IG Markets Futures Trading: Full Guide

Buying or selling standardised contracts, which bind the trader to buying or selling an asset at a fixed future date and price, is what IG Markets futures trading entails. IG Markets offers access to a diverse range of futures contracts, encompassing commodities, stock indices, interest rates, and currencies. To manage a larger position size with a comparatively smaller capital investment, traders frequently use leverage in IG Markets futures trading.

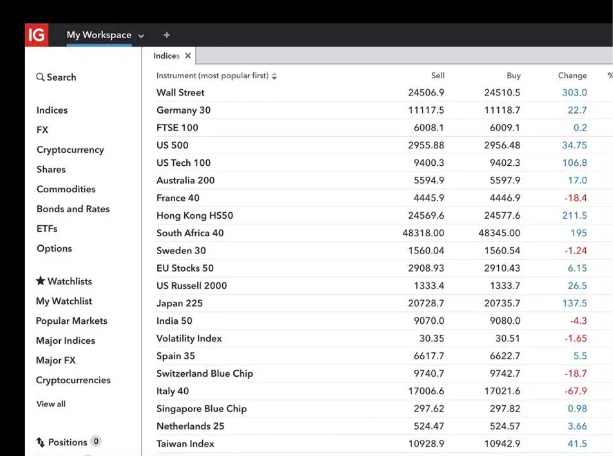

With IG Markets futures, traders can lock in the current price of an asset without having to exchange it until a specific future date. Trading IG Markets futures can be advantageous for investors who want to speculate on market movements or hedge against prospective price changes. Traders can trade futures on indices, Forex, interest rates, bonds, shares, and ETFs. If the actual price is higher for buyers or lower for sellers at the prearranged future date, traders stand to gain.

Continue reading to learn more about the IG Markets futures. In this article, TU experts will present different aspects of future trading on IG Markets. These include the pros and cons, how to trade IG Markets futures, applicable fees, etc.

IG Markets website

-

Do IG Markets have futures?

Yes. IG Markets has futures. According to the broker, “We build our futures markets to mirror the price and expiration dates of an underlying contract.” Select the 'Futures' tab (or 'Forwards' in the case of shares, forex, and ETFs) on the price chart of the IG Market trading platform. Based on your decision, choose the size of your position and whether to buy or sell the underlying market.

-

Can I trade futures in the UK?

Sure. Without physically entering the futures contract, you can speculate on the underlying market price when trading futures in the UK using spread bets and CFDs.

-

How to trade futures on IG Markets?

After opening an account, you must first do your homework and learn about the futures trading market and its operations before deciding which futures market to trade in. Establish your stops and limits before opening a position, and decide whether to go long or short.

-

What is the leverage for the future?

Leveraged futures contracts allow you to trade with more market exposure for a small initial deposit (called margin), with your trading provider lending you the remaining amount to cover the trade value.

IG Markets Futures: Pros and Cons

With its distinctive price alerts, interactive charts, and top risk management tools, IG Markets is an excellent trading platform for futures trading. There are certain clear advantages that the futures market can provide that the equity market cannot, but they all carry risks that you should be aware of. Below are some advantages and disadvantages of trading futures on IG Markets.

👍 Pros

• Investors can use IG Market futures as a hedge to lessen the impact of potential future market movements in a specific commodity on their portfolio or company.

• Commodities, indices, and interest rates are just a few of the kinds of assets that traders can access through the wide range of futures contracts that IG Markets offers.

• Leverage is a feature of IG Markets futures trading that lets traders manage bigger positions with less capital. This can increase prospective gains (as well as losses).

• Trades can effectively manage their risk exposure and minimise potential losses by utilising IG Markets' risk management tools, which include stop-loss orders.

• Futures markets frequently offer extended trading hours, enabling traders to respond to news and events around the clock. In contrast, IG's sophisticated trading platforms, equipped with technical analysis tools and real-time market data, improve the trading experience and decision-making process.

👎 Cons

• The use of leverage increases possible gains and losses in futures markets, which can be extremely volatile.

• Beginners may find it difficult to handle the complexity involved in futures trading. Understanding the contract's terms—including the margin requirements and expiration dates—is essential. To make profitable decisions, traders need to be skilled at timing and market analysis, and beginner traders may lack this knowledge.

• Beginners may find it difficult to handle the complexity involved in futures trading. Understanding the contract's terms—including the margin requirements and expiration dates—is essential. To make profitable decisions, traders need to be skilled at timing and market analysis, and beginner traders may lack this knowledge.

• A trader bears the risk of getting a margin call if the market moves against them due to the leverage.

How to trade futures with IG Markets

IG Markets website

While there are always risks to trading, trading futures on IG Markets can be profitable if you begin with the best steps. However, there are strategies to lessen the chance of losing money when trading futures on IG Markets. Below are steps on how to trade futures with IG Markets.

Step 1: Understand how futures trading works

Opening an IG Market account first could have been the initial step. However, the desire to dive into actual trading might hinder you from acquiring the essential knowledge needed to trade futures effectively. Since you must comprehend how futures trading operates, do extensive research and analysis before trading futures. You need to familiarise yourself with futures contracts and acquire knowledge about them.

Step 2: Decide on the instrument you want to trade

With many IG Markets futures trading options, there might be an urge to try all available options. Diversification is a virtue in trading generally, but in futures trading, establish which is most suited to your trading style. Short-term day traders may find some assets more suitable than others due to their higher volatility. This is comparable to how traders who like lower volatility and smaller risk appetites frequently favour gold or silver commodity futures.

Step 3: Create an IG Markets Account

Next, if you comprehend how futures trading works and the best instruments to trade, you are ready to trade with an IG account; visit the official page and register for an account on IG Markets. After that, make sure to verify your account and go over any requirements.

Step 4: Create a trading tactic and integrate top Risk management Strategies

Using the tools available on the IG Market trading platform, develop trading strategies based on your comprehension of the IG Market future trading research you have conducted. Develop and implement risk management strategies as well.

Step 5: Decide whether to go long or short

Investing for the long run suggests that you are projecting future value to rise, whereas investing for the short term suggests future value to fall.

Step 6: Place your first trade

Select the “Futures” tab (or “Forwards” in the case of shares, Forex, and ETFs) on the price chart of the IG Market trading platform. Based on your decision, choose the size of your position and whether to buy or sell the underlying market. Consider including stops and limits in your trade before opening a position. It is highly recommended that you use stops and limits when trading futures to control your risk.

Step 7: Monitor and close your position

As you monitor the markets, you can close a position before the contract expires if the market deviates from your intended strategy.

Note:

Practice futures trading with IG Markets' demo account before investing real money. This allows you to acquaint yourself with the platform and evaluate your tactics. For any questions or concerns concerning futures trading, get in touch with IG Markets' customer support.

IG Markets Futures Fees

Trading futures on the IG Market has spread costs but no overnight funding fees. The IG Market incorporates the overnight funding fees into the futures trading spreads. Additionally, trading futures involves a margin, which is essentially an investment to offset potential losses. Even though this is not a direct fee, the opportunity cost of using capital as a margin must be considered. Below is an overview of IG Markets futures trading:

| Instruments | The value of one contract | Spread | Margin requirement |

|---|---|---|---|

|

FTSE 100 Futures |

£10 |

4 to 8 |

0.5% |

|

Wall streStreetures |

$10 |

6 to 17 |

0.5% |

|

Treasury Bond (Decimalised) |

$10 |

4 |

0.5% |

|

Gold |

$100 (100 troy oz) |

0.6 |

0.7% |

|

Oil – US Crude |

$10 (cents/barrel) |

6 |

1.5% |

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).