Overall Score

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- Minimum deposit $1

- EUR/USD spread 1.1

- Supported assets 20000

- Regulation FCA, BaFin, ASIC, MAS, CySec, FINMA, CFTC

users picked this broker in 3 months

Brief Look at IG Markets

IG Markets is a globally regulated Forex and CFD broker, authorized by top-tier regulators including the FCA (UK), ASIC (Australia), CFTC (US), and BaFin (Germany). Known for its deep liquidity and institutional-grade infrastructure, IG offers a single, all-inclusive pricing model with competitive spreads and no commission on most markets. Traders can access a wide range of platforms, including MetaTrader 4, ProRealTime, and IG’s proprietary web platform. While the minimum deposit is typically around $250, IG’s broad product range and robust trading tools make it suitable for both novice and professional traders.

- Advantages

- Disadvantages

-

Top-tier regulation — licensed by FCA, ASIC, NFA and other global authorities

-

Wide range of instruments — 20,000+ markets including Forex, indices, stocks, options, and crypto

-

Multiple platforms supported

-

Strong research and analysis tools — integrated news, signals, and educational content

-

Trusted brand with 5+ years of experience

-

Complex fee structure on some markets (e.g. share CFDs or DMA accounts)

-

Inactivity fee — applies after 2 years of no trading

-

Spreads not the lowest in the industry

Why trust us

Traders Union has analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we recommend that users perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

IG Markets Key Parameters Evaluation

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Top Forex brokers vs IG Markets

| IG Markets | FBS | FxPro | |

|---|---|---|---|

| TU overall score | 6.67 | 8.21 | 8.48 |

|

Max. Regulation Level

Tier-1 regulation represents the most stringent oversight by top financial authorities, ensuring the highest level of security and compliance. Tier-2 and Tier-3 regulations indicate moderate to lower levels of oversight, with varying degrees of investor protection.

|

Tier-1 | Tier-1 | Tier-1 |

| Spread EUR/USD (Standard acc) | 1.1 | 0.9 | 1.3 |

| Withdrawal fee, % | No | No | No |

User reviews and loyalty

IG Markets is generally well-regarded by traders, with many positive ratings across independent review platforms. Examining real user feedback offers a clearer view of how the broker performs in practice, beyond its promotional claims. The following sections break down key insights from user reviews and evaluate customer sentiment and loyalty based on verified Trustpilot data.

What are IG Markets reviews?

According to Trustpilot data, users have left over 7,900 reviews about the company. The overall Trustpilot rating for IG Markets is 3.9.

Our score may slightly differ from Trustpilot as we use a different scoring methodology. Our User Reviews Score methodology is superior to a simple average calculation as it takes into account not just ratings but also the volume of reviews, their representativeness, and the proportion of negative ones. It mitigates distortions from limited data, encourages companies to collect more high-quality feedback, and minimizes the impact of outlier negative reviews.

Customer loyalty and perception of IG Markets

The trust and satisfaction index for IG Markets is derived from the ratio of positive to negative reviews, offering a clear measure of customer loyalty and overall sentiment. Built on data from Trustpilot, a globally recognized platform for consumer feedback, this index provides valuable insight into how the brand is perceived by its customers. A high ratio of positive reviews signals strong loyalty, while a prevalence of negative feedback highlights areas for improvement in the customer experience.

How does IG Markets show up in online feedback?

Most reviews for IG Markets are positive, reflecting a generally high level of user satisfaction. Although some negative feedback exists, it does not significantly affect the broker’s overall reputation, which remains strong across major review platforms.

Does IG Markets respond to reviews?

Yes, IG Markets encourages clients to leave feedback on its services, with a total of 77% responses to negative reviews. Engaging with reviews, especially negative ones, is essential as it demonstrates the company's commitment to addressing customer concerns, improving service, and building trust. Responding to feedback shows that the company values transparency and actively works to enhance client satisfaction.

Why do customers appreciate IG Markets?

Over 60% users have shared their positive experiences, highlighting what they appreciate about IG Markets.

Top 5 common reasons why people are satisfied with companies in the financial sector based on reviews:

| Responsive Customer Support | Quick and helpful responses that resolve issues efficiently. |

| Transparent Fee Structure | Clear communication about fees and charges, with no hidden costs. |

| Strong Security Measures | Robust protection and encryption measures, ensuring user data and funds are secure. |

| Fast and Smooth Withdrawals | Efficient processing of withdrawals, allowing easy access to funds. |

| Reliable Platform Performance | Consistent uptime and a user-friendly interface with minimal technical issues. |

Commissions and Fees

The trading and non-trading commissions of broker IG Markets have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, RoboForex and XM Group, to provide the most comprehensive information.

- Advantages

- Disadvantages

-

Low Forex trading fees

-

Tight EUR/USD market spread

-

No inactivity fee

-

No deposit fee

-

No withdrawal fee

-

Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of IG Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, IG Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

| IG Markets | RoboForex | XM Group | |

|---|---|---|---|

| EUR/USD min, pips | 0,6 | 0.5 | 0.7 |

| EUR/USD max, pips | 1.2 | 2.0 | 1.2 |

| GPB/USD min, pips | 0.6 | 0.5 | 0.6 |

| GPB/USD max, pips | 1.5 | 1.5 | 1.2 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

| IG Markets | RoboForex | XM Group | |

|---|---|---|---|

| Commission ($ per lot)

The commission is the fee charged by the broker for trading one standard forex lot (100,000 units of the base currency).

|

2.3 | 2 | 3.5 |

| EUR/USD avg spread | 0.8 | 0.2 | 0.2 |

| GBP/USD avg spread | 1 | 0.4 | 0.2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with IG Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

| IG Markets | RoboForex | XM Group | |

|---|---|---|---|

| Deposit fee, %

The indicated amount does not include possible fees from payment

systems and banks.

|

0 | 0 | 0 |

| Withdrawal fee, %

The indicated amount does not include possible fees from payment

systems and banks.

|

0 | 0-4 | 0 |

| Withdrawal fee, USD, %

The indicated amount does not include possible fees from payment

systems and banks.

|

0 | 0-1.3 | 0 |

| Inactivity fee ($, per month) | 0 | 0 | 10 |

Regulation and Safety

IG Markets has a safety score of 10/10, which corresponds to a High level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Advantages

- Disadvantages

-

Tier-1 regulated

-

Negative balance protection

-

Regulated in the UK

-

Track record over 51 years

-

Strict requirements and extensive documentation to open an account

| Abbreviation | Full Name | Country | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

BaFin BaFin |

Federal Financial Supervisory Authority | Germany | Up to €20,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

NFA NFA |

National Futures Association | United States | No specific fund | Tier-1 |

JFSA JFSA |

Japan Financial Services Agency | Japan | No specific fund | Tier-1 |

CFTC CFTC |

Commodity Futures Trading Commission | United States | No specific fund | Tier-1 |

FINMA FINMA |

Swiss Financial Market Supervisory Authority | Switzerland | CHF 100,000 | Tier-1 |

MAS MAS |

Monetary Authority of Singapore | Singapore | No specific fund | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FMA NZ FMA NZ |

Financial Markets Authority of New Zealand | New Zealand | No specific fund | Tier-2 |

| BMA (Bermuda) | Bermuda Monetary Authority | Bermuda | No specific fund | Tier-3 |

DFSA DFSA |

Dubai Financial Services Authority | Dubai | No specific fund | Tier-2 |

| Foundation date | 1974 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Deposit and Withdrawal

IG Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

IG Markets excels by providing a broad selection of payment methods, ensuring minimal costs and a seamless experience for users seeking efficient fund management.

- Advantages

- Disadvantages

-

Minimum deposit below industry average

-

Bitcoin (BTC) accepted

-

Bank card deposits and withdrawals

-

PayPal supported

-

Wise not supported

-

Only major base currencies available

-

High minimum withdrawal requirement

What are IG Markets deposit and withdrawal options?

IG Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, PayPal, Neteller, BTC.

| IG Markets | RoboForex | XM Group | |

|---|---|---|---|

| Bank wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | Yes | No | No |

| Wise | No | No | No |

| BTC | Yes | No | Yes |

What are IG Markets base account currencies? Base account currencies are the primary currencies in which trading accounts are denominated. They determine the currency used for deposits, withdrawals, and calculating account balances.Using a base currency that matches a trader's local currency can help avoid unnecessary conversion fees.

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. JustMarkets supports the following base account currencies:

What Are IG Markets's Minimum Deposit and Withdrawal Amounts?

The minimum deposit on IG Markets is $1, while the minimum withdrawal amount is $150. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact IG Markets’s support team.

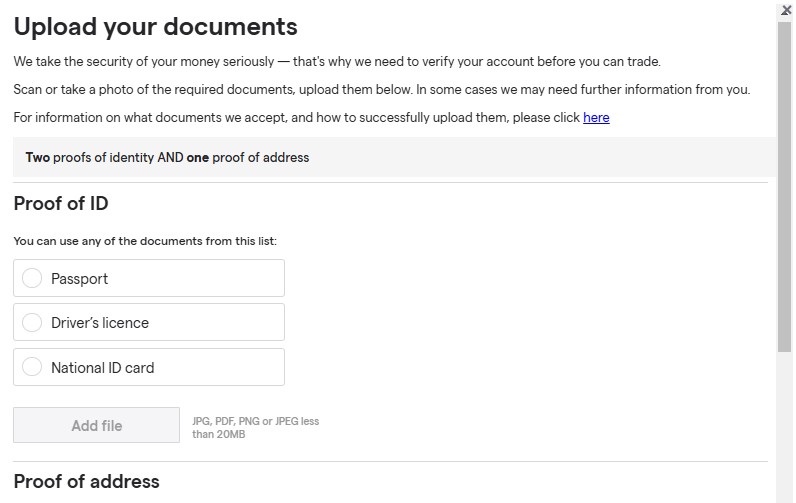

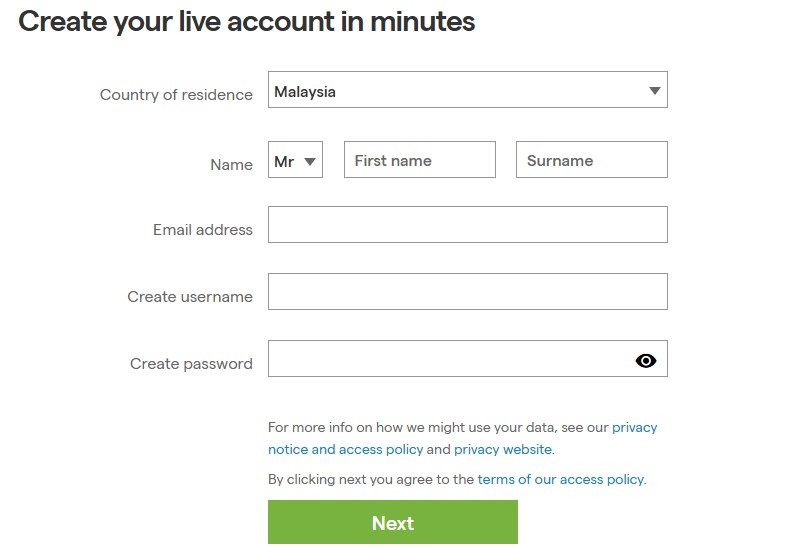

Trading Account Opening

We successfully registered an account with IG Markets, which took 20 minutes. The minimum deposit amount at IG Markets is $1.

- Advantages

- Disadvantages

-

No minimum deposit

-

Fast KYC (1 working day)

-

You may be asked to provide extra documents

| Minimum deposit | $1 |

| Is it fully online? | Yes |

| Registration time | 20 minutes |

| KYC time | 1 working day |

| Account currencies |

USD

|

| Funding options | Bank Card, Bank Wire, PayPal, Neteller, BTC. |

Identity document: Passport, ID card, or driver’s license.

Proof of residence: Any bills, including mobile phone bills, showing your full name and address; bank statements for deposit, credit, or current accounts.

Bank account verification for deposit funding: A screenshot or photo of an online bank statement displaying the following details: the deposit amount to your IG personal account, your full name, bank account number, and the bank’s logo or emblem.

Account types

IG Markets primarily offers a Standard account, which covers most trader needs with competitive spreads and no commissions on many instruments. The broker also provides a Demo account for practice and a Micro lot trading option, allowing for smaller position sizes — useful for beginners.

However, IG does not offer ECN, Cent, Swap-Free (Islamic), VIP, or Managed accounts, which may limit flexibility for certain trading styles or client categories.

|

Standard

A general trading account suitable for most traders, offering access to a variety of markets with standard spreads and conditions.

|

Yes |

|

ECN

Provides direct market access with raw spreads and low latency execution. Typically requires a commission per trade instead of a spread markup. Suitable for high-frequency and professional traders.

|

No |

|

Swap Free

Designed for traders who follow Islamic finance principles, eliminating overnight interest (swap) charges.

|

No |

|

Micro

Allows trading with micro-lots (0.01 lot = 1,000 units), reducing capital requirements and risk. Ideal for beginners and strategy testing. Availability and conditions vary by broker.

|

Yes |

|

Cent

Operates with cent-denominated balances (1 USD = 100 cents), allowing trades with micro-lot sizes (0.01 lot = 1,000 units). Suitable for beginners and low-risk strategies.

|

No |

|

Demo

Enables risk-free trading with virtual funds. Conditions may vary by broker.

|

Yes |

|

VIP

Offers premium services, lower fees, and dedicated support. Requirements vary by broker.

|

No |

|

Managed

A professional handles trading on behalf of the investor. Risks and fees depend on the provider.

|

No |

How to open IG Markets account

To complete your profile, provide the following: your full address, date of birth, citizenship, and phone number. Additionally, enter your financial information, including your average annual income, education level, field of work, and trading experience.

Markets and Products

IG Markets offers a wider selection of trading assets than the market average, with over 20000 tradable assets available, including 80 currency pairs.

- Advantages

- Disadvantages

-

Passive income with bonds

-

ETFs investing

-

20000 assets for trading

-

Regional restrictions are possible

IG Markets supported markets vs top competitors

We have compared the range of assets and markets supported by IG Markets with its competitors, making it easier for you to find the perfect fit.

| IG Markets | RoboForex | XM Group | |

|---|---|---|---|

| Currency pairs | 80 | 40 | 57 |

|

Tradable assets

The total tradable assets listed include all available instruments, including CFDs. Due to regional restrictions, certain CFDs may not be offered in some countries. For example, cryptocurrency CFDs are banned in the UK, and the U.S. has restrictions imposed on CFDs.

|

20000 | 12000 | 1400 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

|

Crypto

Cryptocurrency CFDs are restricted or prohibited in certain regions due to regulatory limitations. These include the United Kingdom, China, Egypt, the United States and Canada.

|

Yes | No | No |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | No | No |

Investment options

We also explored the trading assets and products IG Markets offers for beginner traders and investors who prefer not to engage in active trading.

| IG Markets | RoboForex | XM Group | |

|---|---|---|---|

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | No |

| Copy trading | Yes | Yes | Yes |

| PAMM investing | No | No | No |

| Managed accounts | No | No | No |

Trading Platforms and Tools

IG Markets supports a range of trading platforms, offering traders a flexible and professional trading environment. Available platforms include MetaTrader 4, ProRealTime, and IG’s proprietary web-based platform, each designed to suit different trading styles and experience levels.

- Advantages

- Disadvantages

-

Multiple platform options

-

Advanced charting and analysis tools

-

Trading directly from TradingView

-

No support for automated trading via EAs on IG’s proprietary platform

| Alerts | Yes |

| 2FA | Yes |

| EAs | No |

| Indicators | 30+ |

IG’s proprietary web-based trading platform is designed to deliver a smooth, intuitive, and professional trading experience across multiple markets. Tailored for CFD and spread betting clients, the platform offers a flexible and highly customizable interface suitable for both beginners and experienced traders.

It includes advanced charting tools with over 30 technical indicators, multiple chart types, and drawing tools. The platform also features integrated Reuters news, economic calendars, and sentiment data, helping traders stay informed and make timely decisions.

Key Features:

User-Friendly Interface – Clean layout with drag-and-drop modules and customizable workspaces

Advanced Charting – 30+ indicators, comparison charts, and real-time data

Integrated Tools – In-platform news feed, analysis, and trade signals

Smart Order Management – Partial fills, price tolerance, and order duration settings

Cross-Device Access – Fully compatible with web browsers, tablets, and smartphones

The IG platform is ideal for multi-asset trading and offers seamless access to Forex, indices, shares, commodities, cryptocurrencies, and more. While it lacks support for automated strategies like Expert Advisors (EAs), it stands out for its reliability, depth of features, and strong analytical capabilities.

Additional trading tools

IG Markets offers a range of advanced trading tools designed to enhance the overall trading experience. These features support automation, provide real-time market insights, and improve execution efficiency. Traders can benefit from built-in and third-party solutions such as Expert Advisors (EAs), one-click trading, and customizable alerts.

| IG Markets | Eightcap | FxPro | |

|---|---|---|---|

| Trading bots (EAs) | Yes | Yes | Yes |

|

Trading Central

Trading Central is a leading provider of investment research and financial market commentary. Integration with Trading Central offers traders advanced analytics, trading signals, and expert market insights, aiding in more informed decision-making.

|

Yes | No | Yes |

|

API

An Application Programming Interface (API) allows traders to connect their trading accounts to custom applications, algorithms, or third-party software. This flexibility enables advanced trading strategies and automated trading solutions tailored to individual needs.

|

Yes | Yes | No |

|

Free VPS

A Virtual Private Server (VPS) provides a dedicated and reliable server environment for running trading platforms and EAs without downtime. Free VPS ensures that trading operations continue uninterrupted, even when the trader's personal device is off.

|

Yes | No | No |

|

Signals (alerts)

Trading signals or alerts are notifications that provide buy or sell recommendations based on market analysis. These signals help traders make timely decisions by highlighting potential trading opportunities.

|

Yes | No | Yes |

|

One-click trading

One-click trading simplifies the trading process by allowing traders to open or close positions with a single click. This feature is particularly useful for scalpers and day traders who need to act quickly in fast-moving markets.

|

Yes | Yes | No |

|

Strategy (EA) builder

A Strategy or EA builder is a tool that allows traders to create and test their own automated trading strategies without needing to write code. This empowers traders to customize their trading approaches and backtest them for effectiveness.

|

Yes | Yes | No |

|

Autochartist

Autochartist is a market scanning tool that identifies trading opportunities by analyzing chart patterns and key levels. It provides traders with real-time alerts and actionable insights, helping to improve trading accuracy and efficiency.

|

Yes | No | No |

| TradingView | Yes | Yes | No |

TU Expert Advice: Is IG Markets Worth the Try?

IG Markets offers a wide choice of trading platforms, including the classic MetaTrader 4, the broker’s proprietary IG Trading Platform, and specialized ProRealTime and L2 Dealer platforms for professional trading. If its clients want to trade from smartphones, they can use IG, MT4, or web platforms. All versions of IG Markets platforms support watch lists and chart trading. Available order types are market, stop, limit, guaranteed stop, and trailing stop.

The proprietary platforms are intended for trading numerous instruments. MT4 provides for trading Forex, indices, cryptocurrencies, and commodities. Besides the above assets, the IG Trading Platform offers stocks, options, bonds, interest rates, etc.

IG Markets trading conditions can vary subject to the regulator in a particular country. For example, restrictions apply to available leverage, bonuses, partnership programs, and choice of trading instruments. When opening an account, traders are redirected to the website of the broker that services a certain region. It provides all the working details and trading rules. The Bermuda International Representative Office is more loyal to its clients, but it doesn’t work with traders from other countries.

Video Review of IG Markets

FAQs

IG Markets does not require a minimum deposit, allowing traders to start with any amount they find suitable. However, to maintain open positions and manage risk, clients should ensure their account is sufficiently funded to meet margin requirements. Read more about IG’s funding process in our article.

IG Markets is a fully regulated and trustworthy broker, not a scam. It is licensed by globally respected authorities such as the FCA (UK), ASIC (Australia), NFA (USA), and BaFin (Germany), ensuring strong legal protection and operational transparency. Read more about IG’s regulation and global presence.

IG Markets offers floating spreads, with EUR/USD typically starting from 0.6 pips (1.1 pips in average). There are no commissions on most CFD trades, as costs are included in the spread. Spreads may vary depending on market conditions and the platform used.

IG supports several payment methods, including:

Bank cards (Visa, Mastercard)

Bank transfers

PayPal (available in selected regions)

IG Markets serves clients in over 100 countries worldwide, including most of Europe, Asia-Pacific, Africa, and Latin America. However, services are not available in some restricted regions, including Belgium, Ukraine and certain U.S. states. Visit IG’s website to check regional availability.

IG Markets provides access to over 80 Forex pairs and 20,000+ financial instruments, spanning stocks, indices, commodities, options, cryptocurrencies, bonds, and ETFs — making it one of the most comprehensive multi-asset brokers globally.

Articles that may help you

Our reviews of other companies as well

Latest IG Markets News

IG Group Holdings plc reported stable financial results for the third quarter of the 2025 fiscal year, showing a 12% year-over-year revenue increase to

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).