and Sundays.

If you intend to work with Almahfaza or are already a client of this broker, you can contact support using the following methods:

-

Phone.

-

Email.

-

LiveChat.

Almahfaza clients can get remote help via TeamViewer Quick Support. This program allows the company specialists to connect to the trader's computer and quickly solve many technical problems.

Contacts

| Foundation date | 2019 |

| Registration address | London, England, United Kingdom |

| Official site | https://almahfaza.com/ |

| Contacts |

Email:

PR@almahfaza.com,

Phone: +44 3303902900 |

Review of the Personal Cabinet of Almahfaza

Any person from the authorized jurisdictions can create a user account on the Almahfaza website. This process consists of two stages:

The first stage is the registration of an account. To start it, click on "Sign Up". A form will appear where you can enter your name, surname, email, country, and phone number. It is also necessary to create a password to protect the account.

The second stage is the confirmation of the email and phone number. The company provides detailed instructions, so these two actions should not raise any questions. It is important to enter real data in the first stage, as confirmation codes will be sent to the specified email and phone number.

Features of Almahfaza’s User Account:

Your Almahfaza User Account also provides access to:

Your account balance (the amount of cash on the account) and capital (the sum of the balance + open positions).

Summary of profits and losses on all open positions.

Size of available margin (the amount available for opening new positions) and margins used (the amount of blocked funds that cannot be used for placing new positions).

Full transaction history and executed trades.

Legal documents regarding regulation, trading conditions, and privacy policy.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has Almahfaza been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against Almahfaza by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of Almahfaza is down, not updated or operates with clear errors and some features are not available;

• Almahfaza has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if Almahfaza got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why Almahfaza got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from Almahfaza?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if Almahfaza is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.