Libertex Review 2025

- Local offices are on-site inspected.

- Personal TU dedicated support manager.

- Wire transfers availability.

- Verified active TU customers.

Overall Score

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

people picked profile over the 3 months

Brief Look at Libertex

Libertex is an online broker that provides access to trading CFDs on stocks, commodities, cryptocurrencies, and more. The company has been in the market for over 10 years. One of the advantages and distinctive features of the broker is its proprietary web trading platform with non-standard functionality designed for novice traders. It features a user-friendly interface, high information content, and advanced technical functionality.

- Advantages

- Disadvantages

-

fast registration process;

-

usability of the platform. It has a user-friendly interface for trading online on a PC or laptop as well as other devices;

-

more than 300+ CFDs on stocks, precious metals, oil and gas, indices, cryptocurrencies - almost all popular trading underlying assets in one platform;

-

tight spreads;

-

investment account providing for investing in real stocks without commission fees.

-

Libertex accounts have fees subject to the underlying asset. For example, a 0.0005% fee is charged on Forex CFD.

-

No proprietary technological solutions for passive investing.

-

Libertex is available only in the web version and mobile app which doesn’t allow adding custom indicators and advisors. Algorithmic trading is not available.

Libertex Key Parameters Evaluation

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Libertex Summary

Your capital is at risk. 80% of retail investor accounts lose money when trading CFDs with this provider. Libertex Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| Libertex trading parameters | |

|---|---|

| Trading platform | Libertex, МТ4, МТ5 |

| Accounts | Libertex (Demo, Real, Invest), МТ4 (Market, Market Pro), МТ5 (Market, Instant) |

| Account currency | USD |

| Replenishment / Withdrawal | Bank cards electronic payment systems, Internet banking, bank transfers |

| Minimum deposit | $100 |

| Leverage | 1:1000 |

| PAMM-accounts | No |

| Min Order | 0,01 for MT platform, 20$ for Libertex platform |

| Spread | 0,3-0,7 pips |

| Instruments | 300+ CFDs on stocks, indices, commodities, metals, cryptocurrencies, ETFs, and commodities |

| Margin Call / Stop Out | 50/50 |

| Liquidity provider | MarketPlace |

| Mobile trading | Yes |

| Affiliate program | No |

| Orders execution | Market Execution, Instant Execution |

| Trading features | No |

| Contests and bonuses | No |

Libertex is a reputable broker. It would be worthwhile to look at the platform as a technical solution. It will appeal to those who can not imagine their life without gadgets and are eager to keep up with the time.

Trading Account Opening

To start trading with Libertex you need to:

-

Register an account.

-

Follow the affiliate link to the website of the Libertex broker. On the main page, click "Open an Account".

-

Go through the authorization, indicating the information: your phone number that will be used as login, last name and first name, email address.

-

A code will be sent to the indicated phone number or email (at the trader’s choice) to confirm registration, which must be entered in the appropriate field.

Important:

before replenishing an account, it is obligatory to pass verification.

The following functions are available:

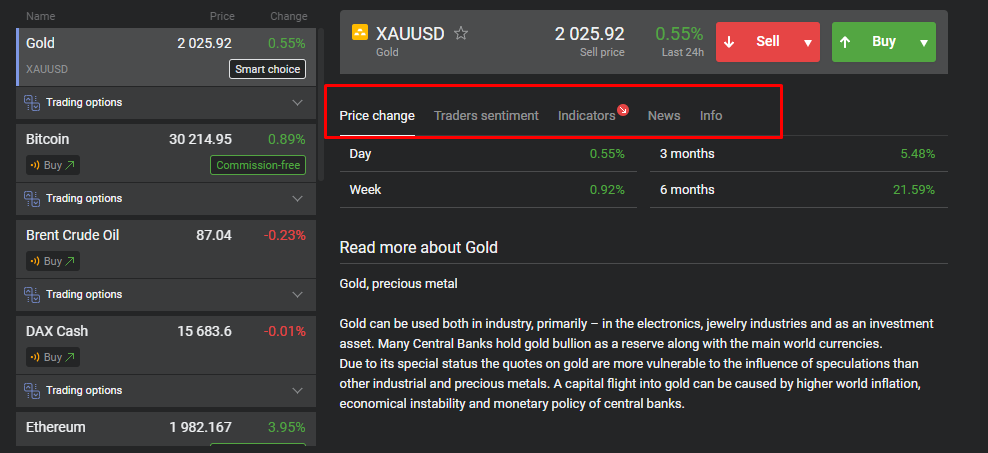

Reviewing information on the trading instrument:

Review of Libertex’s User Account - Reviewing information on the trading instrument

Review of Libertex’s User Account - Reviewing information on the trading instrument

Other features of the Libertex’s user account combined with the trading platform are:

-

Filtering trading underlying assets by such criteria as the asset type, profitability, and uptrend/downtrend.

-

User account management.

-

History and statistics on closed trades.

-

Statistics on financial operations.

Can Libertex be trusted and safe?

Libertex has a safety score of 2.5/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Advantages

- Disadvantages

-

Negative balance protection

-

Track record over 28 years

-

Not tier-1 regulated

-

Not regulated

| Libertex Security Factors | |

|---|---|

| Foundation date | 1997 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Libertex is Not a Regulated Broker

Commissions and Fees

The trading and non-trading commissions of broker Libertex have been analyzed and rated as High with a fees score of 4/10. Additionally, these commissions were compared with those of the top two competitors, AvaTrade and eToro , to provide the most comprehensive information.

- Advantages

- Disadvantages

-

No deposit fee

-

Above-average Forex trading fees

-

No ECN/Raw Spread account

-

Inactivity fee applies

-

Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Libertex with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Libertex’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

| Libertex | AvaTrade | eToro | |

|---|---|---|---|

| EUR/USD min, pips | 0.3 | 0.6 | 0.3 |

| EUR/USD max, pips | 0.7 | 0.9 | 1.1 |

| GPB/USD min, pips | 0.4 | 0.9 | 0.3 |

| GPB/USD max, pips | 0.9 | 1.3 | 1.1 |

Non-Trading Fees

As we discovered, Libertex does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Libertex. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

| Libertex | AvaTrade | eToro | |

|---|---|---|---|

| Deposit fee, %

The indicated amount does not include possible fees from payment

systems and banks.

|

0 | 0 | 0 |

| Withdrawal fee, %

The indicated amount does not include possible fees from payment

systems and banks.

|

0-1 | 0 | 0 |

| Withdrawal fee, USD, %

The indicated amount does not include possible fees from payment

systems and banks.

|

1 | 0 | 5 |

| Inactivity fee ($, per month) | 10 | 16.66 | 10 |

Account Types

Libertex offers Standard and portfolio accounts, along with a demo account for risk-free practice. However, it lacks ECN accounts, limiting direct market access, and does not provide micro or cent accounts, which are useful for small-volume traders. While the available account types meet the needs of most investors, the absence of these options may restrict choices for certain traders.

| Available account types | |||

|---|---|---|---|

| Standard

A general trading account suitable for most traders, offering access to

a variety of markets with standard spreads and conditions.

|

Yes | ECN

Provides direct market access with raw spreads and low latency

execution. Typically requires a commission per trade instead of a spread

markup. Suitable for high-frequency and professional traders.

|

No |

| Swap Free

Eliminates overnight interest (swap) charges. Designed for traders

following Islamic finance principles.

|

No | Micro

Trading with micro-lots (0.01 lot = 1,000 units). Reduced capital

requirements and risk. Ideal for beginners and strategy testing.

Availability and conditions vary by broker.

|

No |

| Cent

Operates with cent-denominated balances (1 USD = 100 cents) for trading

micro-lots (0.01 lot = 1,000 units). Suitable for beginners and low-risk

strategies.

|

No | Demo

Enables risk-free trading with virtual funds. Conditions may vary by

broker.

|

Yes |

| VIP

Offers premium services, lower fees, and dedicated support. Requirements

vary by broker.

|

No | Managed

A professional handles trading on behalf of the investor. Risks and fees

depend on the provider.

|

No |

| Available account types | |||

|---|---|---|---|

| Standard

A general trading account suitable for most traders, offering access to

a variety of markets with standard spreads and conditions.

|

Yes | ||

| ECN

Provides direct market access with raw spreads and low latency

execution. Typically requires a commission per trade instead of a spread

markup. Suitable for high-frequency and professional traders.

|

No | ||

| Swap Free

Eliminates overnight interest (swap) charges. Designed for traders

following Islamic finance principles.

|

No | ||

| Micro

Trading with micro-lots (0.01 lot = 1,000 units). Reduced capital

requirements and risk. Ideal for beginners and strategy testing.

Availability and conditions vary by broker.

|

No | ||

| Cent

Operates with cent-denominated balances (1 USD = 100 cents) for trading

micro-lots (0.01 lot = 1,000 units). Suitable for beginners and low-risk

strategies.

|

No | ||

| Demo

Enables risk-free trading with virtual funds. Conditions may vary by

broker.

|

Yes | ||

| VIP

Offers premium services, lower fees, and dedicated support. Requirements

vary by broker.

|

No | ||

| Managed

A professional handles trading on behalf of the investor. Risks and fees

depend on the provider.

|

No | ||

Deposit and Withdrawal

Libertex received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Libertex provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Pros:

- Cons:

-

USDT (Tether) supported

-

Supports 5+ base account currencies

-

Bank card deposits and withdrawals

-

PayPal supported

-

Withdrawal fee applies

-

BTC not available as a base account currency

-

Wise not supported

What are Libertex deposit and withdrawal options?

Libertex provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, PayPal, Skrill, Neteller, BTC, USDT.

| Libertex | AvaTrade | easyMarkets | |

|---|---|---|---|

| Bank card | Yes | Yes | Yes |

| PayPal | Yes | Yes | No |

| Wise | No | No | No |

| BTC | Yes | Yes | Yes |

Does Libertex Charge Deposit and Withdrawal Fees?

Libertex does not charge deposit fees; however, withdrawal fees may apply. This means that while adding funds is free, withdrawals may incur costs. To provide a clear understanding of the fee structure, We compared Libertex's deposit and withdrawal fees with those of two competitors.

| Libertex | AvaTrade | easyMarkets | |

|---|---|---|---|

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0-1 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0 |

What are Libertex base account currencies? Base account currencies are the primary currencies in which trading accounts are denominated. They determine the currency used for deposits, withdrawals, and calculating account balances.Using a base currency that matches a trader's local currency can help avoid unnecessary conversion fees.

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Libertex supports the following base account currencies:

What Are Libertex's Minimum Deposit and Withdrawal Amounts?

The minimum deposit on Libertex is $100, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Libertex’s support team.

Investment Options

Libertex offers copy trading and an affiliate program, providing opportunities for traders to follow experienced investors and earn through referrals. However, the broker does not provide Managed or PAMM accounts, which may limit options for investors looking for professional fund management solutions.

Libertex investment options

| Available investment options | |||

|---|---|---|---|

| Copy trading

Allows traders to automatically replicate the trades of experienced

investors. Performance and risks depend on the chosen strategy and

provider.

|

Yes | Managed

A professional trader or fund manager executes trades on behalf of the

investor. Fees, strategies, and risks vary by provider.

|

No |

| PAMM

A Percent Allocation Management Module (PAMM) account pools investor

funds under a manager’s control, with profits and losses distributed

proportionally. Terms depend on the broker and manager.

|

No | Affiliate program

Traders earn commissions by referring new clients to a broker. Payouts

and conditions vary based on the broker’s affiliate structure.

|

Yes |

| Available investment options | |||

|---|---|---|---|

| Copy trading

Allows traders to automatically replicate the trades of experienced

investors. Performance and risks depend on the chosen strategy and

provider.

|

Yes | ||

| Managed

A professional trader or fund manager executes trades on behalf of the

investor. Fees, strategies, and risks vary by provider.

|

No | ||

| PAMM

A Percent Allocation Management Module (PAMM) account pools investor

funds under a manager’s control, with profits and losses distributed

proportionally. Terms depend on the broker and manager.

|

No | ||

| Affiliate program

Traders earn commissions by referring new clients to a broker. Payouts

and conditions vary based on the broker’s affiliate structure.

|

Yes | ||

Additional Trading Tools

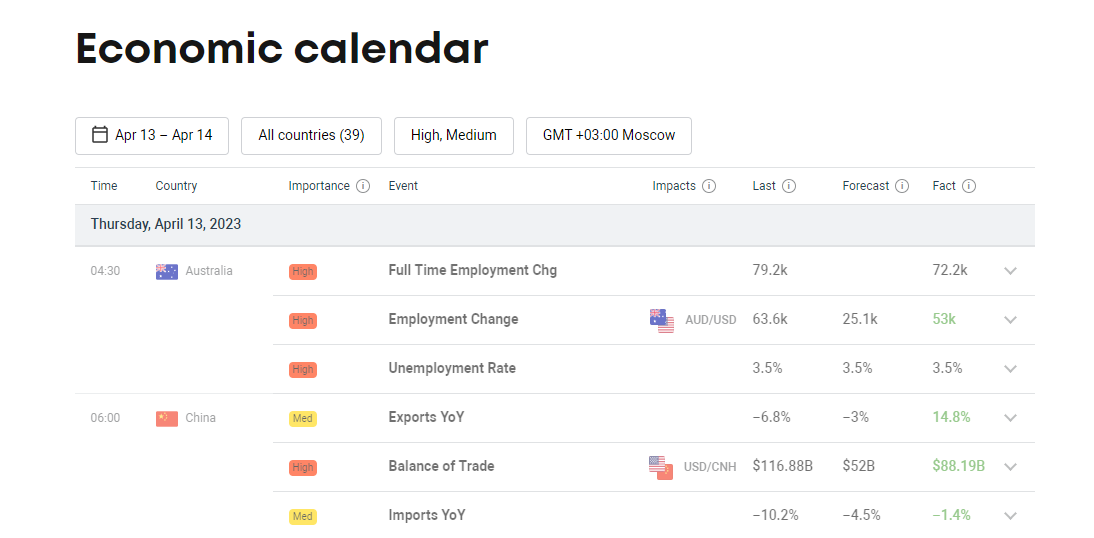

In addition to trading platforms and their functionality, Libertex offers several useful tools.

This is a list of main upcoming news and events having strong short- or long-term impact on the asset value. It can be filtered by country and importance of events.

Libertex’s Useful Tools - Economic calendar

Libertex’s Useful Tools - Economic calendar

Customer Support

Information

The broker provides traders customer support; however, you should not expect an instant

response.

- Pros:

- Cons:

-

Variety of communication methods

-

Multilingual communication

-

Service speed

| Customers can contact Libertex specialists in several ways: |

|---|

| telephone; |

| email; |

| online chat; |

| Contacts | |

|---|---|

| Foundation date | 1997 |

| Registration address | St. Vincent and the Grenadines |

| Official site | https://libertex.org/ |

| Contacts | |

Education

Information

Analytical and educational sections have been created on the official website, where a

trader can find useful materials in video format on how to use the platform, open an

account, and analyze the market.

| Information available in the “Education” section: | Information not available on the Libertex website: |

|---|---|

| Basics of trading for novice traders. | Reviews of indicators, strategies, and expert advisors. |

| Webinars on technical and fundamental market analyses. | The psychology of trading. |

| Separate sections: Economic calendar and FAQs. |

Each of these tools can be tested on a demo (free) account.

TU Expert Advice: Is Libertex Worth the Try?

The company promotes the Libertex platform, which is adapted for novice traders. The approach to calculating lot and pip value is simplified (instead of lots, the trade amount is displayed in fiat currency), statistics are displayed on the percentage change in price per day, underlying asset filters are displayed on the panel by the level of volatility and profitability for 30 days, etc. Although trading using advisors is not available, for novice traders, Libertex platform is a user-friendly tool to learn about trading.

The broker’s advantages are the transparency and flexibility of its fee policy. On a demo account you can see the current prices and spread for each underlying asset even without verification. There is no need to go into the specification for each underlying asset or print fees from tariff conditions, as upon opening a trade in the Libertex platform, you immediately see fees for each underlying asset. Are you a novice trader and haven't chosen a broker yet? I recommend discovering Libertex by trying to open trades on a demo account.

Trade with this broker, if:

You are interested in cryptocurrencies. Libertex offers several dozen cryptocurrency pairs, including with fiat. All assets are traded with no fee, and spreads start as low as 0 pips.

You are open to both trading and cryptocurrency mining. The broker provides its own cryptocurrency mining application with a user-friendly interface, no contributions, and no fees. Coins obtained through this application can be used for trading immediately.

Do not trade with this broker, if:

Your goal is to earn passive income, not just through mining. While the broker offers various affiliate programs, they all require high online activity. Copy trading and joint accounts are not available.

Related Articles

Our reviews of other companies as well

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).