deposit:

- $100

Trading platform:

- MetaTrader4

- Web Trader MT4

- FSA

- FSC

Axiance Review 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of Axiance Trading Company

Axiance is a broker that has been providing services to Forex traders since 2019. Its operation is controlled by two international regulatory bodies: the Seychelles Financial Services Authority (FSA) and the Mauritius Financial Services Commission (FSC). Axiance offers over 300 trading instruments, including major and minor currency pairs, cryptocurrencies, futures, and CFDs on stocks, indices, and commodities. The broker allows copy trading, as well as using expert advisors (EAs) and leverage.

👍 Advantages of trading with Axiance:

- Standard accounts with deposits from $100.

- High leverage (up to 1:500).

- Free VPS (virtual private server).

- Wide variety of CFDs and currency pairs.

- Accounts for professional traders with spreads from 0 pips.

- Broad choice of payment systems for depositing and withdrawing funds.

- Negative balance protection for retail clients.

👎 Disadvantages of Axiance:

- No trading education.

- No cent accounts.

- The average spread is higher than that of popular Forex brokers.

Geographic Distribution of Axiance Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

Axiance does not offer its own investment solutions, such as manageable accounts or ready-made asset portfolios. However, clients have access to social trading, so they can make money without active trading activity. Also, the broker allows using EAs for algorithmic trading and offers several types of partnership. All these methods can be used to earn passive income.

Earning with Axiance without active trading

Clients of Axiance have access to investment solutions supported by MetaTrader. They can copy trades of MQL4.community members and use EAs written in MetaQuotes Language 4 (MQL4) for algorithmic trading. Besides that, Axiance provides access to the ZuluTrade social trading platform. The terms of its use are as follows:

All investors can set up the ZuluGuard account protection feature.

Two types of real accounts are available: Classic and Profit Sharing. Classic is for experienced traders and allows them to combine active trading with copy trading.

The monthly fee for Profit Sharing accounts is $30. The reward for successful trading is 25% of an investor’s profit.

Axiance charges all ZuluTrade users a 1 pips fee on every round-trip trade.

Axiance does not guarantee profits from copy trading on any platform, so investors should realize the risks of losing money. ZuluTrade users can open demo accounts to test automated trading with virtual funds.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Axiance affiliate program

The company offers two types of affiliate cooperation: Introducing Brokers and Affiliates. Axiance concludes a written agreement with every partner, specifying the reward or fee for referrals’ trading.

The company mandatorily provides its partners with transparent statistics on referrals’ performance. At the same time, Axiance is not responsible for interaction between Introducing Brokers/Affiliates and their clients.

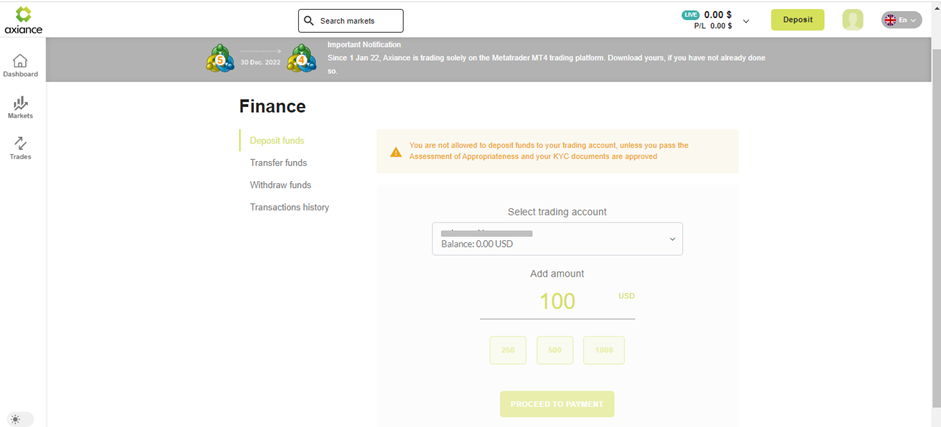

Trading Conditions for Axiance Users

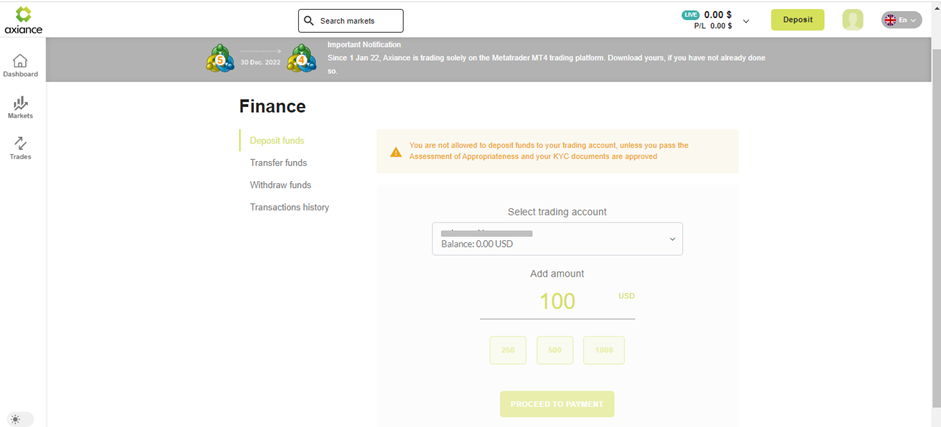

Axiance enables you to trade over 300 instruments with up to 1:500 leverage and floating spreads. Trading on Standard accounts is possible after depositing $100. Only USD and EUR can be deposited via bank transfers. USD, EUR, and GBP can be deposited from cards. You can also add AUD, IDR, MYR, PHP, ZAR, THB, and VND from electronic wallets. The maximum amount of deposit from cards is 30,000 currency units per transaction. There are no limits on other methods.

$100

Minimum

deposit

1:500

Leverage

10/5

Support

| 💻 Trading platform: | MetaTrader 4 (Desktop, Android, iOS) and MT4 WebTrader |

|---|---|

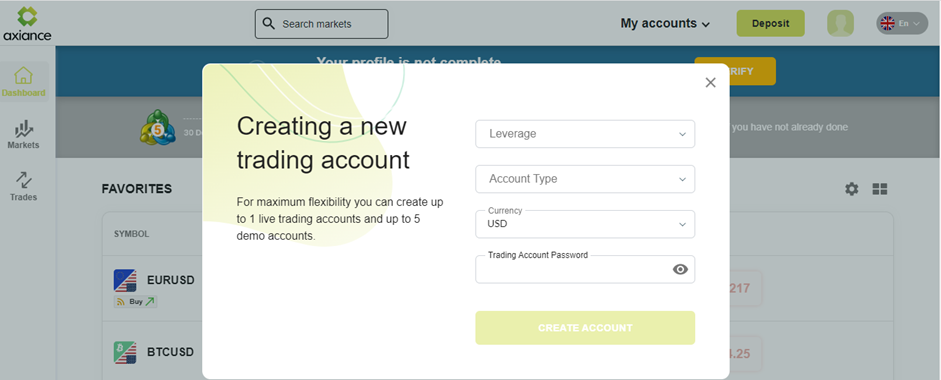

| 📊 Accounts: | Demo, МТ4, Standard, Premium, VIP, and Islamic |

| 💰 Account currency: | USD, EUR, GBP, and ZAR |

| 💵 Replenishment / Withdrawal: | Credit/debit cards (Visa, MasterCard), bank transfers, Skrill, Neteller, AstroPay, Help2Pay, Perfect Money, and other electronic wallets |

| 🚀 Minimum deposit: | 100 USD |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.2 pips (Standard); from 0.8 pips (Premium); and from 0 pips (VIP) |

| 🔧 Instruments: | Forex, commodities, indices, stocks, cryptos, and futures |

| 💹 Margin Call / Stop Out: | Standard and Premium: 100%/10%VIP: 100%/15% |

| 🏛 Liquidity provider: | Proprietary providers of quotes (are not disclosed) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Social trading and EAs |

| 🎁 Contests and bonuses: | Welcome bonus (periodically) |

Axiance Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $12 | No |

| Premium | From $8 | No |

| VIP | From $0 | No |

Pips are used to calculate the swap (overnight rollover) for currency pairs, metals, energies, and cryptocurrencies; a percentage is used for stocks and futures; and margin currency is used for indices.

When analyzing a broker’s trading conditions, it is necessary to compare its fees to charges at other companies. Analysts at Traders Union have compared Axiance to its competitors. The results are in the table below.

| Broker | Average commission | Level |

| Axiance | $6.7 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of Axiance

Axiance upholds socially responsible funding, quality and innovations, as well as transparency and fairness for every client. The broker offers a wide array of assets, margin trading, and classic platforms for Forex trading. Axiance provides access to social trading on proven platforms and offers three real account types and a demo account.

Axiance by the numbers:

-

More than 300 trading instruments.

-

Over 50 currency pairs.

-

17 most popular cryptocurrencies.

-

More than 200 stocks of international companies.

Axiance is a broker for trading six classes of assets with high leverage

Axiance enables you to trade major and minor currency pairs. Maximum trading leverage on the major pairs is 1:500; on other minor pairs, it varies: 1:5, 1:50, 1:100, and 1:500. Maximum leverage on copper, palladium, and platinum is 1:10, and 1:4 on cryptocurrencies; and 1:100 on gold, silver, indices, and energies. Stocks are traded with up to 1:10 leverage. Axiance does not provide access to the stock market and therefore its clients make trades with stocks in the form of CFDs only. You can trade securities issued by companies in the U.S., Germany, Hong Kong, France, Spain, Switzerland, and the United Kingdom.

Previously, Axiance’s clients could trade on МТ5, but since January 1, 2022, the broker has only been providing MT4. The platform supports over 20 chart plotting tools, 30+ technical indicators, and 9 timeframes. One-click trading, EAs, and free Autochartist are available.

Axiance’s useful services:

-

VPS is provided for free to all clients who hold from $5,000 in their balance and close 5 or more lots per month.

-

Forex glossary defines basic terms pertaining to the financial markets.

-

Trading statistics are available in the user account. In the Market section, you can see how actively every asset is traded on a given day. The number of BUYs and SELLs is indicated as a percentage.

Advantages:

Licenses from two financial regulators and compliance with international security standards.

Three types of real accounts for traders with different skills and trading volumes.

A low commission per lot on professional accounts.

Access to well-known and popular copy trading platforms.

Swap-free trading on Islamic accounts intended for Muslims.

The company provides its clients with quotes for currencies, stocks, indices, and other instruments in real-time for free.

Guide on how traders can start earning profits

Axiance offers three types of real accounts that differ in minimum deposit requirements, fees, and additional features. Maximum leverage on all account types is 1:500. Clients have free access to Trading Central (an investment research provider) and can open swap-free Islamic accounts.

Account types:

Before proceeding to real trading, new clients can practice on demo accounts.

Axiance is a broker for beginners, experienced traders, and professionals.

Investment Education Online

There is an Education section on the Axiance website, but it only contains a short glossary. The FAQs section does not have educational content but provides some useful data.

The broker offers demo accounts that can be used to learn to trade.

Security (Protection for Investors)

Axiance is a trademark used by entities of the Axiance Group of companies. Aerarium Limited (International) is regulated by the Financial Services Authority (FSA) Seychelles under license number SD036. Aurum Capital Ltd (Global) is controlled by the Financial Services Commission (FSC) Mauritius under license number GB20025770.

👍 Advantages

- The FSA and the FSC permit brokers to provide their clients with high leverage

- Axiance’s regulators do not prohibit payments through electronic systems

- Negative balance protection

👎 Disadvantages

- To resolve disputes with Axiance, traders have to refer to courts in the Seychelles and Mauritius

- The broker may request a copy of your credit card

Withdrawal Options and Fees

-

Axiance offers a wide variety of payment systems for the withdrawal of profit. USD and EUR can be withdrawn to cards or via bank transfers such as Neteller, Skrill, Perfect Money, and AstroPay. GBP can be withdrawn through Skrill, Neteller, AstroPay, or to cards. AUD can only be withdrawn via Neteller and Skrill. You can also withdraw profits in ZAR, THB, IDR, MYR, PHP, and VND.

-

The minimum withdrawal amount is 50 units of a currency. The maximum amount of withdrawal to a card is 30,000 USD/EUR/GBP.

-

Funds arrive to bank accounts within 3 business days and to cards or electronic wallets within 1 business day.

-

Axiance does not charge any withdrawal fees.

Customer Support Service

Traders can send questions by email anytime, but answers will arrive during the company’s business hours: 08:00-18:00 Eastern European Time (EET), Monday through Friday.

👍 Advantages

- The support service answers questions of both registered and unregistered users.

👎 Disadvantages

- No online chat for quick connection with an operator

- Support is not available at weekends

To contact the broker, you can use:

-

Live chat;

-

email;

-

a feedback form.

Axiance has profiles on Facebook, Instagram, Twitter, LinkedIn, and a YouTube channel.

Contacts

| Foundation date | 2022 |

| Registration address | Aerarium Limited, CT House, Office 9A, Providence, Mahe, Seychelles |

| Regulation |

FSA, FSC |

| Official site | https://axiance.com/ |

| Contacts |

Email:

support@axianceint.com,

|

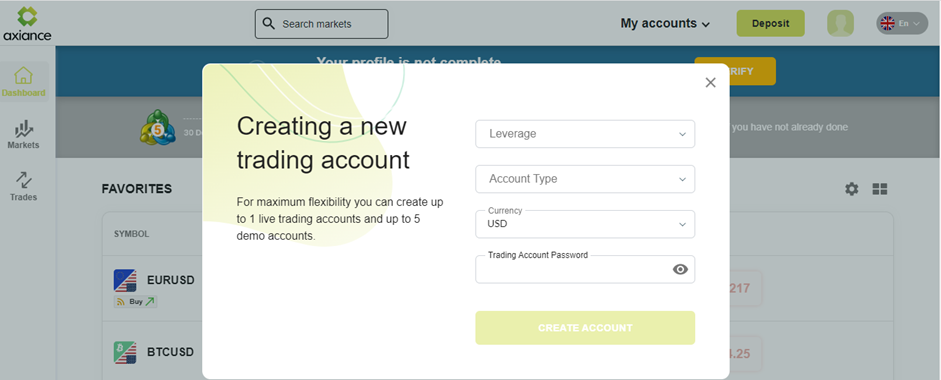

Review of the Personal Cabinet of Axiance

To create a user account on the Axiance website, you need to register. The procedure is rather simple:

On the website’s homepage, click “Start trading” or “Register” (this button is in the top right corner of any page of the website).

Next, fill out the registration form. Include your first and last names, email address and phone number, and create a password. After that, you get access to your user account. To log in to it, you need to enter your email address and password.

In your Axiance user account, you can:

View the following data:

Quotes for financial instruments in real-time.

A percentage of Axiance clients who bought or sold an asset on a given trading day.

Information on open trades and postponed orders.

Fees, swaps, and values of take-profit and stop-loss orders on open positions.

Margin level as a percentage.

Legal documents.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has Axiance been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against Axiance by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of Axiance is down, not updated or operates with clear errors and some features are not available;

• Axiance has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if Axiance got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why Axiance got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from Axiance?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if Axiance is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.