IC Markets Seychelles Review 2025 - TU Expert Opinion

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

IC Markets is a well-regulated Forex broker. Traders looking for an IC Markets review focused on Seychelles will find that the broker offers a range of advantages, including low spreads, ECN execution, and leverage of up to 1:500. For traders in Seychelles, IC Markets provides access to popular trading platforms like MT4/MT5, and cTrader. With fast trade execution and 24/7 support, the broker ensures a seamless trading experience.

IC Markets is a globally recognized broker that provides a seamless trading experience with competitive conditions and a broad selection of financial instruments. In Seychelles, traders benefit from flexible regulations, making Forex trading with IC Markets a popular choice for those seeking a well-regulated environment and tight spreads.

For traders searching for a reliable platform, IC Markets operates as a trusted Forex broker in Seychelles, offering access to a wide range of markets. With its strong regulatory framework and transparent pricing, the broker continues to attract both beginner and professional traders who prioritize efficiency and security in their trades.

This detailed review explores the presence of IC Markets in Seychelles, covering key aspects of Forex trading, regulatory oversight, trading conditions, commissions, fees, and frequently asked questions to help traders make informed decisions.

Is the Forex market legit in Seychelles?

Many traders wonder whether IC Markets is a regulated broker in Seychelles. The answer is yes — it operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA), which enforces strict guidelines to maintain transparency and protect traders.

Seychelles has become a popular destination for offshore Forex brokers due to its business-friendly regulatory environment. The Seychelles FSA regulates IC Markets, ensuring that it meets financial standards and provides secure trading conditions for its clients.

For those asking, is IC Markets legit in Seychelles, the broker is fully licensed and follows compliance measures set by the FSA. This regulation ensures that traders receive a reliable trading experience with oversight that upholds financial integrity and security.

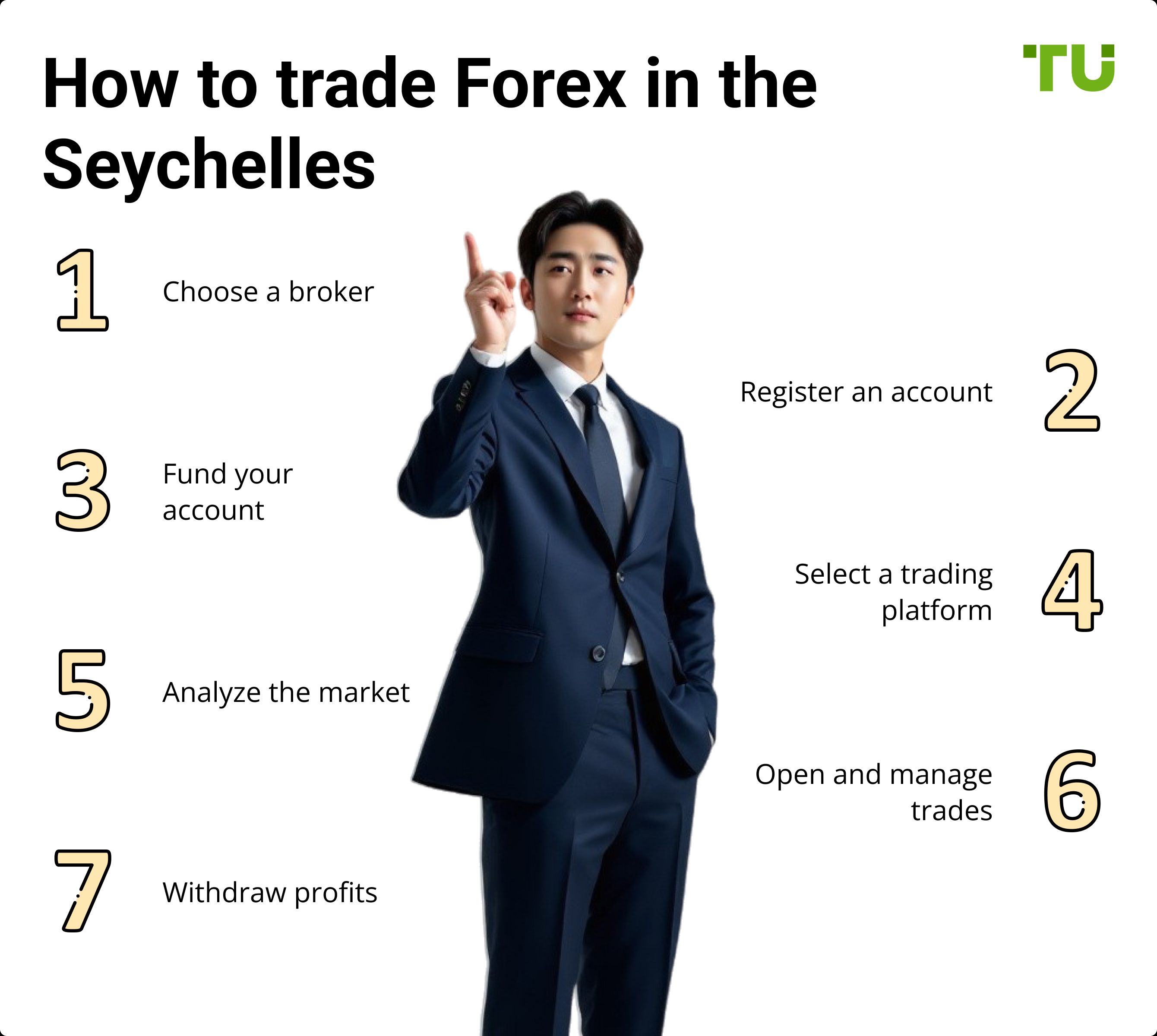

How to trade Forex in the Seychelles

Many traders ask, "Can I use IC Markets in Seychelles?" The answer is yes — trading with this broker is straightforward. It allows traders in Seychelles to access its platform without restrictions, offering a seamless trading experience.

Choose a broker. A regulated broker like IC Markets ensures secure trading.

Register an account. Provide personal details and verify your account.

Fund your account. Make a deposit using supported payment methods.

Select a trading platform. IC Markets offers MetaTrader 4, MetaTrader 5, and cTrader.

Analyze the market. Use technical and fundamental tools for smart trading.

Open and manage trades. Execute trades with stop-loss and take-profit orders.

Withdraw profits. Use available withdrawal options for easy access to your funds.

Our evaluation of IC Markets

IC Markets has built a strong reputation for Forex trading in Seychelles. One of the key factors behind its credibility is its regulatory compliance. For traders considering IC Markets, having a recognized license in Seychelles provides reassurance that the broker adheres to industry standards and offers a secure trading environment. This regulation allows IC Markets to serve international clients while maintaining transparency and accountability in its operations.

Tight spreads and low trading fees.

Fast execution with advanced technology.

A broad selection of trading platforms and assets.

Regulated operations ensuring security and transparency.

24/7 customer support.

Detailed review of IC Markets in Seychelles

IC Markets has gained popularity among traders in Seychelles due to its low spreads, trading flexibility, and access to advanced platforms.

Advantages of IC Markets for trading in Seychelles

Tight spreads. IC Markets spreads for Seychelles traders start from 0.0 pips.

Fast execution. Ideal for scalping and automated trading strategies.

Multiple platforms. Traders can choose from MetaTrader 4, MetaTrader 5, and cTrader.

High leverage. Up to 1:500 for Seychelles-based traders.

Diverse asset selection. Forex, commodities, indices, stocks, and cryptocurrencies.

Customer support. 24/7 availability for all trading inquiries.

Analysis of the main features of IC Markets in Seychelles

IC Markets provides a user-friendly trading platform with the following key features:

IC Markets license in Seychelles. The broker is regulated by the Seychelles FSA.

ECN execution model. Is IC Markets an ECN broker in Seychelles? Yes, it offers low-latency trading with direct market access.

Deposit and withdrawal options. Bank transfers, e-wallets, and credit/debit cards.

Education. It includes Forex trading webinars and market analysis.

Trading conditions for IC Markets traders from Seychelles

For traders wondering, is IC Markets an ECN broker operating in Seychelles, the answer is yes. The broker uses an ECN model for trade execution, meaning there is no dealing desk interference. This setup helps traders execute orders quickly, providing access to deep liquidity and tight spreads starting from 0.0 pips on Raw Spread accounts. These features make it a strong choice for those seeking a direct-market trading experience.

When it comes to Forex trading in Seychelles, IC Markets offers favorable conditions for both beginners and experienced traders. With leverage of up to 1:500, traders can increase their position sizes while effectively managing risk. Additionally, the broker provides multiple deposit and withdrawal methods, including bank transfers, e-wallets, and credit/debit cards, making fund transfers convenient and secure.

For those ready to start trading, the IC Markets minimum deposit in Seychelles is $200. This accessible starting amount allows traders to enter the Forex market while benefiting from the broker’s low spreads and ECN execution. Combined with its regulatory oversight and strong trading infrastructure, IC Markets continues to be a preferred choice among Seychelles-based traders.

| Trading platform: | MetaTrader 4, MetaTrader 5, TradingView and cTrader |

| Accounts: | Demo, Standard, Raw Spread and Islamic (Swap Free) |

| Account currency: | EUR, USD, GBP, CAD, AUD, HKD, NZD, CHF, SGD, and JPY |

| Replenishment / Withdrawal: | All countries: Wire transfers, Visa, Mastercard, Skrill, PayPal, Neteller, RapidPay, and Klarna; Restricted methods: UnionPay, POLI, Fasapay, BPAY, internet banking (Thailand and Vietnam), WebMoney, and Broker to Broker |

| Minimum deposit: | $200 |

| Leverage: | 1:500 (FSA); 1:30 (ASIC and CySEC) |

| PAMM-accounts: | No |

| Min Order: | 0.01 |

| Spread: | Standard: 0.8 pips; Raw Spread: 0 pips; |

| Instruments: | Cryptos and Forex CFDs on indices, commodities, stocks, bonds, and futures |

| ColumnVMargin Call / Stop Out:alue1 | 50%/100% |

| Liquidity provider: | Westpac and National Australia Bank |

| Mobile trading: | Yes |

| Affiliate program: | Yes |

| Orders execution: | Market |

| Trading features: | Scalping and expert advisors; Maximum number of orders is 200 for MT4/MT5; and 2,000 for cTrader. |

| Contests and bonuses: | Rebates for the Global division; Free VPS. |

IC Markets commissions and fees

IC Markets provides competitive trading conditions for traders in Seychelles, making it a great choice for both beginners and experienced professionals. With a minimum deposit of $200, traders can easily enter the Forex market and take advantage of the broker’s offerings. One of the key benefits of trading here is that IC Markets, operating in Seychelles, offers tight spreads, starting as low as 0.0 pips on Raw Spread accounts. This feature helps traders execute cost-effective trades, especially when dealing with major currency pairs.

Additionally, IC Markets ensures transparency when it comes to commissions in Seychelles, maintaining low costs on ECN accounts. Traders benefit from competitive commission rates, allowing them to optimize their trading expenses while accessing deep liquidity and fast execution speeds.

In addition to tight spreads, traders in Seychelles can access leverage up to 1:500, helping them increase their exposure while managing risk effectively. The ECN execution model at IC Markets provides direct market access without dealing desk intervention, ensuring fast order execution and deep liquidity.

Beyond costs, IC Markets supports various deposit and withdrawal methods, including bank transfers, e-wallets, and credit/debit cards, making deposits and withdrawals hassle-free. These features establish IC Markets as a trusted and efficient broker for Forex traders in Seychelles.

Information

Trading fees include spreads, fees per lot, and swaps. IC Markets has variable spreads from 0.8 pips on Standard and from 0 pips on ECN account types. Therefore, fees for one instrument can vary subject to the time of day and the market situation. Fees per lot are charged only on ECN account types. They are $7 per lot on MT4/MT5 and $6 on cTrader. Swaps are charged when positions are transferred overnight, but they do not apply to the Islamic account type. Non-trading fees are fees not related to trades. At IC Markets, these are withdrawal fees when using international bank transfers. The broker doesn’t charge other non-trading fees.

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | $8 | Bank fees apply |

| Raw spread MT4/MT5 | $0 | Bank fees apply |

| Raw spread cTrader | $0 | Bank fees apply |

| Islamic | $0 | Bank fees apply |

Conclusion

IC Markets is known as a reliable Forex broker in Seychelles, providing traders with low spreads, fast execution speeds, and access to multiple trading platforms. The broker operates under the strong regulatory oversight of the Seychelles Financial Services Authority (FSA), ensuring a secure trading environment. For those interested in professional trading services, opening an IC Markets funded account in Seychelles allows both beginners and experienced traders to benefit from high leverage, competitive fees, and advanced trading tools.

As a globally recognized platform, IC Markets continues to attract traders who seek a well-regulated and cost-efficient brokerage. Being an established Forex broker, IC Markets in Seychelles offers a seamless trading experience, with access to deep liquidity, tight spreads, and advanced trading infrastructure that supports different strategies and trading styles.

FAQs

Is IC Markets regulated in Seychelles?

Yes, IC Markets is regulated by the Seychelles FSA and holds a valid IC Markets license Seychelles.

How do I open an account with IC Markets Seychelles?

Visit the IC Markets website, complete the registration, verify your account, and make a deposit.

What are the minimum deposit requirements for IC Markets Seychelles?

The minimum deposit is $200, making it accessible for new traders.

What trading platforms are available with IC Markets Seychelles?

IC Markets provides MetaTrader 4, MetaTrader 5, and cTrader for Forex trading.

What withdrawal options are available for IC Markets Seychelles traders?

Withdrawals can be made via bank transfers, credit/debit cards, and e-wallets.

Is IC Markets Seychelles safe and secure for trading?

Yes, IC Markets is a trusted Forex broker that operates in Seychelles, ensuring trading security through encryption technology and the segregation of client funds.

Can I trade cryptocurrencies with IC Markets Seychelles?

Yes, cryptocurrency trading is available, including Bitcoin and Ethereum.

How can I contact customer support at IC Markets?

Customer support is available 24/7 via live chat, email, and phone.

Are there any bonuses or promotions available for IC Markets Seychelles traders?

IC Markets does not frequently offer promotions, but traders should check the website for updates.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).