deposit:

- $250

Trading platform:

- MT4

- eXcentral Trader

- CySec

- 0%

eXcentral Review 2024

deposit:

- $250

Trading platform:

- MT4

- eXcentral Trader

- CySec

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of eXcentral Trading Company

eXcentral is a broker with higher-than-average risk and the TU Overall Score of 4.76 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by eXcentral clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. eXcentral ranks 140 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The eXcentral broker targets traders within the European Union.

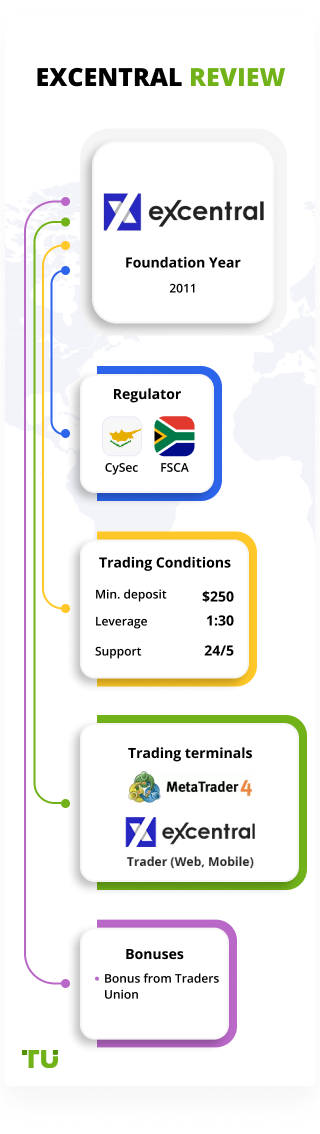

One of the leading CFD and Forex brokers is eXcentral. It has been operating since 2011. The broker provides access to six classes of trading instruments, including currency pairs and contracts for difference (CFDs) on stocks, stock indices, commodities, futures, and cryptocurrencies. The eXcentral broker is registered in Cyprus and operates under the licenses of the Cyprus Securities and Exchange Commission (CySec, 226/14).

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | from 250 USD |

| ⚖️ Leverage: | up to 1:30 |

| 💱 Spread: | from 2.5 pips (Classic, Silver); from 1.5 pips (Gold); and from 0.9 pips (VIP) |

| 🔧 Instruments: | Currency pairs (47), CFD on stocks (88), indices (12), commodities (19), futures (4), cryptocurrencies (7) |

| 💹 Margin Call / Stop Out: | 100% / 50% |

👍 Advantages of trading with eXcentral:

- 170+ trading instruments.

- Spreads from 0.9 pips.

- Withdrawal fee of 0% for verified users.

- Access to Trading Central.

- Minimum deposit starts at USD 250.

👎 Disadvantages of eXcentral:

- There are no tools for passive investments.

- The bank transfer withdrawal requests process period can take up to 10 business days.

- Support works only 24/5.

Evaluation of the most influential parameters of eXcentral

Geographic Distribution of eXcentral Traders

Popularity in

Video Review of eXcentral i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of eXcentral

The eXcentral broker offers services to clients from more than 60 countries, but the key audience of the company is traders from the European Union. The platform does everything possible to make operations in the financial markets as comfortable as possible. The eXcentral broker positions itself as an innovative broker. Automated trading is available here as well. It is especially worth highlighting the Bitcoin Up trading robot, which is ideal for traders who work with the world’s main cryptocurrencies.

The eXcentral’s policy on brokerage fees is not attractive. Minimum spreads of 0.9 pips are provided only for traders with VIP accounts. For traders with other types of trading accounts, the minimum spread ranges from 1.5 to 2.5 pips. They apply separate commissions to commodities which are charged per trade. Its size ranges from 0.1 to 0.14 USD, depending on the type of trading account.

The advantages of eXcentral include a low entry threshold and good training opportunities. To start trading with the company, you need to fund your account with at least 250 USD. Training is provided for all traders free of charge. Clients who enjoy a higher status can access additional content. The broker has negative balance protection, thanks to which traders are protected from troubles in the event of an unsuccessful transaction.

Dynamics of eXcentral’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The eXcentral broker is suitable for professional traders, but this company has nothing to offer investors. Users can only earn additional income through affiliate programs promoting the broker’s services.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

eXcentral’s affiliate programs

-

Affiliate Program. The eXcentral affiliate program is focused on attracting new users such as CPA, CPL, Spread Share, and Revenue Share, etc.

The affiliate program from eXcentral provides remuneration depending on the selected affiliate program plan. You can get payments for registration, for depositing an account, as a commission paid by a partner for a transaction.

Trading Conditions for eXcentral Users

The eXcentral broker offers traders more than 170 trading tools. The company’s clients have access to the classic trading terminal - MetaTrader 4. Margin trading with leverage up to 1:30 is supported for all types of trading accounts. You can choose one of 4 account types. The minimum deposit is 250 USD, which makes the broker a suitable option for both experienced and novice traders. Clients can test the trading conditions of the broker on a free demo account.

$250

Minimum

deposit

1:30

Leverage

24/5

Support

| 💻 Trading platform: | МТ4 (desktop, mobile, web), eXcentral Trader (web, mobile) |

|---|---|

| 📊 Accounts: | Demo, Classic, Silver, Gold, VIP |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Credit cards, bank transfer, Neteller, Skrill |

| 🚀 Minimum deposit: | from 250 USD |

| ⚖️ Leverage: | up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 2.5 pips (Classic, Silver); from 1.5 pips (Gold); and from 0.9 pips (VIP) |

| 🔧 Instruments: | Currency pairs (47), CFD on stocks (88), indices (12), commodities (19), futures (4), cryptocurrencies (7) |

| 💹 Margin Call / Stop Out: | 100% / 50% |

| 🏛 Liquidity provider: | More than 20 major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution, Market execution |

| ⭐ Trading features: | There is a fee for inactivity on the account |

| 🎁 Contests and bonuses: | Yes |

Comparison of eXcentral with other Brokers

| eXcentral | RoboForex | Pocket Option | Exness | TeleTrade | FXGT.com | |

| Trading platform |

eXcentral Trader, MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MetaTrader4, MetaTrader5 |

| Min deposit | $250 | $10 | $5 | $10 | $1 | $5 |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 2.5 points | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0.5 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 50% / 20% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| eXcentral | RoboForex | Pocket Option | Exness | TeleTrade | FXGT.com | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

eXcentral Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Classic | from $25 | No |

| Silver | from $25 | No |

| Gold | from $15 | No |

| VIP | from $9 | No |

There are swaps (fee for moving a position to the next day).

The analysts of Traders Union also compared the size of the average trading commission of eXcentral, RoboForex, and FxPro. The results are presented in the below table.

| Broker | Average commission | Level |

| eXcentral | $18.5 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of eXcentral

The eXcentral broker is keen to make trading as comfortable as possible for its clients. The company does not impose restrictions on the use of any trading strategies. Traders are offered two types of order execution - Instant execution and Market execution. The broker provides an opportunity to work with six classes of trading instruments. Clients have access to automated trading, as well as free analytics from the broker’s specialists. The company offers four types of accounts for retail traders, as well as a free demo account which is without time limits.

The eXcentral broker in numbers:

-

More than 10 years of experience in brokerage services.

-

Over 170 trading instruments.

-

4 types of trading accounts for traders

The eXcentral broker is for active trading

The eXcentral platform does not offer investment opportunities to its clients. However, there are many options for traders here. The company offers clients ECN (Electronic Communication Network) technology so that traders can work directly with eXcentral liquidity providers. To work using ECN technology, you need to open a VIP account. Currency pairs are available for trade as well as contracts for difference (CFDs) on stocks, stock indices, commodities, futures, and cryptocurrencies.

The company’s clients can work with the eXcentral trading terminal. There is also a classic MetaTrader 4 terminal. Platforms are available for all types of devices such as web, desktop, and mobile versions. The broker allows the use of trading advisors and you can execute trades with one click.

Useful services of eXcentral:

Bitcoin Up. A trading robot that eXcentral has been working with since 2015. The bot automatically trades Bitcoin CFDs on behalf of the account owner.

-

Trading Central. It is an analytical platform that allows you to conduct technical analysis and receive trading signals.

-

Economic calendar. This broker provides clients with information about important economic events that are taking place in the world.

-

Trading schedule for the holidays. The eXcentral brokerage publishes information about the peculiarities of trading sessions that take place during the holidays. The information is provided for the next seven days.

-

CFDs expiry dates. Traders who work with CFDs on futures can control expiration dates thanks to a special chart.

-

Blog. In the blog, eXcentral experts provide clients with free analytics and the experts publish weekly and daily market overviews, trading ideas, etc.

Advantages:

There are six asset classes available for trading.

To ensure the safety of client funds, the company stores them in segregated accounts.

There is negative balance protection.

Tight spreads (from 0.9 pips) on VIP accounts.

The broker provides free analytics and online instruments to improve the quality of trading.

All clients, regardless of the size of the deposit, have access to an economic calendar, data on the expiration of contracts, analytics from the broker’s specialist blog, etc. Other services are provided depending on the type of trading account selected.

How to Start Making Profits — Guide for Traders

The eXcentral firm offers its clients four types of retail trading accounts. They differ in the amount of commissions, as well as in the set of additional options that the trader receives. The maximum leverage on the platform is 1:30. The minimum deposit with the eXcentral broker is 250 USD.

Account types:

Demo accounts are available for all types of trading terminals.

For those who are interested in trading and who want to get the maximum range of additional trading options, eXcentral is a wise choice for a broker.

Bonuses Paid by the Broker

Currently eXcentral does not provide bonuses to its clients. Traders who have opened an account here have to use 100% of their personal funds while trading.

Investment Education Online

The owners of eXcentral offer paid and free training. Free training is provided through training videos that are available on the company’s Youtube channel. Paid training includes training webinars and consultation with a personal analyst. The eXcentral training module does not contain educational articles, but it has industry manuals.

The broker does not have cent accounts, so the only way to consolidate the knowledge gained in practice will be training on a demo account.

Security (Protection for Investors)

The eXcentral broker has two offices. The broker’s central office is located in Cyprus, the second office of the company is located in the Republic of South Africa.

The broker has two licenses to carry out financial activities. It provides services in Switzerland and the European Union on the basis of the Cyprus license. The document number is CySec No. 226/14. Also, eXcentral provides negative balance protection for clients, regardless of the type of trading account.

👍 Advantages

- Client funds are segregated from eXcentral capital and are kept in segregated bank accounts

- There is negative balance protection

- In case of violations of the obligations prescribed in the offer by the broker, the client can file a complaint with the regulator

👎 Disadvantages

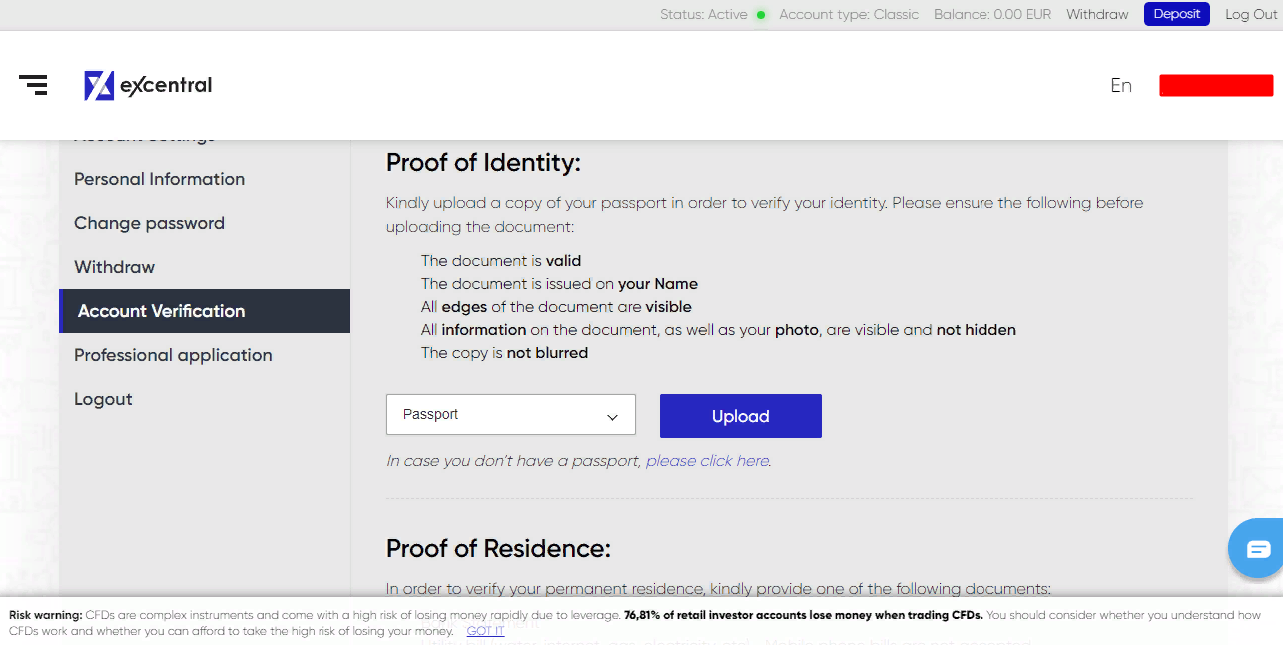

- To open an account, you must provide detailed financial information

- Without verification, account funding and withdrawal are available only for 7 days

Withdrawal Options and Fees

-

This broker processes a withdrawal request within 24 hours.

-

Money can be withdrawn to Visa or Mastercard (debit and credit), bank transfer, and by using the Neteller and Skrill electronic payment systems.

-

A bank transfer takes up to 10 business days. Money is received on EPS within a few minutes after the broker approves the withdrawal request.

-

The broker does not charge a commission for depositing or withdrawing funds for verified users. If the client has not passed the verification, a commission of 10 USD or equivalent will be charged when withdrawing funds. It is also possible that the commission will be written off by a bank or electronic payment system.

-

You can make a deposit or withdraw funds without verification within seven days. After this time, eXcentral reserves the right to cancel withdrawal requests for unverified clients.

Customer Support Service

Support service operators are available 24 hours a day. Support is provided on weekdays.

👍 Advantages

- In the online chat, you can ask a question without being a client of the company.

- Support available in 22 languages

👎 Disadvantages

- Available 24/5

This broker provides the following communication channels for existing clients and potential investors:

-

phone (the number can be found in Contact);

-

email;

-

online chat on the website via the personal account.

Not only a registered client but also a trader without an active account can ask a broker’s representative a question.

Contacts

| Foundation date | 2010 |

| Registration address | Agiou Athanasiou, 66 Toumazis Linopetra Building 4102, Limassol, Cyprus |

| Regulation |

CySec |

| Official site | https://eu.excentral.com/ru/ |

| Contacts |

Email:

support@excentral-eu.com,

Phone: +357 22 032220 |

Review of the Personal Cabinet of eXcentral

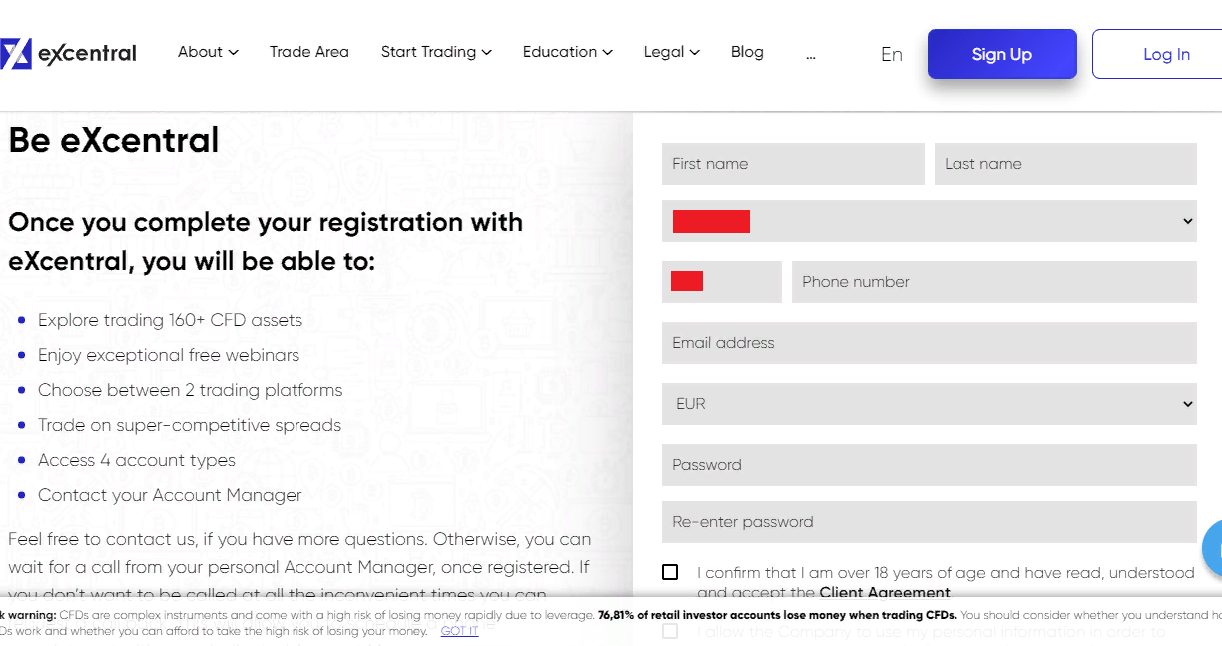

To start trading with eXcentral, you need to complete the registration procedure. A quick guide looks like this:

On the main screen, click on the Sign Up button. After that, a registration form will open.

Next, fill out the registration form by providing detailed information about yourself, such as your name, surname, date of birth, residential address, financial information, etc.

Next, go through the verification procedure. To do this, you need to upload a scanned copy of your ID and confirmation of your registration address to the website.

Also in the personal account, the trader has access to:

-

Quotes for all assets and trading instruments available on the platform, up-to-date information on spreads, and eXcentral commissions.

-

Customized notifications. The broker allows you to set up notifications about opening and closing positions, price notification, stop out, expiration of notifications, etc. The eXcentral broker allows messaging by SMS or email.

-

Market news. The broker’s clients can receive the latest market news, as well as daily and weekly reviews on trading instruments from various markets.

-

Trading Central. In the account, traders have access to the Trading Central platform. Using that platform they can conduct technical analysis, set up trading signals, receive notifications, etc.

Articles that may help you

FAQs

Do reviews by traders influence the eXcentral rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about eXcentral you need to go to the broker's profile.

How to leave a review about eXcentral on the Traders Union website?

To leave a review about eXcentral, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about eXcentral on a non-Traders Union client?

Anyone can leave feedback about eXcentral on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.