IC Markets Bonus Programs - TU Expert review

Bonus programs offered are an important factor for a trader when choosing a broker. The companies can make special offers for beginners as well as experienced traders. Bonus programs depend on a specific broker and they can differ substantially. Traders Union analysts have prepared a review of IC Markets bonus program. You will learn about the available special offers and conditions of the brokers.

Brief introduction of IC Markets

IC Markets is a multi-regulated STP/ECN broker that offers trading of 2,250+ instruments on MetaTrader, TradingView and cTrader platforms. Currently, IC Markets provides its services to over 200,000 clients worldwide. The broker processes over 500,000 trades daily and its monthly trading volume is almost $1.4 trillion as of June 2024. It is regulated by CySEC, ASIC, and FSA. The broker was incorporated in 2007 and is constantly developing, improving, and adding new services and products.

| 💻 Trading platform: |

MetaTrader 4, MetaTrader 5, TradingView and cTrader

|

| 📊 Accounts: |

Demo, Standard МТ4, Standard МТ5, Raw Spread МТ4, Raw Spread МТ5, Raw Spread cTrader, and Islamic (Swap Free)

|

| 💰 Account currency: |

EUR, USD, GBP, CAD, AUD, HKD, NZD, CHF, SGD, and JPY

|

| 💵 Replenishment / Withdrawal: |

All countries: Wire transfers, Visa, Mastercard, Skrill, PayPal, Neteller, RapidPay, and Klarna;

Restricted methods: UnionPay, POLI, Fasapay, BPAY, internet banking (Thailand and Vietnam), WebMoney, and Broker to Broker |

| 🚀 Minimum deposit: |

$200

|

| ⚖️ Leverage: |

1:500 (FSA);

1:30 (ASIC and CySEC) |

| 💼 PAMM-accounts: |

No

|

| 📈️ Min Order: |

0.01

|

| 💱 Spread: |

Standard: 0.6 pips;

Raw Spread, MT4/MT5: 0 pips; Raw Spread, cTrader: 0 pips |

| 🔧 Instruments: |

Cryptos and Forex CFDs on indices, commodities, stocks, bonds, and futures

|

| 💹 Margin Call / Stop Out: |

50%/100%

|

| 🏛 Liquidity provider: |

Westpac and National Australia Bank

|

| 📱 Mobile trading: |

Yes

|

| ➕ Affiliate program: |

Yes

|

| 📋 Orders execution: |

Market

|

| ⭐ Trading features: |

Scalping and expert advisors;

Maximum number of orders is 200 for MT4/MT5; and 2,000 for cTrader. |

| 🎁 Contests and bonuses: |

Rebates for the Global division;

Free VPS. |

IC Markets Pros and Cons

👍 Advantages of trading with IC Markets:

•Availability of three licenses;

•Wide range of assets;

•Standard and ECN account types for trading on different platforms;

•Mobile apps for Android and iOS-based devices;

•Scalping, hedging, and algorithmic trading are allowed;

•Minimum delay when executing orders and ultra-fast market execution;

•Competitive trading fees;

•Wide choice of social trading and copy trading platforms;

•24/7 support via live chat;

•Demo accounts on MT4, MT5, and cTrader;

•Swap-free accounts are available for Muslim traders.

👎 Disadvantages of IC Markets:

•Education materials available on the website are not very informative or diverse;

•Rebates are available outside Australia and the European Economic Area;

•Not all clients are equally protected since compensation for investment is subject to the trader's country of residence.

What kind of bonuses are there?

Forex brokers can offer a wide variety of bonuses.

The main types of bonuses are:

-

Welcome Bonus. Traders can receive additional funds for registration and for making the first deposit.

-

No Deposit Bonus. Brokers provide this kind of reward to the clients for just registration.

-

Deposit Bonus. This is a reward for each deposit made to the account.

Also, brokers may hold various promotions and prize draws that are valid for a specific period of time. In addition, some companies hold competitions among traders with a certain prize pool.

Bonuses Paid by the Broker

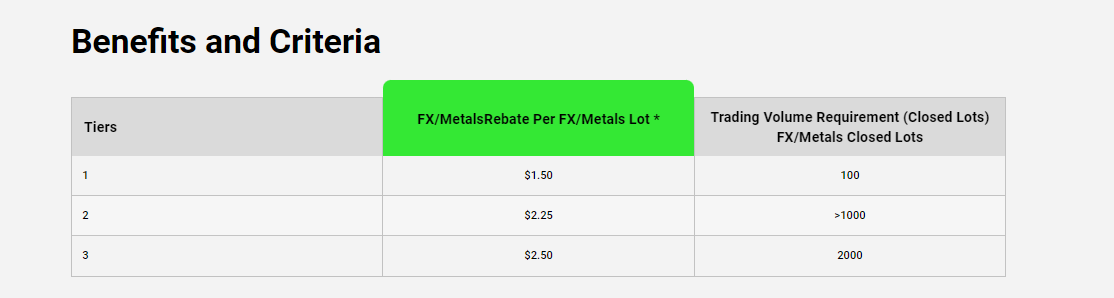

ASIC and CySEC don’t allow broker bonuses, therefore traders from the European Economic Area and Australia are only offered free VPS. IC Markets Global licensed by FSA offers the Raw Trader Plus rebate program, under which traders can receive compensation of $1.50, $2.25, or $2.50 for every closed lot.

Brokers similar to IC Markets

In addition to bonuses, you need to also take into consideration trading conditions. Traders Union analysts have prepared a comparison of IC Markets with similar brokers. In this analysis, traders can learn in detail the trading conditions of IC Markets and compare these conditions with competing brokers.

Comparison of IC Markets with other Brokers

| IC Markets | RoboForex | Pocket Option | Exness | FxPro | |

|---|---|---|---|---|---|

Trading platform |

MT4, cTrader, MT5, TradingView |

MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader |

Pocket Option, MT5, MT4 |

Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 |

MT4, MobileTrading, MT5, cTrader, FxPro Edge |

Min deposit |

$200 |

$10 |

$5 |

$10 |

$100 |

Leverage |

From 1:1 |

From 1:1 |

From 1:1 |

From 1:1 |

From 1:1 |

Trust management |

No |

No |

No |

No |

No |

Accrual of % on the balance |

No |

No |

No |

No |

No |

Spread |

From 0 points |

From 0 points |

From 1.2 point |

From 1 point |

From 0 points |

Level of margin call / stop out |

No |

No |

No |

No |

No |

Execution of orders |

Market Execution |

Market Execution, Instant Execution |

Market Execution |

Market Execution, Instant Execution |

Market Execution |

No deposit bonus |

No |

No |

No |

No |

No |

Cent accounts |

No |

Yes |

No |

No |

No |

IC Markets Trading Company is a great broker for scalping enthusiasts, automated trading lovers, and beginner traders.

The minimum deposit in RoboForex is $10. Leverage up to 1:2000. Traders choose RoboForex for reliability, favorable trading conditions, minimum spreads, and commission fees. The company is recommended for beginner traders and experienced investors.

Pocket Option offers a wide range of trading instruments and copy trading services. It constantly improves its service quality and expands the list of assets and trading platforms. The broker is suitable even for novice traders without significant capital due to the low initial deposit. Experienced traders who work with CFDs and binary options can also use Pocket Option’s services.

Exness broker is a trusted broker partner that is compliant with all relevant terms. Exness complies with all payment obligations and pays money earned.

FxPro is a reliable broker company that offers market access to all traders, regardless of their level of knowledge and experience. Broker's clients are protected from negative balance; their activities are carried out in comfortable conditions and with competent professional support.

Comparison of bonus programs of brokers similar to IC Markets

Many brokers have bonus programs, not only IC Markets. You can choose the most suitable option, depending on your trading experience and needs. Traders Union analysts have prepared a comparison of bonus programs of IC Markets and similar companies.

| Bonus type | IC Markets | RoboForex | Pocket Option | Exness | FxPro |

|---|---|---|---|---|---|

Bonuses |

Not offered |

Welcome bonus $30 Classic first deposit bonus up to 120% |

Welcome bonus 50% when opening a real account |

Not offered |

Not offered |

Affiliate Program |

% of trading commissions |

Up to 40% of trading commissions |

Two types of programs: partner and representative. Commission from profit - up to 80% |

40% of trading commissions |

Up to $1.100 per client you introduce to FxPro |

Other |

No |

No |

Tournaments with a minimum deposit of 1 USD and a prize pool of 100-250 USD. There are free tournaments |

No |

No |

Conclusions

IC Markets Bonus program is well developed. The broker offers a large number of various incentives for the clients. There are special offers for beginners and for experienced traders. The bonus program looks attractive also when compared to the competitors. Therefore, if a client is looking for a broker with a good bonus program, IC Markets is certainly a broker to consider.

FAQs

What do I need to take notice of when choosing a broker?

When choosing a broker, consider the conditions the broker offers. They may turn out to be unacceptable. Also assess the size of the bonus and the rules for its withdrawal.

Is it possible to withdraw bonus money?

It depends on the conditions of the broker. Some brokers allow traders to do it under certain conditions, and some allow to use the bonus only for trading, while also allowing to withdraw only profit earned with the use of bonuses.

Can I refuse to accept a bonus?

Yes. Refusing a bonus is a trader’s right. If the conditions are unacceptable for you, there is no sense in agreeing to them.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!